Professional Documents

Culture Documents

Mortgage

Uploaded by

Vinit PaulCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mortgage

Uploaded by

Vinit PaulCopyright:

Available Formats

MORTGAGE A mortgage is a method of creating charge on immovable properties like land and building.

Section 58 of the Transfer of Property Act 1882 define a mortgage as follo!s" #A mortgage is the transfer of an interest in specific immovable property for the purpose of securing the payment of money advanced or to be advanced by !ay of loan an e$isting or future debt or the performance of an engagement !hich may give rise to a pecuniary liability.# %n terms of the definition the follo!ing are the characteristics of a mortgage" &1' A mortgage can be effected only on immovable property. %mmovable property includes land benefits that arise out of land and things attached to earth like trees buildings and machinery. (ut a machine !hich is not permanently fi$ed to the earth and is shift able from one place to another is not considered to be immovable property. &2' A mortgage is the transfer of an interest in the specific immovable property. This means the o!ner transfers some of his rights only to the mortgagee. )or e$ample the right to redeem the property mortgaged. &*' The ob+ect of transfer of interest in the property must be to secure a loan or performance of a contract !hich results in monetary obligation. Transfer of property for purposes other than the above !ill not amount to mortgage. )or e$ample a property transferred to ,i-uidate prior debt !ill not constitute a mortgage. &.' The property to be mortgaged must be a specific one i.e. it can be identified by its si/e location boundaries etc. &5' The actual possession of the mortgaged property is generally !ith the mortgager. &0' The interest in the mortgaged property is re1conveyed to the mortgager on repayment of the loan !ith interest due on. &2' %n case the mortgager fails to repay the loan the mortgagee gets the right to recover the debt out of the sale proceeds of the mortgaged property. Forms of Mortgages Section 58 of the transfer of Property Act enumerates si$ kinds of mortgages" &1' Simple mortgage. &2' 3ortgage by conditional sale. &*' 4sufructuary mortgage. &.' 5nglish mortgage. &5' 3ortgage ,y deposit of title deeds. &0' Anomalous mortgage. (1) Simple Mortgage %n a simple mortgage the mortgager does not deliver the possession of the mortgaged property. 6e binds himself personally to pay the mortgage money and agrees either e$pressly or impliedly that in case of his failure to repay the mortgagee shall have the right to cause the mortgaged property to be sold and apply the sale proceeds in payment of mortgage money.

The essential feature of the simple mortgage is that the mortgagee has no po!er to sell the property !ithout the intervention of the court. The mortgagee can" &i' apply to the court for permission to sell the mortgaged property or &ii' file a suit for recovery of the !hole amount !ithout selling the property. (2) Mortgage by Conditional Sale %n this form of mortgage the mortgager ostensibly sells the property to the mortgagee on the follo!ing conditions" &i' the sale shall become void on payment of the mortgage money. &ii' the mortgagee !ill retransfer the property on payment of the mortgage money. &iii' the sale shall become absolute if the mortgager fails to repay the amount on a certain date. &iv' the mortgagee has no right of sale but he can sue for foreclosure. )oreclosure means the loss of right possessed by the mortgager to redeem the mortgaged property. The mortgagee has the right to institute a suit for a decree so that the mortgager !ill be absolutely debarred from his right to redeem the property. The right to foreclosure arises !hen the time fi$ed for repayment e$pires and the mortgager fails to repay the mortgage money. 7ithout the fore closure order the mortgagee !ill not become the o!ner of the property. ( ) !s"fr"#t"ary Mortgage 4nder this form of mortgage the mortgager delivers possession of the property or binds himself to deliver possession of the property to the mortgagee. The mortgagee is authori/ed to retain the possession until the debt is repaid. The mortgager reserves the right to recover the property !hen the money is repaid. The essential feature of this form of mortgage is that the mortgagee is entitled to receive rents and profits relating to the mortgaged property till the loan is repaid and appropriate the same in lieu of interest or in repayment of the loan or both. The mortgager is not personally liable to repay the mortgage money. So the mortgagee cannot sue the mortgager for repayment. 6e can neither sue foreclosure nor sue for sale of the mortgaged property8 the only remedy for the mortgagee is to remain in possession of the property and pay himself out of the rents or profits of the mortgaged property. Since there is no time limit he has to !ait for a very long time to recover his dues. ($) Englis% Mortgage The 5nglish mortgage has the follo!ing characteristics" &1' The mortgager transfers the property absolutely to the mortgagee. The mortgagee therefore is entitled to take immediate possession of the property. The transfer is sub+ect to the condition that the property shall be transferred on repayment of the loan. &2' The mortgager also binds himself to pay the mortgage money on a certain date.

