Professional Documents

Culture Documents

Collector Vs La Tondena

Uploaded by

Aiken Alagban LadinesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Collector Vs La Tondena

Uploaded by

Aiken Alagban LadinesCopyright:

Available Formats

Collector vs La Tondena, 5 SCRA 665 (1962) LT is engaged in the business of manufacturing wines and liquor with a distillery in Manila.

It purchases alcohol from Negros Occidental and from Batangas and has been removing this alcohol from the centrals to resp distillery under joint bonds without prepayment of specific taxes. Quantity of alcohol purchased and received-entered into the BIR Official Register Books. In the manufacture of Manila Rum, LR uses as basic materials low test alcohol, purchased in crude form from the suppliers which it re-rectifies or subjects to further rectification or distillation==from this process, losses through evaporation incurs, for which CIR had given resp allowance of not exceeding 7% for said losses. In May 1954, CIR wrote demand letter to LT for payment of specific taxes on alcohol lost by evaporation thu re-rectification or re-distillation from June 1950 to Feb 1954. LT protested and CIR refused to reconsider the assessment. LT appealed to the Conference Staff of the BIR. It was ordered to comply with DOF 213 to deposit of the amount in cash and the balance by a surety bond. LT action to CTA. CTA ordered LT to pay P672.15 by way of specific tax. The amount of P154K which corresponds to the period after January 1951 and up to Feb. 1954, pursuant to RA 592=LT is exempt from liability assessed therefor. CIR appealed to SC. Issue: WON LT should pay the specific tax. Held: No. Sec. 133 of the Tax code states liability shall attach to the susbstance as soon as it is in existence as such, whether it be subsequently separated as pure or impure spirits. However RA 592 took effect on Jan. 1, 1951 which amended 133 deleting the all embracing clause which subjects to tax all kinds of alcoholic substances but only distilled spirits as finished products. This is in harmony with Sec. 129 of the Tax code which states that only the finished product is subject. August 1956, RA 1608 was passed restoring the same clause which was eliminated. From Jan. 1951 to Aug. 1956, the tax on alcohol did not attach as soon as it was in existence as such but on the finished product. In every case of doubt, tax statues are construed most strongly against the government and in favor of the citizens, because burdens are not to be imposed beyond what the statutes expressly and clearly import. The new law should not be given retroactive effect.

You might also like

- 27 CIR V La Tondena G.R. No. L-10431Document1 page27 CIR V La Tondena G.R. No. L-10431Emmanuel Alejandro YrreverreIiiNo ratings yet

- Case DigestDocument1 pageCase DigestquasideliksNo ratings yet

- Limpan Investment Corp v. CIR, 17 SCRA 703Document2 pagesLimpan Investment Corp v. CIR, 17 SCRA 703Gabriel Hernandez100% (1)

- G.R. No. 78780. July 23, 1987. 152 SCRA 284 Case DigestDocument1 pageG.R. No. 78780. July 23, 1987. 152 SCRA 284 Case DigestKTNo ratings yet

- COMMISSIONER OF INTERNAL REVENUE, Petitioner, vs. CITYTRUST INVESTMENT PHILS., INC., Respondent.Document1 pageCOMMISSIONER OF INTERNAL REVENUE, Petitioner, vs. CITYTRUST INVESTMENT PHILS., INC., Respondent.Charles Roger Raya100% (1)

- Republic V CaguioaDocument3 pagesRepublic V CaguioaViolet Parker100% (2)

- Surety Company Deduction CaseDocument1 pageSurety Company Deduction CaseKyle DionisioNo ratings yet

- 11 NDC V CIRDocument3 pages11 NDC V CIRTricia MontoyaNo ratings yet

- Valenton Vs MurcianoDocument2 pagesValenton Vs MurcianoowenNo ratings yet

- Insurance Fraud Case: SC Reverses P40K Award Due to Inflated ClaimsDocument3 pagesInsurance Fraud Case: SC Reverses P40K Award Due to Inflated ClaimsAnit EmersonNo ratings yet

- Taganito vs. Commissioner (1995)Document2 pagesTaganito vs. Commissioner (1995)cmv mendozaNo ratings yet

