Professional Documents

Culture Documents

Test of Controls

Uploaded by

judyaggreyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test of Controls

Uploaded by

judyaggreyCopyright:

Available Formats

TEST OF CONTROLS

Test of controls tests the operating effectiveness of controls in preventing, detecting and correcting material misstatements. (ACCAMAPS are the control activities expected to be put in place by management to ensure that objectives of the company are being met) A. SALES CYCLE Order Received orders not recorded accurately, customers cannot pay, or do not pay on time, orders cannot be honoured, and customer goodwill is lost 1. Select a sample of sales made and inspect a copy of order retained on file 2. Inspect a sample of new customers files to ensure a satisfactory credit check has been obtained 3. With clients permission, attempt to enter a sales order which will take a customer over the agreed credit limit, the system should reject the order 4. Inspect sales orders to ensure sequence is complete, enquire of management as to missing orders Goods despatched goods are not despatched, incorrect goods are sent to customers 5. Inspect orders held by warehouse to ensure sequence is complete 6. Visit warehouse and observe the goods despatch process to assess whether all goods are double checked against the Sales Order and GDN prior to sending out 7. Inspect a sample of orders to ensure signed by Inventory picker 8. Inspect a sample of GDNs and ensure a signed copy of the order is attached and filed with it. 9. Select a sample of GDNs and reperform matching to order, to ensure goods and quantities agree and any differences are noted /followed up. 10. Inspect GDNs for incomplete sequence and unmatched items 11. Inspect a sample of GDNs and ensure a copy was signed by the customer and filed with the original. Invoice Raised Invoices may be missed, incorrectly raised or sent to the wrong customer, credit notes may be raised incorrectly. 12. Inspect numerical sequence of sales invoices, if any breaks in the sequence noted, enquire of management as to missing invoices 13. Inspect sample of GDNs and agree that a valid sales invoice has been correctly raised 14. Inspect sample of invoices to ensure signed as agreed to original Order, GDN and price list 15. Inspect sample of invoices to confirm arithmetical accuracy 16. Review a sample of sales invoices for evidence of authorisation by a responsible official of e.g. any discounts allowed: - Orders authorised by sales/production manager - GDNs signed by the foreman to confirm despatch of goods listed - Credit Notes signed by the manager

Sale Recorded invoices may be inaccurately recorded, missed or recorded for the wrong customer 17. Inspect sample of reconciliation

18. 19. 20. 21.

Inspect receivables ledger for credit balances Reperform receivables ledger reconciliation Inspect customer correspondence re statements sent out for reported errors Inspect samples of invoices and agree to entries made in receivables ledger

Cash received - incorrect amounts received, customer does not pay 22. Agree sample of cash receipts during the year to the copy Invoice 23. Inspect aged debt listings for evidence of review 24. Inspect receivables ledger for evidence of review 25. Review credit control procedures and inspect evidence of compliance with procedures Cash recorded cash incorrectly recorded or recorded against the wrong account, cash stolen 26. Select a sample of customers with outstanding debts and ensure monthly statements sent 27. Reperform bank reconciliations 28. Inspect a sample of bank reconciliation to ensure reconciliations performed on a timely basis and evidenced as reviewed 29. Obtain pay-in slips to ensure cash banked regularly 30. Observe cash receipt and recording procedures to ensure adequate segregation of duties

B. PURCHASES CYCLE Requisition raised unauthorised purchases made 1. Inspect sample of requisitions to ensure authorised by manager 2. Inspect sample of requisitions for evidence of inventory levels having been checked first 3. Inspect a sample of requisitions and ensure an order is attached and supplier confirmation filed with it 4. Inspect requisitions held by purchasing department and ensure sequence is complete Order placed invalid or incorrect orders made or recorded, the most favourable terms not obtained Inspect a sample of orders and ensure price agrees to agreed price list Inspect a sample of orders and ensure placed with suppler on preferred suppliers list Inspect requisition held by purchasing department and ensure sequence is complete Inspect a sample of requisitions and ensure an order is attached and supplier confirmation filed with it. Goods received - goods stolen, goods may be accepted that have not been ordered or are of wrong quality or inferior quality. Visit a warehouse and inspect delivery note for security of goods Inspect a sample of receipt delivery notes to ensure inventory records updated Visit a warehouse to observe goods receipt process to assess whether all goods are double checked against the PO and GDN and inspected for quality Inspect a sample of GRNs for evidence of signature confirming checks Inspect a sample of Pos and ensure GRN raised and filed with, and enquire about action taken i.e. Outstanding Pos For a sample of GRNs reperform matching to PO to confirm amount and description received agrees to amount and description ordered.

5. 6. 7. 8.

9. 10. 11. 12. 13. 14.

