Professional Documents

Culture Documents

D3151 Done

Uploaded by

Pawan Kumar DubeyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

D3151 Done

Uploaded by

Pawan Kumar DubeyCopyright:

Available Formats

International Conference on Technology and Business Management

March 18-20, 2013

Digital Inclusion in India: A Case of Mobile Banking

Ganesan Parimalarani vini_parimal@yahoo.com Dayananda Sagar Business Academy, Bangalore 1. Introduction

Mobile-Banking is a buzz word in the banking sector throughout the world and Indian banks are not exception to it. The liberalization, globalization and privatization of the Indian economy in 1990s paved a more flexible functioning of the services sector and particularly the banking industry. Added to this the adoption of technology in the banking sector has made a remarkable advancement in the service quality of the banks in India. Now bank customers are availing their banking services through internet banking, ATM services and further it has added one more feather to its services by introducing Mobile-Banking to its channel of distribution. Mobile banking is a subset of banking as it allows everyone easy access to their banking activities via., mobile handset (YU&Fang, 2009). Various research findings regarding the penetration of mobile phone, states that the penetration level of mobile in the world is more comparable to that of the banking. The Financial Access Initiative, a research consortium based on New-York University has identified that 2.5 adults worldwide do not have a savings or credit account with either a traditional or alternative financial institution (Chaia, et., 2009). Across the globe the formal banking reaches about 37 per cent of the population, but mobile phone penetration level is 50 per cent of the population. When we analyze the Indian scenario, we should first thank for liberalizing the Indian economy. Due to the liberalization that initiated in the telecom sector, it has boomed to a greater extent of growth and it has registered at$100 billion today and its contribution to the gross domestic product today is to the level of 13 per cent. When we compare India with the rest of the world with regard to the number of mobile subscribers, it stands in the second position next to China. As mobile phones have become an essential communication tool for almost every individual, day by day the subscribers are also increasing. According to the recent reports, India will surpass China to become the worlds largest mobile phone markets by the year 2013 and it is estimated to touch 1.159 billion. Mobile phones are considered to be the most appropriate delivery channel for financial services because of the ubiquity of the mobile phones and secondly the subscribers are more in number compared to that of the number of account holders in the bank. So mobile phones are considered yet another channel for delivering the banking services. This is taken as an effective tool to bring the financially excluded people under the purview of banking. When in country like Africa is succeeding in using mobile banking services then why not it can be utilized in India at full swing?. In the respect the Reserve Bank of India (RBI) has shown its green signal in the year 2008 by giving its guidelines regarding the operation of mobile banking and subsequently in 2011 the RBI issued money transfer guidelines also. By keeping this as a background the present study tries to analyze the mobile banking operations in India.

2. Literature Review

Benoy CS (2011) states that , the Indian Banking Industry had outstanding in the last few years, even during the times when the rest of the world was struggling with the financial meltdown. Today most of the banks in India provide various services such as net banking, ATMs, SMS banking and Mobile banking. USAID (2010), argues for adopting alternatives that are better than cash. Barnes. S. J &Corbitt, B (2003) highlighted that the recent innovations in telecommunications helped the banks to provide mobile banking, whereby a customer interacts with a bank via mobile phone. Archana Sharma (2011) states that the rapid growth in users and wider coverage of mobile phone networks have made this channel an important platform for extending banking services to customers. Clark (2008) opines that mobile as a channel delivers convenience and choice to consumers. But there are a large number of different mobile phone devices and it is a big challenge for banks to offer mobile banking solution for any type of device. Riddhima Gandhi (2010), states that mobile banking is not popular even within the urban area. Today less than 14 per cent of urban dwellers use mobile banking. He further states that the awareness level among the people regarding mobile banking is very less and lack of support in vernacular languages. SaikumarRathod (2012) states that mobile phones present enormous opportunity in spreading financial services to the unbanked citizens of the country because of its unique feature of easy access and availability in remote places with a MNO offering basic financial services, large number of tiny and micro transactions could be operated profitably as the mobile e-money account can be easily accessed cutting down the transaction costs involved in traditional banking firms. Jaideep Ghosh (2011) opines that the mobile banking device can be an important tool to cover the large unbanked population in the country. For the banks it serves as 11

