Professional Documents

Culture Documents

General Provisions

Uploaded by

Buenavista Mae BautistaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

General Provisions

Uploaded by

Buenavista Mae BautistaCopyright:

Available Formats

Section 2 Arnold vs. Willits and Patterson 1916.

. The Firm Willits & Patterson in San Francisco entered into a contract with Arnold whereby Arnold was to be employed for a period of five years as the agent of the firm here in the PI to operate an oil mill for which he was to receive a minimum salary of $200/mth, a 1% brokerage fee from all purchases and sales of merchandise, and half of the profits of the oil business and other businesses. provided if the business was at a loss, Arnold would receive $400/mth. Later, Patterson retired and Willits acquired all interests of the business. Willits organized a new Corp in San Francisco which took over and acquired all assets of the Firm Willits & Patterson. Willits was the owner of all the capital stock. New corp had the same name. After, Willits, organized a new Corporation here in the PI to take over all the business and assets of the firm here in the PI. Willits was the owner of all the capital stock. Later, there was dispute with regard to the construction of the contract as a result, a new contract in the form of a letter was entered into. Willits signed this. The statements of account showed that 106K was due and owing to Arnold. W&P Corp was in financial trouble and all assets were turned over to a creditors committee. 1922. Arnold filed this complaint to recover 106K from W&P. W&P argues that the 2

nd

Although a new corp was created, the new corp dealt with and treated Arnold as its agent in the same manner as the previous corp had, thus the new corp is bound by the contract which the old firm made.

In fact, the 2

nd

contract protected Willits from a larger

claim, which the accountant said, would be over 160K. Where a stock of a corporation is owned by one person whereby the corp functions only for the benefit of such individual owner, the corp and the individual should be deemed to be the same. Thus the corp is bound by the contract.

Palacio vs. Fely Transportation Company Fely Company hired Carillo as a driver. Carillo run over Mario Palacio, son of Plaintiff. Mario Palacio suffered a fracture on his leg. Palacio filed this case to recover expenses that he allegedly incurred. In a previous case, the driver Carillo was found guilty of reckless imprudence and ordered to pay 500 in damages. A motion to dismiss was filed by Fely Corp on 1. No cause of action and 2. Cause is barred by prior judgment. The CFI dismissed the case and held htat the person subsidiarily liable is Isabel Calingasan, the employer. SC reverses. Calingasan and Fely Corp are subsidiary liable. Calingasan and Fely Corp are to be regarded as the same person. The purpose of the corp was to evade his subsidiary civil liability. And thus the corp should not be heard to

contract was signed without

say that it has a personality separate and distinct from its members when to allow it to do so would be to sanction the use of fiction of corporate entity as a shield to further an end subversive to justice. Guanzon vs. RD Five stockholders of Guanzon and Sons Inc., executed a certificate of liquidation of the assets of the Corp. RD denied registration of the certificate of liquidation. The Commissioner of Land Registration. The denial was based o a failure to pay doc stamps and reg fees.

authority. And as counterclaim alleged that Arnold took 30K from the Corp but only 19.1K was due to him thus he owed 10.1K to W&P. CFI ordered Arnold to return the 10.1K. SC reverses. Arnold entitled to 68K plus half of 75K, representing PNs. Both Corps organized by Willits were a One Man Corporation. After the 2

nd

contract was signed it was

recognized by Willits that Arnolds services were to be performed by its terms and there never was any dispute between Arnold and Willits.

Stockholders contend that the certificate of liquidation is not a conveyance or transfer of the assets but merely a distribution of the assets thus they should pay less for doc stamps.

Issue: case dismissed for non-joinder of Pamplona Plantation Leisure Corp? No. 1. For both the Coconut plantation and the golf course, there is just one management which the workers deal with. Weekly payrolls issued bore the name Pamplona Plantation Co. and they got their pay from Manager Bondoc.

