Professional Documents

Culture Documents

Introduction To Debt Policy

Uploaded by

Kamal YagamiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction To Debt Policy

Uploaded by

Kamal YagamiCopyright:

Available Formats

Not covered in class

Debt fixed

EBIT 1485 1485

Tc 0.34 0.34

r0 0.098 0.098

VU 10,000 10,000

B 2500 -

L - 0.25

Wacc 9.03% 8.97%

V 10,850 10,930

VTS 850 930

S 10,000 8,198

B 2,500 2,733

Intro

An Introduction to Debt Policy and Value

This case illustrates 3 different approaches to value a levered firm.

Be aware of the assumptions underlying the formulas: CONSTANT PERPETUITIES & RISKLESS DEBT

Q1 Discount unlevered FCF at the WACC

Q2 Value equity and debt separately

Q3 Add the present value of tax shields to

the value of the unlevered firm

Page 3

Intro

An Introduction to Debt Policy and Value

This case illustrates 3 different approaches to value a levered firm.

Be aware of the assumptions underlying the formulas: CONSTANT PERPETUITIES & RISKLESS DEBT

Page 4

Q1

Value of assets 0% Debt 25%Debt 50% Debt

100% Equity 75% Equity 50% Equity

Book value of debt - 2,500 5,000

Book value of equity 10,000 7,500 5,000

Market value of debt - 2,500 5,000

Market value of equity 10,000 8,350 6,700

Pretax cost of debt 0.05 0.05 0.05

After-tax cost of debt 0.0330 0.0330 0.0330

Market value weights of

Debt 0.00% 23.04% 42.74%

Equity 100.00% 76.96% 57.26%

Unlevered beta 0.8 0.8 0.8

Risk-free rate 0.05 0.05 0.05

Market premium 0.06 0.06 0.06

Levered beta 0.8 0.96 1.19

Cost of equity 9.80% 10.75% 12.16%

WACC 9.80% 9.03% 8.38%

EBIT 1,485 1,485 1,485

-Taxes (34%) 505 505 505

EBIAT 980 980 980

+ Depreciation 500 500 500

- Capital exp. 500 500 500

=Free cash flow 980 980 980

Value of assets 10,000 10,850 11,700

Tax rate 34%

Page 5

Q2

Value of financing

0% Debt 25%Debt 50% Debt

100% Equity 75% Equity 50% Equity

Cash flow to creditors 0 125 250

Pretax cost of debt 0.05 0.05 0.05

Value of debt - 2,500 5,000

Cash flow to stockholders

EBIT 1485 1485 1485

-Interest 0 125 250

Pretax profit 1485 1360 1235

Taxes (34%) 505 462 420

Net income 980 898 815

+ Depreciation 500 500 500

- Capital exp. 500 500 500

-Debt amortization 0 0 0

Residual cash flow 980 898 815

Cost of equity 9.80% 10.75% 12.16%

Value of equity 9,998 8,353 6,699

Value of company S+B 9,998 10,853 11,699

Page 6

Q3

0% Debt 25%Debt 50% Debt

100% Equity 75% Equity 50% Equity

Pure business cash flow

EBIT 1,485 1,485 1,485

Taxes 505 505 505

EBIAT 980 980 980

+Depreciation 500 500 500

-Capital exp. 500 500 500

Cash flow 980 980 980

Unlevered beta 0.8 0.8 0.8

Risk-free rate 0.05 0.05 0.05

Market risk premium 0.06 0.06 0.06

Unlevered WACC 9.80% 9.80% 9.80%

Value of pure business 10,000 10,000 10,000

Financing cash flows

Interest - 125.00 250.00

Tax reduction - 42.50 85.00

Pretax cost of debt 0.05 0.05 0.05

Value of financing effect - 850 1,700

Total value 10,000 10,850 11,700

Page 7

Q4

0% Debt 25%Debt 50% Debt

100% Equity 75% Equity 50% Equity

Initial mkt value of equity 10,000 10,000 10,000

PVTS 0 850 1,700

Mkt value of equity

after announcement 10,000 10,850 11,700

Initial # shares 1,000 1,000 1,000

Price per share 10.00 10.85 11.70

after announcement

Cash paid out 0 2,500 5,000

Market value of equity 10,000 8,350 6,700

# of shares repurchased 0 230 427

# shares after repurchase 1,000 770 573

Share price 10.00 10.85 11.70

Page 8

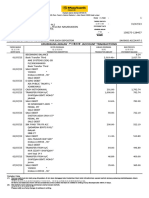

Koppers Company

Koppers Company, Inc.

