Professional Documents

Culture Documents

Extraordinary General Meeting 07th March 2014

Uploaded by

FraserCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Extraordinary General Meeting 07th March 2014

Uploaded by

FraserCopyright:

Available Formats

NOTICE OF EXTRAORDINARY GENERAL

MEETING

Brisbane, 07 March 2014: Intrepid Mines Limited (ASX, TSX: IAU) (Intrepid, or the

Company), advises that Notice of the Extraordinary General Meeting of shareholders to be

held on 9 April 2014 at the Brisbane Marriott Hotel 515 Queen St Brisbane and the related

Proxy Form were mailed to shareholders on 6 March 2014.

A copy of the Notice and Proxy form is attached.

Inquiries regarding this report and Company business may be directed to:

Directors

Ian McMaster (Executive Chairman)

Colin G. Jackson (Deputy Chairman)

Scott F. Lowe (Managing Director Chief Executive

Officer)

Laurence W. Curtis (Non-executive Director)

Robert J. McDonald (Non-executive Director)

Alan Roberts (Non-executive Director)

Garry Gill (Company Secretary)

Stock Exchange Listing

ASX and TSX symbol: IAU

Substantial Shareholders

Taurus Funds Management 8.5%

Van Eck Associates 7.6%

Acorn Capital 6.8%

Surya Paloh 5.0%

Issued Capital

556,612,782 shares

5,218,259 unlisted options

2,472,000 unlisted share rights

For further information pl ease contact:

Scott Lowe, Chief Executive Officer, Brisbane, Australia

:+61730078000 : slowe@intrepidmines.com

Greg Taylor, Toronto, Canada

: +9053377673 : gtaylor@intrepidmines.com +4166055120

Level 1 | 490 Upper Edward Street | Spring Hill Qld 4004 | Tel: +61 7 30078000 | ABN: 11 060 156 452 | Web: www.intrepidmines.com

www.intrepidmines.com

INTREPID MINES LIMITED

ABN 11 060 156 452

Notice Of

Extraordinary

General Meeting

Your Directors

UNANIMOUSLY recommend that you

VOTE IN FAVOUR

of the resolution to be put to shareholders.

9 April 2014 at 2:00pm (AEST)

at Brisbane Marriott Hotel

515 Queen Street, Brisbane, Queensland

www.intrepidmines.com

Intrepid Mines Limited ABN 11 060 156 452 Page 2

Table of Contents

Letter from the Chairman . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Notice of Extraordinary General Meeting. . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Notice of Meeting. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Agenda . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Explanatory Memorandum . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Record Date Snap Shot Time . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Voting Instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Explanatory Memorandum to

Notice of Extraordinary General Meeting 2014 . . . . . . . . . . . . . . . . . . . . . . . 5

Important Notice . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Explanatory Statement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Voting . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Appointment and revocation of proxies

for holders of Ordinary Shares. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Advice to Beneficial Shareholders on the Canadian Registry . . . . . . . 14

Exercise of Discretion by Proxies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Disclosures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Voting Securities and Principal Holders Thereof . . . . . . . . . . . . . . . . . . . 15

Interests of Certain Persons in matters to be acted upon . . . . . . . . . . . 15

Indebtedness of Directors, Executive Officers and Senior Officers . . 15

Interests of management and others in material transactions . . . . . 15

Other material facts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Certificate and Approval of Directors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Glossary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

www.intrepidmines.com

Notice of Extraordinary General Meeting 2014 Page 3

Letter from the Chairman

6 March 2014

Dear Fellow Shareholder

It is with mixed feelings that your board has convened this general meeting to approve the settlement of the

various disputes in which Intrepid has been involved in relation to the Tujuh Bukit Project.

On the one hand, it is disappointing that our efforts to deal with the critical challenges we faced in Indonesia

were not as successful as we had hoped they would be. Our sole objective over the last two years has been to

restore our rights and enable the Company to continue its participation in the development of the Tujuh Bukit

Project. Unfortunately, a range of issues conspired to make that a very difcult objective to achieve.

On the other hand, we have been able to negotiate a settlement which, if approved by our shareholders, will

see the Company recover a substantial portion of the money we have invested in Indonesia and allow us to

make a clean exit from all of the disputes in which we have been involved. For some time now, the Company

has been evaluating investment opportunities in the gold and base metals sector, and this settlement will allow

management to focus its time and attention exclusively on determining the best use for our signicantly

increased cash reserves.

For the reasons outlined in this Notice of Meeting and Explanatory Statement, your Directors have unanimously

concluded that the proposed settlement is in your best interests. The reasons for our decision are set out on

the following pages of this Notice of Meeting and I urge you to consider them carefully.

I am pleased to be able to report to you that since the announcement of the proposed settlement on

19 February, your Directors have received positive feedback from a number of our major shareholders along

with indications that they intend to vote in favour of the settlement.

I urge you to read this document in full and to exercise your vote in FAVOUR of the

resolution to be put to the general meeting on 9 April 2014.

In particular, I draw your attention to the voting instructions on the following page.

Should you be in any doubt about how to cast your vote or if you have any questions about any of the matters

raised in this Notice of Meeting, please call the Intrepid Shareholder Information Line on 1300 481 262 or

+61 3 9415 4256 for shareholders outside of Australia.

We look forward to your continued support as we move to nally settle our Indonesian issues and position the

Company to consider a range of other options for creating value for our shareholders.

Yours sincerely

Ian McMaster AM

Chairman

www.intrepidmines.com

Intrepid Mines Limited ABN 11 060 156 452 Page 4

NOTICE OF EXTRAORDINARY GENERAL MEETING

NOTICE OF MEETING

The Company hereby gives notice that an Extraordinary

General Meeting of Shareholders will be held on Wednesday

9 April 2014 at 2:00 pm (AEST) at Brisbane Marriott Hotel 515

Queen Street, Brisbane QLD (Meeting).

AGENDA

To consider, and if thought t, pass, with or without

amendment, the following resolution (referred to throughout

this Notice of Meeting and Explanatory Statement as the

Resolution) as an ordinary resolution:

That approval is given by the shareholders, for the

purposes of ASX Listing Rule 11.2 and for all other

purposes, for the Company to enter into and complete

the Settlement Documents and Assignment Documents

(as those terms are dened in the Explanatory Statement

accompanying and forming part of the Notice of

Meeting), being a disposal of the main undertaking of the

Company, for the purposes and on terms consistent with

those set out in the Explanatory Statement.

Voting exclusion:

The Company will disregard any votes cast on the Resolution

by a person who might obtain a benet, except a benet

solely in the capacity as a shareholder, if the Resolution is

passed or an associate of that person. However, the

Company need not disregard a vote if it is cast by:

a person as a proxy for a person who is entitled to vote, in

accordance with the directions on the Proxy Form; or

by the person chairing the Meeting as proxy for a person

who is entitled to vote, in accordance with a direction on

the Proxy Form to vote as the proxy decides.

EXPLANATORY MEMORANDUM

Shareholders are referred to the Explanatory Memorandum

accompanying and forming part of this Notice of Meeting.

RECORD DATE - SNAP SHOT TIME

Regulation 7.11.37 of the Corporations Regulations 2001(Cth)

permits the Company to specify a time, not more than 48

hours before the Meeting, at which time a snap shot of

Shareholders will be taken for the purposes of determining

Shareholder entitlements to vote at the Meeting.

The Directors have determined such time will be 7:00 pm

(AEST) for ASX registered holders and 7:00 pm (EDT) for TSX

registered holders on 7 April 2014 (Record Date).

VOTING INSTRUCTIONS

ASX and TSX registered holders of the ordinary shares of the

Company on the Record Date will be entitled either to attend

the Meeting in person and vote the securities held by them or,

provided a completed and executed Proxy Form has been

delivered to the Company or its transfer agents as indicated

below, vote their securities by proxy.

