Professional Documents

Culture Documents

Income FM Other Sources: Charg Eabi Lity

Uploaded by

Prâtèék ShâhOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income FM Other Sources: Charg Eabi Lity

Uploaded by

Prâtèék ShâhCopyright:

Available Formats

V I K R A M BI Y A NI

Income fm Other Sources

CHARGEABILITY

A s p e r s e c . 5 6 ( 1 ) , a n y i n c o m e i s t a xa b l e U / H I O S i f t h e f o l l o wi n g c o n d i t i o n s a r e satisfied: i. ii. iii. Th e r e m u s t b e a n i n c o m e . S u c h i n c o m e i s n o t e xe m p t e d u / s 1 0 t o 1 3 - A . Th a t i n c o m e i s n e i t h e r s a l a r y i n c o m e , n o r r e n t a l i n c o m e f m h o u s e p r o p e r t y, n o r income fm business or profession, nor capital gain.

Points to be remembered 01. S e c . 5 6 ( 2 ) l a ys d o wn t h e f o l l o wi n g l i s t o f i n c o m e s , wh i c h a r e s p e c i f i c a l l y t a xa b l e u n d e r t h i s h e a d :

i.

D i vi d e n d o t h e r t h a n d i vi d e n d r e f e r r e d t o i n s e c t i o n 1 1 5 - 0

D I S C U S S E D I N D E T AI L I N T H E C H AP T E R D I V I D E N D

ii.

W in i n g f m l o t t e r i e s , c r o s s wo r d p u z zl e s , r a c e s ( i n c l u d i n g h o r s e r a c e s ) , c a r d g a m e s , t e l e vi s i o n g a m e s h o ws & o t h e r g a m e s , g a m b l i n g o r b e t t i n g o f a n y form or nature. S u m r e c e i ve d b y e m p l o y e r a s P r o vi d e n t F u n d c o n t r i b u t i o n f m e m p l o ye e s i f t h e i n c o m e i s n o t t a xa b l e a s b u s i n e s s i n c o m e . I n t e r e s t o n s e c u r i t i e s i f h e l d a s a n i n ve s t m e n t . I n c o m e f m l e t t i n g o f m a c h i n e r y, p l a n t o r f u r n i t u r e ( wh e n s u c h l e t t i n g i s n o t incidental to business). L e t t i n g o f m a c h i n e r y, p l a n t o r f u r n i t u r e a l o n g wi t h t h e b u i l d i n g , wh e r e s u c h l e t t i n g o f b u i l d i n g i s i n s e p a r a b l e f m t h e l e t t i n g o f m a c h i n e r y, p l a n t o r furniture, if not charged to tax U/H B&P An y sum of mone y aggregate of which exceeds Rs. 50,000 received w i t h o u t c o n s i d e r a t i o n b y a n i n d i vi d u a l o r a H U F f r o m a n y p e r s o n ( s ) , s u b j e c t t o c e r t a i n e x c e p t i o n [ s e c 5 6 ( 2 ) ( vi i ) i m m o va b l e p r o p e r t y o r p r o p e r t y ] o t h e r t h a n i m m o va b l e p r o p e r t y r e c e i ve d b y a n i n d i vi d u a l o r H U F w i t h o u t c o n s i d e r a t i o n o r a t a p r i c e l o w e r t h a n s t a m p d u t y va l u e o r F M V [ s e c 5 6 ( 2 ) ( vi i ) ]

iii. iv. v. vi.

vii.

v i i i . A n y s u m o f m o n e y a g g r e g a t e va l u e o f w h i c h e x c e e d s R s . 5 0 , 0 0 0 o r

ix. x.

I n c o m e a r e w a y o f i n t e r e s t r e c e i ve d o n c o m p e n s a t i o n o r o n e n h a n c e d compensation referred to in section 145A(b) Sum recd. under Keyman Insurance Policy, if not charged t o tax U/H B&P.

D I S C U S S E D I N D E T AI L I N T H E C H AP T E R I N C O M E

02.

A p a r t f m t h e a b o ve , b y vi r t u e o f s e c . 5 6 ( 1 ) , f o l l o wi n g i n c o m e s a r e a l s o chargeable under this head:

i. ii. iii. iv. v. vi. vii.

Agriculture income fm a place outside India. F a m i l y p e n s i o n r e c e i ve d b y f a m i l y m e m b e r s o f d e c e a s e d e m p l o ye e . Income fm sub letting. Interest on bank or post office deposits or loans. Directors sitting fee. R e m u n e r a t i o n r e c e i ve d f o r e va l u a t i o n o f a n s w e r s c r i p t s f m p e r s o n o t h e r t h a n e m p l o ye r . R e n t f m a va c a n t l a n d .

Income fm Other Sources

13 4

V I K R A M BI Y A NI

viii. Income fm undisclosed source. ix. x. xi. xii.

I n t e r e s t o n I n c o m e t a x r e f u n d . H o w e ve r , i n c o m e t a x r e f u n d i s n o t t a xa b l e . Casual income. R e m u n e r a t i o n r e c e i ve d b y t h e m e m b e r o f p a r l i a m e n t I n c o m e r e c e i ve d a f t e r d i s c o n t i n u a t i o n o f b u s i n e s s Mi n i n g r e n t a n d r o ya l t i e s Directors commission for underwriting shares of new company A n n u i t y p a ya b l e t o t h e l e n d e r o f a t r a d e m a r k

xiii. Insurance commission xiv. xv. xvi.

03 .

I ncome is c har geabl e in acco rdanc e wit h m etho d of accoun ting f ollowe d b y assess ee {S ec. 145 } KEY POINTS A. D i vi d e n d h a s b e e n c h a r g e d a s p e r t h e m e t h o d s p e c i f i e d i n s e c . 8 .

D I S C U S S E D I N D E T AI L I N T H E C H AP T E R D I V I D E N D

Dividend {Sec. 2(22) read with sec. 56(1)}

D I S C U S S E D I N D E T AI L I N T H E C H AP T E R D I V I D E N D

Winning fm lotteries, crossword puzzles, horse race and card games etc. {Sec. 56(2)(ib)}

W in n i n g o f t h e f o l l o wi n g n a t u r e a r e t a xa b l e u n d e r t h i s h e a d : i. ii. iii. i v. v. Lotteries; c r o s s wo r d p u z zl e s ; races including horse races; gambling & betting of any nature; c a r d g a m e s , g a m e s h ow o r e n t e r t a i n m e n t p r o g r a m o n t e l e vi s i o n o r e l e c t r o n i c m o d e a n d a n y o t h e r g a m e o f a n y s o r t i n wh i c h p e o p l e c o m p e t e t o w i n p r i ze s o r any other similar game; Points to be remember ed 01. 02. 03. 04. N o d e d u c t i o n c a n b e c l a i m e d f m s u c h i n c ome e ve n i f s u c h e xp e n d i t u r e i s i n c u r r e d e xc l u s i ve l y & w h o l l y f o r e a r n i n g s u c h i n c o m e . No deduction u/s 80. W in n i n g s a r e t a xa b l e a t t h e f l a t r a t e o f 3 0 % i n c a s e o f a l l t h e a s s e s s e e a s p e r sec. 115-BB. T D S s h a l l b e d e d u c t e d @ 3 0 % i f t h e a m o u n t o f wi n n i n g e xc e e d s R s . 5 , 0 0 0 i n c a s e o f wi n n i n g s f m h o r s e r a c e wh i l e R s 1 0 , 0 0 0 i n c a s e o f o t h e r .