SC affirms CLR. A corp is a juridical person distinct from the members composing it. Properties registered in its name are owned by it as an entity separate and distinct from its members.

Although the 2 corps are separate, this fiction cannot be invoked to further an end subversive of justice. The corp mask may be removed and veil pierced when: the corp is a mere alter ego, badges of fraud exist, public convenience is defeated, a wrong is sought to be justified, used to evade obligations.

Shares of stock do not represent property of the corp. A stock only typifies a right to share in the proceeds but its holder is not the owner of any part of the corp nor is he entitled to the possession of any definite portion of its property or assets. A stockholder is a coowner of corporate property.

The 2 corps have the same incorporators, directors, one office and one payroll, one management. Common Manager Bondoc. Thus the attempt to make the 2 corps distinct should be viewed as a means to defeat the law.

Thus, a liquidation is not partition of community property but rather a transfer or conveyance of the title of the assets to the stockholders.

Pamplona Plantation Corp vs. Tinghil 1993. Pamplona Plantations Company, Inc. was organized to take over the operations of Hacienda Pamplona. 1995. Pamplona Plantation Leisure Corp was established for the leisure and hotel business [golf course]. The Pamplona Plantation Labor Union conducted a meeting wherein several respondents were members or officers. Upon learning that some respondents attended the meeting, Manager Bondoc, did not allow anymore the respondents to work in the plantation. Respondents filed complaints with the NLRC for illegal dismissal, damages, overtime pay, damages, etc. The labor arbiter held respondents entitled to separation pay. The NLRC reversed the decision holding that respondents failed to implead Pamplona Leisure Corp as an indispensible party and that there exists no employee-employer relationship with Pamplona Plantations Company Inc. Except, Tinghil who amended his complaint in time. CA reversed and ordered the reinstatement and payment of backwages or if no longer feasible, separation pay plus backwages. SC affirms.

2. Non-joinder of indispensable parties is not a ground for dismissal. The remedy is to implead the indispensable party.

Lafarge Cement Inc. vs. Continental Cement Corp LCI and CCC entered into a sale and purchase agreement whereby LCI agreed to purchase the cement business of CCC well aware of a pending case of CCC with the SC against Asset Privatization Trust. Under 2C of the contract, LCI was to deposit 117M with CityBank in anticipation of liability the SC may adjudge in favor of APT. LCI refused to apply the sum in payment to APT. Fearing foreclosure, CCC filed a complaint against LCI for the payment of the 117M, APT Retained Amount. LCI filed a motion to dismiss. RTC denied. LCI filed their answer and counterclaims against CCC, majority stockholder Lim and Sec Mariano alleging a baseless complaint and procuring a writ of attachment in bad faith. Only CCC moved to dismiss the counterclaims and RTC dismissed all. SC reverses. 1. Based on the Sagupay Ruling, The prerogative of bringing in new parties to an action is intended to

accord complete relief to all parties and to avert a duplicity and multiplicity of suits. CCC argues that Lim and Mariano need not be impleaded because CCC has juridical capacity to indemnify LCI even without Lim and Mariano. The inclusion of stockholders and corporate officer is based on fraud and bad faith and the veil of corporate fiction may be pierced so that they may be held individually and personally liable. Corporate fiction may be disregarded if used to defeat public convenience, protect fraud, justifiy a wrong or defend crime. 2. CCCs motion to dismiss on behalf of Lim and Mariano is not allowed for lack of authority. The Corp cannot act for its officers and stockholders without being so authorized. Jardine Davies Inc. vs. JRB Realty Inc. JRB Realty built a 9-storey building named, Blanco Center. The Blanco Law Firm needed aircon so JRBs Exec VP purchased 2 10-tonner air conditioners from Morrison, President of Aircon Inc. worth 99K. However, the desired temperature was not reached. Thus JRB and Aircon Inc agreed that the units would be replaced with the new semi-hermitic type instead of the rotary ones. Considering the 10-year period of prescription was approaching, JRB filed an action for specific performance against Aircon Inc., Fedders Aircon USA, Maxim Corp, and Jardine Davies Inc. Jardine Davies was impleaded because Aircon was a subsidiary of it. Aircon Inc. ceased its operations. Fedders USA and Maxim Corp were declared in default. The RTC ordered Jardine Davies, Fedders and Maxim to jointly and severally to deliver the new aircon units and pay 556K for unsaved electricity bills. CA affirmed SC reverses. complaint dismissed. The RTC and CA pierced the corporate veil and held Jardine Inc. liable considering Aircon Inc was its instrumentality or Alter Ego. Jardine Davies Inc. reiterates its defense of separateness and in fact is not a party to the contract.