Proxy Forms for the Meeting for ASX registered holders and

for TSX registered holders, as applicable, are enclosed with

this Notice of Meeting. These Proxy Forms provide further

details on appointing a Proxy. Proxy Forms (and the original

or a certied copy of the power of attorney if the Proxy Form

is signed by an attorney) must be received by the Companys

share registry, Computershare Investor Services Pty Limited

by 2:00 pm (AEST) on Monday 7 April 2014, by the following

means:

delivered by post to the Share Registry of the Company,

Computershare Investor Services Pty Limited, GPO Box

242, Melbourne, Victoria 3001;

sent by fax to the Share Registry of the Company,

Computershare Investor Services Pty Limited on

1800 783 447 (within Australia) or + 61 3 9473 2555

(outside Australia); or

online by visiting www.investorvote.com.au and

logging in using the control number found on the

front of your accompanying proxy form. Intermediary

Online subscribers (Institutions/Custodians) may

lodge their proxy instruction online by visiting

www.intermediaryonline.com.

Any Proxy Form received after the relevant time noted

above will not be valid for the Meeting.

Dated: 6 March 2014

By Order of the Board of Directors

Intrepid Mines Limited

Garry Gill

Company Secretary

www.intrepidmines.com

Notice of Extraordinary General Meeting 2014 Page 5

EXPLANATORY MEMORANDUM

TO NOTICE OF EXTRAORDINARY GENERAL MEETING 2014

IMPORTANT NOTICE

Date of this Explanatory Memorandum

Any information contained in this Explanatory Memorandum is current

as at 6 March 2014 (Notice Date).

Meeting Materials

This Explanatory Memorandum has been prepared for the information

of Shareholders in connection with the business to be considered at

the Meeting for the purposes set out in the accompanying Notice of

Meeting. This Explanatory Memorandum should be read in

conjunction with, and forms part of, the accompanying Notice of

Meeting (collectively the Meeting Materials).

Glossary

Capitalised terms have the meaning given to them in the Glossary or

as other context requires.

Disclsoures

The Company is listed on both the ASX and the TSX under the symbol

IAU. The applicable securities rules and regulations in Australia and

Canada, including the respective listing rules and regulating

instruments in those jurisdictions require differing levels and forms of

disclosure. In the past the Company has set out information in

different formats for Shareholders with shares on each listing. This

Notice of Meeting has been consolidated for ease of reading and all

of the information provided is in accordance with ASX, TSX and

Canadian Securities Law requirements.

Information about the Resolution

The full details of the Resolution to be considered at the Meeting are

set out below.

EXPLANATORY STATEMENT

OVERVIEW

The Company is involved in a range of disputes in relation to

its rights to the Tujuh Bukit project (section i) below

provides shareholders with an overview of the disputes

and the actions taken by or against the Company).

On 19 February 2014, the Company announced that binding

agreements had been signed to settle all disputes and sell all

of the Companys rights in relation to Tujuh Bukit in return for

receiving US$80 million (~A$90 million) in cash (sections ii)

and iii) below summarise the key documents that have

been entered into by the Company).

Two key agreements have been signed:

The rst is a master settlement agreement which effects

the settlement of all disputes relating to ownership of the

project, in exchange for the issue of a convertible bond

and an option to Intrepid (these securities are described

in sections ii) and iii) below).

Voting

The Resolution is an ordinary resolution. This means that, to be

passed, the Resolution needs the approval of a simple majority of

votes cast by Shareholders entitled to vote on the Resolution.

Forward looking statements

Certain statements in these meeting materials relate to the future,

including forward looking statements relating to the Companys

nancial position and strategy.

These forward looking statements involve known and unknown risks,

uncertainties, assumptions and other important factors that could

cause the actual results, performance or achievements of the

Company to be materially different from future results, performance

or achievements expressed or implied by such statements. Such

risks, uncertainties, assumptions and other important factors include,

among other things, general economic conditions, a disruption in the

capital markets, exchange rates, interest rates, the regulatory

environment, structural changes in the industries in which the

Company operates, competitive pressures, selling price and market

demand.

The forward looking statements in the Meeting Materials reect views

held only as of the date of the Meeting Materials. Other than as

required by law, neither the Company nor any other person gives any

representation, assurance or guarantee that the occurrence of the

events expressed or implied in any forward looking statements in the

Meeting Materials will actually occur. Subject to any continuing

obligations under law or the Listing Rules, the Company and its

Directors disclaim any obligation or undertaking to disseminate after

the date of the Meeting Materials any updates or revisions to any

forward looking statements to reect any change in expectations in

relation to those statements or any change in events, conditions or

circumstances on which any such statement is based.

The second is an assignment agreement under which

Intrepid will sell its rights to the convertible bond and the

option to Kendall Court Resources (a company associated

with the Singapore fund manager Kendall Court) for

US$80 million in cash.

A single resolution will be put to Shareholders seeking

approval to enter into both the master settlement agreement

and the assignment agreement (section iv) explains why

only one resolution is being put to shareholders to

approve both the settlement of disputes and the sale of

the Companys rights).

www.intrepidmines.com

Intrepid Mines Limited ABN 11 060 156 452 Page 6

As required by the ASX Listing Rules, these agreements will

only become nally binding if the Resolution the subject of

this Notice of Meeting is passed by Intrepid shareholders

(section v) explains why Shareholder approval is

required).

Your Directors unanimously believe that

it is in the best interests of all shareholders

for the disputes to be settled on the

terms outlined in this Notice of Meeting.

In forming their view, your Directors compared the benet of

receiving a cash payment of US$80 million with a range of

highly subjective factors, including the following:

the prospects of future success in some or all of the

disputes relating to the Project, given the difculties that

the Company has encountered to date;

the potentially lengthy time it would take to resolve all

disputes and the substantial cost (in dollar terms and in

terms of management time) of continuing to pursue legal

remedies; and

the impact on the Company of regulatory changes in

Indonesia which have made the prospect of Intrepid (as a

foreign company) undertaking the development of Tujuh

Bukit more difcult, including:

restrictions imposed on the export of raw and partially

processed minerals; and

regulations enacted by the Indonesian government

in September 2013, which have the effect that the

Company would be unable, even if it successfully

recovers its rights to the Tujuh Bukit Project, to exercise

a right to take more than a 49% interest in the company

holding the Project licences.

Your Directors unanimously concluded that the benets of

settling all disputes outweighed the potential benets of

continuing to pursue legal remedies (full details of the

reasons why your Directors are recommending you vote

in favour of the Resolution are set out below in sections

vi) to xi) below).

The balance of this explanatory memorandum

provides answers to the key questions that

Shareholders need answered when considering

how to vote on the Resolution.

i) WHAT ARE THE DISPUTES?

Prior to the introduction of the new Indonesian Mining Law of

2009 (the Mining Law) and its subsequent implementing

regulations, foreign ownership was not permitted in entities

holding Indonesian mining tenements (kuasa pertambangan,

or KPs). Consequently, the Company was not originally able

to own any direct rights to the Tujuh Bukit Project tenements.

The Tujuh Bukit IUPs (the form of mining licence which

replaced the KPs under the new Mining Law of 2009) were

held by PT Indo Multi Niaga (PT IMN), the Companys

Indonesian joint venture partner.

The Company and its wholly-owned subsidiary, Emperor

Mines Pty Limited (Emperor), through a number of

contractual arrangements with PT IMN, acquired an 80%

economic interest in the Tujuh Bukit Project. Since the

Company had no direct rights in the IUPs, it was reliant on

the observance by PT IMN and its shareholders, Maya

Miranda Ambarsari (Maya) and Andreas Reza Nazaruddin

(Reza) of the contractual arrangements in place and of

legislation and permitting requirements related to the

tenements.

Pursuant to the new Mining Law and prior to July 2012, the

Company had been in the process of restructuring its joint

venture arrangements with PT IMN such that PT IMN would

be converted into a foreign capital investment company in

which the Company, through a subsidiary, would ultimately

have held a direct 80% interest and therefore a direct interest

in the IUPs comprising the Tujuh Bukit Project.

This restructuring process would have required certain

governmental approvals, including recommendations or

authorisations from the Bupati of Banyuwangi, BKPM

(Indonesian Investment Co-ordinating Board) and ESDM

(Ministry of Energy and Mineral Resources). While the

commercial terms upon which the conversion to a direct

equity interest were agreed to between the parties in June

2011, negotiations to document those commercial terms were

protracted and halted entirely in June 2012.

