Professional Documents

Culture Documents

HW01 2014S AccountingBasics BSvaluation

Uploaded by

Bethany WongCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HW01 2014S AccountingBasics BSvaluation

Uploaded by

Bethany WongCopyright:

Available Formats

Engineering E2261: Introduction to Accounting and Finance COLUMBIA UNIVERSITY, School of Engineering and Applied Science

Homework 1 Readings, Problems and Cases

1. Reading: Intro to Accounting, 1st ed (IA): Chapters 1 3.

2. Events impact on assets, liabilities and equity Provide an example of a transaction that creates the described effects for the separate cases a through e. a. b. c. d. e. Decreases an asset and decreases equity. Increases an asset and increases a liability. Decreases an asset and decreases a liability. Increases an asset and decreases an asset. (Consider two different assets). Increases an asset and increases equity.

3. Valuing Drilling Unlimited (DU) Drilling Unlimited (DU) specializes in exploring for, drilling for, and producing natural gas in the newly-rediscovered shale deposits of PA and NY. Review the following balance sheet for DU and note: GAAP rules for valuing natural gas reserves are considered inaccurate throughout the natural gas industry. Proved and Probable reserves, as estimated by a reliable engineering firm are the industy-standard measure for the amount of natural gas under a given piece of land. DU has sole development rights to 350 million (MM) cubic feet of reliablyestimated Proved and Probable natural gas in PA and NY. The rights could be sold today for at least $800MM. DUs Other Current Assets could be sold today for $400,000 and its Other Long-term Assets are worth $9,000,000.

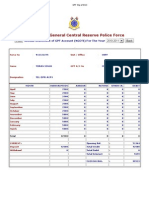

Balance Sheet (000 UON) Balance Sheet (000) UON FOR PERIOD ENDING For Period Ending: Assets Current Assets Cash And Cash Equivalents Net Receivables Other Current Assets Total Current Assets Oil Development Rights Other Long-term Assets Total Assets

DU DU 6/30/08 6/30/20XX

1,159 3,968 876 6,003 387,584 8,624 402,211

Liabilities Accounts Payable Long Term Debt Other Liabilities Total Liabilities Stockholders' Equity Liabilities + Equity

62,230 274,759 4,225 341,214 60,997 402,211

Find: a. An estimate for the value of DU, using the Balance-Sheet Valuation method. Show all work. (Hint; use the techniques shown in Intro to Accounting and Finance ClassBook, 3rd Ed (IAF) on pages Ch01-37 and Ch02-26). b. There is a 10% chance that PA and NY will forbid development of the fields for which DU has sole rights. (The technique for extracting gas from this geology is environmentally damaging). In this case, the market value of DUs equity would be zero. Using this knowledge and your answer to a) above, what is the weightedaverage value of DU? {The formula for weighted average is: (Probability of case 1 * case 1 value) + (Probability of case 2 * case 2 value)}.

4. Cost Concept and Transaction Table Entries a. Review the discussion of the Cost Concept presented in IA, 1 st ed, Chapter 3. Consider the truck example starting on page CH03-3. Assume for this problem that the truck is purchased for $20,000 at EOY 20X0, and has an estimated useful life of just four years. The trucks value declines linearly over the four year period. What would be the book value of the truck on a balance sheet prepared: i. EOY 20X2 ii. BOY 20X3

iii. iv.

5.0 years after purchase 3.5 years after purchase. (Hint: the value of assets that wear out declines continuously). Review the discussion of Transaction Tables in IA, 1st ed, Chapter 2. Create Transaction Table entries for i. and iv. above.

b.

