Professional Documents

Culture Documents

1601-C 2

Uploaded by

sodapecuteCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1601-C 2

Uploaded by

sodapecuteCopyright:

Available Formats

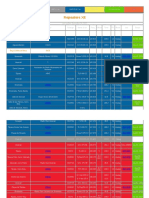

(To be filled up by the BIR)

DLN: Republika ng Pilipinas Kagawaran ng Pananalapi

PSOC:

PSIC: BIR Form No.

Kawanihan ng Rentas Internas

Monthly Remittance Return of Income Taxes Withheld on Compensation

1601-C

September 2001 (ENCS)

Fill in all applicable spaces. Mark all appropriate boxes with an X. For the Month 2 Amended Return? 3 No. of Sheets Attached 4 Any Taxes Withheld? (MM / YYYY) 09 2012 00 Yes X No Yes X No Part I Background Information 5 TIN 6 RDO Code 7 Line of Business/ 007 786 180 000 015 Agri/Const. Supplies Occupation 9 Telephone Number 8 Withholding Agent's Name (Last Name, First Name, Middle Name for Individuals)/(Registered Name for Non-Individuals) 1

CORDON PRIME'S TRADING CORPORATION

10 Registered Address

(078)694-9010

11 Zip Code

LAUREL,CORDON, ISABELA

12 Category of Withholding Agent 13 Are there payees availing of tax relief under Special law or International Tax Treaty? X Private Government No If yes, specify Yes Part II Computation of Tax Particulars Amount of Compensation 15 70,626.00 15 Total Amount of Compensation 16 24,918.00 Less: Non Taxable Compensation 16 17 45,708.00 17 Taxable Compensation 18 18 Tax Required to be Withheld 19 19 Add/Less: Adjustment (from Item 25 of Section A) 20 20 Tax Required to be Withheld for Remittance 21 21 Less: Tax Remitted in Return Previously Filed, if this is an amended return 22 22 Tax Still Due/(Overremittance) Add: Penalties 23 Surcharge 23A 23B Interest 23C Compromise 23D 14 A T C

3312

WW 0 1 0 Tax Due

2,362.48

24 24 Total Amount Still Due/(Overremittance) Section A Adjustment of Taxes Withheld on Compensation For Previous Months Previous Month(s) Date Paid Bank Validation/ (1) (2) ROR No. (MM/YYYY) (MM/DD/YYYY) (3)

2,362.48

Bank Code (4)

Section A (continuation) Tax Paid (Excluding Penalties) for the Month (5)

Should Be Tax Due for the Month (6)

From Current Year (7a)

Adjustment (7) From Year - End Adjustment of the Immediately Preceeding Year (7b)

25 Total (7a plus 7b) (To Item 19) I declare, under the penalties of perjury, that this return has been made in good faith, verified by me, and to the best of my knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. 26 Signature over Printed Name of Taxpayer/ Taxpayer Authorized Representative T I N of Tax Agent (if applicable) Part III Particulars 28 Cash/Bank Debit Memo 29 Check 29A 30 Others 30A Drawee Bank/ Agency Details of Payment Date Number MM DD YYYY

28 29B 30B 29C 30C 29D 30D

27 Title/Position of Signatory

Tax Agent Accreditation No.(if applicable) Stamp of Receiving Office and Date of Receipt

Amount

Machine Validation/Revenue Official Receipt Details (If not filed with the bank)

(ENCS)

Republika ng Pilipinas Ka gawaran ng Pananalapi

Kawanihan ng Rentas Internas

Monthly Remittance Return of Income Taxes Withheld

0 1 0

ent of the

ge and belief, rity thereof.

nce Return s Withheld

BIR Form No.

1601

July 1999 (ENCS)

You might also like

- 2Document2 pages2sodapecuteNo ratings yet

- GMA Network Inc. vs. Movie and Television Review and Classification Board G.R. No. 148579 February 5, 2007 Corona, J.Document1 pageGMA Network Inc. vs. Movie and Television Review and Classification Board G.R. No. 148579 February 5, 2007 Corona, J.sodapecuteNo ratings yet

- 02 April 1Document3 pages02 April 1sodapecuteNo ratings yet

- CruzDocument4 pagesCruzsodapecuteNo ratings yet

- Department of Agrarian ReformDocument4 pagesDepartment of Agrarian ReformsodapecuteNo ratings yet

- Board of Trustees VDocument1 pageBoard of Trustees VsodapecuteNo ratings yet

- Romualdez vs. CSCDocument2 pagesRomualdez vs. CSCsodapecuteNo ratings yet

- 10Document1 page10sodapecuteNo ratings yet

- 2 - Bito-Onon vs. FernandezDocument1 page2 - Bito-Onon vs. FernandezsodapecuteNo ratings yet

- 1Document1 page1sodapecuteNo ratings yet

- 9Document1 page9sodapecuteNo ratings yet

- 20Document1 page20sodapecuteNo ratings yet

- Central Bank Cannot Retroactively Impose Penalty on Past Due LoansDocument2 pagesCentral Bank Cannot Retroactively Impose Penalty on Past Due LoansMczoC.Mczo100% (1)

