Professional Documents

Culture Documents

Are The Glory Days Over For This Driller

Uploaded by

Abdulsani3357Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Are The Glory Days Over For This Driller

Uploaded by

Abdulsani3357Copyright:

Available Formats

1/27/2014

Are the Glory Days Over for This Driller? - Fool.com

Back

ENERGY, MATERIALS, AND UTILITIES

Are the Glory Days Over for This Driller?

H&P will find it difficult to maintain industryleading margins as the technology leadership on land drilling rigs diminishes.

With the gains in drilling-rig efficiency limiting demand, are the glory days over for Helmerich & Payne (NYSE: HP)? According to this WSJ article, the company and the CEO are credited with developing the nextgeneration drilling rigs used to create the U.S. energy boom. With oil above $100, one would expect a driller to trade well. The domestic land-drilling market, however, has faced lower drilling-rig demand due to plunging natural gas prices and more importantly the dramatically improved efficiencies gained in the last couple of years. The stock is sitting close to all-time highs. Now investors must analyze whether future natural gas export demand and possible demand from Mexico can offset a weak domestic climate. While H&P has had a technology lead for the better part of the last decade, investors have to wonder if the CEO isn't stepping up to the chairman position now that competitors Patterson-UTI Energy (NASDAQ: PTEN) and Nabors Industries (NYSE: NBR) are closing the technology gap. Rig demand The weekly Baker Hughes rig reports continue to show weak demand for

http://www.fool.com/investing/general/2013/09/24/are-the-glory-days-over-for-this-driller.aspx 1/5

1/27/2014

Are the Glory Days Over for This Driller? - Fool.com

drilling rigs. The demand that does exist is shifting in favor of the ones that have higher-horsepower AC-powered rigs that serve growing demand for horizontal drilling in unconventional shale plays. H&P clearly leads the AC-rig sector with around 270 domestic rigs and 300 in total; Patterson-UTI is closing the gap with 117 APEX rigs. Nabors lists a fleet of roughly 245 premium-quality rigs that include some SCRPlus rigs that reportedly match the capabilities of an AC-drive rig. Impressive margins H&P continues to maintain impressive margins even in the face of declining revenue. In fact, during Q2, H&P was actually able to increase the average daily margin by $244 per rig.On top of that, the company already has daily margins on the domestic land rigs that greatly exceed those of competitors Patterson-UTI and Nabors Patterson now operates roughly 185 rigs in the U.S. and Canada with an average daily operating margin of $8,730 during the second quarter due to lower daily revenue of only $22,990 and higher costs. Nabors saw an average daily operating margin of $9,388 per day during Q2 with new AC rigs working at average day rates of $22,265. The company had 183 rigs working with 134 of them being AC and 101 padcapable. The end of the Helmerich line The year 2014 will begin with the end of a legacy at H&P, as the last Helmerich will step down in March as the CEO to become the chairman. In 1920, his grandfather founded the company. This move will place the first non-family member in charge of the business and question whether the decision relates to a desire to leave as the business is peaking. Though he has been in the business a long time, he is only 54 years old. At the annual shareholder meeting, Hans Helmerich will turn over the reigns to the current COO, John Lindsay. Mr. Lindsay has been with the company since 1987, providing tons of experience at the company. He was no doubt instrumental in the technological lead and surging rig demand built up in the 2000s. Bottom line

http://www.fool.com/investing/general/2013/09/24/are-the-glory-days-over-for-this-driller.aspx 2/5

1/27/2014

Are the Glory Days Over for This Driller? - Fool.com

With the stock near all-time highs from back in 2008 and competitors catching up in technology, the departure of leadership by Helmerich could signal the end of a decade of significant margin advantage due to technology leadership. H&P could have a difficult time maintaining daily margins at rates 50% higher than Nabors, Patterson-UTI, and new competition. The potential appears greater in the stocks closing the technology and rig gap. Dividend stocks can make you rich. It's as simple as that. While they don't garner the notoriety of high-flying growth stocks, they're also less likely to crash and burn. And over the long term, the compounding effect of the quarterly payouts, as well as their growth, adds up faster than most investors imagine. With this in mind, our analysts sat down to identify the absolute best of the best when it comes to rock-solid dividend stocks, drawing up a list in this free report of nine that fit the bill. To discover the identities of these companies before the rest of the market catches on, you can download this valuable free report by simply clicking here now. Mark Holder and Stone Fox Capital Advisors, LLC have no positions in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

One of the world's greatest stock pickers is on a new mission -- to make YOU rich.

It all begins on Thursday, Jan. 30. That's when Motley Fool co-founder David Gardner will plunk down a sizable amount of cash on a single stock. And we'd like to share all the details with you in advance:

Enter email address...

http://www.fool.com/investing/general/2013/09/24/are-the-glory-days-over-for-this-driller.aspx

3/5

1/27/2014

Are the Glory Days Over for This Driller? - Fool.com

Click Here, It's Free!

