Professional Documents

Culture Documents

Rodriguez G.R. No. 170325: #16 PNB Vs

Uploaded by

Adrian HilarioOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rodriguez G.R. No. 170325: #16 PNB Vs

Uploaded by

Adrian HilarioCopyright:

Available Formats

#16 PNB vs. RODRIGUEZ G.R. No.

170325

FACTS: Spouses Erlando and Norma Rodriguez were clients of Philippine National Bank (PNB) in Cebu City. They maintained savings and demand/checking accounts. The spouses were engaged in the informal lending business. they had a discounting arrangement with the Philnabank Employees Savings and Loan Association (PEMSLA), an association of PNB employees. PEMSLA was likewise a client of PNB Amelia Avenue Branch. The association maintained current and savings accounts with petitioner bank. PEMSLA regularly granted loans to its members. Spouses Rodriguez would rediscount the postdated checks issued to members whenever the association was short of funds. As was customary, the spouses would replace the postdated checks with their own checks issued in the name of the members. It was PEMSLAs policy not to approve applications for loans of members with outstanding debts. To subvert this policy, some PEMSLA officers devised a scheme to obtain additional loans despite their outstanding loan accounts. They took out loans in the names of unknowing members, without the knowledge or consent of the latter. The PEMSLA checks issued for these loans were then given to the spouses for rediscounting. The officers carried this out by forging the indorsement of the named payees in the checks. In return, the spouses issued their personal checks (Rodriguez checks) in the name of the members and delivered the checks to an officer of PEMSLA. The PEMSLA checks, on the other hand, were deposited by the spouses to their account. Meanwhile, the Rodriguez checks were deposited directly by PEMSLA to its savings account without any indorsement from the named payees. This was an irregular procedure made possible through the facilitation of Edmundo Palermo, Jr., treasurer of PEMSLA and bank teller in the PNB Branch. the spouses issued sixty nine (69) checks, in the total amount of P2,345,804.00. These were payable to forty seven (47) individual payees who were all members of PEMSLA.PNB eventually found out about these fraudulent acts. To put a stop to this scheme, PNB closed the current account of PEMSLA. As a result, the PEMSLA checks deposited by the spouses were returned or dishonored for the reason Account Closed. The corresponding Rodriguez checks, however, were deposited as usual to the PEMSLA savings account. The amounts were duly debited from the Rodriguez account. Thus, because the PEMSLA checks given as payment were returned, spouses Rodriguez incurred losses from the rediscounting transactions. Issue The issues may be compressed to whether the subject checks are payable to order or to bearer and who bears the loss?

Held

As a rule, when the payee is fictitious or not intended to be the true recipient of the proceeds, the check is considered as a bearer instrument. A check is a bill of exchange drawn on a bank payable on demand. It is either an order or a bearer instrument. Sections 8 and 9 of the NIL states: SEC. 8. When payable to order. The instrument is payable to order where it is drawn payable to the order of a specified person or to him or his order. It may be drawn payable to the order of (a) A payee who is not maker, drawer, or drawee; or (b) The drawer or maker; or (c) The drawee; or (d) Two or more payees jointly; or (e) One or some of several payees; or (f) The holder of an office for the time being. Where the instrument is payable to order, the payee must be named or otherwise indicated therein with reasonable certainty.

SEC. 9. When payable to bearer. The instrument is payable to bearer (a) When it is expressed to be so payable; or (b) When it is payable to a person named therein or bearer; or (c) When it is payable to the order of a fictitious or non-existing person, and such fact is known to the person making it so payable; or (d) When the name of the payee does not purport to be the name of any person; or (e) Where the only or last indorsement is an indorsement in blank. However, there is a commercial bad faith exception to the fictitious-payee rule. A showing of commercial bad faith on the part of the drawee bank, or any transferee of the check for that matter, will work to strip it of this defense. The exception will cause it to bear the loss. Commercial bad faith is present if the transferee of the check acts dishonestly, and is a party to the fraudulent scheme.In the instant case, the Rodriguez checks were payable to specified payees. It is unrefuted that the 69 checks were payable to specific persons. Likewise, it is uncontroverted that the payees were actual, existing, and living persons who were members of PEMSLA that had a rediscounting arrangement with spouses Rodriguez.

