Professional Documents

Culture Documents

MM Certification Questions

Uploaded by

vinoakhilCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MM Certification Questions

Uploaded by

vinoakhilCopyright:

Available Formats

http://saponlineinfo.blogspot.in/2013/07/sample-sap-mm-answers-for-certification.

html

Sample SAP MM Answers for Certification (Set.1)

1. What are the ways in which invoice postings are possible?

a. Manual posting b. Automatically through electronic transfer c. Evaluated receipt settlement d. Invoicing plan e. Consignment settlement 2. From where can the terms of payment be an input for invoice verification? a. User entry b. Purchase order c. Purchase order history d. Vendor master e. Material master 3. Which of the following does the system copy from the purchase order during invoice verification entry? a. Purchase order number b. Tax amount c. Currency d. Vendor e. Bank information 4. What is the process of invoice verification? a. Purchase order, service or GR referenced for incoming invoice. b. Invoice items suggested by the system against referenced document c. Corresponding automatic account postings carried out. d. Payment proposal list for vendor generated. 5. What happens when an invoice is posted? a. Material master always updated. b. Purchase order history updated c. Individual line items posted to appropriate accounts d. MM invoice document created if necessary. e. FI document always created. 6. What purpose does invoice verification serve in materials management? a. It allows invoice that do not originate in materials procurement to be processed.

b. Completes the materials procurement process c. Handles the payment d. Allows credit memos to be processed e. Handles the analyses of invoices. 7. There is a stock of 60 pc of a material having a standard price of Rs.9. A purchase order has been raised on the vendor for 40 pieces at Rs. 11 per pc. The material was received and invoice verified. What would the accounting entries show for this movement after IV? a. Stock account Rs. 360+, vendor account Rs. 360b. Stock account Rs. 440+, vendor account Rs. 440c. Stock account Rs. 440+, vendor account Rs. 360d. Stock account Rs. 360+, vendor account Rs. 440e. Stock account Rs. 0, vendor account Rs. 808. What happens to accounting entries when an invoice is posted? a. GR/IR account debited, vendor account credited b. GR/IR account credited, vendor account debited 9. From where does the system pick the default quantity of an item when you post invoice receipt? a. Invoice b. Purchase order c. Purchase order history d. System settings e. Vendor master 10. During invoice verification the system picks the rate at which tax is calculated from the vendor master record. a. True b. False 11. What are the tasks of invoice verification? a. Entering invoices and credit memos received. b. Checking the accuracy of invoices c. Executing the account posting resulting from invoice d. Updating open items and material prices e. Checking invoices that were blocked. 12. An invoice can refer to various objects.

a. True b. False

Sample SAP MM Questions for Certification (Set.2)

1. In which kind of posting method in IV is the cash discount amount not credited to the stock or cost account? a. Gross Posting b. Net posting 2. What controls the posting of invoice as gross or net? a. Item category b. Document type 3. How can postings be done in invoice verification for a purchase order in foreign currency? a. Fixed exchange rate at GR and IV. b. Current exchange rate at GR and IV c. Current exchange rate cannot be changed at IV. d. Exchange rate differences can occur e. Exchange rate difference postings are Customization based. 4. How is the quantity that has already been invoiced valuated at goods receipt if the invoice is posted before goods receipt and the subsequent GR quantity is greater than the invoice quantity? a. At purchase order price b. At invoice price 5. During the check of invoices with which of the following variances does the system perform Date variance? a. Quantity Variance b. Price variance c. Purchase order price quantity variance 6. There is a purchase order for 100 pieces at Rs. 0.80. The 100 pieces are received. An invoice is received for 100 pieces at Rs 0.75 per piece. However at the time of receipt of invoice the stock of the material is only 30.What are the effects of the above at invoice verification?

