Professional Documents

Culture Documents

Lincoln Crowne Excellence in Oil & Gas M&a 120314Fnl

Uploaded by

Lincoln Crowne & CompanyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lincoln Crowne Excellence in Oil & Gas M&a 120314Fnl

Uploaded by

Lincoln Crowne & CompanyCopyright:

Available Formats

W

O

R

K

B

O

O

K

WWW.LCC.ASIA | Lincoln Crowne & Company 12 March 2014

E

x

c

e

l

l

e

n

c

e

I

n

O

i

l

&

G

a

s

C

o

n

f

e

r

e

n

c

e

P

r

e

s

e

n

t

a

t

i

o

n

Page | 1

Oil & Gas Services M & A

Prepared for 9

th

Annual Excellence In Oil & Gas Conference, 12

th

March 2014

Resourceful Events

Nicholas A. Assef LLB (Hons), LLM, MBA

W

O

R

K

B

O

O

K

WWW.LCC.ASIA | Lincoln Crowne & Company 12 March 2014

E

x

c

e

l

l

e

n

c

e

I

n

O

i

l

&

G

a

s

C

o

n

f

e

r

e

n

c

e

P

r

e

s

e

n

t

a

t

i

o

n

Workbook Contents

Page | 2

1. Macro Sector & Regional Drivers - Upstream

2. Deal Environment & Drivers

3. Valuation Arbitrage? Cross Border Observations

4. Strategic Due Diligence: Current Deal Challenges

5. Northern Hemisphere Deals: Samples of Specialists

6. Opportunities & Trends

LCC is a specialist M & A Firm that is skilled at leading

Directors and Senior Management through the

complex Strategic, Financial, Governance & Project

Management requirements of Public Transactions

Since 2011 LCC has advised on c. A$500m in closed

M & A transactions, c. A$300m in associated deal

financings and is currently advising on a range of

complex M & A and advisory transactions including

the renegotiation of a multi decade royalty

arrangement with Life of Royalty value c. A$1.5b

LCCs weekly market research updates include M & A

activity in the Engineering & Contracting sector in

Australia

W

O

R

K

B

O

O

K

WWW.LCC.ASIA | Lincoln Crowne & Company 12 March 2014

E

x

c

e

l

l

e

n

c

e

I

n

O

i

l

&

G

a

s

C

o

n

f

e

r

e

n

c

e

P

r

e

s

e

n

t

a

t

i

o

n

Macro Sector & Regional Drivers - Upstream

Page | 3

Macro Picture Looks Attractive, But Many Challenges..

0

5000

10000

15000

20000

25000

30000

Australian Energy Exports

LNG Crude Oil

!""#$"%&'

)*

+&,-./.0.12

34*

5#66.7&'

88*

5#690&1&'

:*

LNG, Gas, Oil Major Project Pipeline

$294 Billion in Notional Projects

! Multiple Gas precincts c. Australia ! Capital deployment priority cheaper taxing nations ?

! South East Asia demand effects Fukushima ? ! US an advanced cheap producer of Oil & Gas (gas glut ?)

! Government desire royalties / cashflows ! Australian track record hitting timetable / budget ?

Source : BREE, LCC Calculations

Gas Exports Trending Up

W

O

R

K

B

O

O

K

WWW.LCC.ASIA | Lincoln Crowne & Company

!"#$%&' ()*+,- .%-+,/ !%$ 1234 (56 7 589(:3 134 :,%; !"<&/=

Seaurlll n?SL : Su8L 18,381 $ 12.80x 10

!acobs Lnglneerlng n?SL : !LC 9,194 $ 11.00x 13 !"#$%&%'%() %) +,-. (/ 012 3()&$4'%)5 /(6 !7-8.,,9

CuanLa Servlces n?SL : W8 7,690 $ 9.20x 6 !"#$%&%'%() (/ :!3!; /(6 !7-,,9

Chlcago 8rldge & lron n?SL : C8l 8,940 $ 11.00x 4 <)"4$=>= ?07@ABC4) 9>65>6 D%'E 0EFD G6($H %) +,-+

