Professional Documents

Culture Documents

Chap 020

Uploaded by

Neetu RajaramanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 020

Uploaded by

Neetu RajaramanCopyright:

Available Formats

Chapter 20 - Production Cost Variance Analyses

CHAPTER 20

PRODUCTION COST VARIANCE ANALYSES

Changes from Twelfth Edition

All changes to Chapter 20 were minor.

Approach

This chapter has a heavy technical content. It is probably desirable to proceed uite slowly with it!

ma"ing sure that each variance is understood. The success#ul student is one who can $reinvent$ the

#ormulas as needed! rather than needing to memori%e them. A good understanding #rom Chapter &' o# the

#low o# costs through the T-accounts in a standard cost system obviously is important in mastering the

techniues o# variance analysis.

Throughout the sessions on this chapter! it is important to stress the uses o# variances. I #eel it particularly

important #or students to reali%e that (&) the overriding goal is to identi#y all o# the elements that caused

actual net income to di##er #rom budget (or another use#ul comparison standard)* (2) the labels

$#avorable$ and $un#avorable$ are algebraic and do not necessarily re#lect whether something $good$ or

$bad$ happened* (+) despite the mathematical #ormulas that isolate variance components! the components

in some instances are interdependent* and (,) the monthly overhead volume variance is not use#ul #or

control purposes.

Cases

SunAir Boat Builders, Inc. as"s students to calculate a #ull set o# production cost variances #or a simple

production company.

Medi-Exam Health Services, Inc. involves both brea"-even analysis and uestions reuiring an

understanding o# overhead variances.

Cotter Company, Inc. is a deceptive case that tests whether the student has really $internali%ed$ the

concepts o# overhead variance analysis.

Lupton Company is a challenging(-) review case on the application o# standard costing and variance

analysis concepts.

Problems

Problem 20-1: Beta Company

a. .aterial variance/

Price variance 0 Price 1 Actual 2uantity

3 Price variance 0 (4&+ - 4&2.,0) 1 +'!000 0 42+!,00 5

6 Price variance 0 (47.80 - 47.90) 1 &&!000 2!200 :

2&!200 5

20-&

Chapter 20 - Production Cost Variance Analyses

:sage variance 0 2uantity 1 ;tandard Price

3 :sage variance 0 (, 1 ,!200 < = 1 +!=00 - +'!000) 1 4&+.00 0 49!700 :

6 :sage variance 0 (& 1 ,!200 < 2 1 +!=00 - &&!000) 1 4 7.80 0 +!,00 5

4,!,00 :

b. >abor variances

?ate variance 0 (4&, - 4&+.=0) 1 2!028 0 47&0 5

@##iciency variance 0 (&A8 1 ,!200 < &A+ 1 +!=00 B 2!028) 1 4&, 0 2&0 5

c. There would be no changes in the answers to & and 2. Prime cost variances are always based on actual

production volume! not planned volume. (;ome students need #reuent reminding o# this #act.)

d. Again! there would be no change* sales volume has no direct impact on production volume! and

hence! not on production cost variances.

Problem 20-2: elta Company

b. Cudgeted overhead at standard volume 0 4&00!000 < 42=.00 (8!000) 0 42+0!000

c. Dverhead absorption rate 0 42+0!000 E 8!000 units 0 4,=.00Aunit

d. .ay absorbed overhead 0 4,=.00Aunit 1 =!000 units 0 429=!000

e. Volume variance 0 Absorbed - Cudgeted

0 429=!000 - F4&00!000 < 42=.00 (=!000)G 0 420!000 5

#. ;pending variance 0 Cudgeted - Actual

0 428=!000 - 4270!000 0 42,!000 :

g. Het variance 0 Absorbed - Actual

0429=!000 - 4270!000 0 4,!000 :

Chec"/ 420!000 5 < 42,!000 : 0 4,!000 :

Problem 20-!: "olb Company

a. (&) Cost system A is the actual variable cost system because 4&0!000 o# #actory indirect costs have

been charged out as an e1pense o# the period in which incurred. Cost o# goods sold is carried

at a lower value than C or C! indicating the inclusion o# only variable costs.