a. Stock account is 5b. Stock account is 1.5c. Stock account is 3.5d. Price difference account is 3.5e. Price difference account is 1.57. Under what situation does the system compares the ratio of PO quantity(in PO price units) / PO quantity (in PO units), invoice quantity (in PO price units / invoice quantity (in PO units)? a. Goods receipt before invoice receipt b. Invoice receipt before goods receipt. 8. The initial Stock of a material is 200 pieces. There is a purchase order for 100 pieces at Rs. 0.75. The 100 pieces are received. An invoice is received for 100 pieces at Rs 0.80 per piece. What are the effects of the above at invoice verification? a. If the material is valuated at a standard price of Rs 1, the stock account will be 5+. b. If the material is valuated at a moving average price of Rs 1, the stock account will be 5+. c. If the material is valuated at a moving average price of Rs 1, the material master record reflects the moving average price at Rs 0.92. d. If the material is valuated at a standard price of Rs 1, the price difference expense account will be 5+. e. If the material is valuated at a standard price of Rs 1, the stock price difference income account will be 5+. 9. The greater the invoice value, the lower the tolerated quantity variance. a. True b. False 10. How is the quantity valuated at IV for the materials received if the invoice quantity is greater than the GR quantity? a. At purchase order price b. At invoice price 11. What happens if an invoice item exceeds the set tolerance limit for amount check? a. The item is blocked for payment

b. The entire invoice is blocked for payment c. The item is given blocking reason 12. Based on what does the system check the value for a schedule variance? a. Purchase Order Price b. Invoice Price c. Invoice value d. Quantity variance e. Days variance

Sample SAP MM Questions for Certification (Set.2) Answers

1. In which kind of posting method in IV is the cash discount amount not credited to the stock or cost account? a. Gross Posting b. Net posting 2. What controls the posting of invoice as gross or net? a. Item category b. Document type 3. How can postings be done in invoice verification for a purchase order in foreign currency? a. Fixed exchange rate at GR and IV. b. Current exchange rate at GR and IV c. Current exchange rate cannot be changed at IV. d. Exchange rate differences can occur e. Exchange rate difference postings are Customization based. 4. How is the quantity that has already been invoiced valuated at goods receipt if the invoice is posted before goods receipt and the subsequent GR quantity is greater than the invoice quantity? a. At purchase order price b. At invoice price 5. During the check of invoices with which of the following variances does the system perform Date variance? a. Quantity Variance b. Price variance c. Purchase order price quantity variance

6. There is a purchase order for 100 pieces at Rs. 0.80. The 100 pieces are received. An invoice is received for 100 pieces at Rs 0.75 per piece. However at the time of receipt of invoice the stock of the material is only 30.What are the effects of the above at invoice verification? a. Stock account is 5b. Stock account is 1.5c. Stock account is 3.5d. Price difference account is 3.5e. Price difference account is 1.57. Under what situation does the system compares the ratio of PO quantity(in PO price units) / PO quantity (in PO units), invoice quantity (in PO price units / invoice quantity (in PO units)? a. Goods receipt before invoice receipt b. Invoice receipt before goods receipt. 8. The initial Stock of a material is 200 pieces. There is a purchase order for 100 pieces at Rs. 0.75. The 100 pieces are received. An invoice is received for 100 pieces at Rs 0.80 per piece. What are the effects of the above at invoice verification? a. If the material is valuated at a standard price of Rs 1, the stock account will be 5+. b. If the material is valuated at a moving average price of Rs 1, the stock account will be 5+. c. If the material is valuated at a moving average price of Rs 1, the material master record reflects the moving average price at Rs 0.92. d. If the material is valuated at a standard price of Rs 1, the price difference expense account will be 5+. e. If the material is valuated at a standard price of Rs 1, the stock price difference income account will be 5+.

9. The greater the invoice value, the lower the tolerated quantity variance. a. True b. False 10. How is the quantity valuated at IV for the materials received if the invoice quantity is greater than the GR quantity? a. At purchase order price

b. At invoice price 11. What happens if an invoice item exceeds the set tolerance limit for amount check? a. The item is blocked for payment b. The entire invoice is blocked for payment c. The item is given blocking reason 12. Based on what does the system check the value for a schedule variance? a. Purchase Order Price b. Invoice Price c. Invoice value d. Quantity variance e. Days variance