McuermoLL lnLernaLlonal n?SL : Mu8 2,146 $ 9.00x 2 IF&' J KLL;0L! G6($H (//&E(6> M%4 N GF& 0>6O%">

Lmcor Croup n?SL : LML 3,400 $ 10.30x 6 !"#$%&%'%() (/ ?02 /6(9 P0L /(6 7++Q9 %) R$)> +,--

>?@ABC D&E,)FG/,H .,%&

0H>"%F4%&' M//&E(6> K6%44>6A ?07-8,S9 9>65>6 D%'E 0"(6H%() M//&E(6> %) +,-,

12 March 2014

E

x

c

e

l

l

e

n

c

e

I

n

O

i

l

&

G

a

s

C

o

n

f

e

r

e

n

c

e

P

r

e

s

e

n

t

a

t

i

o

n

Deal Environment & Drivers

Page | 4

Cross Border / Foreign Direct Investment

Capitalise on market imperfections & expanding market

opportunities

Follow local Upstream client cross border

Seek higher margin markets

Enter / expand on sustainable Projects

Deal with Regulatory & Union issues efficiently

! Valuation Arbitrage

! Abundance of Capital in North America

! Overall Deal Momentum Lifting

Domestic M & A Rationale

Geographic balancing (West & East Coast)

Institutional Investor sentiment (O & G exposure ?)

Seek higher margin sub markets (not commoditised)

Diversify Revenue & Client Base

Liquidity Events For Smaller Players

Valuation arbitrage

! Limited Debt Financing for M & A

! Bidder Valuations Depressed vs Northern Hemisphere

! Opportunism vs Strategic Valuations Prevail

! Strong Balance Sheet The Priority

! PE rotated away from sector for moment

Mining Boom

Over ?

Large Diversified Engineering & Contractors Value in A$m

^ Deal Count since 1 January 2010

Source : Company Data, LCC Research

Just Corporate : Also high interest from Offshore PE / Pension Funds M & A back in vogue : In Australia many Toehold deals

Distressed Deals

W

O

R

K

B

O

O

K

WWW.LCC.ASIA | Lincoln Crowne & Company 12 March 2014

E

x

c

e

l

l

e

n

c

e

I

n

O

i

l

&

G

a

s

C

o

n

f

e

r

e

n

c

e

P

r

e

s

e

n

t

a

t

i

o

n

Valuation Arbitrage? Cross Border Observations

Page | 5

North American Public Company Sample

Australian Public Company Sample

!"#$%&' ()*+,- .%-+,/ !%$ 1234 (56 7 589(:3 134

SouLhern Cross LlecLrlcal ASx : SxL 130 3.10x SpeclallsL LlecLrlcal layer. valuaLlon mulLlple skewed because c$30m Cash (Low uebL)

WuS ASx : WuS 164 $ 3.90x valuaLlon mulLlple skewed because c. $43m Cash (no uebL). LCC assumes clrca A$32m L8l1uA l?14

A! Lucas ASx : A!L 260 $ - LxploraLlon & roducLlon urllllng, lpellne. dlvlslon focussed CSC

uecmll Croup ASx : uCC 362 $ 4.20x Acqulred LasLcoasL uevelopmenL Lnglneerlng for A$30.12m ln leb 2013

1ox lree SoluLlons ASx : 1Cx 446 $ 7.30x upsLream & downsLream Cll & Cas wasLe & lndusLrlal servlces

Mermald Marlne ASx : M8M 334 $ 3.30x Marlne LoglsLlcs. lLchLys Cas pro[ecL 2 laLform Supply vessel deal [ $143m conLracL

Skllled Croup ASx : SkL 740 $ 10.20x PlsLorlcally Labour Plre, buL acqulred 8roadsword Marlne ConLracLlng ln uarwln for A$72m ln !une 2013

Monadelphous ASx : Mnu 1,613 $ 6.10x 8ecenLly won large Cas lM pro[ecL - A$130m [ Woodslde's karraLha Cas lanL

Worleyarsons ASx : WC8 4,082 $ 9.70x SLrong Cff shore & Cnshore presence ln Pydrocarbons ulvlslon