(2) Cost system C is the standard #ull cost system. The presence o# variances indicates this! and

the total costs o# goods sold plus variances euals #ull cost (4'=!000).

(+) Cost system C is the actual #ull cost system (using a predetermined overhead rate) showing the

cost o# goods sold charged with its #air share o# the #actory indirect costs o# the period! and

showing the same total #ull costs o# goods sold as C. (Coth are 4'=!000.)

b.Ac. Dne cannot determine how much o# the overhead was variable because we do not "now how much

o# the 4==!000 actual variable cost represented prime costs (direct material and direct labor). Ie can

say that actual #i1ed #actory overhead was 4+0!000 (4&&0!000 - 470!000 di##erence in other operating

e1penses)! but we cannot determine the amount o# actual variable #actory overhead.

d. 470!000! the operating e1penses are non#actory costs.

20-2

Chapter 20 - Production Cost Variance Analyses

e.

e. ;ince there was an un#avorable overhead variance in system C! not all the #actory indirect costs were

absorbed into the product! meaning #actory volume was not as e1pected. I# two-thirds o# the #i1ed

#actory indirect costs were absorbed into the cost o# goods sold (2A+ 1 4+0!000 0 420!000)! then the

remaining 4&0!000 was not absorbed! indicating volume o# only 2A+! or == 2A+J! o# the normal

#actory volume anticipated when the overhead rate was set. This assumes there was no overhead

spending variance* without this assumption! the answer is indeterminate.

#. Cost system A! the actual variable cost system! is not prepared in accordance with generally accepted

accounting principles! because #ull costs must be used to comply with these principles.

g. Kirect material actual costs were 4,!000 more than planned costs. This is "nown because the

materials variance is un#avorable! indicating actual cost to be greater than planned costs.

h. Problem 20-,/ Koyle Company

a. .olders Trimmers Variance

(&) >abor rate F+!700(4'.00 B '.28)G04'80: F&!=00 (4=.00 B =.&8)G042,0: 4&!&'0:

(2) >abor substitution

(shi#t o# molders to

trimming operation) F200 (=.00 B '.00)G =00:

(+) .aterial substitution

(additional labor due

to discarded cases)

+!&80: 14,.80

&0

9!000

=

&!080: 14&.80

&0

9!000

=

,!200:

(,) Dperating e##iciency

varianceL (28 1 4'.00)0228: (&8 1 4=.00)0'0: +&8:

(8) Idle time (98 1 '.00)0=98: (+8 1 4=.00)02&0: 778:

Total variance............................................................................................................................................................................ 49!&'0:

LKetermination o# operating e##iciency variance.

.olders Trimmers

Actual hours charged to production...................................................................................................................................................... +!700 &!=00

>abor substitution (shi#t o# molders to trimming operation)................................................................................................................. (200) 200

Additional labor hours due to in#erior plastic.......................................................................................................................................

.8

&0

000 ! 9

(+80)

.28

&0

000 ! 9

(&98)

Idle time............................................................................................................................................................................................... (98) (+8)

Actual hours spent producing good cases............................................................................................................................................. +!&98 &!8'0

;tandard hours allowed #or the production o# good cases....................................................................................................................

.8

&0

000 ! =+

+!&80

.28

&0

000 ! =+

&!898

Variance in hours................................................................................................................................................................................. 28: &8:

20-+

Chapter 20 - Production Cost Variance Analyses

b. The supervisor o# the molding department has a valid argument in both cases. The labor substitution

variance was the conseuence o# poor scheduling which is controlled by the production scheduling

department. The supervisor o# the molding department apparently has no responsibility #or or control

over the overall scheduling but has been reuired to compensate #or the production scheduling

departmentMs error. Conseuently! the molding department should not be charged #or the necessary

shi#t o# wor"ers within the department because the supervisor could not control the activities that

caused the shi#t.

The molding department uses the raw materials (plastic) that are acuired by the purchasing department.