5. Various Questions. Select the correct answer from the given choices. A. A building is offered for sale at $300K but is currently assessed at $200K. The purchaser of the building believes the building is worth $275K, but ultimately purchases the building for $250K. The purchaser records the building at: a. $50K b. $200,000 c. $250K d. $275,000 e. $300K B. If the assets of a company increase by $200,000 during the year and its liabilities increase by $35,000 during the same year, then the change in equity of the company during the year must have been: f. An increase of $235,000. g. A decrease of $235,000. h. A decrease of $165,000. i. An increase of $165,000. j. An increase of $200,000. C. LeveredCo. borrows $75K cash from SoonToFail S&L. How does this transaction affect the accounting equation for LeveredCo.? k. Assets increase by $75K; liabilities increase by $75K; no effect on equity. l. Assets increase by $75K; no effect on liabilities; equity increases by $75K. m. Assets increase by $75K; liabilities decrease by $75K; no effect on equity. n. No effect on assets; liabilities increase by $75K; equity increases by $75K. o. No effect on assets; liabilities increase by $75K; equity decreases by $75K. D. Geek Squad performs services for a customer and bills the customer for $500. How would Geek Squad record this transaction? p. q. r. s. Accounts receivable increase by $500; revenues increase by $500. Cash increases by $500; revenues increase by $500. Accounts receivable increase by $500; revenues decrease by $500. Accounts receivable increase by $500; accounts payable increase by $500.

t. Accounts payable increase by $500; revenues increase by $500.

6. Applications of the Fundamental Accounting Equation a. Cadence Office Supplies has assets equal to $123,000 and liabilities equal to $47,000 at year-end. What is the total equity for Cadence at year-end? b. At the beginning of the year, Addison Companys assets are $300,000 and its equity is $100,000. During the year, assets increase $80,000 and liabilities increase $50,000. What is the equity at the end of the year? c. At the beginning of the year, Quasar Companys liabilities equal $70,000. During the year, assets increase by $60,000, and at year-end assets equal $190,000. Liabilities decrease $5,000 during the year. What are the beginning and ending amounts of equity?

7. BreakToMeasure Testing Lab After several months of planning, Denise Murphy started a structural lab-test business for the civil engineering and construction industries called BreakToMeasure. The following events occurred during its first month: a. On May 1, Murphy started the firm, investing $3,000 cash and $15,000 of equipment. b. On May 2, BreakToMeasure paid $600 cash for furniture for the shop. c. On May 3, BreakToMeasure paid $500 cash to rent space in a strip mall for May. d. On May 4, it purchased $1,200 of equipment on credit for the shop (using a long-term note payable). e. On May 5, BreakToMeasure opened for business. Cash received from services provided in the first week and a half of business (ended May 15) is $825. f. On May 15, it provided $100 of lab-test services on account (invoiced). g. On May 17, it received a $100 check for services previously rendered on account. h. On May 17, it paid $125 cash to an assistant for working during the grand opening. i. Cash received from services provided during the second half of May is $930. j. On May 31, it paid a $400 installment toward principal on the note payable entered into on May 4. k. On May 31, it paid $900 cash dividends to Murphy. Find: Create a Transaction Table for the above events. You may wish to use some or all of the following accounts: Cash; Accounts Receivable; Furniture; Store Equipment; Note Payable; Paid in Capital; Dividends; Revenues; and Expenses.

ii. Prepare a balance sheet as of May 31.

You might also like

- Tai Lieu Ke Toan - Docx Khanh.Document20 pagesTai Lieu Ke Toan - Docx Khanh.copmuopNo ratings yet

- Wiley - Practice Exam 3 With SolutionsDocument15 pagesWiley - Practice Exam 3 With SolutionsIvan BliminseNo ratings yet

- Do Not Turn Over This Question Paper Until You Are Told To Do SoDocument17 pagesDo Not Turn Over This Question Paper Until You Are Told To Do SoMin HeoNo ratings yet

- Old Exam Packet - Acct 284 ExamsDocument25 pagesOld Exam Packet - Acct 284 ExamsHemu JainNo ratings yet

