Professional Documents

Culture Documents

Falcon Fraud Manager 1247ps en

Uploaded by

rajsalgyan0 ratings0% found this document useful (0 votes)

331 views0 pagesFICO(tm) Falcon Fraud Manager is the most accurate and comprehensive solution for detecting payment card fraud, reducing losses by up to 50%. The latest release, version 6, introduces adaptive analytics, enabling institutions to identify and respond to new threats with unprecedented speed. Industry-specific models --for credit, debit, retail and oil cards --fine- tune the fraud management solution to detect fraud characteristics specific to the portfolio.

Original Description:

Original Title

Falcon Fraud Manager 1247ps En

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFICO(tm) Falcon Fraud Manager is the most accurate and comprehensive solution for detecting payment card fraud, reducing losses by up to 50%. The latest release, version 6, introduces adaptive analytics, enabling institutions to identify and respond to new threats with unprecedented speed. Industry-specific models --for credit, debit, retail and oil cards --fine- tune the fraud management solution to detect fraud characteristics specific to the portfolio.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

331 views0 pagesFalcon Fraud Manager 1247ps en

Uploaded by

rajsalgyanFICO(tm) Falcon Fraud Manager is the most accurate and comprehensive solution for detecting payment card fraud, reducing losses by up to 50%. The latest release, version 6, introduces adaptive analytics, enabling institutions to identify and respond to new threats with unprecedented speed. Industry-specific models --for credit, debit, retail and oil cards --fine- tune the fraud management solution to detect fraud characteristics specific to the portfolio.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 0

www.fco.

com Make every decision count

TM

FICO Falcon Fraud Manager 6

Detect debit and credit card

fraud quickly and accurately

To stop fraud efectively in real time,

fnancial institutions worldwide trust

the scientifcally based predictive

analytics of FICO Falcon Fraud

Manager. Falcon Fraud Manager is the

most accurate and comprehensive

solution for detecting payment

card fraud, reducing losses by up

to 50%. The latest release, version

6, introduces adaptive analytics,

enabling institutions to identify

and respond to new threats with

unprecedented speed. It also

expands patented fraud detection

and profling techniques with global

profles targeting high-risk ATMs,

merchants, risky geo-graphic regions

and other criteria.

FICO Falcon Fraud Manager provides a single, comprehensive solution for accurate payment

card detection.

fraud

The reliable, responsive fraud detection system

Cardholder

Profiles

Expert Rules

Base

Neural

Network Engine

Expert

Authorization

Response Module

Case

Creation Module

Postings

Authorization

System

Payment

System

Nonmonetary

System

Analyst

Workstation

Configuration

Workstation

Case

Management

Database

1. Auth Request

5. Transaction

and Score

7. Case

Information

8. Payment and

Nonmonetary

Transactions

Rules

Definition

6. Case

Creation

Rules

Execute

4. Auth Recommendation

2. Auth

Request

and Score

3. Expert

Rules

Execute

F

ICO Falcon Fraud Manager is the leading

solution and industry standard in payment

card fraud detection. Built on a robust service-

oriented architecture, Falcon Fraud Manager

uses advanced analytic techniques that

synthesize intelligence drawn from billions

of payment card transactions and hundreds

of person-years of experience to weigh key

attributes and identify fraud with the utmost

reliabilityall in a fraction of a second. Falcon

Fraud Manager provides a single platform for

card fraud detectioncredit and debitand

with a direct link to your authorization system,

you can stop fraudulent transactions right at

the point of sale.

Industry-specic Falcon Fraud Manager models

for credit, debit, retail and oil cardsne-

tune the fraud management solution to detect

fraud characteristics specic to the portfolio,

thereby improving the solutions accuracy.

The reliable, responsive

fraud detection system

Falcon Fraud Manager is designed to reduce

fraud losses with minimal customer impact

through unmatched capabilities including:

Patented Cardholder Profling

Technology. Identies key transaction

behaviors and spending patterns for each

cardholder to ensure rapid recognition of

uncharacteristic expenditures.

Neural Network Modeling. Patented

analytic technology provides the most

accurate predictive models available based on

transaction data and cardholder proles.

Consortium Models. Unique to Falcon Fraud

Manager, the FICO consortium incorporates

data from millions of transactions across

thousands of issuers to leverage powerful

knowledge about fraud patternsspecic to

a region and portfoliofor improved fraud

detection, no matter the size of your portfolio.