SAP MM Sample Questions for Certification (Set.3) Answers

1. What does the system do when you perform the function Reducing Invoices? a. Reduce an invoice b. Post invoice for the actual quantities and values c. Post a credit memo for the amount reduced d. Post a debit memo for the amount reduced e. Facilitate generation of a letter of complaint to the vendor. 2. A vendor is issued a purchase order for 200 pieces at 10 UNI/pc and 10% tax. There was a goods receipt of 140 Pieces. The vendor sends an invoice for 200 pieces at 12 UNI/pc. The Purchase manager decides on a partial reduction with quantity variance. What will be accounting entries for the invoice and credit memo? a. Stock account in the invoice document is 300+ b. Stock account does not get affected. c. Input tax in credit memo is 60d. Vendor account in the credit memo is 660+ e. Vendor account in the credit memo is 440+ 3. What can be the possible entries the system can make during invoice verification if a valuated good receipt is defined for a purchase order with account assignment and there is a price variance? a. Debit consumption

b. Credit consumption c. Debit GR/IR d. Credit GR/IR e. Credit Vendor 4. Which costs are entered at item level in the purchase order? a. Planned delivery costs b. Unplanned delivery costs 5. In Total Based acceptance what validations can the system do before deciding that the balance is too large for the invoice to be posted? a. First checks whether the variance falls within the defined invoice reduction limit. b. First checks whether the variance falls within the small difference. c. If the difference is greater than the small difference it checks whether the variance falls within the defined invoice reduction limit. d. If the positive difference is greater than the small difference it checks whether the variance falls within the defined invoice reduction limit. e. If the invoice reduction limits are set to do not check, the system compares the variance with the acceptance limit. 6. When does the system propose current account assignment? a. Goods receipt b. Invoice Verification 7. A purchase order has been issued on a vendor for two materials. 150 units of material A has been ordered at 4 UNI/pc. 20 units of material B has been ordered at 45 UNI/pc. The vendor has supplied all the materials. The invoice for the supply has been received and posted. He now sends an invoice that includes 875 UNI as freight charges and 125 UNI as custom duty that was not planned. The system has been configured to distribute delivery costs amongst items. How will the cost be apportioned when the invoice is posted? a. Stock account for Material A 380 +, Stock account for Material B 570 + b. Stock account for Material A 500 +, Stock account for Material B 450 + c. Freight clearing 875+ d. Custom clearing 125 +

8. In customizing for invoice verification how can you configure unplanned delivery costs?

a. Distribute among the items b. Post to separate G/L account 9. In which method does the unplanned delivery cost appear in the purchase order history? a. When distributed among items b. When posted to separate G/L accounts 10. What are the features of subsequent debit/credit? a. Changes total invoice value of a PO item. b. Changes total invoice quantity. c. Entries can be made only if an invoice has already been posted for the item d. Refers to a specific invoice. e. Flagged in the Purchase order history 11. Mentioned below are the details for a purchase order:Purchase order: 50 pcs at 2.00 UNI/pcGoodsreceipt: noneInvoice: 50 pcs at 2.00 UNI/pcSubsequent Invoice: 50 pcs = 20.00UNIWhat will be accounting entries when you post the invoice and make the subsequent debit/credit? a. Invoice: Vendor Account 100b. Invoice: GR/IR account 100+ c. Subsequent debit/credit: Stock account: 20+ d. Subsequent debit credit: GR/IR account 20+ e. Subsequent debit/credit: Vendor account 2012. When you post invoice items without reference to purchase orders on which tab page will you enter the currency? a. G/L account b. Material c. Basic Data d. Payment e. Detail

You might also like

- SAP PR Release Strategy Concept and Configuration Guide: A Case StudyFrom EverandSAP PR Release Strategy Concept and Configuration Guide: A Case StudyRating: 4 out of 5 stars4/5 (6)

- Sap MM Interview QuestionaireDocument34 pagesSap MM Interview QuestionaireGadigota Suresh ReddyNo ratings yet

- SAP Variant Configuration: Your Successful Guide to ModelingFrom EverandSAP Variant Configuration: Your Successful Guide to ModelingRating: 5 out of 5 stars5/5 (2)

- SAP MM Configuration and Examples PDFDocument213 pagesSAP MM Configuration and Examples PDFReivel Hernández100% (3)

- Implementing SAP S/4HANA: A Framework for Planning and Executing SAP S/4HANA ProjectsFrom EverandImplementing SAP S/4HANA: A Framework for Planning and Executing SAP S/4HANA ProjectsNo ratings yet

- Briefing Note: "2011 - 2014 Budget and Taxpayer Savings"Document6 pagesBriefing Note: "2011 - 2014 Budget and Taxpayer Savings"Jonathan Goldsbie100% (1)

