Professional Documents

Culture Documents

Basic Methods for Engineering Economy Studies

Uploaded by

xxkooonxxOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basic Methods for Engineering Economy Studies

Uploaded by

xxkooonxxCopyright:

Available Formats

BASIC METHODS FOR MAKING ECONOMY STUDIES

All engineering economy studies of capital projects should be made so as to include consideration of the return that a given project will or should produce. There are six basic methods or patterns for making economy studies. These are: Annual Worth (A.W.); Present Worth (P.W.); Future Worth (F.W.); Internal Rate of Return (I.R.R.); External Rate of Return (E.R.R.); and Explicit Reinvestment Rate of Return (E.R.R.R.).

ANNUAL WORTH METHOD (A.W.)

a uniform annual series of net cash flows for a certain period of time that is equivalent in amount to a particular schedule of cash inflows (receipts or savings) and/or cash outflows (disbursements or opportunity cost) under consideration.

Criterion: if AW 0, the project is feasible, otherwise, it is not Capital Recovery (CR) cost- the equivalent uniform annual cost of the capital invested. It is annual amount which covers the Depreciation (loss in value of the asset) and Interest (minimum required profit) on invested capital. Formulas in solving for CR cost

eq. 1 eq. 2 eq. 3 Note:

F/P = (1+ ) N P/F = (1 + )-N F/A = P/A = A/F = A/P =

PRESENT WORTH METHOD (P.W.) -

is based on the concept of equivalent worth of all cash flows relative to some base or beginning point in time called the present. That is, all cash inflows and outflows are discounted back at an interest rate that is generally the M.A.R.R.

Criterion: if PW 0, the project is feasible, otherwise, it is not.

FUTURE WORTH METHOD (F.W.) -

is exactly comparable to the present worth method except that all cash inflows and outflows are compounded forward to a reference point in time called the future.

Criterion: if FW 0, the project is feasible, otherwise, it is not

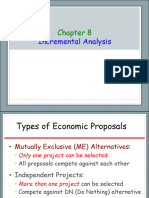

Rate of return - the ratio between the money gained or lost on an investment and the amount of money invested. The other three methods for making economy studies are based on the investments rate of return. Minimum Attractive Rate of Return (M.AR.R.) the minimum return level at which the capital project must provide in order for it to be feasible. INTERNAL RATE OF RETURN METHOD (I.R.R.) I.R.R. - discount rate at which the net negative cash flows (or the net present worth of costs) of the investment is equal to the net positive cash flows (or the net present worth of benefits) of the investment. Computation of I.R.R. where Rk = net receipts for kth year Dk = net disbursements for kth year EXTERNAL RATE OF RETURN (E.R.R.) E.R.R. - all recovered funds or the net cash flows can be reinvested at some specified rate of return (usually the M.A.R.R.) until the life or study period for the project. N = project life or maximum number of years for study = Single Payment Present Worth Factor

Computation of E.R.R. where Rk = net inflow for kth year Dk = net outflow for kth year N = project life e = reinvestment rate EXPLICIT REINVESTMENT RATE OF RETURN METHOD E.R.R.R. used when there is a single lump sum investment and uniform cash savings or returns at the end of each period throughout the life N of the project. Computation of E.R.R.R. = Single Payment Present Worth Factor = Single Payment Compound Amount Factor

where R = uniform annual receipts or savings D = uniform annual costs or disbursements P = investment F = salvage value e = reinvestment rate = sinking fund factor

Comparison of Economy Study Methods Method Annual Worth Present Worth Future Worth E.R.R E.R.R.R. I.R.R. Assumption can be reinvested at the i% which is normally at the M.A.R.R.

all the funds are reinvested at a particular I.R.R. rate computed

You might also like

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Basic Method For Making Economy Study NotesDocument3 pagesBasic Method For Making Economy Study NotesMichael DantogNo ratings yet

- Decoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisFrom EverandDecoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisNo ratings yet

- Essential Economy Study MethodsDocument1 pageEssential Economy Study MethodsFRANCISCO JERHYL KEITH G.No ratings yet

- Main Project Capital Budgeting MbaDocument110 pagesMain Project Capital Budgeting MbaRaviKiran Avula65% (34)

- CHAPTER 5 Engineering EconomicDocument44 pagesCHAPTER 5 Engineering EconomicLaila AzreenNo ratings yet

- Chapter 14Document2 pagesChapter 14jhouvanNo ratings yet

- Engeco Chap 05 - Evaluating A Single Project - ADocument45 pagesEngeco Chap 05 - Evaluating A Single Project - ALJHNo ratings yet