The Company took the position that PT IMN was in breach of

the agreements in place with the Company. PT IMN ceased

communication with the Companys management in July

2012 when the Company was evicted from the Tujuh Bukit

site. In June 2012, the Company had become aware that new

shareholders had been added to the register of PT IMN and

that these new shareholders collectively held 80% of the

expanded issued capital in PT IMN. In December 2012, the

Company further became aware that the Tujuh Bukit IUPs

had been transferred to another company, PT Bumi

SuksesIndo (BSI), which was initially a subsidiary of PT

IMN. According to public records, since the date of transfer

of the IUPs, the shareholding in BSI has changed such that

PT IMN is no longer a shareholder in that company.

EXPLANATORY MEMORANDUM (Cont.)

www.intrepidmines.com

Notice of Extraordinary General Meeting 2014 Page 7

Furthermore, the Exploration IUP has been further transferred

to PT Damai SuksesIndo (DSI).

Given these developments, the Company pursued a range of

legal and commercial avenues in an attempt to protect its

rights in and entitlement to the Tujuh Bukit Project. These are

summarised below:

Criminal Complaints

Initially, in October 2012, the Company made two

complaints to the Indonesian Police. The rst complaint

related to an allegation of fraud and embezzlement of funds

from Emperor by PT IMN and its associates. The second

complaint related to an allegation of unlawful denial of

access to the project site and unlawful retention of

intellectual property owned by Emperor.

The investigation of the rst complaint is ongoing, while the

second complaint has been quashed by the Indonesian

police.

Singapore Arbitration Proceedings

Emperor adopted the position that PT IMN and its

shareholders were in material breach of the joint venture

agreements in place with Emperor and the Company.

Accordingly, Emperor commenced arbitration proceedings

against PT IMN, Maya and Reza under the rules of the

Singapore International Arbitration Centre in Singapore, to

pursue its entitlements to the Tujuh Bukit Project.

Whilst proceedings have commenced, it would likely take

up to two years for the arbitration to be concluded. In the

event of Emperor being successful in obtaining an

arbitration award, it would then be required to seek to

enforce any award through the mechanisms of the

Indonesian court system.

Administrative Proceedings

In December 2012, the Company became aware that the

Tujuh Bukit IUPs had been transferred by PT IMN, to BSI

(Transfer). BSI was a subsidiary of PT IMN at the time of

the Transfer.

The Company also became aware that PT IMN

subsequently transferred all of its shares in BSI to other

parties.

Under Indonesian law, IUPs are not transferrable except for

transfers to majority-held subsidiaries. Emperor therefore

commenced proceedings against the Bupati of

Banyuwangi, (the regional head of government) who

effected the Transfer and approved the changes in

shareholding, seeking to set aside the Transfer, in the State

Administrative Court in Surabaya (Tribunal).

The Tribunal of three judges was split in its decision, but a

majority of two judges ruled against Emperor on procedural

grounds of lack of standing. The dissenting judge accepted

the Companys standing to institute proceedings and went

on to examine the merits of the matter, concluding that the

Bupati of Banyuwangi had acted contrary to Indonesian

law in approving the transfer of the IUPs and subsequent

corporate reorganisation of BSI.

In the course of the Tribunal proceedings, it emerged that

the Exploration IUP has been further transferred to DSI.

The Company therefore instituted a separate action in the

Tribunal in respect of that further transfer. The Tribunal in a

unanimous decision, dismissed the second action on

procedural grounds relating to lack of standing.

The decisions of the Tribunal are not nal and binding until

all appeal rights have been exhausted. Emperor has lodged

appeals against the judgments, to the State Administrative

Appeals Tribunal.

In addition to the above, the following is a summary of the

proceedings that have been instituted against the Company

by third parties in respect of the Tujuh Bukit Project:

South Jakarta Proceedings

In April 2008, IndoAust Mining Limited (IABVI) and Paul

Michael Willis (Willis) entered into a Termination and

Settlement Agreement with Reza and Maya, and a Deed of

Termination and Release with Emperor, under which Willis

and IABVI ceased to hold any direct or indirect interest in

the Tujuh Bukit Project (IMN/Willis Termination and

Settlement Agreements).

In November 2012, proceedings were instituted by IABVI,

IndoAust Mining Pty Limited (IAAUS) and Willis

(Plaintiffs) in connection with the execution of the IMN/

Willis Termination and Settlement Agreements, against the

Company, Emperor, two Company executives (Intrepid

Parties) and the Companys Indonesian joint venture

partners, PT IMN, Reza and Maya (Defendants).

On 11 November 2013, the South Jakarta District court

(District Court) made an award in favour of the Plaintiffs

in relation to the South Jakarta Proceedings, as follows:

the Plaintiffs 70% economic interest in the Tujuh Bukit

project was recognised, with the result that subsequent

agreements entered into between PT IMN and Emperor,

including the agreements establishing the Tujuh Bukit

joint venture, were declared void;

compensation for material damages of $A3.7 million in

respect of alleged expenditure incurred in relation to the

Tujuh Bukit project;

www.intrepidmines.com

Intrepid Mines Limited ABN 11 060 156 452 Page 8

compensation for immaterial damages, in the amount of

$A10 million, for intangible harm (the Plaintiffs had made

a claim for $250 million); and

the dismissal of the Defendants counterclaims.

The Intrepid Parties appealed the decision to the Jakarta

High Court, as important elements of the case for the

Defendants appeared to have received limited

consideration by the District Court in forming its

conclusions about the matter. The decision of the District

Court is not nal and binding until the appeals process has

been exhausted.

ii) WHAT IS THE PROPOSAL TO SETTLE

THE DISPUTES?

Without an admission of liability and subject to approval by

the Companys shareholders, the Plaintiffs, Defendants and

other parties to the Tujuh Bukit ownership dispute, have

entered into a series of documents which will settle all

disputes relating to the Tujuh Bukit Project, including the

disputes outlined in i) above.

Two binding agreements and a range of ancillary documents

which take effect on settlement have been signed.

Master Settlement Deed

The rst document is the deed of settlement which has been

signed by all of the parties involved in the ownership dispute,

including Intrepids former Indonesian partners, PT IMN,

Maya, Reza, IABVI, IAAUS and Willis, and the shareholders of

the holding company of BSI and DSI (Master Settlement

Deed). Under this deed, all parties have agreed to settle the

disputes between them, including the Singapore Arbitration

Proceedings and the South Jakarta Proceedings described

above.

Under the Master Settlement Deed, Emperor will exchange a

US$70 million promissory note issued by IMN under the PT

IMN Settlement and Termination Deed and its remaining

rights in the Project for a bond which is mandatorily

convertible into a 15% pre-IPO shareholding in PT Merdeka

Serasi Jaya (MSJ), which is the current holding company

for the companies holding the Tujuh Bukit mining tenements

(Convertible Bond) on an IPO of that company. The

controlling shareholders of MSJ have advised Intrepid that

they intend to list MSJ, although the timing and jurisdiction of

that listing have not been nalised. Under the Master

Settlement Deed, Emperor would also be granted an option

to subscribe for a further 7.5% of the expanded share capital

of MSJ for US$37.5m at the time of the proposed IPO

(Option).

Settlement under the Master Settlement Agreement will

occur within 24 hours of the passing by Intrepid shareholders

of the Resolution. To ensure that settlement will occur, a

number of other agreements and related documentation

associated with the Master Settlement Deed have been

signed and will take effect as and from the date of settlement

(i.e. within 24 hours of the Resolution being passed). These

other agreements and documents are being held by the

Ashurst (the Companys legal adviser) in escrow pending the

passing of the Resolution and comprise:

PT IMN Settlement and Termination Deed under

this deed, all of the disputes between Emperor and the

Company involving PT IMN, Maya, Reza and Tujuh Bukit

Pte Ltd are settled and those parties release each other

from all claims. IMN will issue Emperor with a US$70

million promissory note to settle Emperors claims,

including its claims on account of monies expended by

Emperor on the Project. Once settlement occurs under

the Master Settlement Deed, the Singapore Arbitration

Proceedings will be withdrawn.