;&<,)=>/,? .,%& @ABCD

!"#$%&' ()*+,- .%-+,/ !%$ 1234 (56 7 589(:3 134 :,%; !"<&/=

Seaurlll n?SL : Su8L 18,381 $ 12.80x 10

!acobs Lnglneerlng n?SL : !LC 9,194 $ 11.00x 13 !"#$%&%'%() %) +,-. (/ 012 3()&$4'%)5 /(6 !7-8.,,9

CuanLa Servlces n?SL : W8 7,690 $ 9.20x 6 !"#$%&%'%() (/ :!3!; /(6 !7-,,9

Chlcago 8rldge & lron n?SL : C8l 8,940 $ 11.00x 4 <)"4$=>= ?07@ABC4) 9>65>6 D%'E 0EFD G6($H %) +,-+

McuermoLL lnLernaLlonal n?SL : Mu8 2,146 $ 9.00x 2 IF&' J KLL;0L! G6($H (//&E(6> M%4 N GF& 0>6O%">

Lmcor Croup n?SL : LML 3,400 $ 10.30x 6 !"#$%&%'%() (/ ?02 /6(9 P0L /(6 7++Q9 %) R$)> +,--

>?@ABC D&E,)FG/,H .,%&

0H>"%F4%&' M//&E(6> K6%44>6A ?07-8,S9 9>65>6 D%'E 0"(6H%() M//&E(6> %) +,-,

Source : Company Data : LCC Research

W

O

R

K

B

O

O

K

WWW.LCC.ASIA | Lincoln Crowne & Company 12 March 2014

E

x

c

e

l

l

e

n

c

e

I

n

O

i

l

&

G

a

s

C

o

n

f

e

r

e

n

c

e

P

r

e

s

e

n

t

a

t

i

o

n

EMCOR Group Inc. (NYSE : EME)

Page | 6

Source : Company data, LCC Calculations, CapitalIQ, Bloomberg

Consistent M & A activity since 2010, including acquisition USM from TSE for c. $230m

W

O

R

K

B

O

O

K

WWW.LCC.ASIA | Lincoln Crowne & Company 12 March 2014

E

x

c

e

l

l

e

n

c

e

I

n

O

i

l

&

G

a

s

C

o

n

f

e

r

e

n

c

e

P

r

e

s

e

n

t

a

t

i

o

n

Jacobs Engineering Group Inc. (NYSE : JEC)

Page | 7

11 of 15 deals executed when TEV / EBITDA Multiple Higher than 8.0x (A)

T

E

V

/

E

B

I

T

D

A

x

(

A

)

Rapid Fire Deal Window

7 Deals in c. 8 Months

Deal Momentum

Source : Company data, LCC Calculations, CapitalIQ, Bloomberg

W

O

R

K

B

O

O

K

WWW.LCC.ASIA | Lincoln Crowne & Company 12 March 2014

E

x

c

e

l

l

e

n

c

e

I

n

O

i

l

&

G

a

s

C

o

n

f

e

r

e

n

c

e

P

r

e

s

e

n

t

a

t

i

o

n

Strategic Due Diligence: Current Deal Challenges

Page | 8

Each Deal Is Different : On High Alert For Areas That Can Cause Margin Collapse

Client Lists

Recent CAPEX

Spend

Contract Waterfall

Technology vs

Plain Vanilla

Union & Personnel

Issues

Health & Safety

Issues

Variations &

Claims

Outstanding

Spread of Clients

Project Lifecycle

Client Pedigree

CAPEX Starved ?

CAPEX Bubbles

Current Competitiveness

of Kit Technology Shift

Term of Contracts

Style of Contract

- Fixed

- Open Book

- Cost Reimburse

How Technical Work ?

Competitors for Work ?

Cost of Technology ?

How Easy To Replace

Contractor on Site ?