- 12-Applications of Money-Time RelationshipDocument12 pages12-Applications of Money-Time RelationshipFelix Elamparo0% (1)

- Unit 5 - Single Project EvaluationDocument38 pagesUnit 5 - Single Project EvaluationAadeem NyaichyaiNo ratings yet

- CB 1Document3 pagesCB 1Shreyas KothiNo ratings yet

- 5 Evaluating A Single ProjectDocument32 pages5 Evaluating A Single ProjectImie CamachoNo ratings yet

- unitiiieam-140916060644-phpapp01Document20 pagesunitiiieam-140916060644-phpapp01BRAHIMNo ratings yet

- Chapter 5Document71 pagesChapter 5Saif AlbaddawiNo ratings yet

- Weighted Average Cost of CapitalDocument6 pagesWeighted Average Cost of CapitalStoryKingNo ratings yet

- Enecono Investment Balance Chenelyn PDF VersionDocument52 pagesEnecono Investment Balance Chenelyn PDF Versionapi-19961306No ratings yet

- Profitability Analysis Method PresentationDocument16 pagesProfitability Analysis Method PresentationArnab DasNo ratings yet

- Capital BudgetingDocument22 pagesCapital BudgetingRajatNo ratings yet

- MAS - Capital BudgetingDocument7 pagesMAS - Capital BudgetingJohn Mahatma AgripaNo ratings yet

- Capital BudgetingDocument24 pagesCapital BudgetingMD. SHORIFUL ISLAMNo ratings yet

- ECONNNDocument2 pagesECONNNKRISCHELLE MAGRACIANo ratings yet

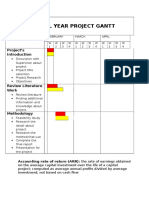

- Final Year Project Gantt Chart: February March April W 1 W 2 W 3 W 4 W 1 W 2 W 3 W 4 W 1 W 2 W 3 W 4Document5 pagesFinal Year Project Gantt Chart: February March April W 1 W 2 W 3 W 4 W 1 W 2 W 3 W 4 W 1 W 2 W 3 W 4AnkitNo ratings yet

- Payback Period:: Period in Capital Budgeting Refers To The Period of Time Required For The Return On An InvestmentDocument4 pagesPayback Period:: Period in Capital Budgeting Refers To The Period of Time Required For The Return On An InvestmentshabnababuNo ratings yet

- MAS 14 Capital Budgeting With Investment Risks ReturnsDocument16 pagesMAS 14 Capital Budgeting With Investment Risks ReturnsPRINCESS ANN GENEROSO ALINGIGNo ratings yet

- Basic Methods For Making Economy Study (Written Report)Document9 pagesBasic Methods For Making Economy Study (Written Report)xxkooonxx100% (1)

- Capital Budgeting: 1. Discounted Cash Flow Criteria (Time Adjusted Methods)Document7 pagesCapital Budgeting: 1. Discounted Cash Flow Criteria (Time Adjusted Methods)Vinoth KarthicNo ratings yet

- Basic Economic Study MethodsDocument53 pagesBasic Economic Study MethodsDrix ReyesNo ratings yet

- Combined Heating, Cooling & Power HandbookDocument8 pagesCombined Heating, Cooling & Power HandbookFREDIELABRADORNo ratings yet

- TVM Concepts ExplainedDocument4 pagesTVM Concepts ExplainedMark AlderiteNo ratings yet

- Chapter 5Document46 pagesChapter 5xffbdgngfNo ratings yet

- Techniques of Investment AnalysisDocument32 pagesTechniques of Investment AnalysisPranjal Verma0% (1)

- Non Discounted Techniques LectureDocument3 pagesNon Discounted Techniques Lectureamormi2702No ratings yet

- CAPITAL BUDGETING PROCESSDocument15 pagesCAPITAL BUDGETING PROCESSJoshua Cabinas100% (1)

- Internal Rate of Return - WikipediaDocument6 pagesInternal Rate of Return - Wikipediapuput075No ratings yet

- Chapter 4 Evaluating A Single Project IRR and ERRDocument12 pagesChapter 4 Evaluating A Single Project IRR and ERRSarah Mae WenceslaoNo ratings yet

- TOPIC 5 Ecu 402Document16 pagesTOPIC 5 Ecu 402Mksu GeniusNo ratings yet

- Project Valuation Methods for Financial AnalysisDocument16 pagesProject Valuation Methods for Financial Analysisknowledge informationNo ratings yet