Willis Settlement and Termination Deed under

this deed all of the disputes between Emperor and IABVI,

IAAUS, Willis, PT IMN, Maya and Reza are settled and

those parties release each other from all claims. Once

settlement occurs under the Master Settlement Deed,

the South Jakarta Proceedings referred to above will be

discontinued with no residual liability remaining for any of

the parties to that litigation. Once settlement occurs the

provision of $A13.7 million taken against the claim in the

accounts of the Company will be reversed.

Letters of discontinuation of the South Jakarta

Proceedings, the Singapore Arbitration Proceedings and

the Administrative Proceedings referred to above.

Tujuh Bukit Pte. Transfer documents to allow for

the transfer of shares of Maya and Reza in the Singapore

company which was to be the Tujuh Bukit joint venture

vehicle, to Emperor.

An Escrow Agreement, pursuant to which Ashurst holds the

documents referred to above, with instructions to release

those documents to the relevant parties at settlement, has

been entered into.

The Master Settlement Deed and the other ancillary

documentation described above comprise the Settlement

Documents as that term is used in the Resolution.

EXPLANATORY MEMORANDUM (Cont.)

www.intrepidmines.com

Notice of Extraordinary General Meeting 2014 Page 9

MSJ Securities Assignment Agreement

An assignment agreement has also been signed, under which

Intrepid and Emperor have sold and assigned all of their

rights under the Master Settlement Deed, including the right

to receive the Convertible Bond and the Option, to Kendall

Court Resource Investments Ltd (KCR) a company

associated with the Singapore-based funds manager Kendall

Court (Sale Agreement).

The purchase price payable by KCR is US$80 million (~A$90

million).

KCRs obligation to pay Intrepid US$80 million under the Sale

Agreement has been secured by:

payment of a US$40 million cash deposit into an escrow

account controlled by Intrepids lawyers (the Deposit);

and

the provision by DBS Bank in Singapore of a Standby

Letter of Credit in favour of Emperor, for US$40 million

(Standby Letter of Credit).

These funding arrangements provided the Directors with the

comfort they required regarding KCRs ability to complete the

sale transaction.

Settlement under the MSJ Securities Assignment Agreement

will occur concurrently with settlement taking place under the

Master Settlement Deed. To ensure that settlement occurs

concurrently, a number of other documents have been signed

and will take effect as and from the date of settlement. These

other agreements and documents are being held by Ashurst

(the Companys legal adviser) in escrow, pending the passing

of the Resolution and comprise:

a transfer of the Convertible Bond and the Option from

Emperor to KCR; and

a Notice of Assignment from Emperor to KCR.

An Escrow Agreement, pursuant to which Ashurst holds the

Deposit, the Standby Letter of Credit and the documents

referred to above, with instructions to release those

documents to the relevant parties at settlement, has been

entered into.

The MSJ Securities Assignment Agreement and the other

ancillary documentation described above comprise the

Assignment Documents as that term is used in the

Resolution.

iii) WHAT ARE THE MATERIAL TERMS OF

THE SETTLEMENT DOCUMENTS AND THE

ASSIGNMENT DOCUMENTS?

Master Settlement Deed Key Terms

Parties

The parties to the Master Settlement Deed include all of the

parties involved in the ownership dispute, including Intrepid,

Emperor and Tujuh Bukit Pte Ltd (together the Intrepid

Parties) and Intrepids former Indonesian partners, PT IMN,

Maya, Reza and Willis.

Effect of Settlement occurring under the Master

Settlement Deed

Settlement of the transactions contemplated under the

Master Settlement Deed will result in:

the parties effecting:

the discontinuance of the administrative proceedings

brought against the Bupati of Banyuwangiin relation to

the Transfer;

the settlement of the civil disputes between Emperor,

PT IMN, Maya and Reza;

the discontinuance of the Singapore Arbitration

Proceedings between Emperor, IMN, Maya and Reza;

and

the discontinuance of the South Jakarta Proceedings

between the Intrepid parties, two executives of Intrepid,

PT IMN, Maya, Reza, IAAUS, IABVI and Willis;

the parties releasing and forever discharging each other

(and any of their Associates (which includes related

entities and current or former shareholders, ofcers,

employees or agents of the party or its related parties))

from any claims relating to the subject matter of any of the

above proceedings/disputes;

Emperor being issued with:

the Convertible Bond; and

the Option (collectively, the MSJ Securities).

Other obligations

There are a number of ongoing obligations placed on the

Intrepid Parties but other than those obligations that relate to

the discontinuance of proceedings, releases of further claims

between the parties, condentiality and non-disparagement

obligations and an obligation on the Intrepid Parties to make

certain project information available to MSJ, these will drop

away at Settlement (as a result of the contemporaneous

assignment of the MSJ Securities).

www.intrepidmines.com

Intrepid Mines Limited ABN 11 060 156 452 Page 10

Condition Precedent to Settlement

The Master Settlement Deed is conditional upon approval of

the shareholders of Intrepid being obtained at a general

meeting (Condition Precedent).

Intrepid is required to use its reasonable endeavours to

ensure that the Condition Precedent is satised prior to the

date which is 12 weeks after the signing of the Master

Settlement Deed.

Escrow

The parties to the Master Settlement Deed have also entered

into escrow arrangements, under which all of the documents

required for Settlement to occur are held in escrow by

Ashurst Australia as the Escrow Agent.

Under the terms of the escrow arrangements, once the

Chairman of the Intrepid EGM and another director provide a

certicate to the Escrow Agent conrming that the Intrepid

shareholders have approved the entry into the Master

Settlement Deed, Settlement will occur and the Escrow

Agent will be required to release all of the documents to the

relevant parties.

This will also be the trigger for the release of documents

under a separate escrow arrangement entered into in relation

to the MSJ Securities Assignment Agreement.

MSJ Securities Assignment Agreement

Key Terms

Effect of Completion occurring under the

Assignment Agreement

Completion of the transactions contemplated under the

Assignment Agreement will result in:

assignment of Emperors rights (other than certain

excluded rights) under the Master Settlement Deed,

including its rights to the MSJ Securities (being the

Convertible Note and the Option); and

Emperor receiving the purchase price of US$80 million.

Conditions Precedent

The Assignment Agreement is also conditional upon Intrepid

shareholder approval being obtained.

Escrow

The parties to the Assignment Agreement have entered into

escrow arrangements, under which the parties have placed

all of the documents required for completion under the MSJ

Securities Assignment Agreement in escrow with Ashurst

Australia as the Escrow Agent.

Under the terms of the escrow arrangements, completion will

be effected concurrently with completion under the Master

Settlement Deed, at which time the Escrow Agent will be

required to release all of the documents to the relevant

parties. This will include releasing the purchase price to

Emperor, which is required under the escrow arrangements

to be held as follows:

a cash deposit of US$40 million; and

a Letter of Credit in the amount of $40 million which

Intrepid will be able to draw down on once it is released

from escrow.

iv) WHY IS THE RESOLUTION APPROVING

ENTRY INTO BOTH THE SETTLEMENT

DOCUMENTS AND THE ASSIGNMENT

DOCUMENTS?

Negotiations in relation to a possible settlement have been

ongoing for several months. In the nal phase of negotiations

regarding the Master Settlement Deed, a commercial

impasse arose and Intrepid concluded that it was not

prepared to proceed on the terms proposed unless Intrepid

was able to concurrently sell its rights under the Master

Settlement Deed for an acceptable cash sum.

The Companys decision not to sign the Master Settlement

Agreement without an ability to immediately sell its rights for

cash was based on a range of factors including:

a belief that the right to 15% of the pre-IPO shares in MSJ

granted under the Convertible Bond was not sufcient,

given the difculty of assessing the likely value of that

interest (see further comments on valuation in (iv) below);

a belief that the face value of the bond should have been

higher;

the lack of certainty about the timing and place of listing

for MSJ and the dilution that Intrepid would be exposed to

as a consequence of any capital raising associated with

the IPO;

a concern about holding a minority contingent right in an

unlisted Indonesian company controlled by parties with

whom the Company has been in dispute; and

concerns about various legal risks for Intrepid (particularly

as a foreign company) identied by the Companys

Indonesian counsel arising out of the Master Settlement

Deed.

