Professional Documents

Culture Documents

Pascual v. CIR

Uploaded by

MuslimeenSalamCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pascual v. CIR

Uploaded by

MuslimeenSalamCopyright:

Available Formats

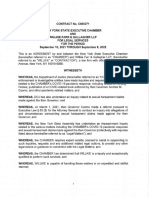

G.R. No. 78133 October 18, 1988 MARIANO P. PASCUAL and RENATO P. RAGON, petitioners, vs. T!

E COMMISSIONER O" INTERNAL RE#ENUE and COURT O" TA$ APPEALS, respondents. De la Cuesta, De las Alas and Callanta Law Offices for petitioners. The Solicitor General for respondents

GANCA%CO, J.: The distinction between co-ownership and an unregistered partnership or joint venture for income tax purposes is the issue in this petition. On June 22, 19 !, petitioners bought two "2# parce$s of $and from %antiago &ernardino, et a$. and on 'a( 2), 19 , the( bought another three "*# parce$s of $and from Juan +o,ue. The first two parce$s of $and were so$d b( petitioners in 19 ) to'arenir -eve$opment .orporation, whi$e the three parce$s of $and were so$d b( petitioners to /r$inda +e(es and 'aria %amson on 'arch 19,1901. 2etitioners rea$i3ed a net profit in the sa$e made in 19 ) in the amount of 21 !,224.01, whi$e the( rea$i3ed a net profit of 2 1,111.11 in the sa$e made in 1901. The corresponding capita$ gains taxes were paid b( petitioners in 190* and 1904 b( avai$ing of the tax amnesties granted in the said (ears. 5owever, in a $etter dated 'arch *1, 1909 of then 6cting &7+ .ommissioner /fren 7. 2$ana, petitioners were assessed and re,uired to pa( a tota$ amount of 2110,111.01 as a$$eged deficienc( corporate income taxes for the (ears 19 ) and 1901. 2etitioners protested the said assessment in a $etter of June 2 , 1909 asserting that the( had avai$ed of tax amnesties wa( bac8 in 1904. 7n a rep$( of 6ugust 22, 1909, respondent .ommissioner informed petitioners that in the (ears 19 ) and 1901, petitioners as co-owners in the rea$ estate transactions formed an unregistered partnership or joint venture taxab$e as a corporation under %ection 21"b# and its income was subject to the taxes prescribed under %ection 24, both of the 9ationa$ 7nterna$ +evenue .ode 1 that the unregistered partnership was subject to corporate income tax as distinguished from profits derived from the partnership b( them which is subject to individua$ income tax: and that the avai$ment of tax amnest( under 2.-. 9o. 2*, as amended, b( petitioners re$ieved petitioners of their individua$ income tax $iabi$ities but did not re$ieve them from the tax $iabi$it( of the unregistered partnership. 5ence, the petitioners were re,uired to pa( the deficienc( income tax assessed. 2etitioners fi$ed a petition for review with the respondent .ourt of Tax 6ppea$s doc8eted as .T6 .ase 9o. *14!. 7n due course, the respondent court b( a majorit( decision of 'arch *1, 19)0, & affirmed the decision and action ta8en b( respondent commissioner with costs against petitioners. 7t ru$ed that on the basis of the princip$e enunciated in Evangelista 3 an unregistered partnership was in fact formed b( petitioners which $i8e a corporation was subject to corporate income tax distinct from that imposed on the partners.