Income fm Other Sources

13 5

V I K R A M BI Y A NI

Interest on securities

Interest on securities means: i. ii. I n t e r e s t o n a n y s e c u r i t y o f t h e C e n t r a l / S t a t e G o vt . ; Interest on debentures or other securities for money issued by or on behalf of a local authority or a company or a corporation established by Central, State or P r o vi n c i a l A c t .

Points to be remembered 01. 02. 03. 04. 05. I n t e r e s t o n s e c u r i t i e s w h i c h a r e h e l d a s s t o c k - i n - t r a d e s h a l l b e t a xa b l e U / H P&G fm B/P. I n t e r e s t o n s e c u r i t i e s d o e s n o t a c c r u e e ve r y d a y o r a c c o r d i n g t o t h e p e r i o d o f h o l d i n g . Ge n e r a l l y, i t b e c o m e s d u e o n d u e d a t e s p e c i f i e d f o r s e c u r i t i e s . I n t e r e s t o n s p e c i f i e d s e c u r i t i e s i s e xe m p t f m t a x u / s 1 0 ( 1 5 ) . Any reasonable sum paid by way of commission or remuneration for realising such income on behalf of the assessee shall be deducted fm interest income. R a t e o f T D S o n i n t e r e s t o n l i s t e d d e b e n t u r e s i s 1 0 % wh i l e i n c a s e o f n o n - l i s t e d debentures is 10%.

Interest exempt u/s 10(15):

12-Year National Savings Annual Certificate National Defence Gold Bonds, 1980 Special Bearer Bonds, 1991 Treasury Savings Deposit Certificate (10 Years) Post Office Cash Certificates (5 Years) National Plan Certificates (10 Years) National Plan Savings Certificates (12 Years) P.O. National Plan Certificates (12 Years / 7 Years) P.O. Savings Bank Account P.O. Cumulative Time Deposit Account (15 Years) Fixed Deposit Scheme governed by the Government Savings certificate (Fixed Deposit) Rules, 1968. Fixed Deposit Scheme governed by the Post Office (Fixed Deposit) Rules, 1981. Public Account in P.O. (upto Rs.5,000) Gold Deposit Bonds, 1999xv. Bonds issued by local authority and specified by the Central Government. Interest on notified bonds issued by local authority or by state pooled finance entity

Income fm Other Sources

13 6

V I K R A M BI Y A NI

Receipt without considerations {Sec. 56(2)(v ii)&(vii a ) }

Ap pl i ca bl e t o:

I n d i vi d u a l a n d H U F Th e f o l l o w i n g t h r e e k i n d o f g i f t s r e c e i ve d b y a n i n d i vi d u a l o r H U F f r o m a n u n r e l a t e d p e r s o n ( s ) s h a l l b e t a xa b l e u / s 5 6 ( 2 ) ( vi i ) A. B. C. Gift in money G i f t o f i m m o va b l e p r o p e r t y r e c e i ve d wi t h o u t c o n s i d e r a t i o n o r a c q u i r e d for inadequate consideration (w.e.f 1.04.09) G i f t o f a n y p r o p e r t y , o t h e r t h a n i m m o va b l e p r o p e r t y w h e t h e r r e c e i ve d wi t h o u t c o n s i d e r a t i o n o r a c q u i r e d f o r i n a d e q u a t e c o n s i d e r a t i o n

Cond it i ons : A. G if t i n m on e y

D u r i n g t h e P Y h e o r i t h a s r e c e i ve d a n y s u m o f m o n e y e xc e e d i n g R s 5 0 , 0 0 0 / - ( i n a g g r e g a t e ) wi t h o u t c o n s i d e r a t i o n [ o n l y a p p l i c a b l e i f g i f t r e c e i ve d b e f o r e 1 - 1 0 - 0 9 ]

B. G if t of i mmov abl e pr op er t y (i) W it h out con sid e r at i on wh e r e a n y i m m o va b l e p r o p e r t y i s r e c e i ve d b y a n

i n d i vi d u a l o r H U F f r o m a n y p e r s o n w i t h o u t c o n s i d e r a t i o n , t h e s t a m p d u t y va l u e o f w h i c h e xc e e d s R s . 5 0 , 0 0 0 , t h e s t a m p d u t y va l u e o f s u c h p r o p e r t y s h a l l b e t a xa b l e i n the hands of the recipient .[single transaction]

(ii) Ac qu i re d f or in a dequ at e co ns id e rat io n W h e r e s u c h i m m o va b l e p r o p e r t y

i s a c q u i r e d b y a n i n d i vi d u a l o r H U F f o r a c o n s i d e r a t i o n w h i c h i s l e s s t h a n t h e s t a m p d u t y va l u e o f t h e p r o p e r t y , b y a n a m o u n t e xc e e d i n g R s . 5 0 , 0 0 0 , t h e e xc e s s o f s t a m p d u t y va l u e o f s u c h p r o p e r t y o ve r s u c h c o n s i d e r a t i o n s h a l l b e t a xa b l e i n t h e hands of the recipient .[single transaction] DELETED BY FINANCE BILL 2010

C. G if t of pr ope rt y ot he r t han i mm ov ab le prop e rt y (i) W it hout con s id er a t ion W h e r e a n y p r o p e r t y o t h e r t h a n i m m o va b l e p r o p e r t y i s

r e c e i ve d b y a n i n d i vi d u a l o r H U F , t h e a g g r e g a t e f a i r m a r k e t va l u e o f wh i c h e xc e e d s R s . 5 0 , 0 0 0 , t h e w h o l e o f t h e a g g r e g a t e , F MV o f s u c h p r o p e r t y s h a l l b e t a xa b l e i n the hands of the recipient.[all transaction ]

(ii) Ac qu i re d f or t h e inad equ at e con s id e ra tio n wh e r e s u c h p r o p e r t y o t h e r

t h a n i m m o va b l e p r o p e r t y i s a c q u i r e d f o r a c o n s i d e r a t i o n w h i c h i s l e s s t h a n t h e a g g r e g a t e F MV o f s u c h p r o p e r t y a s e xc e e d s s u c h c o n s i d e r a t i o n s h a l l be t a xa b l e i n the hands of the recipient . [all transaction]

Income fm Other Sources

13 7

V I K R A M BI Y A NI

E xc ept ion s:

i. ii. A n y s u m o f m o n e y wh i c h i s r e c e i ve d b y wa y o f c o n s i d e r a t i o n ; A n y s u m o f m o n e y wh i c h i s r e c e i ve d f m a n y r e l a t i v e ; R e l a t i ve s i n c l u d e s : a. b. c. d. e. f. g. iii. i v. v. vi . vi i . S p o u s e o f t h e i n d i vi d u a l ; B r o t h e r o r s i s t e r o f t h e i n d i vi d u a l ; B r o t h e r o r s i s t e r o f t h e s p o u s e o f t h e i n d i vi d u a l ; B r o t h e r o r s i s t e r o f e i t h e r o f t h e p a r e n t s o f t h e i n d i vi d u a l ; A n y l i n e a l a s c e n d a n t o r d e s c e n d a n t o f t h e i n d i vi d u a l ; A n y l i n e a l a s c e n d a n t o r d e s c e n d a n t o f t h e s p o u s e o f t h e i n d i vi d u a l ; Spouse of the person referred to in (b) to (c).