- QuizDocument13 pagesQuizErlyNo ratings yet

- Unit 1 Exam Review - Chapters 1-3Document5 pagesUnit 1 Exam Review - Chapters 1-3Jullian LimNo ratings yet

- PA Sample MCQs 2Document15 pagesPA Sample MCQs 2ANH PHẠM QUỲNHNo ratings yet

- ACC 577 Quiz Week 3Document12 pagesACC 577 Quiz Week 3Mary100% (2)

- Midterm Exam ReviewDocument12 pagesMidterm Exam ReviewAllison0% (1)

- PACE Sample ExamDocument13 pagesPACE Sample ExamjhouvanNo ratings yet

- ACCOUNTING COMPETENCY EXAM SAMPLEDocument12 pagesACCOUNTING COMPETENCY EXAM SAMPLEAmber AJNo ratings yet

- EY ENTRANCE TEST final-ACE THE FUTUREDocument18 pagesEY ENTRANCE TEST final-ACE THE FUTURETrà Hương100% (1)

- Financial Statements Types Presentation Limitations UsersDocument20 pagesFinancial Statements Types Presentation Limitations UsersGemma PalinaNo ratings yet

- Midterm 2022 - v1Document6 pagesMidterm 2022 - v1JF FNo ratings yet

- Midterm 2022 - v2Document6 pagesMidterm 2022 - v2JF FNo ratings yet

- Trắc nghiệmDocument8 pagesTrắc nghiệmHồ Đan Thục0% (1)

- Acc 112 MockDocument10 pagesAcc 112 Mockالسيد علي علوي السيد خليل إبراهيمNo ratings yet

- Accountancy TestDocument9 pagesAccountancy TestGaurav PitaliyaNo ratings yet

- Mgmt-E100 Spring 2010mtDocument7 pagesMgmt-E100 Spring 2010mtPetrônio LuísNo ratings yet

- Accounting Week 2Document3 pagesAccounting Week 2Erryn M. ParamythaNo ratings yet

- Financial and Managerial Accounting 11th Edition Warren Solutions ManualDocument10 pagesFinancial and Managerial Accounting 11th Edition Warren Solutions Manualcharlesdrakejth100% (13)

- 1Document21 pages1DrGeorge Saad AbdallaNo ratings yet

- Practice Final Exam ReviewDocument200 pagesPractice Final Exam ReviewChad Vincent B. BollosaNo ratings yet

- CH01Document41 pagesCH01ahmad_habibi_70% (1)

- Ch01 Ex AnswersDocument8 pagesCh01 Ex AnswersRana MahmoudNo ratings yet

- MAA716 - T2 - 2012 v2Document11 pagesMAA716 - T2 - 2012 v2ssusasi4769No ratings yet

- Accounting Exam Multiple Choice QuestionsDocument8 pagesAccounting Exam Multiple Choice QuestionsPrincess ArceNo ratings yet

- Practice Exam 1gdfgdfDocument49 pagesPractice Exam 1gdfgdfredearth2929100% (1)

- BUSI 353 Assignment #6 General Instructions For All AssignmentsDocument4 pagesBUSI 353 Assignment #6 General Instructions For All AssignmentsTan0% (1)

- Accouting ExamDocument7 pagesAccouting ExamThien PhuNo ratings yet

- Accounting AdvanceDocument9 pagesAccounting Advancedaryoon82No ratings yet

- 340 Exam 1 F 01Document7 pages340 Exam 1 F 01Din Rose GonzalesNo ratings yet

- Solutions Manual To Accompany Corporate Finance The Core 2nd Edition 9780132153683Document38 pagesSolutions Manual To Accompany Corporate Finance The Core 2nd Edition 9780132153683auntyprosperim1ru100% (14)

- Solutions Manual To Accompany Corporate Finance The Core 2nd Edition 9780132153683Document38 pagesSolutions Manual To Accompany Corporate Finance The Core 2nd Edition 9780132153683verawarnerq5cl100% (12)