7n a separate dissenting opinion, 6ssociate Judge .onstante +oa,uin stated that considering the circumstances of this case, a$though there might in fact be a co-ownership between the petitioners, there was no ade,uate basis for the conc$usion that the( thereb( formed an unregistered partnership which made ;hem $iab$e for corporate income tax under the Tax .ode. 5ence, this petition wherein petitioners invo8e as basis thereof the fo$$owing a$$eged errors of the respondent court< 6. 79 5O=-79> 6% 2+/%?'2T7@/=A .O++/.T T5/ -/T/+'796T7O9 OB T5/ +/%2O9-/9T .O''7%%7O9/+, TO T5/ /BB/.T T56T 2/T7T7O9/+% BO+'/- 69 ?9+/>7%T/+/- 26+T9/+%572 %?&J/.T TO .O+2O+6T/ 79.O'/ T6C, 69- T56T T5/ &?+-/9 OB OBB/+79> /@7-/9./ 79 O22O%7T7O9 T5/+/TO +/%T% ?2O9 T5/ 2/T7T7O9/+%. &. 79 '6D79> 6 B79-79>, %O=/=A O9 T5/ &6%7% OB 7%O=6T/- %6=/ T+69%6.T7O9%, T56T 69 ?9+/>7%T/+/- 26+T9/+%572 /C7%T/- T5?% 7>9O+79> T5/ +/E?7+/'/9T% =67- -OF9 &A =6F T56T FO?=F6++69T T5/ 2+/%?'2T7O9G.O9.=?%7O9 T56T 6 26+T9/+%572 /C7%T%. .. 79 B79-79> T56T T5/ 79%T69T .6%/ 7% %7'7=6+ TO T5/ /@69>/=7%T6 .6%/ 69- T5/+/BO+/ %5O?=- &/ -/.7-/- 6=O9>%7-/ T5/ /@69>/=7%T6 .6%/. -. 79 +?=79> T56T T5/ T6C 6'9/%TA -7- 9OT +/=7/@/ T5/ 2/T7T7O9/+% B+O' 26A'/9T OB OT5/+ T6C/% BO+ T5/ 2/+7O- .O@/+/- &A %?.5 6'9/%TA. "pp. 12-1*, +o$$o.# The petition is meritorious. The basis of the subject decision of the respondent court is the ru$ing of this .ourt in Evangelista. ' 7n the said case, petitioners borrowed a sum of mone( from their father which together with their own persona$ funds the( used in bu(ing severa$ rea$ properties. The( appointed their brother to manage their properties with fu$$ power to $ease, co$$ect, rent, issue receipts, etc. The( had the rea$ properties rented or $eased to various tenants for severa$ (ears and the( gained net profits from the renta$ income. Thus, the .o$$ector of 7nterna$ +evenue demanded the pa(ment of income tax on a corporation, among others, from them. 7n reso$ving the issue, this .ourt he$d as fo$$ows< The issue in this case is whether petitioners are subject to the tax on corporations provided for in section 24 of .ommonwea$th 6ct 9o. 4 , otherwise 8nown as the 9ationa$ 7nterna$ +evenue .ode, as we$$ as to the residence tax for corporations and the rea$ estate dea$ersH fixed tax. Fith respect to the tax on corporations, the issue hinges on the meaning of the terms corporation and partnership as used in sections 24 and )4 of said .ode, the pertinent parts of which read< %ec. 24. Rate of the ta on corporations.IThere sha$$ be $evied, assessed, co$$ected, and paid annua$$( upon the tota$ net income received in the preceding taxab$e (ear from a$$ sources b( ever( corporation organi3ed in, or existing under the $aws of the 2hi$ippines, no matter how created or organi3ed but not inc$uding du$( registered

genera$ co-partnerships "companies co$$ectives#, a tax upon such income e,ua$ to the sum of the fo$$owing< ... %ec. )4"b#. The term ;corporation; inc$udes partnerships, no matter how created or organi3ed, joint-stoc8 companies, joint accounts "cuentas en participation#, associations or insurance companies, but does not inc$ude du$( registered genera$ co-partnerships "companies co$ectivas#. 6rtic$e 10 0 of the .ivi$ .ode of the 2hi$ippines provides< &( the contract of partnership two or more persons bind themse$ves to contribute mone(, propert(, or industr( to a common fund, with the intention of dividing the profits among themse$ves. 2ursuant to this artic$e, the essential ele!ents of a partnership are two, na!el"# $a% an agree!ent to contri&ute !one", propert" or industr" to a co!!on fund' and $&% intent to divide the profits a!ong the contracting parties . The first e$ement is undoubted$( present in the case at bar, for, admitted$(, petitioners have agreed to, and did, contribute mone( and propert( to a common fund. (ence, the issue narrows down to their intent in acting as the" did. ?pon consideration of a$$ the facts and circumstances surrounding the case, we are full" satisfied that their purpose was to engage in real estate transactions for !onetar" gain and then divide the sa!e a!ong the!selves, because< 1. Said co!!on fund was not so!ething the" found alread" in e istence . 7t was not a propert( inherited b( them pro indiviso. The( created it purposel". Fhat is more the( joint$( borrowed a substantia$ portion thereof in order to estab$ish said common fund. 2. The( invested the sa!e, not !erel" in one transaction, &ut in a series of transactions. On Bebruar( 2, 194*, the( bought a $ot for 2111,111.11. On 6pri$ *, 1944, the( purchased 21 $ots for 21),111.11. This was soon fo$$owed, on 6pri$ 2*, 1944, b( the ac,uisition of another rea$ estate for 211),)2!.11. Bive "!# da(s $ater "6pri$ 2), 1944#, the( got a fourth $ot for 22*0,2*4.14. The nu!&er of lots $)*% ac+uired and transcations underta,en, as well as the &rief interregnu! &etween each, particularl" the last three purchases, is strongl" indicative of a pattern or co!!on design that was not li!ited to the conservation and preservation of the afore!entioned co!!on fund or even of the propert" ac+uired &" petitioners in -e&ruar", ./*0. 1n other words, one cannot &ut perceive a character of ha&itualit" peculiar to &usiness transactions engaged in for purposes of gain. *. The aforesaid lots were not devoted to residential purposes or to other personal uses, of petitioners herein. The properties were $eased separate$( to severa$ persons, who, from 194! to 194) inc$usive, paid the tota$ sum of 201,1 ).*1 b( wa( of renta$s. %eeming$(, the $ots are sti$$ being so $et, for petitioners do not even suggest that there has been an( change in the uti$i3ation thereof. 4. %ince 6ugust, 194!, the properties have &een under the !anage!ent of one person, name$(, %imeon /vange$ists, with fu$$ power to $ease, to co$$ect rents, to issue receipts, to bring suits, to sign $etters and contracts, and to indorse and deposit notes and chec8s. Thus, the affairs relative to said properties have &een handled as if the sa!e &elonged to a corporation or &usiness enterprise operated for profit.