Intrepids refusal to sign the Master Settlement Deed without

a cash on-sale led to an effort to sell the rights Intrepid would

obtain under the settlement. Kendall Court was introduced to

Intrepid as a potential buyer and agreement for the on-sale

was subsequently reached. Kendall Court is a well known

investor in South East Asia.

EXPLANATORY MEMORANDUM (Cont.)

www.intrepidmines.com

Notice of Extraordinary General Meeting 2014 Page 11

Given that the Company would not support entry into the

Master Settlement Deed alone, one resolution is being put to

Shareholders seeking approval to enter into BOTH the

Settlement Documents and the Assignment Documents.

v) WHY IS THE PROPOSED SETTLEMENT

SUBJECT TO SHAREHOLDER APPROVAL?

Rule 11.2 of the ASX Listing Rules requires a company to

seek the approval of its shareholders to any disposal of its

main undertaking.

For the purposes of the ASX Listing Rules, the main

undertaking of the Company comprises its rights and

entitlement to an interest in the Tujuh Bukit Project.

As a result, Shareholder approval is required for the Company

to enter into and complete the Settlement Documents and

the Assignment Documents.

vi) WHY DO YOUR DIRECTORS RECOMMEND

THAT YOU VOTE IN FAVOUR OF THE

SETTLEMENT AND ASSIGNMENT?

Your Directors took account of a range of factors when

considering whether the best interests of all shareholders

would be served by settling the disputes on the terms

proposed.

In essence, your Directors compared the benet of receiving

a cash payment of US$80 million with the following:

the prospects of future success in some or all of the

disputes given the signicant challenges which the

Company has faced in trying to pursue its rights through

the Indonesian legal system;

the potentially lengthy time it would take to resolve all

disputes and the substantial cost (in dollar terms and in

terms of management time) of continuing to pursue legal

remedies; and

the impact on the Company of regulatory changes in

Indonesia which have made the prospect of Intrepid (as a

foreign company) undertaking the development of Tujuh

Bukit more difcult, including:

restrictions imposed on the export of raw and partially

processed minerals; and

regulations enacted by the Indonesian government

in September 2013, the effect of which is that the

Company would be unable, even if it successfully

recovers its rights to the Tujuh Bukit Project, to exercise

a right to take more than a 49% interest in the company

holding the Project licences.

Your Directors concluded that the benets of settling all disputes

outweighed the potential benets of continuing pursue legal

remedies.

vii) HOW DID THE DIRECTORS DETERMINE

THAT THE CASH PRICE OF US$80 MILLION

WAS FAIR?

In considering whether it was in the best interests of Intrepid

shareholders to settle all disputes on the terms nally

negotiated, your Directors gave careful consideration to value

issues associated with the rights conferred by the Convertible

Bond and the Option, as one of the factors to consider when

deciding whether the cash price of US$80 million was

reasonable.

Assessing the potential value of MSJ immediately prior to a

future IPO is a difcult task given that the future value of MSJ

is subject to a number of highly subjective and variable

factors that makes a valuation at this time inherently difcult.

Those factors include:

the early stage of development of the Tujuh Bukit Project:

the fact that only a preliminary economic assessment

and initial engineering study of the stage one gold oxide

project has been completed;

the fact that no detailed valuation work is possible on the

porphyry copper/gold project given that no economic

assessments or engineering studies have yet been

undertaken;

the fact that the project is situated within a protected

forest area, which gives rise to uncertainties regarding

permitting;

the fact that no detailed analysis has been undertaken

of the effect of the recently-imposed restrictions on the

export of raw and semi-processed minerals;

the uncertainty around nancing the development of both

stages of the project;

the fact that the timing for the listing remains uncertain

and is not guaranteed;

the fact that a decision has not yet been taken as to the

exchange on which MSJ is to be listed;

the fact that a range of issues which will drive investor

interest have yet to be resolved (e.g. composition of the

board of directors, senior management team, corporate

governance arrangements, share capital structure,

liquidity and free oat etc); and

the view of investors of Indonesian sovereign risk and

regulatory framework at the time of listing.

www.intrepidmines.com

Intrepid Mines Limited ABN 11 060 156 452 Page 12

Despite these variables, the Directors considered a range of

possible valuation metrics for MSJ, including:

Trading and transaction comparables in the gold

and copper sectors, noting that it is risky to rely on

comparable companies within a peer group of mining

exploration and development companies, given:

differing stages and time to production of each

companys projects;

differing depths of ore bodies;

varying ore quality and metallurgical factors;

differing cash cost positions;

widely varying project economics; and

varying degrees of country risk.

Enterprise value (EV) per Resource (ounce/tonne) and EV/

Reserve comparisons, recognising that these are also

potentially an unreliable value measure given the variety

of factors that inuence the economics of a particular

deposit and, therefore, the value attributed to undeveloped

copper and gold resources by the market.

Price to net asset value comparisons,which are similarly

an unreliable measure of value,given the net asset values

for Tujuh Bukit are based on early stage studies, project

assumptions (capex and opex) that have yet to be

conrmed and a lack of reliable assumptions to assess

development and nancing risks.

The Directors also considered whether it would be

appropriate to seek an independent experts opinion on the

merits of the proposed settlement. The Directors

unanimously concluded that there was no reasonable basis

to conclude that an independent expert could form a better

view on the merits of the settlement than the Directors. This

conclusion reects the fact that the Directors and senior

management of the Company:

have an intimate knowledge of the long and complex

history of the various disputes and are in the best position

to assess the merits of each element of each dispute; and

are in the best position to assess the circumstances

surrounding the negotiation of the proposed settlement

and the prospects of future success in the disputes or a

future settlement on better terms as compared to settling

on the proposed terms.

In addition, when considering the potential role of an

independent expert, the Directors took into account:

the inability of an expert to prepare a denitive valuation of

the Tujuh Bukit project with a meaningful value range given

the uncertainties and risks outlined above; and

the fact that the Company no longer has access to the

Tujuh Bukit site, key personnel or records which makes

the preparation of a meaningful valuation even more

challenging.

After due consideration of all of these factors and after

comparing the risks of continuing the disputes rather than

accepting the nally negotiated settlement terms, the

Directors unanimously concluded that the nally negotiated

terms supported the unanimous view of the Directors that it

was in the best interests of Intrepid shareholders to enter into

the Settlement Documents and the Assignment Documents.

viii) WHAT ARE THE IMPLICATIONS FOR THE

COMPANY IF SHAREHOLDERS APPROVE

THE SETTLEMENT AND ASSIGNMENT?

The settlement as recommended, when combined with the

existing cash reserves held by the Company, will result in a

total cash holding in excess of A$160 million.

The Company would have no debt or other liabilities and will

have made a clean and complete exit from Indonesia and all

of the disputes in which the Company was involved.

The Company will then be in a position to consider a range of

potential options for deploying its substantial cash reserves,

ranging from investing those funds into a new mining project

through to winding up the Company and distributing cash to

Shareholders.

The Company has commenced business development

activities to seek new investment opportunities and this

process will continue. In this regard, the Company is aware

that ASX Guidance Notes state that the ASX will, in the

absence of any other reason to suspend quotation, generally

continue the quotation of the Companys securities for up to

six months to allow the Company time to identify and make

an announcement of its intention to acquire a suitable new

investment or to allow it time to complete the formalities

needed to commence its winding up. Further, the ASX may

exercise its discretion such that any potential new investment

may require the approval of Shareholders, or may require the

Company to re-comply with the conditions of admission to

the ofcial list of the ASX.

These options will be considered by the Directors after

settlement has occurred and after taking into account the

views expressed between now and then by Intrepid

shareholders.

EXPLANATORY MEMORANDUM (Cont.)

www.intrepidmines.com

Notice of Extraordinary General Meeting 2014 Page 13

ix) WHAT ARE YOUR DIRECTORS

RECOMMENDING?

