Professional Documents

Culture Documents

Open Access in Gujarat

Uploaded by

Joshi DhvanitCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Open Access in Gujarat

Uploaded by

Joshi DhvanitCopyright:

Available Formats

Open Access in Gujarat

Venu Birappa

Gujarat Energy Transmission Corporation Limited

27

th

May 2013

Flow of Presentation

GETCO at a glance

Open Access in Gujarat

Short Term, Medium term and Long term Open Access

Merchant plant, Captive generation, Third party sale

Technical requirement

Redundancy, Reactive power, Future load growth

Open Access to Wind and solar power

Impact of Open Access

Major Impediments

No Network as such in planned for

Short term/ Medium term Open Access.

3

Current status

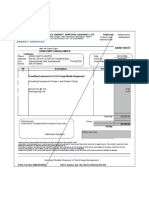

Installed Capacity including Central Sector Share (as on 30.04.2013):

Sr.

No.

Sector

Installed

Capacity in

MW

1 State Sector 4996

2 Private Sector 7400

3 Central Sector 5571

Total 17967*

* Excluding renewable capacity 4003 MW

Sr. No. Particulars

Substations

(Nos.)

Transmission Lines

(CKM)

Transformation

Capacity (MVA)

1 400 KV 11 3602 8355

2 220 KV 83 15774 20770

3 132 KV 50 4938 6323

4 66 KV 1206 23658 26230

Total 1350 47972 61678

Transmission Network Development (as on 31.03.2013)

Installed Capacity in MW

41%

28%

31%

State Sector

Private Sector

Central Sector

Open Access in Gujarat

GERC notified Open Access Regulation in 2005

State of Gujarat has implemented intra-state ABT

w.e.f. 05.04.2010 which is pre-requisite for

implementation of open access

Subsequently, GERC Open Access Regulation 2011

notified as per model Regulation of Forum of

Regulators

State providing adequate infrastructure support to

open access consumers in the state

4

Open Access Rules : GERC

Long-term customer:

Full Transmission charges shall be determined as per the Terms & Conditions of

tariff notified by appropriate Commission from time to time.

Rs.2970/MW/day for the year 2013-14

Period --exceeding12 year but not exceeding 25 years

Exit option for customer available by paying compensation

Medium Term Customer

Full Transmission Charges

Allowed on available margins

Rs.2970/MW/day for the year 2013-14

Period exceeding 3months but not exceeding 3 years

Exit option available by paying compensation.

Priority over Short Term Open Access

Short Term Customer

Intra-state

ST-Rate = 0.25 x [TSC / AV-cap]/365

Rs.742.5 /MW/day for the year 2013-14

Period ----less than 3 months and not exceeding 6 months in a year

Transmission Charges:

Connectivity and Open Access relationship

Connectivity should always be simultaneously applied with either Medium

Term Open Access or Long Term Open Access

Open Access users may take undue advantage of taking connectivity and

then trading in short term

Many Generators demand connectivity as merchant plants and then trade

power under short term open access as per the availability in market.

Captive power plants also seek connectivity and trade the surplus power.

Captive user and Merchant power plants find consumers within Gujarat for

trading power as third party sale

Eventually disparity among Open Access users, mainly DISCOMs who pay

for the existing network

Consumers grievance due to such disparity

Power not availed by such open access consumers within contract

demand is being backed down/sold at lower price in market for which fixed

cost is payable by DISCOMs

Open Access granted in Gujarat

Sr.

No

Year

Short Term Open Access

Medium

Term Open

Access

Long Term

Open Access

Numbers of

STOA

Application

approved

Total

STOA

User

Capacity

Approved

Sale

(MW)*

Capacity

Approved

Purchase

(MW)*

Nos. MW Nos. MW

1 2009-10 603 25 2404 -- - - 16 9547

2 2010-11 541 27 2738 -- - - 16 12745

3 2011-12 1070 49 3189 1355 6 279 15

13482

4 2012-13 4635 232 3255 3271 10 354 18 18033

*Average MW capacity approved during each month (approximately)