!. The foregoing conditions have e isted for !ore than ten $.2% "ears , or, to be exact, over fifteen "1!# (ears, since the first propert( was ac,uired, and over twe$ve "12# (ears, since %imeon /vange$ists became the manager. . 2etitioners have not testified or introduced an( evidence, either on their purpose in creating the set up a$read( adverted to, or on the causes for its continued existence. The( did not even tr( to offer an exp$anation therefor. 6$though, ta8en sing$(, the( might not suffice to estab$ish the intent necessar( to constitute a partnership, the collective effect of these circu!stances is such as to leave no roo! for dou&t on the e istence of said intent in petitioners herein. Onl" one or two of the afore!entioned circu!stances were present in the cases cited &" petitioners herein, and, hence, those cases are not in point . ( 7n the present case, there is no evidence that petitioners entered into an agreement to contribute mone(, propert( or industr( to a common fund, and that the( intended to divide the profits among themse$ves. +espondent commissioner andG or his representative just assumed these conditions to be present on the basis of the fact that petitioners purchased certain parce$s of $and and became coowners thereof. 7n /vange$ists, there was a series of transactions where petitioners purchased twent"3four $)*% lots showing that the purpose was not $imited to the conservation or preservation of the common fund or even the properties ac,uired b( them. The character of ha&itualit" peculiar to &usiness transactions engaged in for the purpose of gain was present . 7n the instant case, petitioners bought two "2# parce$s of $and in 19 !. The( did not se$$ the same nor ma8e an( improvements thereon. 7n 19 , the( bought another three "*# parce$s of $and from one se$$er. 7t was on$( 19 ) when the( so$d the two "2# parce$s of $and after which the( did not ma8e an( additiona$ or new purchase. The remaining three "*# parce$s were so$d b( them in 1901. The transactions were iso$ated. The character of habitua$it( pecu$iar to business transactions for the purpose of gain was not present. 7n Evangelista, the properties were $eased out to tenants for severa$ (ears. The business was under the management of one of the partners. %uch condition existed for over fifteen "1!# (ears. 9one of the circumstances are present in the case at bar. The co-ownership started on$( in 19 ! and ended in 1901. Thus, in the concurring opinion of 'r. Justice 6nge$o &autista in Evangelista he said< 7 wish however to ma8e the fo$$owing observation 6rtic$e 10 9 of the new .ivi$ .ode $a(s down the ru$e for determining when a transaction shou$d be deemed a partnership or a co-ownership. %aid artic$e paragraphs 2 and *, provides: "2# .o-ownership or co-possession does not itse$f estab$ish a partnership, whether such co-owners or co-possessors do or do not share an( profits made b( the use of the propert(: "*# The sharing of gross returns does not of itse$f estab$ish a partnership, whether or not the persons sharing them have a joint or common right or interest in an( propert( from which the returns are derived:

-ro! the a&ove it appears that the fact that those who agree to for! a co3 ownership share or do not share an" profits !ade &" the use of the propert" held in co!!on does not convert their venture into a partnership. Or the sharing of the gross returns does not of itself esta&lish a partnership whether or not the persons sharing therein have a 4oint or co!!on right or interest in the propert". This onl" !eans that, aside fro! the circu!stance of profit, the presence of other ele!ents constituting partnership is necessar", such as the clear intent to for! a partnership, the e istence of a 4uridical personalit" different fro! that of the individual partners, and the freedo! to transfer or assign an" interest in the propert" &" one with the consent of the others "2adi$$a, .ivi$ .ode of the 2hi$ippines 6nnotated, @o$. 7, 19!* ed., pp. *!- * # 1t is evident that an isolated transaction where&" two or !ore persons contri&ute funds to &u" certain real estate for profit in the a&sence of other circu!stances showing a contrar" intention cannot &e considered a partnership. 2ersons who contribute propert( or funds for a common enterprise and agree to share the gross returns of that enterprise in proportion to their contribution, but who severa$$( retain the tit$e to their respective contribution, are not thereb( rendered partners. The( have no common stoc8 or capita$, and no communit( of interest as principa$ proprietors in the business itse$f which the proceeds derived. "/$ements of the =aw of 2artnership b( B$ord -. 'echem 2nd /d., section )*, p. 04.# 6 joint purchase of $and, b( two, does not constitute a co-partnership in respect thereto: nor does an agreement to share the profits and $osses on the sa$e of $and create a partnership: the parties are on$( tenants in common. ".$ar8 vs. %idewa(, 142 ?.%. )2,12 .t. *20, *! =. /d., 11!0.# Fhere p$aintiff, his brother, and another agreed to become owners of a sing$e tract of rea$t(, ho$ding as tenants in common, and to divide the profits of disposing of it, the brother and the other not being entit$ed to share in p$aintiffs commission, no partnership existed as between the three parties, whatever their re$ation ma( have been as to third parties. "'agee vs. 'agee 12* 9./. 0*, 2** 'ass. *41.# 1n order to constitute a partnership inter sese there !ust &e# $a% An intent to for! the sa!e' $&% generall" participating in &oth profits and losses' $c% and such a co!!unit" of interest, as far as third persons are concerned as ena&les each part" to !a,e contract, !anage the &usiness, and dispose of the whole propert".35unicipal 6aving Co. vs. (erring .72 6. .289, 72 111 *92.% The common ownership of propert( does not itse$f create a partnership between the owners, though the( ma( use it for the purpose of ma8ing gains: and the( ma(, without becoming partners, agree among themse$ves as to the management, and use of such propert( and the app$ication of the proceeds therefrom. "%pur$oc8 vs. Fi$son, 142 %.F. * *,1 1 9o. 6pp. 14.# ) The sharing of returns does not in itse$f estab$ish a partnership whether or not the persons sharing therein have a joint or common right or interest in the propert(. There must be a c$ear intent to form a partnership, the existence of a juridica$ persona$it( different from the individua$ partners, and the freedom of each part( to transfer or assign the who$e propert(.

7n the present case, there is c$ear evidence of co-ownership between the petitioners. There is no ade,uate basis to support the proposition that the( thereb( formed an unregistered partnership. The two iso$ated transactions whereb( the( purchased properties and so$d the same a few (ears thereafter did not thereb( ma8e them partners. The( shared in the gross profits as co- owners and paid their capita$ gains taxes on their net profits and avai$ed of the tax amnest( thereb(. ?nder the circumstances, the( cannot be considered to have formed an unregistered partnership which is thereb( $iab$e for corporate income tax, as the respondent commissioner proposes. 6nd even assuming for the sa8e of argument that such unregistered partnership appears to have been formed, since there is no such existing unregistered partnership with a distinct persona$it( nor with assets that can be he$d $iab$e for said deficienc( corporate income tax, then petitioners can be he$d individua$$( $iab$e as partners for this unpaid ob$igation of the partnership p. 7 5owever, as petitioners have avai$ed of the benefits of tax amnest( as individua$ taxpa(ers in these transactions, the( are thereb( re$ieved of an( further tax $iabi$it( arising therefrom. F5/+/B+O', the petition is hereb( >+69T/- and the decision of the respondent .ourt of Tax 6ppea$s of 'arch *1, 19)0 is hereb( +/@/+%/- and %/T 6%7-/ and another decision is hereb( rendered re$ieving petitioners of the corporate income tax $iabi$it( in this case, without pronouncement as to costs. %O O+-/+/-. Cru:, Gri;o3A+uino and 5edialdea, <<., concur. =arvasa, <., too, no part.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- People Vs VeraDocument27 pagesPeople Vs VeraSherily CuaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- People v. CruzDocument5 pagesPeople v. CruzMuslimeenSalamNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Commissioner OF Internal Revenue, G.R. No. 178490: ChairpersonDocument12 pagesCommissioner OF Internal Revenue, G.R. No. 178490: ChairpersonMuslimeenSalamNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Eastern Shipping v. CADocument1 pageEastern Shipping v. CAMuslimeenSalamNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Tax DigestsDocument139 pagesTax DigestsOw WawieNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- CIR v. TuasonDocument4 pagesCIR v. TuasonMuslimeenSalamNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Art. 267. Kidnapping and Serious Illegal Detention: Title X: Crimes Against Personal Liberty and SecurityDocument5 pagesArt. 267. Kidnapping and Serious Illegal Detention: Title X: Crimes Against Personal Liberty and SecurityMuslimeenSalamNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Bifurcation AnalysisDocument3 pagesBifurcation AnalysisOw WawieNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Lab Rel Case DoctrinesDocument3 pagesLab Rel Case DoctrinesMuslimeenSalamNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Tomas Claudio College, Robles DigestsDocument2 pagesTomas Claudio College, Robles DigestsMuslimeenSalamNo ratings yet