With FICO Falcon Fraud

Manager 6 you can:

Improve fraud detection by up to

5% with adaptive analytics. Falcon

6 has new adaptive analytics, which

augment the robust base analytics

with models that learn in real time

from your case dispositions.

Improve detection by up to

44% with global profles. Falcon

6 has new global proles, which

complement cardholder proles

with the ability to focus on high risk

entities such as ATMs, merchants

and countries.

Control fraud across the enterprise.

Now you can manage fraud related

to multiple products from a single

platform, and take a customer-level

view of fraud cases with enterprise

case management capabilities.

Transaction-Based Scoring. Analyzes each

authorization transaction to assess risk of

fraudulent activity. Provides an accurate fraud

score, indicating the likelihood that the account

is fraudulent.

New to Falcon 6:

Improved Rules Management. Provides

an easy method for independently dening,

testing and deploying rules based on your

organizations strategies, by leveraging the

industry-leading FICO Blaze Advisor business

rules management system. Enables you to

respond quickly to new threats as they arise

and ne-tune the fraud solution to your

organizations policies and practices.

Improved Case Management. Oers a web-

based, user-friendly, customizable environment

for analysts to investigate referred accounts,

providing comprehensive information to

quickly and eciently disposition cases.

Through the conguration workstation, super-

visors are able to set workow parameters,

dene score thresholds, develop and manage

rules and obtain reporting information.

Global profles. Many patterns of fraud

are best detected by global proling, which

provides a more complete picture of fraud

by looking across multiple entities such as

merchants, devices, or countries. By looking for

unusual behavior of a device, such as an ATM or

point-of-sale (POS) terminal, strongly predictive

variables can be created and combined with

the account information to better identify

fraud. ATM proling can provide about a

10% lift in account detection and about 15%

improvement in real-time value detection over

the standard Falcon model.

Adaptive models. Adaptive models use

recent fraud activity to sharpen detection

by creating a more precise separation

between frauds and non-frauds based on

case dispositions. While retaining the benet

of the consortium model approach, adaptive

models quickly learn the unique fraud patterns

at play for each issuer, and provide a real-

time adjustment to the consortium model

score for the immediate fraud situation being

experienced by the bank. Adaptive modeling

techniques can provide a 10% performance

lift in real-time value detection over a standard

Falcon model.

FICO Card Alert Service.

1

Integration of the

Card Alert Service with Falcon Fraud Manager

cuts fraud run time and increases the ability

to block risky transactions. You can manage

alerts in Falcon Fraud Manager, create cases for

Suspect Activity Reports and build rules around

the reports.

Multi-channel detection. Falcon Fraud

Manager can detect multiple types of frauds

across channels and/or bank products within a

single instance and investigative view. Falcon

Fraud Manager consolidates multi-channel

fraud cases and account activity at the

customer level.

An architecture for

smarter decisions

Falcon 6 is built on FICOs scalable Decision

Management architecture. This provides a

common service-oriented foundation for

rapidly bringing analytics-driven decisioning

into more areas of the customer lifecycleand

for connecting decisions across it in ways that

create more value for you and your customers.

Falcon 6 makes extensive use of the new

service-oriented Decision Management

architecture, including a common customer

data model, case management and rules

management components.

The industry leader in

card fraud detection

Falcon Fraud Manager monitors transactions

for more than 1.8 billion active accounts

across six continents. First introduced in 1992,

it now saves leading card issuers millions of

dollars every day. In fact, US fraud losses, as

a percentage of sales, have declined from a

peak of over 18 basis points in 1992 to 6.2 basis

points in 2006.

2

Find out how many of our clients have

reduced fraud losses by 50% or more.

Contact us today about FICO Falcon Fraud

Manager and FICOs approach to fraud.

