Professional Documents

Culture Documents

Report of The Assignment

Uploaded by

Salman RahiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Report of The Assignment

Uploaded by

Salman RahiCopyright:

Available Formats

Report of the assignment:

A. First of all I select two companies stocks GRICENERAL ELECTRIC and GENERAL MOTER

from www.yahoo.com there in that yahoo page I visit yahoo finance after that I click on

market data than select stock option and then I choose this two companies monthly

stock the companys stock I selected is for the periods of 2011, 2012and 2013.

Report of the General Electric Company (GE) Company A:

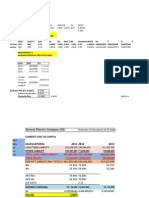

A. As I mention above the data and selection of the companies and their stocks. For this

assignment our first requirement was to find out the wacc of the company for that first

we need to calculate weightages of debt (Wd ) ,weightages of equity (We), cost of debt

(kd) and cost of equity (ke).

I. For calculation of weightages of debt first I find total long term liabilities and

total equity for the three years which is Liabilities (2011 345860000 2012

307140000 and 2013 286661000) and Equities(2011 116438000 2012

123026000 and 2013 130566000)

II. After the summation of total long term Liabilities and total equity I find Wd and

We for the three years which is (Wd=total long term Liabilities/ sum of total long

term liability and equity) We= total equity / sum of total long term liability and

equity).

III. After that I average the three years debt and equity for the purpose to find

average Wd and We. Average Wd was 71.64% which we assumed as 70% and

average We was 28.36% which we assumed as 30%. Our debt to equity ratio was

2.33.

IV. Then I calculate the cost of Debt (Kd) for that first I find interest expenses from

the income statement of General electric company for the given three years. By

the help of interest expenses I calculate cost of debt easily which is the division

of interest expenses our total long term liability (kd=interest expenses/total long

term liability).

V. By tacking average of the three years Kd our average Kd we calculated as 3.50%.

VI. Also for wacc we need to calculate tax rate for that I select EBT and income tax

expenses for the given three years from the income statement of General

Electric Company. By the help of that I calculate effective income tax rate for

each periods (Formula is Effective income tax rate= Income Tax Expense/EBT).

VII. For each year effective income tax rate was (2011 28.50%, 2012 15.69%, 2013

4.19%) by tacking average of this three years income tax rate our average

income tax rate we calculated as 16.12% but we assumed 16%.

VIII. For calculation of wacc we need to find out the cost of equity we calculated cost

of equity using capm (capital asset pricing model),.

IX. CAPM=RFR+(*(RM-RFR)

X. RFR is the united states treasury bill rate which is free of default risk some time

having risk but some degree of chances like inflation risk, exchange rate risk etc.

which is already given by the instructor.

XI. We calculate beta () and market return (RM) by using historical prices (Jan 1,

2011-dec 31, 2013) of General Electric company and standard and poor 500 (S&P

500.

XII. By the help of this historical prices I calculate TR of the Market (S&P 500) and TR

General Electric (TRRI)

XIII. Formula for total return is TR=(CLOSING PRICE-BEGENING PRICE)/ BEGENING

PRICE

XIV. After calculating the TR of MR and RI, I calculate the average return of the

market (RM) and average RFR, which is (RM=0.00426) and (RFR=1.84).

XV. Then I calculate the existing beta () of the firm for that I calculate equity risk

premium of GE (ERP RI-RF of GE Y) and Market risk premium (MRP S&P

500X)

XVI. By tacking slope of y and x I calculate existing beta which is 1.00323.

XVII. Now for the calculation of cost of equity for capm we have all the information.

By using capm cost of equity calculated as Ke=(0.55%) which is negative and still

very low so i assumed cost of equity double of cost of debt which is 3.50% so

assumed Ke is 7% or o.07.

2 Now we have all the information for calculating the wacc which is our first requirement

of the assignment.

i) We know that WACC=Wd*Kd(1-T)+We*Ke+Wp*Kp

ii) Wd=70%, We=0.30%, Kd(1-t)=0.029, Kd=0.035, =1.0032, so by putting the

values we calculating WACC is 0.04158 or 4.16%.