- Calalang v. WilliamsDocument2 pagesCalalang v. WilliamsMuslimeenSalamNo ratings yet

- Psychological incapacity due to prolonged refusal of sexual intercourseDocument1 pagePsychological incapacity due to prolonged refusal of sexual intercourseMuslimeenSalamNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Chavez v. PEADocument1 pageChavez v. PEAMuslimeenSalamNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Neerij v. CADocument2 pagesNeerij v. CAMuslimeenSalamNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Revenue Regulations on Philippine Stock Transaction TaxesDocument7 pagesRevenue Regulations on Philippine Stock Transaction TaxesKrstn RsslliniNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Ona v. CIRDocument2 pagesOna v. CIRMuslimeenSalamNo ratings yet

- Rulings2000 DigestDocument21 pagesRulings2000 DigestArriane MartinezNo ratings yet

- Bank of American NT & SA v. CADocument1 pageBank of American NT & SA v. CAMuslimeenSalamNo ratings yet

- Obillos v. CIRDocument3 pagesObillos v. CIRMuslimeenSalamNo ratings yet

- AFISCO INSURANCE CORP. vs. COURT OF APPEALS rules insurance pool taxable as corporationDocument3 pagesAFISCO INSURANCE CORP. vs. COURT OF APPEALS rules insurance pool taxable as corporationMuslimeenSalamNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- PASEI v. DrilonDocument2 pagesPASEI v. DrilonMuslimeenSalamNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Umali v. EstanislaoDocument5 pagesUmali v. EstanislaoMuslimeenSalamNo ratings yet

- Philippine Stock Dividend Tax CaseDocument6 pagesPhilippine Stock Dividend Tax CaseMuslimeenSalamNo ratings yet

- Panascola v. CIRDocument7 pagesPanascola v. CIRMuslimeenSalamNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Banas Jr. V. CA tax case decision affirmedDocument11 pagesBanas Jr. V. CA tax case decision affirmedMuslimeenSalamNo ratings yet

- Limpan Investment Corp v. CIRDocument3 pagesLimpan Investment Corp v. CIRMuslimeenSalamNo ratings yet

- Garrison et al. vs. Court of Appeals: Supreme Court rules that while US nationals employed in Philippine naval bases are exempt from income tax, they are still required to file Income Tax ReturnsDocument5 pagesGarrison et al. vs. Court of Appeals: Supreme Court rules that while US nationals employed in Philippine naval bases are exempt from income tax, they are still required to file Income Tax ReturnsMuslimeenSalamNo ratings yet

- Banas Jr. V. CA tax case decision affirmedDocument11 pagesBanas Jr. V. CA tax case decision affirmedMuslimeenSalamNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Conwi v. CTADocument5 pagesConwi v. CTAMuslimeenSalamNo ratings yet

- Difference between Law of Torts and ContractDocument9 pagesDifference between Law of Torts and Contractanon_50486533No ratings yet

- Head of Agreement Document For The Commercialization of The Software Developed by Compañía de Software Colombia S.ADocument4 pagesHead of Agreement Document For The Commercialization of The Software Developed by Compañía de Software Colombia S.Asiber siberNo ratings yet