Before After

Recapitalization Recapitalization

New borrowing 1,565,686

Book-Value Balance Sheets:

Net working capital 212,453 212,453

Fixed assets 601,446 601,446

Total assets 813,899 813,899

Long-term debt 172,409 1,738,095

Deferred taxes, etc.. 195,616 195,616

Preferred stock 15,000 15,000

Common equity 430,874 -1,134,812

Total capital 813,899 813,899

Market-Value Balance Sheets:

Net working capital 212,453 212,453

Fixed assets 1,618,081 1,618,082

PV debt tax shield 58,619 590,952

Total assets 1,889,153 2,421,487

Long-term debt 172,409 1,738,095

Deferred taxes, etc.. 0 0

Preferred stock 15,000 15,000

Common equity 1,701,744 668,392

Total capital 1,889,153 2,421,487

Number of shares 28,128 28,128

Price per share 60.50 23.76

Value to Public Shareholders

Cash received 0 1,565,686

Value of shares 1,701,744 668,392

Total 1,701,744 2,234,078

Total per share 60.50 79.43

You might also like

- WACC and valuation with varying debt levelsDocument4 pagesWACC and valuation with varying debt levelsrohitNo ratings yet

- Value-Based ManagementDocument21 pagesValue-Based ManagementPrathamesh411No ratings yet

- Group4 SectionA SampavideoDocument5 pagesGroup4 SectionA Sampavideokarthikmaddula007_66No ratings yet

- CQF L02P01Document18 pagesCQF L02P01Mn AbdullaNo ratings yet

- ACCTG 115 Lecture (01-27-2022)Document3 pagesACCTG 115 Lecture (01-27-2022)Janna Mari FriasNo ratings yet

- Dividend Policy and Capital Structure WACC CalculationsDocument7 pagesDividend Policy and Capital Structure WACC CalculationssahilkuNo ratings yet

- SampaSoln EXCELDocument4 pagesSampaSoln EXCELRasika Pawar-HaldankarNo ratings yet

- Keith Corporation Generates Significant Positive Cash FlowsDocument24 pagesKeith Corporation Generates Significant Positive Cash FlowsMaiko KopadzeNo ratings yet

- 14 Jan 13Document4 pages14 Jan 13Sneh Toshniwal MaheswariNo ratings yet

- Fsa Questions and SolutionsDocument11 pagesFsa Questions and SolutionsAnjali Betala KothariNo ratings yet

- Maximizing Market Value Through Equity FinancingDocument5 pagesMaximizing Market Value Through Equity FinancingNeelNo ratings yet

- FM Assignment1Document6 pagesFM Assignment1Rishi Kumar SainiNo ratings yet

- Delta Project and Repco AnalysisDocument9 pagesDelta Project and Repco AnalysisvarunjajooNo ratings yet

- 2nd Assignment of Financial ManagementDocument6 pages2nd Assignment of Financial Managementpratiksha24No ratings yet

- FSA - Intro PDFDocument10 pagesFSA - Intro PDFsingh somyadeepNo ratings yet

- Magsino Hannah Florence Activity 5 Discounted Cash FlowsDocument36 pagesMagsino Hannah Florence Activity 5 Discounted Cash FlowsKathyrine Claire Edrolin100% (1)

- Ch-15, Capital StructureDocument14 pagesCh-15, Capital StructureManas MksNo ratings yet

- Financial Position and Income Statement Analysis of Simple CompanyDocument2 pagesFinancial Position and Income Statement Analysis of Simple CompanyAndrea Monique AlejagaNo ratings yet

- Debt Policy and ValueDocument7 pagesDebt Policy and ValueMuhammad Nabil EzraNo ratings yet