1

2

3

4 5

6

7

Delays in Payment

% of Actual Claim or

Variation

Track record of Sponsor in

Resolving

Who the Sponsor is

Safety Standards

Effect On Insurances

Harmonisation of Work

Standards

Union Presence On Site

Key Personnel - Roles

Relationships With Client

Employee Benefits

- Accommodations

Schedules where FIFO

1

2

3

4

5

6

7

W

O

R

K

B

O

O

K

WWW.LCC.ASIA | Lincoln Crowne & Company 12 March 2014

E

x

c

e

l

l

e

n

c

e

I

n

O

i

l

&

G

a

s

C

o

n

f

e

r

e

n

c

e

P

r

e

s

e

n

t

a

t

i

o

n

International Deals : Samples of Specialists

Page | 9

Natural Gas

Partners LLC

www.msenergyservices.com 6.86x **

Onshore gas field Horizontal

Directional Driller (USA)

Alta Disposal www.altadisposal.com 7.00x **

Oilfield Waste Disposal including

Fracing Water (Canada)

Intertek Group PLC www.int-inspec.com 6.17x

Onshore & Offshore Non Destructive

Testing & Inspection Services

(Norway)

EQT Partners AB www.akersolutions.com 6.9x

Well intervention services including

well casing, testing, metering &

wireline services (Norway)

** Minority Interest Deals

Business Growth Fund

PLC

www.spex-innovation.com 6.14x

Offshore recovery, severing &

explosives operator

(Scotland)

HitecVision AS www.reefsubsea.com 7.81x

Offshore Construction, trenching &

cabling Fleet Operator

(Norway)

O

n

s

h

o

r

e

T

r

a

n

s

a

c

t

i

o

n

s

O

f

f

s

h

o

r

e

T

r

a

n

s

a

c

t

i

o

n

s

CSG, Shale & LNG Driven Demand ACQUIRER TEV / EBITDA

W

O

R

K

B

O

O

K

WWW.LCC.ASIA | Lincoln Crowne & Company 12 March 2014

E

x

c

e

l

l

e

n

c

e

I

n

O

i

l

&

G

a

s

C

o

n

f

e

r

e

n

c

e

P

r

e

s

e

n

t

a

t

i

o

n

Opportunities & Trends

Page | 10

Deal Activity Will Continue In Particular Cross Border Deal Activity In Marine & Unconventional Gas

Planets are aligned for ongoing Cross Border activity

! Weak AUD compared to 12 months ago

! Ongoing strong Onshore & Offshore Project Pipeline

! Unconventionals (CSG, Shale Oil)

! High International Valuations

! M & A Activity Warming Up In Northern Hemisphere

! High Access To Capital In Northern Hemisphere

! Good Pipeline of Potential Projects

! Weak Domestic Valuations

! Difficulty in Deal Financing (Debt and Equity)

! Reasonable Public Domestic Balance Sheets (Targets ?)

! Deal Challenges May Go To Value/Structure or Kill Deals

Baytex Energy acquires Aurora Oil & Gas for

A2,316m. Assets include Eagle Ford Shale Belt

in South Texas

(Both complex service delivery areas)

W

O

R

K

B

O

O

K

WWW.LCC.ASIA | Lincoln Crowne & Company

PHILANTHROPY lincolncrownefoundation.org

The Lincoln Crowne Foundation is an extension of the Firms corporate social

responsibility arm that director, Nicholas Assef initiated.The foundations main

purpose is to support and extend partnership development to grass roots

charities.

GOVERNANCE unglobalcompact.org

We are governed by our commitment as a signatory to the UN Global

Compact. The UN Global Compact is a strategic policy initiative for

businesses that are committed to aligning their operations and strategies to

ten universally accepted principles in the areas of human rights, labour,

environment and anti-corruption.

ACADEMIA bond.edu.au

LCC and Bond University has established a relationship around the

importance of success, academic integrity and outstanding performance. To

this end, LCC has sponsored various faculty awards in both the Business and

Law Schools.

SPORT lincolncrownesailing.com.au

LCC has sponsored 12 and 16ft skiffs in Sydney, over numerous sailing

seasons and championships.