A n y s u m o f m o n e y wh i c h i s r e c e i ve d o n t h e o c c a s i o n o f m a r r i a g e o f t h e i n d i vi d u a l ; A n y s u m o f m o n e y wh i c h i s r e c e i ve d u n d e r w i l l o r b y w a y o f i n h e r i t a n c e ; A n y s u m o f m o n e y wh i c h i s r e c e i ve d i n c o n t e m p l a t i o n o f t h e d e a t h o f t h e p a ye r ; A n y s u m o f m o n e y n o t e xc e e d i n g R s 5 0 , 0 0 0 / - ; A n y s u m o f m o n e y r e c e i ve d f r o m a n y l o c a l a u t h o r i t y u / s 1 0 ( 2 0 ) ; a n y f u n d o r f o u n d a t i o n o r u n i ve r s i t y o r o t h e r e d u c a t i o n a l i n s t i t u t e o r a n y t r u s t c o ve r e d u / s 10(23C) or any trust institute registered u/s 12AA

Points to be remembered

Propert y means I m m o va b l e p r o p e r t y b e i n g l a n d o r b u i l d i n g o r b o t h , S h a r e s a n d

s e c u r i t i e s , J e w e l l e r y, a r c h a e o l o g i c a l c o l l e c t i o n , D r a w i n g , P a i n t i n g , S c u l p t u r e s o r a n y work of art and Bullion w.ef. 1 -06-2010

Income fm Other Sources

13 8

V I K R A M BI Y A NI

D if f er en t ca s e s

C a s e 1 - X r e c e i ve a c a s h g i f t o f R s . 5 0 , 0 0 0 on September 30,2011 from his friend A. He r e c e i ve s a n o t h e r c a s h g i f t o f R s . 5 0 , 0 0 0 from his friend B on Oct 1,2011.

Tax tr ea t me n t

C a s e 2 - X r e c e i ve s t h e f o l l o wi n g h o u s e p r o p e r t i e s f r o m h i s f r i e n d s wi t h o u t a n y consideration Place where p r op e rt y situated Delhi Patna Chennai Date gift of Stamp duty value

30-09-2011 1-10-2011 10-10-2011

Rs.20 crore Rs.50,000 Rs. 2.3 lakh

Case 3- Z purchases gold for Rs. 5 lakh ( F . M. V ; R s . 5 . 5 l a k h ) o n O c t 1 0 , 2 0 1 1 . H e further purchases a painting for Rs. 20 lakh ( F . M. V 2 0 . 5 L a k h ) o n D e c 1 , 2 0 1 1

Case 4- suppose in the aforesaid cases,the recipient is only one person (P)

A MO U N T TA X A B L E I N T H E H A N D S O F d W IL L B E R s .

Income fm Other Sources

13 9

V I K R A M BI Y A NI

Receipts of shares by a firm or a closely held company 56(2) (VII a )

C l a u s e ( vi i a ) h a s b e e n i n s e r t e d i n s e c t i o n 5 6 ( 2 ) ( vi i a ) w . e . f 1 - 0 6 - 2 0 1 0 . Th i s c l a u s e i s applicable if the following cond ition satisfied a. b. c. d. e. Recipient is a firm or closely held company Th e a s s e t s ( w h i c h i s r e c e i ve d ) i s i n t h e f o r m o f s h a r e s i n a c l o s e l y h e l d company Th e s e s h a r e s a r e r e c e i v e d f r o m a n y p e r s o n o n o r a f t e r 1 - 0 6 - 2 0 1 0 Such share are consideration r e c e i ve d wi t h o u t consideration or for an adequate

S u c h s h a r e s a r e n o t r e c e i ve d b y s h a r e h o l d e r i n a s c h e m e o f a m a l g a m a t i o n or demerger

I f t h e s e c o n d i t i o n s a t i s f i e d , t h e n va l u e o f s u c h s h a r e s wi l l b e t a xa b l e I t h e h a n d s o f recipient.(firm or closely held co.)

Diff e re nt si t uat ion

S h a r e s a r e r e c e i ve d wi t h o u t c o n s i d e r a t i o n a n d a g g r e g a t e F MV o f t h e s e s h a r e s r e c e i ve d d u r i n g t h e P Y d o e s n o t e xc e e d s Rs. 50,000 S h a r e s a r e r e c e i ve d wi t h o u t c o n s i d e r a t i o n a n d a g g r e g a t e F MV o f t h e s e s h a r e s r e c e i ve d d u r i n g t h e P Y S h a r e s a r e r e c e i ve d f o r a c o n s i d e r a t i o n w h i c h i s l e s s t h a n F MV a n d t h e a g g r e g a t e d i f f e r e n c e d o e s n o t e xc e e d s R s . 5 0 , 0 0 0 S h a r e s a r e r e c e i ve d f o r a c o n s i d e r a t i o n w h i c h i s l e s s t h a n F MV a n d t h e a g g r e g a t e d i f f e r e n c e e xc e e d s R s . 5 0 , 0 0 0

T axa bi lit y in the h an ds of r ec ip ie nt

N o t h i n g i s t a xa b l e

A g g r e g a t e F MV w i l l t a xa b l e i n t h e h a n d s o f recipient

N o t h i n g i s t a xa b l e

Aggregate F MV minus c o n s i d e r a t i o n wi l l b e t a x a b l e

aggregate

Income fm Other Sources

14 0

V I K R A M BI Y A NI

AM OUNT NO T DEDUCTI BL E

A s p e r s e c . 5 8 , t h e f o l l o wi n g a m o u n t s s h a l l n o t b e d e d u c t i b l e i n co m p u t i n g t h e income chargeable under the head "Income from other sources": i. ii. iii. i v. P e r s o n a l e xp e n s e s o f t h e a s s e s s e e ; W ea l t h Ta x; I n t e r e s t o r s a l a r y p a i d o u t s i d e I n d i a o n wh i c h t a x h a s n o t b e e n p a i d o r de d u c t e d at source; A n y a m o u n t p a i d t o a p e r s o n s p e c i f i e d u / s 4 0 - A ( p a ym e n t t o r e l a t i ve i n e xc e s s of requirement).

ALLOW ABLE DEDUCTIONS

U/s 57, the income chargeable U/H Income fm Other Sources shall be computed a f t e r m a k i n g t h e f o l l o wi n g d e d u c t i o n s : i. I n r e s p e c t o f a n y s u m c o l l e c t e d f m e m p l o ye e s t o wa r d s t h e W e l f a r e F u n d c o n t r i b u t i o n , d e d u c t i o n s h a l l b e a l l o we d t o t h e e xt e n t t h e a m o u n t i s r e m i t t e d wi t h i n t h e r e l e va n t d u e d a t e . KEY POINTS A. Due date is the date by which the assessee is required as e m p l o ye r t o c r e d i t s u c h c o n t r i b u t i o n t o t h e e m p l o ye e s a c c o u n t i n t h e r e l e va n t f u n d u n d e r t h e p r o vi s i o n o f a n y l a w o r t e r m s o f c o n t r a c t o f s e r vi c e o r o t h e r w i s e .

D I S C U S S E D I N D E T AI L I N P & G f m B / P : C O M P U T AT I O N

ii.

I n c a s e o f i n c o m e f m ma c h i n e r y, p l a n t a n d f u r n i t u r e l e t o n h i r e , t h e f o l l o wi n g deductions are permissible: a. b. c. C u r r e n t r e p a i r s t o m a c h i n e r y, p l a n t a n d f u r n i t u r e I n s u r a n c e p r e m i u m p a i d f o r m a c h i n e r y, p l a n t o r f u r n i t u r e Depreciation and unabsorbed depreciation as per sec. 32.

iii.

