Professional Documents

Culture Documents

ROI Calculator US

Uploaded by

ch_yepCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ROI Calculator US

Uploaded by

ch_yepCopyright:

Available Formats

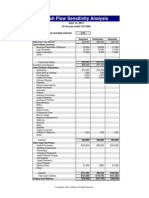

Year 1 Year 2 Year 3

Area, sq ft: 0 0 0

Rent, USD/sq ft: 0.00 0.00 0.00

Rent, %: 0% 0% 0%

Public utilities, USD/sq ft 0.00 0.00 0.00

Marketing fee, USD/sq ft 0.00 0.00 0.00

# of employees 0 0 0

Average gross salary 0 0 0

Interest rate per annum 0.0% 0.0% 0.0%

Employment taxes and benefits, % of salaries 0% 0% 0%

Sales growth rate 0% 0% 0%

New shop - main assumptions

Sales tax rate

0%

Product groups

Product group 1

Product group 2

Product group 3

Product group 4

Product group 5

Product group 6

Instructions Assumptions

This is an ROI calculator for retail companies that plan to open a new shop and want to calculate their

return on investment with given assumptions and breakeven sales volume.

This worksheet contains key assumptions that are needed to calculate current costs and sales in the NPV

plan worksheet.

Fill the data for the new shop for each year:

Rent area in square feet;

Rent price in $ per square foot;

% of annual sales that should be paid as a rent, if there is such a condition in your rent agreement,

otherwise put 0%.

For example, if annual sales are $1,000,000 and Rent, % is 7%, then $70,000 is the annual amount of

rent. If during the year you have paid less than $70, 000 then difference between this sum and actually

paid sum will be added to current costs in 13th, 25th and 36th months (row 21 Rental adjustment in

worksheet NPV plan).

Public utilities in $ per square foot;

Marketing fee in $ per square foot;

Number of employees;

Average gross salary;

Interest rate per annum;

Employment taxes and benefits, % of salaries;

Sales growth rate.

For example, if you assume that sales per month in Year 1 are $10,000 and sales growth rate in Year 2

is 5%, then sales for Year 2 in calculations will be $10,000 + 5% = $10,500.

Effective sales tax rate (federal+state taxes).

Type Product groups' names in cells G9:G14. These names will be automatically used in other

tables in the model.

After you finish filling in this worksheet please proceed to Scenarios.

If you wish to change something in this template, just order customization to your

needs at info@cfotemplates.com.

To order customization:

Think about changes that need to be made to your new template;

Send your requests and other comments to info@cfotemplates.com.

We will estimate the number of hours needed to customize your template

and we will send you a price quote.

Proceed to customization link at www.cfotemplates.com/Customization.htm.

If you wish to change something in this template, just order customization to your

needs at info@cfotemplates.com.

To order customization:

Think about changes that need to be made to your new template;

Send your requests and other comments to info@cfotemplates.com.

We will estimate the number of hours needed to customize your template

and we will send you a price quote.

Proceed to customization link at www.cfotemplates.com/Customization.htm.

Andrew Grigolyunovich, CFA

AG Capital

www.cfotemplates.com

Scenarios

Instructions Assumptions

This is an ROI calculator for retail companies that plan to open a new shop and want to calculate their

return on investment with given assumptions and breakeven sales volume.

This worksheet contains key assumptions that are needed to calculate current costs and sales in the NPV

plan worksheet.

Fill the data for the new shop for each year:

Rent area in square feet;

Rent price in $ per square foot;

% of annual sales that should be paid as a rent, if there is such a condition in your rent agreement,

otherwise put 0%.

For example, if annual sales are $1,000,000 and Rent, % is 7%, then $70,000 is the annual amount of

rent. If during the year you have paid less than $70, 000 then difference between this sum and actually

paid sum will be added to current costs in 13th, 25th and 36th months (row 21 Rental adjustment in

worksheet NPV plan).

Public utilities in $ per square foot;

Marketing fee in $ per square foot;

Number of employees;

Average gross salary;

Interest rate per annum;

Employment taxes and benefits, % of salaries;

Sales growth rate.

