Professional Documents

Culture Documents

Terjemahan Buku Jhonny Rotten: No Irish No Blacks, No Dogs

Uploaded by

Muhammad Irfan ArdiansyahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Terjemahan Buku Jhonny Rotten: No Irish No Blacks, No Dogs

Uploaded by

Muhammad Irfan ArdiansyahCopyright:

Available Formats

THE MINISTER OF FINANCE OF THE REPUBLIC OF INDONESIA COPY REGULATION OF THE MINISTER OF FINANCE OF THE REPUBLIC OF INDONESIA NUMBER

6/PMK.02/2013 CONCERNING DEPOSITING PROCEDURES FOR NON-TAX STATE REVENUES FROM BANK INDONESIA SURPLUS OF GOVERNMENTS SHARE BY THE GRACE OF GOD ALMIGHTY THE MINISTER OF FINANCE OF THE REPUBLIC OF INDONESIA, Considering : a. that in order to enhance the regulation of depositing the Non-Tax State Revenues to be more clear, efficient, transparent, accountable, and comprehensive, it is necessary to re-adjust the depositing procedures for Non-Tax State Revenue from Bank Indonesia Surplus of Governments Share previously regulated under Regulation of the Minister of Finance Number 34/PMK.02/2010; b. That based on the considerations referred to in paragraph a, it is necessary to stipulate Regulation of the Minister of Finance on Depositing Procedures for Non-Tax State Revenues From Bank Indonesia Surplus of Governments Share; 1. Law Number 20 Year 1997 concerning Non-Tax State Revenues (State Gazette of the Republic of Indonesia Year 1997 Number 43, Supplement to State Gazette of the Republic of Indonesia Number 3687); 2. Law number 23 Year 1999 concerning Bank Indonesia (State Gazette of the Republic of Indonesia Year 1999 Number 66, Supplement to State Gazette of the Republic of Indonesia Number 3843) as last amended by Law Number 6 of 2009 (State Gazette of the Republic of Indonesia Year 2009 Number 7); 3. Law Number 17 Year 2003 concerning State Finance (State Gazette of the Republic of

In View of

Indonesia Year 2003 Number 47, Supplement to the State Gazette of the Republic of Indonesia Number 4286); 4. Law Number 1 Year 2004 concerning State Treasury (State Gazette of the Republic of Indonesia Year 2004 Number 5, Supplement to the State Gazette of the Republic of Indonesia Number 4355); 5. Government Regulation Number 22 Year 1997 concerning Types and Depositing of Non-Tax State Revenues (State Gazette of the Republic of Indonesia Year 1997 Number 57, Supplement to State Gazette of the Republic of Indonesia Number 5075); 6. Government Regulation Number 29 Year 2009 concerning Procedures for Determining Amount, Payment, and Depositing of Non-Tax State Revenues Payable (State Gazette of the Republic of Indonesia Year 2009 Number 58, Supplement to State Gazette of the Republic of Indonesia Number 4995); HAS DECIDED To Stipulate : REGULATION OF THE MINISTER OF FINANCE CONCERNING DEPOSITING PROCEDURES FOR NONTAX STATE REVENUES FROM BANK INDONESIA SURPLUS OF GOVERNMENTS SHARE Article 1 In this Ministerial Regulation, hereinafter referred to as: 1. Bank Indonesia is the Central Bank of The Republic of Indonesia. 2. Bank Indonesia is a legal entity pursuant to Law Number 23 Year 1999 concerning Bank Indonesia, as last amended by Law Number 6 Year 2009. 3. Bank Indonesia Surplus of Governments Share is Bank Indonesia Surplus net of Purpose Reserves 30%, and Public Reserves thus Capital and Public Reserves become 10% of all monetary obligations. Article 2 (1) Bank Indonesia pays Bank Indonesia Surplus of Governments Share by no later than the due date. (2) Due date payments for Bank Indonesia Surplus of Government s Share referred to in paragraph (1), that is seven (7) working days after Bank Indonesia received Letter of The Minister of Finance regarding the amount of Bank Indonesia Surplus which intended for Government Share, in accordance with Mutual Agreement between Government and Bank Indonesia.