The acuisition o# plastic is the responsibility o# the purchasing department and the supervisor o# the

molding department neither controls nor is responsible #or this activity. The purchasing department made

the switch to the in#erior plastic! and they should be held accountable #or this action and resulting

variance.

Cases

Case 20-1: SunAir Boat Builders, Inc

#ote: This case is unchaned !rom the T"el!th Edition# $lease see the printed Instructor%s &esource

'uide !or the Harvard Teachin (otes#

Case 20-2: Medi-Exam Health Services, Inc

!

#ote: This case is unchaned !rom the T"el!th Edition.

Approach

This case provides a review o# brea"-even analysis and pro#itgraphs! while at the same time lin"ing pro#it

budgets and actual results in a way that involves understanding overhead variances. @1hibit & illustrates a

more detailed pro#itgraph #ormat than is described in the te1t* some instructors may wish to ta"e a #ew

minutes to develop the algebraic e1pressions #or the total cost and revenue lines (&2!000 < +23 and 703

respectively) be#ore starting the case discussion. Proceeding in order with the uestions should move

smoothly until 2uestion +! where the conceptual di##erence between a periodMs overhead costs (debits to

the Dverhead clearing account) and overhead e1penses (the amount charged to the periodMs income

statement) will cause di##iculties #or many students. This is one o# several opportunities to rein#orce the

notion that the overhead production volume variance is a #unction o# production volume (tests

per#ormed)! not sales volume (tests billed).

*

This teaching note was prepared by Pro#essor Names ;. ?eece. Copyright O by Names ;. ?eece.

20-,

Chapter 20 - Production Cost Variance Analyses

Answers to $%estions

)uestion *+ Brea,-even

Crea"-even volume 0

.argin on Contributi :nit

Costs 5i1ed

5i1ed costs 0 5i1ed >ab. Dverhead < 5i1ed Admin.

0 420!000 < 4,!000 0 42,!000

:nit contribution margin 0 ;ales revenueA:nit - Variable costA:nit

0 4&=0- (4+2!000L A 800)

0 4&=0-4=,

0 4'=

LVariable costs at 800 e1amsAmonth 0

;upplies............................................................................................................................................................................................................................................ 4 7!000

>abor................................................................................................................................................................................................................................................. =!000

Variable >ab. Dverhead.................................................................................................................................................................................................................... &0!000

Variable Admin................................................................................................................................................................................................................................. 7!000

4+2!000

Crea"-even volume 0

'= 4

000 ! 2, 4

0 280 e1ams

At this point or in 2uestion 2! it is also worthwhile to develop the #ull standard cost o# an e1am! based

on a normal volume o# 800/

@1ams 800

#i1ed 420!000 vbl. 42,!000 +

0 477 A e1am

Hote that the administrative e1penses! which are period rather than product costs! are e1cluded. This

number can be used to veri#y the August standard cost o# services billed/ +&0 e1ams P477 0 429!270.

20-8

Chapter 20 - Production Cost Variance Analyses

)uestion -+ $ro!it per $ro!itraph

Total preta1 pro#it 0 ?evenue - Variable costs - 5i1ed costs

Total preta1 pro#it #or 3 e1ams 0 4&=03 - 4=,3 - 42,!000

Total preta1 pro#it #or +&0 e1ams 0 4&=0(+&0) - 4=,(+&0) - 42,!000

0 4,'!=00 - 4&'!7,0 - 42,!000

0 48!9=0

)uestion .+ Auust /$roduction0 1olume

5i1ed laboratory overhead is absorbed at the rate o# 4,0.00 per physical administered/

,0 4

800

000 ! 20 4

n e1aminatio o# number s monthM Hormal

overhead laboratory 5i1ed

= =

There is a volume variance (debit) o# 4&!=00 #or the period! indicating that overhead has been

underabsorbed (number o# e1aminations given was less than #ormal). 5i1ed laboratory overhead

absorbed by e1aminations given must total 420!000 - 4&!=00 0 4&7!,00. I# 4&7!,00 was absorbed and

the absorption rate is 4,0Aphysical! then ,=0 e1aminations must have been given this period.