For example, if you assume that sales per month in Year 1 are $10,000 and sales growth rate in Year 2

is 5%, then sales for Year 2 in calculations will be $10,000 + 5% = $10,500.

Effective sales tax rate (federal+state taxes).

Type Product groups' names in cells G9:G14. These names will be automatically used in other

tables in the model.

After you finish filling in this worksheet please proceed to Scenarios.

If you wish to change something in this template, just order customization to your

needs at info@cfotemplates.com.

To order customization:

Think about changes that need to be made to your new template;

Send your requests and other comments to info@cfotemplates.com.

We will estimate the number of hours needed to customize your template

and we will send you a price quote.

Proceed to customization link at www.cfotemplates.com/Customization.htm.

If you wish to change something in this template, just order customization to your

needs at info@cfotemplates.com.

To order customization:

Think about changes that need to be made to your new template;

Send your requests and other comments to info@cfotemplates.com.

We will estimate the number of hours needed to customize your template

and we will send you a price quote.

Proceed to customization link at www.cfotemplates.com/Customization.htm.

Andrew Grigolyunovich, CFA

AG Capital

www.cfotemplates.com

1 2 3 4 5

Min Jan 12 Feb 12 Mar 12 Apr 12 May 12 Jun 12

Product group 1 0% 0.00 0.00 0.00 0.00 0.00

Product group 2 0% 0.00 0.00 0.00 0.00 0.00

Product group 3 0% 0.00 0.00 0.00 0.00 0.00

Product group 4 0% 0.00 0.00 0.00 0.00 0.00

Product group 5 0% 0.00 0.00 0.00 0.00 0.00

Product group 6 0% 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00

1 2 3 4 5

Avg Jan 12 Feb 12 Mar 12 Apr 12 May 12 Jun 12

Product group 1 0% 0.00 0.00 0.00 0.00 0.00

Product group 2 0% 0.00 0.00 0.00 0.00 0.00

Product group 3 0% 0.00 0.00 0.00 0.00 0.00

Product group 4 0% 0.00 0.00 0.00 0.00 0.00

Product group 5 0% 0.00 0.00 0.00 0.00 0.00

Product group 6 0% 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00

1 2 3 4 5

Max Jan 12 Feb 12 Mar 12 Apr 12 May 12 Jun 12

Product group 1 0% 0.00 0.00 0.00 0.00 0.00

Product group 2 0% 0.00 0.00 0.00 0.00 0.00

Product group 3 0% 0.00 0.00 0.00 0.00 0.00

Product group 4 0% 0.00 0.00 0.00 0.00 0.00

Product group 5 0% 0.00 0.00 0.00 0.00 0.00

Product group 6 0% 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00

1 2 3 4 5

Break-even Jan 12 Feb 12 Mar 12 Apr 12 May 12 Jun 12

Product group 1 0% 0.00 0.00 0.00 0.00 0.00

Product group 2 0% 0.00 0.00 0.00 0.00 0.00

Product group 3 0% 0.00 0.00 0.00 0.00 0.00

Product group 4 0% 0.00 0.00 0.00 0.00 0.00

Product group 5 0% 0.00 0.00 0.00 0.00 0.00

Product group 6 0% 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00

Correction factor 0%

Graph

NPV plan 0 0 0 0 0 0

6 7 8 9 10 11 12 13

Jul 12 Aug 12 Sep 12 Oct 12 Nov 12 Dec 12 Jan 13 Feb 13

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

6 7 8 9 10 11 12 13

Jul 12 Aug 12 Sep 12 Oct 12 Nov 12 Dec 12 Jan 13 Feb 13

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

6 7 8 9 10 11 12 13

Jul 12 Aug 12 Sep 12 Oct 12 Nov 12 Dec 12 Jan 13 Feb 13

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

6 7 8 9 10 11 12 13

Jul 12 Aug 12 Sep 12 Oct 12 Nov 12 Dec 12 Jan 13 Feb 13

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0 0 0 0 0 0 0 0

14 15 16 17 18 19 20 21

Mar 13 Apr 13 May 13 Jun 13 Jul 13 Aug 13 Sep 13 Oct 13

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

14 15 16 17 18 19 20 21

Mar 13 Apr 13 May 13 Jun 13 Jul 13 Aug 13 Sep 13 Oct 13

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

