Professional Documents

Culture Documents

Petron Business Plan

Uploaded by

Desiree de la RosaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Petron Business Plan

Uploaded by

Desiree de la RosaCopyright:

Available Formats

PETRON ENERGY, INC

CONFIDENTIAL

BUSINESS PLAN

17950 PRESTON ROAD

SUITE 960

DALLAS, TEXAS 75252

PH (877) 373-8766

FAX (972) 485-1324

PROPRIETARY STATEMENT

The material presented herein is the property

of Petron Energy, Inc. and should not be

reproduced or shared in any manner without

the expressed written consent of Petron.

ii

1

Table of Contents

Pages

1 Table of Contents

2 Table of Exhibits

3 Mission/Vision Statement

4 Company at a Glance

5 The Opportunity Ahead

6 Introduction to the Cotton Valley Sandstone Trend

7 New Hybrid Frac Optimize Development in Sand Formations

8 Long-life, Multi-zone Production

9 Known Producing Field/Severance Tax Reduction/Horizontal

Drilling: New Developments in East Texas

10-11 New Terminology/History & Current Technology

12 Geological Summary-Cotton Valley Sandstone

Trend/Introduction

13 Technological Advancements/Opportunities/Stratigraphy

14 Stratigraphy-Rodessa/Pettit/Travis Peak/Cotton Valley

15 Industry at a Glance-National Energy Policy/Taking Stock

Energy Challenges Facing the United States/Natural Gas

16 U.S. Natural Gas Markets

17 Natural Gas Demand-Projected Natural Gas Use for Electricity

Generation Peaks in 2020

18 Natural Gas Consumption Varies with Fuel Prices and

Economic Growth/ Natural Gas Supply-Net Exports of Natural

Gas Grow in the Projections/Energy Trends to 2030

19 Unconventional Production is a Growing Source of U.S. Gas

Supply/Natural Gas Supply Projections Reflect Rates of

Technology Progress

20 Natural Gas Prices Remain Above Historical Levels/Product

21 Marketing Strategy

22 Customers/Financial Forecast

23-24 Operational Plan/Management and Organization

25-26 Economic and Future Outlook

27 Capitalization/Use of Proceeds

28 3 Year Cash Flow Projections

32 Earnings Per Share Worksheet

33 Assumptions & 5 Year Operating Projections

2

Exhibits

Page Exhibit Description

39 A New Hybrid Frac Sheet

40 B Tax Benefits Sheet

41 C C.V. Horizontal/Vertical vs. Horizontal

42 D Packer Plus IP Comparison

43 E Stratigraphic Column

44 F U.S. Energy Prices Chart

45 G Energy Consumption Chart

46 H Total Energy Supply Chart

47 I C. V. Wells Success Rate & IP

Comparison

48 J 20 Year Production History Chart

49 K 12 Month Production History Chart

50 L Natural Gas Demand Chart

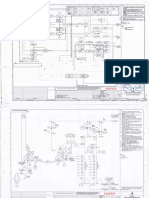

51 M Schematic Diagram

52 N Well Location Map

53 O Pipeline Infrastructure

54 P Gas Well Prod. Charts A & B

55 Q Start of World Energy

56 R Mineral Lease Contract

PETRON ENERGY, INC. BUSINESS PLAN

Mission

Petron Energys mission creates a solid foundation for the company. Our

core beliefs upon which we founded the company are represented and the

basic essentials are in position for our continued success.

Mission Statement

Petron Energy is a performance based oil and gas company. We are

committed to an old fashion way of doing business which involves integrity,

diligence, honesty, trustworthiness and responsibility when developing

investor relationships and associate relationships.

Vision Statement

Petron Energy is very committed to establishing long-term relationships with

its investment partners based on our solid performance. The marketing

niche for Petron is apparent. Our company unites with our partners to

identify and capitalize on low risk drilling opportunities by working in areas

with years of proven production history. Petron is committed to integrity,

diligence, honesty, trustworthiness, and responsibility when developing

partner relationships. We feel our industry offers investors an opportunity to

participate in an investment vehicle, which provides conservative, long-term

monthly income potential and favorable tax benefits. The Cotton Valley

Trend has proven to be an area which provides conservative long-term asset

appreciation and our experiences validate the success of this area. Petron

Energys goal is to further develop the Cotton Valley Trend and other

energy properties which are congruent with our strategy.

3

Company At A Glance

Petron Energy, Inc. is a 9 year old oil and gas exploration and development

company. We have invested primarily in mineral properties in Texas and

Louisiana since the companys inception. Petron Energy has been a Texas

corporation since 1998, Mr. Floyd Smith founder, has been the sole owner

since its inception. During the companies years of operations it has

weathered challenges, such as under performing well and re-entry failures.

We have been very diligent in researching more productive locations which

provide a long-term proven history of success and display characteristics of

being an under developed asset. By applying new technologies we are able

to exploit and produce more natural gas and oil from these assets. Mr. Floyd

Smith has been involved in the industry for 15 years. He is a very detailed

oriented driven owner who knows how to set goals and initiate execution

through completion.

Our target market is the East Texas Cotton Valley Trend, which offers an

extremely high success rate with respect to developing producing wells and

it offers long term cash flow. Typical production from Cotton Valley wells

usually have a life expectancy of 10 - 25 years. The Cotton Valley Trend is

primarily a Natural Gas trend; however some wells make oil production

along with gas production. Demand for natural gas is growing at a rate of

3% per year, while supply is only growing at a rate of 1% per year. Natural

Gas is a clean burning alternative fuel and is environmentally friendly.

Petron will be known as a natural gas company because of the long term

implications of this environmentally friendly alternative fuel. We have a

unique opportunity to capitalize on the newest form of innovative

technology in the Cotton Valley Trend which involves a new process in

fracture stimulation techniques. This process allows a far more efficient

stimulation effect over a greater production area and the results have the

potential of improving production rates by 5 - 10 times in horizontal wells

versus the rate of vertical wells.

We found such an opportunity in the Cotton Valley. Petron has invested in

the development of 26 wells in the Cotton Valley Trend during the past 30

months. We developed a process that is successful in the Trend. Our wells

are producing at a higher sustained rate with conservative declines.

4

One of the challenges of the company will be securing the mineral lease

prior to becoming a public company (see Exhibit R). Our plan is to use

$1,500,000.00 of the investment capital for lease acquisitions. The mineral

leases provide the company with a firm position for future development and

improves shareholder value. In considering a more short term approach to

improved share value and company cash flow, we plan to trade shares in the

company for interest owned by investors in 3 of our earlier multiple well

projects. We will utilize our current industry relationships to acquire a 10 -

25 % industry level participation in 4 - 5 multiple well projects.

Our long-term plan is to grow the company at a rate of 5% per year thru

three approaches 1) lease acquisition and development, 2) industry level

participation through current industry partners, 3) acquisitions of small

operators in the Cotton Valley Trend and other areas which are congruent

with our methodology. Items 1 & 2 of the long-term plan should be initiated

within 12- 18 months of our successful investment capital campaign.

The Opportunity Ahead

Petron Energy is focusing on natural gas development in the U.S. because

the U.S. offers a very mature basin for oil and a virgin market with upside

for natural gas opportunities. U.S. offshore oil exploration or international

oil plays face political, environmental, operational and financial risk

whereas, the U.S. Natural Gas development offers:

Low risk opportunities

Growth opportunities

Unlimited upside profit potential with unconventional gas reserves

Completion technological improvements which increase gas

reserves

Benefits of Natural Gas over other energy sources:

Natural Gas is potentially a key solution to global warming

Clean burning Natural Gas meets critical environmental concerns

Natural Gas is the fuel of choice for industry, residential and

electricity

5

The Cotton Valley Trend encompasses a nine county area. In this nine

county area there is a vast amount of available lease acreage to develop oil

and gas production. During the last twenty years, the Cotton Valley Trend

has experienced a 98 % success rate in wells finding commercial production

in the Cotton Valley reservoir. During the last twenty four months we have

been active in developing 26 consecutive natural gas wells. All of these

wells are vertical producers. Each well was fracture stimulated for optimal

production. The initial production rate on these wells are 750 thousand cubic

feet of gas per day (mcfg/d) to 1850 million cubic feet of gas per day

(mmcfg/d), each well has additional behind pipe reserves which extends the

wells long term production and these reserves will be produced later in the

wells production life. On vertical wells, the fracture stimulation process

effects a production radius of 250 - 500 feet. around the vertical wellbore.