In partnership with Variety the Childrens Charity, Nicholas Assef proudly

supported the Variety Port Jackson 12ft Skiff Championships. This event

marked the launch of a series of projects committed to raising support for

Alopecia Areata, which is a medical condition of which there is no known cure.

12 March 2014

E

x

c

e

l

l

e

n

c

e

I

n

O

i

l

&

G

a

s

C

o

n

f

e

r

e

n

c

e

P

r

e

s

e

n

t

a

t

i

o

n

Page | 11

LCCs Community Focus

W

O

R

K

B

O

O

K

WWW.LCC.ASIA | Lincoln Crowne & Company

E

x

c

e

l

l

e

n

c

e

I

n

O

i

l

&

G

a

s

C

o

n

f

e

r

e

n

c

e

P

r

e

s

e

n

t

a

t

i

o

n

12 March 2014

Contact us

Page | 12

AUSTRALIAN OFFICE

Suite 1, Level 30

Governor Phillip Tower

1 Farrer Place

Sydney NSW 2000

Australia

Correspondence

GPO Box 4154

Sydney NSW 2001

T: +612 9262 2121

F: +612 8088 1239

PRESENTER

Nicholas Assef

naa@lcc.asia

T: +612 8288 8688

HONG KONG REP OFFICE

20/F

One International

Finance Centre

1 Harbour View Street

Central Hong Kong

HONG KONG

T: +852 3960 6532

F: +852 3669 8008

AFSL 278054

ACN 105 807 645

www. l cc. asi a

W

O

R

K

B

O

O

K

WWW.LCC.ASIA | Lincoln Crowne & Company 12 March 2014

E

x

c

e

l

l

e

n

c

e

I

n

O

i

l

&

G

a

s

C

o

n

f

e

r

e

n

c

e

P

r

e

s

e

n

t

a

t

i

o

n

Page | 13

Important Information

This presentation (Presentation) has been drafted by Lincoln Crowne & Company Pty Limited and/or its affiliates (together, LCC) for the exclusive use of the party to whom LCC delivers this presentation (the Recipient) using information

provided from a variety of sources, including publicly available information and potentially information from the Recipient. You acknowledge and agree LCC has not independently verified the information contained in this Presentation, nor does

LCC make any representation or warranty, either express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation. This Presentation should not be regarded by the Recipient as a substitute for

the exercise of its own judgment, and the Recipient is expected to rely on its own due diligence, including separate legal, tax and accounting, if it wishes to proceed further in relation to any transaction concept outlined in this Presentation.

The indicative valuations, forecasts, estimates, opinions and projections contained in this Presentation involve elements of subjective judgment and analysis. They are based on facts and data that are often subject to rapid change. Any

opinions expressed in this material are subject to change without notice. This Presentation may contain forward-looking statements, included those reported by various Companies. LCC undertakes no obligation to update these forward-looking

statements for events or circumstances that occur subsequent to such dates or to update or keep current any of the information contained in this Presentation. Any estimates or projections as to events that occur in the future (including

projections of revenue, expense, net income and stock performance) are based upon the best judgment of LCC from the information provided by the Recipient and other publicly available as of the date of this presentation. Any statements,

estimates or projections as to LCCs fees or other pricing are accurate only as at the date of this presentation. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary from the projections and

such variations may be material.

Nothing contained in this Presentation is, or shall be relied upon as, a promise or presentation as to the past or the future. LCC, its affiliates, directors, employees and/or agents expressly disclaim any and all liability relating or resulting from

inaccurate or incomplete information and the use or reliance of all or any part of this Presentation or any of the information contained within this Presentation.

By accepting this Presentation, the Recipient acknowledges and agrees that LCC will at all times act as an independent contractor on an arms-length basis and will not act in any other capacity, including in a fiduciary capacity, with respect to

the Recipient. LCC may provide services to any member of the same group as the Recipient or any other entity or person (a Third Party), engage in any transaction (on its own account or otherwise) with respect to the Recipient or a Third

Party, or act in relation to any matter for itself or any Third Party, notwithstanding that such services, transactions or actions may be adverse to the Recipient or any member of its group, and LCC may retain for its own benefit any related

remuneration or profit.