14 15 16 17 18 19 20 21

Mar 13 Apr 13 May 13 Jun 13 Jul 13 Aug 13 Sep 13 Oct 13

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

14 15 16 17 18 19 20 21

Mar 13 Apr 13 May 13 Jun 13 Jul 13 Aug 13 Sep 13 Oct 13

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0 0 0 0 0 0 0 0

22 23 24 25 26 27 28 29

Nov 13 Dec 13 Jan 14 Feb 14 Mar 14 Apr 14 May 14 Jun 14

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

22 23 24 25 26 27 28 29

Nov 13 Dec 13 Jan 14 Feb 14 Mar 14 Apr 14 May 14 Jun 14

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

22 23 24 25 26 27 28 29

Nov 13 Dec 13 Jan 14 Feb 14 Mar 14 Apr 14 May 14 Jun 14

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

22 23 24 25 26 27 28 29

Nov 13 Dec 13 Jan 14 Feb 14 Mar 14 Apr 14 May 14 Jun 14

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0 0 0 0 0 0 0 0

30 31 32 33 34 35 36

Jul 14 Aug 14 Sep 14 Oct 14 Nov 14 Dec 14 Jan 15

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

30 31 32 33 34 35 36

Jul 14 Aug 14 Sep 14 Oct 14 Nov 14 Dec 14 Jan 15

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

30 31 32 33 34 35 36

Jul 14 Aug 14 Sep 14 Oct 14 Nov 14 Dec 14 Jan 15

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

30 31 32 33 34 35 36

Jul 14 Aug 14 Sep 14 Oct 14 Nov 14 Dec 14 Jan 15

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0 0 0 0 0 0 0 0

NPV Plan

Instructions Scenarios

This model facilitates evaluating investments in four different scenarios:

Min the worst-case scenario with the lowest sales per month,

Avg the base case scenario,

Max the optimistic scenario with the highest sales per month,

Break-Even corrects Avg scenario by multiplying Avg sales by a correction factor.

This scenario shows the minimal amount of sales needed to ensure the recoupment of

investments at a desired rate of return (NPV=0).

NB! Correction factor calculation steps are described in the worksheet NPV plan

Type the total amount of monthly sales, including sales tax, for each scenario in the

blue cells B9, B19 and B39. Dont mind about the names of the product groups yet.

The names of the product groups may be changed in cells G9-G14 at Assumptions

worksheet.

To provide for yearly seasonality, use row 14 on the Assumptions worksheet.

For each scenario in column B put the proportion of each product group in the total

sales.

It is possible to change scenarios in cell B54 in worksheet "NPV Plan".

After you finish filling in this worksheet please proceed to NPV plan.

NPV Plan

Instructions Scenarios

This model facilitates evaluating investments in four different scenarios:

Min the worst-case scenario with the lowest sales per month,

Avg the base case scenario,

Max the optimistic scenario with the highest sales per month,

Break-Even corrects Avg scenario by multiplying Avg sales by a correction factor.

This scenario shows the minimal amount of sales needed to ensure the recoupment of

investments at a desired rate of return (NPV=0).

NB! Correction factor calculation steps are described in the worksheet NPV plan

Type the total amount of monthly sales, including sales tax, for each scenario in the

blue cells B9, B19 and B39. Dont mind about the names of the product groups yet.

The names of the product groups may be changed in cells G9-G14 at Assumptions

worksheet.

To provide for yearly seasonality, use row 14 on the Assumptions worksheet.

For each scenario in column B put the proportion of each product group in the total

sales.

It is possible to change scenarios in cell B54 in worksheet "NPV Plan".

After you finish filling in this worksheet please proceed to NPV plan.