Robust neural network models with

patented cardholder proling and

monitoring of other entities

Real-time rule creation, rule simulation

and rule implementation

Ecient investigations with sophisticated

case management system

Seamless integration with your

authorization system for real-time scoring

Region and portfolio-specic fraud

models leverage industry-wide

consortium data

Adaptive models generate fraud scores

based on analyst feedback

Detects more fraud with lower false

positives to provide minimal impact on

good customers

Delivers earliest possible warning of

fraud activity

Boosts analyst productivity and improves

eectiveness of fraud operations

Identies fraud sooner to give you more

opportunity to reduce losses

Leverages known fraud patterns to

achieve highest fraud detection levels

Adjusts to your ndings about fraud

dispositions

Fair Isaac, FICO, Blaze Advisor, Falcon and Make every decision count are trademarks or registered trademarks of Fair Isaac Corporation in the United States and in other countries. Other product and company names herein may

be trademarks of their respective owners. 2004-2009 Fair Isaac Corporation. All rights reserved.

1247PS_EN 05/09 PDF

For more information US toll-free International toll-free email web

+1 888 342 6336 +44 (0) 207 940 8718 info@co.com www.co.com

Features Benefts

1

Currently available in the US only

2

Source: The Nilson Report

You might also like

- Financial Market FinalDocument327 pagesFinancial Market Finalvarshadumbre100% (3)

- BPC Training CatalogueTemplate V2.2Document28 pagesBPC Training CatalogueTemplate V2.2trongnvtNo ratings yet

- Payment Platform Architecture OverviewDocument30 pagesPayment Platform Architecture OverviewAhmedFAbdeenNo ratings yet

- Mastercard Switch Rules March 2018Document80 pagesMastercard Switch Rules March 2018raosunil99No ratings yet

- Best Practices in Cash ManagementDocument5 pagesBest Practices in Cash Managementadi2005No ratings yet

- Tokenization Everything You Need To KnowDocument21 pagesTokenization Everything You Need To KnowJose Alberto Lopez PatiñoNo ratings yet

- BASE24 DR With AutoTMF and RDF WhitepaperDocument38 pagesBASE24 DR With AutoTMF and RDF WhitepaperMohan RajNo ratings yet

- Graph Data Science With Neo4J Learn How To Use The Neo4j Graph Data Science Library 2.0 and Its Python Driver For Your Project (Estelle Scifo) (Z-Library)Document289 pagesGraph Data Science With Neo4J Learn How To Use The Neo4j Graph Data Science Library 2.0 and Its Python Driver For Your Project (Estelle Scifo) (Z-Library)Agaliev100% (1)

- 05 Best Practices For The Design or SelectionDocument5 pages05 Best Practices For The Design or SelectionGaurav MalhotraNo ratings yet

- Project Implementation Manual: Yes No N/A Comments / Notes A. Internal Control EnvironmentDocument8 pagesProject Implementation Manual: Yes No N/A Comments / Notes A. Internal Control EnvironmentrajsalgyanNo ratings yet

- Trade Life CycleDocument9 pagesTrade Life CycleJohn YantsulisNo ratings yet

- 4.digital PaymentsDocument54 pages4.digital PaymentsnbprNo ratings yet

- LogicDocument712 pagesLogicsuresh vedpathiNo ratings yet

- How Credit Cards Work: A Guide to Credit Card ProcessingDocument4 pagesHow Credit Cards Work: A Guide to Credit Card ProcessingJyoti JhajhraNo ratings yet

- Frictionless Cross-Border Payments Alternatives To Correspondent Banking Volante PDFDocument17 pagesFrictionless Cross-Border Payments Alternatives To Correspondent Banking Volante PDFBen ChampionNo ratings yet

- Ovum Selecting A Card Management SystemDocument59 pagesOvum Selecting A Card Management SystemTedh ShinNo ratings yet

- Common Loan Origination (InfoSys)Document2 pagesCommon Loan Origination (InfoSys)Baatar SukhbaatarNo ratings yet

- UPI-NPCI PresentationDocument17 pagesUPI-NPCI PresentationAmr KhaterNo ratings yet

- Consumer Lending in IndiaDocument25 pagesConsumer Lending in IndiaGautamNo ratings yet

- User's Manual B202Document12 pagesUser's Manual B202Aswa Tama100% (2)

- Visionplus System ModulesDocument8 pagesVisionplus System Modulesvattikondaa0% (1)

- Vision Plus Is A Software Based On MainframeDocument1 pageVision Plus Is A Software Based On MainframeVenkata ReddyNo ratings yet

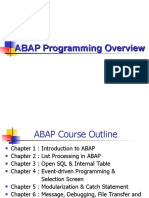

- ABAP Programming OverviewDocument393 pagesABAP Programming OverviewDuy SơnNo ratings yet