For the fictitious-payee rule to be available as a defense, PNB must show that the makers did not intend for the named payees to be part of the transaction involving the checks. At most, the banks thesis shows that the payees did not have knowledge of the existence of the checks. This lack of knowledge on the part of the payees, however, was not tantamount to a lack of intention on the part of spouses that the payees would not receive the checks proceeds. Considering that spouses were transacting with PEMSLA and not the individual payees, it is understandable that they relied on the information given by the officers of PEMSLA that the payees would be receiving the checks.

Verily, the subject checks are presumed order instruments because PNB failed to present sufficient evidence to defeat the claim of the spouses that the named payees were the intended recipients of the checks proceeds. The bank failed to satisfy a requisite condition of a fictitious-payee situation that the maker of the check intended for the payee to have no interest in the transaction. Because of a failure to show that the payees were fictitious in its broader sense, the fictitious payee rule does not apply. Thus, the checks are to be deemed payable to order. Consequently, the drawee bank bears the loss. Plus, it does not dispute the fact that its teller or tellers accepted the 69 checks for deposit to the PEMSLA account even without any indorsement from the named payees. It bears stressing that order instruments can only be negotiated with a valid indorsement. This Court has recognized the unique public interest possessed by the banking industry and the need for the people to have full trust and confidence in their banks. For this reason, banks are minded to treat their customers accounts with utmost care, confidence, and honesty. In a checking transaction, the drawee bank has the duty to verify the genuineness of the signature of the drawer and to pay the check strictly in accordance with the drawers instructions, i.e., to the named payee in the check. It should charge to the drawers accounts only the payables authorized by the latter. Otherwise, the drawee will be violating the instructions of the drawer and it shall be liable for the amount charged to the drawers account . In the case at bar, spouses were the banks depositors. The checks were drawn against spouses accounts. PNB, as the drawee bank, had the responsibility to ascertain the regularity of the indorsements, and the genuineness of the signatures on the checks before accepting them for deposit. Lastly, PNB was obligated to pay the checks in strict accordance with the instructions of the drawers. Petitioner miserably failed to discharge this burden. Moreover, PNB was negligent in the selection and supervision of its employees. The trustworthiness of bank employees is indispensable to maintain the stability of the banking industry. Thus, banks are enjoined to be extra vigilant in the management and supervision of their employees. Banks handle daily transactions involving millions of pesos. By the very nature of their work the degree of responsibility, care and trustworthiness expected of their employees and officials is far greater than those of ordinary clerks and employees. For obvious reasons, the banks are expected to exercise the highest degree of diligence in the selection and supervision of their employees PNBs tellers and officers, in violation of banking rules of procedure, permitted the invalid deposits of checks to the PEMSLA account. Indeed, when it is the gross negligence of the bank employees that caused the loss, the bank should be held liable. A bank that has been remiss in its duty must suffer the consequences of its negligence. Being issued to named payees, PNB was duty-bound by law and by banking rules and procedure to require that the checks be properly indorsed before accepting them for deposit and payment. In fine, PNB should be held liable for the amounts of the checks.

You might also like

- 20 PNB vs. Erlando T. Rodriguez, Et. Al., G.R. No. 170325, Sept. 26, 2008Document2 pages20 PNB vs. Erlando T. Rodriguez, Et. Al., G.R. No. 170325, Sept. 26, 2008Lara YuloNo ratings yet

- 35) PNB V RodriguezDocument2 pages35) PNB V RodriguezRubyNo ratings yet

- Chan Wan Vs Tan KimDocument2 pagesChan Wan Vs Tan KimDianaNo ratings yet

- PNB V PicornellDocument1 pagePNB V PicornellEinstein NewtonNo ratings yet

- 16 Equitable Banking vs. IAC (Galicia) - Converted (With Watermark) B2021 PDFDocument2 pages16 Equitable Banking vs. IAC (Galicia) - Converted (With Watermark) B2021 PDFJustineNo ratings yet

