Professional Documents

Culture Documents

Cyber-Boom and The Domination of Tablets April 2012

Uploaded by

gkk820 ratings0% found this document useful (0 votes)

22 views8 pagescyber boom

Original Title

Cyber-Boom and the Domination of Tablets April 2012

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcyber boom

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views8 pagesCyber-Boom and The Domination of Tablets April 2012

Uploaded by

gkk82cyber boom

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

Cyber boom: Why tablet

domination has only just begun

A publication of the Telecommunications,

Media, and Technology Practice

No.20

RECALL

Telecom, Media & High Tech Extranet

June 2012

Copyright McKinsey & Company, Inc.

14

By: Bengi Korkmaz /// Christian Kraus /// Jean-Hubert Lenotte

Cyber boom: Why tablet

domination has only just begun

15

RECALL No.20 A new era of personalized computing

Cyber boom: Why tablet domination has only just begun

By: Bengi Korkmaz /// Christian Kraus /// Jean-Hubert Lenotte

Bigger and brainier than a smartphone but sleeker

and smaller than a netbook, the tablet computer

has gained unexpected momentum since Apple

created the market segment in 2010 with the

iPad. Sales gures have consistently deed analyst

expectations as hardware makers worldwide have

launched arrays of competing offers. While device

makers and application developers have been

quick to benet from the trend, tablets also offer

substantial opportunities to other players further

down the value chain, including mobile operators

with dedicated data plans.

Signicant amounts of research into how, why,

where, and when people use tablets has already

been undertaken, but ndings are sometimes

contradictory. Key insights often become buried

beneath the sheer amount of data available. In

an effort to cut through the clutter, McKinsey has

examined the research, distilled the data, and

identied a number of key market insights regard-

ing tablets and their users. The following six take-

aways can help telecoms, media, and high-tech

players and other value chain participants capture

more of this growing opportunity.

Tablet market growth will continue to

exceed analyst expectations

Attempts to predict the market uptake of dis-

ruptive innovations like tablet computers are

inherently difficult; results are usually fraught

with errors. Thats why initial analyst forecasts

for iPad sales were so overwhelmingly wrong,

underestimating sales in the first six months after

launch by up to a factor of seven. While predic-

tions are rarely right on target the number of

new market entries, consumer interest levels,

and the trend toward lower prices tend to throw

a monkey wrench into forecast models recent

McKinsey analysis indicates tablet sales levels

that will again exceed analyst expectations. Even

using conservative assumptions, tablets are likely

to surpass 350 million units by 2016.

Regionally, Europe along with Russia and Turkey

are expected to constitute the largest market ac-

counting for one third of tablet demand followed

by North America and Asia. The Middle East and

Latin America will likely show the largest growth,

representing around 50 million units by 2016.

Five main factors will drive tablet growth. First,

affordability with the introduction of low-end

devices and the natural price decline curve will

shift demand, supporting uptake among new, less

afuent customer segments. This will fuel around

60percent of the total cumulative sales through

2016. Second, consumers will replace outdated

tablets over time, contributing about 28percent

of expected growth. Third, 6percent of the overall

increase will stem from substituting conventional

laptops and notebooks with tablets. The two re-

maining drivers are business adoption (4percent)

and education initiatives (3percent).

Introducing new, smarter tablets with more exten-

sive input capabilities or more countries launching

government-driven initiatives could easily increase

the base case scenario.

Social media buzz sheds new light on

product usages

The sales breakdown is certainly one indicator of

current competition levels among tablet operating

systems. By the end of 2011, Android powered

from 35 to 40 percent of all tablets sold globally

Tablet computers have disrupted markets and outperformed

analyst predictions from the start McKinsey research points

to more surprises to come.

16

a major change from the prior year when Apples

OS was the only market player. The more complex

indicator of social media buzz, however, points to

how the market may evolve.

While Apple still accounts for about 90percent

of consumer commentary from forums, blogs,

Facebook, Twitter, etc., one recent arrival to

the Android scene is getting more buzz than

the others. Amazons Kindle Fire is generating

nearly 43percent of total Android buzz, making

it the iPads main competition in online consumer

conversation (Exhibit1). Delving deeper into buzz

analysis also indi-

cates that the Kindle

Fire generates the

most actionable

product talk with

users recommend-

ing the device and

telling their friends

about it. For some

other tablets, in

comparison, a sig-

nicant share of the

buzz is related to corporate contests and device

giveaways which is an indication of less genuine

user engagement.