(see Exhibits A, M, N)

Introduction To The Cotton Valley Sandstone Trend

East Texas has long been an extremely active area of drilling, discovery and

production for over 70 years. In the counties which include Panola, Rusk,

Harrison, Gregg, Smith, Shelby, Wood & Upshur in Texas, and Caddo, Red

River, and Desoto Parishes in Louisiana, there is an extensive blanket sand

group commonly referred to as the Cotton Valley Trend. It reaches from

northeast Texas, through northwest Louisiana, and north to southwest

Arkansas. The existence of this field has been known since mid-1930, but

focused development did not truly begin until mid-1970 catalyzed by

improvements in hydraulic fracturing technology and higher gas prices.

Spacing guidelines have also changed over the years. Originally the

guidelines were one well per 640 acres. Drilling is currently occurring on 40

acre spacing due to improved reservoir engineering indicating an effective

drainage area of only 40 acres per well. Drilling and developmental activity

is nearing an all time high.

Areas of development were previously limited historically to wells that

could achieve production equal to or greater than 2 billion cubic feet of gas

(bcfg) per well. Higher prices, lower cost stimulation techniques, coupled

with the fact that there is virtually no exploration risk for this extensive

blanket-like formation. Also, the very reasonable opportunity to also

encounter the Pettit formation between 6,500-7,000 and the Travis Peak

6

formation between 7,500 8,500 in some 20% of wells drilled, makes the

Cotton Valley Trend a low risk opportunity. Transporting natural gas to

market is accomplished by using a well developed transportation pipeline

infrastructure which has been in place for over 30 years. (see Exhibit O)

New Hybrid Fracs Optimize Development In Sand Formations

When sandstone rocks contain oil or gas in commercial quantities, recovery

can be vastly improved by a process called fracturing which is used to

increase permeability to its optimum level. Basically, to fracture a formation,

a fracturing service company pumps a specifically blended fluid down the

well and into the formation under great pressure. Pumping continues until

the formation literally cracks open. Meanwhile, a special type of frac sand is

mixed into the fracturing fluid. These materials are called proppants. The

proppant enters the fractures in the formation and when pumping is stopped

and the pressure allowed to dissipate, the proppant remains in the fractures.

Since the fractures try to close back together after the pressure on the well is

released, the proppant is needed to hold or prop the fractures open. These

propped-open fractures provide passages for oil or gas to flow into the well.

A series of studies and experimentation in the design of frac treatments have

improved development and stimulation practices in the Sandstone

formations of East Texas. Advanced hydraulic fracture diagnostics and

documented production results over the first six months of well life have

been used to better understand fracture geometry and well performance. The

objective of the diagnostics is to improve fracture length and optimize

fracture treatment design. The resulting changes to completion and

stimulation design have resulted in improved well performance.

The East Texas Basin has a series of productive formations which include

the Rodessa (limestone), the Pettit (limestone), the Travis Peak (sandstone

and shale), and the Cotton Valley (sandstone and shale). The primary target

of drilling is generally to the Cotton Valley Sands at 9,000 to 11,000 in

depth.

The adoption of slick water and hybrid fracture treatments, sand

proppants, plus multi-staging the treatments in the Lower, Middle and Upper

Cotton Valley, when utilized in certain wells, may increase initial production

rates, decrease decline rates and improve total reserve recoverability. This

7

has to be determined area by area, and well by well, and may not be

appropriate in all cases.

In addition to new technology, a myriad of other variables can be applied to

produce better results. We are constantly tracking different well completion

strategies and production results to generate an approach that will yield the

following:

Higher initial flow rates

Slower decline rates

Improved recoverability

We are convinced that all three of the above goals can be achieved.

Texas oil and gas industry records as of J une 2004 in the eight Texas

counties which are listed above, indicated some 80 companies, including

Anadarko, BP America, Chevron, Devon Energy, Exxon Mobil, EOG, El

Paso Natural, Texaco, Union Oil of CA and others, have been issued

approximately 551 drilling permits. In the last year between April 2004 to

April 2005, there were 1,508 permits issued in the six primary Texas

Counties of Gregg, Harrison, Panola, Rusk, Smith and Upshur, giving rise to

higher costs and creating intense rig demand.

We have established a four star criteria for a Cotton Valley Trend drilling

location.

Onstrike and close proximity to other excellent producers

Geographic access to inter-state markets

Multi-zone potential

Favorable lease terms (high net revenue leases)

Long-life, Multi-zone Production

Typical Cotton Valley Sandstone wells continue to produce in economic

quantities from a low of 10 years, but commonly up to 25 years. Also, the

Travis Peak and Pettit Formations can add significant reserves to any Cotton

Valley well. However, unlike Cotton Valley Sandstone Formation, these

behind pipe reservoirs will not produce in every well. (see Exhibit P)

8

Known Producing Field

The proposed drilling area is part of a well known trend that extends over a

large area in the corners of northeast Texas, northwest Louisiana, and

southwest Arkansas. The fields have been known and active since mid-1930,

with earnest development occurring subsequent to mid-1970. With the

advent of spacing changes and improved technology, recent drilling in this

area is approaching an all time high.

Severance Tax Reduction

Cotton Valley production is subject to a significantly reduced Severance Tax

from the normal 7.5% to 2.1% for the first 120 months (10 years), and then

graduates up over an extended period of time. This reduction was enacted to

stimulate drilling in the Cotton Valley Trend. Typical Cotton Valley wells

continue to produce in economic quantities from 10 years, up to potentially

25 years. Decline rates are modest as viewed over an extended period of

time. (see Exhibit B)

Horizontal development is now being implemented in the Trend; this

procedure has been around for decades. However, what is new about this

drilling technique is the completion process. In years past horizontal wells

were completed like their sibling vertical wells, which lead to poor

efficiency in the completion process and well production rates.

(see Exhibit C)

Horizontal Drilling: New Developments In East Texas

Devon Energy has recently permitted, drilled and completed a horizontal

well in Panola County, in the Cotton Valley, with a 5 Stage fracture

stimulation the well produced at 6.635 million cubic feet of gas per day

(mmcfg/d) plus 105 barrels of oil per day (bo/d) on a 12/64 choke. They

have 5 more wells scheduled for horizontal drilling in that area. We have

been following and analyzing the introduction of horizontal drilling in the

Cotton Valley Trend. The major service companies associated with our

Cotton Valley operation also handled the job for Devon. It was clear that the

time had come to step-up and participate in this increased production

opportunity for our wells.

9

The key participants in the technological effort include Halliburton,

Schlumberger, as well Packer Plus Technology, including StackFrac and

RapidMatrix Multi-Stage Fracturing and Stimulation Systems, which are

designed specifically for isolated open hole fracturing of both sandstone and

carbonate reservoirs. This innovative and field proven system greatly

increases both the initial productivity, as well as the long-term recoverability

from each wellbore when utilizing the high performance RockSeal II

Packer. This system allows for precise placement of fracturing fluids for

optimum stimulation results and maximized post-fracturing productivity of

the well. When combined with newly designed advanced stimulation fluids,

you produce multiple fractures of greater effective conductivity along the

entire wellbore. This open hole fracturing and treating provides less

reservoir contamination from cement, and allows for a wider, longer frac

matrix. (see Exhibit D)

New Terminology

(TVD) Total Vertical Depth: Total depth reached as measured along a line

drawn to the bottom of the hole that is also perpendicular to the earths

surface.

(MSD) Measured Depth: Measures total distance drilled along the well

bore. (Note that in a vertical hole, (MSD) would equal (TD), Total Depth).

(HD) Horizontal Displacement: Total distance drilled along the quasi-

horizontal portion of the wellbore.

History & Current Technology

The first recorded true horizontal well, was drilled near Texon, Texas (just

west of San Angelo), and was completed in 1929. Another was drilled in

1944 in the Franklin Heavy Oil Field, Vanago County, Pennsylvania, at a

depth of 500 feet. China tried horizontal drilling as early as 1957, and later

on the Soviet Union tried as well. Generally, however, little practical

application occurred until the early 1980s, by which time the advent of

improved downhole drilling motors and the invention of other necessary

supporting equipment, materials, and technologies, particularly downhole

telemetry equipment, had brought some kinds of applications within the

imaginable realm of commercial viability.

10

A widely accepted definition of what qualifies as horizontal drilling had

yet to be written, however the following combines the essential components

of previously published definitions.