- Gempesaw V CaDocument2 pagesGempesaw V Caבנדר-עלי אימאם טינגאו בתולהNo ratings yet

- "Quickie" Philippine Bank of Commerce V. AruegoDocument15 pages"Quickie" Philippine Bank of Commerce V. AruegoRhaegar TargaryenNo ratings yet

- Metropolitan Bank and Trust Company Vs Ba FinanceDocument1 pageMetropolitan Bank and Trust Company Vs Ba FinanceJENNY BUTACANNo ratings yet

- Metropolitan Bank and Trust Company Vs BA Finance CorpDocument1 pageMetropolitan Bank and Trust Company Vs BA Finance CorpPhil Montances100% (3)

- 50 Crisologo Vs CADocument10 pages50 Crisologo Vs CACharm Divina Lascota100% (1)

- BDO V EquitableDocument13 pagesBDO V EquitableMp CasNo ratings yet

- 2019 Negotiable Instruments Case DigestDocument33 pages2019 Negotiable Instruments Case DigestEstrellita GlodoNo ratings yet

- Development Bank of Rizal v. Sima WeiDocument6 pagesDevelopment Bank of Rizal v. Sima WeiKaren Patricio LusticaNo ratings yet

- Caltex (Philippines) Inc. vs. CA GR 97753, 10 August 1992 - NegotiabilityDocument5 pagesCaltex (Philippines) Inc. vs. CA GR 97753, 10 August 1992 - Negotiabilitykitakattt100% (1)

- Metropolitan Bank vs. CA (194 SCRA 169, 18 February 1991)Document2 pagesMetropolitan Bank vs. CA (194 SCRA 169, 18 February 1991)Howard ClarkNo ratings yet

- Gempesaw Vs CA - Final DigestDocument3 pagesGempesaw Vs CA - Final DigestCee JayNo ratings yet

- People vs. SisonDocument25 pagesPeople vs. SisonClaudine Ann ManaloNo ratings yet

- Juanita Salas Vs Court of Appeals (Negotiable Instruments Law)Document1 pageJuanita Salas Vs Court of Appeals (Negotiable Instruments Law)Lance ClementeNo ratings yet

- De Ocampo and Co V GatchalianDocument3 pagesDe Ocampo and Co V GatchalianJazem AnsamaNo ratings yet

- San Beda College of Law Mendiola, ManilaDocument19 pagesSan Beda College of Law Mendiola, ManilaEvitha Bernabe-RodriguezNo ratings yet

- BDO Vs EBCDocument1 pageBDO Vs EBCmargaserranoNo ratings yet

- Salas vs. Court of Appeals: 296 Supreme Court Reports AnnotatedDocument7 pagesSalas vs. Court of Appeals: 296 Supreme Court Reports AnnotatedAngelie FloresNo ratings yet

- Credit Transaction RulingsDocument12 pagesCredit Transaction RulingsCnfsr KayceNo ratings yet

- Ting Ting Pua Vs Spouses Benito Bun Tiong and Caroline Siok Ching TengDocument2 pagesTing Ting Pua Vs Spouses Benito Bun Tiong and Caroline Siok Ching TengLenie Sanchez100% (1)

- NEGO Case DigestDocument15 pagesNEGO Case DigestFrancis Gillean Orpilla100% (4)

- PNB Vs Manila Oil DigestDocument1 pagePNB Vs Manila Oil DigestLoi VillarinNo ratings yet

- 02 Equitable PCI Bank Vs ONGDocument1 page02 Equitable PCI Bank Vs ONGJimenez LorenzNo ratings yet

- 11 11) Engr. Jose E. Cayanan North Star Int'l Travel, Inc., G.R. No. 172954 Oct. 5, 2011Document2 pages11 11) Engr. Jose E. Cayanan North Star Int'l Travel, Inc., G.R. No. 172954 Oct. 5, 2011AlexandraSoledadNo ratings yet

- Nego Case Digest (GROUP 2)Document24 pagesNego Case Digest (GROUP 2)Mjay GuintoNo ratings yet