While it is true that Aircon is a Subsidiary of Jardine Inc., it does not necessarily follow that Aircons separate legal existence can just be disregarded.

A subsidiary has an independent and separate juridical personality distinct from its parent company, hence any claim against one does not bind the other.

To treat them the same, the following requisites must be established: o o Control, not merely majority or complete stock control Control was used to commit fraud or violate a legal duty or dishonest acts in contravention of plaintiffs rights o Control and breach of duty must proximately cause the injury or loss complained of.

Jardine does not exercise complete control over Aircon. Jardine Inc is a financial and trading company and Aircon is a manufacturing company.

To warrant the resort to the extraordinary remedy of piercing the corporate veil, there must be proof that the corp is used as a cloak for fraud or illegality or to work injustice.

Here, there was nothing fraudulent about the acts of Aircon Inc. and that it was established to defraud creditors or evade its obligations.

After enjoying 10 years of cooling from the serviceable aircons, JRB cannot now complain about the performance of these units, nor can it demand the replacement thereof.

Section 3 CIR vs. Club Filipino Inc., Cebu CIR assessed and demanded from the Club 12K for percentage tax on its gross receipts and other charges and penalties allegedly due as a keeper of bar and resto. The Club wrote the CIR requesting for cancellation of the assessment. The CTA reversed the CIR. SC affirms. 1. For tax liability to attach, the operator of the bar and resto must be engaged in the business as a barkeeper and restaurateur. Business activities where profit is the purpose The club derived profit from the bar and resto, but such are merely necessary adjuncts of the Club. That

a club makes some profit does not make it a profitmaking club. The club is not engaged in the business as barkeeper and restaurateur. 2. For a stock corp to exist: o o a capital stock divided into shares an authority to distribute to the holders of such shares, dividends or allotments of the suplus profits on the basis of the shares held. Nowhere in the articles of incorporation or by-laws could be found an authority for the distribution of dividends. Thus it cant be considered a stock corp. A tax is a burden, it should not be deemed imposed upon fraternal, civic, non-profit, non-stock organizations unless the intent to the contrary is manifest and patent, which is not the case here. Section 4 Gonzales vs. PNB Gonzales as taxpayer and stockholder of PNB filed a complaint for mandamus against PNB praying that he be allowed to look into the books of PNB to satisfy himself as to the truth of reports that PNB has guaranteed the obligation of Southern Negros Dec Corp for the purchase of $23M sugar-mill, financing a P21M Ceb-Mactan bridge, construction of a Sugar Mill in Iloilo. PNB earlier denied his request to inspect its books The CFI dismissed the petition. SC affirms. 1. Inspection of the books must be in good faith and for a legitimate purpose. Although Gonzales claims he has justifiable motives, he has not set for the reasons and purpose for which he desires such inspection, except as to satisfy himself of the truth. 2. The inspection cannot be exercised because its violative of the charter of PNB, under Sec 15 and 16. And since the PNB is not an ordinary corporation, having a charter of its own, it is not governed by the Corporation Code. Sec 74 of the Corp Code which grants the right of inspection of the books cannot be reconciled with the provisions of the charter of PNB. The provisions of the Corp code are only supplementary insofar as they are applicable. Section 5 Sunset View Condo Corp vs. Campos Sunset Corp filed 2 collection cases for 10K and 6K against respondents who are assignees of 2 condo units under a contract to buy and sell. Both were dismissed by the CFI and are consolidated in this case. SC reverses and remands for trial. Both respondents have not fully paid the purchase price of their units. Respondents argue that they are shareholders of the condo corp and thus the issue should be vented out in the SEC. wrong. Under the contracts to sell, conveyance shall be made only upon full payment of the purchase price and at which time he will also become the owner of a unit. Only owners of units can be members of the Condo Corp under the Condo Act. Under sec 10, membership in the Condo Corp cannot be transferred separately from the unit of which it is an appurtenance Thus, since respondents are not owners of the units, thus not shareholders of the condo corp, the instant cases for collection are under jurisdiction of the regular courts and not the SEC Section 6 Castillo vs. Balinghasay Medical Center Pque, Inc was organized in 1977 with 2 classes of Stock, A and B. Petitioners hold Class B and respondents Class A. under the 1992 amended Articles of Incorporation of MCPI, only holders of Class A shares have the right to vote and the right to be elected as directors or corporate officers. During the annual stockholders meeting and election for directors, Respondent Jimenez cited Article 7 of the Articles of Inc went on to announce that the candidates holding Class A shares were the winners of all seats in the Board. Petitioners, Class B, filed for injunction, accounting and damages. Petitioners argued that Art 7 was void for being contrary to the Corp Code.