Invoice received invoices are not recorded resulting in non payment and loss of supplier goodwill, invoices may be logged for goods not received, invoices may contain errors 15. Inspect sample of GRNs and check that an invoice has been recorded and payment made for the goods received. Obtain explanations for missing invoices/payments 16. Inspect a sample of purchase invoices to ensure signed as agreed to PO, GRN and Suppliers price list 17. Inspect a sample of invoices and match to PO, GRN and Suppliers price list Purchase recorded Purchase missed or recorded incorrectly 18. Inspect sample of invoices for record stamp 19. Reperform the supplier statement reconciliation for a sample of suppliers to ensure the control has been done accurately and complied with 20. Inspect batch control sheets for evidence of performance of batch controls Cash paid invoices not paid or incorrect amount paid Observe procedures for keeping paid invoices separate from unpaid ones Inspect sample of invoices for payment stamp Inspect evidence of cheque signatory reviewing invoices before payment Review authorised cheque signatories for appropriate seniority of signatories and limits.

21. 22. 23. 24.

C. PAYROLL CYCLE Timesheets submitted bogus employees paid or employees paid for hours not worked 1. Observe procedures for supervision of clocking in and out 2. Reconcile recorded number of cards issued to number of employees 3. Observe procedures for locking spare cards away 4. Inspect sample of timesheets for supervisor authorisation Standing data input standing data could be changed without authorisation, unprocessed updates may mean employees who have left are paid or joiners are missed. Inspect monthly print of changes to standing data for senior management signature Inspect sample of printed standing data files for evidence of department managers confirmation Attempt (with clients permission) to access and amend standing data without the appropriate passwords Select a sample of leavers forms and inspect payroll records to ensure leavers were not paid after departure Select a sample of joiners forms and inspect payroll records to ensure first pay date is correct and joiners were paid the correct amount

5. 6. 7. 8. 9.

Processing of data Inaccurate processing of data could lead to wages and taxes being incorrectly calculated 10.Reperform manual recalculation of a sample of wages 11.Review exception report produced and evidence of action taken in respect of exceptions identified 12.Reperform recalculation of sample of deductions. E.g. Tax, NICs 13.Inspect evidence of managerial review of weekly payment summaries

Recording of payroll recorded payroll may not match actual payroll 14.Inspect payroll print out for ledger clerks signature 15.Inspect evidence of managerial review of wages expenses Staff Paid Staff may not be paid OR bogus staff could be paid 16.Observe procedures in place for payment of cash wages 17.Inspect BACs payroll summary for signature of responsible individual.

D. INVENTORY CYCLE Inventory received Inventory stolen on arrival, new purchases mixed up with returns, poor quality inventory accepted 1. Visit warehouse and observe goods receipt process to assess whether all goods are signed for and logged in by stores manager, and whether all goods are double checked against PO & GRN and inspected for quality 2. Visit returns department, and observe process for checking and recording returns Inventory Stored Poor storage conditions lead to damaged inventory, Inventory items not used before their useful life ends, Inventory stolen from storage areas 3. Visit warehouse and inspect for appropriate storage conditions and adequate security measures 4. Inspect inventory for use by dates and adequate rotation Raw materials used in production Material over-ordered to enable theft 5. Inspect requisitions for signed authorisation from production manager 6. Inspect sample of requisitions and check for quality compliance with standards Inventory despatched wrong goods sent, goods being stolen (no real sale), poor quality sent, records not updated 7. Visit warehouse and observe the goods despatch process to assess whether all goods are double checked against the order and goods despatch note (GDN) prior to sending out 8. Inspect a sample of orders to ensure signed by inventory picker 9. Inspect a sample of GDNs and ensure an order is attached and a signed copy filed with it Inventory Count Counting lacks accuracy, Staff lie about amounts counted to cover up their theft, inventory records lost during count, inventory wrongly counted because it is moved during the count 10.Inspect areas counted for marking as complete 11.Inspect managers records of second counts for completion and issues identified 12.Review instructions for counting to ensure staff are not counting areas of responsibility 13.Observe counting procedures to ensure done in pair 14.Check sequence of inventory sheets for completeness 15.Review management authorisation for inventory movements if open during count.