I n c a s e o f i n c o m e f m m a c h i n e r y, p l a n t a n d f u r n i t u r e a l o n g wi t h b u i l d i n g l e t o n hire, the following deductions are permissible: a. b. c. d. e. If the assessee owns the building, only current repairs is deducted o t h e r wi s e b o t h c u r r e n t a s we l l a s c a p i t a l r e p a i r s a r e d e d u c t i b l e . R e n t , r a t e s a n d t a xe s p a i d b y t h e a s s e s s e e f o r b u i l d i n g . C u r r e n t r e p a i r s t o m a c h i n e r y, p l a n t a n d f u r n i t u r e I n s u r a n c e p r e m i u m p a i d f o r m a c h i n e r y, p l a n t o r f u r n i t u r e o r b u i l d i n g . Depreciation and unabsorbed depreciation as per sec. 32.

Income fm Other Sources

14 1

V I K R A M BI Y A NI

i v.

D e d u c t i o n o f / 3 r d o f s u c h i n c o m e o r R s 1 5 , 0 0 0 / - wh i c h e ve r i s l o w e r , i s a l l o we d fm the income in the nature of family fund. KEY POINTS A. F a m i l y P e n s i o n m e a n s a r e g u l a r m o n t h l y a m o u n t p a ya b l e b y t h e e m p l o ye r t o a p e r s o n b e l o n g i n g t o t h e f a m i l y i n t h e e ve n t o f h i s death. R e l i e f u / 8 9 i s a l s o a va i l a b l e o n f a m i l y p e n s i o n .

B. v.

A n y o t h e r e xp e n d i t u r e n o t b e i n g i n t h e n a t u r e of c a p i t a l e xp e n d i t u r e , i n c u r r e d w h o l l y a n d e xc l u s i ve l y f o r e a r n i n g s u c h i n c o m e .

Income fm Other Sources

14 2

V I K R A M BI Y A NI

a.

X , a r e s i d e n t i n d i vi d u a l , s u b m i t s t h e f o l l o wi n g p a r t i c u l a r s o f h i s i n c o m e f o r t h e p r e vi o u s ye a r e n d i n g Ma r c h 3 1 , 2 0 1 2 : D i vi d e n d p a ye r Is it d i vi d e n d under section 2(22)(e) Date declaration d i vi d e n d of of Amount of tax deducted under section 194 Rs. Net amount paid to X Interest paid by X on capital b o r r o we d t o i n ve s t in shares Rs. 3,000 50,000 2,000 11,000

Name of Company

Rs. 70,000 43,000 2,500 15,920

A Ltd., Co. B Ltd., Co. C Ltd, Co. D Ltd. Co.

a foreign a foreign on Indian on Indian

No No No ye s

July 15, 2011 April 1, 2011 Oct 31,2011 Ma y 1 , 2 0 1 1

Nil Nil Nil 4,080

R e n t f r o m l e t t i n g a f a c t o r y a l o n g wi t h p l a n t a n d m a c h i n e r y ( l e t t i n g o u t o f f a c t o r y c a n n o t b e s e p a r a t e d f r o m l e t t i n g o u t o f p l a n t a n d m a c h in e r y ) : R s . 3 0 , 6 0 0 . C o l l e c t i o n c h a r g e s i n respect of rent: Rs. 400. Fire insurance premium in respect of building: Rs. 600. Fire Insurance premium in respect of plant and machinery :Rs. 750. Repairs in respect of b u i l d i n g : R s . 4 , 6 0 0 . D e p r e c i a t i o n o f b u i l d i n g , p l a n t a n d m a c h i n e r y: R s . 1 8 , 6 0 0 . W i n n i n gs from lottery on December 1, 2010 : net amount: Rs. 69,400; tax deducted at source: Rs. 3 0 , 6 0 0 . W i n n i n g s f r o m ca r d g a m e s : R s . 1 3 , 5 0 0 ( g r o s s ) . I n t e r e s t o n s e c u r i t i e s i s s u e d b y t h e G o ve r n m e n t o f J a p a n : R s . 3 0 , 6 7 0 D u r i n g t h e p r e vi o u s ye a r , X h a s r e c e i ve d t h e f o l l o wi n g g i f t s G i f t f r o m wh o m Gift Gift Gift Gift Gift X Gift from from from from from a friend a friend brother g r a n d f a t h e r r e c e i ve d b y w i l l friends at the time of marriage of Data of gift August 20, 2011 September 10, 2011 September 15, 2011 september16, 2011 September 18, 2011 N o ve m b e r 2 0 , 2 0 1 1 Amount Rs. 1,00,000 60,000 90,000 1,40,000 1,35,000 25,000

from a friend

Determine the income chargeable under the head Income from other sources for the A s s e s s m e n t Ye a r 2 0 1 2 - 1 3 .

Income fm Other Sources

14 3

V I K R A M BI Y A NI

Income fm Other Sources

14 4

V I K R A M BI Y A NI

Dividends

Fundamentals

D i vi d e n d h a s n t b e e n d e f i n e d u n d e r I . T . A c t . I n l a ym a n l a n g u a g e , d i v i d e n d r e f e r s to distribution of profit. D i vi d e n d i s t a xa b l e U / H I n c o m e f m O t h e r S o u r c e s ( I O S ) u / s 5 6 ( 2 ) ( i ) . I n t e r i m D i vi d e n d r e f e r s t o d i vi d e n d p a i d b y D i r e c t o r p r i o r t o s h a r e h o l d e r s a p p r o va l a t a n y t i m e d u r i n g t h e F Y a n d u p t o t h e t i m e o f A n n u a l G e n e r a l Me e t i n g . KEY POINTS A. B. I n t e r i m d i vi d e n d c a n b e p a i d o n l y i f A r t i c l e s o f A s s o c i a t i o n p e r m i t t h e c o m p a n y t o p a y. I t c a n b e r e s c i n d e d b y t h e B o a r d a n y t i m e b e f o r e t h e a c t u a l p a ym e n t .

C o m p a n y c a n p a y d i vi d e n d o n l y o u t o f p r o f i t s , c u r r e n t o r a c c u m u l a t e d . D i vi d e n d c a n a l s o b e p a i d o u t o f m o n e y p r o vi d e d b y t h e G o ve r n m e n t . D i vi d e n d g e n e r a l l y b e p a i d i n c a s h o r e q u i va l e n t t o c a s h . KEY POINTS A. I n I . T . Ac t , d i s t r i b u t i o n o f d i vi d e n d i n k i n d m a y a l s o b e d e e m e d a s d i vi d e n d .

D i vi d e n d s t o b e p a i d o n l y t o t h e r e g i s t e r e d s h a r e h o l d e r s o r t o t h e i r o r d e r o r t o t h e i r bankers. KEY POINTS A. I n c a s e o f j o i n t h o l d e r s , t h e d i vi d e n d s h a l l b e s e n t t o t h e f i r s t n a m e a p p e a r i n g i n t h e R e g i s t e r o f Me m b e r s t o s u c h a d d r e s s a s t h e s h a r e h o l d e r s p r o vi d e d .