International Conference on Technology and Business Management

March 18-20, 2013

a cost-efficient mechanism, with the cost of transaction on a mobile estimated to be one-tenth of the transaction cost of a bank branch and one-sixth the cost of a transaction through an ATM. Kelvin Donovan (2011), expressed that as mobile money matters, people are increasingly discussing the cashless society. Although that is unlikely, mobile money may displace many users of cash. Srinivas Nidugondi(2012), in his write up opines that that the mobile financial services value chain is complex, incorporating wholesale arrangements between financial service providers and strong partners with a wide reach like mobile network operators, security, reliability and performance are critical factors in ensuring the successful extension of mobile financial services uptake which also pose a challenge. Dan Radcliffe& Rodger (2012) in their work opines that the expansion of digital payment platforms has linked a large number of poor people to digital accounts, but no country has successful in their attempt. Dikit.S.V, Shringarpur (2012) opines that to gain popularity for mobile banking banks should make tie-ups with the moservicevices providers and try to provide services at cheaper rates. Prerna Sharma Bamoniya &Preeti Singh (2012) paper focuses on the barriers to adoption of mobile banking. It further focuses on preferred services by the mobile banking customers and influence of mobile banking services adoption. Gazelle Aggarwal & Harminder Kaur (2012) In their paper states that the major concern of all the customers is security and privacy related to mobile banking. Enbeck& Tarazi (2011) states that to facilitate more sophisticated service regulatory development is necessary. Rao& Prathima (2003) states that there is huge potential of mobile banking in India but Indian banks offering mobile banking services still have a long way to go. Peter Dittus and Michael Klein (2011) in their working paper described about M-Pesa in Kenya and analyzed in detail the transactions involved. It argues that in order to harness the potential of financial inclusion it is vital to permit experimentation with different business models. Maimbo, Samuel and Tania Saravya (2010) states that for mobile banking to reach its full potential in South Africa, the African Government must establish a more efficient regulatory framework. Hanudin, et al., (2006) analyzed the mobile banking acceptance level of Malaysian customers. The study certifies that traditional TAM measure was found to be significant factors of the behavioral intention to use mobile banking and this was influenced by the extent of security and privacy factor. The present paper made an attempt to analyze the reach of mobile banking among bank customers in Bangalore (city in Karnataka, India). It also ranked the banks on the basis of the volume and value of mobile transaction registered during January 2012-December 2012.

3. Objective of the study and the Research Methodology

The study is based on two objectives. The first objective is to analyze the usage of mobile banking services by people in Bangalore, India. The second objective is to analyze the performance of banks in India in the area of mobile banking and to rank the best mobile banking service provider on the basis of the value of transactions. The study is based on primary and secondary data. Primary data collected through questionnaire from 100 respondents in Bangalore who have accounts in the bank. The respondents were selected through simple random sampling method. For secondary data the main source of information is RBI web site. For sanalysing the data tools like correlation analysis, percentage, average , growth rate and conjoint analysis are used. \

4. Analysis

The concept digital inclusion in the banking industry has become a common parlance throughout the world. The term digital inclusion means giving people the basic technology skills to participate in the knowledge economy which in turn lead to improved macro-economic performance. In other word digital inclusion also known as using any digital technology in communities to tackle area-based deprivation. The study deals with respect to mobile banking in India. Mobile banking transactions refer to banking transactions through mobile phones by bank customers that involve credit/debit to their accounts. The first part of the analysis deals with usage of mobile banking services by people in Bangalore, India. and second part analyze the performance of the commercial and cooperative banks in India in the area of mobile banking. The sample size is 100. The study consists of 65male and 35 female respondents. All the respondents are possessing mobile phones with them and they also have accounts in the bank. In that 48 respondents are having their bank account with the public sector banks and the rest of the 52 respondents have their account in private sector banks. Among the 100 respondents 86 respondents heard about mobile banking. 14 respondents are not having any idea about mobile banking. Added to this among 86 respondents only 62 respondents are availing the mobile banking services .Table 1 represents the demographic profile ofrespondents.