Captive Capacity catered by grid--------2957 MW

Details of Open Access Consumers in Gujarat

Details DGVCL UGVCL PGVCL MGVCL

TPL

AEC TOTAL

No. of OA Consumers

(as on Mar-12) 12 11 19 7 -- 49

Power purchased under

OA in Mus (FY 2011-12) 946 154 280 111 --- 1491

No. of OA Consumers

(as on Mar-13) 68 50 68 32 14 232

Power purchased under

OA in Mus (FY 2012-13-

upto 31.3.13) 2948 456 661 350 12 4427

Presently, 232 OA consumers have been purchasing power under short term open

access from Power Exchanges/ Short term Market in the State

States tied up capacity to supply their consumers on long term basis to meet the

existing as well as future demand is remaining unutilized/ stranded

Cost of power purchased from DISCOM

W/o demand charge

Charges Rs/unit

Demand Charges -

Energy charges 4.30

Fuel Surcharge 1.18

Time of Usage charges (75 paisa/ unit) 0.25

Total 5.73

15% Electricity duty is applicable but same is also applicable for

purchase under open access

Power purchase by Open access user in range of Rs. 3.75-5.43/unit

as against the supply of power by DISCOM at the rate of Rs. 5.73/unit

Technical Requirement

Reactive Power compensation

Sr.

No.

Voltage Class

Shunt Capacitor

(in MVAR)

Reactor (in MVAR)

Bus Line

1 400KV 0 705 313

2 220KV 0 100 0

3 132KV 216 0 0

4 66/33KV 1328 0 0

5 22KV 73 0 0

6 11KV 3121 0 0

Total 4738 805 313

180 MVAR Shunt Capacitor will be installed upto March-2014

1885 MVAR of 400KV class Bus Reactors (7X125 + 12X80 + 1X50) will be

installed

628MVAR of 400KV class Line Reactors (3X50 + 6X63) will be installed.

(Up to March-2013)

10

Redundancy of Transmission Network

Technical Requirement

Unable to handle contingency during peak load condition

Critical line loading during peak load condition

Single source substations

Non availability of parallel corridors.

Transfer of Power

(Existing)

Expected load growth Transfer of Power

(2012-13)

PGVCL

8770 MW (G)

4152 MW (D)

UGVCL

870 MW (G)

2918 MW (D)

MGVCL

2240 MW (G)

1423 MW (D)

DGVCL

6485 MW (G)

2146 MW (D)

DISCOM

(G)-Generation

(D)-Demand

TPAEC

500 MW (G)

1315 MW (D)

TPSEC

1148 MW (G)

600 MW (D)

12

Open Access to Renewable Energy

Variability: generation changes according to the availability of wind

velocity/sunlight resulting in swings of the plant output

Uncertainty : magnitude and time of the generation output is unpredictable &

unreliable and need ramping requirements

Low Plant Load Factor (PLF) to the tune of 20-22%

Limited control on generation

Not having proximity to the load centre.

The over voltage problem may be observed during period of low wind / solar

generation and off-peak load condition due to integration of large scale

renewable energy projects.

Due to the large oscillations in the wind / solar generation, the electrical grid is

affected in its voltage control and transient stability.

Adequate reserve capacity of gas / hydro generation is essential to meet the

system demand, when there is a sudden and substantial drop in wind / solar

generation.