P r e f e r e n c e s h a r e h o l d e r s e n j o y a p r e f e r e n t i a l r i g h t o ve r t h e e q u i t y s h a r e h o l d e r s ( E S H ) i n t h e m a t t e r o f d i vi d e n d . Th e y a r e e n t i t l e d t o r e c e i ve d i vi d e n d a t t h e f i xe d r a t e b e f o r e a n y d i vi d e n d i s p a i d t o e q u i t y s h a r e h o l d e r . KEY POINTS A. I f c o m p a n y i s s u e s c u m u la t i ve p r e f e r e n c e s h a r e , t h e h o l d e r s o f s u c h s h a r es a r e e n t i t l e d t o r e c e i ve a l l a r r e a r s o f d i vi d e n d i n a d d i t i o n t o d i vi d e n d f o r t h e c u r r e n t ye a r b e f o r e a n y d i vi d e n d i s p a i d t o e q u i t y s h a r e h o l d e r .

D i vi d e n d s h a l l b e d e e m e d t o a c c r u e o r a r i s e i n I n d i a , i f i t i s d e c l a r e d b y a n I n d i a n c o m p a n y.

Judicial Citation B.V.VENKATESAM CHETTY Th e d a t e o f r e c e i p t o f d i vi d e n d i s r e l e va n t a n d n o t t h e d a t e o f d e c l a r a t i o n w h e r e c a s h m e t h o d o f a c c o u n t i n g i s f o l l o we d .

Income fm Other Sources

14 5

V I K R A M BI Y A NI

DEEMED DIVIDEND

Distribution of accumulated profit entailing release of co. asset {Sec . 2(22)(a)}

Any distribution by a compan y to its shareholder resulting in the release of all or a n y p a r t o f t h e a s s e t s o f t h e c o m p a n y i s d e e m e d d i vi d e n d . Points to be remembered 01. 02. To t h e e xt e n t t o capitalised or not. wh i c h company possess accumulated profit, whether

S u c h a c c u m u l a t e d p r o f i t s a r e d i s t r i b u t e d i n c a s h o r i n k i n d . W h er e t h e d i s t r i b u t i o n i s i n k i n d , m a r k e t va l u e o f t h e a s s e t ( a n d n o t i n t h e b o o k va l u e ) o n t h e d a t e o n w h i c h t h e s h a r e h o l d e r b e c o m e s e n t i t l e d t o r e c e i ve d i vi d e n d , s h a l l b e d e e m e d d i vi d e n d i n t h e h a n d s o f s h a r e h o l d e r .

Judicial Citation

S H A S H B AL A N AV N I T L A L Issue of bonus share does not entail release of any assets of the company as the assets sides remains intact.

Distribution of accumulated profits in the debentures, debentures stock etc. {Sec. 2(22)(b)}

form

of

As per sec. 2(22)(b), any distribution to its shareholder by a company of i. ii. d e b e n t u r e s , d e b e n t u r e - s t o c k o r d e p o s i t - c e r t i f i c a t e s wi t h o r wi t h o u t i n t e r e s t t o i t s ( e q u i t y a s we l l a s p r e f e r e n c e s h a r e h o l d e r ) ; bonus share to preference shareholder;

i s d e e m e d d i vi d e n d . Points to be remembered 01. U n d e r t h e a f o r e s a i d c i r c u m s t a n c e s , d i s t r i b u t i o n a m o u n t s t o d i vi d e n d i n t h e h a n d s o f t h e r e c i p i e n t e ve n i f t h e r e i s n o r e l e a s e o f a s s e t s a t t h e t i m e o f distribution.

Distribution of accumulated profit liquidation {Sec. 2(22)(c) read w ith sec. 46}

at

the

time

of

Any distribution made to its equity shareholder on the liquidation of company is d e e m e d d i vi d e n d . Points to be remembered 01. To t h e e xt e n t t o w h i c h s u c h d i s t r i b u t i o n i s a t t r i b u t a b l e t o t h e a c c u m u l a t e d p r o f i t o f t h e c o m p a n y i m m e d i a t e l y b e f o r e i t s l i q u i d a t i o n , wh e t h e r c a p i t a l i s e d o r n o t ; W he r e t h e l i q u i d a t i o n i s c o n s e q u e n t o n t h e c o m p u l s o r y a c q u i s i t i o n o f t h e u n d e r t a k i n g o f t h e c o m p a n y b y t h e G o vt . o r b y a n y C o r p o r a t i o n o w n e d o r c o n t r o l l e d b y t h e G o vt . u n d e r a n y l a w i n f o r c e , t h e a c c u m u l a t e d p r o f i t s h a l l n o t

02.

Income fm Other Sources

14 6

V I K R A M BI Y A NI

i n c l u d e a n y p r o f i t o f t h e c o m p a n y p r i o r t o t h r e e c o n s e c u t i ve P Y i m m e d i a t e l y preceding the PY in which such acquisition takes place. 03. I m p l i c a t i o n o f t a xa t i o n o f C a p i t a l G a i n a t t h e t i m e o f l i q u i d a t i o n .

D I S C U S S E D I N C AP I T AL G AI N : U N T O U C H E D I S S U E S

Distribution of accumulated profits on the reduction of its capital {Sec. 2(22)(d )}

Any distribution by co. to its shareholder on a/c of reduction of share capital is d e e m e d d i vi d e n d . Points to be remembered 01. To t h e e xt e n t t o capitalised or not. wh i c h company possess accumulated profit, whether

D is t ri b ut i on of a c cu m ul a t e d p r of i t by w ay of a d van ce or l oan

{Sec.

2(22)(e)}

A n y p a ym e n t b y a c l o s e l y h e l d c o m p a n y , o f a n y s u m : i. b y w a y o f l o a n o r a d va n c e t o a. a shareholder being the beneficial owner of equity shares holding not l e s s t h a n 1 0 % vo t i n g p o w e r ; or b. ii. any concern in which such shareholder is a member or partner and in which s/he has substantial interest.

t o a n y p e r s o n o n b e h a l f o f o r f o r t h e i n d i vi d u a l b e n e f i t o f s u c h s h a r e h o l d e r ;

i s d e e m e d d i vi d e n d . Points to be remembered 01. 02. To t h e e xt e n t t o wh i c h c o m p a n y p o s s e s s a cc u m u l a t e d p r o f i t . ( C a p i t a l i s e d profits not included). Closely held companies is a company in which public are not substantially interested.

D I S C U S S E D I N I N C O M E T AX - J AR G O N

03.

C o n c e r n m e a n s a H U F , f i r m , a n A O P , B O I o r a c o m p a n y.

04.

A p e r s o n s h a l l b e d e e m e d t o h a ve a s s u b s t a n t i a l i n t e r e s t i n a c o n c e r n i f s/he is, at any time during the PY, beneficially entitled to not less than 20% of t h e i n c o m e o f s u c h c o n c e r n . ( 2 0 % o f vo t i n g p o w e r i n c a s e o f a c o m p a n y) ;

AL S O D I S C U S S E D I N T H E C H AP T E R C L U B B I N N G O F I N C O M E / P & G f m B / P C O M P U T AT I O N / S AL AR Y / AS S E S S M E N T O F T R U S T . Relevant Chapter Clubbing of Income Salary P&G fm B/P- Computation Relevant Section 64(1)(ii) 17(2) 40-A(2)

Income fm Other Sources

14 7

V I K R A M BI Y A NI

05.

I f t h e l o a n i s g i ve n t o a c o n c e r n i n w h i c h s u c h s h a r e h o l d e r h a s 2 0 % s h a r e s i n p r o f i t / vo t i n g p o w e r a t a n y t i m e d u r i n g t h e P Y, B O T H t h e f o l l o wi n g c o n d i t i o n s are to be satisfied: i. ii. S h a r e h o l d e r s h o u l d h a v e 1 0 % vo t i n g p o w e r i n t h e c l o s e l y h e l d c o m p a n y o n t h e d a t e wh e n t h e l o a n i s g i ve n t o t h e c o n c e r n . S h a r e h o l d e r s h o u l d b e a m e m b e r / p a r t n e r o n t h e d a t e l o a n i s g i ve n t o such concern.