Alternatively! i# the approach described in the chapterMs #irst appendi1 is used! the production volume

variance is 4&!=00:! and the absorption rate #or #irst overhead is 4,0Ae1am* so 4&!=00A4,0 0 ,0 #ewer

e1ams than normal (,=0 0 800 - ,0) must have been per#ormed.

)uestion 2+ $ro!it &econciliation

Het pro#it indicated by brea"-even chart #or +&0 e1aminations (2uestion 2) 0 4 8!9=0

Add (items which increased the pro#it shown above)/..........................................................................................................................

5i1ed laboratory overhead assigned to unbilled ;ummations............................................................................................................... =!000L

4&&!9=0

;ubtract (items which dec"ed the pro#it shown above)/.......................................................................................................................

?evenue less than e1pected.................................................................................................................................................................. (,00)<

Dther variances (per income statement)............................................................................................................................................... (&!&20)

Dverspending on administrative e1penses............................................................................................................................................ (2,0)

4&0!000

L,=0 e1aminations were per#ormed but only +&0 were billed. There#ore &80 e1aminations were still unbilled (an

intangible IIP inventory). @ach o# these is allocated 4,0 o# laboratory overhead (4,0 L &80 0 4=!000).

<4&=0 L +&0 e1aminations 0 4,'!=00. Actual revenue was 4,'!200.

@1pected Administrative e1penses were 4,!000 #i1ed < 47!000A800 variable or 4,!000 < 4&= per e1am. 5or +&0

e1aminations! planned costs are 4,!000 < (4&= L +&0) 0 47!'=0. Actual costs were 4'!200.

Case 20-": Cotter Co, Inc

#ote: This case is unchaned !rom the T"el!th Edition. $lease see the printed Instructor%s &esource

'uide !or the Harvard Teachin (otes#

Case 20-#: $u%ton Com%an&

!

#ote: This case is unchaned !rom the T"el!th Edition.

*

This teaching note was prepared by Pro#essor Names ;! ?eece. Copyright O by Names ;. ?eece.

20-=

Chapter 20 - Production Cost Variance Analyses

Approach

This case provides an e1cellent review o# standard costing and variance analysis concepts. ;tudents

cannot plug numbers into #ormulas to uic"ly arrive at most o# the answers* rather! basic concepts and

procedures have to be care#ully thought through. .any students #ind the case #rustrating because it is too

challenging #or them* the instructor should there#ore warn students not to get discouraged i# some

uestions seem beyond them. (The case ma"es an e1cellent e1am! i# the instructor pre#ers di##icult e1ams

to more straight#orward ones.) I suggest devoting two class sessions to this case! trying to get through

uestion && in the #irst session.

Comments on $%estions

&. Ie can de#initely say that material usage and total labor costs were not up to e1pectations (although

without #urther detailed analysis! we do not "now the rate and e##iciency components o# the labor

variance). Ie also "now that actual prices o# materials purchases e1ceeded standard* but this tells us

nothing about the prices o# materials used in production! which is the connotation o# $did we spend

more #or our production operationsQ$ Also! without the detailed analysis called #or in uestions &,-

&9! we cannot say that the un#avorable overhead variances represent overruns o# spending budgets*

conceivably! #avorable spending variances could have been more than o##set by un#avorable

production volume variances.

2. ;ince net overhead variance 0 absorbed - actual! and actual was the same both months! then more

overhead must have been absorbed in .ay than in April. This means that production volume!

however de#ined #or overhead absorption purposes (see uestion ')! was higher in .ay than in April.

Hote that overhead in Cost o# Roods ;old was lower in .ay! but overhead absorbed into Ior" in

Process was higher. ;tudents o#ten #orget the distinction between production volume and sales

volume when answering this sort o# uestion.

+. Iithout re#erence to the supplementary data! we cannot determine whether AprilMs overhead volume

variance was #avorable or un#avorable (uestion &=). ;ome students will incorrectly state that

production volume was above standard! based on the 4&7,!800 direct labor portion o# cost o# goods

sold.