Taking into account the advantages and disadvantages set

out above, the Directors unanimously recommend that

Shareholders vote in favour of the Resolution, for the

following reasons:

the advantages of settling the disputes and entering

into the Settlement Documents and the Assignment

Documents outweigh the disadvantages; and

the settlement of the disputes and the sale of the

Companys interests in the Tujuh Bukit Project pursuant

to the Settlement Documents and the Assignment

Documents for US$80 million is in the best interests of the

Company and its Shareholders.

In considering the Directors recommendation, Shareholders

should note that the Directors have a potential interest in the

Settlement Deed by virtue of the releases being granted.

x) WHAT ARE THE CHAIRMANS

VOTING INTENTIONS?

The Chairman of the Meeting intends to vote all undirected

Proxies for the Resolution.

xi) WHAT ARE THE IMPLICATIONS FOR THE

COMPANY IF SHAREHOLDERS DO NOT

APPROVE THE SETTLEMENT AND

ASSIGNMENT?

The Company will pursue the various legal actions, but there

is no guarantee of success and, in the opinion of the

Directors, limited prospect of a future negotiated settlement

on better terms.

If the Resolution is not approved by Shareholders, among

other things, this means the disputes will not be settled and

the Company will continue to expend funds and management

time in dealing with the litigation and associated issues.

If the Settlement and Assignment is not approved, the ability

for the Company to make a clean exit from the Tujuh Bukit

Project and associated disputes, will be lost.

VOTING

APPOINTMENT AND REVOCATION OF

PROXIES FOR HOLDERS OF ORDINARY

SHARES

A Shareholder of one or more ordinary share is entitled to

attend and vote at the Meeting or, if unable to attend, a

Shareholder may, by using the applicable Proxy Form

enclosed, appoint another person (who need not be a

Shareholder of the Company), to attend the Meeting and

represent the Shareholder (Proxy). The Chairman of the

Meeting will be appointed as Proxy if a Proxy Form is

submitted by a Shareholder, but no one is named on the

form.

A Shareholder desiring to appoint a Proxy may do so by

inserting another persons name in the blank space provided

in the Proxy Form and returning the completed and executed

Proxy Form by no later than 2:00 pm AEST for ASX registered

holders and 12:00 am EDT for TSX registered holders on

7 April 2014 to the Companys share registry, Computershare

Investor Services Pty Limited,in accordance with the

lodgement instructions detailed on the applicable

Proxy Form.

A Shareholder is entitled to appoint up to two Proxies to

attend the Meeting and represent the Shareholder. If a

Shareholder appoints two Proxies, the Shareholder must

specify the percentage of votes or number of shares for each

Proxy; otherwise each Proxy may exercise half of the votes.

A Proxy can be appointed by the Shareholder or the

Shareholders attorney duly authorised in writing, or, if the

Shareholder is a corporation, under its corporate seal by an

ofcer or attorney thereof duly authorised.

A Shareholder submitting the Proxy Form may indicate the

manner in which the Proxy is to vote with respect to any

specic item of business by ticking the appropriate box. If

the Shareholder wishes to confer discretionary authority on

the Proxy (or Chairman of the Meeting) with respect to any

item of business, then the boxes opposite the item can be left

blank. The shares represented by the Proxy Form submitted

by a Shareholder will be voted in accordance with the

directions, if any, given in the Proxy Form.

In addition to any other manner permitted by law, the Proxy

may be revoked before it is exercised. Such revocation must

be in writing and executed and delivered in the same manner

as the Proxy Form at any time up to and including 7:00 pm

AEST for ASX registered holders and 5:00 am EDT for TSX

registered holders on 7 April 2014 or delivered to the

Chairman of the Meeting on the day of the Meeting or any

adjournment thereof, prior to the time of voting and upon

either such occurrence, the Proxy is revoked.

www.intrepidmines.com

Intrepid Mines Limited ABN 11 060 156 452 Page 14

has not been signed by the Intermediary and which,

when properly completed and signed by the Benecial

Shareholder and returned to the Intermediary (or its

service company), will constitute voting instructions (often

called a Voting Instruction Form) which the Intermediary

must follow. Typically the Benecial Shareholder will also

be given a page of instructions that contains a removable

label containing a bar code and other information. In order

for the form to constitute a valid Voting Instruction Form,

the Benecial Shareholder must remove the label from the

instructions and afx it to the Voting Instruction Form and

properly complete and sign the Voting Instruction Form

and submit it to the Intermediary (or its service company)

in accordance with the instructions of the Intermediary (or

its service company).

In either case, the purpose of this procedure is to permit

Benecial Shareholders to direct the voting of the ordinary

shares they benecially own.

Benecial Shareholders should carefully follow

the instructions of their Intermediary including

those regarding when and where the Proxy Form

is to be submitted.

EXERCISE OF DISCRETION BY PROXIES

The persons appointed as Proxy may attend the Meeting and

will vote the shares or voting rights in respect of which they

are appointed in accordance with the directions of the

persons appointing them.

The enclosed Proxy Form confers discretionary authority

upon the persons named therein with respect to any

amendment, variation or other matter to come before the

Meeting other than the matters referred to in the Notice of

Meeting.

However, if any such amendments, variations, or other

matters which are not now known to management, should

properly come before the meeting, the ordinary shares and

voting rights represented by the Proxies hereby solicited will

be voted in accordance with the best judgment of the person

or persons voting such Proxies.

Where the Chairman has been appointed as Proxy and there

is no direction from Shareholders, all available Proxies

shares will be voted for the Resolution.

Please note that Shareholders who receive their Meeting

materials from Broadridge Investor Communications

Solutions (Broadridge) must return the proxy forms, once

voted, to Broadridge for the proxy to be dealt with.

ADVICE TO BENEFICIAL

SHAREHOLDERS ON THE CANADIAN

REGISTRY

Only Shareholders with registered ordinary shares or the

persons they appoint as their Proxies are permitted to vote at

the Meeting.

In many cases, ordinary shares that are benecially owned by

a person (Benecial Shareholder) are registered either:

in the name of an Intermediary that the Benecial

Shareholder deals with in respect of the ordinary shares;

or

in the name of a clearing agency (such as the Canadian

Depository for Securities Limited (CDS) of which the

Intermediary is a participant (Intermediary).

The Company has distributed the Meeting Materials to

Intermediaries for onward distribution to Benecial

Shareholders in accordance with the requirements of

National Instrument 54-101. Intermediaries are required to

forward the Meeting Materials to Benecial Shareholders

(unless a Benecial Shareholder has waived the right to

receive them). Very often, Intermediaries will use service

companies to forward the Meeting Materials to Benecial

Shareholders. Generally Benecial Shareholders, who have

not waived the right to receive Meeting Materials, will either

be given a form that:

has already been signed by the Intermediary (typically by

a facsimile stamped signature), and indicates the number

and class of securities benecially owned by the Benecial

Shareholder but the voting direction and other information

has not been completed. This form does not need to

be signed by the Benecial Shareholder however, if the

Benecial Shareholder wishes to direct their vote, they

should ll in the voting direction and submit it as specied;

or

Voting (Cont.)

www.intrepidmines.com

Notice of Extraordinary General Meeting 2014 Page 15

DISCLOSURES

VOTING SECURITIES AND PRINCIPAL

HOLDERS THEREOF

As at the Notice Date, the Company has outstanding

556,612,782 ordinary shares, each of which carries one vote.

Therefore, as of the Notice Date, the total number of votes

which may be cast at the Meeting is 556,612,782.

To the knowledge of the Directors and executive ofcers of

the Company, there are no parties who benecially own,

directly or indirectly, or exercise control or direction over

ordinary shares who are entitled to more than 10% of the

votes to be cast at the Meeting as of the Record Date.

A simple majority of votes cast is required to approve all

matters to be submitted to a vote of Shareholders at the

Meeting.

INTERESTS OF CERTAIN PERSONS IN

MATTERS TO BE ACTED UPON

Except as disclosed in this Notice of Meeting, no person who

has been a Director or executive ofcer of the Company at

any time since 1 January 2012 and their associates and

afliates has any material interest, direct or indirect, by way of

benecial ownership of securities or otherwise in any of the

matters to be acted upon at the Meeting other than in respect

of the Resolution on page 4 of this Notice of Meeting.