06.

S e c . 2 ( 2 2 ) ( e ) c o ve r s n o t o n l y l o a n a n d a d va n c e s t o s h a r e h o l d e r b u t a n y o t h e r p a ym e n t o n b e h a l f o f o r f o r t h e i n d i vi d u a l b e n e f i t o f s h a r e h o l d e r s . F o r e x a m p l e : P a ym e n t o f s h a r e h o l d e r s p e r s o n a l e xp e n s e s , i n s u r a n c e p r e m i u m etc.

07. 08.

L o a n i s d e e m e d d i vi d e n d , e ve n i f r e f u n d e d b e f o r e t h e e n d o f P Y , e i t h e r i n f u l l o r in part. A n y a d va n c e o r l o a n t o a s h a r e h o l d e r o r t h e c o n c e r n i n w h i c h t h e s h a r e h o l d e r h a s s u b s t a n t i a l i n t e r e s t b y a c o m p a n y w i l l n o t b e t r e a t e d a s d i vi d e n d :

i.

i f t h e l o a n o r a d va n c e i s g i ve n d u r i n g t h e n o r m a l c o u r s e o f i t s b u s i n e s s p r o vi d e d t h e l e n d i n g o f m o n e y i s s u b s t a n t i a l p a r t o f t h e b u s i n e s s o f t h e c o m p a n y; A n y d i vi d e n d p a i d b y t h e c o m p a n y w h i c h i s s e t o f f b y t h e c o m p a n y a g a i n s t t h e wh o l e o r a n y p e r t o f t h e l o a n wh i c h h a s b e e n d e e m e d a s d i vi d e d u / s 2(22)(e);

ii.

C AUTION

A s p e r s e c . 2 ( 2 2 ) , d i vi d e n d s h a l l n o t i n c l u d e s : i. A n y p a ym e n t m a d e b y a c o m p a n y o n p u r c h a s e o f i t s o wn s h a r e s f m a s h a r e h o l d e r i n a c c o r d a n c e wi t h t h e p r o vi s i o n o f s e c . 7 7 - A o f C o m p a n i e s A c t , 1956. KEY POINTS A. S u c h b u y b a c k o f s h a r e s a t t r a c t s c a p i t a l g a i n ta x i n t h e h a n d s o f t h e shareholder.

D I S C U S S E D I N C AP I T AL G AI N : U N T O U C H E D I S S U E S

ii.

Any distribution of assets pursuant to a demerger by the resulting co. to the shareholders of the demerged co. (whether or not there is reduction of capital i n t h e d e m e r g e d c o m p a n y) . A n y d i s t r i b u t i o n m a d e i n a c c o r d a n c e wi t h s e c . 2 ( 2 2 ) ( c ) / ( d ) i n r e s p e c t o f preference shareholder issued for full cash consideration as they arent entitled to participate in surplus assets.

iii.

Income fm Other Sources

14 8

V I K R A M BI Y A NI

Accumulated Profit:

I f r e s e r ve i s c r e a t e d o u t o f t h e p r o f i t o f t h e c o m p a n y, t h e n i t f o r m s p a r t o f t h e accumulated profit. I t i n c l u d e s t h e c r e d i t b a l a n c e o f P & L A / c , g e n e r a l r e s e r ve s , t a x f r e e i n c o m e i . e . a g r i c u l t u r e i n c o m e , d e v e l o p m e n t r e b a t e r e s e r v e , d e ve l o p m e n t a l l o w a n c e r e s e r ve , i n ve s t m e n t a l l o w a n c e r e s e r ve , a d d i t i o n m a d e b y t h e A s s e s s i n g O f f i c e r o n a / c o f concealed income, etc. H o we ve r , i t d o e s n t i n c l u d e p r o vi s i o n a n d r e s e r ve m e a n t f o r s p e c i f i c l i a b i l i t y i . e . p r o vi s i o n o f d e p r e c i a t i o n / t a xa t i o n / d i vi d e n d , a d d i t i o n m a d e b y t h e A O o n a / c o f d i s a l l o w a n c e o f e xp e n d i t u r e e t c . KEY POINTS A. B. A c c u m u l a t e d p r o f i t i n c l u d e s c a p i t a l i s e d p r o f i t e xc e p t f o r s e c . 2 ( 2 2 ) ( e ) . Accumulated profit for the purpose of sec. 2(22) include Company liquidation which is not in : : compulsory : Upto the day of distribution or p a ym e n t ; Upto the day of liquidation Any profit of company just p r e c e d i n g 3 ye a r s i m m e d i a t e l y preceding the PY in which such acquisition took place. Upto the day of grant of such loan.

Company in liquidation Liquidation acquisition due to

D i vi d e d u / s 2 ( 2 2 ) ( e )

T axa bi lit y:

D i vi d e n d r e c e i v e d f m Domestic company D i vi d e n d e xc l u d i n g d e e m e d d i vi d e n d u / s 2 ( 2 2 ) ( e ) other than concern loan to a : : : : : E xe m p t e d 10(34). Shareholder. Recipient. Shareholder. Recipient. u/s Taxable in the hands of

Deemed 2(22)(e)

d i vi d e n d

u/s

loan to a concern Foreign compan y C o - o p e r a t i ve s o c i e t y

KEY POINTS A. D i vi d e n d a s s p e c i f i e d u / s 2 ( 2 2 ) ( a ) / ( b ) / ( c ) / ( d ) i s e xe m p t e d i n t h e h a n d s o f s h a r e h o l d e r . O n w h i c h c o m p a n y i s r e q u i r e d t o p a y d i vi d e n d t a x @ 1 5 % p l u s s u r c h a r g e @ 5 % p l u s e d u c a t i o n c e s s @ 3 % . H o we ve r d i vi d e n d a s p e r s e c . 2 ( 2 2 ) ( e ) i s t a xa b l e i n t h e h a n d s o f s h a re h o l d e r o n wh i c h TD S i s required to be deducted.

Income fm Other Sources

14 9

You might also like

- The Corporate Governance of BanksDocument56 pagesThe Corporate Governance of BankspriyankafreshNo ratings yet

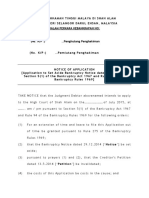

- Notice of Application - Set Aside Bankruptcy NoticeDocument3 pagesNotice of Application - Set Aside Bankruptcy NoticeCharumathy NairNo ratings yet

- Instructions For Recipient: Statement FOR Recipients OF Unemployment InsuranceDocument13 pagesInstructions For Recipient: Statement FOR Recipients OF Unemployment InsuranceChristian RiveraNo ratings yet

- Inhoud: Overnment Otice OewermentskennisgewingDocument5 pagesInhoud: Overnment Otice Oewermentskennisgewingbellydanceafrica9540No ratings yet

- Burlington's Unbriddled GrowthDocument14 pagesBurlington's Unbriddled GrowthChuck MorseNo ratings yet

- This SchemeDocument9 pagesThis Schemeshashi shekhar dixitNo ratings yet

- External Debt of States Concept, Structure, IndicatorsDocument14 pagesExternal Debt of States Concept, Structure, IndicatorslidibarvNo ratings yet