&*' %n case of non1repayment the mortgagee has the right to sell the mortgaged property !ithout seeking permission of the court in circumstances mentioned in section 09 of the Transfer of Property Act. (&) Mortgage by 'eposit of Title 'eeds 7hen a debtor delivers to a creditor or his agent document of title to immovable property !ith an intention to create a security there on the transaction is called mortgage by deposit of title deeds. Such a mortgage is restricted to the to!ns of :olkata 3umbai and ;hennai and other to!ns notified by the State government for this purpose in the <fficial =a/ette. This type of mortgage re-uires no registration. This form of mortgage is also kno!n as e-uitable mortgage. (() Anomalo"s Mortgage %n terms of this definition an anomalous mortgage is one !hich does not fall under anyone of the above five terms of mortgages. Such a mortgage can be effected according to the terms and conditions of the mortgager and the mortgagee. 4sually it arises by a combination of t!o or more of the above said mortgages. %t may> take various forms depending upon custom usage or contract. )egal Mortgage *s+ E,"itable Mortgage <n the basis of transfer of title to the mortgaged property mortgages are divided into t!o types namely" &i' ,egal 3ortgage. &ii' 5-uitable 3ortgage. )egal Mortgage %n a legal mortgage the legal title to the property is transferred in favour of mortgagee by a deed. The deed is to be registered !hen the principal money is ?s. 1@@A1 or more. <n repayment of the loan the legal title is retransferred to the mortgagor. This method of creating charge is e$pensive as it involves registration charges and stamp duty. E,"itable Mortgage An e-uitable mortgage is effected by mere delivery of documents of title to property to the mortgagee. The mortgagor through 3emorandum of deposit undertakes to grant a legal mortgage if he fails to pay the mortgage money. 5ssential ?e-uirements of 5-uitable 3ortgage &1' An e-uitable mortgage re-uires three essential features i. ii. there must be a debt e$isting or future there must be deposit of title deeds are the title deeds should be deposited as security for the debt.

&2' ?egistration of documents is not necessary.

?oyal Printing 7orks and <thers Bs. <riental (ank of ;ommerce &299@'. %t !as established in the above case that !here a security is furnished by deposit of title deeds no registration is necessary. &*' An e-uitable mortgage can be effected only in the to!ns of :olkata 3umbai and ;hennai and in certain places notified by the State =overnment. Sulochana and <thers Bs. The Pandyan (ank ,td. %t !as held in the above case that the debtor need not produce the documents and deposit the same in person in any of the to!ns mentioned in that Section. %f the intention !as to deposit the documents in the to!ns mentioned and the documents !ere duly for!arded such deposit shall be deemed to have been made in the to!ns specified in the Section. Sabasiva ?ao Bs. (ank of (aroda &1989'. %t !as held that even if certified copies of documents of title to goods are deposited if the intention of the deposit is for. security to cover a loan it !ould amount to e-uitable mortgage. &.' The documents are to be retransferred to the mortgagee on repayment of the debt. &5' The mortgagee is empo!ered to apply to the court to convert the e-uitable mortgage into a legal mortgage if the mortgager fails to repay the loan on a specified date. Ad-antages &1' Co registration is re-uired in e-uitable mortgage and so stamp duty is saved. &2' %t involves minimum formalities. &*' The information regarding such mortgage is kept confidential bet!een the lender and borro!er. So the reputation of the borro!er is not affected. 'isad-antages &1' %f the mortgagor fails to repay the mortgagee must get the decree for the sale of the property. =etting a decree is e$pensive and time consuming. &2' The borro!er may hold the title deeds not on his o!n account but in the capacity of a trustee. %f an e-uitable charge is created the claim of the beneficiary under the trust !ill prevail over e-uitable mortgage. &*' There is the risk of subse-uent legal mortgage in favour of another party. %f the e-uitable mortgagee parts !ith the security even for a short period the debtor may create a second legal mortgage over the same property. %n that case the second mortgage shall have the first priority over the e-uitable mortgagee. The mortgagee should be very careful in this regard.

Rig%ts of Mortgager &1' Rig%ts of Redemption. The mortgager has a right to redeem the mortgaged property provided" a. he1pays the mortgage money on due date at the proper place and time b. the right of redemption has not been terminated by an act of the parties or by decree of a court. The mortgager !ho has redeemed the mortgage is entitled to the follo!ing rights" &a' to get back the mortgage deed and all other documents relating to the mortgaged property &b' to obtain possession of the mortgaged property from the mortgagee as in the case of 5nglish mortgage &c' to have the mortgaged property retransferred at his cost to him or to such third person as he may direct. &2' A##ession to Mortgaged /roperty. During the possession of the property if the mortgagee has voluntarily made any improvement in the property the mortgager on redeeming the property is entitled to all such additions or improvements unless there is a contract to the contrary. &*' Rig%t to Transfer to T%ird /arty. The mortgager may re-uire the mortgagee to transfer the mortgaged property to a third person instead of retransfer to him. &.' Rig%t to 0nspe#tion and /rod"#tion of 'o#"ments. The mortgager has the right to inspect and make copies of all documents of title in the custody of mortgagee. Rig%ts of Mortgagee &1' Rig%t to s"e for mortgage money. The mortgagee has the right to file a suit in a court of la! for the mortgage money in the follo!ing cases" a. 7here the mortgager binds himself to repay the mortgage money as in the case of simple and 5nglish mortgage. b. 7here the mortgaged property is !holly or partly destroyed or the security is rendered insufficient and to mortgager has not provided further security. c. 7here the mortgagee is deprived of the !hole or a part of his security by the !rongful act of the mortgager. d. 7here the mortgager fails to deliver the mortgaged property in case the mortgagee is entitled to it. &2' Rig%t of sale. The mortgagee in case of a simple 5nglish and e-uitable mortgage has the right to sell the property after filing a suit and getting a decree from a court.