Privacy/Legal Information

Mark Holder

Fool Contributor

Profile

Sep 24, 2013 at 5:31pm Energy, Materials, and Utilities Commentary NYSE:NBR NASDAQ:PTEN NYSE:HP

http://www.fool.com/investing/general/2013/09/24/are-the-glory-days-over-for-this-driller.aspx

4/5

1/27/2014

Are the Glory Days Over for This Driller? - Fool.com

Related Articles

Texas Industries, Inc. May Be Cementing a New Growth Plan

Rich Duprey - 5 hours, 39 minutes ago

What Happens After the Shale Revolution?

Oilprice - 8 hours, 39 minutes ago

Forget the Aluminum F-150, Fords Next Move is Truly Eco-Friendly

Matt DiLallo - 9 hours, 34 minutes ago

Home About The Motley Fool Fool Disclosure Radio Show Work at The Fool Member Services Advertise w ith The Fool Privacy Policy Email Subscriptions RSS Headlines Help Site Map Fool UK Fool Friends: Yahoo Finance MSN Money AOL Business New s Mint Personal Finance Softw are lovemoney.com Copyright, Trademark and Patent Information Terms of Use 1995 -2013 The Motley Fool. All rights reserved. BATS data provided in real-time. NYSE, NASDAQ and NYSEMKT data delayed 15 minutes. Real-Time prices provided by BATS. Market data provided by Interactive Data. Company fundamental data provided by Morningstar. Earnings Estimates, Analyst Ratings and Key Statistics provided by Zacks. SEC Filings and Insider Transactions provided by Edgar Online. Pow ered and implemented by Interactive Data Managed Solutions. Terms & Conditions

http://www.fool.com/investing/general/2013/09/24/are-the-glory-days-over-for-this-driller.aspx

5/5

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Drilling Rig Checklist Rev1Document29 pagesDrilling Rig Checklist Rev1Abdulsani3357No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- BBVA OpenMind Libro El Proximo Paso Vida Exponencial2Document59 pagesBBVA OpenMind Libro El Proximo Paso Vida Exponencial2giovanniNo ratings yet

- Crisil Sme Connect Dec11Document60 pagesCrisil Sme Connect Dec11Lao ZhuNo ratings yet

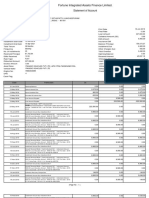

- Statement of Account for Mohansri ADocument2 pagesStatement of Account for Mohansri ASanthosh SehwagNo ratings yet

- SubstructureDocument7 pagesSubstructureAbdulsani3357No ratings yet

- Petronas - Enhanced SWEC Products and Services For Electrical Mapping Old To New 22072013 - SWECDocument32 pagesPetronas - Enhanced SWEC Products and Services For Electrical Mapping Old To New 22072013 - SWECAbdulsani3357No ratings yet

- Percent Practice SheetDocument55 pagesPercent Practice SheetkamalNo ratings yet

- Petronas - SWECs External 30092013 - SERVICESDocument41 pagesPetronas - SWECs External 30092013 - SERVICESAbdulsani3357No ratings yet

- Rig Skidding System PDFDocument4 pagesRig Skidding System PDFAbdulsani3357No ratings yet

- INFINITI RETAIL LIMITED (Trading As Cromā) : Tax InvoiceDocument3 pagesINFINITI RETAIL LIMITED (Trading As Cromā) : Tax Invoice2018hw70285No ratings yet

- Drilling Rig Inspection ChecklistDocument33 pagesDrilling Rig Inspection Checklistmr_heera75% (4)

- UPS Group Case Analysis - Group 2 PDFDocument76 pagesUPS Group Case Analysis - Group 2 PDFJhenelle Trowers50% (10)

- Drilling Services Scope of Works Company'S General ObligationsDocument2 pagesDrilling Services Scope of Works Company'S General ObligationsAbdulsani3357No ratings yet

- 006 SRP - 001 Safety Report Procedure (Latest) RevisionDocument17 pages006 SRP - 001 Safety Report Procedure (Latest) RevisionAbdulsani3357No ratings yet

- East Baghdad Oil Field - Oil4AllDocument1 pageEast Baghdad Oil Field - Oil4AllAbdulsani3357No ratings yet

- Volgograd Drilling Equipment PlantDocument2 pagesVolgograd Drilling Equipment PlantAbdulsani3357No ratings yet

- All About Oilgas-Training - Introduction To Drilling Fluid TechnologyDocument6 pagesAll About Oilgas-Training - Introduction To Drilling Fluid TechnologyAbdulsani3357No ratings yet

- Malaysia Field Development Sector Keeps Busy - July 2013Document3 pagesMalaysia Field Development Sector Keeps Busy - July 2013Abdulsani3357No ratings yet