- Multiple Choices and Exercises Chapter 2Document4 pagesMultiple Choices and Exercises Chapter 2Mi Đỗ Thị KhảNo ratings yet

- (123doc) - Tai-Lieu-Accounting-Principles-Mid-Semester-Test PDFDocument4 pages(123doc) - Tai-Lieu-Accounting-Principles-Mid-Semester-Test PDFTrung HậuNo ratings yet

- Financial Reporting Objectives and StandardsDocument10 pagesFinancial Reporting Objectives and StandardsYoshidaNo ratings yet

- Multiple ChoicesDocument5 pagesMultiple ChoicesAdlan AfnanNo ratings yet

- Individual and Group Assignment-Project Cost ManagementDocument4 pagesIndividual and Group Assignment-Project Cost ManagementYonas AbebeNo ratings yet

- Multiple Choices and Exercises - AccountingDocument33 pagesMultiple Choices and Exercises - Accountinghuong phạmNo ratings yet

- Singapore Institute of Management: University of London Preliminary Exam 2020Document20 pagesSingapore Institute of Management: University of London Preliminary Exam 2020Kəmalə AslanzadəNo ratings yet

- ACCA FA1 - 40-mark Practice TestDocument11 pagesACCA FA1 - 40-mark Practice TestAkash RadhakrishnanNo ratings yet

- ACCO 320 Midterm Exam ReviewDocument15 pagesACCO 320 Midterm Exam ReviewzzNo ratings yet

- Test Bank For Financial Statement Analysis and Valuation 2nd Edition by EastonDocument29 pagesTest Bank For Financial Statement Analysis and Valuation 2nd Edition by EastonRandyNo ratings yet

- Mid Advanced Acc. First09-10Document4 pagesMid Advanced Acc. First09-10Carl Adrian ValdezNo ratings yet

- MCQ For Practise (Pre-Mids Topics) PDFDocument6 pagesMCQ For Practise (Pre-Mids Topics) PDFAliNo ratings yet

- SOLUTION Midterm Exam Winter 2016 PDFDocument13 pagesSOLUTION Midterm Exam Winter 2016 PDFhfjffjNo ratings yet

- Sample Midterm Exam I Professor Sarath: FALL 2019Document7 pagesSample Midterm Exam I Professor Sarath: FALL 2019Raushan ZhabaginaNo ratings yet

- Final Trial Exam k6 Sbs Final PaDocument32 pagesFinal Trial Exam k6 Sbs Final PaChi PhanNo ratings yet

- Dwnload Full Corporate Finance The Core 4th Edition Berk Solutions Manual PDFDocument36 pagesDwnload Full Corporate Finance The Core 4th Edition Berk Solutions Manual PDFdesidapawangl100% (15)

- Fo A I Assignment1Document2 pagesFo A I Assignment1solomon tadeseNo ratings yet

- FSA-Tutorial 1-Fall 2022Document4 pagesFSA-Tutorial 1-Fall 2022chtiouirayyenNo ratings yet

- Practice Quiz 02 ACTG240 Q2202021Document9 pagesPractice Quiz 02 ACTG240 Q2202021Minh DeanNo ratings yet

- Soal Ujian Akhir: Intermediate Financial Management Kelas: Magister Ilmu Management /feb Usu 1Document4 pagesSoal Ujian Akhir: Intermediate Financial Management Kelas: Magister Ilmu Management /feb Usu 1ninaNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Annual GPF Statement for NGO TORA N SINGHDocument1 pageAnnual GPF Statement for NGO TORA N SINGHNishan Singh Cheema56% (9)

- Organized Crime in Central America The Northern Triangle, Report On The Americas #29 DRAFTDocument125 pagesOrganized Crime in Central America The Northern Triangle, Report On The Americas #29 DRAFTLa GringaNo ratings yet