A mortgagee has a right of sale !ithout the intervention of the court under certain circumstances mentioned in Section 09 of Transfer of Property Act. &*' Rig%t of fore#los"re. The mortgagee has a right to obtain from the ;ourt a decree for foreclosure against the mortgager that is the mortgager is absolutely debarred of his right to redeem the property. The right of fore closure is allo!ed in &i' a mortgage by a conditional sale and the anomalous mortgage. &.' Rig%t of a##ession to property. %f any addition is made to the mortgaged property the mortgagee is entitled to such addition for the purpose of security provided there is no contract to the contrary. )or e$ample A mortgages a certain plot of land to ( and after!ards constructs a building on it. ( is entitled to the building and land as security for the loan. &5' Rig%t of possession. The mortgagee is entitled to the possession of the mortgaged property as per the terms of mortgage deed. Such a right is available in usufructuary mortgage. S"b1Mortgage A sub1mortgage is created !hen the mortgagee gives the mortgaged property as security for advance. The mortgaged security is the property of the mortgagee and so he has the right to re1mortgage for securing loans. The sub1mortgagee is placed in the position of the original mortgagee and entitled to receive the mortgage money sue for the property and realise the security. Therefore a sub1mortgage is also kno!n as >mortgage of mortgagee.> Tacking A borro!er can legally create any number of mortgages on his property. (ut the mortgage !ill rank in priority according to the dates of mortgage. )or e$ample a property is mortgaged in the follo!ing order. 1111@* in favour of A 1121@* in favour of ( 11*1@* in favour of ; ?s.l@ <<< ?s. 8 @@@ ?s. 0 @@@

A -uestion may raise in this connection !hether ; by redeeming the prior mortgage of A is entitled to tack to the first mortgageE

According to Section 9* ofTransfer of Property Act no subse-uent mortgagee by paying off a prior mortgage ac-uires any priority in respect of his original security.

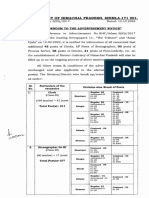

A Mortgage means transfer of an interest in a specific immovable property for the purpose of securing the payment of money advanced as a loan, an existed or future debt. The transferor is called a Mortgagor and transferee a Mortgagee and an instrument by which transfer is made called MORTGAGE DEED which actually depends upon the payment of money secured as Mortgage Money as defined under Section !" ofThe Transfer Of Property Act, 1882. Reverse Mortgage is the new concept in #ndia and less effective though it is very popular in the western countries, but in #ndia it can be seen as from the numbers of persons i.e. $!% persons have availed its benefit till now and this type of mortgage is basically helps senior citi&ens to get regular payments from the financial entities or ban's against the mortgage of his property. A reverse mortgage is totally a different concept from a regular mortgage process where a person pays the ban' for a mortgaged property and unli'e other loans, this need not be repaid by the borrower. Reverse Mortgage is one of the important types of mortgage where owner of the immovable property surrenders his title of the property to a finan ial entity or ban!" The concept is simple, a senior citi&en who holds a house or property, but lac's a regular source of income can put mortgage his property with a ban' or housing finance company ()*+, and the ban' or financial entity pays the person a regular payment. The good thing is that the person who reverse mortgages his property can stay in the same house for his life time and continue to receive the much needed regular payments. So, effectively owner of the property will continue to stay at the same place and also get paid for it. Any house owner over -% years of age is eligible for a reverse mortgage and the maximum loan which can be granted is up to -%. of the value of residential property. The Reverse Mortgage is otherwise called as lifetime mortgage. /everse Mortgage loan amount based on the three things i.e. value of the property, term of the mortgage agreement and rate of payment with interest which depends upon the age of the owner of the property0 borrower of the loan amount. A mechanism for valuation and computation of the mortgage property depends upon the law of probability which will be assessed by the professionals. The loan amount can be provided through monthly, 1uarterly, half2yearly or annually or lump sum money based on the mutual understanding of the parties to the mortgage agreement. The maximum period of a loan which can be provided by the ban's to the reverse mortgage borrower is for $! years but the lender has to revaluate the property at least once in the ! years so that it will assist him to get more money as a loan from the ban' which is totally based on the value of the property. The value of the property is generally revisited periodically, if the value of the property increased then senior citi&en will get an option to increase the loan amount. An advantage of the Reverse Mortgage scheme is that the owner of property will not be liable to pay Income Tax under Income Tax Act because in reverse mortgage transaction whatever amount has been received either in lump sum or monthly installment by the owner of the property as loan amount will not be considered as a Income earned. A reverse mortgage scheme which is basically for the benefit of senior citi&ens, however in a reverse mortgage transaction any transfer of capital asset will not be considered as transfer or alienation of immovable property as it is also stated by the central government notification, hence it will not attract the provision of capital gains tax.