This Presentation has been prepared solely for informational purposes and is not to be constructed as a solicitation or an offer to buy or sell any securities or related financial instruments. The Recipient should not construe the contents of this

presentation as legal, tax, accounting or investment advice or a recommendation. The Recipient should consult its own counsel, tax and financial advisors as to legal and related matters concerning any transaction described in this

Presentation. This Presentation does not purport to be all-inclusive or to contain all of the information that the Recipient may require. No investment, divestment or other financial decisions or actions should be based solely on the information in

this Presentation.

This presentation has been prepared on a confidential basis solely for the use and benefit of the Recipient. Distribution of this presentation to any person other than the Recipient and those persons retained to advice the Recipient, who agree

to maintain the confidentiality of this material and be bound by the limitations outlined herein, is not authorized by LCC. LCC specifically prohibits the redistribution or reproduction of this material in whole or in part without the written permission

of LCC and LCC accepts no liability whatsoever for the actions of third parties in this respect

Lincoln Crowne & Company holds a series of registered trademarks in the United States of America and Australia to protect its intellectual property. Those trademarks are Lincoln Crowne & Company: Reg. No. 4,107,955 with the United

States Patent & Trademark Office and the following with the Australian Government as certified by the Registrar of Trade Marks : Lincoln Crowne (Trade Mark No. 1423960); Lincoln Crowne & Company (Trade Mark No. 1423961);

LCC (Trade Mark No. 142116) and lincolncrowne (Trade Mark No. 1424175).

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Lincoln Crowne Engineering Mining Services Report 22 November 2013Document2 pagesLincoln Crowne Engineering Mining Services Report 22 November 2013Lincoln Crowne & CompanyNo ratings yet

- Lincoln Crowne Copper Gold Report 20131125Document4 pagesLincoln Crowne Copper Gold Report 20131125Lincoln Crowne & CompanyNo ratings yet

- Lincoln Crowne Engineering Sector Weekly 07032014Document2 pagesLincoln Crowne Engineering Sector Weekly 07032014Lincoln Crowne & CompanyNo ratings yet

- Lincoln Crowne Engineering Mining Services M & A Report 25 October 2013 PDFDocument2 pagesLincoln Crowne Engineering Mining Services M & A Report 25 October 2013 PDFLincoln Crowne & CompanyNo ratings yet

- Lincoln Crowne Engineering Mining Services Weekly 11102013Document2 pagesLincoln Crowne Engineering Mining Services Weekly 11102013Lincoln Crowne & CompanyNo ratings yet

- Market Review: S&P/ASX 100 Index Aud Vs UsdDocument2 pagesMarket Review: S&P/ASX 100 Index Aud Vs UsdLincoln Crowne & CompanyNo ratings yet

- Market Review: S&P/ASX 100 Index Aud Vs UsdDocument2 pagesMarket Review: S&P/ASX 100 Index Aud Vs UsdLincoln Crowne & CompanyNo ratings yet

- Lincoln Crowne Engineering Mining Services Research 26 July 2013Document2 pagesLincoln Crowne Engineering Mining Services Research 26 July 2013Lincoln Crowne & CompanyNo ratings yet

- Lincoln Crowne Engineering Mining Services 12 July 2013Document2 pagesLincoln Crowne Engineering Mining Services 12 July 2013Lincoln Crowne & CompanyNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- (1921) Manual of Work Garment Manufacture: How To Improve Quality and Reduce CostsDocument102 pages(1921) Manual of Work Garment Manufacture: How To Improve Quality and Reduce CostsHerbert Hillary Booker 2nd100% (1)

- Fertilization Guide For CoconutsDocument2 pagesFertilization Guide For CoconutsTrade goalNo ratings yet

- Escaner Electromagnético de Faja Transportadora-Steel SPECTDocument85 pagesEscaner Electromagnético de Faja Transportadora-Steel SPECTEdwin Alfredo Eche QuirozNo ratings yet

- Listen and Arrange The Sentences Based On What You Have Heard!Document3 pagesListen and Arrange The Sentences Based On What You Have Heard!Dewi Hauri Naura HaufanhazzaNo ratings yet