12

International Conference on Technology and Business Management

March 18-20, 2013

Table 1: Demographic Profile of Respondents Characteristics Frequency Percentage Gender : Male 65 65 Female 35 35 Age : 16-25 years 20 20 25-45 years 54 54 45-60 years 17 17 61 plus 9 9 Income : Rs.10000 or less 15 15 (per month)Rs 10000 - Rs. 20000 22 22 Rs.20000- Rs.30000 52 52 Rs.30000- Rs.40000 4 4 Rs.40000- Rs.50000 7 7 Rs.50000- 100000 Nil Nil Rs.100000 and above Nil Nil Source: Primary data Table 2 represents with awareness of the respondents about mobile banking. Only 86 respondents know about mobile banking services. 14 respondents are not having any idea about mobile banking. 53% of the respondents came to know about mobile banking services from their banks. 26% of the respondents got some information about mobile banking services through advertisement and the rest of the 21% of the respondent gained some idea through their family members and through their friends. The awareness created by the banks in this area is quite healthy. Table 2: Awareness about Mobile Banking Mode of awareness Respondents Percentage Directly from Bank 46 53 Advertisement 22 26 Family/Friends 18 21 Total 86 100 Source: Primary data Table 3 deals with reason for not availing mobile banking services. Table 3: Reason for not availing Mobile Banking Services Reason for not availing mobile banking Respondents Percentage Difficult- Need more knowledge 11 45 Security Factors 10 42 Costly 3 13 Total 24 100 Source: Primary data Four reasons were identified. Among them 45% of the respondent opined that they are not comfortable with the operational device and 42% of the respondent felt that security factor is the major reason for not using mobile banking services. Subsequently only 13% of the respondents expressed that mobile banking services are costly. Table 4 depicts the reason for availing mobile banking services by the respondents.89 % of the respondents use mobile banking services due to the flexibility in services i.e., anywhere and anytime banking. 10% of the respondents states that the main reason for availing such services is mainly due to the cost is less compared to visiting the branch. No one has mentioned about easy to use. Table 4: Reason for availing Mobile Banking Services by the Respondents Reason for availing mobile banking Respondents Percentage Flexibility (anywhere/anytime) 55 89 13

International Conference on Technology and Business Management

March 18-20, 2013

The cost is less compared to visiting the branch SMS alerts Easy to use Total Source: Primary data

6 1 --62

10 1 --100

Table 5 represents the mobile banking services availed by the respondents. The respondents ranked the services availed by them. The services are classified into four classifications (1) Enquiry services (Balance enquiry/Mini Statement/ATM/Branch location search) (2) Fund transfer (3) Bill payment (utility bills, credit cards,) (4) Check book request, check status inquiry. Table 5: Ranking the Mobile Banking Services used by the Respondents Services Score Rank Enquiry Status 514 I Fund transfer 416 II Cheque book request, cheque status enquiry 410 III Bill Payment 338 IV Source : Primary data Through Conjoint analysis the mobile banking services availed by the consumers are ranked. From the Table 5 it is noted that the consumers ranked the enquiry status as number I followed by fund transfers II place, cheque book request/cheque status enquiry and bill payments as rank III and IV respectively. Still many respondents are not using the mobile banking in an effective way. The Major segment of the respondents avails enquiry status as the most important services. Performance of Banks in India in providing mobile banking services:Banks are considered as the nerve center of an economy. Through their varied services they cater the need of the customers. Now we are in the era of technology and the banks throughout the world has optimized the technology by introducing technology oriented channel of distribution. Presently we are much taking about mobile banking services. In India we have Public sector banks, Private sector banks, Regional rural banks and cooperative banks. Presently we have 20 Nationalized Banks, 6 State Bank& Group, 13 old private sector banks, 7 New generation private sector banks, 41 foreign banks, 52 Urban co-operative banks and Regional Rural banks with operations. Among the group of 20 nationalized banks only one bank i.e., the Punjab& Sind Bank is not providing mobile banking services and in old private sector categories two banks namely Nainital Bank Ltd and Ratnakar Bank Ltd are not providing mobile banking services. All the new generation private sector banks and State bank & its group are providing mobile banking services at full swing. It is quite appreciating about co-operative banks. Though we have 52 urban co-operative banks only seven of them are very active in providing mobile banking services. Table 6 depicts the total volume and value of mobile transaction for the period January 2010 to December 2012 and figure pictures the total volume and value of mobile transaction for the period May 2009 to December 2012. Table 6: Total Volume and value of Mobile Banking Transaction of Indian Banking Industry for the Period January 2010 December 2012 Volume Growth rate Value Growth rate Month & Year (In 0000) (In %) (In 0000) (In %) Jan-10 196380 ----117466.03 ---Feb-10 195067 -0.67 127530.45 8.57 Mar-10 271920 39.40 236245.68 85.25 Apr-10 289214 6.36 283956.77 20.20 May-10 351977 21.7 366072.68 28.92 Jun-10 371639 5.59 345473.45 -5.63 Jul-10 472978 27.27 467635.5 35.36 Aug-10 528589 11.76 473266.07 1.20 Sep-10 499039 -5.58 437947.43 -7.46 14