The financial entity or the ban' has authoritative power to recover the loan amount, wherein it has been conferred with a right to sell the mortgage property in the case if incumbent or borrower either passes away or leaves the house. The loan amount can be repaid or prepaid by the legal heirs of the borrower at any time during the period of loan with the accumulated interest amount and have the mortgage released without resorting to the sale of property. #n case if there is a sale of mortgage property by the ban' for repayment of the loan amount then whatever is the additional amount received by the ban' need to be paid to the heirs of the senior citi&en but only after clearing the loan amount payment by the ban'. The reverse mortgage scheme offered by some of the leading ban's in #ndia could bring the re1uired answers to the suffering senior citi&ens. Most of the people in the senior age groups, either by inheritance or by virtue of building assets have properties in their names, but they were not able to convert it into instant and regular income stream due to its illi1uid nature. The 3nion 4udget 5%%625%%" had a great proposal which introduced the /everse Mortgage scheme. A Reverse Mortgage scheme is always provides more benefits to the senior citi!ens who does not have any source of income and through this scheme owner of the property can ensure a regular cash flow in times of need and can en"oy the benefit of staying in the property as well. 4ut a reverse mortgage scheme is a big failure in the country li'e #ndia where number of persons using this scheme is very less. /everse Mortgage thus, is very beneficial for senior citi&ens who want a regular income to meet their everyday needs, without leaving their houses.

Introduction The Foreign Exchange Management Act, 1999 (FEMA) replaces the Foreign Exchange Regulation Act (FERA). FERA was introduced in 19 ! to consolidate and amend the then existing law relating to "oreign exchange. FERA was amended in 199# to $ring a$out certain changes, as a result o" introduction o" economic re"orms and li$erali%ation o" &ndian Econom'. (ut it was soon reali%ed that FERA had $' and large outli)ed its utilit' in the changed economic scenario and there"ore replaced $' FEMA in 1999. Meaning FEMA was introduced $' the Finance Minister in *o+ ,a$ha on August !, 199-. The (ill aims .to consolidate and amend the law relating to foreign exchange with the objective of facilitating external trade and payments and for promoting the orderly development and maintenance of foreign exchange market India./ &t was adopted $' the parliament in 1999 and is +nown as the Foreign Exchange Management Act, 1999. This Act extends to the whole o" &ndia and shall also appl' to all $ranches, o""ices and agencies outside &ndia owned or $' a person resident in &ndia. Objectives and Reasons for enactment of FEMA FEMA was enacted to consolidate and amend the law relating to "oreign exchange with the o$0ecti)e o" "acilitating external trade and pa'ments and "or promoting the orderl' de)elopment and maintenance o" "oreign exchange mar+et in &ndia (1ream$le). The statement o" o$0ects and reasons set the tone o" the enactment o" new legislation2 i. The Foreign Exchange Regulation Act, 19 #, was re)iewed in 199# and se)eral amendments were enacted as part o" the ongoing process o" economic li$erali%ation relating to "oreign in)estments and "oreign trade "or closer interaction with the world econom'. At that stage, the central go)ernment decided that the "urther exchange o" the Foreign Exchange Regulation Act would $e underta+en in the light o" su$se3uent de)elopments and experience in relation to "oreign trade and in)estment. &t was su$se3uentl' "elt that a $etter course would $e to repeal the existing Foreign Exchange Regulation Act and enact a new legislation. A tas+ "orce constituted "or the purpose su$mitted its report in 199! recommending su$stantial changes in the existing Act. ii. ,igni"icant de)elopments ha)e $een ta+ing place since 199# such as su$stantial increase in "oreign exchange reser)es, growth in "oreign trade, rationali%ation o" tari""s, current account