Jan 12 Feb 12 Mar 12

0 1 2

Investments 0.00 0.00 0.00

Furniture 0.00

Purchase of POS 0.00

Purchase of hardware 0.00

Video surveillance system 0.00

Security system 0.00

Fire system, fire extinguisher 0.00

Repairs 0.00

Marketing materials 0.00

Advertisement and training 0.00

Deposits 0.00

Initial inventory 0.00

Bank changes 0.00

Sales incl. Sales tax 0.00 0.00

Sales w/o Sales tax 0.00 0.00 0.00

Product group 1 0.00 0.00

Product group 2 0.00 0.00

Product group 3 0.00 0.00

Product group 4 0.00 0.00

Product group 5 0.00 0.00

Product group 6 0.00 0.00

Purchases Markup 0.00 0.00

Product group 1 0% 0.00

Product group 2 0% 0.00

Product group 3 0% 0.00

Product group 4 0% 0.00

Product group 5 0% 0.00

Product group 6 0% 0.00

Current costs 0.00 0.00 0.00

Rental of premises 0.00 0.00 0.00

Rental adjustment

Public utilities payments 0.00 0.00

Electricity 0.00 0.00

Marketing fee 0.00 0.00

Employee salaries 0.00 0.00

Employment Taxes 0.00 0.00

Communication expenses, internet 0.00 0.00 0.00

Security 0.00 0.00

Stationery 0.00 0.00

Card Fees 0.00 0.00

New shop

Shop insurance 0.00

Interest payments 0.00 0.00 0.00

Marketing costs 0.00 0.00 0.00

Project cash flow

Net cash flow per month 0 0 0

Discount factor 1.0000 1.0000 1.0000

PV (CF) 0 0 0

NPV at the end of the period 0 0 0

Necessary funds 0.00 0.00 0.00

Interest rate per month 0.00%

Interest rate per annum (WACC) 0.00%

Scenario Min

Takeover date 1/1/2012

Project NPV 0

ROI 0.0%

ROI annualized 0.0%

Scenarios:

Min

Avg

Max

Break-even 0%

Instructions Totals

This is the main worksheet, which contains table with the main calculations for the investment project. In this worksheet

such indicators as NPV and ROI are calculated:

PV (Present value) - The current worth of a future sum of money or stream of cash flows given a specified rate of return.

Future cash flows are discounted at the discount rate, and the higher the discount rate, the lower the present value of the

future cash flows.

NPV (Net Present Value) The difference between the present value of cash inflows and the present value of cash

outflows. NPV is used in capital budgeting to analyze the profitability of an investment or project. If NPV > 0, it is worth

investing in the project, and it will bring you at least the expected return. If NPV < 0, you should not invest in this

project.

ROI (Return on Investment) the percentage income that you get on your investment.

Type a start date in cell B65 and interest rate per annum (WACC or desired return on your investment) in cell

B63. The higher is interest rate per annum, the lower is NPV.

The model assumes that all investments are made in the 0th month, but the new shop starts working in the next (1

st

) month.

If you need to project for a longer period before the opening to make investments - you can order a customization of the

model by contacting us at info@cfotemplates.com.

Make a list of investments in appropriate table (rows 5-16) and put the appropriate amounts for each position.

The model foresees: 1) that at the end of the period guarantee deposit (row 14) will be returned and this sum

with the sign minus will appear in column AM; 2) that the initial inventory will be sold at the end of the period (at

purchase prices). As a result, this will increase sales in the last month (cell AM20). In row 16 Bank funding

changes in 0

th

month loan sum should be written with sign minus, but further loan payments should be written

with sign plus.

Current costs (rows 39-52): if data are written in a light blue color, it is possible to change them manually. Data

written in a dark blue color are calculated automatically, according to assumptions (see worksheet

"Assumptions");

In cells B30:35 show the markup for each product group the average percentage that is added to COGS in order

to create the sales price. You should take into account discounts that the shop may be giving to its clients and

adjust the markup downwards accordingly.

It is possible to change scenarios (which are described in worksheet Scenarios) in cell B64 by clicking on this

cell and choosing scenario from the validation list.

If the Break-even scenario is chosen, go to Solver worksheet.