INDEBTEDNESS OF DIRECTORS,

EXECUTIVE OFFICERS AND SENIOR

OFFICERS

During the 12 month period ended 31 December 2013 none

of the Directors, senior ofcers or key employees of the

Company was indebted to the Company.

INTERESTS OF MANAGEMENT AND

OTHERS IN MATERIAL TRANSACTIONS

On 2 January 2012, Mr Machribie (Non-executive Director)

and the Company entered into a consulting services

agreement (Agreement) whereby it was agreed that Mr.

Machribie would provide services in respect of the

Companys Singaporean and Indonesian interests and

provide any other additional services as requested by the

Company under the terms of the Agreement. Mr. Machribies

consulting services will be performed in Indonesia and shall

be compensated based on agreed monthly instalments. The

consulting fee is in addition to Mr. Machribies directors fees.

Except as disclosed in this Notice of Meeting or in the 2012

Annual Report, no informed person, proposed Director or

associate or afliate of any informed person or proposed

Director has any material interest, direct or indirect in any

transaction entered into by the Company since 1 January

2012 or in any proposed transaction of the Company, save

that the Master Settlement Deed provides for releases from

liability and covenants not to take or support proceedings

against Directors, ofcers and employees of the Company

and its associates, All Directors and employees will have the

benet of these releases and covenants.

OTHER MATERIAL FACTS

For particulars of the Companys operations, please see the

Annual Information Form and the 2012 Annual Report.

CERTIFICATE AND APPROVAL OF

DIRECTORS

The Notice of Meeting and the mailing of same to

Shareholders have been approved by the Board.

Dated: 6 March 2014

By Order of the Board of Directors

Intrepid Mines Limited

Garry Gill

Company Secretary

Level 1 | 490 Upper Edward Street | Spring Hill Qld 4004 | Tel: +61 7 30078000 | Web: www.intrepidmines.com

www.intrepidmines.com

Page 16

Glossary

Term Meaning

ASX Australian Securities Exchange

BSI PT Bumi SuksesIndo

CEO Chief Executive Ofcer

Company Intrepid Mines Limited

Disputes The Criminal Complaints, the South Jakarta Proceedings, Adminstrative Proceeeings

and the Singapore Arbitration Proceedings

Emperor Emperor Mines Pty Limited

IAAUS IndoAust Mining Pty Limited

IABVI IndoAust Mining Limited

IMN PT Indo Multi Niaga

Maya Maya Miranda Ambarsari

McDonald McDonald and Company (Australasia) Pty Ltd

Meeting The Extraordinary General Meeting of Shareholders will be held on Wednesday 9 April

2014 at 2:00 pm (AEST) at Brisbane Marriott Hotel 515 Queen Street Brisbane QLD

MSJ PT Merdeka Serasi Jaya

MSJ Securities Convertible Bond and Option

Record Date 7:00 pm (AEST) for ASX registered holders and 7:00 am (EDT) for TSX registered

holders on 7 April 2014

Reza Andreas Reza Nazaruddin

Settlement Deed The Master Settlement Deed dated 17 February 2014 between Emperor Mines Pty

Limited, Intrepid Mines Limited, Tujuh Bukit Pte Ltd, PT Indo Multi Niaga, Maya

Miranda Ambarsari, Andreas Reza Nazaruddin, Garibaldi Thohir, PT Bumi Suksesindo,

PT Damai Suksesindo, PT Alfa Suksesindo, PT Merdeka Serasi Jaya, PT Trimitra Karya

Jaya. PT Mitra Daya Mustika, Edwin Soeryadjaya, PT Provident Capital Indonesia,

Sakti Wahyu Trenggono, PT Srivijaya Kapital, Paul Michael Willis, Indoaust Mining

Limited, Indoaust Mining Pty Ltd. Provident Capital Partners Pte Ltd subject to

approval under Resolution

Share Transfer The transfer of Maya and Rezas shares in Tujuh Bukit Pte Ltd to Emperor.

Shareholders Shareholders of record of ordinary shares, unless specically stated otherwise

TSX Toronto Stock Exchange

Willis Paul Michael Willis

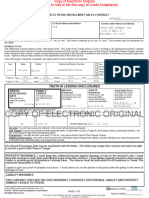

SRN/HIN: I9999999999

Lodge your vote:

Online:

www.investorvote.com.au

By Mail:

Computershare Investor Services Pty Limited

GPO Box 242 Melbourne

Victoria 3001 Australia

Alternatively you can fax your form to

(within Australia) 1800 783 447

(outside Australia) +61 3 9473 2555

For Intermediary Online subscribers only

(custodians) www.intermediaryonline.com

For all enquiries call:

(within Australia) 1300 552 270

(outside Australia) +61 3 9415 4000

Proxy Form

For your vote to be effective it must be received by 2:00pm (AEST) Monday, 7 April 2014

How to Vote on Items of Business

All your securities will be voted in accordance with your directions.

Appointment of Proxy

Voting 100% of your holding: Direct your proxy how to vote by

marking one of the boxes opposite each item of business. If you do

not mark a box your proxy may vote as they choose. If you mark

more than one box on an item your vote will be invalid on that item.

Voting a portion of your holding: Indicate a portion of your

voting rights by inserting the percentage or number of securities

you wish to vote in the For, Against or Abstain box or boxes. The

sum of the votes cast must not exceed your voting entitlement or

100%.

Appointing a second proxy: You are entitled to appoint up to two

proxies to attend the meeting and vote on a poll. If you appoint two

proxies you must specify the percentage of votes or number of

securities for each proxy, otherwise each proxy may exercise half of

the votes. When appointing a second proxy write both names and

the percentage of votes or number of securities for each in Step 1

overleaf.

Signing Instructions for Postal Forms

Individual: Where the holding is in one name, the securityholder

must sign.

Joint Holding: Where the holding is in more than one name, all of

the securityholders should sign.

Power of Attorney: If you have not already lodged the Power of

Attorney with the registry, please attach a certified photocopy of the

Power of Attorney to this form when you return it.

Companies: Where the company has a Sole Director who is also

the Sole Company Secretary, this form must be signed by that

person. If the company (pursuant to section 204A of the Corporations

Act 2001) does not have a Company Secretary, a Sole Director can

also sign alone. Otherwise this form must be signed by a Director

jointly with either another Director or a Company Secretary. Please

sign in the appropriate place to indicate the office held. Delete titles

as applicable.

Attending the Meeting

Bring this form to assist registration. If a representative of a corporate

securityholder or proxy is to attend the meeting you will need to

provide the appropriate Certificate of Appointment of Corporate

Representative prior to admission. A form of the certificate may be

obtained from Computershare or online at www.investorcentre.com

under the information tab, "Downloadable Forms".

Comments & Questions: If you have any comments or questions

for the company, please write them on a separate sheet of paper and

return with this form.

GO ONLINE TO VOTE,

or turn over to complete the form

A proxy need not be a securityholder of the Company.

Control Number: 999999

Go to www.investorvote.com.au or scan the QR Code with your mobile device.

Follow the instructions on the secure website to vote.

Vote online

Your access information that you will need to vote:

PLEASE NOTE: For security reasons it is important that you keep your SRN/HIN confidential.

Information line:

(within Australia) 1300 481 262

(outside Australia) +61 3 9415 4256

T 000001 000 IAU

MR SAM SAMPLE

FLAT 123

123 SAMPLE STREET

THE SAMPLE HILL

SAMPLE ESTATE

SAMPLEVILLE VIC 3030

Samples/000001/000001/i

*S000001Q01*

*

S

0

0

0

0

0

1

Q

0

1

*

I 9999999999

Change of address. If incorrect,

mark this box and make the

correction in the space to the left.

Securityholders sponsored by a

broker (reference number

commences with X) should advise

your broker of any changes.