- Assignment 6.1Document9 pagesAssignment 6.1Abigail ConstantinoNo ratings yet

- Assignment N3Document12 pagesAssignment N3Maiko KopadzeNo ratings yet

- FM Model - Coffee ParlorDocument11 pagesFM Model - Coffee ParlorPRITESH PATILNo ratings yet

- Understanding Financial Statements: Chris DroussiotisDocument23 pagesUnderstanding Financial Statements: Chris Droussiotisnimitjain10No ratings yet

- Lobrigas - Week6 Ia3Document18 pagesLobrigas - Week6 Ia3Hensel SevillaNo ratings yet

- AFM Solution SumitDocument4 pagesAFM Solution SumitSumitNo ratings yet

- FORMAT Complete The BS ISDocument1 pageFORMAT Complete The BS ISAmien MujibNo ratings yet

- Final Ratio Analysis (2) - 2Document4 pagesFinal Ratio Analysis (2) - 2anjuNo ratings yet

- Horizontal and Vertical AnalysisDocument4 pagesHorizontal and Vertical AnalysisJasmine ActaNo ratings yet

- Amount REVENUE From Sales (-) COGS Total Revenue Expenses Direct CostsDocument6 pagesAmount REVENUE From Sales (-) COGS Total Revenue Expenses Direct CostsGurucharan BhatNo ratings yet

- DCF Valuation TemplateDocument15 pagesDCF Valuation TemplateDEV DUTT VASHIST 22111116No ratings yet

- Solution Manual - Capital Budgeting Part 2Document21 pagesSolution Manual - Capital Budgeting Part 2Lab Dema-alaNo ratings yet

- Financial Statements AssessmentDocument24 pagesFinancial Statements AssessmentLorgie Khim IslaNo ratings yet

- Taxation Situational ProblemsDocument32 pagesTaxation Situational ProblemsMilo MilkNo ratings yet

- Sampa VideoDocument24 pagesSampa Videopawangadiya1210No ratings yet

- Capital BudgetingDocument20 pagesCapital BudgetingAngelo VilladoresNo ratings yet

- Company Structure. Q1) A Company S Balance Sheet Shows The Following Capital StructureDocument6 pagesCompany Structure. Q1) A Company S Balance Sheet Shows The Following Capital StructureDullah AllyNo ratings yet

- Profit Tax ClassDocument9 pagesProfit Tax ClassAndreea MateiNo ratings yet

- FCFF and FcfeDocument23 pagesFCFF and FcfeSaurav VidyarthiNo ratings yet

- WACC Mar 25Document6 pagesWACC Mar 25Elcah Myrrh LaridaNo ratings yet

- Economy ExcelDocument7 pagesEconomy ExcelCarina MariaNo ratings yet

- Financial analysis of multiple companiesDocument7 pagesFinancial analysis of multiple companiesCarina MariaNo ratings yet

- Sampa VideoDocument24 pagesSampa VideodoiNo ratings yet

- 250,000 300,000 400,000 500,000 Cash Flow: Year 1 2 3 4Document9 pages250,000 300,000 400,000 500,000 Cash Flow: Year 1 2 3 4Kai ZhaoNo ratings yet

- 7.chapter 16 - Capital StructureDocument23 pages7.chapter 16 - Capital StructureMohamed Sayed FadlNo ratings yet

- Capital Budgeting Cash Flows ComputationDocument6 pagesCapital Budgeting Cash Flows Computationnelle de leonNo ratings yet

- Real Estate Investment AnalysisDocument1 pageReal Estate Investment AnalysisJoelleCabasaNo ratings yet

- Assgnmnt 2 FIN658Document5 pagesAssgnmnt 2 FIN658markNo ratings yet

- DCF ModelDocument14 pagesDCF ModelmfaisalidreisNo ratings yet

- Budget L1 Understanding Financial StatementsDocument22 pagesBudget L1 Understanding Financial StatementsRojohn ValenzuelaNo ratings yet