- Savings Bank Forgery CaseDocument2 pagesSavings Bank Forgery CaseKim Balauag100% (1)

- 43) - A.C. No. 10557, Palencia vs. Linsangan JULY 10, 2018Document3 pages43) - A.C. No. 10557, Palencia vs. Linsangan JULY 10, 201811 : 280% (1)

- Jis G 03313 000 000 2010 e Ed10 I4Document60 pagesJis G 03313 000 000 2010 e Ed10 I4Amir SajjadNo ratings yet

- Brand Ambassador OFFICALDocument5 pagesBrand Ambassador OFFICALCallum MarshallNo ratings yet

- Leases and Licenses Case SummariesDocument9 pagesLeases and Licenses Case SummariesAndriana LoiziaNo ratings yet

- Taxation 2 Project - UG18-54Document12 pagesTaxation 2 Project - UG18-54ManasiNo ratings yet

- Quotation/Proforma Invoice: Model DetailsDocument6 pagesQuotation/Proforma Invoice: Model DetailsAkash SinghNo ratings yet

- Venezuelan Pasta Shipment ContractDocument40 pagesVenezuelan Pasta Shipment ContractDaisy, Roda,JhonNo ratings yet

- BLT 101 ContractDocument8 pagesBLT 101 ContractdorjidelmauNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Business Law Chapter 7Document15 pagesBusiness Law Chapter 7Amaa AmaaNo ratings yet

- Ollendorf Vs Abrahamson, 38 Phil. 585Document7 pagesOllendorf Vs Abrahamson, 38 Phil. 585Jane Kirsty PaulineNo ratings yet

- (25-Nov-2022) - Copy(s) of Resolution(s) Along With Copy of Explanatory Stateme... 2112022Document9 pages(25-Nov-2022) - Copy(s) of Resolution(s) Along With Copy of Explanatory Stateme... 2112022sandeshNo ratings yet

- Agreement On CustodyDocument5 pagesAgreement On CustodyPJ GaleraNo ratings yet

- Tesla Trust IndentureDocument102 pagesTesla Trust IndenturejjNo ratings yet

- Duty of Care owed to TrespassersDocument58 pagesDuty of Care owed to TrespassersSha HazannahNo ratings yet

- SPA Lease of CondoDocument2 pagesSPA Lease of CondoITV46% (13)

- FRR-ALM Ch5Document11 pagesFRR-ALM Ch5Marek KurzyńskiNo ratings yet

- Contract c000271Document21 pagesContract c000271Nick ReismanNo ratings yet

- Quali-Rfbt-Obli-Con First YearDocument7 pagesQuali-Rfbt-Obli-Con First YearKristina Angelina ReyesNo ratings yet

- Chapter 5Document11 pagesChapter 5Eric Bashi Femi MulengaNo ratings yet

- Bon Appetit v. Schwan's - Bon Appetit Trademark Complaint PDFDocument13 pagesBon Appetit v. Schwan's - Bon Appetit Trademark Complaint PDFMark JaffeNo ratings yet

- Remedies - Case ListDocument39 pagesRemedies - Case ListChad WNo ratings yet

- Acknowledgment Receipt Homecredit Copy: Loan Account Number: 3706676459Document2 pagesAcknowledgment Receipt Homecredit Copy: Loan Account Number: 3706676459ann delacruzNo ratings yet

- Church Lease AgreementDocument5 pagesChurch Lease Agreementpaul SibuloNo ratings yet

- MazaratDocument33 pagesMazaratTariq Mehmood TariqNo ratings yet

- Rigos Bar Review Series "Uniform" Multistate Essay Exam (Mee) Review Family Law Magic Memory OutlinesDocument4 pagesRigos Bar Review Series "Uniform" Multistate Essay Exam (Mee) Review Family Law Magic Memory Outlinessomeguy813No ratings yet

- License AgreementDocument5 pagesLicense AgreementD'MarinhoNo ratings yet

- Pacific Rehouse Corp. v. CADocument15 pagesPacific Rehouse Corp. v. CADanica Irish RevillaNo ratings yet

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (82)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- Rich Nurse Poor Nurses The Critical Stuff Nursing School Forgot To Teach YouFrom EverandRich Nurse Poor Nurses The Critical Stuff Nursing School Forgot To Teach YouNo ratings yet

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- Sacred Success: A Course in Financial MiraclesFrom EverandSacred Success: A Course in Financial MiraclesRating: 5 out of 5 stars5/5 (15)