B. Now our second requirement is to calculate the optimal capital structure. For that first

build different firm structures with deferent debt and equity ratio by the deference of

10%.for that we also find different betas like our exiting beta is levered which is 1.0032

we also calculated unlevered beta using levered beta formula is (Bu

()(

)

)

unlevered beta calculate is 0.737647 using this unlevered beta we calcite the levered

beta for the different time periods using formula as BL ( ) (

)

I) Kd for existing Beta is 4.50 for the other periods we calculate Kd is 5% increase

and decrease.

II) We calculate Ke using capm using the same RFR , beta, and RM. Which is

negative in each capital structure so we assumed ke is the double of ke which is

(Kd*2).

III) We calculate wacc using the same method (formula) mentioned above.

IV) Than for the calculation of value of firm (v=FCF(1+g)/(wacc-g). for the calculation

of FCF(formula is FCF=OCF-NOWC-F.ASSETS) where is operating cash flows

equal to (OCF=EBIT(1-T)+DEPRECIATION) We use EBIT value of the last year

which is 26267000, EBIT(1-T)=22064280, OCF=31826280, NOWC=12420000,

F.Assets=(24586000) and FCF=43992280

V) Now for the calculation of the value of firm we also need to calculate the growth

rate of the firm (GROWTH RATE=ROE*(1-PAYOUT RATIO). Where is ROE=11.07%

and Payout ratio=63.00% and growth rate =0.040959.

VI) Now we have the entire requirements to calculate value of the firm. We know

that v=FCF(1+g)/(wacc-g). by putting the values we have find firm values of

different capital structure.

VII) Our optimal capital structure is:

DE

BT

EQUI

TY

D/

E Kd

Kd(1-

T) Ke

Assumed

Ke

WAC

C Vo E

10

% 90%

0.1

1

0.8064

94

3.50

%

2.94

%

-

1.83765

64 0.07

0.065

94

1848359

039

1663523

136

Where WACC is low than each capital structure and where the firm value is higher than all so

we can say its the best capital structure for the firm.

C. Our third and last requirement is to calculate business risk, financial risk and total risk of

the firm.

I. For that first we need EBIT and N.I values for the three given years. By the help

of that values I calculate the std of EBIT (std of EBIT=1889389.3) and std of N.I=

261717.83.

II. After that I calculate average of EBIT and N.I which is (EBIT avg=17487000) and

(N.I avg=13272667.

III. After that I calculate business risk, financial risk and total risk easily.

IV. Business risk is simply the CV of EBIT=std of EBIT/ avg of EBIT =0.1080

V. Where is Firm risk equls to std of N.I/avg of N.I =0.0197

VI. And financial risk is simply the deference between business risk and firm risk

which is (0.0883).

Company B: General Motors Company (GM)

A) Our first requirement Is to find out the wacc of the company for that first we need to

calculate weightages of debt (Wd ) ,weightages of equity (We), cost of debt (kd) and

cost of equity (ke) listed above in company A.

XVIII. For calculation of weightages of debt first I find total long term liabilities and

total equity for the three years which is Liabilities (2011 52386000 2012

58430000 and 2013 60758000) and Equities(2011 38120000 2012 36244000

and 2013 42607000)

XIX. After the sum of total long term Liabilities and total equity I find Wd and We for

the three years which is (Wd=total long term Liabilities/ sum of total long term

liability and equity) We= total equity / sum of total long term liability and

equity).

XX. After that I average the three years debt and equity for the purpose to find

average Wd and We. Average Wd was 59.46% which we assumed as 60% and

average We was 40.54% which we assumed as 40%. Our debt to equity ratio was

1.50.

XXI. Then I calculate the cost of Debt (Kd) for that first I find interest expenses from

the income statement of General Motors company (GM) for the given three

years. By the help of interest expenses I calculate cost of debt easily which is the

division of interest expenses our total long term liability (kd=interest

expenses/total long term liability).

XXII. By tacking average of the three years Kd our average Kd we calculated as 0.81%

which is very low so we assumed Kd as US treasury ytm (10 years)=4.50%.

XXIII. Also for wacc we need to calculate tax rate for that I select EBT and income tax

expenses for the given three years from the income statement of General

Motors Company (GM). By the help of that I calculate effective income tax rate

for each periods (Formula is Effective income tax rate= Income Tax

Expense/EBT).