- 4Document1 page4sodapecuteNo ratings yet

- 17Document1 page17sodapecuteNo ratings yet

- 7Document1 page7sodapecuteNo ratings yet

- 18Document1 page18sodapecuteNo ratings yet

- 11Document1 page11sodapecuteNo ratings yet

- CarlosDocument4 pagesCarlossodapecuteNo ratings yet

- 11Document1 page11sodapecuteNo ratings yet

- 9Document3 pages9sodapecuteNo ratings yet

- Malaga PrintDocument3 pagesMalaga PrintsodapecuteNo ratings yet

- MalagaDocument9 pagesMalagasodapecuteNo ratings yet

- 8Document1 page8sodapecuteNo ratings yet

- There Was No Need For CBC and CBC-PCCI To Exhaust All Available Administrative RemediesDocument2 pagesThere Was No Need For CBC and CBC-PCCI To Exhaust All Available Administrative RemediessodapecuteNo ratings yet

- Leyson PrintDocument2 pagesLeyson PrintsodapecuteNo ratings yet

- De La LlanaDocument73 pagesDe La LlanasodapecuteNo ratings yet

- Executive Order No 2Document2 pagesExecutive Order No 2sodapecuteNo ratings yet

- PPA Employee Disputes DOTC AAB JurisdictionDocument2 pagesPPA Employee Disputes DOTC AAB JurisdictionsodapecuteNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Yale Film Analysis WebsiteDocument5 pagesYale Film Analysis WebsiteizmcnortonNo ratings yet

- 100 Inspirational Quotes On LearningDocument9 pages100 Inspirational Quotes On LearningGlenn VillegasNo ratings yet

- G.R. No. 190583 - People vs FrontrerasDocument12 pagesG.R. No. 190583 - People vs FrontrerasKaren Faye TorrecampoNo ratings yet

- The Sociopath's MantraDocument2 pagesThe Sociopath's MantraStrategic ThinkerNo ratings yet

- The Dynamic Law of ProsperityDocument1 pageThe Dynamic Law of Prosperitypapayasmin75% (4)

- Whole Brain Lesson Plan: 3 QuarterDocument5 pagesWhole Brain Lesson Plan: 3 QuarterNieve Marie Cerezo100% (1)

- QuizInfo8 6 10Document373 pagesQuizInfo8 6 10Gill BeroberoNo ratings yet

- Repeaters XE PDFDocument12 pagesRepeaters XE PDFenzzo molinariNo ratings yet

- TNT Construction PLC - Tender 3Document42 pagesTNT Construction PLC - Tender 3berekajimma100% (1)

- 11th House of IncomeDocument9 pages11th House of IncomePrashanth Rai0% (1)

- Rizal's First Return Home to the PhilippinesDocument52 pagesRizal's First Return Home to the PhilippinesMaria Mikaela MarcelinoNo ratings yet

- Economics of Money Banking and Financial Markets 12th Edition Mishkin Solutions ManualDocument3 pagesEconomics of Money Banking and Financial Markets 12th Edition Mishkin Solutions Manualalexanderyanggftesimjac100% (15)

- Budget Planner Floral Style-A5Document17 pagesBudget Planner Floral Style-A5Santi WidyaninggarNo ratings yet

- Effect of Disinfectants On Highly Pathogenic Avian in Uenza Virus (H5N1) in Lab and Poultry FarmsDocument7 pagesEffect of Disinfectants On Highly Pathogenic Avian in Uenza Virus (H5N1) in Lab and Poultry FarmsBalvant SinghNo ratings yet

- Tentative Quotation For Corporate Video (5 Minutes)Document2 pagesTentative Quotation For Corporate Video (5 Minutes)Lekha JauhariNo ratings yet

- Hamodia Parsonage ArticleDocument2 pagesHamodia Parsonage ArticleJudah KupferNo ratings yet

- All India Ticket Restaurant Meal Vouchers DirectoryDocument1,389 pagesAll India Ticket Restaurant Meal Vouchers DirectoryShauvik HaldarNo ratings yet

- Philippines Disaster Response PlanDocument7 pagesPhilippines Disaster Response PlanJoselle RuizNo ratings yet

- Schneider Electric Strategy PresentationDocument10 pagesSchneider Electric Strategy PresentationDeepie KaurNo ratings yet

- Csd88584Q5Dc 40-V Half-Bridge Nexfet Power Block: 1 Features 3 DescriptionDocument26 pagesCsd88584Q5Dc 40-V Half-Bridge Nexfet Power Block: 1 Features 3 DescriptionJ. Carlos RGNo ratings yet

- F. nucleatum L-cysteine Desulfhydrase GeneDocument6 pagesF. nucleatum L-cysteine Desulfhydrase GeneatikramadhaniNo ratings yet

- OPGWDocument18 pagesOPGWGuilhermeNo ratings yet

- STSDSD QuestionDocument12 pagesSTSDSD QuestionAakash DasNo ratings yet

- IFM Goodweek Tires, Inc.Document2 pagesIFM Goodweek Tires, Inc.Desalegn Baramo GENo ratings yet

- David Emmett & Graeme Nice - What You Need To Know About Cannabis - Understanding The FactsDocument120 pagesDavid Emmett & Graeme Nice - What You Need To Know About Cannabis - Understanding The FactsJovana StojkovićNo ratings yet

- Laporan Keuangan Tahun 2018Document264 pagesLaporan Keuangan Tahun 2018Weni PatandukNo ratings yet

- Margiela Brandzine Mod 01Document37 pagesMargiela Brandzine Mod 01Charlie PrattNo ratings yet

- Sweet Emotion: Bass Line ForDocument2 pagesSweet Emotion: Bass Line ForJames Gale100% (1)

- Leases 2Document3 pagesLeases 2John Patrick Lazaro Andres100% (1)

- City of Manila vs. Hon CaridadDocument2 pagesCity of Manila vs. Hon CaridadkelbingeNo ratings yet