- Dyesebel 3Document7 pagesDyesebel 3Leachez Bbdear BarbaNo ratings yet

- United Nations Industrial Development Organization (Unido)Document11 pagesUnited Nations Industrial Development Organization (Unido)Ayesha RaoNo ratings yet

- New Jersey V Tlo Research PaperDocument8 pagesNew Jersey V Tlo Research Paperfvg7vpte100% (1)

- Lecture Law On Negotiable InstrumentDocument27 pagesLecture Law On Negotiable InstrumentDarryl Pagpagitan100% (3)

- Bob Marley - SunumDocument5 pagesBob Marley - SunumNaz SakinciNo ratings yet

- DDT Use Raises Ethical IssuesDocument15 pagesDDT Use Raises Ethical IssuesNajihah JaffarNo ratings yet

- Datura in VajramahabhairavaDocument6 pagesDatura in VajramahabhairavaНандзед ДорджеNo ratings yet

- UntitledDocument1,422 pagesUntitledKarinNo ratings yet

- James Tucker - Teaching Resume 1Document3 pagesJames Tucker - Teaching Resume 1api-723079887No ratings yet

- 0025 Voters - List. Bay, Laguna - Brgy Calo - Precint.0051bDocument3 pages0025 Voters - List. Bay, Laguna - Brgy Calo - Precint.0051bIwai MotoNo ratings yet

- Product BrochureDocument18 pagesProduct Brochureopenid_Po9O0o44No ratings yet

- Pinagsanhan Elementary School Kindergarten AwardsDocument5 pagesPinagsanhan Elementary School Kindergarten AwardsFran GonzalesNo ratings yet

- EH2741 HT16 Lecture 5 PDFDocument25 pagesEH2741 HT16 Lecture 5 PDFNiels Romanovich RomanovNo ratings yet

- PMLS Professional Organization ActivityDocument4 pagesPMLS Professional Organization ActivityHershei Vonne Baccay100% (1)

- The Seven ValleysDocument17 pagesThe Seven ValleyswarnerNo ratings yet

- Political Science Assignment Sem v-1Document4 pagesPolitical Science Assignment Sem v-1Aayush SinhaNo ratings yet

- Math FINALDocument16 pagesMath FINALCecille IdjaoNo ratings yet

- Find Offshore JobsDocument2 pagesFind Offshore JobsWidianto Eka PramanaNo ratings yet

- HSS S6a LatestDocument182 pagesHSS S6a Latestkk lNo ratings yet

- TestbankDocument11 pagesTestbankA. MagnoNo ratings yet

- PSR-037: Comprehensive Review and Assessment of RA 9136 or The Electric Power Industry Reform Act of 2001Document2 pagesPSR-037: Comprehensive Review and Assessment of RA 9136 or The Electric Power Industry Reform Act of 2001Ralph RectoNo ratings yet

- Intestate of Luther Young v. Dr. Jose BucoyDocument2 pagesIntestate of Luther Young v. Dr. Jose BucoybearzhugNo ratings yet

- Complete Spanish Grammar 0071763430 Unit 12Document8 pagesComplete Spanish Grammar 0071763430 Unit 12Rafif Aufa NandaNo ratings yet

- I I I I I I I: Quipwerx Support Request FormDocument2 pagesI I I I I I I: Quipwerx Support Request Form08. Ngọ Thị Hồng DuyênNo ratings yet

- Looc Elementary School Accomplishment Report on DRRM and Child ProtectionDocument2 pagesLooc Elementary School Accomplishment Report on DRRM and Child ProtectionKASANDRA LEE ESTRELLA100% (1)

- P&WC S.B. No. A1427R3Document16 pagesP&WC S.B. No. A1427R3Elmer Villegas100% (1)

- Backflush Costing, Kaizen Costing, and Strategic CostingDocument9 pagesBackflush Costing, Kaizen Costing, and Strategic CostingShofiqNo ratings yet

- Research TitleDocument5 pagesResearch TitleAthena HasinNo ratings yet