XXIV. For each year effective income tax rate was (2011 (1.20%), 2012 121.38%, 2013

28.52%) by tacking average of this three years income tax rate our average

income tax rate we calculated as 49.57% but we assumed 50%.

XXV. For calculation of wacc we need to find out the cost of equity we calculated cost

of equity using capm (capital asset pricing model),.

XXVI. CAPM=RFR+(*(RM-RFR)

XXVII. RFR is the united states treasury bill rate which is free of default risk some time

having risk but some degree of chances like inflation risk, exchange rate risk etc.

which is already given by the instructor.

XXVIII. We calculate beta () and market return (RM) by using historical prices (Jan 1,

2011-dec 31, 2013) of General Motors company (GM) and standard and poor

500 (S&P 500.

XXIX. By the help of this historical prices I calculate TR of the Market (S&P 500) and TR

General Electric (TRRI)

XXX. Formula for total return is TR=(CLOSING PRICE-BEGENING PRICE)/ BEGENING

PRICE

XXXI. After calculating the TR of MR and RI, I calculate the average return of the

market (RM) and average RFR, which is (RM=0.00426) and (RFR=1.84).

XXXII. Then I calculate the existing beta () of the firm for that I calculate equity risk

premium of GE (ERP RI-RF of GE Y) and Market risk premium (MRP S&P

500X)

XXXIII. By tacking slope of y and x I calculate existing beta which is 0.99655 OR 99.7%.

XXXIV. Now for the calculation of cost of equity for capm we have all the information.

By using capm cost of equity calculated as Ke=0.43039 or 43%.

XXXV. Now we have all the information for calculating the wacc which is our first

requirement of the assignment.

iii) We know that WACC=Wd*Kd(1-T)+We*Ke+Wp*Kp

iv) Wd=60%, We=40%, Kd(1-t)=0.225, Kd=0.45, =0.997, so by putting the values

we calculating WACC is 0.3071555 or 30.72%.

B) Now our second requirement is to calculate the optimal capital structure. For that first

build different firm structures with deferent debt and equity ratio by the deference of

10%. For that we also find different betas like our exiting beta is levered which is 0.997

we also calculated unlevered beta using levered beta (formula is (Bu

()(

)

)

unlevered beta calculate is 0.5697143 using this unlevered beta we calculate the levered

beta for the different time periods using formula as BL ( ) (

)

VIII) Kd for existing Beta is 4.50 for the other periods we calculate Kd is 5% increase

and decrease.

IX) We calculate Ke using capm using the same RFR , beta, and RM. Which is

negative in each capital structure so we assumed ke is the double of ke which is

(Kd*2).

X) We calculate wacc using the same method (formula) mentioned above.

XI) Than for the calculation of value of firm (v=FCF(1+g)/(wacc-g). for the calculation

of FCF(formula is FCF=OCF-NOWC-F.ASSETS) where is operating cash flows

equal to (OCF=EBIT(1-T)+DEPRECIATION) We use EBIT value of the last year

which is 7792000, EBIT(1-T)=3896000, OCF=12051000, NOWC=3085000,

F.Assets=3549000 and FCF=3549000

XII) Now for the calculation of the value of firm we also need to calculate the growth

rate of the firm (GROWTH RATE=ROE*(1-PAYOUT RATIO). Where is ROE=10.89%

and Payout ratio=20.00% and growth rate =0.08712 or 8.71%.

XIII) Now we have the entire requirements to calculate value of the firm. We know

that v=FCF(1+g)/(wacc-g).

XIV) By putting the values we have find firm values of different capital structure.

XV) Our optimal capital structure is:

DEB

T

EQUIT

Y D/E Kd

Kd(1-

T) Ke WACC Vo E

80% 20%

4.0

0

1.709142

9

5.50

% 3.91%

0.728

4

17.69

%

42968417.5

5

8593683.50

9

Where WACC is low than each capital structure and where the firm value is higher than all so

we can say its the best capital structure for the firm.