,. 5or the reason given in the answer to uestion 2! we "now that .ayMs production volume was higher

than AprilMs. 5or the reason given in the response to uestion +! we do not "now i# .ayMs production

volume was above or below standard volume. ;ome students will incorrectly in#er that production

volume was 4&2+!000 K>4 because direct labor in cost o# goods sold was 4&2+!000.

20-9

Chapter 20 - Production Cost Variance Analyses

8. ;ales revenues dropped 28 percent while total standard gross margin #ell &&.7 percent. This could

have been caused by two #actors/ (&) an increase in weighted-average per-unit selling price obtained!

or (2) a change in product mi1 that increased the proportion o# sales o# the product having the higher

unit margin. @ither o# these would increase the standard gross margin percentage! which went #rom

27.+ percent in April to ++.+ percent in .ay. (Chapter 2& describes techniues #or isolating these two

#actors.)

=. The easy e1planation is that >upton buys more than one raw material! and other materialsM price

increases more than o##set the decrease on this one particular material. Sowever! the phenomenon

could occur i# >upton had only one raw material/ i# .ayMs purchase price! though lower than AprilMs!

was above the standard! and i# the increase in uantity purchased in .ay versus April more than

o##set the decrease in unit price variance! then the un#avorable price variance would increase. 5or

e1ample/

April &ay

;tandard price per lb............................................................................................................................................................................ 4 8.00 4 8.00

Actual price per lb................................................................................................................................................................................ 4 8.28 4 8.20

Price variance per lb............................................................................................................................................................................. 4 (.28) 4 (.20)

2uantity purchased............................................................................................................................................................................... &!000 lbs. &!+00 lbs.

Total price variance.............................................................................................................................................................................. 4 (280) 4 (2=0)

9. Actual total gross margin in >upton (and many other companies having standard cost systems and

preparing monthly income statements)! is based on standard cost per unit sold and on the monthMs

production variances. Total gross margin at standard is not a##ected by any production activity! nor by

purchasing. The .ay materials price variance was less un#avorable than it would have been had the

price o# this material not dropped* but note that the impact is the same! whether or not the lower-

priced material enters the production process in .ay. The un#avorable material price variance

resulted in an increase in total actual gross margin.

7. The e##ect is e1actly the same as e1plained #or uestion 9. It is caused by the act o# purchasing the

lower-priced materials! not by issuing these materials or selling the goods containing them.

'. Although overhead is absorbed based on production volume! not sales volume! the standard cost

sheets used to determine cost o# goods sold at standard nevertheless will incorporate the absorption

basis. 5or the April and .ay statements! it can be seen that standard overhead is 70 percent o#

standard labor #or both months! whereas it is 98 percent o# standard materials dollars in April and ==

2A+ percent in .ay. There#ore overhead absorption must be based on direct labor dollars! not material

dollars. (Dne would surmise this! o# course! since standard volume is e1pressed in terms o# direct

labor dollars.)

&0. 5rom supplementary note 8! we "now that the sum o# Product AMs standard labor and overhead is

4++.2& (4,8.8& - 4&2.+0). 5rom uestion '! we "now that overhead is absorbed at 70 percent o# direct

labor. Thus! letting 3 0 standard direct labor per unit! we have/

3 < 0.73 0 ++.2&

3 0 &7.,8

&&. The #ollowing calculation can be per#ormed/

20-7

Chapter 20 - Production Cost Variance Analyses

&2.

April &ay

Kebits P std. to IIP............................................................................................................................................................................ +=!'00 &&0!900

.aterials usage variance (dr.).............................................................................................................................................................. &!2+0 +!='0

Variance as percent o# standard............................................................................................................................................................ +.+J +.+J

This shows that the rate at which material was wasted was the same #or both months! even though the

total un#avorable variance was larger in .ay. Thus! whether the uestion is answered in absolute

terms or relative terms! there de#initely was no improvement in materials usage per#ormance.