Another sign that the Kindle Fire is emerging as a

key contender is that its buzz is relatively positive,

despite some critical early reviews in the profes-

sional technology blogs. One user noted that

although the Kindle Fire did not have all the bells

and whistles of an iPad, it was an excellent book

and document reader and Android app device all

delivered in brilliant HD color. Another user who

bought the Kindle Fire as a gift for her daughter

favorably mentioned the picture quality of the

screen and the devices ease of use via the touch

interface as compared to a laptop.

Where Apple scores higher than competitors is the

brand loyalty of smartphone users. For instance,

77percent of iPhone users said they would prefer

an iPad to other tablets, perhaps revealing how

invested these users are in their ecosystems. And

while 59percent of Android smartphone users said

they preferred something other than an iPad, their

loyalty to other specic brands was quite low.

Among Android-operated devices, the Kindle Fire generates the most positive user engagement buzz

1 Based on a random selection of 200 relevant posts between August 2011 and January 2012

2 E.g., Archos, Toshiba, HP, Sony, Dell

SOURCE: NM Incite; McKinsey

Level of social media buzz for Android tablets

Frequency mentioned, percent of posts

1

(multiple mentions possible)

Other

2

/unspecified

Barnes & Noble

(Nook Tablet only)

Motorola

Acer

Samsung

Asus

Amazon

(Kindle Fire only)

Breakdown of social media buzz by type

Percent of posts

1

44

86

52

100% =

User product

talk/reviews

Professional

reviews/coverage

Troubleshooting

inquiries

Device giveaways

Accessories/

protective cases

Other

29

24

3

3

40

Samsung Asus Kindle Fire

19

6

6

9

15

20

43

32

14

24

12

12

9

12

3

0

15

28

10

3

Among Android-operated devices, the Kindle Fire generates the most positive user

engagement buzz

Exhibit 1

Amazons Kindle

Fire is getting

lots of king of

Androids buzz,

indicating that it

might become stiff

competition for

Apples iPad

17

Tablets are conquering new user

demographics

Even if younger, tech-savvy demographic seg-

ments initially powered the tablets market rise,

ownership is expanding to other age (and income)

segments. Where early tablet adopters were

mostly younger, afuent men, more women, older

users, and middle-income households are becom-

ing tablet owners today. This trend extends to

both young children and senior citizens.

A Nielsen survey of 6- to 12-year-olds in the

United States from October 2011 indicates the

tablets appeal among the youngest of users.

Asked what electronic device they would be

interested in purchasing in the next six months,

44percent said an iPad by far the highest re-

sponse rate for any device. A further 25 percent

were interested in another type of tablet.

This preference should be no surprise, given the

fact that one in ve of the top 200 iPad apps

targets kids. Beyond this, tablets also appeal to

senior citizens, helping them boost their memory

capacity. For older consumers, tablets make

reading easier and can also provide specialized

healthcare services (see text box).

The business world is likewise rapidly adopting

tablets especially for knowledge workers and

executives. Both groups use them for work and

personal activities. Among knowledge workers in

Europe and North America, 5 percent (11 million)

use their tablets at the ofce, and 20 percent of

them purchased their tablets themselves.

RECALL No.20 A new era of personalized computing

Cyber boom: Why tablet domination has only just begun

From the sidelines to the playing feld: Tablets put

seniors squarely in the high-tech game

Senior citizens have often been left out of the consumer technology equation. At best, simplifed versions

of popular devices and services such as e-mail that does not require a PC and large-button, single-func-

tion mobile phones have been launched as afterthoughts for the oldest consumers who tend to be farther

behind the adoption curve. Tablets whether by design or simply by nature have changed the technol-

ogy landscape for seniors.

Usability. For seniors, tablets address some of the biggest traditional barriers to technology.

Arthritis and other impairments often limit a seniors fne motor skills a disability is incompatible with

mouse and keyboard requirements. Tablets deliver touch screen technology, facilitating usage and mini-

mizing user frustration.

Tablets also offer an improvement over one of the most traditional form factors books. For those with

poorer vision, a once-enjoyed activity like reading could be a thing of the past. Not only can those with

limited mobility avoid a diffcult trip to a bookstore or library by downloading a book, they can also easily

adjust the text size.

Healthcare. Tablets are also enabling greater independence for the elderly through remote

evaluation and monitoring. From the diagnostic side, tablet-based mobile assessment tools provide a rapid

assessment of a patients ability to complete mobility-related tasks. Tablets also enable ongoing care. One

example is Angela, a specialized tablet designed to give patients medication and appointment reminders as

well as video access to family and caregivers.