International Conference on Technology and Business Management

March 18-20, 2013

11.41 517688.5 11.96 552651.92 9.41 607101.93 6.41 627731.7 87.62 616190.74 55.11 846277.32 -1.40 762448.43 18.02 912273.33 10.23 984664.03 23.88 1200103.67 13.60 1364643.3 3.69 1464598.57 8.47 1606940.92 3.30 1739171.89 15.15 1979847.65 6.13 1909045.33 -1.60 1960417.16 11.56 2325320.68 1.77 2345677.57 5.30 2865454.43 2.63 3067107 7.82 3379714.95 7.08 3548627.57 -1.78 4104519.01 13.85 4976472.7 6.39 5389547.56 10.59 5981382.78 12.93 1680312 CORRELATION 0.97 Source: Compiled from RBI web site, Monthly report

Oct-10 Nov-10 Dec-10 Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12 Feb-12 Mar-12 Apr-12 May-12 Jun-12 Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 Dec-12 AVERAGE

556003 622480 681037 724682 707406 1097251 1081921 1277643 1408396 1744691 1981924 2055003 2245138 2319145 2670488 2844938 2799554 3123105 3178405 3346743 3437074 3705690 3968226 3897614 4437342 4720871 5221007 1917516

18.21 6.75 9.85 3.40 -1.84 37.34 -9.91 19.65 7.94 21.88 13.71 7.32 9.72 8.23 13.84 -3.58 2.69 18.61 0.88 22.16 7.04 10.19 5.0 13.54 21.24 8.30 10.98 12.84

Figure 1: Total volume and value of Mobile Banking Transaction of Indian Banking Industry for the period May 2009 December 2012 12000000 10000000 8000000 6000000 4000000 2000000 0

May-09 Mar-10 May-10 Mar-11 May-11 Mar-12 May-12 Jul-09 Sep-09 Nov-09 Jan-10 Jul-10 Sep-10 Nov-10 Jan-11 Jul-11 Sep-11 Nov-11 Jan-12 Jul-12 Sep-12 Nov-12

VOLUME

VALUE

During the period of study the volume as well as the value of mobile transactions has increased by 26.59 times and 50.92 times respectively. The average growth rate for volume of mobile transaction and value of transactions for the period has registered at 12.93 per cent and 12.84 per cent respectively. The growth rate for the volume of transaction during February 2010, September 2010, April 2011, February 2012 and September 2012 registered negative growth rate of 0.67%, 5.58%, 1.40%, 1.60% and 1.78% respectively. Likewise the 15

International Conference on Technology and Business Management

March 18-20, 2013

growth rate for the value of transaction for June 2010, September 2010, February 2011, April 2011 and January 2012 registered negative growth rate of 5.63 %, 7.46%,1.84%,9.9% and 3.58% respectively. It is noticed that in the month of September 2010 and April 2011 the growth rate of volume of transaction as well as value of transactions recorded a negative growth rate. There exists a positive correlation ( 0.97) between the total volume and value of mobile transactions for the period May 2009- December 2012. Table 7 depicts Bank-Group- Wise total mobile banking transactions on the basis of value and volume for the period January 2012-December 2012.SBI & its group registered the highest growth in the volume of transaction, followed by the New Generation private sector banks. From the above table it is clear that the share to the total volume of transaction is highest for SBI & Group (76.9%) which is followed by New Generation Private sector banks, Nationalized banks, Old generation private sector banks, foreign banks and co-operative banks to the tune of 18.64%, 2.88%, 1.12%, 0.16% and 0.3% respectively. On the basis of the value of transactions the New Generation Banks registered the highest share of 47.8 % and which is followed by SBI & Groups, Foreign Banks, Old Generation private sector banks, nationalized banks Co-operative banks to the extent of 40.97%, 9.64%, 1.09%, 0.4% and 0.08% respectively. From the table it is clear that even co-operative banks are taking effective steps in implementing the mobile banking in an effective way. Their share to the total volume and value is quite considerable. Table 7: Bank Group- Wise total Mobile Banking Transactions on the basis of Value and Volume for the period January 2012-December 2012