- Global Financial CrisisDocument47 pagesGlobal Financial CrisisArul DassNo ratings yet

- Bajaj Life InsuranceDocument71 pagesBajaj Life InsuranceHoney MinhasNo ratings yet

- 03-2007 (Lubna Vs Khalid) Order & GDDocument23 pages03-2007 (Lubna Vs Khalid) Order & GDNurulhuda Binte KamisNo ratings yet

- Book VII - Transitory and Final ProvisionsDocument7 pagesBook VII - Transitory and Final ProvisionsNathaniel LepasanaNo ratings yet

- Project ReportDocument79 pagesProject Reportjinalpanchal962No ratings yet

- Services Rendered To Customers by Life Insurance CorporationDocument73 pagesServices Rendered To Customers by Life Insurance CorporationPooja YadavNo ratings yet

- 1980 1128 PGRDocument12 pages1980 1128 PGRTim KitchenNo ratings yet

- Sy vs. de Vera-Navarro - Article 1602 - CorpinDocument3 pagesSy vs. de Vera-Navarro - Article 1602 - CorpinJemNo ratings yet

- Detention and control of habitual criminalsDocument4 pagesDetention and control of habitual criminalsJNo ratings yet

- Entrepreneusrhip Assignment Syed AmirDocument7 pagesEntrepreneusrhip Assignment Syed AmirAmirNo ratings yet

- Maharani: C R A F TDocument13 pagesMaharani: C R A F TDaniel dwipermanaNo ratings yet

- Merger Is Defined As The Combination of Two RelativelyDocument16 pagesMerger Is Defined As The Combination of Two RelativelyPawar SachinNo ratings yet

- Inhoud: Overnment Otice OewermentskennisgewingDocument5 pagesInhoud: Overnment Otice Oewermentskennisgewingbellydanceafrica9540No ratings yet

- SkyTrain, WCE 2015 Business PlanDocument22 pagesSkyTrain, WCE 2015 Business PlanBob MackinNo ratings yet

- Definition: Assistance by Governemnt in The Form of TransferDocument4 pagesDefinition: Assistance by Governemnt in The Form of TransferImma Therese YuNo ratings yet

- Case Digest Batch 2 FINALDocument42 pagesCase Digest Batch 2 FINALDan BermasNo ratings yet

- Full PFRS: Jeff-Mikesmith Sule, Friacc, Enp, Reb, Rea, Cpa, Micb L E CturerDocument20 pagesFull PFRS: Jeff-Mikesmith Sule, Friacc, Enp, Reb, Rea, Cpa, Micb L E Cturerメアリー フィオナNo ratings yet

- CEHv8 Module 13 Hacking Web ApplicationsDocument263 pagesCEHv8 Module 13 Hacking Web ApplicationsMiles GelidusNo ratings yet

- Establishment of Small Claims Courts in Five AreasDocument2 pagesEstablishment of Small Claims Courts in Five Areasbellydanceafrica9540No ratings yet

- Independence Act 1947 PDFDocument22 pagesIndependence Act 1947 PDFFarrukh Javed BegNo ratings yet

- Memo Circular No. 16 003Document3 pagesMemo Circular No. 16 003Ylmir_1989No ratings yet

- Daily Market Update: US Remains Centre StageDocument2 pagesDaily Market Update: US Remains Centre Stagepathanfor786No ratings yet

- About UsDocument44 pagesAbout UsdugdugdugdugiNo ratings yet

- High spinal anesthesia in total knee replacementDocument14 pagesHigh spinal anesthesia in total knee replacementRafael BagusNo ratings yet

- Lyones Combined Team FlyerDocument13 pagesLyones Combined Team FlyerTariq J FaridiNo ratings yet

- Effects of Sodium Concentration and Osmolality On Water and Electrolyte Absorption From The Intact Human ColonDocument12 pagesEffects of Sodium Concentration and Osmolality On Water and Electrolyte Absorption From The Intact Human ColonDannieCiambelliNo ratings yet

- Troubleshooting ISDN BRI Layer 1Document7 pagesTroubleshooting ISDN BRI Layer 1theajkumarNo ratings yet

- 12nov Attestation FormDocument10 pages12nov Attestation FormBubun GoutamNo ratings yet

- Traditional Affairs Bill, 2013Document0 pagesTraditional Affairs Bill, 2013Nqabisa MtwesiNo ratings yet

- Den 1698 RDocument5 pagesDen 1698 RAnton AnfalovNo ratings yet

- Main Street Renewal - AutoPay Setup Instructions in MSR Resident PortalDocument2 pagesMain Street Renewal - AutoPay Setup Instructions in MSR Resident PortalCarlos FdezNo ratings yet

- InfographicDocument1 pageInfographichzheng1No ratings yet

- Generate Regular Income with LIC MF Monthly Income PlanDocument4 pagesGenerate Regular Income with LIC MF Monthly Income PlanSaptha GiriNo ratings yet

- Icwsm CFPDocument3 pagesIcwsm CFPakshayjavaNo ratings yet

- Detailed NIT-Lime Package CDocument5 pagesDetailed NIT-Lime Package CKajal NayakNo ratings yet

- Circulation 1991 Bonow 1625 35Document12 pagesCirculation 1991 Bonow 1625 35Cristina AdamacheNo ratings yet

- My Fraud DetectionDocument20 pagesMy Fraud DetectionLakshmi GurramNo ratings yet

- Tapatio Springs Declaration of CovenantsDocument38 pagesTapatio Springs Declaration of CovenantsCraig JordanNo ratings yet

- PIL Case Digest - Subjects of International Law and Territory (Parts IV, V, VI)Document24 pagesPIL Case Digest - Subjects of International Law and Territory (Parts IV, V, VI)Apple LavarezNo ratings yet

- 1968-01-17 The Enterprise RomanDocument20 pages1968-01-17 The Enterprise RomanRomulus Historical NewspapersNo ratings yet

- Offline File Pushing To Mediation PDFDocument7 pagesOffline File Pushing To Mediation PDFBizura SarumaNo ratings yet

- Burlington EconomyDocument13 pagesBurlington EconomyChuck MorseNo ratings yet

- Establishment of Small Claims Courts For The Areas of WelkomDocument1 pageEstablishment of Small Claims Courts For The Areas of Welkombellydanceafrica9540No ratings yet

- Caffeine and Alcohol InteractionDocument8 pagesCaffeine and Alcohol Interactionwalter slowNo ratings yet

- Latest Amendments Central ExciseDocument95 pagesLatest Amendments Central ExcisevickycdNo ratings yet

- Jejunal and Ileal Calcium Absorption in Patients With Chronic Renal DiseaseDocument6 pagesJejunal and Ileal Calcium Absorption in Patients With Chronic Renal DiseaseDannieCiambelliNo ratings yet

- New Wipro Company ProjectDocument73 pagesNew Wipro Company ProjectsunilmamaNo ratings yet

- Internal Report on Financial and Market PerformanceDocument2 pagesInternal Report on Financial and Market PerformanceAkshay BhattNo ratings yet

- In The High Court of South Africa (Western Cape Division, Cape Town)Document14 pagesIn The High Court of South Africa (Western Cape Division, Cape Town)Owm Close CorporationNo ratings yet

- 7th C L Agrawal Moot Preposition 1Document4 pages7th C L Agrawal Moot Preposition 1Rio vijayNo ratings yet

- Variable On-Time Control of The Critical Mode Correction Improve Zero-Crossing DistortionDocument5 pagesVariable On-Time Control of The Critical Mode Correction Improve Zero-Crossing DistortionPrabhu VijayNo ratings yet