18

Apps are winning versus browser-

based experiences

Tablet users often have a choice between us-

ing dedicated native apps (programmed for a

specific OS) and accessing a Web site or HTML5

Web application. The latest tablet user research

shows that consumers make distinctions re-

garding how they access content during differ-

ent activities. For example, 48percent of iPad

users say they prefer apps when playing video

games while 26percent like to use the brows-

er 20percent use both (7percent say they

dont know). When reading a book, newspaper,

or magazine on a tablet, 32percent use apps,

35percent prefer the browser, 25percent use

both, and the rest dont know.

Recent research indicates that apps provide a

much better customer experience even for

tasks where consum-

ers are split fairly

evenly between using

an app or a browser.

Users found read-

ing the news, for

example, more than

twice as enjoyable

on an app, thought

the news was twice

as worthwhile, and

considered it much

easier to learn new

things. This has clear

implications for content and application provid-

ers, but is essentially positive. While smart-

phones have educated consumers about using

(and paying for) apps, tablet users download

even more apps and willingly pay significantly

more for them. For instance, the annual app

revenue potential of each iPad is USD 60, com-

pared with an iPhones USD 20. Based on cur-

rent download metrics, app revenue for Android

seems lower. These users download only half as

many apps as those using Apples iOS, and iOS

users pay for apps (as opposed to seeking out

free ones) three to four times more often.

Good news for media companies:

Tablets stimulate usage

Before the advent of tablets, publishers and media

companies had long struggled to monetize their

online offerings beyond advertising. When the

tablet was rst introduced, it sparked major excite-

ment, and tablets started to be seen as a poten-

tial savior of news and magazine publishers. The

hopes were that this new device category could

persuade consumers to pay for content they had

formerly obtained for free on the open Web.

Tablets might not have been a cure-all for media

companies so far, but evidence supports reason for

hope and points to tablets starting to make good

on part of their initial promise: tablets are actually

boosting news readership. The latest research indi-

cates that 30 percent of tablet users actually spend

more time reading news than they did before

purchasing their device, while only 4percent spend

less. This is because most consumers nd it more

enjoyable to read newspapers and magazines on

their tablets. One survey reveals that consumers

who formerly spent about 45minutes (per issue)

reading a magazine in print, boosted their time to

160 minutes on the tablet.

Beyond this, tablets are actually pulling in new

users who had previously expressed no interest in

the print products. One international news maga-

zine developed an app for tablets and found that

25 percent of its app users were willing to pay for

content, compared with only 5percent of browser

users. Amazon similarly found that customers who

purchased the Kindle e-book reader tended to in-

crease their book purchases more than threefold.

As a result, sales of e-books in the US, the UK,

and Germany are expected to increase 30, 59,

and 77percent respectively through 2015.

Initially slow to act, mobile players have

large upside potential

While media companies have been quick to benet

from the tablet opportunity, the experience among

mobile operators has been more mixed so far.

Apps provide a

superior custom-

er experience with

tablet revenue

potential three

times higher than

that of the smart-

phone

19

The expectation that tablets would transform the

mobile operators retail business into a major sales

channel that could compete with Apple Store out-

lets or big box consumer electronics retailers such

as Best Buy has largely failed to materialize.

In fact, McKinsey experts see two patterns across

major developed markets. First, many mobile

players lack clear strategies to deal with the tablet

phenomenon. No real best-practice approaches

to tablet data plans are apparent. Across and even

within key countries, pricing and plans offered

actually vary greatly from player to player. Second,

many mobile operators play it safe when it comes

to tablets, making few bold or innovative moves.

From a pricing perspective, they usually treat tab-

lets as separate devices similar to smartphones.

One apparent fear: introducing novel approaches

like multi-SIM could lead to plan cannibalization.

Comparing prices for tablet data plans across

markets helps underline the above points. In tablet

data pricing, a lot of experimentation is still taking

place. Price differences across major markets, for

example, show signicantly more variability than

in traditional voice rate structures tablet plans in

the most expensive countries cost 3.6 times more

than in the least expensive ones the difference

is only 2.2 times for voice. As a consequence, the

market uptake of 3G-enabled tablets correlates

strongly with data pricing (Exhibit 2). High prices

in the Netherlands appear to have constricted 3G

tablet sales, for example, while Germanys lower

prices have led to much higher penetration.