- CIR V SantosDocument1 pageCIR V SantosLizzy WayNo ratings yet

- CIR v. Hedcor Sibulan, Inc.Document2 pagesCIR v. Hedcor Sibulan, Inc.SophiaFrancescaEspinosa100% (1)

- Calalang v. LorenzoDocument1 pageCalalang v. LorenzoJay-ar Rivera BadulisNo ratings yet

- Cir Vs Algue, Inc. GR No. L-28896 February 7, 1996Document2 pagesCir Vs Algue, Inc. GR No. L-28896 February 7, 1996ian ballartaNo ratings yet

- 46-Quezon City Vs BayantelDocument3 pages46-Quezon City Vs BayantelIshNo ratings yet

- Vegetable Oil Corporation Tax Ruling ReversedDocument1 pageVegetable Oil Corporation Tax Ruling ReversedLouNo ratings yet

- Western Minolco v. CommissionerDocument2 pagesWestern Minolco v. CommissionerEva TrinidadNo ratings yet

- CIR Vs PinedaDocument2 pagesCIR Vs PinedaPiaNo ratings yet

- Unitrust Devt Bank vs. CaoibesDocument1 pageUnitrust Devt Bank vs. CaoibesEderic ApaoNo ratings yet

- CIR Ordered to Refund Alhambra Industries P520K in Erroneously Paid Excise TaxesDocument9 pagesCIR Ordered to Refund Alhambra Industries P520K in Erroneously Paid Excise TaxesChristopher Joselle MolatoNo ratings yet

- Roxas Vs RaffertyDocument2 pagesRoxas Vs RaffertyBruno GalwatNo ratings yet

- Maceda Vs MacaraigDocument3 pagesMaceda Vs MacaraigAnonymous 5MiN6I78I0100% (2)

- 19.d Philex Mining Corporation vs. CIR (G.R. No. 125704 August 28, 1998) - H DigestDocument1 page19.d Philex Mining Corporation vs. CIR (G.R. No. 125704 August 28, 1998) - H DigestHarleneNo ratings yet

- Cir Vs Mega GeneralDocument2 pagesCir Vs Mega GeneralAiken Alagban LadinesNo ratings yet

- CIR vs. PNB 736 SCRA 609 2014 VELOSODocument2 pagesCIR vs. PNB 736 SCRA 609 2014 VELOSOAnonymous MikI28PkJc100% (2)

- FRANCIA V. INTERMEDIATE APPELLATE COURT, ET AL., 162 SCRA 753 - TAX VS DEBT - DigestDocument1 pageFRANCIA V. INTERMEDIATE APPELLATE COURT, ET AL., 162 SCRA 753 - TAX VS DEBT - DigestKate GaroNo ratings yet

- Case Digest Remedies Part 1Document23 pagesCase Digest Remedies Part 1Aprille S. AlviarneNo ratings yet

- Case Digest Iron Steel Vs CADocument2 pagesCase Digest Iron Steel Vs CAEbbe Dy100% (1)

- Taxation DigestsDocument87 pagesTaxation DigestsMeng Goblas67% (3)

- Vegetable Oil Corp. V Trinidad, G.R. No. 21475, March 26, 1924, 45 Phil. 822Document2 pagesVegetable Oil Corp. V Trinidad, G.R. No. 21475, March 26, 1924, 45 Phil. 822Maria Fiona Duran MerquitaNo ratings yet

- Judge fined for acting as real estate brokerDocument3 pagesJudge fined for acting as real estate brokerilovetwentyonepilots100% (1)

- HILADO, VS. CIR G.R. No. L-9408, October 31, 1956Document1 pageHILADO, VS. CIR G.R. No. L-9408, October 31, 1956Cyrus DaitNo ratings yet

- Commissioner vs Fireman's FundDocument2 pagesCommissioner vs Fireman's FundjulyenfortunatoNo ratings yet

- G.R. No. L-36081 April 24, 1989 Progressive Development Corporation, Petitioner, QUEZON CITY, RespondentDocument3 pagesG.R. No. L-36081 April 24, 1989 Progressive Development Corporation, Petitioner, QUEZON CITY, RespondentMary Anne100% (1)