C) Our third and last requirement is to calculate business risk, financial risk and total risk of

the firm.

i) For that first we need EBIT and N.I values for the three given years. By the help of

that values I calculate the std of EBIT=17441061.25 and std of N.I= 1604550.

ii) After that I calculate average of EBIT and N.I which is EBIT avg=(3565667) and N.I

avg=5404667.

iii) After that I calculate business risk, financial risk and total risk easily.

iv) Business risk is simply the CV of EBIT=std of EBIT/ avg of EBIT =(4.8914)

v) Where is Firm risk equls to std of N.I/avg of N.I =0.29688

vi) And financial risk is simply the deference between business risk and firm risk which

is 5.18827.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- How To Trade Options - 12 Tenets of Daily Trade DisciplineDocument2 pagesHow To Trade Options - 12 Tenets of Daily Trade DisciplineHome Options TradingNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Chart of AccountsDocument8 pagesChart of AccountsMariaCarlaMañagoNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Robles v. YapcincoDocument2 pagesRobles v. YapcincoRem SerranoNo ratings yet

- Money Flow IndexDocument8 pagesMoney Flow IndexShahzad DalalNo ratings yet

- MBA Finance Thesis Topics: Stock Analysis, Mutual Funds, Banks, InsuranceDocument2 pagesMBA Finance Thesis Topics: Stock Analysis, Mutual Funds, Banks, InsuranceSalman Rahi100% (2)

- B.Ethics (Part 2)Document110 pagesB.Ethics (Part 2)Hamza KianiNo ratings yet

- Stock Market Scams in India: A Historical Overview (1991-PresentDocument16 pagesStock Market Scams in India: A Historical Overview (1991-Presentsachincool0100% (2)

- BYD Company's Growth in Automotive and Battery BusinessesDocument7 pagesBYD Company's Growth in Automotive and Battery BusinessesYograj Singh ChauhanNo ratings yet

- How to Invest in Gold: Spot Markets, Futures, ETFs, Bars and CoinsDocument5 pagesHow to Invest in Gold: Spot Markets, Futures, ETFs, Bars and CoinsLeonard NgNo ratings yet

- APCF Research Grant Starch Final Report 2017 October 2017Document177 pagesAPCF Research Grant Starch Final Report 2017 October 2017kyaq001No ratings yet

- Basic Question and Answer On ComputerDocument16 pagesBasic Question and Answer On ComputerSalman RahiNo ratings yet

- Financial Detective Case AnalysisDocument11 pagesFinancial Detective Case AnalysisBrian AlmeidaNo ratings yet

- Question Bank For The Final ExamDocument2 pagesQuestion Bank For The Final ExamRaktim100% (1)

- Mis of DellDocument17 pagesMis of DellMohammad Al Amin71% (7)

- Fin. Analysis MBA Fall. 2015Document4 pagesFin. Analysis MBA Fall. 2015Salman RahiNo ratings yet

- OIL Development Limited: & GAS CompanyDocument1 pageOIL Development Limited: & GAS CompanySalman RahiNo ratings yet

- Research Proposal of Hunain, Majid and SalmanDocument13 pagesResearch Proposal of Hunain, Majid and SalmanSalman RahiNo ratings yet

- Subject: Application For The Post of Junior AssistantDocument1 pageSubject: Application For The Post of Junior AssistantSalman RahiNo ratings yet

- Is There A Future For International BanksDocument20 pagesIs There A Future For International BanksSalman RahiNo ratings yet

- Kraus & Litzenberger, 1976 Homaifar & Graddy, 1988 Fang & Lai, 1997Document2 pagesKraus & Litzenberger, 1976 Homaifar & Graddy, 1988 Fang & Lai, 1997Salman RahiNo ratings yet

- Risk and Return QuestionsDocument1 pageRisk and Return QuestionsSalman RahiNo ratings yet

- Time Table For Spring 2015: Masters of Business AdministrationDocument1 pageTime Table For Spring 2015: Masters of Business AdministrationSalman RahiNo ratings yet

- How To Give References and CitationsDocument5 pagesHow To Give References and CitationsSalman RahiNo ratings yet

- NHA1 - Stress in Simple and Complex WordsDocument18 pagesNHA1 - Stress in Simple and Complex Words08AV2D78% (18)

- BEJ-10 Vol2010Document9 pagesBEJ-10 Vol2010Agung WicaksonoNo ratings yet

- Title Page of The Assignment ARM Litrature ReviewDocument1 pageTitle Page of The Assignment ARM Litrature ReviewSalman RahiNo ratings yet