Bank group-Wise Nationalized Bank SBI& GROUP Foreign Banks New Generation private sector Banks Old Generation private sector Banks Co-operative Banks TOTAL Total volume of transaction (In 000) 1258331 33511271 6182104 8121650 488000 130242 49691598 Share of the total volume of transaction 2.88 76.9 0.16 18.64 1.12 0.3 100 Total value of transaction (In 000) 161774 16334879 3842197 19064504 436934.1 32452.79 39872741 Share of the total value of transaction 0.4 40.97 9.64 47.8 1.09 0.08 100

Source: Compiled from RBI website Table 8 deals with ranking the commercial banks and Co-operative banks in India on the basis of volume and value of mobile transaction for twelve months i.e., January 2012- December 2012. Currently in India 52 (commercial banks and urban Co-operative banks) banks are providing mobile banking services. Among the 52 banks best 10 banks have been ranked based on the volume and value of mobile banking transaction .On the basis of volume of mobile transactions SBI topped the list followed by State Bank of Mysore and ICICI Bank. When we analyze Bank Group-Wise SBI & Group ranked the position of 1, 2 and 7 the place. Among the New Generation Private sector Banks ICICI Bank stood in the 3rd place, AXIS Bank in the 4th position and HDFC Bank in the 6th position .Among the foreign Banks only Citi Bank occupied the 5th Position. Two nationalized banks i.e., Union Bank of India and Bank of Baroda got the place of 8th and 9th position. Only one Old private sector bank namely South Indian Bank got the place of 10th rank. On the basis of the value of transaction ICICI Bank topped the list followed by SBI, Oriental Bank of Commerce, City Bank, State Bank of F Mysore, AXIS Bank etc. KUDOS to SBI and ICICI Bank Ltd for scoring the best bank in the volume and value of mobile banking transactions. Table 8: Ranking the Banks on the basis of volume and value of transactions for the period January2012-December2012 RANKING BASED ON VOLUME OF RANKING BASED ON VALUE OF MOBILE TRANSACTIONS MOBILE TRANSACTIONS State Bank Of India 1 ICICI Bank Ltd 1 State Bank of Mysore 2 State Bank Of India 2 ICICI Bank Ltd 3 Oriental Bank of Commerce 3 AXIS Bank Ltd 4 Citi Bank 4 Citi Bank 5 State Bank of Mysore 5 HDFC Bank Ltd 6 AXIS Bank Ltd 6 State Bank of Travancore 7 Bank of Baroda 7 16

International Conference on Technology and Business Management

March 18-20, 2013

Union Bank of India 8 ING Vysya Bank Ltd Bank of Baroda 9 Union Bank of India South Indian Bank 10 HDFC Bank Ltd Source: Compiled from the monthly report on the RBI website

8 9 10

5. Conclusion

Mobile banking is of recent origin. Many banks in India are providing this service to their customers with limited services. The statistical data reveals that the penetration level of mobile in India is much more than that of the bank account holders in India i.e., only 55 per cent of the people in India have a deposit account. In India we have 90,000 bank branches which are not enough to bring all the people under the purview of banking. To cover all the population with brick & mortar banking stream it will take more than 20 years. So to overcome these difficulties mobile banking can be implemented in an effective way. Apart from this to promote mobile banking in a full swing the bankers and the regulators can take appropriate effective steps. The newspaper information reveals that in India mobile banking currently constitutes 0.1 percent of total banking transactions. As per the HDFC and SBI bank data the number of mobile banking customers has increased to 1.2 million and 5.2 million respectively. Every month the number of customers registering for mobile banking is increasing considerably. Very recently to expand the mobile banking services for Hindi knowing people the HDFC Bank have started Hindi mobile banking services and net safe light virtual card. To facilitate the mobile users, now the RBI has allowed the mobile bank users to use a semi closed wallet by mobile companies via semi closed wallet accounts. Through this the mobile bank users can spend and send money through mobile network but they cannot withdraw cash. From the study it is noticed that still in City like Bangalore people lack knowledge about mobile banking and some customers are reluctant to use mobile banking services. It is identified that still there is lacuna on the part of the banker in promoting mobile banking services. To overcome this problem the following steps can be taken. 1. Information regarding the mobile banking has not reached the customers in a larger way. So bank should take effective steps in this regard to popularize this channel of banking. 2. Banks should arrange a demo-fares regarding mobile banking. They have to educate the customers in this regard. 3. There should be a tie-up with mobile service provider and the banks in a broader way. Like how ICICI Bank and SBI are having tie-up with vodofone. 4. The bank should offer mobile banking services for both low-end and high-end segments. 5. To popularize the mobile banking the banks have to give training to its employees. 6. Banks should be transparent about the service tax, charges etc. 7. In Bangladesh to bring the non- banking people under the banking stream they use mobile banking as the channel .For this telecom authority in Bangladesh have reduced the charges on mobile banking. In the near future the digital inclusion will bring revolution in the Indian banking arena by successfully adopting the mobile banking as the channel for bringing all the people under the umbrella of banking.