- B PlanDocument6 pagesB PlansauravNo ratings yet

- FAR1 SolutionsDocument8 pagesFAR1 SolutionsJoebin Corporal LopezNo ratings yet

- Capital Structure Theory 2Document39 pagesCapital Structure Theory 2sanjupatel333No ratings yet

- Chapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document44 pagesChapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Maf 5102: Financial Management CAT 1 20 Marks Instructions Attempt All Questions Question OneDocument6 pagesMaf 5102: Financial Management CAT 1 20 Marks Instructions Attempt All Questions Question OneMuya KihumbaNo ratings yet

- Capital Structure-3Document28 pagesCapital Structure-3DRIP HARDLYNo ratings yet

- Internal Test - 2 - FSA - QuestionDocument3 pagesInternal Test - 2 - FSA - QuestionSandeep Choudhary40% (5)

- Sampa VideoDocument24 pagesSampa VideoPranav AggarwalNo ratings yet

- Complete Financial ModelDocument47 pagesComplete Financial ModelArrush AhujaNo ratings yet

- Fin ProbDocument15 pagesFin ProbTestNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Chapter 5: Financial Forwards & Futures ContractsDocument2 pagesChapter 5: Financial Forwards & Futures ContractsKamal YagamiNo ratings yet

- Solutions Chap007Document13 pagesSolutions Chap007Said Ur RahmanNo ratings yet

- Chap 003 Financial Risk ManagementDocument11 pagesChap 003 Financial Risk ManagementmallumainhunmailNo ratings yet

- Financial TableDocument9 pagesFinancial Tableapi-299265916No ratings yet

- Chapter 3: Evaluating Financial Performance: Kmart vs. Wal-MartDocument22 pagesChapter 3: Evaluating Financial Performance: Kmart vs. Wal-MartGreyWiseNo ratings yet

- Financial TableDocument9 pagesFinancial Tableapi-299265916No ratings yet

- BMW PLC Case - QuestionsDocument4 pagesBMW PLC Case - QuestionsKamal YagamiNo ratings yet

- ASWchapter 6Document30 pagesASWchapter 6Kamal YagamiNo ratings yet

- Basic MarketingDocument12 pagesBasic MarketingKamal Yagami50% (2)

- Maruti Celerio ReviewDocument18 pagesMaruti Celerio ReviewKamal Yagami100% (1)

- Writing Examples Revised 08Document32 pagesWriting Examples Revised 08Kamal Yagami100% (1)

- The Reddin Survey of University Tuition Fees2013-14Document3 pagesThe Reddin Survey of University Tuition Fees2013-14saleemut3No ratings yet

- Enviromental Factors Affecting Management SystemDocument2 pagesEnviromental Factors Affecting Management SystemKamal YagamiNo ratings yet

- CH 4Document14 pagesCH 4Kamal YagamiNo ratings yet

- Chapter 1Document20 pagesChapter 1Kamal YagamiNo ratings yet

- Enviromental Factors Affecting Management SystemDocument2 pagesEnviromental Factors Affecting Management SystemKamal YagamiNo ratings yet

- The Money MarketDocument1 pageThe Money MarketKamal YagamiNo ratings yet

- Actuarial and Technical Aspects of TakafulDocument22 pagesActuarial and Technical Aspects of TakafulCck CckweiNo ratings yet

- Lecture 5 PDFDocument28 pagesLecture 5 PDFJaniceNo ratings yet

- PFRS of SME and SE - Concept MapDocument1 pagePFRS of SME and SE - Concept MapRey OñateNo ratings yet

- Info Edge (India) Limited: India's Internet Classifieds CompanyDocument24 pagesInfo Edge (India) Limited: India's Internet Classifieds CompanyAbhilashaNo ratings yet

- Choose Letter of The Correct Answer.Document3 pagesChoose Letter of The Correct Answer.Peng GuinNo ratings yet

- Intoduction To BankingDocument41 pagesIntoduction To BankingAbhilash ShahNo ratings yet

- ISO 9001:2000 Goat Production Profitability AnalysisDocument38 pagesISO 9001:2000 Goat Production Profitability AnalysisJay AdonesNo ratings yet

- Principal and Agent: Joseph E. StiglitzDocument13 pagesPrincipal and Agent: Joseph E. StiglitzRamiro EnriquezNo ratings yet