- Airline Leader - Issue 15Document91 pagesAirline Leader - Issue 15capanaoNo ratings yet

- SAPCOOKBOOK Training Tutorials: SAP MM Inventory ManagementFrom EverandSAPCOOKBOOK Training Tutorials: SAP MM Inventory ManagementRating: 4 out of 5 stars4/5 (13)

- MM ConfigurationDocument50 pagesMM Configurationgsamsr100% (3)

- Movement Types in SAP-MMDocument32 pagesMovement Types in SAP-MMSam6530100% (14)

- Sap MMDocument19 pagesSap MMnbhaskar bhaskarNo ratings yet

- SAP IS-Retail Interview Questions, Answers, and ExplanationsFrom EverandSAP IS-Retail Interview Questions, Answers, and ExplanationsRating: 3 out of 5 stars3/5 (11)

- Types of special stocks and MRP procedures in SAPDocument12 pagesTypes of special stocks and MRP procedures in SAPkhaniqlNo ratings yet

- SAP MM Interview Questions and Answers For ExperiencedDocument24 pagesSAP MM Interview Questions and Answers For ExperiencedReji George100% (1)

- SAP Tools Methodologies and Techniques: Methodologies and TechniquesFrom EverandSAP Tools Methodologies and Techniques: Methodologies and TechniquesNo ratings yet

- Top 21 SAP MM Interview QuestionsDocument9 pagesTop 21 SAP MM Interview QuestionsVishnu Kumar SNo ratings yet

- SAP MM RealTime Problems Solutions Part1 PDFDocument53 pagesSAP MM RealTime Problems Solutions Part1 PDFRoshan Singh100% (1)

- Cracking the SAP S/4HANA Interview: Get Your Dream Job Today with Intelligent Responses to the EmployerFrom EverandCracking the SAP S/4HANA Interview: Get Your Dream Job Today with Intelligent Responses to the EmployerNo ratings yet

- SAP MM - Inventory ManagementDocument19 pagesSAP MM - Inventory ManagementIris Lim100% (1)

- SAP Enterprise Structure Concept and Configuration Guide: A Case StudyFrom EverandSAP Enterprise Structure Concept and Configuration Guide: A Case StudyRating: 5 out of 5 stars5/5 (3)

- 01 - Real Time Support Issues - 20.04.2019Document42 pages01 - Real Time Support Issues - 20.04.2019sachin100% (1)

- SAP Service Management: Advanced ConfigurationFrom EverandSAP Service Management: Advanced ConfigurationRating: 4.5 out of 5 stars4.5/5 (3)

- QM Quality Management Overview FunctionsDocument16 pagesQM Quality Management Overview Functionsrvk386No ratings yet

- Sap End User Shyamadas Pati Sample ResumeDocument4 pagesSap End User Shyamadas Pati Sample ResumeBijay Agarwal100% (1)

- Sap MM Config TutorialDocument78 pagesSap MM Config TutorialSAYANDEEP MITRA50% (2)

- SAP MM Real Time Interview QuestionsDocument84 pagesSAP MM Real Time Interview QuestionsSambit Mohanty100% (4)

- SAP MM Questions and AnswersDocument32 pagesSAP MM Questions and AnswersMohan Ganganala100% (7)

- Common SAP MM Functional IssueDocument4 pagesCommon SAP MM Functional IssueSahil JadhavNo ratings yet

- C TSCM52 67 Sample QuestionsDocument5 pagesC TSCM52 67 Sample QuestionsmarishaNo ratings yet

- Managing in Global EnvironmentDocument21 pagesManaging in Global EnvironmentShelvy SilviaNo ratings yet

- Sap MM Interview QuestionsDocument5 pagesSap MM Interview QuestionsAntony HegdeNo ratings yet

- SAP PP Interview Questions, Answers, and ExplanationsDocument145 pagesSAP PP Interview Questions, Answers, and Explanationscvcgvgdf100% (9)

- SAP MM Interview Questions and AnswersDocument2 pagesSAP MM Interview Questions and Answersatoztarget71% (7)

- The Up & Away Advisors’ Guide to Implementing and Executing Sap’s Vehicle Management SystemFrom EverandThe Up & Away Advisors’ Guide to Implementing and Executing Sap’s Vehicle Management SystemNo ratings yet