6. References

1. 2. 3. Archna Sharma (2011), Mobile banking as technology adoption and challenges[online] Available: www.zenithresearch.org.in/images/stories/Pdf 2011 [4.2.2013]. Barnes&Corbitt (2003), Mobile banking: Concept and potential, International journal of mobile communication (3), 273-288. Benoy C.S (2011), Mobile banking: Opportunities and challenges in the India market, discussion board, [online].Available:www.tele.net.in/discussion_borad/item/7732-mobile-banking-opportunities and challenges-in the India market? [22.1.2013]. Chai, et.al (2009), Mobile on the move ABA Banking journal, Vol 101, Issue 5, p-26-29. Clark, Adam (2008), Mobile banking& switching. [Online] Available: www.mcom.co/nz/assets/Sm/163/ /criticalswitchingevents_whitepaper.pdf. [23.1.2013]. Dan Radcliffe & Rodger Varhies (2012), A Digital pathway to financial inclusion[Online] Dixit S.V & et.al (2012), Strategies to make mobile banking popular in India, Advances in management, Vol5 (12). [Online] Available :www.managein.net/pdf_Articles/Dec-2012 [15.1.2013]. Enbech & tarazi (2011), Putting the banking in branchless banking : The case for interest-bearing and insured E money savings account, Washington, DC: World economic forum. 17

4. 5.

6. 7. 8.

International Conference on Technology and Business Management

March 18-20, 2013

9.

10. 11. 12.

13. 14.

15. 16. 17. 18.

19. 20. 21. 22. 23.

Gazelle Aggarwal 7 Harminderkaur (2012), Mobile banking: A new paradigm shift in buying channel., IJRFM Volume 2, Issue 1. [Online] Available: http://www.mairec.org/IJRFM/Jan2012/5.pdf.[28.1.2013]. Hanudin(2006), An Analysis of Mobile Banking Acceptance by Malaysian customers, Journal of financial services marketing, Vol 1. Jaideep Ghosh (2011), Mobile banking: Opportunities and challenges in the India market, Discussion board, April 29,2011. Kevin Donovan (2011), Mobile money for financial inclusion, The mobile financial services development report, 37-42.Washington, DC: World economic forum. [Online] Available :http://siteresources.worldbank.org/ Petter Dittus & et.al (2011) , Working paper No 347. Maimbo , Samuel &et. al (2010), Facilitating cross-Border mobile banking in Southern Africa, Poverty reduction & Economic Management network, World Bank. Prerna Sharma Bamoniya& Preeti Singh (2012), Mobile banking in India: Barriers in adoption & service preferences, Integral review-A journal of management, Vol5, No.1, June. [Online] Available: www.integraluniversity.ac.in/12052010[ 16.2.2013]. Rajanish Dass & Sujoy Pal (2011), A meta analysis on adoption of financial services Working paper No 2011-01-05, IIM Ahmedabad. Riddhima Gandhi (2010), Calling a mobile banking: Financial inclusion in rural India, Center for strategic and International studies , No 143, July. Rao& Prathima (2003), Online banking in India, Mondaq business briefing, April 2003 Sai Kumar rehash (2012) An adhaar- based mobile money framework for financial inclusion in India, IIM Calcutta, working paper series WPS. No 692. [Online] Available :http://facultylive.iimcal.ac.in/sites/wps%20692-opdf[18.1.2013]. Shirley J.H.O & et.al (2006), The impact of information technology on the banking industry; theory & empiric. Sridhar Pai (2011), Mobile banking: Opportunities and challenges in the India market, Discussion board, April 29,2011. Srinivas Nidugondi (2012), Mobile banking- A springboard to financial inclusion. Weber, Rolf & et.al (2010), Legal issues in mobile banking, Journal of Banking Regulation , Vol 11, p-129-145. YU, T.K., & Fang. K (2009), Measuring the post adoption customers perception of mobile banking services cyber psychology and behavior.[online]