Horizontal drilling is the process of drilling and completing, for production,

a well that begins as a vertical or inclined linear bore which extends from the

surface to a subsurface location just above the target reservoir, then bears off

on an arc to intersect the reservoir at the entry point, and, thereafter,

continues at a near-horizontal angle and will substantially or entirely remain

within the reservoir until the desired bottom hole location is reached.

According to an Energy Information Administration (EIA) review of

horizontal well technology and its domestic applications, horizontal drilling

technology achieved commercial viability during the late 1980s. It has been

successfully employed in a variety of fields and formations in many

domestic geographic regions and geologic situations. Completion

and production techniques have been modified for the horizontal

environment, with more change required as the well radius decreases. The

specific geologic environment and production history of the reservoir also

determine the completions methods employed.

The technical objective of horizontal drilling is to expose significantly more

reservoir rock to the well bore surface than can be achieved via drilling of a

conventional vertical well. The two primary benefits of horizontal drilling

success are 1) increased productivity of the reservoir, as well as 2)

prolongation of the reservoirs commercial life.

An offset to the benefits provided by successful horizontal drilling is its

higher cost, but the average cost is going down. It is probable that the cost

premium associated with horizontal drilling will continue to decline as

horizontal drilling activity increases. But there is always the possibility that

new and improved technology could add additional costs in the future.

Horizontal wells have a higher productivity and pay zone contact per well

than vertical wells, and allow operators to take advantage of highly

heterogeneous or layered reservoirs, like the Cotton Valley Sandstone.

Horizontal drilling is now utilized in a variety of carbonate and sandstone

reservoirs across the country, including the Austin Chalk, J ames Lime,

Woodbine and the Barnett Shale here in Texas.

11

The new Packer Plus System has revolutionized the completion process with

regard to horizontal wells (see exhibit D). It allows for the completion job

in the horizontal leg of the hole to be customized. We are able to isolate

individual 500 feet sections and plan 5 to 7 fracture stimulation treatments

on a 2500 feet leg. This provides a greater level of effectiveness in the

stimulation process and daily production levels reflect this technological

improvement. This stimulation procedure provides a greater area of

production, usually 10 times greater production area than a vertical wells

radius. Rates have improved 5 to 10 times that of vertical wells. We feel our

niche is clearly defined, we have identified the area and this process allows

Petron an opportunity to exploit the Cotton Valley Trend and capitalize on

the vast amounts of Natural Gas Reserves in place.

Geological Summary

Cotton Valley Sandstone Trend

Introduction

The Cotton Valley sand group contains many massive, low permeability,

low porosity sands. These extend over a large area in the corners of

northeast Texas, northwest Louisiana, and southwest Arkansas. Although

this fields existence had been known since mid-1930, earnest development

did not start until mid-1970 after improvements in hydraulic fracture

technology and higher gas prices. The original spacing rules in the Cotton

Valley Field were established at one well for each 640 acres, this spacing

rule was changed in February 1981 to 320 acres per well. With the recent

stability of higher gas prices, and the most recent spacing change to 40 acres

per well, Cotton Valley drilling is approaching an all time high.

The Cotton Valley sands were deposited during the late J urassic Period. The

depositional environment is interpreted as a regressive and transgressive

sequence of shallow water, bioturbated, shoreface sediments dominated by

barrier bars with minor interbeds of tidal deltaic deposits. Each of these

shallow marine bars contain many layers of sand and shale. The sand layers

were deposited during the storms and shale layers during fair weather

periods. This is typical of a prograding barrier bar system.

12

Technological Advancements

The adoption of water fracs or hybrid fracs in the Cotton Valley sandstone

has greatly reduced the fracture stimulation cost, while providing similar

production results to the massive proppant procedures previously used in the

field. The water fracs employ a polymer-free fracturing fluid composed of

water, clay stabilizers, surfactants and friction reducer. The proppant

concentrations are reduced to a maximum amount of 0.5 lbs/gal, which is

kept constant throughout the proppant laden stage. At the end of the job (last

5%) proppant concentration is ramped up to a maximum of 5 lbs/gal as a

safety measure to ensure that the near-wellbore region is propped.

Traditional fracture treatments in this area used cross-linked-fracturing

fluids with maximum proppant concentrations up to 8 lbs/gal.

Opportunities

The current interest in the Cotton Valley sandstone trend is clearly prompted

by the long-term confidence of natural gas pricing. The trend development

has historically limited itself to selected areas that could achieve greater than

2 BCF. However, with higher prices, lower cost stimulation techniques,

coupled with the fact that there is virtually no exploration risk for the Cotton

Valley, and a reasonable opportunity to also encounter a productive Travis

Peak formation, makes the Cotton Valley Trend a low risk opportunity to

build long-term gas reserves.

Stratigraphy

The producing reservoirs in the fields are of Lower Cretaceous Age

Rodessa, Pettit, and Travis Peak, ranging in depth from 6,700 to 9,000 feet,

and the Upper J urassic Age Cotton Valley ranging in depth of 9,000 to

10,800 feet. The producing zones in descending order are the Upper Gloyd,

Lower Gloyd, Upper Young, Lower Young, the Pettit E, Upper Travis

Peak, Middle Travis Peak, Lower Travis Peak, Upper Cotton Valley and

Lower Cotton Valley (Taylor).

13

Rodessa

The Rodessa section is 825 feet of limestone, sand and shale. Five individual

limestone zones produce in the Trend. They are the Upper and Lower Gloyd

Deep Sand and the Upper and Lower Young. The Upper Gloyd is a

limestone interval in the upper part of the Rodessa section. The Upper Gloyd

in one area of interest is 6 to 14 feet thick.

Pettit

The Pettit is a 330 foot interval of limestone and shale. There are two to five

limestone intervals, in the Pettit reservoir. The lower limestone interval, the

Pettit E is the most productive interval. Production comes from porosity

development within the interval.

Travis Peak

The Travis Peak is a 1,730 foot interval of sand and shale. The Upper Travis

Peak is a sandstone interval comprising the top third (~550 feet) of the

Travis Peak. Production comes from multiple sands with an average pay

thickness of 7 feet and 10% porosity and 37% water saturation in one area of

interest. The Middle Travis Peak is a sandstone interval comprising the

middle third (~550 feet) of the Travis Peak. Production comes from multiple

sands with an average thickness of 8 feet and 10% porosity and 34% water

saturation in several areas of interest. The Lower Travis Peak is a sandstone

interval comprising the lower third (~550 feet) of the Travis Peak.

Production comes from multiple sands with some areas showing an average

pay thickness of 10 feet and 9% porosity and 31% water saturation. There

are the potential of 10-15 individual pay zones available in the Travis Peak

reservoir.

Cotton Valley

The Upper Cotton Valley is a 1,300 foot interval consisting of a series of

sandstones and shales. The upper 1,000 feet of the interval is productive

with scattered pay. The Lower Cotton Valley (Taylor) is a 300 foot

sandstone and shale interval above the Bossier Shale. There is the potential

of 15-30 individual pay zones available in the Cotton Valley reservoir.

(see Exhibit E, M)

14

Industry At A Glance

National Energy Policy

From the Report of the National Energy Policy Development Group May

2001, entitled Taking Stock, Energy Challenges Facing the United States

Taking Stock Energy Challenges Facing the United States

Americas current energy challenges can be met with rapidly improving

technology, dedicated leadership, and a comprehensive approach to our

energy needs. Our challenge is clear we must use technology to reduce

demand for energy, repair and maintain our energy infrastructure, and

increase energy supply.

Natural Gas

Natural gas is the third largest source of U.S. electricity generation,

accounting for 16% of generation in 2000. Under existing policy, natural gas

generation capacity is expected to constitute about 90 percent of the

projected increase in electricity generation between 1999 and 2020.

Electricity generated by natural gas is expected to grow to 33 percent in

2020 a growth driven by electricity restructuring and the economics of

natural gas power plants. Lower capital costs, shorter construction lead

times, higher efficiencies, and lower emissions give gas an advantage over

coal and other fuels for new generation in most regions of the country.

Overall, natural gas accounts for 24 percent of total U.S. energy consumed

and for all purposes 27 percent of domestic energy produced. Eighty-five

percent of total U.S. natural gas consumption is produced domestically.