The relative lack of conformity in tablet data pricing

across markets points to a clear upside opportuni-

ty based on the potential for sharing best-practice

pricing strategies across markets. As an example,

one innovative approach centers on multi-SIM of-

fers that allow users to extend their current smart-

phone/voice contracts to include data access for

their tablets. As a result, subscribers dont have

to buy a second contract just for the tablet. Tele2

in Sweden, for instance, allows current mobile

broadband customers to receive one extra SIM

with a separate one gigabyte data allowance. Like-

wise, T-Mobile in Germany gives users the option

to receive up to two extra SIMs for a one-time fee

and no additional monthly charges. The data use

is drawn from their current plans. Other operators

RECALL No.20 A new era of personalized computing

Cyber boom: Why tablet domination has only just begun

Operators are still experimenting 3G/4G tablet penetration and pricing vary considerably as a result

1 Indicative figures based on McKinsey iConsumer 2011 survey figures should primarily be used to compare countries. Analyst figures diverge slightly

(e.g., Strategy Analytics reports 51% of tablets sold in 2010 in US to have 3G, IDC reports 44%)

2 Average price of available iPad data plans with 1 - 2 GB data allowance

SOURCE: McKinsey iConsumer survey, 2011; Tariff Consultancy, Q2 2011; Strategy Analytics, July 2011; IDC, Sep 2011

Cost of mid-tier data plan

EUR/month

2

3G tablet penetration

Percent of installed tablet base

1

40

0

25 20 10 5 0

45

55

65

70

US

UK

Poland

Netherlands

Italy

Germany

France

15

60

50

A tablet data plan in the Netherlands is almost

four times as expensive as one in Italy

Germany has 50%

higher penetration

than the Netherlands

Operators are still experimenting 3G tablet penetration and pricing vary

considerably as a result

Exhibit 2

20

Jean-Hubert Lenotte

is a Principal in McKinseys Paris ofce.

jean-hubert_lenotte@mckinsey.com

Christian Kraus

is an Engagement Manager in McKinseys

Berlin ofce.

christian_kraus@mckinsey.com

Bengi Korkmaz

is a Principal in McKinseys Istanbul ofce.

bengi_korkmaz@mckinsey.com

bundle tablets with 3G access and attractive con-

tent. Vodafone Italy, for example, links tablet plans

with live streaming sports coverage and subscrip-

tions to some of the leading national newspapers.

The tablet phenomenon is still on the rise, creat-

ing new opportunities for players across the

telecoms, media, and high-tech value chain. The

six trends described here should provide leaders

interested in capturing more of this opportunity

with a solid foundation regarding what to expect

next from this vital new source of value.

You might also like

- Form 25Document2 pagesForm 25gkk82No ratings yet

- ISPE Order FormDocument1 pageISPE Order Formgkk82No ratings yet

- ISPE Order FormDocument1 pageISPE Order Formgkk82No ratings yet

- 2013 Capstone Team Member GuideDocument28 pages2013 Capstone Team Member GuideMohamed AzarudeenNo ratings yet

- Transferred FilesDocument1 pageTransferred Filesgkk82No ratings yet

- Skin Anti Aging StrategiesDocument12 pagesSkin Anti Aging Strategiesgkk82No ratings yet

- India's Goods and Service Tax: The Case For Distribution Network RedesignDocument7 pagesIndia's Goods and Service Tax: The Case For Distribution Network RedesignCognizantNo ratings yet

- 2012 Amazon Annual ReportDocument90 pages2012 Amazon Annual Reportdp6242No ratings yet

- Manual MinitabDocument124 pagesManual MinitabAna-Maria AlexeNo ratings yet

- R QCC PackageDocument7 pagesR QCC Packagegkk82No ratings yet

- Manual Financial Calculator FC-200V - 100V - EngDocument149 pagesManual Financial Calculator FC-200V - 100V - Engm2biz05No ratings yet

- An Introduction To Modern Portfolio Theory: Markowitz, CAP-M, APT and Black-LittermanDocument31 pagesAn Introduction To Modern Portfolio Theory: Markowitz, CAP-M, APT and Black-Littermangkk82No ratings yet

- Z-Chart & Loss Function TablesDocument1 pageZ-Chart & Loss Function Tablesgkk82No ratings yet

- Random Word DocumentDocument1 pageRandom Word Documentgkk82No ratings yet

- Random TextDocument1 pageRandom Textgkk82No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Clinical Eval Brittany RivasDocument8 pagesClinical Eval Brittany Rivasapi-613460741No ratings yet

- Business Simulation Training Opportunity - V1.0Document15 pagesBusiness Simulation Training Opportunity - V1.0Waqar Shadani100% (1)

- MBA Third Semester Model Question Paper - 2009: Management and Organization Development-MU0002 (2 Credits)Document11 pagesMBA Third Semester Model Question Paper - 2009: Management and Organization Development-MU0002 (2 Credits)ManindersuriNo ratings yet