- BUAD 839 ASSIGNMENT (Group F)Document4 pagesBUAD 839 ASSIGNMENT (Group F)Yemi Jonathan OlusholaNo ratings yet

- Summary of Capital Budgeting Techniques GitmanDocument12 pagesSummary of Capital Budgeting Techniques GitmanHarold Dela FuenteNo ratings yet

- Capitalbudgeting 2Document16 pagesCapitalbudgeting 2patrickjames.ravelaNo ratings yet

- Ebtm3103 Slides Topic 3Document26 pagesEbtm3103 Slides Topic 3SUHAILI BINTI BOHORI STUDENTNo ratings yet

- IE312 - Chapter 5 Part1 PW FW AWDocument13 pagesIE312 - Chapter 5 Part1 PW FW AWANCHETA, Yuri Mark Christian N.No ratings yet

- Eecon FinalsDocument6 pagesEecon FinalsShania Kaye SababanNo ratings yet

- Unit 4Document11 pagesUnit 4ajinkyapolNo ratings yet

- Capital Budgeting: Navigation SearchDocument16 pagesCapital Budgeting: Navigation SearchVenkat Narayana ReddyNo ratings yet

- Internal Rate of ReturnDocument6 pagesInternal Rate of ReturnNeeraj DhariaNo ratings yet

- Discounted Cash Flow Method:: NPV PVB - PVC Where, PVB Present Value of BenefitsDocument3 pagesDiscounted Cash Flow Method:: NPV PVB - PVC Where, PVB Present Value of BenefitsReven BalazonNo ratings yet

- 1cm8numoo 253914Document105 pages1cm8numoo 253914sagar sharmaNo ratings yet

- Topic IV - Economic Study MethodsDocument13 pagesTopic IV - Economic Study MethodsMc John PobleteNo ratings yet

- Chapter 02 Investment AppraisalDocument3 pagesChapter 02 Investment AppraisalMarzuka Akter KhanNo ratings yet

- STRATEGIC COST MANAGEMENT - Week 12Document46 pagesSTRATEGIC COST MANAGEMENT - Week 12Losel CebedaNo ratings yet

- Economic Evaluation: DefinitionsDocument5 pagesEconomic Evaluation: DefinitionsAnglicaNo ratings yet

- Chapter 3Document173 pagesChapter 3Maria HafeezNo ratings yet

- Capital Investment AppraisalDocument3 pagesCapital Investment AppraisalGeorge Ayesa Sembereka Jr.No ratings yet

- Capital Budgeting Investment: Net Present Value. Net Present Value Is A Calculation That Compares The Amount InvestedDocument2 pagesCapital Budgeting Investment: Net Present Value. Net Present Value Is A Calculation That Compares The Amount InvestedpeterjohnlibreNo ratings yet

- Financial Management: A Project On Capital BudgetingDocument20 pagesFinancial Management: A Project On Capital BudgetingHimanshi SethNo ratings yet

- Investment Project AppraisalDocument3 pagesInvestment Project AppraisalLe Vinh QuangNo ratings yet

- Project Eco Begrippen LijstDocument3 pagesProject Eco Begrippen LijstKishen HarlalNo ratings yet

- MAS-42N (Capital Budgeting With Investment Risks - Returns)Document16 pagesMAS-42N (Capital Budgeting With Investment Risks - Returns)saligumba mikeNo ratings yet

- 6 Capital Budgeting TechniquesDocument49 pages6 Capital Budgeting TechniquesAkwasi BoatengNo ratings yet

- Scientific Trivia (Chemical Engineering)Document4 pagesScientific Trivia (Chemical Engineering)xxkooonxx100% (4)

- Revised PFD - Aniline ProductionDocument1 pageRevised PFD - Aniline Productionxxkooonxx100% (2)

- Co2 CatchDocument4 pagesCo2 CatchxxkooonxxNo ratings yet

- Simplifying Business Permit and Licensing Process of Local Governments: A ToolkitDocument197 pagesSimplifying Business Permit and Licensing Process of Local Governments: A ToolkitCarl100% (9)

- Material BalanceDocument42 pagesMaterial Balancealireza_e_20% (1)

- Air Blast Freezing Design and EfficiencyDocument13 pagesAir Blast Freezing Design and EfficiencyxxkooonxxNo ratings yet

- Block Flow Diagram - Aniline From NitrobenzeneDocument1 pageBlock Flow Diagram - Aniline From NitrobenzenexxkooonxxNo ratings yet