Between 2000 and 2020, U.S. natural gas demand is projected by the Energy

Information Administration to increase by more than 50 percent, from 22.8

to 34.7 trillion cubic feet. More than half of the increase in overall gas

consumption will result from rising demand for electricity generation. The

projected rise in domestic natural gas production from 19.3 trillion cubic

feet in 2000 to 29.0 trillion cubic feet in 2020 may not be high enough to

meet projected demand.

The most significant long-term challenge relating to natural gas is whether

adequate supplies can be provided to meet sharply increased projected

15

demand at reasonable prices. If supplies are not adequate, the high natural

gas prices experienced over the past years could become a continuing

problem. To meet this long-term challenge, the United States not only needs

to boost production, but also must ensure that the natural gas pipeline

network is expanded to the extent necessary.

The U.S. Natural Gas market has enjoyed consistent growth for the last

several years. Current demand for natural gas product to end users has

grown at a rate of 3% per year, whereas supply has only grown at a rate of

1%. The winter of 2006 was colder later into the winter unlike winters past

and it was reflected in our price point and in our inventory levels. Prices

were low compared to the normal double digit increases we typically see

with colder winter conditions. Inventory levels were drawn down in record

amounts in February. As a result after 13 consecutive months of year-over-

year increases, February stocks dropped below the year-ago level. Stocks are

263bcf below the level at the same time last year (AEO2007). Michael

Zenker with Cambridge Energy Research Associates said I would estimate

prices would average about $7.00 mcf through 2008. The rising demand for

gas, coupled with flat production, has tripled prices in the last four years.

The Energy Information Administration (EIA), the statistical branch of the

Department of Energy has completed its comprehensive Annual Energy

Outlook 2007 Report (AEO2007), with projections to 2030. This report

presents a projection and analysis of U.S. energy supply, demand, and prices

through 2030. The projections are based on results from the EIAs national

modeling system.

U. S. Natural Gas Markets

Prices. The Henry Hub natural gas price is projected to average $7.58 per

thousand cubic feet (mcf) in 2007 compared with $6.94 in the previous

Outlook (Henry Hub Natural Gas Price). For 2008, the Henry Hub spot

price is projected to average $7.86 per mcf. ( see exhibit F)

Production. Domestic dry natural gas production is expected to increase by

2.4 percent in 2007, a slight increase from production growth in 2006, as

drilling for natural gas continues at historically high levels. Net imports of

natural gas in 2007 are projected to drop for the second consecutive year,

though a smaller decline is expected in 2007.

16

Inventories. On February 23, 2007, working gas in storage stood at an

estimated 1,733 billion cubic feet (bcf). Due to cold weather, a record

amount of natural gas was withdrawn from storage in February. As a result,

after 13 consecutive months of year-over-year increases, February stocks

dropped below the year-ago level. Stocks are 263 bcf below the level at this

time last year, but are still 179 bcf above the 5-year average (U.S. Working

Natural Gas in Storage).

Consumption. A return to normal temperatures in 2007 is expected to drive

strong year-over-year growth in residential consumption of natural gas. A

first quarter comparison of EIAs estimated residential consumption shows a

14 percent increase from 2006-2007. Taking the year as a whole, residential

consumption is expected to increase 10.8 percent in 2007. Similarly,

commercial and industrial sector consumption are expected to increase by

6.3 and 1.9 percent, respectively, in 2007 because of a return to normal

weather, lower commercial prices, and growing industrial output. Total

natural gas consumption growth for 2007 and 2008 is projected to increase

by 2.9 and 1.8 percent, respectively, after falling by 1.7 percent in 2006

(Total U.S. Natural Gas Consumption Growth.)

Natural Gas Demand

Projected Natural Gas Use for Electricity Generation Peaks in 2020

Total natural gas consumption in the United States is projected to increase

from 22.0 trillion cubic feet in 2005 to 26.1 trillion cubic feet (tcf) in 2030 in

the AEO2007 reference case (see exhibit G). Much of the growth is

expected before 2020, with demand for natural gas in the electric power

sector growing from 5.8 tcf in 2005 to a peak of 7.2 tcf in 2020.

Continued growth in residential, commercial, and industrial consumption of

natural gas is roughly offset by the projected decline in natural gas demand

for electricity generation. As a result, overall natural gas consumption is

almost flat between 2020 and 2030 in the AEO2007 reference case, and the

natural gas share of total projected energy consumption drops from 23

percent in 2005 to 20 percent in 2030.

17

Natural Gas Consumption Varies with Fuel Prices and Economic

Growth

In contrast, the price of natural gas directly affects the level of natural gas

consumption. High prices provide a direct economic incentive for users to

reduce their natural gas consumption, and low prices encourage more

consumption. The strength of the relationship between natural gas prices

and consumption depends on the short- and long-term capabilities for fuel

conservation and substitution in each consuming sector.

Natural Gas Supply

Net Exports of Natural Gas Grow in the Projections

Net exports of U.S. natural gas to Mexico are projected to decline from

nearly 400 billion cubic feet (bcf) in 2007 to 35 billion in 2019. After 2019

they are expected to increase steadily to nearly 250 bcf in 2030.

Energy Trends to 2030

Despite the rapid growth projected for biofuels and other nonhydroelectric

renewable energy sources and the expectation that orders will be placed for

new nuclear power plants for the first time in more than 25 years, oil, coal,

and natural gas still are projected to provide roughly the same 86 percent

share of the total U.S. primary energy supply in 2030 that they did in 2005.

The energy price projections for natural gas and coal in the AEO2007

reference case also are similar to those in AEO2006. The real wellhead price

of natural gas is projected to decline from current levels through 2015, when

new supplies enter the market, but it does not return to the levels of the

1990s. After 2015, the natural gas price rises to $8.27 per thousand cubic

feet in 2030. (see Exhibit H)

Natural gas consumption is projected to grow to 26.1 trillion cubic feet (tcf)

in 2030, down from the projection of 26.9 (tcf) in 2030. Total natural gas

consumption is almost flat from 2020 through 2030, when growth in

residential, commercial, and industrial consumption is offset by a decline in

natural gas use for electricity generation as a result of greater coal use.

The average U.S. natural gas in the AEO2007 reference case declines

gradually from the current level, as increased drilling brings on new supplies

18

and new import sources become available. The average price falls to just

under $6.46 per thousand cubic feet in 2015 (2005 dollars), then rises

gradually to about $8.27 per thousand cubic feet in 2030. (see Exhibit H)

In the AEO2007 reference case, the natural gas share of electricity

generation (including generation in the end-use sectors) is projected to

increase from 19 percent in 2005 to 22 percent around 2016, before falling

to 16 percent in 2030.

Total domestic natural gas production, including supplemental natural gas

supplies, increases from 18.3 trillion cubic feet in 2005 to 21.1 trillion cubic

feet in 2022, before declining to 20.6 trillion cubic feet in 2030 in the

AEO2007 reference case. In comparison, domestic natural gas production

was projected to peak at 21.6 trillion cubic feet in 2019 in the AEO2006

reference case.

Unconventional Production Is a Growing Source of U.S. Gas Supply

A large proportion of the onshore lower 48 conventional natural gas resource

base has been discovered. Discoveries of new conventional natural gas

reservoirs are expected to be smaller and deeper, and thus more expensive

and riskier to develop and produce. Accordingly, total lower 48 onshore

conventional natural gas production declines in the AEO2007 reference case

from 6.4 trillion cubic feet in 2005 to 4.9 trillion cubic feet in 2030.

Incremental production of lower 48 onshore natural gas comes primarily

from unconventional resources, including coalbed methane, tight sandstones,

and gas shales. Lower 48 unconventional production increases in the

reference case from 8.0 trillion cubic feet in 2005 to 10.2 trillion cubic feet

in 2030, when it accounts for 50 percent of projected domestic U.S. natural

gas production.

Natural Gas Supply Projections Reflect Rates of Technology Progress

Technological progress generally reduces the cost of natural gas production,

leading to lower wellhead prices, more end-use consumption, and more

production.

19

Natural Gas Prices Remain Above Historical Levels

In the AEO2007 report the natural gas prices are projected to decline from

current levels to an average of $6.91 per thousand cubic feet in 2010, then

rise to $8.27 per thousand cubic feet in 2030. (see exhibit D)

Current high natural gas prices are expected to stimulate the construction of

new LNG terminal capacity, resulting in a significant increase in LNG

import capacity. Projected natural gas prices are expected to stimulate the

construction of an Alaska natural gas pipeline (projected to begin in

operation in 2018), as well as increased unconventional natural gas

production. This is a plus for us because the Cotton Valley Trend has 25%

NGLs (natural gas liquids) which represents additional revenue from the

sell of those liquids.