&+. In >uptonMs system! as goods are moved #rom Ior" in Process to 5inished Roods! the credit to the

#ormer euals the debit to the latter. Thus! the combined accountsM balance is una##ected by this

transaction* so we can #ocus on .ayMs debits to Ior" in Process #or production costs and credits to

5inished Roods #or cost o# goods sold. To determine the debits! we must determine production

volume #or .ay. .ayMs actual production overhead was eual to budgeted overhead at standard

volume (supplementary item ,)! which is 70J L 4&2+!000 0 4'7!,00. ;ince .ayMs net overhead

variance was 4&7!,=0 :! .ayMs absorbed overhead was 49'!',0. Kividing this by the overhead rate

gives .ayMs volume/ 49'!',0 A 0.7 0 ''!'28 K>4. This plus supplementary item & gives us the total

.ay debits to Ior" in Process/ 4+&!+=8 < 49'!++8 < 4''!'28 < 49'!',0 0 42'0!8=8. This is less than

the 4+0!000 credits to 5inished Roods #or cost o# goods sold! so the combined balance in the accounts

decreased.

&,. 5rom uestion &0 and @1hibit & we "now/

'tandard

(nit of

Pdt) A

C*'

April

C*'

&ay

.aterials.............................................................................................................................................................................................. &2.+0 &'=!700 &,9!=00

Kirect labor.......................................................................................................................................................................................... &7.,8 &7,!800 &2+!000

5ull cost................................................................................................................................................................................................ ,8.8& 827!'00 +='!000

.aterials A 5ull cost.............................................................................................................................................................................. 29JL +9J ,0J

K> A 5ull cost....................................................................................................................................................................................... ,&JL +8J ++J

LThese would be the percentages in cost o# goods sold in a hypothetical month in which only Product A was sold.

Either the line o# the ratios o# materials to #ull cost or the line o# the ratios o# direct labor to #ull cost

shows that the proportion o# A sold decreased #rom April to .ay. (I li"e to thin" this is a very subtle

analysis! since the #irst time I taught the case I thought the answer was! $6ou canMt tell.$ The above

analysis was given by a student in that class.) ;ome students will say that the proportion o# A

decreased because supplementary item & shows its production volume decreased* again! this is an

invalid in#erence! since one cannot determine sales volume #rom production volumes without

"nowing changes in inventory.

&8. The #ollowing seuence o# logical steps is needed to answer this uestion (some calculations #rom

above are repeated #or completeness)/

a. The standard volume is 4&2+!000 K>4 (given).

b. The absorption rate is 70J o# K>4 (uestion ').

c. These two #acts imply that budgeted overhead at standard volume 0 70J L 4&2+!000 0 4'7!,00.

Thus! we have one point on the budget line.

20-'

Chapter 20 - Production Cost Variance Analyses

d.

e. The budget #or a volume o# 4&+8!+00 K>4 is 4&02!0'0 (supplementary item 2)* this is our second

point.

#. ;lope 0 rise A run 0 (4&02!0'0 - '7!,00)A(4&+8!+00 - &2+!000)0 4+!='0 A 4&2!+00 0 0.+0. Thus!

budgeted variable overhead is 40.+0 per K>4.

g. ;ince TC 0 :VC L 3! we have

4&02!0'0 0 T5C < 0.+(4&+8!+00)

T5C 0 4&02!0'0 - ,0!8'0

0 4=&!800 budgeted #i1ed

overhead

Chec" '7!,00 0 4=&!800 < 0.+(4&2+!000)

4'7!,00 0 4'7!,00

h. .ayMs actual overhead 0 AprilMs actual overhead 0 4'7!,00 (supplementary items + and , and step

c. above).

i. Het overhead variance 0 absorbed - actual 0 absorbed - 4'7!,00 - &7!,=0 in .ay. Thus .ay

absorbed overhead 0 49'!',0.

T. Cut absorbed overhead 0 0!70 L volume* thus .ay volume 0 49'!',0 A0.7 0 4''!'28 K>4.

". .ayMs overhead budget there#ore is 4=&!800 < 0.+0 (4''!'28) 0 4'&!,99.80.

l. ;ince spending variance 0 budget - actual! .ayMs spending variance 0 4'&!,9 9.80 - '7!,00 0

4=!'22.80 :.