- Petronas - SWECs External 30092013 - PRODUCTSDocument29 pagesPetronas - SWECs External 30092013 - PRODUCTSAbdulsani3357No ratings yet

- Petronas - SWECs External 30092013 - PRODUCTSDocument29 pagesPetronas - SWECs External 30092013 - PRODUCTSAbdulsani3357No ratings yet

- Malaysian Billionaire Emerges as Major Player in Sarawak OilfieldsDocument2 pagesMalaysian Billionaire Emerges as Major Player in Sarawak OilfieldsAbdulsani3357No ratings yet

- RB SolutionsDocument25 pagesRB SolutionsAbdulsani3357No ratings yet

- SimonDekker KPI PDFDocument27 pagesSimonDekker KPI PDFAbdulsani3357No ratings yet

- RIGZONE - How Does Fishing Work - PDFDocument2 pagesRIGZONE - How Does Fishing Work - PDFAbdulsani3357No ratings yet

- SapuraKencana Petroleum - May 2012 PDFDocument28 pagesSapuraKencana Petroleum - May 2012 PDFAbdulsani3357100% (1)

- Think Safety PDFDocument1 pageThink Safety PDFAbdulsani3357No ratings yet

- SapuraKencana Petroleum - May 2012 PDFDocument28 pagesSapuraKencana Petroleum - May 2012 PDFAbdulsani3357100% (1)

- Safety Poster 8Document1 pageSafety Poster 8manojNo ratings yet

- Is Banking Becoming More CompetitiveDocument42 pagesIs Banking Becoming More CompetitiveSwarnima SinghNo ratings yet

- SUPA Economics Presentation, Fall 2023Document47 pagesSUPA Economics Presentation, Fall 2023bwangNo ratings yet

- Maintenance and replacement of internal fixtures at residential areaDocument40 pagesMaintenance and replacement of internal fixtures at residential areamvs srikarNo ratings yet

- Abakada v. ErmitaDocument351 pagesAbakada v. ErmitaJm CruzNo ratings yet

- Assets Liobililies Owner's Equity: Balance SheetsDocument2 pagesAssets Liobililies Owner's Equity: Balance SheetsVARGAS PALOMINO KIARA PAMELANo ratings yet

- MBA Financial Management AssignmentDocument4 pagesMBA Financial Management AssignmentRITU NANDAL 144No ratings yet

- 10 Grammar Empower. PassiveDocument1 page10 Grammar Empower. PassiveMariola Buendía VivoNo ratings yet

- Dissolution QuizDocument2 pagesDissolution QuizveriNo ratings yet

- Banks Vietnam Risks From Real 16jan2023 PBC - 1349912Document9 pagesBanks Vietnam Risks From Real 16jan2023 PBC - 1349912Kim Yen NguyenNo ratings yet

- Project Management Concepts And ClassificationDocument29 pagesProject Management Concepts And Classificationankitgupta16No ratings yet

- Krisna Mae Macabenta ResumeDocument4 pagesKrisna Mae Macabenta ResumeKrisna MacabentaNo ratings yet

- Cash Flow StatementDocument16 pagesCash Flow Statementrajesh337masssNo ratings yet

- The Entrepreneur Who Built Modern JapanDocument2 pagesThe Entrepreneur Who Built Modern JapanSteve RosenNo ratings yet

- 1991 Indian Economic Crisis and Reforms v4Document20 pages1991 Indian Economic Crisis and Reforms v4Hicham Azm100% (1)

- LIC Jeevan Anand Plan PPT Nitin 359Document11 pagesLIC Jeevan Anand Plan PPT Nitin 359Nitin ShindeNo ratings yet

- IITK Parental Income CertificateDocument3 pagesIITK Parental Income CertificateSaket DiwakarNo ratings yet

- Business Finance - 5 - 24 - 23Document8 pagesBusiness Finance - 5 - 24 - 23Angel LopezNo ratings yet

- CEO CFO CertificationDocument30 pagesCEO CFO CertificationAbhishek GhoshNo ratings yet

- Transfer Register All: Bangladesh Krishi BankDocument13 pagesTransfer Register All: Bangladesh Krishi Bankabdul kuddusNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21Document8 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21MaheshNo ratings yet

- Banking Legal and Regulatory Aspects Janbi Model QuestionsDocument8 pagesBanking Legal and Regulatory Aspects Janbi Model QuestionsKhanal PremNo ratings yet

- Form 7Document5 pagesForm 7NagamaheshNo ratings yet

- Finance For Non-Financial Managers Final ReportDocument11 pagesFinance For Non-Financial Managers Final ReportAli ImranNo ratings yet

- Financial Ratio AnalysisDocument21 pagesFinancial Ratio AnalysisVaibhav Trivedi0% (1)