Product

The petroleum industry has long been an integral thread in the fabric of the

world. It offers certain features and benefits to those of us who actively

invest. Some are listed below.

Features

Long term monthly income

Per share value appreciation

Tax incentives

Depletion allowance

Publicly traded companies offer a secondary market for exit

Multiple pay zone production

Proven historical development success

Severance tax savings

Benefits

Monthly disposable income

Estate and Net worth appreciation

Reduction in taxes

Tax free income

Flexible exit strategy through secondary market

Reduces risk of low commercial production

20

Reduction of dry hole risk

Increased monthly cash flow

Marketing Strategy

Experts look through futuristic lens and the energy industry looks bright for

a healthy pricing environment. Global demand is high, yet global

production is on the decline. We have spent the last few years strategizing

how to effectively capitalize on these unique times in our industry, and we

believe the time is right to generate a core asset base through low risk

natural gas reserves.

Our three-point approach would involve:

(1) The creation of a leasebank which would allow for acquisition of leases

in proven developmental areas. Our lease position in low risk development

areas provides us the ability to diversify into multiple wells further reducing

our risk, and more accurately predicting return on investment. In summary,

Petron Energy will be uniquely positioned to generate, develop and manage

low-risk projects with proven predictability. Through the development of

theses leases, we would be able to add value to the company from monthly

production of each well and the book value of the behind pipe reserves of

each well and puds (proved underdeveloped reserves) of the lease.

(2) The second approach would involve the continued participation with

current industry relationships. The company can achieve prime production

acreage and interest by partnering with pre-existing industry relationships

that we are familiar with and in areas were comfortably positioned. It

provides our company with an opportunity to add value by increasing our

interest in a core asset, at the same time improving the book value of our

overall reserves.

(3) The third approach would allow us to acquire pre-existing development

properties from small operators. This strategy allows the company to

quicken its pace in growing its core asset base and its position in low risk

developmental areas that are congruent with our methodology. We are able

to pick up infrastructure that is already in place and improve on reserves and

21

22

monthly cash flow from existing monthly production and future behind pipe

reserves.

We would fund programs via private placement as we have always done,

however, as a public company, our clients would have a secondary market

available as an exist strategy which allows more client flexibility when

investing in and existing out of oil and gas projects.

We will work with our trusted investor base in large part to raise the

investment capital needed for this opportunity. And we will use road shows,

trade shows, word of mouth and a network of friends and professionals to

secure investment capital.

Our two year plan beyond securing the investment capital for future funding

of projects will involve the development of broker dealer to handle the

funding requirements of our future projects and line of credits will be

incorporated long term to facilitate our growth in development wells.

Customers

Petron Energys customers would be gas marketers who presently

represents the company. Their job is to negotiate the best spot market price

for us and execute the sales contract once an agreement is completed. As the

company grows in production, we will seek to expand our customer base.

The majority of natural gas produced in the Cotton Valley Trend is

purchased by end users in the state of Texas.

Financial Forecast

This financial forecast assume several variables; the interest the company

received from trading shares in the company for investor working interest,

which will improved the companies cash flow and the investment of

$2,000,000.00 @ industry level (cost) participation, which will improve the

cash flow of the company while at the same time adding value to our

balance sheet and subsequently our share price. We are currently working

with one of our industry partners to secure a 25% interest position in 5000

production and developmental acres within the Cotton Valley Trend.

23

These highly coveted acres will allow our active participation in multiple

well projects (two vertical wells, one horizontal well or two horizontal

wells) with the horizontal well packer plus system budgeted for

implementation. This approach allows us to create value in our share price

ultimately and improve our cash flow position. Review the use of proceeds

section in our Confidential Private Placement Memorandum for breakdown

of fund allocation.

Operational Plan

We presently have adequate office space to house our operational needs. We

have a 5 year lease currently on the approximate 3000 feet space. Our

offices are positioned on a main thoroughfare in North Dallas (County)

Texas at 17950 Preston Road, Suite 960, Dallas, TX 75252. Our business

hours are 8:00 a.m. to 5:00 p.m.

Our product development involves leasing oil and natural gas minerals in the

Cotton Valley Trend in East Texas. This process is achieved by

subcontracting the service of Landmen in the various counties of interest to

us in East Texas. (see Exhibit R mineral lease contract)

Management and Organization

Mr. Floyd Smith will manage the day-to-day operations.

Mr. Floyd Smith is President of Petron Energy, Inc. He has 15 years

experience in the energy industry. As a graduate of Harding University in

Searcy, AR., Mr. Smith has a diverse background. He spent eight years with

Wal-Mart Stores (store director for five years). While there he learned the

essentials of business operations and people management. After retiring

from Wal-Mart, Mr. Smith was introduced to the energy industry, over a six-

year span; he started as an assistant broker and worked his way up to a

senior level manager. During that time he was a top producer for the

organization. He became well versed in client relations, product marketing,

log analysis, completions, drilling operations and well rework operations. In

1998 he founded Petron Energy, Inc. His efforts have been focused on

operations and investor relations of oil and gas project/properties for Petron

24

Energy investors. Through Mr. Smiths efforts, Petron Energy, Inc. has

amassed client relationships from industry partners, private estates, trusts

and individual investors. Since Petron Energys inception, it has

participated in approximately 46 wells through the funding of approximately

$14,000,000 in equity capital from its investors.

Our corporate attorney is Richard Dick Hewitt; Dick has worked with

the U.S. Securities and Exchange Commission (S.E.C.) in varying legal

positions including Chief Enforcement Attorney for 15 years prior to starting

R.M. Hewitt P.C.. During his career with the S.E.C., Mr. Hewitt investigated

numerous oil and gas fraud cases in the Southwest. He has been in private

practice of 26 years. Dick is responsible for Petron Energys security and

legal duties.

Our corporate accountant is Nathan Reeder, CPA; Nathan has been CPA

specializing in oil and gas accounting for roughly 50 years. He has been a

proven asset to our organization during our 10 year association. Nathan

attended SMU. Nathan currently performs oil and gas accounting for clients

domestically and internationally.

Petron Energy has consulted its geological and petroleum engineering works

in the past and will eventually need to hire a geologist and petroleum

engineer for its future developmental opportunities. As the company seeks

to acquire leases, it will eventually need to add a landman to its staff.

Mike Hoover has been a trusted friend and oil and gas consultant and

advisor. Mike has over 25 years of oil and gas experience in all aspects of

geological, engineering, geophysical, property management, log analysis and

well operations. He is a graduate of Abilene Christian University.

Larry Crain has been a trusted friend and consultant. Larry has over 20

years of oil and gas experience in operations and investor relations. He is a

graduate of University of Texas at Arlington.

Tom Kidd has been a trusted friend and consultant. Tom has over 35 years

of oil and gas experience in field operations, well completion, log analysis

and well operations. Tom is a graduate of Bradley University.

Robert Sparks has been a trusted friend consultant and advisor. Robert has

over 25 years of oil and gas experience in acquisition, development,

25

exploration and operation of oil and gas properties. Robert is a graduate of

Lamar University.

Economic and Future Outlook

The energy market is coming off a 2006 year which saw activity indicators

hit 21 year highs. With higher prices, company revenue grew consistently.

Oil futures have cooled down between $55 and $58/bbl for West Texas

intermediate as of mid-November. Average futures from J anuary through

September were 68.22/bbl. Operators have enjoyed very attractive revenue

for most of 2006.

Natural gas has seen softened prices due to the mild winter for 2006 verses

2005. As of November 2006, U.S. storage levels are up 7.4% from their five

year averages. Prices have cooled somewhat because of this, wellhead

prices are down 15%, 6.51mcf/d verses 7.68mcf/d in August 2005. Due to

the hurricanes of 2005, we saw a 54% decline in gas prices in comparing

October 2005 to October 2006.

Between 2000 and 2020, U.S. natural gas demand is projected by the Energy

Information Administration to increase by more than 50 percent, from 22.8

to 34.7 trillion cubic feet. More than half of the increase in overall gas

consumption will result from rising demand for electricity generation. The

projected rise in domestic natural gas production from 19.3 trillion cubic

feet in 2000 to 29.0 trillion cubic feet in 2020 may not be high enough to

meet projected demand.