- Finacle Menu BookDocument12 pagesFinacle Menu Bookvpsrnth100% (2)

- Fis-Opf Ach PaymentsDocument5 pagesFis-Opf Ach PaymentscrazytrainNo ratings yet

- TMF635 Usage Management API REST Specification R14.5.1Document51 pagesTMF635 Usage Management API REST Specification R14.5.1DuyHung DangNo ratings yet

- Finacle InnovationDocument54 pagesFinacle InnovationGhana ShyamNo ratings yet

- Core Banking Partner GuideDocument19 pagesCore Banking Partner GuideClint JacobNo ratings yet

- Clear 2 PayDocument2 pagesClear 2 PayJyoti KumarNo ratings yet

- Mobility, LOS, CRM, LMS, Lead-gen-Underwriting, Field AutomationDocument8 pagesMobility, LOS, CRM, LMS, Lead-gen-Underwriting, Field AutomationAniket ThakurNo ratings yet

- RuPay Operating Regulations 1.0Document114 pagesRuPay Operating Regulations 1.0Amit Bhardwaj50% (2)

- BEKEN Risk Management Tools PDFDocument4 pagesBEKEN Risk Management Tools PDFJoseph LimNo ratings yet

- UPI PSP Apps Guide for Payment Service ProvidersDocument1 pageUPI PSP Apps Guide for Payment Service ProvidersAnonymous igVRM2mA6kNo ratings yet

- Operating GuideDocument37 pagesOperating Guideakshay yadavNo ratings yet

- National Common Mobility Card Program: Enabling Interoperable Digital Payments Across IndiaDocument15 pagesNational Common Mobility Card Program: Enabling Interoperable Digital Payments Across IndiaMmNo ratings yet

- Harnessing Technology Creating A Less Cash Society: Connect With UsDocument32 pagesHarnessing Technology Creating A Less Cash Society: Connect With UsPunyabrata Ghatak100% (1)

- Bank Audit Through CBSDocument43 pagesBank Audit Through CBSSudershan ThaibaNo ratings yet

- Fptbank Data Dictionary of Frequently Queried Tables: March 2008Document20 pagesFptbank Data Dictionary of Frequently Queried Tables: March 2008Artmin100% (3)

- E-KYC Interface Specification Version 1.3Document24 pagesE-KYC Interface Specification Version 1.3Krishna TelgaveNo ratings yet

- Paytm Payment Solutions Feb15 PDFDocument30 pagesPaytm Payment Solutions Feb15 PDFRomeo MalikNo ratings yet

- Tink - The Future of Payments Is OpenDocument46 pagesTink - The Future of Payments Is OpenDavid HelmanNo ratings yet

- TCS BaNCS Research Journal Issue 3 0713 1Document52 pagesTCS BaNCS Research Journal Issue 3 0713 1Poovana Kokkalera PNo ratings yet

- AML System Design and Implementation: Aligning Regulatory, Business, and Technological RequirementsDocument16 pagesAML System Design and Implementation: Aligning Regulatory, Business, and Technological RequirementsrajsalgyanNo ratings yet

- AML System Design and Implementation: Aligning Regulatory, Business, and Technological RequirementsDocument16 pagesAML System Design and Implementation: Aligning Regulatory, Business, and Technological RequirementsrajsalgyanNo ratings yet

- RBI's Account Aggregator frameworkDocument7 pagesRBI's Account Aggregator frameworkFrancis NeyyanNo ratings yet

- Aci PRM Enterprise RiskDocument23 pagesAci PRM Enterprise RiskRajesh VasudevanNo ratings yet

- IMPS Process FlowDocument12 pagesIMPS Process FlowThamil Inian100% (1)

- HSBC's Mortgage Lending DecisionDocument22 pagesHSBC's Mortgage Lending Decisionbestchi19No ratings yet

- AEPS Interface Specification v2.7 PDFDocument55 pagesAEPS Interface Specification v2.7 PDFSanjeev PaulNo ratings yet

- DigitalPaymentBook PDFDocument76 pagesDigitalPaymentBook PDFShachi RaiNo ratings yet

- Oracle ERP For BankingDocument47 pagesOracle ERP For BankingCuong VuNo ratings yet