- Case of WaccDocument2 pagesCase of WaccSalman RahiNo ratings yet

- 15 Answers To All ProblemsDocument25 pages15 Answers To All ProblemsPushpa BaruaNo ratings yet

- GEDocument6 pagesGESalman RahiNo ratings yet

- 7Cs Effective Business CommunicationDocument23 pages7Cs Effective Business CommunicationSalman Rahi100% (1)

- MGT Assignment Basic Elements of Control in RganizationDocument31 pagesMGT Assignment Basic Elements of Control in RganizationSalman RahiNo ratings yet

- Income Statement: Dec 31, 2009 Dec 31, 2008 Dec 31, 2007 Total Revenue 796,800 1,042,800 1,112,900Document2 pagesIncome Statement: Dec 31, 2009 Dec 31, 2008 Dec 31, 2007 Total Revenue 796,800 1,042,800 1,112,900Salman RahiNo ratings yet

- B RecorderDocument5 pagesB RecorderMuhammad HishamNo ratings yet

- Merce and SecurityDocument48 pagesMerce and SecuritySalman RahiNo ratings yet

- Introduction to MCB Islamic Banking Deposit and Financing SchemesDocument24 pagesIntroduction to MCB Islamic Banking Deposit and Financing SchemesSalman RahiNo ratings yet

- Tenses MADE EASY BY SALMAN RAHIDocument1 pageTenses MADE EASY BY SALMAN RAHISalman RahiNo ratings yet

- Ratio AnalysisDocument10 pagesRatio AnalysisSalman RahiNo ratings yet

- P 6 KK 6 UDocument33 pagesP 6 KK 6 URichard OonNo ratings yet

- International Business & Trade Research Paper ReviewDocument3 pagesInternational Business & Trade Research Paper ReviewKiyan YunNo ratings yet

- Fixed Income Analyst Jan 2023Document2 pagesFixed Income Analyst Jan 2023FransNo ratings yet

- ALFI and ABBL Guidelines and Recommendations For Depositaries Safekeeping of Other AssetsDocument62 pagesALFI and ABBL Guidelines and Recommendations For Depositaries Safekeeping of Other AssetsludivineNo ratings yet

- Chapter9 - FinalDocument17 pagesChapter9 - FinalbraveusmanNo ratings yet

- A Study On Market Analysis On Life Insurance CompanyDocument52 pagesA Study On Market Analysis On Life Insurance CompanyNitin DubeyNo ratings yet

- Báo Cáo Thực TậpDocument35 pagesBáo Cáo Thực TậpTuấn HuỳnhNo ratings yet

- Periasamy Resume 08.11.19Document13 pagesPeriasamy Resume 08.11.19Pandy PeriasamyNo ratings yet

- AFA QuizDocument15 pagesAFA QuizNoelia Mc DonaldNo ratings yet

- Comparative Financial Analysis of Tata Steel and SAILDocument53 pagesComparative Financial Analysis of Tata Steel and SAILManu GCNo ratings yet

- Ch10 TB RankinDocument6 pagesCh10 TB RankinAnton Vitali100% (1)

- Business Incubators SystemDocument31 pagesBusiness Incubators SystemPrashanth KumarNo ratings yet

- Test Bank For Investments Analysis and Management 12th Edition JonesDocument38 pagesTest Bank For Investments Analysis and Management 12th Edition Jonessidneynash9mc5100% (14)

- MarriottDocument10 pagesMarriottimwkyaNo ratings yet

- CFO Tax Partner CPA in Houston TX Resume Darryl SiefkasDocument3 pagesCFO Tax Partner CPA in Houston TX Resume Darryl SiefkasDarrylSiefkasNo ratings yet

- Chapter 2Document3 pagesChapter 2AyylmaoNo ratings yet

- Airport BackgroundDocument27 pagesAirport Backgroundseanne07No ratings yet

- Sales Quota - All Types of QuotaDocument17 pagesSales Quota - All Types of QuotaSunny Bharatbhai Gandhi100% (2)

- Three questions to grow your investment returnsDocument21 pagesThree questions to grow your investment returnsMOVIES SHOPNo ratings yet