The most significant long-term challenge relating to natural gas is whether

adequate supplies can be provided to meet sharply increased projected

demand at reasonable prices. If supplies are not adequate, the high natural

gas prices experienced over the past years could become a continuing

problem. To meet this long-term challenge, the United States not only needs

to boost production, but also must ensure that the natural gas pipeline

network is expanded to the extent necessary.

Consumption of natural gas worldwide increased from 95 trillion cubic feet

in 2003 to 182 trillion cubic feet in 2030 in the IEO2006 reference case.

Although natural gas is expected to be an important fuel source in the

26

electric power and industrial sectors, the annual growth rate for natural gas

consumption in the projections is slightly lower than the growth rate for coal

consumptionin contrast to past editions of the IEO. Higher world oil

prices in IEO2006 increase the demand for and price of natural gas, making

coal a more economical fuel source in the projections.

Natural gas consumption worldwide increases an average rate of 2.4 percent

annually from 2003 to 2030. Coal increases an average rate of 2.5 percent

per year and 1.4 percent per year for oil. Nevertheless, natural gas remains a

more environmentally attractive energy source and burns more efficiently

than coal, and it still is expected to be the fuel of choice in many regions of

the world. As a result, the natural gas share of total world energy

consumption (on a Btu basis) grows from 24 percent in 2003 to 26 percent in

2030.

Worldwide, the industrial and electric power sectors are the largest

consumers of natural gas. In 2003, the industrial sector accounted for 44

percent and the electric power sector 31 percent of the worlds total natural

gas consumption. In the projections, natural gas use grows by 2.8 percent

per year in the industrial sector and 2.9 percent per year in the electric power

sector from 2003 to 2030. In both sectors, the share of total energy demand

met by natural gas grows over the projection period. In the industrial sector,

natural gas overtakes oil as the dominant fuel by 2030. In the electric power

sector, however, despite its rapid growth, natural gas remains a distant

second to coal in terms of share of total energy use for electricity generation.

(see Exhibit Q)

Capitalization

We are raising $5 million dollars in working capital to be dispensed as

follows:

USE OF PROCEEDS

(200 Units)

Source of Funds:

Amount Percent

Purchase of Units consisting of Series A

Preferred Stock and Class A Warrants

$5,000,000

100%

Amount

Percent

Per

Unit

Invest In Development Gas and Oil Wells $2,000,000 40.0% $10,000

Purchase Oil and Gas Leases 1,000,000 20.0% 5,000

Legal, Accounting, and Printing Costs 25,000 .5% 125

Exchange Program

Working Capital

800,000

750,000

16.0%

15.0%

4,000

3,750

Interest Reserve 300,000 6.0% 1,500

Syndication Costs 125,000 2.5% 625

Totals: $5,000,000 100.0% $25,000

There may be some changes in the use of proceeds authorized by the Board of Directors

depending upon various factors related to the success of drilling the developmental wells

and also the availability of high quality oil and gas leases.

27

Petron Energy

3 Year Cashflow Projections

By Month

Time period

Pre Start Jan-08 Feb-08 Mar-08 Apr-08 May-08 Jun-08 Jul-08 Aug-08 Sep-09 Oct-08 Nov-08 Dec-08

CASH

Beginning cash balance 4,075,000 3,510,009 3,445,018 3,380,027 2,865,036 2,850,045 2,835,054 2,370,063 2,405,072 2,440,081 524,590 609,099

Revenue 50,000 50,000 50,000 100,000 100,000 100,000 150,000 150,000 150,000

Total available cash 0 4,075,000 3,510,009 3,445,018 3,430,027 2,915,036 2,900,045 2,935,054 2,470,063 2,505,072 2,590,081 674,590 759,099

LESS

Cost of Goods 515,000 15,000 15,000 515,000 15,000 15,000 515,000 15,000 15,000 515,000 15,000 15,000

Operating Expenses 49,991 49,991 49,991 49,991 49,991 49,991 49,991 49,991 49,991 50,491 50,491 50,491

Land Leases 1,500,000

Purchase Shell Company 800,000

Syndication Costs 125,000

Total disbursements 925,000 564,991 64,991 64,991 564,991 64,991 64,991 564,991 64,991 64,991 2,065,491 65,491 65,491

Cash balance (925,000) 3,510,009 3,445,018 3,380,027 2,865,036 2,850,045 2,835,054 2,370,063 2,405,072 2,440,081 524,590 609,099 693,608

ADD

Line of Credit

Long-term loans

Capital stock issues 5,000,000

Total additions 5,000,000 0 0 0 0 0 0 0 0 0 0 0 0

Ending cash balance 4,075,000 3,510,009 3,445,018 3,380,027 2,865,036 2,850,045 2,835,054 2,370,063 2,405,072 2,440,081 524,590 609,099 693,608

Petron Energy

3 Year Cashflow Projections

By Month

Time period

Jan-09 Feb-09 Mar-09 Apr-09 May-09 Jun-09 Jul-09 Aug-09 Sep-09 Oct-09 Nov-09 Dec-09

CASH

Beginning cash balance 693,608 641,608 749,608 907,608 55,608 363,608 671,608 19,608 527,608 1,035,608 583,608 1,291,608

Revenue 1,540,000 200,000 250,000 1,740,000 400,000 400,000 1,940,000 600,000 600,000 2,140,000 800,000 800,000

Total available cash 0 2,233,608 841,608 999,608 2,647,608 455,608 763,608 2,611,608 619,608 1,127,608 3,175,608 1,383,608 2,091,608

LESS

Cost of Goods 2,530,000 30,000 30,000 2,530,000 30,000 30,000 2,530,000 30,000 30,000 2,530,000 30,000 30,000

Operating Expenses 62,000 62,000 62,000 62,000 62,000 62,000 62,000 62,000 62,000 62,000 62,000 62,000

Repay Line of Credit 1,000,000

Total disbursements - 2,592,000 92,000 92,000 2,592,000 92,000 92,000 2,592,000 92,000 92,000 2,592,000 92,000 1,092,000

Cash balance 0 (358,392) 749,608 907,608 55,608 363,608 671,608 19,608 527,608 1,035,608 583,608 1,291,608 999,608

ADD

Line of Credit 1,000,000

Long-term loans

Capital stock issues

Total additions - 1,000,000 0 0 0 0 0 0 0 0 0 0 0

Ending cash balance 0 641,608 749,608 907,608 55,608 363,608 671,608 19,608 527,608 1,035,608 583,608 1,291,608 999,608

Petron Energy

3 Year Cashflow Projections

By Month

Time period

Jan-10 Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10 Aug-10 Sep-10 Oct-10 Nov-10 Dec-10

CASH

Beginning cash balance 999,608 (284,142) 417,108 1,118,358 34,608 935,858 2,062,108 1,403,358 2,727,608 4,273,858 4,035,108 5,781,358

Revenue 4,015,000 1,000,000 1,000,000 4,215,000 1,200,000 1,425,000 4,640,000 1,625,000 1,850,000 5,065,000 2,050,000 2,275,000

Total available cash 0 5,014,608 715,858 1,417,108 5,333,358 1,234,608 2,360,858 6,702,108 3,028,358 4,577,608 9,338,858 6,085,108 8,056,358

LESS

Cost of Goods 5,100,000 100,000 100,000 5,100,000 100,000 100,000 5,100,000 100,000 100,000 5,100,000 100,000 100,000

Operating Expenses 198,750 198,750 198,750 198,750 198,750 198,750 198,750 200,750 203,750 203,750 203,750 203,750

Total disbursements - 5,298,750 298,750 298,750 5,298,750 298,750 298,750 5,298,750 300,750 303,750 5,303,750 303,750 303,750

Cash balance 0 (284,142) 417,108 1,118,358 34,608 935,858 2,062,108 1,403,358 2,727,608 4,273,858 4,035,108 5,781,358 7,752,608

ADD

Line of Credit

Long-term loans

Capital stock issues

Total additions - 0 0 0 0 0 0 0 0 0 0 0 0

Ending cash balance 0 (284,142) 417,108 1,118,358 34,608 935,858 2,062,108 1,403,358 2,727,608 4,273,858 4,035,108 5,781,358 7,752,608

EARNINGS PER SHARE WORKSHEET

2008 2009 2010 2011 2012

Net Profit (3,381,396) 256,000 6,753,000 27,337,500 47,465,000

Outstanding

Shares 65,000,000 65,000,000 65,000,000 65,000,000 65,000,000

Earnings Per

Share (.05) .003 .10 .42 .73

Value of Share (.003) .05 1.50 6.30 10.95

These projections are estimates only and not to be intended as guaranteed

performances.