con)erti$ilit', li$erali%ation o" &ndian in)estments a$road, increased access to external $orrowings $' &ndian corporate and participation o" Foreign in)estors in the stoc+ mar+ets. Accordingl', a $ill to repeal and replace Foreign Exchange Regulation Act, 19 # was introduced *o+ ,a$ha on 4!.4-.199-. 5n re"erence to the standing committee modi"ications and suggestions were su$mitted $' the standing committee in its report. A"ter incorporating modi"ications and suggestions o" the standing committee, the central go)ernment decided to introduce the new law, the Foreign Exchange Management (ill and repeal the Foreign Exchange Regulation Act, 19 # Salient Features of FEMA FEMA extends to whole o" &ndia. &t shall also appl' to all $ranches, o""ices and agencies outside &ndia, owned or controlled $' a person resident in &ndia and also to an' contra)ention there under committed outside &ndia $' an' person to whom the Act applies. There"ore 0oint )entures or wholl' owned su$sidiaries, though outside &ndia, $ut controlled "rom &ndia are intended to $e co)ered $' the Act. The new Act is meant to $e user "riendl' with the o$0ect to "acilitate external trade and pa'ments "or promoting the orderl' de)elopment o" "oreign exchange in &ndia. 6nder the new law, the emphasis "or determining the residential status is on the actual period o" sta' in &ndia, whereas under FEMA, the emphasis was on the intention o" the person. 6nder the new law, it is not necessar' that the person should $e continuousl' and ph'sicall' present in &ndia. &t will $e su""icient the total o" sta' in &ndia is 1-7 da's or more during the 'ear. The central go)ernment ma' "rom time to time gi)e general or special directions to the Reser)e (an+ and Reser)e (an+ shall compl' with such directions. The central go)ernment ma' $' noti"ication ma+e rules to carr' out the pro)isions o" the Act. The Reser)e (an+ ma' $' noti"ication ma+e regulation to carr' out the pro)isions o" the Act and rules there under. E)er' rule and regulation made under the Act shall as soon as a"ter it is made, $e laid $e"ore each house o" parliament. &" an' di""icult' arises in gi)ing e""ect ti the pro)isions o" the Act, the central go)ernment ma' $' order, do an'thing not inconsistent with the pro)isions i" the Act "or the purpose o" remo)ing the di""icult'. Suspension of operation of FEMA &" the central go)ernment is satis"ied that circumstances ha)e arisen rendering it necessar' that an' permission granted

or restriction imposed $' the Act should cease to $e granted or imposed or i" it considers necessar' in pu$lic interest, the central go)ernment ma' $' noti"ication, suspend or relax to such extent either inde"initel' or "or such period as noti"ied, the operation o" all or an' o" the pro)isions o" the Act. Bar of legal proceedings 8o suit, prosecution or other legal proceedings shall lie against the central go)ernment or the Reser)e (an+ or an' o""icer o" the go)ernment or o" the Reser)e (an+ or an' person exercising an' power or discharging an' "unctions or per"orming an' duties under the Act "or an'thing done in good "aith or extended to $e done under the Act or rule, regulation, noti"ication, direction or order made there under. Repeal, Savings and Cogni ance of offences 9ith the enactment o" FEMA, FERA stands repealed and appellate $oard constituted under FERA shall stand dissol)ed. 8o court and ad0udicating o""icer shall ta+e cogni%ance or notice o" an o""ence or an' contra)ention under FEMA a"ter the expir' o" two 'ears period "rom 1.:.7444. ;owe)er, while FERA was in "orce all o""ences committed under FERA shall continue to $e go)erned $' FERA as i" FERA had not $een repealed. An' appeal pre"erred to the Appellate (oard under FERA $ut not disposed o"" $e"ore the commencement o" FEMA shall stand trans"erred and shall $e disposed o"" $' the Appellate Tri$unal constituted under FEMA. FEMA is "or regulation and management o" "oreign exchange through authori%ed person and pro)ides "or penalt' "or contra)ention o" the pro)isions. The o$0ect is "or promoting orderl' de)elopment and maintenance o" "oreign exchange mar+et in &ndia.

Focus o" law changed < "rom accounting = controlling in FERA to orderl' de)elopment o" "orex mar+et and, "acilitating external pa'ments Alignment o" certain de"initions such as 1erson, 1erson Resident in &ndia, similar to &ncome Tax law Transaction regulated according to 8ature < >urrent A?c and >apital A?c Transactions Rigour o" penal pro)isions diluted <3uantum o" penalt' reduced <concept o" Mens rea a$olished <8o automatic imprisonment. Arrest onl' i" penalt' is not paid