RTC rendered a Partial Judgment declaring Art 7 valid as Class B are not entitled to vote and be voted. SC reverses. Issue: may Class B be deprived of the right to vote and be voted for? No. 1. Under Sec 6, no share may be deprived of voting rights except preferred or redeemable share, unless otherwise provided in this code and there shall always be a class or series of shares which have complete voting rights.

Thus unless Class B share are categorized as preferred or redeemable share, holders of Class B may not be deprived of voting rights

The right to vote is inherent and incidental to ownership of stock and as such is a property right. It may not be deprived or impaired through amendment of the Articles or by-laws without his consent.

2. When the articles were amended in 1992, the board must have been aware of sec 6 which is the reason for the insertion of the clause except when otherwise provided by law, this was to harmonize art 7 with the law.

You might also like

- Risk CabreraDocument54 pagesRisk CabreraJohn Rey Enriquez100% (2)

- TRADING COURSE'sDocument51 pagesTRADING COURSE'sDHAVAL40% (5)

- Company Law Case LawsDocument12 pagesCompany Law Case LawsAayushNo ratings yet

- Piercing Corporate Veil in Labor CasesDocument602 pagesPiercing Corporate Veil in Labor CasesMhayBinuyaJuanzonNo ratings yet

- Project Report On Merger of BanksDocument118 pagesProject Report On Merger of Banksbirendra100% (1)

- DaveLandrys10Best Swing Trading Patterns and StratigiesDocument191 pagesDaveLandrys10Best Swing Trading Patterns and Stratigiesvenkatakrishna1nukal100% (7)

- Piercing Corporate Veil to Recover Ill-Gotten WealthDocument8 pagesPiercing Corporate Veil to Recover Ill-Gotten WealthÝel ÄcedilloNo ratings yet

- State V Standard OilDocument17 pagesState V Standard OilAngelo BasaNo ratings yet

- Rufina Lim Vs Court of AppealsDocument3 pagesRufina Lim Vs Court of AppealslegardenathanNo ratings yet

- Corporate Veil Piercing in Tax Evasion CasesDocument2 pagesCorporate Veil Piercing in Tax Evasion CasesJune RudiniNo ratings yet

- Case Digest in Corporation Law - Melchor, Maryjoy P.Document96 pagesCase Digest in Corporation Law - Melchor, Maryjoy P.Maryjoy MelchorNo ratings yet