- Assignment On:: Financial AnalysisDocument5 pagesAssignment On:: Financial AnalysisMd. Mustafezur Rahaman BhuiyanNo ratings yet

- List of OCNs and key indicators of their activity as of Dec 31, 2021Document20 pagesList of OCNs and key indicators of their activity as of Dec 31, 2021Dragomir MariusNo ratings yet

- John Rasplicka Resume 2016 09 07Document1 pageJohn Rasplicka Resume 2016 09 07api-356233900No ratings yet

- Financial Accounting With International Financial Reporting Standards 4th Edition Weygandt Solutions ManualDocument46 pagesFinancial Accounting With International Financial Reporting Standards 4th Edition Weygandt Solutions ManualJordanChristianqryox100% (14)

- Forensic Auditor’s Report on Fabricated Expenditures by ABC Electricity BoardDocument7 pagesForensic Auditor’s Report on Fabricated Expenditures by ABC Electricity BoardChaitanya DeshpandeNo ratings yet

- DBP v. Arcilla Ruling on Loan Disclosure ComplianceDocument3 pagesDBP v. Arcilla Ruling on Loan Disclosure ComplianceKarenliambrycejego RagragioNo ratings yet

- Corporate Mission: To Maximize The Value Shareholder's WealthDocument14 pagesCorporate Mission: To Maximize The Value Shareholder's WealthCamille GrandeNo ratings yet

- RATIO HavellsDocument22 pagesRATIO HavellsMandeep BatraNo ratings yet

- BDA Advises Quasar Medical On Sale of Majority Stake To LongreachDocument3 pagesBDA Advises Quasar Medical On Sale of Majority Stake To LongreachPR.comNo ratings yet

- Megaworld Corporation: Liabilities and Equity 2010 2009 2008Document9 pagesMegaworld Corporation: Liabilities and Equity 2010 2009 2008Owdray CiaNo ratings yet

- Hudson Law of Finance 2e 2013 Syndicated Loans ch.33Document16 pagesHudson Law of Finance 2e 2013 Syndicated Loans ch.33tracy.jiang0908No ratings yet

- AR PresentationDocument32 pagesAR PresentationSaq IbNo ratings yet

- M2U SA 128457 Jul 2023Document5 pagesM2U SA 128457 Jul 2023syafiqah.mohdali38No ratings yet

- Forex Earthquake: by Raoul WayneDocument21 pagesForex Earthquake: by Raoul WayneDavid100% (1)

- Wealth Management in Delhi and NCR Research Report On Scope of Wealth Management in Delhi and NCR 95pDocument98 pagesWealth Management in Delhi and NCR Research Report On Scope of Wealth Management in Delhi and NCR 95pSajal AroraNo ratings yet

- Bank Marketing 1Document69 pagesBank Marketing 1nirosha_398272247No ratings yet

- G.R. No. 109172 August 19, 1994 Trans-Pacific Industrial Supplies, Inc., Petitioner, The COURT OF APPEALS and ASSOCIATED BANK, RespondentsDocument3 pagesG.R. No. 109172 August 19, 1994 Trans-Pacific Industrial Supplies, Inc., Petitioner, The COURT OF APPEALS and ASSOCIATED BANK, RespondentsOnana100% (2)

- Employee Stock Option PlanDocument7 pagesEmployee Stock Option Plankrupalee100% (1)

- Sample Solved Question Papers For IRDA 50 Hours Agents Training ExamDocument15 pagesSample Solved Question Papers For IRDA 50 Hours Agents Training ExamPurnendu Sarkar100% (3)

- Financial Reporting and Analysis: - Session 4-Professor Raluca Ratiu, PHDDocument54 pagesFinancial Reporting and Analysis: - Session 4-Professor Raluca Ratiu, PHDDaniel YebraNo ratings yet

- Auditing 2&3 Theories Reviewer CompilationDocument9 pagesAuditing 2&3 Theories Reviewer CompilationPaupauNo ratings yet

- Marty Interview 4Document16 pagesMarty Interview 4Health NobelNo ratings yet