<1enalt' su$0ect to Ad0udication <>ompounding made possi$le >entral @o)ernment retains residuar' power to suspend ? relax the law Acti)ities such as pa'ments made to an' person outside &ndia or receipts "rom them, along with the deals in "oreign exchange and "oreign securit' is restricted. &t is FEMA that gi)es the central go)ernment the power to impose the restrictions. ARestrictions are imposed on people li)ing in &ndia who carr' out transactions in "oreign exchange, "oreign securit' or who own or hold immo)a$le propert' a$road. 9ithout general or speci"ic permission o" the MA restricts the transactions in)ol)ing "oreign exchange or "oreign securit' and pa'ments "rom outside the countr' to &ndia < the transactions should $e made onl' through an authorised person. Beals in "oreign exchange under the current account $' an authorised person can $e restricted $' the >entral @o)ernment, $ased on pu$lic interest. Although selling or drawing o" "oreign exchange is done through an authorised person, the R(& is empowered $' this Act to su$0ect the capital account transactions to a num$er o" restrictions. 1eople li)ing in &ndia will $e permitted to carr' out transactions in "oreign exchange, "oreign securit' or to own or hold immo)a$le propert' a$road i" the currenc', securit' or propert' was owned or ac3uired when he?she was li)ing outside &ndia, or when it was inherited $' him?her "rom someone li)ing outside &ndia. Exporters are needed to "urnish their export details to R(&. To ensure that the transactions are carried out properl', R(& ma' as+ the exporters to compl' to its necessar' re3uirements.

You might also like

- Transfer of Property ActDocument24 pagesTransfer of Property ActshraddhaNo ratings yet

- Pure Barre - 2020-04-29 - FDD - Xponential FitnessDocument285 pagesPure Barre - 2020-04-29 - FDD - Xponential FitnessFuzzy PandaNo ratings yet

- Mortgages-Transfer of Property ActDocument18 pagesMortgages-Transfer of Property Actsamsun009No ratings yet

- Contracts II Final ProjectDocument23 pagesContracts II Final ProjectHarshit GuptaNo ratings yet

- Doctrine of Lis PendensDocument7 pagesDoctrine of Lis PendensAsfandyar KhanNo ratings yet

- MortgageDocument24 pagesMortgageSomnath TayalNo ratings yet

- Mortage PDFDocument83 pagesMortage PDFnilofer shallyNo ratings yet

- Sale of Goods Act 1930Document24 pagesSale of Goods Act 1930Cryptic LollNo ratings yet

- Rights of Surety Against CreditorDocument16 pagesRights of Surety Against CreditorPrasenjit Tripathi100% (1)

- Chanakya National Law University, Patna: Submitted To: Dr. B. Ravi Narayan SharmaDocument24 pagesChanakya National Law University, Patna: Submitted To: Dr. B. Ravi Narayan Sharmaanveshac1100% (6)

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- MortgageDocument8 pagesMortgageShruti KambleNo ratings yet

- Specific Relief ActDocument16 pagesSpecific Relief ActRushabh DoshiNo ratings yet

- Government Securities MarketDocument11 pagesGovernment Securities MarketVikasDalal100% (2)

- Contract-II Model AnswerDocument49 pagesContract-II Model AnswerRazal Nadeem100% (1)

- Banker-Customer RelationshipDocument17 pagesBanker-Customer RelationshipAdharsh VenkatesanNo ratings yet

- Easement @lawforcivilservicesDocument20 pagesEasement @lawforcivilservicesBilalNo ratings yet

- Sale of Goods Act 1930Document56 pagesSale of Goods Act 1930mspahwaNo ratings yet

- Contract of AgencyDocument14 pagesContract of AgencyRamasayi Gummadi100% (1)

- Dishonour of ChequesDocument17 pagesDishonour of Chequeschirag78775% (4)

- Doctrine On ElectionDocument10 pagesDoctrine On ElectionVishal Agarwal0% (2)

- Kalpeshkumar L Gupta: Assistant Professor of Law Kalpesh - Gupta@aurouniversity - Edu.inDocument57 pagesKalpeshkumar L Gupta: Assistant Professor of Law Kalpesh - Gupta@aurouniversity - Edu.inHiren Shah100% (1)

- The Transfer of Property Act, 1882Document21 pagesThe Transfer of Property Act, 1882Masud Khan ShakilNo ratings yet

- International Trade LawDocument39 pagesInternational Trade Lawpauline1988No ratings yet

- Banking Law NotesDocument12 pagesBanking Law NotesSoham BandyopadhyayNo ratings yet

- Project Report On Scenario of Cyber Crimes in IndiaDocument10 pagesProject Report On Scenario of Cyber Crimes in Indiasowmyasujatha100% (2)

- Duties of BankersDocument3 pagesDuties of BankersEmaan AnumNo ratings yet

- Nistar Patrak and Regulation of FishingDocument39 pagesNistar Patrak and Regulation of FishingPoonam SharmaNo ratings yet

- Promisory Note: Unit - 2 BY Prof. Thaseen Sultana GFGC Frazer Town, BangaloreDocument12 pagesPromisory Note: Unit - 2 BY Prof. Thaseen Sultana GFGC Frazer Town, BangaloreThaseen SultanaNo ratings yet

- Marina Llemos Et Al. vs. Romeo Llemos Et Al. G.R. No. 150162, January 26, 2007 Austria-Martinez, J.: DoctrineDocument2 pagesMarina Llemos Et Al. vs. Romeo Llemos Et Al. G.R. No. 150162, January 26, 2007 Austria-Martinez, J.: DoctrineTootsie GuzmaNo ratings yet