- PROSPECTIVITY OF LAWS - Commissioner of Internal Revenue vs. AcostaDocument2 pagesPROSPECTIVITY OF LAWS - Commissioner of Internal Revenue vs. AcostaKath LeenNo ratings yet

- 4 11 1 Luzon Stevedoring Vs Trinidad and CADocument4 pages4 11 1 Luzon Stevedoring Vs Trinidad and CAKing BautistaNo ratings yet

- SISON V ANCHETADocument4 pagesSISON V ANCHETAMayflor BalinuyusNo ratings yet

- Lotto Restaurant Corp Vs BPIDocument5 pagesLotto Restaurant Corp Vs BPIEricson Sarmiento Dela CruzNo ratings yet

- Progressive Development Corp vs. QCDocument2 pagesProgressive Development Corp vs. QCKing BadongNo ratings yet

- City of Baguio Vs de Leon GR No. L-24756Document6 pagesCity of Baguio Vs de Leon GR No. L-24756KidMonkey2299No ratings yet

- TAN Vs DEL ROSARIODocument3 pagesTAN Vs DEL ROSARIOKath LeenNo ratings yet

- Digested CasesDocument36 pagesDigested CasesJepoy Nisperos ReyesNo ratings yet

- 1 Churchill v. ConcepcionDocument7 pages1 Churchill v. ConcepcionJoan Dela CruzNo ratings yet

- CIR v. Mitsubishi Metal, 181 SCRA 214Document2 pagesCIR v. Mitsubishi Metal, 181 SCRA 214Homer Simpson100% (1)

- 22 - GR No. 25299Document1 page22 - GR No. 25299Lloyd LiwagNo ratings yet

- Pilinas Shell Petroleum Vs Coc - GR No. 176380 June 18, 2009Document1 pagePilinas Shell Petroleum Vs Coc - GR No. 176380 June 18, 2009Ray John Uy-Maldecer AgregadoNo ratings yet

- RCBC Vs CIRDocument2 pagesRCBC Vs CIRAnneNo ratings yet

- Cir Vs Bank of Commerce DigestDocument3 pagesCir Vs Bank of Commerce Digestwaws20No ratings yet

- Gutierrez v. Collector, 101 Phil 743Document1 pageGutierrez v. Collector, 101 Phil 743Wolf DenNo ratings yet

- Smietanka, Collector of Internal Revenue v. First Trust & Savings Bank, 257 U.S. 602 (1921)Document4 pagesSmietanka, Collector of Internal Revenue v. First Trust & Savings Bank, 257 U.S. 602 (1921)Scribd Government DocsNo ratings yet

- Tax deduction for unpaid war damage claim deniedDocument2 pagesTax deduction for unpaid war damage claim deniedAlan Gultia100% (1)

- JACINTO-HENARES vs. ST. PAUL COLLEGE OF MAKATIDocument2 pagesJACINTO-HENARES vs. ST. PAUL COLLEGE OF MAKATIRose Ann VeloriaNo ratings yet

- Hilado Vs CIRDocument6 pagesHilado Vs CIRMi AmoreNo ratings yet

- CIR Vs Gonzales GR LDocument4 pagesCIR Vs Gonzales GR LKaira Marie CarlosNo ratings yet

- First National Bank of Portland v. NobleDocument2 pagesFirst National Bank of Portland v. NoblePat NaffyNo ratings yet

- Collector vs. La TondenaDocument2 pagesCollector vs. La TondenaClaudine Allyson DungoNo ratings yet

- Collector of Internal Revenue vs. La Tonde A Inc. (1962, 5 SCRA 665)Document7 pagesCollector of Internal Revenue vs. La Tonde A Inc. (1962, 5 SCRA 665)KTNo ratings yet

- CIR vs. La Tondena, Inc.Document4 pagesCIR vs. La Tondena, Inc.Prince CayabyabNo ratings yet

- La Tondena To Bagatsing CasesDocument27 pagesLa Tondena To Bagatsing CasesSofiaNo ratings yet

- Waiver of Rights - SampleDocument1 pageWaiver of Rights - SampleAiken Alagban LadinesNo ratings yet