- Caltex Vs CA (Digest)Document2 pagesCaltex Vs CA (Digest)Glorious El Domine100% (1)

- NIL - Case Digest by KCabusDocument104 pagesNIL - Case Digest by KCabusjohn nestor cabusNo ratings yet

- Metrobank Vs CabilzoDocument12 pagesMetrobank Vs CabilzocarinokatrinaNo ratings yet

- Bataan Cigar vs. CADocument2 pagesBataan Cigar vs. CAStefan Henry P. RodriguezNo ratings yet

- Caltex V CaDocument2 pagesCaltex V CaCarlyn Belle de Guzman100% (2)

- San Miguel Corporation Vs PuzonDocument3 pagesSan Miguel Corporation Vs PuzonMon Che100% (1)

- Clark Vs Sellner DigestDocument1 pageClark Vs Sellner Digestjim jim100% (1)

- Dela Victoria Vs Burgos (Digest)Document1 pageDela Victoria Vs Burgos (Digest)Glorious El DomineNo ratings yet

- Far East Bank & Trust Co. v. Gold Palace Jewelry Co DIGESTDocument3 pagesFar East Bank & Trust Co. v. Gold Palace Jewelry Co DIGESTAprilNo ratings yet

- Samsung Construction Company Philippines, Inc. vs. FEBTCDocument3 pagesSamsung Construction Company Philippines, Inc. vs. FEBTCJackie CanlasNo ratings yet

- Dela Victoria v. BurgosDocument1 pageDela Victoria v. BurgosPre PacionelaNo ratings yet

- Credit Cases 1 1 9 DigestDocument14 pagesCredit Cases 1 1 9 DigestTrick San AntonioNo ratings yet

- Nego QuizDocument2 pagesNego QuizMheryza De Castro PabustanNo ratings yet

- Nil Digested CasesDocument69 pagesNil Digested CasesPamela Denise100% (1)

- Negotiable Instruments NotesDocument9 pagesNegotiable Instruments NotesVic RabayaNo ratings yet

- Abubakar v. Auditor GeneralDocument1 pageAbubakar v. Auditor GeneralAvs SalugsuganNo ratings yet

- Metrobank vs. CA (GR No 88866)Document1 pageMetrobank vs. CA (GR No 88866)Katharina CantaNo ratings yet

- Samsung Construction Company Vs FEBTCDocument2 pagesSamsung Construction Company Vs FEBTCBeverlyn JamisonNo ratings yet

- NIL 02 Areza Vs Express Savings Bank PDFDocument23 pagesNIL 02 Areza Vs Express Savings Bank PDFnette PagulayanNo ratings yet

- Nego-International Bank v. GuecoDocument3 pagesNego-International Bank v. GuecoIrish GarciaNo ratings yet

- Negotiable Instruments - Case DigestDocument73 pagesNegotiable Instruments - Case Digestjuan dela cruzNo ratings yet

- NEGO Case DigestDocument13 pagesNEGO Case DigestptbattungNo ratings yet

- Nego Case DigestDocument5 pagesNego Case DigestFaye BuenavistaNo ratings yet

- Astro Electronics Corp Vs PhilguaranteeDocument2 pagesAstro Electronics Corp Vs Philguaranteeadonis.orillaNo ratings yet

- HSBC Vs CIRDocument1 pageHSBC Vs CIRAbrahamNo ratings yet

- JD 17 39 Gempesaw Vs CADocument2 pagesJD 17 39 Gempesaw Vs CAJerric CristobalNo ratings yet

- Salas Vs CADocument4 pagesSalas Vs CAHiroshi Carlos100% (1)

- Gempesaw v. CADocument15 pagesGempesaw v. CAPMVNo ratings yet

- Metrobank V BA FinanceDocument1 pageMetrobank V BA FinanceRubyNo ratings yet

- Nego 2j Case Digest CompilationDocument70 pagesNego 2j Case Digest CompilationKrizel BianoNo ratings yet