- PNB vs. Andrada Dispute Over Corporate Liability <40Document66 pagesPNB vs. Andrada Dispute Over Corporate Liability <40Ray LegaspiNo ratings yet

- Study Guide - Corpo Law - Separate Judicial EntityDocument8 pagesStudy Guide - Corpo Law - Separate Judicial EntityJesselei MamadaNo ratings yet

- Separate Legal EntityDocument18 pagesSeparate Legal EntityJagdesh SinghNo ratings yet

- Mambulao Lumber Company VsDocument8 pagesMambulao Lumber Company VshansNo ratings yet

- 7.) Pioneer Insurance Vs Court of Appeals - DigestDocument11 pages7.) Pioneer Insurance Vs Court of Appeals - DigestSylvia SecuyaNo ratings yet

- Philippine Associated Smelting and Refining Corp. Vs Pablito LimDocument6 pagesPhilippine Associated Smelting and Refining Corp. Vs Pablito LimOlan Dave LachicaNo ratings yet

- Important Caselaws On Company LawDocument15 pagesImportant Caselaws On Company LawMohit Prasad100% (2)

- Mambulao Lumber Company Vs .January 30, 1968 Norte RiffDocument8 pagesMambulao Lumber Company Vs .January 30, 1968 Norte RiffhansNo ratings yet

- Mambulao Lumber Company vs Philippine National Bank dispute over loan collateralDocument8 pagesMambulao Lumber Company vs Philippine National Bank dispute over loan collateralhansNo ratings yet

- Mambulao Lumber Company vs Philippine National BankDocument8 pagesMambulao Lumber Company vs Philippine National BankhansNo ratings yet

- Mambulao Lumber Company VsDocument8 pagesMambulao Lumber Company VshansNo ratings yet

- Mambulao Lumber Company Vs .January 30, 1968 NorteDocument8 pagesMambulao Lumber Company Vs .January 30, 1968 NortehansNo ratings yet

- PNB prevails in piercing corporate veil caseDocument8 pagesPNB prevails in piercing corporate veil casehansNo ratings yet

- Mambulao Lumber Company Vs .January 30, 1968 NorteDocument8 pagesMambulao Lumber Company Vs .January 30, 1968 NortehansNo ratings yet

- Mambulao Lumber Company Vs - of Tioned El of Land, PhilippineDocument8 pagesMambulao Lumber Company Vs - of Tioned El of Land, PhilippinehansNo ratings yet

- Mambulao Lumber Company Vs .January 30, 1968Document8 pagesMambulao Lumber Company Vs .January 30, 1968hansNo ratings yet

- G.R. No. 151438 July 15, 2005 Jardine Davis Inc. Vs JRB RealtyDocument3 pagesG.R. No. 151438 July 15, 2005 Jardine Davis Inc. Vs JRB RealtyEugene Albert Olarte JavillonarNo ratings yet

- Court upholds separate legal personalities of corporationsDocument8 pagesCourt upholds separate legal personalities of corporationshansNo ratings yet

- Mambulao Lumber Company Vs - NorteDocument8 pagesMambulao Lumber Company Vs - NortehansNo ratings yet

- PNB and Corporate Veil PiercingDocument8 pagesPNB and Corporate Veil PiercinghansNo ratings yet

- Mambulao Lumber Company Vs .January 30, 1968 NorteDocument8 pagesMambulao Lumber Company Vs .January 30, 1968 NortehansNo ratings yet

- Mambulao Lumber Company VsDocument8 pagesMambulao Lumber Company VshansNo ratings yet

- Corporation Law Case DigestDocument6 pagesCorporation Law Case DigestMilcah Mae PascualNo ratings yet

- Mambulao Lumber Company vs Philippine National BankDocument8 pagesMambulao Lumber Company vs Philippine National BankhansNo ratings yet

- Important Caselaws On Company LawDocument15 pagesImportant Caselaws On Company Lawshaurya JainNo ratings yet