- Value Help Web Dynpro TutorialDocument6 pagesValue Help Web Dynpro TutorialManoj GoyalNo ratings yet

- Stock Transfer Plant To PlantDocument36 pagesStock Transfer Plant To Plantbalu4indians100% (1)

- 100 TOP L&T Infotech SAP MM Interview Questions 2017Document13 pages100 TOP L&T Infotech SAP MM Interview Questions 2017sidharth kumarNo ratings yet

- SAP MM Material Management Training TutorialsDocument3 pagesSAP MM Material Management Training TutorialsRahul100% (1)

- How to Pass SAP MM: Study Guides, Questions & AnswersDocument13 pagesHow to Pass SAP MM: Study Guides, Questions & AnswersSatish Dhamapurkar0% (2)

- 50 REAL TIME SAP MM Interview QuestionsDocument19 pages50 REAL TIME SAP MM Interview QuestionsjusufjkNo ratings yet

- MRP Procedures, Planned Orders, Organizational Levels, and Special Stocks in SAPDocument53 pagesMRP Procedures, Planned Orders, Organizational Levels, and Special Stocks in SAPDeepak Wagh0% (1)

- SAP MM Interview QuestionsDocument15 pagesSAP MM Interview QuestionsHaja Peer Mohamed H75% (8)

- PRESENTATION: Myth or Magic Singapore Health SystemDocument45 pagesPRESENTATION: Myth or Magic Singapore Health SystemADB Health Sector Group100% (1)

- SAP Activate Methodology in a Nutshell: Activate Methodology in a NutshellFrom EverandSAP Activate Methodology in a Nutshell: Activate Methodology in a NutshellRating: 1 out of 5 stars1/5 (1)

- Programmed Search Help in Web Dynpro For ABAP PDFDocument13 pagesProgrammed Search Help in Web Dynpro For ABAP PDFMarius UrsacheNo ratings yet

- Sap MM C - tscm52 - 67 QuestionsDocument28 pagesSap MM C - tscm52 - 67 QuestionsAshutosh PandeyNo ratings yet

- 101 Examples of How Things Post Pre-Configured ClientDocument94 pages101 Examples of How Things Post Pre-Configured Clientrajendrakumarsahu88% (8)

- Sap MM IqDocument20 pagesSap MM IqDora BabuNo ratings yet

- SAP MM Complete Self-Assessment GuideFrom EverandSAP MM Complete Self-Assessment GuideRating: 3.5 out of 5 stars3.5/5 (4)

- Sap MM QuestionsDocument12 pagesSap MM QuestionsBhaskar NagNo ratings yet

- BI Concepts: Info Objects, Data Types, Modelling and ReportingDocument6 pagesBI Concepts: Info Objects, Data Types, Modelling and ReportingvinoakhilNo ratings yet

- Project Systems Super User 11-07webDocument47 pagesProject Systems Super User 11-07webvinoakhilNo ratings yet

- Materials Management TermsDocument8 pagesMaterials Management Termsbobo1010No ratings yet

- CERT10OFFDocument14 pagesCERT10OFFvinoakhilNo ratings yet

- 071709Document223 pages071709vinoakhilNo ratings yet

- ChapterX - User Programmed Value HelpDocument54 pagesChapterX - User Programmed Value Helpeljohn1No ratings yet

- 11 Intro ERP Using GBI Data Sheet PS (Letter) en v2.11Document1 page11 Intro ERP Using GBI Data Sheet PS (Letter) en v2.11David TjongNo ratings yet

- 071709Document223 pages071709vinoakhilNo ratings yet

- ChapterX - User Programmed Value HelpDocument54 pagesChapterX - User Programmed Value Helpeljohn1No ratings yet

- AbapDocument22 pagesAbapVinoth Kumar PeethambaramNo ratings yet

- PDF FileDocument1 pagePDF FilevinoakhilNo ratings yet

- ChapterX - User Programmed Value HelpDocument54 pagesChapterX - User Programmed Value Helpeljohn1No ratings yet

- A SapDocument1 pageA SapvinoakhilNo ratings yet

- Mile Stone BillingDocument1 pageMile Stone Billingvinodbabu78No ratings yet

- SAP FICO Transaction CodesDocument16 pagesSAP FICO Transaction CodesHussani ArsathNo ratings yet