&=. ;ince .ayMs net overhead variance 0 4&7!,=0 :! and the spending variance was 4=!''2.80 :! then the

production volume variance must have been 4&!8+9.80 :. As a chec"! volume variance 0 absorbed -

budget 0 0.7(4''!'28) - F=&!800 < 0.+(''!'28)G 0 49'!',0 - '&!,9980 0 4&&!8+9.80 :.

&9. :sing the same logic as in the answer to uestion &,/

a. Het overhead variance 0 absorbed - actual 0 absorbed - 4'7!,00 0 - 488!+=0. Thus AprilMs

absorbed overhead 0 4,+!0,0.

b. There#ore April volume 0 4,+!0,0 A 0.7 0 48+!700 K>4.

c. Volume variance 0 absorbed - budget 0 4,+!0,0 - F=&!800 < 0.+(8+!700)G 0 4,+!0,0 - 99!=,0 0

4+,!=00 :.

&7. As in uestion &8! since we "now the net variance and one component! the other can be deduced/ -

488!+=0 0 -4+,!=00 < spending variance* there#ore spending variance 0 420!9=0 :.

Dr! as a chec" spending variance 0 budget - actual 0 F4=&!800 < 0.+(8+!700)G - '7!,00 0 499!=,0 -

'7!,00 0 420!9=0 :.

20-&0

You might also like

- Solution Manual For AccountingDocument21 pagesSolution Manual For AccountingNeetu RajaramanNo ratings yet

- Chap 017Document12 pagesChap 017Neetu Rajaraman100% (1)

- Lieberose Solar ParkDocument23 pagesLieberose Solar ParkNeetu RajaramanNo ratings yet

- Lieberose Solar Park - Presentation-WorkedDocument43 pagesLieberose Solar Park - Presentation-WorkedNeetu RajaramanNo ratings yet

- Chap 014Document7 pagesChap 014Neetu RajaramanNo ratings yet

- Chap 021Document19 pagesChap 021Neetu Rajaraman100% (1)

- Chap 025Document17 pagesChap 025Neetu Rajaraman100% (7)

- Management Accounting System Design Case StudyDocument12 pagesManagement Accounting System Design Case StudyRand Al-akam100% (1)

- Chap 026Document17 pagesChap 026Neetu Rajaraman100% (2)

- Chap 018Document25 pagesChap 018Neetu RajaramanNo ratings yet

- Chap 023Document23 pagesChap 023Neetu RajaramanNo ratings yet

- Chap 013Document12 pagesChap 013Neetu RajaramanNo ratings yet

- Chap 024Document22 pagesChap 024Neetu RajaramanNo ratings yet

- Chap 019Document20 pagesChap 019Neetu RajaramanNo ratings yet

- Chap 016Document8 pagesChap 016Neetu Rajaraman100% (2)

- Chap 015Document4 pagesChap 015Neetu RajaramanNo ratings yet

- Chap 008Document17 pagesChap 008Neetu RajaramanNo ratings yet

- Chap 010Document22 pagesChap 010Neetu RajaramanNo ratings yet

- Chap 009Document19 pagesChap 009Neetu RajaramanNo ratings yet

- Chap 007Document13 pagesChap 007Neetu RajaramanNo ratings yet

- Chap 012Document11 pagesChap 012Neetu RajaramanNo ratings yet

- Chap 011Document8 pagesChap 011Neetu RajaramanNo ratings yet

- Chap 006Document15 pagesChap 006Neetu RajaramanNo ratings yet

- Chap 005Document12 pagesChap 005SurajAluruNo ratings yet

- Chap 3 Accounting For ManagersDocument19 pagesChap 3 Accounting For ManagersBitan BanerjeeNo ratings yet

- Chap 004Document28 pagesChap 004mzblossom100% (1)

- Chap 001Document17 pagesChap 001Neetu RajaramanNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Fiji Police Force Other Ranks FS 2023Document15 pagesFiji Police Force Other Ranks FS 2023Augustine SamiNo ratings yet

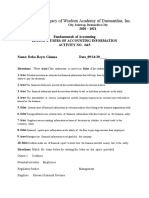

- Legacy of Wisdom Academy of Dasmariñas, IncDocument2 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Financial Accounting Assignment PDFDocument11 pagesFinancial Accounting Assignment PDFRiz Fahan0% (1)