18

You might also like

- Beginners Guide To Debt Mutual Funds LeafletDocument4 pagesBeginners Guide To Debt Mutual Funds LeafletPawan Kumar DubeyNo ratings yet

- E-Banking 1209.2368Document4 pagesE-Banking 1209.2368Sanjay JainNo ratings yet

- Prov Bs 31 Dec 2012 HiplDocument11 pagesProv Bs 31 Dec 2012 HiplPawan Kumar DubeyNo ratings yet

- Why Invest in Bad Times Leaflet Aug 2013Document2 pagesWhy Invest in Bad Times Leaflet Aug 2013Pawan Kumar DubeyNo ratings yet

- Im en 2007 04 SrivastavaDocument7 pagesIm en 2007 04 SrivastavaArpit MehtaNo ratings yet

- Hcii2009 Medhi Ratan Toyama D 26Document12 pagesHcii2009 Medhi Ratan Toyama D 26Pawan Kumar DubeyNo ratings yet

- Online Banking SpringerDocument9 pagesOnline Banking SpringerPawan Kumar DubeyNo ratings yet

- 1011965421394211120136821750Document0 pages1011965421394211120136821750Pawan Kumar DubeyNo ratings yet

- Ahmed E Banking Paper 09Document18 pagesAhmed E Banking Paper 09Humayun KhanNo ratings yet

- PHD Couse 13Document2 pagesPHD Couse 13Pawan Kumar DubeyNo ratings yet

- 4Document20 pages4Pawan Kumar DubeyNo ratings yet

- Emerging Issues and Strategies To Enhance M-Banking ServicesDocument8 pagesEmerging Issues and Strategies To Enhance M-Banking ServicesCharu ModiNo ratings yet

- NDocument10 pagesNPawan Kumar DubeyNo ratings yet

- Case Study of Mobile BankingDocument5 pagesCase Study of Mobile BankingShefali Garg100% (1)

- 41122606 (1)Document48 pages41122606 (1)Pawan Kumar DubeyNo ratings yet

- Challenges of pension reforms in Western Balkan countriesDocument10 pagesChallenges of pension reforms in Western Balkan countriesPawan Kumar DubeyNo ratings yet

- SadhakDocument28 pagesSadhakPawan Kumar DubeyNo ratings yet

- PHD Couse 13Document2 pagesPHD Couse 13Pawan Kumar DubeyNo ratings yet

- Make The New Pension System Work For You-MoneyoutlookindiaDocument3 pagesMake The New Pension System Work For You-MoneyoutlookindiaPawan Kumar DubeyNo ratings yet

- ZDocument5 pagesZPawan Kumar DubeyNo ratings yet

- DSDDocument9 pagesDSDPawan Kumar DubeyNo ratings yet

- Financial MarketDocument97 pagesFinancial MarketPawan Kumar DubeyNo ratings yet

- FDI in Indian Retail Sector Analysis of Competition in Agri-Food SectorDocument57 pagesFDI in Indian Retail Sector Analysis of Competition in Agri-Food SectorTimur RastomanoffNo ratings yet

- FdiDocument5 pagesFdiPawan Kumar DubeyNo ratings yet

- Constitution of IndiaDocument9 pagesConstitution of IndiaPawan Kumar DubeyNo ratings yet

- Performance Highlights Q3 - 2010-11Document4 pagesPerformance Highlights Q3 - 2010-11Pawan Kumar DubeyNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- HP MOQ Traditional BPC Mar'21 Pricelist - FTPDocument8 pagesHP MOQ Traditional BPC Mar'21 Pricelist - FTPrachamreddyrNo ratings yet

- Five Model Intragroup Conflict ManagemantDocument22 pagesFive Model Intragroup Conflict ManagemantmarsNo ratings yet