Proxy Form

Please mark to indicate your directions

Appoint a Proxy to Vote on Your Behalf

I/We being a member/s of Intrepid Mines Limited hereby appoint

STEP 1

the Chairman

OR

PLEASE NOTE: Leave this box blank if

you have selected the Chairman of the

Meeting. Do not insert your own name(s).

or failing the individual or body corporate named, or if no individual or body corporate is named, the Chairman of the Meeting, as my/our proxy

to act generally at the meeting on my/our behalf and to vote in accordance with the following directions (or if no directions have been given, and

to the extend permitted by law, as the proxy sees fit) at the Extraordinary General Meeting of Intrepid Mines Limited to be held at the Marriott

Hotel Brisbane, 515 Queen St, Brisbane QLD 4000 on Wednesday, 9 April 2014 at 2:00pm (AEST) and at any adjournment or postponement of

that meeting.

STEP 2

Items of Business

PLEASE NOTE: If you mark the Abstain box for an item, you are directing your proxy not to vote on your

behalf on a show of hands or a poll and your votes will not be counted in computing the required majority.

SIGN

Signature of Securityholder(s) This section must be completed.

Individual or Securityholder 1 Securityholder 2 Securityholder 3

Sole Director and Sole Company Secretary Director Director/Company Secretary

Contact

Name

Contact

Daytime

Telephone Date

Your Directors unanimously believe that it is in the best interests of all shareholders for

the disputes to be settled on the terms outlined in this Notice of Meeting.

ORDINARY BUSINESS

of the Meeting

I ND

I A U 1 7 9 4 3 8 A

MR SAM SAMPLE

FLAT 123

123 SAMPLE STREET

THE SAMPLE HILL

SAMPLE ESTATE

SAMPLEVILLE VIC 3030

/ /

XX

That approval is given by the shareholders, for the purposes of ASX Listing Rule 11.2 and for all other

purposes, for the Company to enter into and complete the Settlement Documents and Assignment

Documents (as those terms are defined in the Explanatory Statement accompanying and forming part

of the Notice of Meeting), being a disposal of the main undertaking of the Company, for the purposes

and on terms consistent with those set out in the Explanatory Statement.

Item 1

You might also like

- Business PlanDocument30 pagesBusiness PlanMwas GavanaNo ratings yet

- PE2-001 - Nigerian Labour Law (Regu)Document7 pagesPE2-001 - Nigerian Labour Law (Regu)Tega Nesirosan100% (1)

- Credit Acceptance ContractDocument24 pagesCredit Acceptance ContractTracy SmithNo ratings yet

- Last BillDocument8 pagesLast BillnitinNo ratings yet

- (Non-Circumvention, Non-Disclosure Agreement (Ncnda) )Document4 pages(Non-Circumvention, Non-Disclosure Agreement (Ncnda) )Jorge100% (4)

- Managed Services Agreement TemplateDocument37 pagesManaged Services Agreement TemplateHawanatu Momoh0% (1)

- NFL V Eisma 127 SCRA 419Document9 pagesNFL V Eisma 127 SCRA 419GraceNo ratings yet

- Scope of Project Management Consultancy ServicesDocument20 pagesScope of Project Management Consultancy Servicesjayprakash101692% (13)

- Dale Strickland vs. Ernst & Young LLP DigestDocument8 pagesDale Strickland vs. Ernst & Young LLP DigestEmir MendozaNo ratings yet

- Rattiner's Review for the CFP Certification Examination, Fast Track, Study GuideFrom EverandRattiner's Review for the CFP Certification Examination, Fast Track, Study GuideRating: 4.5 out of 5 stars4.5/5 (2)

- Post Contract AdministrationDocument9 pagesPost Contract Administrationvaasto2003100% (1)

- Strickland v. Ernst & Young LLPDocument4 pagesStrickland v. Ernst & Young LLPYuri NishimiyaNo ratings yet

- Article 128Document4 pagesArticle 128Chard Faustino100% (1)

- NCNDA Uluslararasi Anlasma SablonuDocument10 pagesNCNDA Uluslararasi Anlasma SablonuCarlos SanchezNo ratings yet

- Pizza HutDocument80 pagesPizza HutPia CamilleNo ratings yet

- Hewlett Packard 2010proxyDocument78 pagesHewlett Packard 2010proxyCorinaChiritaNo ratings yet

- Hewlett Packard Proxy As-Filedtypeset PDF No BannersDocument80 pagesHewlett Packard Proxy As-Filedtypeset PDF No BannersCorinaChiritaNo ratings yet

- Accenture ProxyDocument177 pagesAccenture ProxyBinoj V JanardhananNo ratings yet

- Electronic Arts Inc. Fiscal Year 2011 Proxy Statement and Annual ReportDocument192 pagesElectronic Arts Inc. Fiscal Year 2011 Proxy Statement and Annual ReportXiao QianNo ratings yet

- International BreweriesDocument53 pagesInternational Breweriessolo66No ratings yet

- Fluor ProxyDocument86 pagesFluor ProxytopaNo ratings yet

- 004 BMK7Document92 pages004 BMK7Louis Mourre Del RioNo ratings yet

- Twitter Inc 2014 Notice and Proxy Statement BDocument34 pagesTwitter Inc 2014 Notice and Proxy Statement Bapi-270739408No ratings yet

- Lucky Lanka Milk Processing Co. Ltd. IPODocument147 pagesLucky Lanka Milk Processing Co. Ltd. IPOTharindu Chathuranga100% (1)

- Under Armour 2011 Annual Meeting NoticeDocument48 pagesUnder Armour 2011 Annual Meeting NoticeJohnny KimNo ratings yet

- Bluemont Way Reston, Virginia 20190Document61 pagesBluemont Way Reston, Virginia 20190Xinjay HuangNo ratings yet

- Polaris Shareholders Invited to 2016 Annual MeetingDocument71 pagesPolaris Shareholders Invited to 2016 Annual MeetingThiagoCostaNo ratings yet

- Disney 2003 Annual Meeting AgendaDocument48 pagesDisney 2003 Annual Meeting AgendaЂорђе МалешевићNo ratings yet

- Areit EGM Circular 31may2021Document106 pagesAreit EGM Circular 31may2021fefefNo ratings yet

- Panera Bread Company Annual Meeting NoticeDocument75 pagesPanera Bread Company Annual Meeting Noticebookluvver212No ratings yet

- Asensus 2021 Proxy StatementDocument88 pagesAsensus 2021 Proxy StatementFrancisco CruzNo ratings yet

- Diaspora Fund Fund ProspectusDocument56 pagesDiaspora Fund Fund ProspectusjohnagboNo ratings yet

- Public Bank 2013 Annual ReportDocument312 pagesPublic Bank 2013 Annual ReportArmi Faizal Awang100% (1)

- Borg Warner Inc - Proxy 03-18-16Document64 pagesBorg Warner Inc - Proxy 03-18-16ThiagoCostaNo ratings yet

- Fy 2022 23 1Document306 pagesFy 2022 23 1aswinia499No ratings yet

- 2022 Annual Report enDocument372 pages2022 Annual Report enffxv4metalNo ratings yet

- 2005 2006Document62 pages2005 2006aswinia499No ratings yet

- MEDIA-AnnualReport2007 (3MB) PDFDocument236 pagesMEDIA-AnnualReport2007 (3MB) PDFSharma Reddy Sri RamuluNo ratings yet

- Annual Report 05 06Document92 pagesAnnual Report 05 06www_mageshmba2410No ratings yet

- Report Reviews India's Depository Receipt Scheme to Facilitate Global Capital AccessDocument110 pagesReport Reviews India's Depository Receipt Scheme to Facilitate Global Capital AccessNeerajKapoorNo ratings yet

- Del Monte IPODocument201 pagesDel Monte IPOhandsomefaceNo ratings yet

- RCL AGM Report 2019-20Document188 pagesRCL AGM Report 2019-20amrita choudharyNo ratings yet

- RHF Annual Report 2020-21Document132 pagesRHF Annual Report 2020-21crsmaniNo ratings yet

- Business P.Document15 pagesBusiness P.Mustefa Usmael100% (1)

- Luen Wong Group ProspectusDocument405 pagesLuen Wong Group ProspectusKelvin ChanNo ratings yet