Article 3 (1) Bank Indonesia depositing the entire Bank Indonesia Surplus of Governments Share to the State Public Treasury Account number 502.000000980 in Bank Indonesia in currency of rupiah. (2) Payments made by Bank Indonesia as a liability repayment pursuant to the date of payment. Article 4 (1) In the event of delays and / or lack of payments of Bank Indonesia Surplus of Governments Share referred to in Article 2, subject to administrative sanctions in form of fines of 2% (two percent) per month from the amount of Bank Indonesia Surplus of Governments Share which is delayed and / or poorly paid and part of the month shall be counted as 1 (one) full month. (2) Bank Indonesia depositing the entire payment deficiency and / or delayed fees referred to in paragraph (1) to the State Public Treasury Account as referred to in Article 3. (3) Administrative sanctions in form of fines referred to in paragraph (1) shall be imposed for a maximum of 24 (twenty four) months. Article 5 Bank Indonesia submits proof of payment as referred to in Article 3 to the Minister of Finance c.q. Director General of Budgeting by no later than 7 (seven) working days after the date of deposit. Article 6 (1) Director General of Budgeting administer collections to Bank Indonesia for delays and / or lack of payments of Bank Indonesia Surplus of Governments Share as referred to in Article 4, by issuing First Collection Letter. (2) If within a period of 1 (one) month from the date of First Collection Letter as referred to in paragraph (1) has accepted and Bank Indonesia has not or is not meeting their obligations, the Director General of Budgeting issued a Second Collection Letter. (3) If within a period of 1 (one) month from the date of Second Collection Letter as referred to in paragraph (2) has accepted and Bank Indonesia has not or is not meeting their obligations, the Director General of Budgeting issued a Third Collection Letter. (4) If within a period of 1 (one) month from the date of Third Collection Letter as referred to in paragraph (3) has accepted and Bank Indonesia has not or is not meeting their obligations, the Director General of

Budgeting issued a Collection Delivery Letter to the competent authorities for taking care of the State Receivables in order for the completion to be processed further. Article 7 (1) In the event of excess deposit or payment of Bank Indonesia Surplus of Governments Share that caused by miscalculations or errors deposits, Bank Indonesia may apply for the refund of the overpayment to the Minister of Finance c.q. Director General of Budgeting. (2) Director General of Budgeting on behalf of the Minister of Finance will approve or disapprove the application from Bank Indonesia as referred to in paragraph (1) in writing. (3) In the event of application for refunding excess payment referred to in sub-article (2) is approved, the excess payment shall be treated as advance payment for the amount of Bank Indonesia Surplus of Governments Share payable in subsequent periods. Article 8 At the time this Ministerial Regulation applies, the provisions on the procedure for depositing Non-Tax State Revenues from Bank Indonesia Surplus as stipulated in the Regulation of the Minister of Finance Number 34/PMK.02/2010 on Procedures for Depositing of Non-Tax State Revenues From Dividends and Remaining Surplus of Bank Indonesia, revoked and declared void. Article 9 This Ministerial Regulation shall come into force as of its stipulation date. For public cognizance, it is ordered to promulgate this Ministerial Regulation by announcing it in the Official Gazette of the Republic of Indonesia. Stipulated in Jakarta On January 2, 2013 THE MINISTER OF FINANCE OF THE REPUBLIC OF INDONESIA, Signed AGUS DW MARTOWARDOJO Enacted in Jakarta On January 2, 2013 THE MINISTER OF JUSTICE AND HUMAN RIGHTS OF THE REPUBLIC OF INDONESIA,

Signed AMIR SYAMSUDIN OFFICIAL GAZETTE OF THE REPUBLIC OF INDONESIA YEAR 2013 NUMBER 9

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Chapter 1 Accounting For Business Combinations SolmanDocument10 pagesChapter 1 Accounting For Business Combinations SolmanKhen FajardoNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Bank Officer's Handbook of Commercial Banking Law 5thDocument363 pagesBank Officer's Handbook of Commercial Banking Law 5thCody Morgan100% (5)

- Iec60364 PDFDocument105 pagesIec60364 PDFMircea Murar60% (5)

- Chapter 5: Newton's Laws of Motion.Document26 pagesChapter 5: Newton's Laws of Motion.Sadiel Perez100% (2)