Petron Energy

3 Year Operating Projections

By Month

Assumptions:

Petron will do a minimum of 8 industry deals between 2008-2010. Each deal represents 3 wells. Each deal will cost $500k to participate.

Return on investment should begin in the 4th month after the investment at a monthly rate of $50k.

Petron will seek a line of credit for one half of the cost to do each industry deal of $500k.

Petron will lease 7,500 acres of land at a estimated cost of $200 per acre to pursue the drilling of vertical and horizontal wells.

The rights to the leases should be complete by the fall of 2008.

The first 8 Petron Wells will be 2 vertical wells per deal at an estimated cost of $2,000,000 per well. Petron will keep a 50% stake in each of its

deals and sell the remaining 50% in retail packages. Retail packages are turnkey in structure and have contingencies

factored into the cost of the project. Wells will begin in 2009.

Gross monthly income from Petron Wells are estimated at $375k per month. A total of 24 wells will be done over a 24 month period beginning

in 2010. Revenue should begin in the 4th month after each deal (3 wells) is done.

Each Petron well is a 3 well project consisting of 2 vertical and 1 horizontal. Vertical wells estimated operating expenses are $5k per month.

Horitzonal wells are estimated at $20k per month.

Field labor represents the following: Engineer - $65k, geologist - $65k, Land manager - $50k, executive administrator - $50k

The position for land manager will not be filled until 2009 along with other increases in field staff.

Horizontal wells will cost $5,000,000. each to do. Expected drillings for these types will begin in 2010.

Payroll for the office include the management team, administrative support, public relations coordinator, accounting, etc.

Petron Energy

3 Year Operating Projections

By Month

1 deal 1 deal 1 deal 1 deal 4 wells

Income Jan-08 Feb-08 Mar-08 Apr-08 May-08 Jun-08 Jul-08 Aug-08 Sep-08 Oct-08 Nov-08 Dec-08 Total

Industry Deals - - - 50,000 50,000 50,000 100,000 100,000 100,000 150,000 150,000 150,000 900,000

Petron Wells

Retail Packages

Total Income - - - 50,000 50,000 50,000 100,000 100,000 100,000 150,000 150,000 150,000 900,000

COGS

Field Labor 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 180,000

Petron Wells 1,500,000 1,500,000

Industry Deals 500,000 500,000 500,000 500,000 2,000,000

Total COGS 515,000 15,000 15,000 515,000 15,000 15,000 515,000 15,000 15,000 2,015,000 15,000 15,000 3,680,000

Gross Profit (515,000) (15,000) (15,000) (465,000) 35,000 35,000 (415,000) 85,000 85,000 (1,865,000) 135,000 135,000 (2,780,000)

Operating Expenses

Payroll 27,083 27,083 27,083 27,083 27,083 27,083 27,083 27,083 27,083 27,083 27,083 27,083 324,996

Payroll Tax 4,208 4,208 4,208 4,208 4,208 4,208 4,208 4,208 4,208 4,208 4,208 4,208 50,500

Advertising 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 24,000

Office expenses 500 500 500 500 500 500 500 500 500 500 500 500 6,000

Telephone 1,000 1,000 1,000 1,000 1,000 1,000 1,000 1,000 1,000 1,500 1,500 1,500 13,500

Insurance 1,000 1,000 1,000 1,000 1,000 1,000 1,000 1,000 1,000 1,000 1,000 1,000 12,000

Legal Expenses 4,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 48,000

Accounting 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 36,000

Vehicle(s) 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 24,000

Rent 2,500 2,500 2,500 2,500 2,500 2,500 2,500 2,500 2,500 2,500 2,500 2,500 30,000

Interest Expense - - - - - - - - - - - - -

Postage/Shipping 300 300 300 300 300 300 300 300 300 300 300 300 3,600

Depreciation - - - - - - - - - - - - -

Misc 400 400 400 400 400 400 400 400 400 400 400 400 4,800

Travel 1,500 1,500 1,500 1,500 1,500 1,500 1,500 1,500 1,500 1,500 1,500 1,500 18,000

Equipment Rental 500 500 500 500 500 500 500 500 500 500 500 500 6,000

Total Expenses 49,991 49,991 49,991 49,991 49,991 49,991 49,991 49,991 49,991 50,491 50,491 50,491 601,396

Net Profit b/tax (564,991) (64,991) (64,991) (514,991) (14,991) (14,991) (464,991) 35,009 35,009 (1,915,491) 84,509 84,509 (3,381,396)

Petron Energy

3 Year Operating Projections

By Month

1 deal 1 deal 1 deal 1 deal 12 wells

Income Jan-09 Feb-09 Mar-09 Apr-09 May-09 Jun-09 Jul-09 Aug-09 Sep-09 Oct-09 Nov-09 Dec-09 Total

Industry Deals 200,000 200,000 200,000 250,000 250,000 250,000 300,000 300,000 300,000 350,000 350,000 350,000 3,300,000

Petron Wells 150,000 150,000 150,000 300,000 300,000 300,000 450,000 450,000 450,000 2,700,000

Retail Packages 1,340,000 1,340,000 1,340,000 1,340,000 5,360,000

Total Income 1,540,000 200,000 200,000 1,740,000 400,000 400,000 1,940,000 600,000 600,000 2,140,000 800,000 800,000 11,360,000

COGS

Field Labor 25,000 25,000 25,000 25,000 25,000 25,000 25,000 25,000 25,000 25,000 25,000 25,000 300,000

Petron Wells 2,000,000 2,000,000 2,000,000 2,000,000 8,000,000

Industry Deals 500,000 500,000 500,000 500,000 2,000,000

Cost of Operation 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 60,000

Total COGS 2,530,000 30,000 30,000 2,530,000 30,000 30,000 2,530,000 30,000 30,000 2,530,000 30,000 30,000 10,360,000

Gross Profit (990,000) 170,000 170,000 (790,000) 370,000 370,000 (590,000) 570,000 570,000 (390,000) 770,000 770,000 1,000,000

Operating Expenses

Payroll 30,000 30,000 30,000 30,000 30,000 30,000 30,000 30,000 30,000 30,000 30,000 30,000 360,000

Payroll Tax 5,500 5,500 5,500 5,500 5,500 5,500 5,500 5,500 5,500 5,500 5,500 5,500 66,000

Advertising 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 36,000

Office expenses 500 500 500 500 500 500 500 500 500 500 500 500 6,000

Telephone 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 36,000

Insurance 1,200 1,200 1,200 1,200 1,200 1,200 1,200 1,200 1,200 1,200 1,200 1,200 14,400

Legal Expenses 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 60,000

Accounting 4,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 48,000

Vehicle(s) 3,500 3,500 3,500 3,500 3,500 3,500 3,500 3,500 3,500 3,500 3,500 3,500 42,000

Rent 2,500 2,500 2,500 2,500 2,500 2,500 2,500 2,500 2,500 2,500 2,500 2,500 30,000

Interest Expense - - - - - - - - - - - - -

Postage/Shipping 400 400 400 400 400 400 400 400 400 400 400 400 4,800

Depreciation - - - - - - - - - - - - -

Misc 400 400 400 400 400 400 400 400 400 400 400 400 4,800

Travel 2,500 2,500 2,500 2,500 2,500 2,500 2,500 2,500 2,500 2,500 2,500 2,500 30,000

Equipment Rental 500 500 500 500 500 500 500 500 500 500 500 500 6,000

Total Expenses 62,000 62,000 62,000 62,000 62,000 62,000 62,000 62,000 62,000 62,000 62,000 62,000 744,000

Net Income b/tax (1,052,000) 108,000 108,000 (852,000) 308,000 308,000 (652,000) 508,000 508,000 (452,000) 708,000 708,000 256,000

Petron Energy

3 Year Operating Projections

By Month

1 1 1 1 4

Income Jan-10 Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10 Aug-10 Sep-10 Oct-10 Nov-10 Dec-10 Total

Industry Deals 400,000 400,000 400,000 450,000 450,000 450,000 500,000 500,000 500,000 550,000 550,000 550,000 5,700,000

Petron Wells 600,000 600,000 600,000 750,000 750,000 975,000 1,125,000 1,125,000 1,350,000 1,500,000 1,500,000 1,725,000 12,600,000