- UNIT 2 - Belajar Bahasa Inggris Dari NolDocument10 pagesUNIT 2 - Belajar Bahasa Inggris Dari NolDyah Wahyu Mei Ima MahananiNo ratings yet

- Bandwidth and File Size - Year 8Document2 pagesBandwidth and File Size - Year 8Orlan LumanogNo ratings yet

- FOCGB4 Utest VG 5ADocument1 pageFOCGB4 Utest VG 5Asimple footballNo ratings yet

- Classen 2012 - Rural Space in The Middle Ages and Early Modern Age-De Gruyter (2012)Document932 pagesClassen 2012 - Rural Space in The Middle Ages and Early Modern Age-De Gruyter (2012)maletrejoNo ratings yet

- ms3 Seq 01 Expressing Interests With Adverbs of FrequencyDocument3 pagesms3 Seq 01 Expressing Interests With Adverbs of Frequencyg27rimaNo ratings yet

- RumpelstiltskinDocument7 pagesRumpelstiltskinAndreia PintoNo ratings yet

- Communicative Competence: Noam ChomskyDocument2 pagesCommunicative Competence: Noam ChomskyKiara Denise SuarezNo ratings yet

- 2Document5 pages2Frances CiaNo ratings yet

- Set up pfSense transparent Web proxy with multi-WAN failoverDocument8 pagesSet up pfSense transparent Web proxy with multi-WAN failoverAlicia SmithNo ratings yet

- Pharmaceuticals CompanyDocument14 pagesPharmaceuticals CompanyRahul Pambhar100% (1)

- Transformation of Chinese ArchaeologyDocument36 pagesTransformation of Chinese ArchaeologyGilbert QuNo ratings yet

- Independent Study of Middletown Police DepartmentDocument96 pagesIndependent Study of Middletown Police DepartmentBarbara MillerNo ratings yet

- Detailed Lesson Plan School Grade Level Teacher Learning Areas Teaching Dates and Time QuarterDocument5 pagesDetailed Lesson Plan School Grade Level Teacher Learning Areas Teaching Dates and Time QuarterKhesler RamosNo ratings yet

- Solidworks Inspection Data SheetDocument3 pagesSolidworks Inspection Data SheetTeguh Iman RamadhanNo ratings yet

- Technical Contract for 0.5-4X1300 Slitting LineDocument12 pagesTechnical Contract for 0.5-4X1300 Slitting LineTjNo ratings yet

- Digital Movement Guide CodesDocument18 pagesDigital Movement Guide Codescgeorgiou80No ratings yet

- Popular Painters & Other Visionaries. Museo Del BarrioDocument18 pagesPopular Painters & Other Visionaries. Museo Del BarrioRenato MenezesNo ratings yet

- RA 4196 University Charter of PLMDocument4 pagesRA 4196 University Charter of PLMJoan PabloNo ratings yet

- 14 Jet Mykles - Heaven Sent 5 - GenesisDocument124 pages14 Jet Mykles - Heaven Sent 5 - Genesiskeikey2050% (2)

- Introduction To Computing (COMP-01102) Telecom 1 Semester: Lab Experiment No.05Document7 pagesIntroduction To Computing (COMP-01102) Telecom 1 Semester: Lab Experiment No.05ASISNo ratings yet

- Tax Q and A 1Document2 pagesTax Q and A 1Marivie UyNo ratings yet

- GASB 34 Governmental Funds vs Government-Wide StatementsDocument22 pagesGASB 34 Governmental Funds vs Government-Wide StatementsLisa Cooley100% (1)

- IJAKADI: A Stage Play About Spiritual WarfareDocument9 pagesIJAKADI: A Stage Play About Spiritual Warfareobiji marvelous ChibuzoNo ratings yet

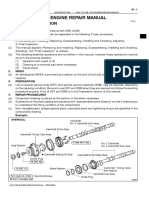

- How To Use This Engine Repair Manual: General InformationDocument3 pagesHow To Use This Engine Repair Manual: General InformationHenry SilvaNo ratings yet

- York Product Listing 2011Document49 pagesYork Product Listing 2011designsolutionsallNo ratings yet

- Lesson 1 Reviewer in PmlsDocument10 pagesLesson 1 Reviewer in PmlsCharisa Joyce AgbonNo ratings yet

- Module 6: 4M'S of Production and Business ModelDocument43 pagesModule 6: 4M'S of Production and Business ModelSou MeiNo ratings yet