- ST Kiss The Miss Goodbye 8x10 1Document1 pageST Kiss The Miss Goodbye 8x10 1Aiken Alagban LadinesNo ratings yet

- Abstract of Tomato PlantationDocument1 pageAbstract of Tomato PlantationAiken Alagban LadinesNo ratings yet

- ClubsDocument1 pageClubsAiken Alagban LadinesNo ratings yet

- Christmas CardsDocument1 pageChristmas CardsAiken Alagban LadinesNo ratings yet

- Affidavit of LossDocument1 pageAffidavit of LossAiken Alagban LadinesNo ratings yet

- Cases - SourcesDocument15 pagesCases - SourcesAiken Alagban LadinesNo ratings yet

- SPA SampleDocument2 pagesSPA SampleAiken Alagban LadinesNo ratings yet

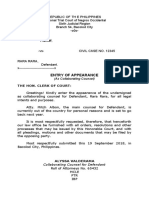

- Entry of Appearance: (As Collaborating Counsel)Document2 pagesEntry of Appearance: (As Collaborating Counsel)Aiken Alagban LadinesNo ratings yet

- Judicial Affidavit - SampleDocument7 pagesJudicial Affidavit - SampleAiken Alagban LadinesNo ratings yet

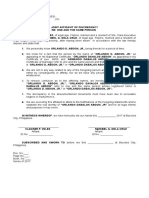

- Joint Affidavit of Discrepancy SampleDocument1 pageJoint Affidavit of Discrepancy SampleAiken Alagban Ladines100% (5)

- Materials UsedDocument3 pagesMaterials UsedAiken Alagban LadinesNo ratings yet

- Joint affidavit clarifying true name of Ser John TumpagDocument1 pageJoint affidavit clarifying true name of Ser John TumpagAiken Alagban LadinesNo ratings yet

- Effective Communication As A Means To Global PeacDocument2 pagesEffective Communication As A Means To Global PeacAiken Alagban Ladines100% (1)

- Compassion in Action - EditedDocument1 pageCompassion in Action - EditedAiken Alagban LadinesNo ratings yet

- Registered VotersDocument1 pageRegistered VotersAiken Alagban LadinesNo ratings yet

- Celebrating His Love - EditedDocument1 pageCelebrating His Love - EditedAiken Alagban LadinesNo ratings yet

- Affidavit of LossDocument1 pageAffidavit of LossAiken Alagban LadinesNo ratings yet

- Protect Children from Colds & Flu with VaccinesDocument1 pageProtect Children from Colds & Flu with VaccinesAiken Alagban LadinesNo ratings yet

- Answer - Reswri 2Document6 pagesAnswer - Reswri 2Aiken Alagban LadinesNo ratings yet

- Daily RemindersDocument4 pagesDaily RemindersAiken Alagban LadinesNo ratings yet

- LTFRB Revised Rules of Practice and ProcedureDocument25 pagesLTFRB Revised Rules of Practice and ProcedureSJ San Juan100% (2)

- Revised Rules On Administrative Cases in The Civil ServiceDocument43 pagesRevised Rules On Administrative Cases in The Civil ServiceMerlie Moga100% (29)

- Bar SchedDocument1 pageBar SchedAiken Alagban LadinesNo ratings yet

- Colds/Flu Prevention Through VaccinationDocument1 pageColds/Flu Prevention Through VaccinationAiken Alagban LadinesNo ratings yet

- Tax NotesDocument6 pagesTax NotesAiken Alagban LadinesNo ratings yet

- Galatians 5 Living by The Spirit's PowerDocument1 pageGalatians 5 Living by The Spirit's PowerAiken Alagban LadinesNo ratings yet

- Get Your First Passport: Requirements for New ApplicantsDocument2 pagesGet Your First Passport: Requirements for New ApplicantsAiken Alagban LadinesNo ratings yet

- Resolution To Open Bank AccountsDocument1 pageResolution To Open Bank AccountsAiken Alagban LadinesNo ratings yet

- Code of Professional ResponsibilityDocument3 pagesCode of Professional ResponsibilityAiken Alagban LadinesNo ratings yet