- PNB Vs RodriguezDocument2 pagesPNB Vs RodriguezRoe DirectoNo ratings yet

- RemedyDocument5 pagesRemedyAdrian HilarioNo ratings yet

- Nego LastDocument4 pagesNego LastAdrian HilarioNo ratings yet

- Civpro Case AssignmentDocument53 pagesCivpro Case AssignmentAdrian HilarioNo ratings yet

- Orion Vs KaflamDocument4 pagesOrion Vs KaflamAdrian HilarioNo ratings yet

- Project PaperworkDocument2 pagesProject PaperworkAdrian HilarioNo ratings yet

- PCIB Vs Sps SantosDocument16 pagesPCIB Vs Sps SantosAdrian HilarioNo ratings yet

- G.R. No. L-17845Document16 pagesG.R. No. L-17845Adrian HilarioNo ratings yet

- 1-Leticia Y Medel Et Al Vs CA Et AlDocument5 pages1-Leticia Y Medel Et Al Vs CA Et AlAdrian HilarioNo ratings yet

- HLURBDocument2 pagesHLURBAdrian HilarioNo ratings yet

- CDDocument32 pagesCDAdrian HilarioNo ratings yet

- Nego Case DoctrinesDocument4 pagesNego Case DoctrinesAdrian HilarioNo ratings yet

- Persons OutlineDocument6 pagesPersons OutlineAdrian HilarioNo ratings yet

- BaiDocument13 pagesBaiAdrian HilarioNo ratings yet

- Set CasesDocument10 pagesSet CasesAdrian HilarioNo ratings yet

- Can 11Document1 pageCan 11Adrian HilarioNo ratings yet

- Jai-Alai Corp. of The Phil. vs. Bank of The Phil. Islands G.R. No. L-29432 August 6, 1975 66 SCRA 29 - ForgeryDocument4 pagesJai-Alai Corp. of The Phil. vs. Bank of The Phil. Islands G.R. No. L-29432 August 6, 1975 66 SCRA 29 - ForgeryAdrian HilarioNo ratings yet

- G.R. No. L-17845Document16 pagesG.R. No. L-17845Adrian HilarioNo ratings yet

- Original Fulltext of The CaseDocument64 pagesOriginal Fulltext of The CaseAdrian HilarioNo ratings yet

- New Code of Judicial Conduct AnnotatedDocument74 pagesNew Code of Judicial Conduct Annotatedramuj2094% (16)

- BiologyDocument1 pageBiologyAdrian HilarioNo ratings yet

- Admin List of CasesDocument4 pagesAdmin List of CasesAdrian HilarioNo ratings yet

- Labor Relation Case DigestDocument3 pagesLabor Relation Case Digestunosais50% (2)

- 2014 Bar Exam: Civil Law (Property Only!!!)Document3 pages2014 Bar Exam: Civil Law (Property Only!!!)Adrian HilarioNo ratings yet

- Jai-Alai Corp. of The Phil. vs. Bank of The Phil. Islands G.R. No. L-29432 August 6, 1975 66 SCRA 29 - ForgeryDocument4 pagesJai-Alai Corp. of The Phil. vs. Bank of The Phil. Islands G.R. No. L-29432 August 6, 1975 66 SCRA 29 - ForgeryAdrian HilarioNo ratings yet

- To What Extent Should The Decisions of Administrative Bodies Be RDocument8 pagesTo What Extent Should The Decisions of Administrative Bodies Be RKat PinedaNo ratings yet

- Property CasesDocument45 pagesProperty CasesAdrian HilarioNo ratings yet

- PALE DigestsDocument14 pagesPALE DigestsAdrian HilarioNo ratings yet

- Credit FulltextDocument28 pagesCredit FulltextAdrian HilarioNo ratings yet

- Credit DigestDocument5 pagesCredit DigestAdrian HilarioNo ratings yet

- Admin List of CasesDocument4 pagesAdmin List of CasesAdrian HilarioNo ratings yet

- Illegal ContractDocument2 pagesIllegal ContractMukul BhutdaNo ratings yet

- Affidavit - MortgageDocument2 pagesAffidavit - MortgagePeeJay ArvesuNo ratings yet