Retail Packages 3,015,000 3,015,000 3,015,000 3,015,000 12,060,000

Total Income 4,015,000 1,000,000 1,000,000 4,215,000 1,200,000 1,425,000 4,640,000 1,625,000 1,850,000 5,065,000 2,050,000 2,275,000 30,360,000

COGS

Field Labor 50,000 50,000 50,000 50,000 50,000 50,000 50,000 50,000 50,000 50,000 50,000 50,000 600,000

Petron Wells 4,500,000 4,500,000 4,500,000 4,500,000 18,000,000

Industry Deals 500,000 500,000 500,000 500,000 2,000,000

Cost of Operations 50,000 50,000 50,000 50,000 50,000 50,000 50,000 50,000 50,000 50,000 50,000 50,000 600,000

Total COGS 5,100,000 100,000 100,000 5,100,000 100,000 100,000 5,100,000 100,000 100,000 5,100,000 100,000 100,000 21,200,000

Gross Profit (1,085,000) 900,000 900,000 (885,000) 1,100,000 1,325,000 (460,000) 1,525,000 1,750,000 (35,000) 1,950,000 2,175,000 9,160,000

Operating Expenses

Payroll 75,000 75,000 75,000 75,000 75,000 75,000 75,000 75,000 75,000 75,000 75,000 75,000 900,000

Payroll Tax 12,500 12,500 12,500 12,500 12,500 12,500 12,500 12,500 12,500 12,500 12,500 12,500 150,000

Advertising 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 20,000 20,000 20,000 20,000 200,000

Office expenses 1,500 1,500 1,500 1,500 1,500 1,500 1,500 1,500 1,500 1,500 1,500 1,500 18,000

Telephone 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 60,000

Insurance 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 120,000

Legal Expenses 25,000 25,000 25,000 25,000 25,000 25,000 25,000 25,000 25,000 25,000 25,000 25,000 300,000

Accounting 20,000 20,000 20,000 20,000 20,000 20,000 20,000 22,000 20,000 20,000 20,000 20,000 242,000

Vehicle(s) 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 180,000

Rent 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 120,000

Interest Expense - - - - - - - - - - - - -

Postage/Shipping 750 750 750 750 750 750 750 750 750 750 750 750 9,000

Depreciation - - - - - - - - - - - - -

Misc 1,000 1,000 1,000 1,000 1,000 1,000 1,000 1,000 1,000 1,000 1,000 1,000 12,000

Travel 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 60,000

Equipment Rental 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 36,000

Total Expenses 198,750 198,750 198,750 198,750 198,750 198,750 198,750 200,750 203,750 203,750 203,750 203,750 2,407,000

Net Income b/tax (1,283,750) 701,250 701,250 (1,083,750) 901,250 1,126,250 (658,750) 1,324,250 1,546,250 (238,750) 1,746,250 1,971,250 6,753,000

Petron Energy

2 Year Operating Projections

By Year

Sales Year 4 Year 5

Industry Deals 8,100,000 10,500,000

Petron Wells 30,150,000 48,150,000

Retail Packages 12,060,000 12,060,000

Total Sales 50,310,000 70,710,000

COGS

Field Labor 675,000 750,000

Petron Wells 18,000,000 18,000,000

Industry Deals 2,000,000 2,000,000

Cost of Field Operations 600,000 600,000

Total COGS 21,275,000 21,350,000

Gross Profit 29,035,000 49,360,000

Operating Expenses

Payroll 1,000,000 1,200,000

Payroll Tax 167,500 195,000

Advertising 250,000 300,000

Office expenses 20,000 25,000

Telephone 65,000 70,000

Insurance 130,000 140,000

Legal Expenses 325,000 350,000

Accounting 265,000 285,000

Vehicle(s) 200,000 200,000

Rent 175,000 200,000

Interest Expense

Postage/Shipping 10,000 12,500

Depreciation

Misc 15,000 17,500

Travel 75,000 100,000

Equipment Rental 40,000 45,000

Total Expenses 1,697,500 1,895,000

Net Income b/tax 27,337,500 47,465,000

Exhibits

PETRON ENERGY, INC. Cotton Valley Trend

www.petronenergy.net

traditional frac job

slick water only

hybrid slick water

the fracturing uid. These materials are called proppants. The proppant enters the fractures

in the formation and, when pumping is stopped and the pressure allowed to dissipate, the

proppant remains in the fractures. Since the fractures try to close back together afer the pres-

sure on the well is released, the proppant is needed to hold or prop the fractures open. These

propped-open fractures provide passages for oil or gas to ow into the well.

A series of studies and experimentation in the design of frac treatments have improved de-

velopment and stimulation practices in the Sandstone formations of East Texas. Advanced

hydraulic fracture diagnostics and documented production results over the rst six months of

well life have been used to beter understand fracture geometry and well performance. The

objective of the diagnostics is to improve fracture length and optimize fracture treatment de-

sign. The resulting changes to completion and stimulation design have resulted in improved

well performance.

New Hybrid Fracs Optimize

Development In Sand Formations

When sandstone rocks contain oil or gas in commercial quantities, recovery can be vastly

improved by a process called fracturing which is used to increase permeability to its optimum

level. Basically, to fracture a formation, a fracturing service company pumps a specically

blended uid down the well and into the formation under great pressure. Pumping continues

until the formation literally cracks open. Meanwhile, a special type of frac sand is mixed into

Exhibit A

www.petronenergy.net

PETRON ENERGY, INC. Cotton Valley Trend

Tax Benefts Of Oil And Gas Investment

For the individual investor not subject to the alternative minimum tax, there are some potentially

signicant tax advantages arising from development of domestic oil and gas prospects. These benets

are manifested in two distinct tax atributes: the election to expense intangible drilling costs and the

percentage depletion expense.

The election to expense intangible drilling costs helps the individual investor recoup the

original cash investment by oseting that expense against other ordinary income. Since a substantial

portion of the investment in an oil and gas prospect will be intangible drilling cost, this potential benet

can be very signicant depending on the investors incremental tax rate. This election creates an alternative

minimum tax preference item and its eect should be considered in advance of making this election. The

balance of a participants investment will fall into two categories: equipment and leasehold improvements,

which should be depreciated over seven years and amortized over ten years respectively.

The percentage depletion expense is an expense created upon the successful completion of a well and

the subsequent production. The gross oil and gas revenue from the well will determine this deduction.

Currently the percentage of the gross revenue used for calculating the depletion expense is 15% for light,

sweet crude. This percentage can rise for heavier oil when the price of oil drops below a specied

price. Since the deduction is based on gross revenue, the eective taxable rate on net income from the

prospect is much lower than other ordinary income. There is a potential alternative minimum tax impact

of percentage depletion that should be considered.

Simplifed Summary

1. Intangible Drilling Costs (IDC) are writen o 100% against adjusted gross income (taxable

income), thus lowering taxable income. IDC can vary from 65% to 95% of total unit cost.

2. Lease And Well Capital Costs (TDC) are principally for equipment such as pumpjacks, tankage,

wellheads, etc. and are capitalized and depreciated over seven years.

3. Lease Operating Expense (LOE) is a fully deductible business expense with the exception of

additional capitalized equipment.

4. Oil And Gas Production Income (Depletion Allowance) is 15% TAX FREE INCOME (minimum

15%) with the percentage determined annually by the IRS based on average price of crude oil and other

factors.

*This is not to be construed as tax advice. Petron recommends the use of a Certied Public Accountant competent in oil and gas maters.

Cotton Valley Trend 2006-IV 3-well Project

One Unit investment in three wells $ 45,000.00

Est. 85% Intangible Drilling Cost (IDC expense) $ 38,250.00

1st year write-o

100% IDC $ 38,250.00

1/7th TDC $ 964.00

Estimated rst year write-o $ 39,214.00

*39,214 Write-O X 35% Tax Bracket = $13,725 in Tax Savings

Exhibit B

www.petronenergy.net

PETRON ENERGY, INC. Cotton Valley Trend

Exhibit C

PETRON ENERGY, INC. Cotton Valley Trend

www.petronenergy.net

PETRON ENERGY, INC. Cotton Valley Trend

www.petronenergy.net

D

r

i

l

l

i

n

g

v

e

r

t

i

c

a

l

l

y

f

r

o

m

t

h

e

s

u

r

f

a

c

e

t

o

a

p

o

i

n

t

s

o

m

e

w

h

e

r

e

a

b

o

v

e

t

h

e

t

a

r

g

e

t

r

e

s

e

r

v

o

i

r