- Splunk-Certification-Handbook-v 8 31 2018Document30 pagesSplunk-Certification-Handbook-v 8 31 2018Devang VohraNo ratings yet

- False Colour Room Rendering Office Typical FloorDocument1 pageFalse Colour Room Rendering Office Typical FloorMuhammad Irfan ArdiansyahNo ratings yet

- Flow Chart Kuliah PendidikanDocument2 pagesFlow Chart Kuliah PendidikanMuhammad Irfan ArdiansyahNo ratings yet

- Agenda Ramadhan 2017Document2 pagesAgenda Ramadhan 2017Muhammad Irfan ArdiansyahNo ratings yet

- IESLuxLevel 1Document12 pagesIESLuxLevel 1tr_nisitNo ratings yet

- 01.4TB.047 X-R RatioDocument1 page01.4TB.047 X-R RatioMuhammad Irfan ArdiansyahNo ratings yet

- Struktur Arus Hubung SingkatDocument3 pagesStruktur Arus Hubung SingkatMuhammad Irfan ArdiansyahNo ratings yet

- Typical Office Floor (Lighting Simulation)Document27 pagesTypical Office Floor (Lighting Simulation)Muhammad Irfan ArdiansyahNo ratings yet

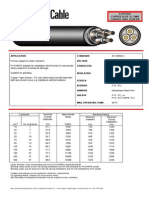

- Kabelindo NYFGBY CableDocument9 pagesKabelindo NYFGBY Cableben_splNo ratings yet

- Transformer Tapchanging Under Load: A Review of Concepts and StandardsDocument24 pagesTransformer Tapchanging Under Load: A Review of Concepts and StandardsbansalrNo ratings yet

- Calculate demand factor and diversity factor for machine shop loadsDocument9 pagesCalculate demand factor and diversity factor for machine shop loadssoumenb2bNo ratings yet

- 18 44 48Document5 pages18 44 48Muhammad Irfan ArdiansyahNo ratings yet

- #1. Main Carrier Oil TheoryDocument10 pages#1. Main Carrier Oil TheoryMuhammad Irfan ArdiansyahNo ratings yet

- How to Calculate Short Circuits Using the Point-to-Point MethodDocument9 pagesHow to Calculate Short Circuits Using the Point-to-Point MethodMuhammad Irfan Ardiansyah100% (1)

- Short Circuit Calculation GuideDocument5 pagesShort Circuit Calculation Guideashok203No ratings yet

- Lecture1-Review of Power System Networks, Complex Power, and Per UnitsDocument29 pagesLecture1-Review of Power System Networks, Complex Power, and Per Unitsleo232No ratings yet

- Fault Analysis & OCRDocument8 pagesFault Analysis & OCRMuhammad Irfan ArdiansyahNo ratings yet

- Mamdani FIS (Fuzzy Inference Systems) ExplainedDocument7 pagesMamdani FIS (Fuzzy Inference Systems) ExplainedMuhammad Irfan ArdiansyahNo ratings yet

- Overcurrent and Ground Fault ProtectionDocument7 pagesOvercurrent and Ground Fault Protectiondeepthik27No ratings yet

- Coordinating Ground Fault Protection With Phase Overcurrent ProtectionDocument7 pagesCoordinating Ground Fault Protection With Phase Overcurrent Protectionhalel111No ratings yet

- 3C Cu 11kV CTS SWADocument2 pages3C Cu 11kV CTS SWAMuhammad Irfan ArdiansyahNo ratings yet

- Ground Fault Protection Isolated NeutralDocument18 pagesGround Fault Protection Isolated NeutralbajricaNo ratings yet

- Point To Point Method Short Circuit Current CalculationDocument7 pagesPoint To Point Method Short Circuit Current CalculationMuhammad Irfan ArdiansyahNo ratings yet

- Analisis Koordinasi Over Current Relay Dan Recloser Di Sistem Proteksi FeederDocument10 pagesAnalisis Koordinasi Over Current Relay Dan Recloser Di Sistem Proteksi FeederMuhammad Irfan ArdiansyahNo ratings yet

- Current TransformersDocument30 pagesCurrent TransformersMuhammad Irfan ArdiansyahNo ratings yet