E. BANK AND CASH CONTROL PROCEDURES Cash balances are safeguarded: 1. Safes/strong room/locked cash box with restricted access 2. Security locks 3. Swipe card access 4. Key access to tills 5. Night safes 6. Imprest system 7. Use of security services for large cash movements 8. People making banking vary routes and timing Cash balances are kept to a minimum 1. Tills emptied regularly 2. Frequent banking of cash and cheques received Money can only be extracted from bank accounts for authorised purposes 1. Restricted list of cheque signatories 2. Dual signatories for large amounts 3. Similar controls over bank transfers and online banking e.g. Secure passwords and pin numbers 4. Cheque books and cheque stationery locked away 5. Regular bank reconciliations reviewed by person with suitable level of authority

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- QCM Part 145 en Rev17 310818 PDFDocument164 pagesQCM Part 145 en Rev17 310818 PDFsotiris100% (1)

- Huawei Core Roadmap TRM10 Dec 14 2011 FinalDocument70 pagesHuawei Core Roadmap TRM10 Dec 14 2011 Finalfirasibraheem100% (1)

- EC2 406006 001 EFE 0121 - Controgen Generator Excitation System Description - Rev - ADocument29 pagesEC2 406006 001 EFE 0121 - Controgen Generator Excitation System Description - Rev - AAnonymous bSpP1m8j0n50% (2)

- Hitt PPT 12e ch08-SMDocument32 pagesHitt PPT 12e ch08-SMHananie NanieNo ratings yet

- Delta PresentationDocument36 pagesDelta Presentationarch_ianNo ratings yet

- We Move You. With Passion.: YachtDocument27 pagesWe Move You. With Passion.: YachthatelNo ratings yet

- Managerial Accounting-Fundamental Concepts and Costing Systems For Cost Analysis Module 1Document40 pagesManagerial Accounting-Fundamental Concepts and Costing Systems For Cost Analysis Module 1Uzma Khan100% (1)

- Sacmi Vol 2 Inglese - II EdizioneDocument416 pagesSacmi Vol 2 Inglese - II Edizionecuibaprau100% (21)

- Elliot WaveDocument11 pagesElliot WavevikramNo ratings yet

- CSA Report Fahim Final-1Document10 pagesCSA Report Fahim Final-1Engr Fahimuddin QureshiNo ratings yet

- Labor CasesDocument47 pagesLabor CasesAnna Marie DayanghirangNo ratings yet

- Ethercombing Independent Security EvaluatorsDocument12 pagesEthercombing Independent Security EvaluatorsangelNo ratings yet

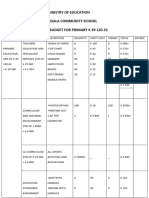

- Ministry of Education Musala SCHDocument5 pagesMinistry of Education Musala SCHlaonimosesNo ratings yet

- Reference: Digital Image Processing Rafael C. Gonzalez Richard E. WoodsDocument43 pagesReference: Digital Image Processing Rafael C. Gonzalez Richard E. WoodsNisha JosephNo ratings yet

- 3.13 Regional TransportationDocument23 pages3.13 Regional TransportationRonillo MapulaNo ratings yet

- Project Job Number EngineerDocument2 pagesProject Job Number Engineertekno plus banatNo ratings yet

- Icom IC F5021 F6021 ManualDocument24 pagesIcom IC F5021 F6021 ManualAyam ZebossNo ratings yet

- CavinKare Karthika ShampooDocument2 pagesCavinKare Karthika Shampoo20BCO602 ABINAYA MNo ratings yet

- CH 2 Nature of ConflictDocument45 pagesCH 2 Nature of ConflictAbdullahAlNoman100% (2)

- PanasonicDocument35 pagesPanasonicAsif Shaikh0% (1)

- Gis Tabels 2014 15Document24 pagesGis Tabels 2014 15seprwglNo ratings yet

- Certification and LettersDocument6 pagesCertification and LettersReimar FerrarenNo ratings yet

- Computer System Architecture: Pamantasan NG CabuyaoDocument12 pagesComputer System Architecture: Pamantasan NG CabuyaoBien MedinaNo ratings yet

- Data Mining - Exercise 2Document30 pagesData Mining - Exercise 2Kiều Trần Nguyễn DiễmNo ratings yet

- 6 AsianregionalismDocument32 pages6 AsianregionalismChandria Ford100% (1)

- Residential BuildingDocument5 pagesResidential Buildingkamaldeep singhNo ratings yet

- Class 11 Accountancy NCERT Textbook Chapter 4 Recording of Transactions-IIDocument66 pagesClass 11 Accountancy NCERT Textbook Chapter 4 Recording of Transactions-IIPathan KausarNo ratings yet

- Bea Form 7 - Natg6 PMDocument2 pagesBea Form 7 - Natg6 PMgoeb72100% (1)

- NIELIT Scientist B' Recruitment 2016 - Computer Science - GeeksforGeeksDocument15 pagesNIELIT Scientist B' Recruitment 2016 - Computer Science - GeeksforGeeksChristopher HerringNo ratings yet

- Remuneration Is Defined As Payment or Compensation Received For Services or Employment andDocument3 pagesRemuneration Is Defined As Payment or Compensation Received For Services or Employment andWitty BlinkzNo ratings yet