- CHE 31 Chemical Engineering CalculationsDocument13 pagesCHE 31 Chemical Engineering CalculationsxxkooonxxNo ratings yet

- Che 14 A Computer Applications in Chemical EngineeringDocument1 pageChe 14 A Computer Applications in Chemical EngineeringxxkooonxxNo ratings yet

- HACCP BookletDocument14 pagesHACCP BookletIwan SiahaanNo ratings yet

- Basic Methods For Making Economy Study (Written Report)Document9 pagesBasic Methods For Making Economy Study (Written Report)xxkooonxx100% (1)

- HACCP BookletDocument14 pagesHACCP BookletIwan SiahaanNo ratings yet

- Simplifying Business Permit and Licensing Process of Local Governments: A ToolkitDocument197 pagesSimplifying Business Permit and Licensing Process of Local Governments: A ToolkitCarl100% (9)

- SGN Hardness Test Instruction Shee B2F536C8DA5ABDocument8 pagesSGN Hardness Test Instruction Shee B2F536C8DA5ABxxkooonxxNo ratings yet

- Engineering EconomyDocument37 pagesEngineering EconomyxxkooonxxNo ratings yet

- Steps For Design of Heat ExchangerDocument10 pagesSteps For Design of Heat ExchangerBHAVINNo ratings yet

- Cusum PDFDocument9 pagesCusum PDFxxkooonxx0% (1)

- Food TechnologyDocument55 pagesFood Technologyxxkooonxx100% (2)

- Chapter 2: Heat Exchangers Rules of Thumb For Chemical Engineers, 5th Edition by Stephen HallDocument85 pagesChapter 2: Heat Exchangers Rules of Thumb For Chemical Engineers, 5th Edition by Stephen HallNadirah RahmanNo ratings yet

- Training On Good Manufacturing PracticesDocument26 pagesTraining On Good Manufacturing PracticesxxkooonxxNo ratings yet

- Particles TechnologyDocument3 pagesParticles TechnologyxxkooonxxNo ratings yet

- PRC Modernization Act SummaryDocument9 pagesPRC Modernization Act SummaryronaleepNo ratings yet

- ASCEND Computer ProgrammingDocument139 pagesASCEND Computer ProgrammingxxkooonxxNo ratings yet

- Training On Good Manufacturing PracticesDocument26 pagesTraining On Good Manufacturing PracticesxxkooonxxNo ratings yet

- Understanding The One-Way ANOVADocument13 pagesUnderstanding The One-Way ANOVAxxkooonxxNo ratings yet

- Written Report On Enzymes-NomenclatureDocument6 pagesWritten Report On Enzymes-NomenclaturexxkooonxxNo ratings yet

- Multi-Media Filter Guide Removes TurbidityDocument2 pagesMulti-Media Filter Guide Removes TurbidityxxkooonxxNo ratings yet

- Food TechnologyDocument55 pagesFood Technologyxxkooonxx100% (2)

- Global Money Dispatch: Credit Suisse EconomicsDocument7 pagesGlobal Money Dispatch: Credit Suisse EconomicsRishrisNo ratings yet

- The Effect of Return On Assets (ROA) and Earning Per Share (EPS) On Stock Returns With Exchange Rates As Moderating VariablesDocument5 pagesThe Effect of Return On Assets (ROA) and Earning Per Share (EPS) On Stock Returns With Exchange Rates As Moderating VariablesInternational Journal of Business Marketing and ManagementNo ratings yet

- Investors' Guide to Engro Polymer IPODocument134 pagesInvestors' Guide to Engro Polymer IPOowais khalidNo ratings yet

- Fact Find Sample - Multiple EntitiesDocument28 pagesFact Find Sample - Multiple Entitiesapi-239405473No ratings yet

- ASSET LIABILITIES Mnagament in BanksDocument25 pagesASSET LIABILITIES Mnagament in Bankspriyank shah100% (6)

- SIRA1H11Document8 pagesSIRA1H11Inde Pendent LkNo ratings yet

- CRISIL Research - Ipo Grading Rat - Modern TubeDocument12 pagesCRISIL Research - Ipo Grading Rat - Modern Tubejaydeep daveNo ratings yet

- SBP Basel IIII Islamia College 29 Dec 2021Document46 pagesSBP Basel IIII Islamia College 29 Dec 2021Abdul HaseebNo ratings yet

- Project Viability FinalDocument79 pagesProject Viability FinalkapilNo ratings yet

- Chapter 38 - Teacher's ManualDocument27 pagesChapter 38 - Teacher's ManualHohoho67% (6)