Investment for integration of Wind power

14

400 KV

Halvad

400 KV

Varsana

220 KV

Nakhatrana

220 KV

Radhanpur

400 KV

Chorania

220 KV

Tankara

220 KV

Bhatia

220 KV

Kangasiyali

220 KV

Jasddan

Proposed 400/220 KV S/S

Proposed 220/132 KV OR

220/66 KV S/S

Proposed 400 KV D/C line

Proposed 220 KV D/C line

Proposed 132 KV D/C line

Geographical locations for Wind Power Projects

Euro Solar, Bhachau5MW

Back Bone Enterprise 5 MW

Konark Gujarat 5 MW

ICML 9 MW

Zeba Solar 10 MW

India Solar Ray 10MW

Ambit Advisory 5MW

Taxus infrastructure-5MW

Lanco, Bhadrada-5MW

Lanco, Chandiyala 15 MW

PLG Power, Sami-20MW

Astonfield Solar 11.5 MW

PLG Photovoltaic-20MW

JaiHindi 5 MW

Solitaire, Mitha-15.20 MW

Precious, Akhaj-15 MW

Solar Semi Conductor20 MW

Cargo Motors, Rapar 25 MW

S J Green Park Energy 5MW

15

Sunkon Energy -5 MW

Mono Steel 10MW

Responsive 25 MW

Ujjwala -25 MW

Chhatel (Ispat) -25 MW

Welspun Ltd 15 MW

Unity 5 MW

Azure Power, Dhama 5 MW

ESP Urja Ltd 5 MW

Millenium Synergy, Dasada 10 MW

Loroux Bio Energy 25 MW

EMCO 5 MW

WAA Solar 10 MW

Visual Percept 25MW

Environmental 10 MW

Tata Power Limited -25 MW

CBC solar -10 MW

Ganges Green 15 MW

Ganeshwani 5 MW

Green Infra -10 MW

Aravli Infra 5 MW

GHI Energy - 10 MW

MoserBear 15MW

APCA Power 5MW

Hiraco Renewable 20MW

Kemrock 10 MW

Adani Ltd 40MW

GMDC -5 MW

ACME 15 MW

Azure Haryana 10.20 MW

Aatash Power 5MW

Dreisatz MySolar-15MW

MySolar24 15MW

Tathith Energies- 5 MW

Sun Borne 15MW

Sand land-25MW

GIPCL 5 MW

JSW Energy, Deodar-5MW

Solar Semiconductor, Ajwada-20MW

Solitaire (MoserBear), Mudetha-15MW

Torrent Power, Savpura-25MW

NTPC, Morwada-50MW

Welspun Urja-40MW

Green colour Projects commissioned

Red colour - Projects to be commissioned

Charanka Solar Park

Projects Commissioned 221 MW

Project of Solar Generating Plants in Gujarat

Total Installed Capacity: 857MW

15

Impact of Open Access

Per unit fixed cost works out to Rs. 2.07 & DISCOMs recovers

approx. Rs. 0.50/unit as fixed charge from HT consumers

Retail energy charges includes partial recovery towards fixed

charges

Open access consumers pays around 55 paisa/unit (39 paisa- cross

subsidy & 16 paisa wheeling & transmission

Power not availed by such open access consumers is being backed

down/sold at lower price in market for which fixed cost is payable

by DISCOMs

Reasons for Thrust in Open Access

Open access is crucial for

Mobilizing larger private investment in generation through

guaranteed access to credible buyers.

Enhancing competition amongst generators and suppliers to

have option for consumers.

Investment promotion objective is of higher priority in view of the

prevailing electricity shortages.

18

Major impediment

Open Access users may take undue advantage of taking connectivity and

then trading in short term.Regulations of connectivity need to be

revisited

Eventually disparity among Open Access users, mainly DISCOMs who pay

for the existing network

Power not availed by such open access consumers within contract

demand is being backed down/sold at lower price in market for which fixed

cost is payable by DISCOMs

Renewable Open Access due to its unpredictable nature is creating

constraint for normal Open Access consumers during peak harvesting

period

You might also like

- SmartGrid vs MicroGrid; Energy Storage Technology: Energy, #2From EverandSmartGrid vs MicroGrid; Energy Storage Technology: Energy, #2No ratings yet

- Format 16 Guidelines To Consumers1Document18 pagesFormat 16 Guidelines To Consumers1raj sekharNo ratings yet

- Offshore Wind Energy Generation: Control, Protection, and Integration to Electrical SystemsFrom EverandOffshore Wind Energy Generation: Control, Protection, and Integration to Electrical SystemsNo ratings yet

- Project Report - Subham Saini (New)Document22 pagesProject Report - Subham Saini (New)Vishvajeet SinghNo ratings yet

- Energy Storage: Legal and Regulatory Challenges and OpportunitiesFrom EverandEnergy Storage: Legal and Regulatory Challenges and OpportunitiesNo ratings yet

- Project Inception Report - High Capacity Power Transmission Corridor - Main ReportDocument59 pagesProject Inception Report - High Capacity Power Transmission Corridor - Main ReportMin100% (1)

- Annual Report - 2019-20 PDFDocument67 pagesAnnual Report - 2019-20 PDFdeep_redNo ratings yet