- The Rights of The Banker IncludeDocument5 pagesThe Rights of The Banker Includem_dattaias67% (3)

- Negotiable Instrument Act 1881Document19 pagesNegotiable Instrument Act 1881Shaktikumar95% (19)

- Easement of Light and ViewDocument13 pagesEasement of Light and Viewkook0% (1)

- Unit 1 .Role and Importance of ArchitectsDocument15 pagesUnit 1 .Role and Importance of Architectsகபிலன் சந்திரசேகரன்100% (1)

- Mortgage 14 - Chapter 6Document37 pagesMortgage 14 - Chapter 6NishantvermaNo ratings yet

- Doctrine of Part PerformanceDocument4 pagesDoctrine of Part Performancejyothi g s100% (1)

- Indemnity & Guarantee PDFDocument55 pagesIndemnity & Guarantee PDFKomal SandhuNo ratings yet

- DAR v. Trinidad Valley Realty & Development CorporationDocument6 pagesDAR v. Trinidad Valley Realty & Development CorporationCourtney TirolNo ratings yet

- MortgageDocument8 pagesMortgagePriyanjali BanerjeeNo ratings yet

- What Is A Mortgage DeedDocument2 pagesWhat Is A Mortgage DeedAdan HoodaNo ratings yet

- Rights and Duties of MortgagorDocument2 pagesRights and Duties of Mortgagorrahul_khanna4321100% (6)

- Garnishee Order: Order 21 R 46 A To 46 IDocument6 pagesGarnishee Order: Order 21 R 46 A To 46 IAnusha V RNo ratings yet

- Business and Environment Laws: Negotiable Instrument Act 1881 MBA Sem:3Document41 pagesBusiness and Environment Laws: Negotiable Instrument Act 1881 MBA Sem:3UtsavNo ratings yet

- Dishonour of ChequeDocument4 pagesDishonour of ChequeRaj Kumar100% (1)

- Law Mantra: Changing Definitions and Dimensions of Consumer': Emerging Judicial TrendsDocument13 pagesLaw Mantra: Changing Definitions and Dimensions of Consumer': Emerging Judicial TrendsLAW MANTRANo ratings yet

- Rights and Liabilities of SuretyDocument22 pagesRights and Liabilities of SuretyPAYAL SINGHNo ratings yet

- Contracts IIDocument8 pagesContracts IISushmaSuresh100% (1)

- Breach of Contract of Sale AssignmentDocument12 pagesBreach of Contract of Sale AssignmentAnkit Kumar100% (1)

- Harshad Mehta ScamDocument17 pagesHarshad Mehta ScamJaywanti Akshra GurbaniNo ratings yet

- Duties or Responsibilities or Liabilities of The BaileeDocument4 pagesDuties or Responsibilities or Liabilities of The BaileeRitesh Shrinewar100% (2)

- BailmentDocument14 pagesBailmentNitya Nand PandeyNo ratings yet

- Capacity To ContractDocument33 pagesCapacity To ContractAbhay MalikNo ratings yet

- Law of AgencyDocument4 pagesLaw of AgencyDania iqbalNo ratings yet

- Simple MortgageDocument10 pagesSimple MortgagesubramonianNo ratings yet

- Notice Transfer of PropertyDocument13 pagesNotice Transfer of PropertyAnshul SinghNo ratings yet

- Law of Property ProjectDocument8 pagesLaw of Property ProjectdhatriksNo ratings yet

- Law Negotiable Instrument 1881 NotesDocument71 pagesLaw Negotiable Instrument 1881 Notesshubh1612100% (2)

- 08 - Chapter 4Document33 pages08 - Chapter 4Vinay Kumar KumarNo ratings yet

- Types of Goods Under Sales of Goods ACTDocument22 pagesTypes of Goods Under Sales of Goods ACTAlka Singh100% (1)

- Transfer of Property ActDocument8 pagesTransfer of Property ActAnkush JadaunNo ratings yet

- Notes - Quasi COntractsDocument4 pagesNotes - Quasi COntractsKumar AtulyaNo ratings yet

- Banker-Customer RelationshipDocument17 pagesBanker-Customer RelationshipAshish Srivastava0% (1)

- Property Law Transfer by Ostensible OwnerDocument12 pagesProperty Law Transfer by Ostensible OwnerMRINMAY KUSHAL100% (1)

- Sale of Goods Act, 1930Document16 pagesSale of Goods Act, 1930shazebkhannNo ratings yet

- DR - Ram Manohar Lohiya National Law University, Lucknow 2020Document17 pagesDR - Ram Manohar Lohiya National Law University, Lucknow 2020divyavishalNo ratings yet