- Mambulao Lumber Company Vs - FACTS: January 30, 1968 RiffDocument8 pagesMambulao Lumber Company Vs - FACTS: January 30, 1968 RiffhansNo ratings yet

- Agent Authority DisputeDocument13 pagesAgent Authority DisputeMary.Rose RosalesNo ratings yet

- Mambulao Lumber Company Vs - Norte Provincial Upon The Buildin Af FACTS: January 30, 1968Document8 pagesMambulao Lumber Company Vs - Norte Provincial Upon The Buildin Af FACTS: January 30, 1968hansNo ratings yet

- Case DigestDocument7 pagesCase DigestYolanda Janice Sayan FalingaoNo ratings yet

- Corpo Digest PollyDocument24 pagesCorpo Digest PollyPaul Christopher PinedaNo ratings yet

- Mambulao Lumber Company VsDocument8 pagesMambulao Lumber Company VshansNo ratings yet

- Corporatelaw CaselawsDocument8 pagesCorporatelaw Caselawslekha1997No ratings yet

- Mambulao Lumber Company Vs .January 30, 1968Document7 pagesMambulao Lumber Company Vs .January 30, 1968hansNo ratings yet

- Liddell & Co., vs. CIRDocument9 pagesLiddell & Co., vs. CIRCedric CruzNo ratings yet

- Case Digests - Partnership, Agency and TrustsDocument14 pagesCase Digests - Partnership, Agency and TrustslarrybirdyNo ratings yet

- Dominion Insurance Corp. V. Court of Appeals FactsDocument7 pagesDominion Insurance Corp. V. Court of Appeals FactsweygandtNo ratings yet

- 005-Pioneer Insurance v. CADocument3 pages005-Pioneer Insurance v. CAArnold Rosario ManzanoNo ratings yet

- FILIPINAS PORT SERVICES INC VDocument14 pagesFILIPINAS PORT SERVICES INC VChristopher GuevarraNo ratings yet

- Conjugal Partnership of GainsDocument9 pagesConjugal Partnership of Gainsroseil shane tanilonNo ratings yet

- Mambulao Lumber Company Vs .January 30, 1968Document7 pagesMambulao Lumber Company Vs .January 30, 1968hansNo ratings yet

- Mambulao Lumber Company Vs .January 30, 1968Document7 pagesMambulao Lumber Company Vs .January 30, 1968hansNo ratings yet

- Corpo Digested IncompleteDocument28 pagesCorpo Digested IncompleteERWINLAV2000No ratings yet

- Commercial Law FinalDocument7 pagesCommercial Law FinalED RCNo ratings yet

- DBP v. NLRC prioritizes equitable distribution over workers' preferenceDocument7 pagesDBP v. NLRC prioritizes equitable distribution over workers' preferenceJason ToddNo ratings yet

- Mambulao Lumber Company Vs .January 30, 1968Document7 pagesMambulao Lumber Company Vs .January 30, 1968hansNo ratings yet

- Lim vs. CaDocument2 pagesLim vs. CaaquinojanelynNo ratings yet

- Corporation Law Digests (Sec1 - 10) UPDATED 112912Document95 pagesCorporation Law Digests (Sec1 - 10) UPDATED 112912Paul Angelo TombocNo ratings yet

- DigestcivDocument6 pagesDigestcivKamille Villalobos100% (1)

- CPG Fc121,122 - Ayala v. CADocument1 pageCPG Fc121,122 - Ayala v. CATrinNo ratings yet

- Good Earth Emporium Vs CA G.R. No. 82797 February 27, 1991 Paras, J.: DoctrineDocument7 pagesGood Earth Emporium Vs CA G.R. No. 82797 February 27, 1991 Paras, J.: DoctrineLyssa TabbuNo ratings yet

- Key Philippine Corporate Law Cases ExplainedDocument7 pagesKey Philippine Corporate Law Cases ExplainedPJ HongNo ratings yet