- Er Kalra PSPCL Net Metering Presentation Solar On Dt. 11.11.14Document28 pagesEr Kalra PSPCL Net Metering Presentation Solar On Dt. 11.11.14Sourav DebnathNo ratings yet

- Electricity System in SingaporeDocument30 pagesElectricity System in SingaporeglenlcyNo ratings yet

- Karnataka Power Sector Planning DocumentDocument58 pagesKarnataka Power Sector Planning Documentdilipeline100% (1)

- En 1305533371Document15 pagesEn 1305533371divyaraj.zala1804No ratings yet

- Overview of Indian Power SectorDocument26 pagesOverview of Indian Power SectorAnand KumarNo ratings yet

- Indian Power Sector: Prepared By: Group 1Document31 pagesIndian Power Sector: Prepared By: Group 1inwanadNo ratings yet

- Electrical ProjectDocument3 pagesElectrical ProjectdugdugdugdugiNo ratings yet

- Solar Power Plant Project-LibreDocument43 pagesSolar Power Plant Project-LibreRamana KanthNo ratings yet

- Department OF Electrical Engineering Semester - 06 GREEN TECHNOLOGY (4360904)Document28 pagesDepartment OF Electrical Engineering Semester - 06 GREEN TECHNOLOGY (4360904)viharshyadav652No ratings yet

- Solar PV Project Planing, Installation and Commissioning TechniquesDocument43 pagesSolar PV Project Planing, Installation and Commissioning TechniquesAnonymous EePp3z100% (1)

- MNREDocument36 pagesMNRESangeet BhandariNo ratings yet

- NEPRA Internship ReportDocument8 pagesNEPRA Internship ReportAtif NawazNo ratings yet

- Switch Solar: Babu IlangkannanDocument24 pagesSwitch Solar: Babu IlangkannanPhu, Le HuuNo ratings yet

- Solar Power Policy Related To HT Consumers (TANGEDCO-MPNo14of2018), dt.29-10-2019Document9 pagesSolar Power Policy Related To HT Consumers (TANGEDCO-MPNo14of2018), dt.29-10-2019girivalamsupermarketNo ratings yet

- INDIAN POWER SCENARIO - PAST, PRESENT AND FUTUREDocument45 pagesINDIAN POWER SCENARIO - PAST, PRESENT AND FUTURENaresh KumarNo ratings yet

- A Presentation ON Solar Wind Hybrid SystemDocument21 pagesA Presentation ON Solar Wind Hybrid Systemindian4uuNo ratings yet

- DPR Rooftop SolarDocument30 pagesDPR Rooftop SolarPrathik Joshi100% (1)

- Grid Failure A Perspective As A Power ProducerDocument30 pagesGrid Failure A Perspective As A Power Producersasi15augNo ratings yet

- 150 MW Mega Solar PV Plant at Gujarat Solar Park CharankaDocument14 pages150 MW Mega Solar PV Plant at Gujarat Solar Park CharankaSayari Das100% (2)

- Jawaharlal Nehru National Solar Mission - 2010, INDIA: ConnectedthinkingDocument10 pagesJawaharlal Nehru National Solar Mission - 2010, INDIA: ConnectedthinkingamiticfaiNo ratings yet

- Prospects of Renewable Energy in PakistanDocument34 pagesProspects of Renewable Energy in PakistanADBI EventsNo ratings yet

- Power Sector - Opportunities and IssuesDocument28 pagesPower Sector - Opportunities and IssuesRamesh AnanthanarayananNo ratings yet

- Summer Training at SeccoDocument13 pagesSummer Training at SeccoHassan SaeedNo ratings yet

- Open Access GJDocument1 pageOpen Access GJPranay PatelNo ratings yet

- Chapter 1-About The Organization.: Karnataka Power Transmission Corporation LimitedDocument48 pagesChapter 1-About The Organization.: Karnataka Power Transmission Corporation LimitedKavya R100% (3)

- Ghana 100mw Plant - 1.4Document16 pagesGhana 100mw Plant - 1.4Mohd NB MultiSolarNo ratings yet

- 100 KWp Solar Power Plant Proposal for Nazareth Foods Pvt LtdDocument24 pages100 KWp Solar Power Plant Proposal for Nazareth Foods Pvt LtdRabindra SinghNo ratings yet