- 6 Non-Executive-Presidents-In-Parliamentary-Democracies-PrimerDocument34 pages6 Non-Executive-Presidents-In-Parliamentary-Democracies-PrimerWorawut Von SarkhanNo ratings yet

- Manila Bay accretion disputeDocument24 pagesManila Bay accretion disputeRoman KushpatrovNo ratings yet

- Gildan - Asia - 2019 Catalogue - English - LR PDFDocument21 pagesGildan - Asia - 2019 Catalogue - English - LR PDFKoet Ji CesNo ratings yet

- Utah County Attorney Prioritized CrimesDocument9 pagesUtah County Attorney Prioritized CrimesThe Salt Lake TribuneNo ratings yet

- Tkinter Cheat SheetDocument2 pagesTkinter Cheat Sheetphanina01No ratings yet

- Scrum Developer AssessmentDocument11 pagesScrum Developer Assessmentmohannad44% (9)

- Afl Fact SheetDocument1 pageAfl Fact Sheetapi-257609033No ratings yet

- k-Means-Lite: Real Time Clustering For Large Datasets: Peter O. OlukanmiDocument6 pagesk-Means-Lite: Real Time Clustering For Large Datasets: Peter O. OlukanmiHomeNo ratings yet

- 2020 Scrum Guide ArabicDocument15 pages2020 Scrum Guide Arabicnbo100% (1)

- Scanning A School Prospectus PDFDocument2 pagesScanning A School Prospectus PDFJorge MeléndezNo ratings yet

- Joint Operations Doctrine Core PublicationDocument182 pagesJoint Operations Doctrine Core Publicationfredscout76100% (2)

- Practice Test 13Document3 pagesPractice Test 13anhkiett27112008No ratings yet

- Introduction To RF For Particle Accelerators Part 1: Transmission LinesDocument58 pagesIntroduction To RF For Particle Accelerators Part 1: Transmission LinesJohn McCarthyNo ratings yet

- Cases On 9 (1) (A)Document2 pagesCases On 9 (1) (A)Dakshita Dubey100% (2)

- IVMS Pharmacology Flash FactsDocument8,250 pagesIVMS Pharmacology Flash FactsMarc Imhotep Cray, M.D.No ratings yet

- Beumer HD Gurtbecherwerk GBDocument8 pagesBeumer HD Gurtbecherwerk GBrimarima2barNo ratings yet

- Robot ReportDocument49 pagesRobot ReportJiya MakwanaNo ratings yet

- Career Interest Inventory HandoutDocument2 pagesCareer Interest Inventory HandoutfernangogetitNo ratings yet

- LM - Top Voicemail HacksDocument5 pagesLM - Top Voicemail HacksMaksi UnairNo ratings yet

- Direct Cuspal Coverage Posterior Resin Composite RestorationsDocument8 pagesDirect Cuspal Coverage Posterior Resin Composite Restorationsdentace1No ratings yet

- Eco System and Green Logistics BasicsDocument32 pagesEco System and Green Logistics BasicsBudmed GanbaatarNo ratings yet

- International Tax Transfer Pricing MethodsDocument17 pagesInternational Tax Transfer Pricing MethodsAshish pariharNo ratings yet

- How To Model A Square Foundation On PlaxisDocument4 pagesHow To Model A Square Foundation On Plaxisomarrashad84No ratings yet

- Proof of Stock OwnershipDocument5 pagesProof of Stock OwnershipSebastian GarciaNo ratings yet

- Business Strategy and CSR 1Document19 pagesBusiness Strategy and CSR 1Vania WimayoNo ratings yet

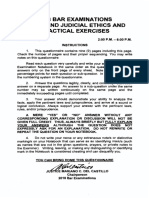

- 2018 Bar Examinations Practical Exercises: Legal and Judicial Ethics andDocument9 pages2018 Bar Examinations Practical Exercises: Legal and Judicial Ethics andrfylananNo ratings yet

- Haulotte Compact 8-10-12 Elec Scissor ManualDocument76 pagesHaulotte Compact 8-10-12 Elec Scissor Manualezeizabarrena96% (27)

- STM Turbine Overspeed Failure Investigation-1Document11 pagesSTM Turbine Overspeed Failure Investigation-1Abdulrahman AlkhowaiterNo ratings yet