- THesis On Budgeting and Budgetary Control 5 PDFDocument35 pagesTHesis On Budgeting and Budgetary Control 5 PDFPavithra GowthamNo ratings yet

- Budgetory ControlDocument36 pagesBudgetory ControlAkash RsNo ratings yet

- Budget Imp..Document5 pagesBudget Imp..lavanya2401No ratings yet

- FMCGDocument77 pagesFMCGPrâtèék ShâhNo ratings yet

- Share MarketDocument31 pagesShare MarketPrâtèék ShâhNo ratings yet

- FMCGDocument53 pagesFMCGPrâtèék ShâhNo ratings yet

- FMCGDocument78 pagesFMCGPrâtèék ShâhNo ratings yet

- Budgeting and Budgetary ControlDocument44 pagesBudgeting and Budgetary ControlPrâtèék Shâh100% (1)

- Share MarketDocument92 pagesShare MarketPrâtèék ShâhNo ratings yet

- FMCGDocument76 pagesFMCGNupur SinghalNo ratings yet

- Stock Exchange: - InmantecDocument44 pagesStock Exchange: - InmantecSarita MohantyNo ratings yet

- Indian Share Market ReportDocument63 pagesIndian Share Market ReportSanket VaidyaNo ratings yet

- Share MarketDocument33 pagesShare MarketPrâtèék ShâhNo ratings yet

- Indian FMCG Industry, September 2012Document77 pagesIndian FMCG Industry, September 2012Arushi DobhalNo ratings yet

- Share MarketDocument25 pagesShare MarketPrâtèék ShâhNo ratings yet

- ManualDocument9 pagesManualteesmarkNo ratings yet

- Share MarketDocument83 pagesShare MarketKasak Punia100% (1)

- "General Awareness Regarding Stock Market in Jalandhar.": A Research Report OnDocument53 pages"General Awareness Regarding Stock Market in Jalandhar.": A Research Report OnKirandeep GhaiNo ratings yet

- Ac Know Leg DementDocument1 pageAc Know Leg DementPrâtèék ShâhNo ratings yet

- Personal FinanceDocument3 pagesPersonal FinancePrâtèék Shâh100% (1)

- Public FinanceDocument10 pagesPublic FinancePrâtèék ShâhNo ratings yet

- Personal FinanceDocument3 pagesPersonal FinancePrâtèék Shâh100% (1)

- Public FinanceDocument10 pagesPublic FinancePrâtèék ShâhNo ratings yet

- Income From Other Sources AY 2009-2010: Ca Vivek GoelDocument7 pagesIncome From Other Sources AY 2009-2010: Ca Vivek GoelPrâtèék ShâhNo ratings yet

- Income Tax PPT 120114083854 Phpapp01Document155 pagesIncome Tax PPT 120114083854 Phpapp01Prâtèék ShâhNo ratings yet

- Ac Know Leg DementDocument1 pageAc Know Leg DementPrâtèék ShâhNo ratings yet

- Power Point Presentation Tax AuditDocument37 pagesPower Point Presentation Tax AuditPrâtèék ShâhNo ratings yet

- Incomefromsourcesotherthansalary 131207134233 Phpapp01Document16 pagesIncomefromsourcesotherthansalary 131207134233 Phpapp01Prâtèék ShâhNo ratings yet

- Turbine Stress Evaluator: 17 February 2018 PMI Revision 00 1Document23 pagesTurbine Stress Evaluator: 17 February 2018 PMI Revision 00 1NILESHNo ratings yet

- Therapeutic Interventions in The Treatment of Dissociative DisordersDocument18 pagesTherapeutic Interventions in The Treatment of Dissociative DisordersCarla MesquitaNo ratings yet

- Benefits of HobbiesDocument6 pagesBenefits of HobbiesAdam YapNo ratings yet

- The Bondage of Sin Edward WelchDocument8 pagesThe Bondage of Sin Edward Welchandrés_torres_58No ratings yet

- Management of BurnDocument42 pagesManagement of BurnArisa KudidthalertNo ratings yet

- RescueLogicCutSheet Full Bleed 2 PDFDocument2 pagesRescueLogicCutSheet Full Bleed 2 PDFStevenNo ratings yet

- 3G3EV Installation ManualDocument55 pages3G3EV Installation ManualHajrudin SinanovićNo ratings yet

- Civil Engineering Final Year Projects Topic List - HTMLDocument4 pagesCivil Engineering Final Year Projects Topic List - HTMLJohn Meverick E EdralinNo ratings yet

- Foundations of Special and Inclusive EducationDocument24 pagesFoundations of Special and Inclusive EducationStephanie Garciano94% (53)

- Esea Elementary and Secondary Education Act Outline CampionDocument9 pagesEsea Elementary and Secondary Education Act Outline Campionapi-340155293No ratings yet

- Experi Men 22Document7 pagesExperi Men 22bernardNo ratings yet

- Fire Watch DutiesDocument2 pagesFire Watch DutiesNomsa Thando100% (1)

- Level I Questions Thermal and Infrared Testing Method: Southern Inspection ServicesDocument8 pagesLevel I Questions Thermal and Infrared Testing Method: Southern Inspection Servicesprabhakaran.SNo ratings yet

- NTS Test 02 (ANS REQ)Document6 pagesNTS Test 02 (ANS REQ)talal hussainNo ratings yet

- Event Details Report - Algoma SteelDocument66 pagesEvent Details Report - Algoma SteelThe NarwhalNo ratings yet

- PME4 KeyDocument2 pagesPME4 KeyyazicigaamzeNo ratings yet

- Disjointed.S01E03.720p.webrip.x264 STRiFE (Ettv) .SRTDocument32 pagesDisjointed.S01E03.720p.webrip.x264 STRiFE (Ettv) .SRTArthur CarvalhoNo ratings yet

- Test NovDocument4 pagesTest NovKatherine GonzálezNo ratings yet

- Assessment and Management of Patients With Biliary DisordersDocument33 pagesAssessment and Management of Patients With Biliary DisorderssarahkaydNo ratings yet

- Rock CycleDocument30 pagesRock CycleDenny PrawiraNo ratings yet

- LPT22Document3 pagesLPT22Leonardo Vinicio Olarte CarrilloNo ratings yet

- LDRRMPDocument39 pagesLDRRMPMarlon VillenaNo ratings yet

- Gregg Perkin QualificationsDocument10 pagesGregg Perkin QualificationsOSDocs2012No ratings yet

- Service Manual: For Hyundai Heavy Industries Co.,LtdDocument27 pagesService Manual: For Hyundai Heavy Industries Co.,LtdDmitry100% (1)

- November 2017 (v1) QP - Paper 4 CIE Chemistry IGCSEDocument16 pagesNovember 2017 (v1) QP - Paper 4 CIE Chemistry IGCSEGhulam Mehar Ali ShahNo ratings yet

- Bearing From Copper AlloyDocument7 pagesBearing From Copper AlloyPhung Tuan AnhNo ratings yet

- NeurobiologyDocument2 pagesNeurobiologyjulianaNo ratings yet

- Public Safety BriefingDocument23 pagesPublic Safety BriefingHNNNo ratings yet

- Signs and SymptomsDocument2 pagesSigns and SymptomsKristine GurimbaoNo ratings yet

- Mass XL Workout Plan by Guru Mann PDFDocument4 pagesMass XL Workout Plan by Guru Mann PDFSaptarshi BiswasNo ratings yet