- 100 KWp Solar Power Plant Proposal for Nazareth Foods Pvt LtdDocument24 pages100 KWp Solar Power Plant Proposal for Nazareth Foods Pvt LtdJehanzeb Saleem100% (1)

- 100 KWP Solar Cell PDFDocument24 pages100 KWP Solar Cell PDFFaisal AhmadNo ratings yet

- Information MemorandumDocument32 pagesInformation Memorandumsurajit81No ratings yet

- New Nuclear Power Plant To Interface With The GridDocument39 pagesNew Nuclear Power Plant To Interface With The Grid210zhoqueNo ratings yet

- FinalOrderdated22.02.2024onSRTPVRegulation.pdf APDocument132 pagesFinalOrderdated22.02.2024onSRTPVRegulation.pdf APdillibabu.rNo ratings yet

- Wind Solar HybridDocument21 pagesWind Solar HybridSukumar AnanthapuramNo ratings yet

- Performance Analysis of A PVFC Hybrid System For Generating Electricity in Iraqi's Remote AreasDocument12 pagesPerformance Analysis of A PVFC Hybrid System For Generating Electricity in Iraqi's Remote AreasAli Saleh AzizNo ratings yet

- A Presentation ON Solar Wind Hybrid SystemDocument21 pagesA Presentation ON Solar Wind Hybrid SystempriyaNo ratings yet

- Training 400 KV SubstaionDocument69 pagesTraining 400 KV SubstaionDeepak Yadav100% (1)

- Specification Grid Tie SPV PlantDocument24 pagesSpecification Grid Tie SPV PlantAnonymous iNZUlcNo ratings yet

- Guidelines for Rooftop Solar PV in Tamil NaduDocument24 pagesGuidelines for Rooftop Solar PV in Tamil NaduBala SVDNo ratings yet

- PGVCL Training ReportDocument39 pagesPGVCL Training ReportSiddharth TalaviyaNo ratings yet

- Industrial Training Report OnDocument27 pagesIndustrial Training Report OnHarshita Gautam100% (1)

- Detailed Project Report For GreenDocument31 pagesDetailed Project Report For GreenanilNo ratings yet

- Indonesia Applying Distributed Generation-SHANGHAIDocument23 pagesIndonesia Applying Distributed Generation-SHANGHAINyx RubyNo ratings yet

- Connection Conditions For Generators of Electricity From Solar EnergyDocument12 pagesConnection Conditions For Generators of Electricity From Solar EnergyjayapalNo ratings yet

- ASM Alamgir Kabir - Solar Projects in BangladeshDocument34 pagesASM Alamgir Kabir - Solar Projects in BangladeshADB_SAEN_ProjectsNo ratings yet

- Transmission AllDocument95 pagesTransmission Alldubuli123100% (1)

- 500KV Grid Station Project Report (Final) Power EngineeringDocument39 pages500KV Grid Station Project Report (Final) Power EngineeringEngr Kami Sayal50% (4)

- Optimal MPPT Control Using Boost Converter For Power Management in PV - Diesel Remote AreaDocument8 pagesOptimal MPPT Control Using Boost Converter For Power Management in PV - Diesel Remote AreaGRD JournalsNo ratings yet

- Manipur Solar Policy 2014Document8 pagesManipur Solar Policy 2014Sourav ShomeNo ratings yet

- Green Energy Corridors Transmission Plan for India's Growing Renewable SectorDocument32 pagesGreen Energy Corridors Transmission Plan for India's Growing Renewable SectorSai SwaroopNo ratings yet

- Saudi Electricity CompanyDocument19 pagesSaudi Electricity CompanyAmeerah SaNo ratings yet

- Instruction Manual NewDocument253 pagesInstruction Manual NewManoj Garg100% (1)

- Introduction To Electricity Act 2003: Presented by Indu Maheshwari Dy. DirectorDocument41 pagesIntroduction To Electricity Act 2003: Presented by Indu Maheshwari Dy. DirectorSantosh Kumar100% (1)

- Mounting StructureDocument41 pagesMounting StructureAcharan Chandel100% (1)