- Job Description PsDocument5 pagesJob Description PsvinoakhilNo ratings yet

- A SapDocument1 pageA SapvinoakhilNo ratings yet

- Kheda Satyagraha - 3291404Document27 pagesKheda Satyagraha - 3291404Bhaskar AmasaNo ratings yet

- Impact of Annales School On Ottoman StudiesDocument16 pagesImpact of Annales School On Ottoman StudiesAlperBalcıNo ratings yet

- Cloud Family PAMM IB PlanDocument4 pagesCloud Family PAMM IB Plantrevorsum123No ratings yet

- US Internal Revenue Service: f945 - 1996Document3 pagesUS Internal Revenue Service: f945 - 1996IRSNo ratings yet

- Factors Making Common Consumers Bike Opinion LeadersDocument5 pagesFactors Making Common Consumers Bike Opinion Leaderssumit5558No ratings yet

- Communication Matrix 2018Document4 pagesCommunication Matrix 2018Mahmood ArafatNo ratings yet

- Analysis of Mutual Funds as an Investment in IndiaDocument19 pagesAnalysis of Mutual Funds as an Investment in IndiaVivek GuptaNo ratings yet

- Understanding Consumer Equilibrium with Indifference CurvesDocument6 pagesUnderstanding Consumer Equilibrium with Indifference CurvesJK CloudTechNo ratings yet

- History and Types of Insurance in IndiaDocument72 pagesHistory and Types of Insurance in India6338250% (4)

- Organic Chicken Business RisksDocument13 pagesOrganic Chicken Business RisksUsman KhanNo ratings yet

- Dgcis Report Kolkata PDFDocument12 pagesDgcis Report Kolkata PDFABCDNo ratings yet

- (Topic 6) Decision TreeDocument2 pages(Topic 6) Decision TreePusat Tuisyen MahajayaNo ratings yet

- Credit 243112012575 12 2023Document2 pagesCredit 243112012575 12 2023bhawesh joshiNo ratings yet

- The Impact of Rapid Population Growth On Economic Development in Ethiopia - 045539Document51 pagesThe Impact of Rapid Population Growth On Economic Development in Ethiopia - 045539ABAYNEGETAHUN getahunNo ratings yet

- Position Description WWF Serbia Operations ManagerDocument3 pagesPosition Description WWF Serbia Operations ManagerMilica Lalovic-BozicNo ratings yet

- Teacher's Notes - Reading File 7: Learning Objectives in This LessonDocument1 pageTeacher's Notes - Reading File 7: Learning Objectives in This LessonKsusha HNo ratings yet

- Reconstruction Opportunity Zones in PakistanDocument6 pagesReconstruction Opportunity Zones in Pakistantaimoor_qureshiNo ratings yet

- Proposal Letter of B 2 B Redeifined Angel (2) (1) 3 (New)Document3 pagesProposal Letter of B 2 B Redeifined Angel (2) (1) 3 (New)Hardy TomNo ratings yet

- Transaction History: Dola Mall Electronic Commerce Co LTDDocument1 pageTransaction History: Dola Mall Electronic Commerce Co LTDNeil LeeNo ratings yet

- Management of Environmental Quality: An International JournalDocument21 pagesManagement of Environmental Quality: An International Journalmadonna rustomNo ratings yet

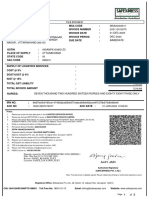

- Invoice: Deepnayan Scale CompanyDocument1 pageInvoice: Deepnayan Scale CompanyDssp StmpNo ratings yet

- 2022 Obc GuidelinesDocument3 pages2022 Obc Guidelinesbelle pragadosNo ratings yet

- Tanzania: Dar Es Salaam Urban ProfileDocument36 pagesTanzania: Dar Es Salaam Urban ProfileUnited Nations Human Settlements Programme (UN-HABITAT)50% (2)

- Budget Deficit: Some Facts and InformationDocument3 pagesBudget Deficit: Some Facts and InformationTanvir Ahmed SyedNo ratings yet

- Example Accounting Ledgers ACC406Document5 pagesExample Accounting Ledgers ACC406AinaAteerahNo ratings yet

- Civpro Cases FinalsDocument4 pagesCivpro Cases FinalsMc DalayapNo ratings yet