- Essential Elements of Drafting A Gift DeedDocument9 pagesEssential Elements of Drafting A Gift DeedAniruddha Kaul100% (1)

- TPA ProjectDocument9 pagesTPA Projectसौम्या जैनNo ratings yet

- Audit of Limited Companies - Company AuditorDocument8 pagesAudit of Limited Companies - Company AuditorAshiqul HaqueNo ratings yet

- United States v. Leon E. Boomershine Ann Cramer, Individually and as Trustee of the Leon Eugene Boomershine Irrevocable Trust and the Gene Boomershine Irrevocable Trust Duane Cramer Jacqueline Helscel Dena Helscel and Tammy Helscel, and Mary M. Boomershine, 968 F.2d 1224, 10th Cir. (1992)Document5 pagesUnited States v. Leon E. Boomershine Ann Cramer, Individually and as Trustee of the Leon Eugene Boomershine Irrevocable Trust and the Gene Boomershine Irrevocable Trust Duane Cramer Jacqueline Helscel Dena Helscel and Tammy Helscel, and Mary M. Boomershine, 968 F.2d 1224, 10th Cir. (1992)Scribd Government DocsNo ratings yet

- Eu Report 2019 A PDFDocument8 pagesEu Report 2019 A PDFFahmida M RahmanNo ratings yet

- Addendumto Advertisement 121022Document3 pagesAddendumto Advertisement 121022Robin SinghNo ratings yet

- NO Maintenance - Adultery - Punjab & Haryana High CoutDocument7 pagesNO Maintenance - Adultery - Punjab & Haryana High CoutKAPIL DEVNo ratings yet

- Test Bank For Soc 5th Edition Nijole V Benokraitis 2Document10 pagesTest Bank For Soc 5th Edition Nijole V Benokraitis 2skeneisatin.qsdujz100% (42)

- WIS New Hire Forms - 2022Document5 pagesWIS New Hire Forms - 2022Binh TranNo ratings yet

- Muntilupa Blank QuestionnaireDocument6 pagesMuntilupa Blank QuestionnaireRoy VidalNo ratings yet

- Joffe Opposition To K&S Motion For Summary JudgmentDocument30 pagesJoffe Opposition To K&S Motion For Summary JudgmentabdNo ratings yet

- Office Memorandum Sub: Revised Timeline For Verification of Arrear Demand Under Section 245 of The Income-Tax Act, 1961Document2 pagesOffice Memorandum Sub: Revised Timeline For Verification of Arrear Demand Under Section 245 of The Income-Tax Act, 1961VenkatNo ratings yet

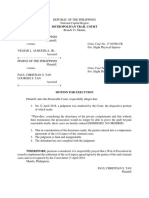

- Motion For ExecutionDocument2 pagesMotion For ExecutiongeelovesgalaxyboyNo ratings yet

- Ajmal Kasab 26 - 11Document17 pagesAjmal Kasab 26 - 11Neel Dalal0% (1)

- CHINA STATE FOUNDATION ENGINEERING LTD v. GOLD BRILLIANT INVESTMENT LTD HCCT000016 - 2020Document17 pagesCHINA STATE FOUNDATION ENGINEERING LTD v. GOLD BRILLIANT INVESTMENT LTD HCCT000016 - 2020Ping Hung TongNo ratings yet

- Roxas V CaDocument4 pagesRoxas V Cajadifer_anneNo ratings yet

- Software PatentsDocument5 pagesSoftware PatentsoguzzerkanNo ratings yet

- Himachal Pradesh E-Mail/ Regd. Public Works Department: NO - SRJ/AB/PMGSY/HP-08-39A/2018-19-Dated: - ToDocument4 pagesHimachal Pradesh E-Mail/ Regd. Public Works Department: NO - SRJ/AB/PMGSY/HP-08-39A/2018-19-Dated: - ToKULDEEP SINGH THAKURNo ratings yet

- Article 32 FinalDocument18 pagesArticle 32 FinalShubham Jain Modi100% (1)

- G. O. (P) No. 3812009ISWD.Document14 pagesG. O. (P) No. 3812009ISWD.Navod PrasannanNo ratings yet

- Jehan Mutin Contract GAD AgendaDocument4 pagesJehan Mutin Contract GAD AgendaLyns EnriquezNo ratings yet

- Fisher V BellDocument2 pagesFisher V BellKim SoonNo ratings yet

- LAW203 - Yu Ming Jin - Prof Maartje de VisserDocument55 pagesLAW203 - Yu Ming Jin - Prof Maartje de VisserLEE KERNNo ratings yet

- Bidding Documents For Contract of Different Canteens in Mayo Hospital, Lahore For The Financial Year 2020-21Document84 pagesBidding Documents For Contract of Different Canteens in Mayo Hospital, Lahore For The Financial Year 2020-21Rana Ahmad AamirNo ratings yet

- Ra 2382Document12 pagesRa 2382Remy BedañaNo ratings yet