- ASME B31.3 InterpretationDocument743 pagesASME B31.3 Interpretationiangregorrustria100% (3)

- Appointment Letter FormatDocument7 pagesAppointment Letter FormatAdv Kunal KapoorNo ratings yet

- Pollution Control Guidelines for Conversion to Solid FuelsDocument24 pagesPollution Control Guidelines for Conversion to Solid FuelsdurgamadhabaNo ratings yet

- Transforming India PDFDocument160 pagesTransforming India PDFShantanu NandaNo ratings yet

- ANNEXURE-7.pdf BHEL PDFDocument10 pagesANNEXURE-7.pdf BHEL PDFSuleman KhanNo ratings yet

- Haripura - Analysis Sheet 15-07-15Document58 pagesHaripura - Analysis Sheet 15-07-15Joshi DhvanitNo ratings yet

- Schneider NS800Document64 pagesSchneider NS800Anonymous Lh3Yh8basINo ratings yet

- Appointment Letter FormatDocument7 pagesAppointment Letter FormatAdv Kunal KapoorNo ratings yet

- Jim Meyer LPG Expansion Joints White PaperDocument7 pagesJim Meyer LPG Expansion Joints White PaperJoshi DhvanitNo ratings yet

- Siemens Basics of PLCDocument89 pagesSiemens Basics of PLCAlejandro Cortes Bolados100% (1)

- 14 - 8 - 15 FinalDocument118 pages14 - 8 - 15 FinalJoshi DhvanitNo ratings yet

- Conclusion & RecommendationDocument4 pagesConclusion & RecommendationJoshi DhvanitNo ratings yet

- 2011 C FnodeDocument1 page2011 C FnodeJoshi DhvanitNo ratings yet

- 144 BDocument14 pages144 BJoshi DhvanitNo ratings yet

- Control of Moisture Content in Bagasse by Using Bagasse DryerDocument3 pagesControl of Moisture Content in Bagasse by Using Bagasse DryerseventhsensegroupNo ratings yet

- JJDocument5 pagesJJJoshi DhvanitNo ratings yet

- Convert Electricity Use to CO2 EmissionsDocument1 pageConvert Electricity Use to CO2 EmissionsJoshi DhvanitNo ratings yet

- Lec37 PDFDocument35 pagesLec37 PDFAli AlengineerNo ratings yet

- Thermopac BlowerDocument2 pagesThermopac BlowerJoshi DhvanitNo ratings yet

- Coal CombustionDocument73 pagesCoal Combustionsaliheren100% (1)

- Savings Calculation: Overall Chiller SPC TR Saved Power Savings Can Be Achieved Energy SavingsDocument2 pagesSavings Calculation: Overall Chiller SPC TR Saved Power Savings Can Be Achieved Energy SavingsJoshi DhvanitNo ratings yet

- 144 ADocument14 pages144 AJoshi DhvanitNo ratings yet

- Urban AreaDocument2 pagesUrban AreaJoshi DhvanitNo ratings yet

- 142 ADocument16 pages142 AJoshi DhvanitNo ratings yet

- Equipment 20checkingDocument18 pagesEquipment 20checkingJoshi DhvanitNo ratings yet

- Energy Efficient Compressed Air Systems: GPG385 Good Practice GuideDocument40 pagesEnergy Efficient Compressed Air Systems: GPG385 Good Practice GuideDerek White100% (2)

- Sr.NO Savings Calculation kW/TR TR kW kWh/Annum Lakh Rs Lakh Rs/Annum Years Savings CalculationDocument2 pagesSr.NO Savings Calculation kW/TR TR kW kWh/Annum Lakh Rs Lakh Rs/Annum Years Savings CalculationJoshi DhvanitNo ratings yet

- DARCY FRICTION LOSS CALCULATOR FOR PIPESDocument1 pageDARCY FRICTION LOSS CALCULATOR FOR PIPESJoshi DhvanitNo ratings yet

- H LookDocument1 pageH LookJoshi DhvanitNo ratings yet

- Savings Calculation: Overall Chiller SPC TR Saved Power Savings Can Be Achieved Energy SavingsDocument2 pagesSavings Calculation: Overall Chiller SPC TR Saved Power Savings Can Be Achieved Energy SavingsJoshi DhvanitNo ratings yet