- Financial Statement AnalysisDocument79 pagesFinancial Statement AnalysisAbdi Rahman Bariise100% (2)

- Regulations On Fdi, Adr, GDR, Idr, Fii &ecbDocument59 pagesRegulations On Fdi, Adr, GDR, Idr, Fii &ecbAvinash SinghNo ratings yet

- Group 2 Section B PDFDocument33 pagesGroup 2 Section B PDFShaikh Saifullah KhalidNo ratings yet

- Chapter 8Document30 pagesChapter 8Kad SaadNo ratings yet

- Income Statement AddidasDocument1 pageIncome Statement Addidasnaveen srivastavaNo ratings yet

- Tax Reform For Acceleration and Inclusion ActDocument6 pagesTax Reform For Acceleration and Inclusion ActRoiven Dela Rosa TrinidadNo ratings yet

- Ross12e Chapter01 TBDocument12 pagesRoss12e Chapter01 TBHải YếnNo ratings yet

- Chapter 8 StudentDocument15 pagesChapter 8 Studentmaha aleneziNo ratings yet

- Accounting Statements and Cash FlowDocument33 pagesAccounting Statements and Cash Flowfathir alhakimNo ratings yet

- Ferrous at The LMEDocument4 pagesFerrous at The LMEericmNo ratings yet

- Edge 13 JuneDocument33 pagesEdge 13 JuneRichard OonNo ratings yet

- Financial Analysis Cheat Sheet: by ViaDocument2 pagesFinancial Analysis Cheat Sheet: by Viaheehan6No ratings yet

- Mod 1 - Framework For Analysis & ValuationDocument33 pagesMod 1 - Framework For Analysis & ValuationbobdoleNo ratings yet

- BTMM Price-ActionDocument4 pagesBTMM Price-ActionHamlet GalvezNo ratings yet

- Comparison Table of Luxembourg Investment VehiclesDocument11 pagesComparison Table of Luxembourg Investment Vehiclesoliviersciales100% (1)

- Sustainability 13 01933 v2Document15 pagesSustainability 13 01933 v2ronNo ratings yet

- AFARDocument15 pagesAFARBetchelyn Dagwayan BenignosNo ratings yet

- 500 PDFDocument45 pages500 PDFkrishna bajaitNo ratings yet

- FIN347 DraftDocument11 pagesFIN347 DraftMUHAMMAD AIMANNo ratings yet

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (82)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- Rich Nurse Poor Nurses The Critical Stuff Nursing School Forgot To Teach YouFrom EverandRich Nurse Poor Nurses The Critical Stuff Nursing School Forgot To Teach YouNo ratings yet

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- Sacred Success: A Course in Financial MiraclesFrom EverandSacred Success: A Course in Financial MiraclesRating: 5 out of 5 stars5/5 (15)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouFrom EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouRating: 5 out of 5 stars5/5 (5)

- How To Budget And Manage Your Money In 7 Simple StepsFrom EverandHow To Budget And Manage Your Money In 7 Simple StepsRating: 5 out of 5 stars5/5 (4)

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessFrom EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessRating: 4.5 out of 5 stars4.5/5 (4)

- Happy Go Money: Spend Smart, Save Right and Enjoy LifeFrom EverandHappy Go Money: Spend Smart, Save Right and Enjoy LifeRating: 5 out of 5 stars5/5 (4)

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonFrom EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonRating: 5 out of 5 stars5/5 (9)

- Budgeting: The Ultimate Guide for Getting Your Finances TogetherFrom EverandBudgeting: The Ultimate Guide for Getting Your Finances TogetherRating: 5 out of 5 stars5/5 (14)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyFrom EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyRating: 5 out of 5 stars5/5 (1)

- Retirement Reality Check: How to Spend Your Money and Still Leave an Amazing LegacyFrom EverandRetirement Reality Check: How to Spend Your Money and Still Leave an Amazing LegacyNo ratings yet

- Lean but Agile: Rethink Workforce Planning and Gain a True Competitive EdgeFrom EverandLean but Agile: Rethink Workforce Planning and Gain a True Competitive EdgeNo ratings yet

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayFrom EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayRating: 3.5 out of 5 stars3.5/5 (2)

- The New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningFrom EverandThe New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningRating: 4.5 out of 5 stars4.5/5 (8)

- How to Save Money: 100 Ways to Live a Frugal LifeFrom EverandHow to Save Money: 100 Ways to Live a Frugal LifeRating: 5 out of 5 stars5/5 (1)