- Vijaya Bank Officer Employees (Acceptance of Jobs in Private Sector Concerns After Retirement) Regulations, 2000Document4 pagesVijaya Bank Officer Employees (Acceptance of Jobs in Private Sector Concerns After Retirement) Regulations, 2000Latest Laws TeamNo ratings yet

- Sky Galley - Lease (2019) (Executed by Lessee)Document23 pagesSky Galley - Lease (2019) (Executed by Lessee)WCPO 9 NewsNo ratings yet

- Complaint Legal FormsDocument6 pagesComplaint Legal FormsJewn KroosNo ratings yet

- DEED OF DONATION Brgy. San Juan BautistaDocument4 pagesDEED OF DONATION Brgy. San Juan BautistaAedrian MacawiliNo ratings yet

- National Rice and Corn CorporationDocument1 pageNational Rice and Corn CorporationIda ChuaNo ratings yet

- Bentir V Leanda April 12 2000Document2 pagesBentir V Leanda April 12 2000lawfoolNo ratings yet

- Macalincag v. ChangDocument1 pageMacalincag v. ChangGRNo ratings yet

- Commonwealth of Australia Act PDFDocument2 pagesCommonwealth of Australia Act PDFJeffNo ratings yet

- GR 115838 - de Castro Vs CADocument6 pagesGR 115838 - de Castro Vs CAJane MarianNo ratings yet

- Macua Vda. de Avenido vs. AvenidoDocument13 pagesMacua Vda. de Avenido vs. AvenidocanyoumovemeNo ratings yet

- Equitable Bank v. NLRC and SadacDocument4 pagesEquitable Bank v. NLRC and SadacMaria AnalynNo ratings yet

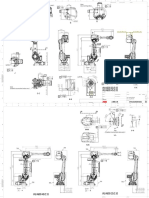

- Irb 4600Document3 pagesIrb 4600Arvydas Gaurilka0% (1)

- PNB Roi New Supplementry Agreement-WordDocument2 pagesPNB Roi New Supplementry Agreement-WordAnonymous XsYDXMVNo ratings yet

- Will & Last TestamentDocument7 pagesWill & Last Testamentwms_klangNo ratings yet

- NATIONAL POWER CORPORATION vs. JUDGE JOCSON DIGESTDocument2 pagesNATIONAL POWER CORPORATION vs. JUDGE JOCSON DIGESTClavel Tuason100% (1)

- Case No. 2 LTDDocument2 pagesCase No. 2 LTDManuel DancelNo ratings yet

- Case Law On Section 31,32 and 33 of Specific Relief Act 1877Document5 pagesCase Law On Section 31,32 and 33 of Specific Relief Act 1877ahsanjutt333No ratings yet

- Promissory Note PDFDocument4 pagesPromissory Note PDFdoxgaloreNo ratings yet

- Insurance Cases Blucross Vs NEOMIDocument4 pagesInsurance Cases Blucross Vs NEOMIvivivioletteNo ratings yet

- Julhash Mollah v. BangladeshDocument5 pagesJulhash Mollah v. BangladeshActusReusJurorNo ratings yet

- Special Power of Attorney: Noliber C. AnchetaDocument3 pagesSpecial Power of Attorney: Noliber C. AnchetaRandy HurtadoNo ratings yet

- Civil Service Commission V BudgetDocument3 pagesCivil Service Commission V BudgetGustavo Fernandez DalenNo ratings yet

- COA Res 91-52Document2 pagesCOA Res 91-52Kath Erine75% (4)

- 01 PSBA Vs CADocument9 pages01 PSBA Vs CAIzzy Roxas MaxinoNo ratings yet

- CAP 417 SurveyorsboardDocument13 pagesCAP 417 SurveyorsboardpschilNo ratings yet

- Torts & Damages Actual Damages Case DigestsDocument4 pagesTorts & Damages Actual Damages Case DigestsNilsy YnzonNo ratings yet

- Strict Construction RuleDocument4 pagesStrict Construction RuleReubenPhilipNo ratings yet

- Totnes Deeds ProjectDocument95 pagesTotnes Deeds ProjectjrwrightNo ratings yet