- Jam Disiplin 098 2Document2 pagesJam Disiplin 098 2Muhammad Irfan ArdiansyahNo ratings yet

- Tugas Bahasa InggrisDocument3 pagesTugas Bahasa InggrisMuhammad Irfan ArdiansyahNo ratings yet

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- GST Registration CertificateDocument3 pagesGST Registration CertificateChujja ChuNo ratings yet

- Civil Appeal 14 of 2015Document21 pagesCivil Appeal 14 of 2015JamesNo ratings yet

- Expert committee review engineering projectsDocument4 pagesExpert committee review engineering projectsSyed AhmedNo ratings yet

- DeclarationDocument6 pagesDeclarationzdvdfvsdvsNo ratings yet

- Duterte's 1st 100 Days: Drug War, Turning from US to ChinaDocument2 pagesDuterte's 1st 100 Days: Drug War, Turning from US to ChinaALISON RANIELLE MARCONo ratings yet

- Freight RatesDocument16 pagesFreight RatesnishulalwaniNo ratings yet

- MC 09-09-2003Document5 pagesMC 09-09-2003Francis Nicole V. QuirozNo ratings yet

- Balkanika - 27 (1996) - 117Document39 pagesBalkanika - 27 (1996) - 117skeniranaNo ratings yet

- Fourth Grade-Social Studies (Ss4 - 4)Document7 pagesFourth Grade-Social Studies (Ss4 - 4)MauMau4No ratings yet

- Haripriya SoniDocument1 pageHaripriya SoniKamlesh PrajapatiNo ratings yet

- Florida Bar Complaint Strip Club Owner V Miami Beach CommissionerDocument56 pagesFlorida Bar Complaint Strip Club Owner V Miami Beach CommissionerDavid Arthur WaltersNo ratings yet

- GP Fund Form ADocument2 pagesGP Fund Form Aihsan ul haqNo ratings yet

- G.R. No. 152295 Montesclaros vs. COMELECDocument2 pagesG.R. No. 152295 Montesclaros vs. COMELECRia N. HipolitoNo ratings yet

- Ministry of Finance and Financiel Services Joint Communiqué On Mauritius LeaksDocument4 pagesMinistry of Finance and Financiel Services Joint Communiqué On Mauritius LeaksION NewsNo ratings yet

- Akun-Akun Queen ToysDocument4 pagesAkun-Akun Queen ToysAnggita Kharisma MaharaniNo ratings yet

- Thesis Property ManagementDocument7 pagesThesis Property Managementfjnsf5yf100% (2)

- USA Vs AnthemDocument112 pagesUSA Vs AnthemAshleeNo ratings yet

- People v. NitafanDocument2 pagesPeople v. NitafanSocrates Jerome De GuzmanNo ratings yet

- Cma End Game NotesDocument75 pagesCma End Game NotesManish BabuNo ratings yet

- 1 2 PNP Professional Code of Conduct and Ethical StandardsDocument47 pages1 2 PNP Professional Code of Conduct and Ethical Standardsunknown botNo ratings yet

- MUH050220 O-12 - Final PDF 061221Document123 pagesMUH050220 O-12 - Final PDF 061221Ricardo OkabeNo ratings yet

- T1 B24 Various Interrogation Reports FDR - 4-12-95 FBI Investigation - Murad 579Document18 pagesT1 B24 Various Interrogation Reports FDR - 4-12-95 FBI Investigation - Murad 5799/11 Document Archive100% (1)

- Credit Bureau Development in The PhilippinesDocument18 pagesCredit Bureau Development in The PhilippinesRuben Carlo Asuncion100% (4)

- PI200 User Guide 230 V 50 HZDocument26 pagesPI200 User Guide 230 V 50 HZEsneider Rodriguez BravoNo ratings yet

- Intro To Aviation Ins (Fahamkan Je Tau)Document4 pagesIntro To Aviation Ins (Fahamkan Je Tau)Anisah NiesNo ratings yet

- Notice: Valid Existing Rights Determination Requests: Daniel Boone National Forest, KY Existing Forest Service Road UseDocument5 pagesNotice: Valid Existing Rights Determination Requests: Daniel Boone National Forest, KY Existing Forest Service Road UseJustia.comNo ratings yet