- Notes:: Reinforcement in Manhole Chamber With Depth To Obvert Greater Than 3.5M and Less Than 6.0MDocument1 pageNotes:: Reinforcement in Manhole Chamber With Depth To Obvert Greater Than 3.5M and Less Than 6.0Mسجى وليدNo ratings yet

- QuexBook TutorialDocument14 pagesQuexBook TutorialJeffrey FarillasNo ratings yet

- Wholesale Terminal Markets - Relocation and RedevelopmentDocument30 pagesWholesale Terminal Markets - Relocation and RedevelopmentNeha Bhusri100% (1)

- WarringFleets Complete PDFDocument26 pagesWarringFleets Complete PDFlingshu8100% (1)

- The RBG Blueprint For Black Power Study Cell GuidebookDocument8 pagesThe RBG Blueprint For Black Power Study Cell GuidebookAra SparkmanNo ratings yet

- YIC Chapter 1 (2) MKTDocument63 pagesYIC Chapter 1 (2) MKTMebre WelduNo ratings yet

- Quarter 1-Week 2 - Day 2.revisedDocument4 pagesQuarter 1-Week 2 - Day 2.revisedJigz FamulaganNo ratings yet

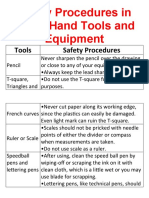

- Safety Procedures in Using Hand Tools and EquipmentDocument12 pagesSafety Procedures in Using Hand Tools and EquipmentJan IcejimenezNo ratings yet

- Sample - SOFTWARE REQUIREMENT SPECIFICATIONDocument20 pagesSample - SOFTWARE REQUIREMENT SPECIFICATIONMandula AbeyrathnaNo ratings yet

- Nanolithography - Processing Methods PDFDocument10 pagesNanolithography - Processing Methods PDFNilesh BhardwajNo ratings yet

- Clockwork Dragon's Expanded ArmoryDocument13 pagesClockwork Dragon's Expanded Armoryabel chabanNo ratings yet

- Phytotherapy On CancerDocument21 pagesPhytotherapy On CancerSiddhendu Bhattacharjee100% (1)

- PDFDocument10 pagesPDFerbariumNo ratings yet

- NCP - Major Depressive DisorderDocument7 pagesNCP - Major Depressive DisorderJaylord Verazon100% (1)

- Development Developmental Biology EmbryologyDocument6 pagesDevelopment Developmental Biology EmbryologyBiju ThomasNo ratings yet

- Quarter 1 - Module 1Document31 pagesQuarter 1 - Module 1Roger Santos Peña75% (4)

- LSCM Course OutlineDocument13 pagesLSCM Course OutlineDeep SachetiNo ratings yet

- Synthesis, Analysis and Simulation of A Four-Bar Mechanism Using Matlab ProgrammingDocument12 pagesSynthesis, Analysis and Simulation of A Four-Bar Mechanism Using Matlab ProgrammingPedroAugustoNo ratings yet

- MCI Approved Medical College in Uzbekistan PDFDocument3 pagesMCI Approved Medical College in Uzbekistan PDFMBBS ABROADNo ratings yet

- PC Model Answer Paper Winter 2016Document27 pagesPC Model Answer Paper Winter 2016Deepak VermaNo ratings yet

- The Influence of Irish Monks On Merovingian Diocesan Organization-Robbins BittermannDocument15 pagesThe Influence of Irish Monks On Merovingian Diocesan Organization-Robbins BittermanngeorgiescuNo ratings yet

- AMULDocument11 pagesAMULkeshav956No ratings yet

- Micro EvolutionDocument9 pagesMicro EvolutionBryan TanNo ratings yet

- Kazon Greater Predator MothershipDocument1 pageKazon Greater Predator MothershipknavealphaNo ratings yet

- SSP 237 d1Document32 pagesSSP 237 d1leullNo ratings yet

- Export Management EconomicsDocument30 pagesExport Management EconomicsYash SampatNo ratings yet