- Piercing Corporate Veil Doctrine AppliedDocument1 pagePiercing Corporate Veil Doctrine AppliedNei BacayNo ratings yet

- PH Ruling on Forcible Abduction with RapeDocument9 pagesPH Ruling on Forcible Abduction with RapeBuenavista Mae BautistaNo ratings yet

- CivDocument2 pagesCivBuenavista Mae BautistaNo ratings yet

- De Castro-Legal EthicsDocument17 pagesDe Castro-Legal EthicsMaricelBaguinonOchate-NaragaNo ratings yet

- Para Sa Short and Sweet Calls: 15 Centavos Per Second To USA, UK, Canada, Australia, China, Hawaii, Hong Kong, MalaysiaDocument1 pagePara Sa Short and Sweet Calls: 15 Centavos Per Second To USA, UK, Canada, Australia, China, Hawaii, Hong Kong, MalaysiaBuenavista Mae BautistaNo ratings yet

- Crim Part 2Document20 pagesCrim Part 2Buenavista Mae BautistaNo ratings yet

- Delisting of CompanyDocument3 pagesDelisting of CompanyBuenavista Mae BautistaNo ratings yet

- E6 ApplicationformDocument2 pagesE6 ApplicationformBuenavista Mae BautistaNo ratings yet

- AbellaDocument21 pagesAbellaBuenavista Mae BautistaNo ratings yet

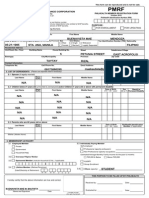

- Philhealth FormDocument2 pagesPhilhealth FormBuenavista Mae BautistaNo ratings yet

- Treasurer's AffidavitDocument1 pageTreasurer's AffidavitMelis BironNo ratings yet

- Inventory Request of Supplies: Person-In-Charge ForDocument1 pageInventory Request of Supplies: Person-In-Charge ForBuenavista Mae BautistaNo ratings yet

- Unlawful Detainer & Forcible Entry Case RulesDocument16 pagesUnlawful Detainer & Forcible Entry Case RulesBuenavista Mae Bautista100% (1)

- White Chocolate Cookie Dough FudgeDocument4 pagesWhite Chocolate Cookie Dough FudgeBuenavista Mae BautistaNo ratings yet

- Parañaque and Pasig City Regional Trial Courts Contact GuideDocument4 pagesParañaque and Pasig City Regional Trial Courts Contact GuideBuenavista Mae Bautista0% (1)

- Template Judicial AffidavitDocument7 pagesTemplate Judicial AffidavitBuenavista Mae Bautista100% (1)

- Maurice Nicoll The Mark PDFDocument4 pagesMaurice Nicoll The Mark PDFErwin KroonNo ratings yet

- Phil PottsDocument1 pagePhil PottsBuenavista Mae BautistaNo ratings yet

- 2.63 - Bautista, BMMDocument2 pages2.63 - Bautista, BMMBuenavista Mae BautistaNo ratings yet

- Baking LifDocument7 pagesBaking LifBuenavista Mae BautistaNo ratings yet

- CANON 3 Section 5Document14 pagesCANON 3 Section 5Buenavista Mae BautistaNo ratings yet

- PDF Expert GuideDocument25 pagesPDF Expert GuideBuenavista Mae BautistaNo ratings yet

- Ordinance 0524Document3 pagesOrdinance 0524Buenavista Mae BautistaNo ratings yet

- PDF Expert GuideDocument25 pagesPDF Expert GuideBuenavista Mae BautistaNo ratings yet

- Baking LifDocument7 pagesBaking LifBuenavista Mae BautistaNo ratings yet

- Affidavit of OwnershipDocument1 pageAffidavit of OwnershipBuenavista Mae BautistaNo ratings yet

- HS Admission Application FormDocument4 pagesHS Admission Application FormBuenavista Mae BautistaNo ratings yet

- October 31, 2012Document1 pageOctober 31, 2012Buenavista Mae BautistaNo ratings yet