- Financial Accounting 7th Edition Harrison Test BankDocument27 pagesFinancial Accounting 7th Edition Harrison Test Bankjessicapatelojgsfyqmbt100% (16)

- Describing The Business Transaction (20 Items X 2 Points) : Property of STIDocument1 pageDescribing The Business Transaction (20 Items X 2 Points) : Property of STInew genshinNo ratings yet

- Uniform CostingDocument8 pagesUniform CostingFenilNo ratings yet

- Solitude Infra PVT LTD Ledger StatementsDocument1 pageSolitude Infra PVT LTD Ledger Statementszubair.afuNo ratings yet

- Accounting Important Q'sDocument399 pagesAccounting Important Q'sTripti Jindal100% (1)

- ACTG 360 Midterm Exam ReviewDocument3 pagesACTG 360 Midterm Exam ReviewSubha ManNo ratings yet

- General Ledger Debits and Credits Normal Account Balances Journal Entries The Income StatementDocument15 pagesGeneral Ledger Debits and Credits Normal Account Balances Journal Entries The Income StatementPriyashini RajasegaranNo ratings yet

- Flipkart Labels 30 Sep 2022-10-44Document25 pagesFlipkart Labels 30 Sep 2022-10-44NANDA KUMARNo ratings yet

- Chapter - 2 Cost TermsDocument23 pagesChapter - 2 Cost TermsZubair Chowdhury0% (1)

- 563d24a8-2ae4-487f-9818-f2acb8108caeDocument6 pages563d24a8-2ae4-487f-9818-f2acb8108caeSwamy Dhas DhasNo ratings yet

- Aa2e Hal Testbank Ch04Document26 pagesAa2e Hal Testbank Ch04jayNo ratings yet

- Resume Chirag VaishnavDocument4 pagesResume Chirag VaishnavchiragvaishnavNo ratings yet

- 1Document13 pages1Mikasa MikasaNo ratings yet

- Financial Accounting - AP PDFDocument44 pagesFinancial Accounting - AP PDFanand_sapNo ratings yet

- ASSIGNMENTSDocument13 pagesASSIGNMENTSJpzelleNo ratings yet

- Just Dial's Q2 FY20 resultsDocument10 pagesJust Dial's Q2 FY20 resultsGovardhan RaviNo ratings yet

- Revenue Accounting and RecognitionDocument7 pagesRevenue Accounting and RecognitionjsphdvdNo ratings yet

- White Corporation Depreciation CalculationsDocument8 pagesWhite Corporation Depreciation CalculationsAlbert Macapagal100% (2)

- Functions of Management AccountingDocument8 pagesFunctions of Management AccountingAbhishek Kumar100% (1)

- Cycle audit reveals sales and receivables risksDocument42 pagesCycle audit reveals sales and receivables risksBonifasia SeptianaNo ratings yet

- FARAP-4501 (Cash and Cash Equivalents)Document10 pagesFARAP-4501 (Cash and Cash Equivalents)Marya NvlzNo ratings yet

- Cap. 5 The Statement of Cash FlowsDocument42 pagesCap. 5 The Statement of Cash FlowsJose Rafael Roman-NievesNo ratings yet

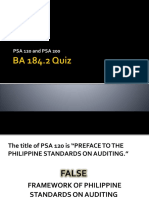

- PSA 120 and PSA 200Document26 pagesPSA 120 and PSA 200Anna CastroNo ratings yet

- CHAPTER 11 - PFRS For SMEsDocument40 pagesCHAPTER 11 - PFRS For SMEsarlynajero.ckcNo ratings yet

- Hoa by Laws NeighborhoodDocument19 pagesHoa by Laws Neighborhoodtheengineer3100% (2)

- Monthly Sales: PriceDocument5 pagesMonthly Sales: PriceChicken NoodlesNo ratings yet

- Sub Order LabelsDocument163 pagesSub Order LabelsHitzz LalwaniNo ratings yet