- Annexure - NACH Procedural Guidelines V 3.1Document158 pagesAnnexure - NACH Procedural Guidelines V 3.1Pratim MajumderNo ratings yet

- Citi Trade May14Document23 pagesCiti Trade May14Marlon RelatadoNo ratings yet

- PayU Payments API DocumentationDocument14 pagesPayU Payments API Documentationanon_383483169No ratings yet

- Presentation MSME Products 24092018 - Ver 1Document52 pagesPresentation MSME Products 24092018 - Ver 1Murali KrishnanNo ratings yet

- CBDCDocument9 pagesCBDCdhruvNo ratings yet

- Payment and Settlement SystemDocument16 pagesPayment and Settlement Systemchitra_shresthaNo ratings yet

- Report on Credit Scoring's Effects on Availability and AffordabilityDocument304 pagesReport on Credit Scoring's Effects on Availability and AffordabilityhbsqnNo ratings yet

- Mobile Payment Service Enables 24/7 Fund Transfers via Mobile NumberDocument10 pagesMobile Payment Service Enables 24/7 Fund Transfers via Mobile NumberRitesh KumarNo ratings yet

- Cheque Management System FinalDocument35 pagesCheque Management System FinalPrerna Sharma0% (1)

- Finacle Solutionofferingsoverviewdec15 101215001659 Phpapp02Document21 pagesFinacle Solutionofferingsoverviewdec15 101215001659 Phpapp02Pranay JadhavNo ratings yet

- Nucleus SoftwareDocument50 pagesNucleus SoftwareGunveen SinghNo ratings yet

- Unique Identification Number.. (Aadhaar) JJJJJJJJJJJJJDocument67 pagesUnique Identification Number.. (Aadhaar) JJJJJJJJJJJJJnehavarghese19No ratings yet

- DBS IDEAL CURATED - Case Study - Screening Solution V1Document6 pagesDBS IDEAL CURATED - Case Study - Screening Solution V1Himanshu GhadigaonkarNo ratings yet

- ROC Fraud ManagementDocument6 pagesROC Fraud Managementcatch_ahteshamNo ratings yet

- Investor Brochure July 14 PDFDocument4 pagesInvestor Brochure July 14 PDFrajsalgyanNo ratings yet

- FavouriteDocument1 pageFavouriterajsalgyanNo ratings yet

- The Ideabridge White Paper Series: Time Management and Sealing The Cracks!Document3 pagesThe Ideabridge White Paper Series: Time Management and Sealing The Cracks!rajsalgyanNo ratings yet

- ExportDocument1 pageExportrajsalgyanNo ratings yet

- 7) FatcaDocument9 pages7) FatcarajsalgyanNo ratings yet

- Fraud IndicatorsDocument12 pagesFraud IndicatorsrajsalgyanNo ratings yet

- ACPO Final Nature Extent and Economic Impact of FraudDocument119 pagesACPO Final Nature Extent and Economic Impact of FraudrajsalgyanNo ratings yet

- Fraud Prevention PlanDocument22 pagesFraud Prevention PlanrajsalgyanNo ratings yet

- 11Document62 pages11qweeeeeqweweNo ratings yet

- Ideabridge Goal Tracking Template12Document4 pagesIdeabridge Goal Tracking Template12underwood@eject.co.zaNo ratings yet

- 2013 04 002 Banking ControlsDocument18 pages2013 04 002 Banking ControlsrajsalgyanNo ratings yet

- Proactive Fraud MonitoringDocument12 pagesProactive Fraud MonitoringrajsalgyanNo ratings yet

- ACPO Final Nature Extent and Economic Impact of FraudDocument119 pagesACPO Final Nature Extent and Economic Impact of FraudrajsalgyanNo ratings yet

- Internal ControlDocument46 pagesInternal ControlKumaran VelNo ratings yet

- Fraud IndicatorsDocument12 pagesFraud IndicatorsrajsalgyanNo ratings yet

- Internal ControlDocument46 pagesInternal ControlKumaran VelNo ratings yet

- Fraud Prevention PlanDocument22 pagesFraud Prevention PlanrajsalgyanNo ratings yet

- Feature List 093Document15 pagesFeature List 093rajsalgyanNo ratings yet

- Proactive Fraud MonitoringDocument12 pagesProactive Fraud MonitoringrajsalgyanNo ratings yet