- PDF Expert Guide PDFDocument31 pagesPDF Expert Guide PDFBuenavista Mae BautistaNo ratings yet

- AOI Template SECDocument15 pagesAOI Template SECEdison Flores0% (1)

- Malacanang HistoryDocument4 pagesMalacanang HistoryBuenavista Mae BautistaNo ratings yet

- CPA 8 - Financial Management - Paper 8 SolutionsDocument15 pagesCPA 8 - Financial Management - Paper 8 SolutionsjustinorchidsNo ratings yet

- GMAT111 Week 11 19 1Document9 pagesGMAT111 Week 11 19 1Aehra Josh PascualNo ratings yet

- Problems Stocks ValuationDocument3 pagesProblems Stocks Valuationmimi96No ratings yet

- Sources of Financial InformationDocument13 pagesSources of Financial InformationSanjit SinhaNo ratings yet

- Determinants of Financial StructureDocument15 pagesDeterminants of Financial StructureAlexander DeckerNo ratings yet

- Gann Square of 9 - Introduction Gann Square of 9 - IntroductionDocument13 pagesGann Square of 9 - Introduction Gann Square of 9 - IntroductionDummy User100% (2)

- JF - India 31 01 07 PDFDocument3 pagesJF - India 31 01 07 PDFstavros7No ratings yet

- DDMPR Q1 2021 Quarterly ReportDocument36 pagesDDMPR Q1 2021 Quarterly ReportChristian John RojoNo ratings yet

- Credit monitoring: key part of credit managementDocument15 pagesCredit monitoring: key part of credit managementSyam Sandeep67% (3)

- NJMSR Super Final DraftDocument105 pagesNJMSR Super Final DraftHồng QuyênNo ratings yet

- Material Cost PDFDocument45 pagesMaterial Cost PDFtnchsg0% (2)

- Original Work ProposalDocument2 pagesOriginal Work Proposalapi-483723493No ratings yet

- SME Bank employees illegally dismissed after change in ownershipDocument3 pagesSME Bank employees illegally dismissed after change in ownershipJerickson A. ReyesNo ratings yet

- Concepts of Company LawDocument15 pagesConcepts of Company Lawkuashask2No ratings yet

- 8553Document6 pages8553AbdullahNo ratings yet

- Fundamental Equity Analysis & Analyst Recommendations - S&P ASIA 50 Index ComponentsDocument103 pagesFundamental Equity Analysis & Analyst Recommendations - S&P ASIA 50 Index ComponentsQ.M.S Advisors LLCNo ratings yet

- Comparing Mutual Funds and ULIPsDocument44 pagesComparing Mutual Funds and ULIPsKrishna Prasad GaddeNo ratings yet

- BIR FORM 2307 SampleDocument6 pagesBIR FORM 2307 SampleEasyHear Philippines by NuGen Hearing Devices, Inc.No ratings yet

- 4201 SyllabusDocument5 pages4201 Syllabuszahir2020No ratings yet

- Sanoifi Aventis 2010 Annual ReportDocument80 pagesSanoifi Aventis 2010 Annual Reportsajay_suryaNo ratings yet

- Working Capital Management StudyDocument80 pagesWorking Capital Management Studydurga prasadNo ratings yet

- Coco Bonds ThesisDocument6 pagesCoco Bonds Thesispuzinasymyf3100% (2)

- Railroad Tycoon II - Platinum - Manual - PCDocument92 pagesRailroad Tycoon II - Platinum - Manual - PCtalentlessclodNo ratings yet

- Financial Management Multiple Choice QuestionsDocument22 pagesFinancial Management Multiple Choice QuestionsDiqra Laziz100% (1)

- 9.1 Overview of The Cost of CapitalDocument21 pages9.1 Overview of The Cost of CapitalTawan VihokratanaNo ratings yet

- The Professional Ticker Reader ®Document6 pagesThe Professional Ticker Reader ®11lkNo ratings yet