- E-Ue The Universe ElectricDocument210 pagesE-Ue The Universe ElectricJavier OteroNo ratings yet

- CV TuanDocument6 pagesCV TuanMinh VuNo ratings yet

- Chapter 1Document17 pagesChapter 1DrGopikrishna PasamNo ratings yet

- PEM Electrolyzers GuideDocument6 pagesPEM Electrolyzers Guidecderin2000No ratings yet

- Reinforcement Chapter 2 Force and MotionDocument5 pagesReinforcement Chapter 2 Force and MotionNurlini SulimanNo ratings yet

- CF Revisi 1Document3 pagesCF Revisi 1Dedy AfriNo ratings yet

- Chapter 18: Planar Kinetics of A Rigid Body: Work and EnergyDocument111 pagesChapter 18: Planar Kinetics of A Rigid Body: Work and EnergyStephanie CastroNo ratings yet

- 130321-APU Project Specification Form (PSF)Document8 pages130321-APU Project Specification Form (PSF)Ahmed AsnagNo ratings yet

- Ee1451 - Renewable Energy SourcesDocument10 pagesEe1451 - Renewable Energy SourcesJagabar SathikNo ratings yet

- Solar Energy Conclave 2010 13Document19 pagesSolar Energy Conclave 2010 13Mayank TripathiNo ratings yet

- MIGA - InsuranceDocument2 pagesMIGA - InsuranceRaghav ArroraNo ratings yet

- Research PaperDocument7 pagesResearch PaperJafarNo ratings yet

- Batoka Gorge Hydro Power ProjectDocument3 pagesBatoka Gorge Hydro Power ProjectMuhammad Abdul WahidNo ratings yet

- DC Bus Voltage RegulationDocument2 pagesDC Bus Voltage RegulationHasRasfaNo ratings yet

- Kinetic and Potential Energy ConservationDocument17 pagesKinetic and Potential Energy ConservationCole CitrenbaumNo ratings yet

- Review On Frequency Control of Power Systems With Wind Power Penetration51Document8 pagesReview On Frequency Control of Power Systems With Wind Power Penetration51Mohamed BerririNo ratings yet

- Solar Energy For Dhal MillsDocument2 pagesSolar Energy For Dhal MillsBenjamin StricklandNo ratings yet

- THE IDEAL GAS LAW AND KINETIC THEORYDocument13 pagesTHE IDEAL GAS LAW AND KINETIC THEORYLuis AndersonNo ratings yet

- Gosaba's pioneering 5 X 100 KWe biomass gasifier plantDocument2 pagesGosaba's pioneering 5 X 100 KWe biomass gasifier plantAkhilesh GuptaNo ratings yet

- Hydrogen Economy - EssayDocument10 pagesHydrogen Economy - EssayKai PflughauptNo ratings yet

- Scope of Energy ConservationDocument5 pagesScope of Energy ConservationRishav HarshNo ratings yet

- PM TB Solutions C06Document7 pagesPM TB Solutions C06Vishwajeet Ujhoodha88% (8)

- Energy Efficiency Opportunities in IndiaDocument33 pagesEnergy Efficiency Opportunities in Indianitin guptaNo ratings yet

- Diffusion and MT CoefficientDocument74 pagesDiffusion and MT CoefficientParitosh ChaudharyNo ratings yet

- Ugvcl Godrej AUG 2017Document1 pageUgvcl Godrej AUG 2017jha.sofcon5941No ratings yet

- The Energy Story - Chapter 6 - Turbines, Generators and Power PlantsDocument3 pagesThe Energy Story - Chapter 6 - Turbines, Generators and Power PlantslumagbasNo ratings yet

- Table of SpecificationDocument5 pagesTable of SpecificationRustan LacanilaoNo ratings yet

- Irradiation Damage in Graphite from Fast NeutronsDocument221 pagesIrradiation Damage in Graphite from Fast NeutronsHafidzManafNo ratings yet

- Concepts of MatterDocument14 pagesConcepts of Matteralimoya13No ratings yet

- Heat Transfer Methods: Conduction, Convection & RadiationDocument14 pagesHeat Transfer Methods: Conduction, Convection & RadiationMuqeet76No ratings yet