- The Financial System in IndiaDocument0 pagesThe Financial System in IndiarajsalgyanNo ratings yet

- India Banking Fraud Survey 2012Document0 pagesIndia Banking Fraud Survey 2012rajsalgyanNo ratings yet

- India Banking Fraud Survey 2012Document0 pagesIndia Banking Fraud Survey 2012rajsalgyanNo ratings yet

- 029 2011Document16 pages029 2011rajsalgyanNo ratings yet

- ACI Online Banking Fraud Management BR US 0211 4558Document8 pagesACI Online Banking Fraud Management BR US 0211 4558rajsalgyanNo ratings yet

- First Steps To Investing A Beginners Guide Prithvi Haldea PDFDocument21 pagesFirst Steps To Investing A Beginners Guide Prithvi Haldea PDFnagaravikrishnadiviNo ratings yet

- Nadia Natasya: Working Experiences About MeDocument1 pageNadia Natasya: Working Experiences About MeNurul SyafiqahNo ratings yet

- Senior SDET with 6+ Years ExperienceDocument2 pagesSenior SDET with 6+ Years Experiencehimanshu tiwariNo ratings yet

- SZB4 (GB)Document2 pagesSZB4 (GB)naami2004No ratings yet

- Software Assisted Hardware Verification: About CoverifyDocument4 pagesSoftware Assisted Hardware Verification: About CoverifypuneetSchemeNo ratings yet

- Describe Three Common and Mark Recognition DevicesDocument2 pagesDescribe Three Common and Mark Recognition Devicesdark angelNo ratings yet

- Ministry of Communications & Informatics: Libyan National Frequency Plan (LNFP)Document255 pagesMinistry of Communications & Informatics: Libyan National Frequency Plan (LNFP)Ali AbushhiwaNo ratings yet

- Oracle Fusion Applications Supply Chain Planning Upload: Calendar AssignmentsDocument6 pagesOracle Fusion Applications Supply Chain Planning Upload: Calendar AssignmentsgokulNo ratings yet

- DSP ProcessorDocument29 pagesDSP Processorm2k77100% (1)

- SE-Unit Test TimetableDocument1 pageSE-Unit Test TimetableBadshah YTNo ratings yet

- Ship Building Computer AidsDocument4 pagesShip Building Computer AidsAnkit MauryaNo ratings yet

- Hibernate TestDocument12 pagesHibernate Testidatoo@hotmail.comNo ratings yet

- AttachmentDocument16 pagesAttachmentArest DoiNo ratings yet

- Update Statistics For The Oracle Cost-Based OptimizerDocument21 pagesUpdate Statistics For The Oracle Cost-Based Optimizerbe.kiddoNo ratings yet

- To Mask A 8 Bit and 16 Bit Number Using Emulator 8086Document12 pagesTo Mask A 8 Bit and 16 Bit Number Using Emulator 8086amar sivaNo ratings yet

- Sqlassignment 03Document3 pagesSqlassignment 03pokegex798No ratings yet

- Job Description - Active Directory EngineerDocument2 pagesJob Description - Active Directory EngineerLukk IlNo ratings yet

- Epson T-Series Robot Manual (r10)Document262 pagesEpson T-Series Robot Manual (r10)FlorinNo ratings yet

- Monkey1280notesbokks PDFDocument6 pagesMonkey1280notesbokks PDFRaymond LiuNo ratings yet

- SQL Server add-on services overviewDocument3 pagesSQL Server add-on services overviewShilpa SulekhNo ratings yet

- Mysql Installation Path Apache Server DirectoryDocument2 pagesMysql Installation Path Apache Server DirectorySergey DemchukNo ratings yet

- Distributed Database DesignDocument22 pagesDistributed Database DesignAmit Vashisht100% (2)

- 3c Terraform TLS ProviderDocument4 pages3c Terraform TLS ProviderEyad ZaenNo ratings yet

- A3 LogicsDocument14 pagesA3 LogicsAayush GargNo ratings yet

- Computational ThinkingDocument1 pageComputational Thinkingapi-353376412No ratings yet

- Edyza Sensors For Indoor FarmingDocument35 pagesEdyza Sensors For Indoor FarmingranabasheerNo ratings yet

- DM 1106cognosinformix PDFDocument27 pagesDM 1106cognosinformix PDFphbnaiduNo ratings yet