Instructions Totals

This is the main worksheet, which contains table with the main calculations for the investment project. In this worksheet

such indicators as NPV and ROI are calculated:

PV (Present value) - The current worth of a future sum of money or stream of cash flows given a specified rate of return.

Future cash flows are discounted at the discount rate, and the higher the discount rate, the lower the present value of the

future cash flows.

NPV (Net Present Value) The difference between the present value of cash inflows and the present value of cash

outflows. NPV is used in capital budgeting to analyze the profitability of an investment or project. If NPV > 0, it is worth

investing in the project, and it will bring you at least the expected return. If NPV < 0, you should not invest in this

project.

ROI (Return on Investment) the percentage income that you get on your investment.

Type a start date in cell B65 and interest rate per annum (WACC or desired return on your investment) in cell

B63. The higher is interest rate per annum, the lower is NPV.

The model assumes that all investments are made in the 0th month, but the new shop starts working in the next (1

st

) month.

If you need to project for a longer period before the opening to make investments - you can order a customization of the

model by contacting us at info@cfotemplates.com.

Make a list of investments in appropriate table (rows 5-16) and put the appropriate amounts for each position.

The model foresees: 1) that at the end of the period guarantee deposit (row 14) will be returned and this sum

with the sign minus will appear in column AM; 2) that the initial inventory will be sold at the end of the period (at

purchase prices). As a result, this will increase sales in the last month (cell AM20). In row 16 Bank funding

changes in 0

th

month loan sum should be written with sign minus, but further loan payments should be written

with sign plus.

Current costs (rows 39-52): if data are written in a light blue color, it is possible to change them manually. Data

written in a dark blue color are calculated automatically, according to assumptions (see worksheet

"Assumptions");

In cells B30:35 show the markup for each product group the average percentage that is added to COGS in order

to create the sales price. You should take into account discounts that the shop may be giving to its clients and

adjust the markup downwards accordingly.

It is possible to change scenarios (which are described in worksheet Scenarios) in cell B64 by clicking on this

cell and choosing scenario from the validation list.

If the Break-even scenario is chosen, go to Solver worksheet.

NPV of the project and necessary funds are illustrated graphically in worksheet NPV chart.

Necessary funds - project cash balance. If it is negative then it shows the amount that should be invested by the

owners.

If you need to make more changes in assumptions or scenarios, proceed to appropriate

worksheet.

The model provides calculations for 3-year investment (36 months). If you need longer period, you

can order a customization of the model by contacting us at info@cfotemplates.com.

Apr 12 May 12 Jun 12 Jul 12 Aug 12 Sep 12 Oct 12

3 4 5 6 7 8 9

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0 0 0 0 0 0 0

1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000

0 0 0 0 0 0 0

0 0 0 0 0 0 0

0.00 0.00 0.00 0.00 0.00 0.00 0.00

Instructions Totals

This is the main worksheet, which contains table with the main calculations for the investment project. In this worksheet

such indicators as NPV and ROI are calculated:

PV (Present value) - The current worth of a future sum of money or stream of cash flows given a specified rate of return.

Future cash flows are discounted at the discount rate, and the higher the discount rate, the lower the present value of the

future cash flows.

NPV (Net Present Value) The difference between the present value of cash inflows and the present value of cash

outflows. NPV is used in capital budgeting to analyze the profitability of an investment or project. If NPV > 0, it is worth

investing in the project, and it will bring you at least the expected return. If NPV < 0, you should not invest in this

project.

ROI (Return on Investment) the percentage income that you get on your investment.

Type a start date in cell B65 and interest rate per annum (WACC or desired return on your investment) in cell

B63. The higher is interest rate per annum, the lower is NPV.

The model assumes that all investments are made in the 0th month, but the new shop starts working in the next (1

st

) month.

If you need to project for a longer period before the opening to make investments - you can order a customization of the

model by contacting us at info@cfotemplates.com.

Make a list of investments in appropriate table (rows 5-16) and put the appropriate amounts for each position.

The model foresees: 1) that at the end of the period guarantee deposit (row 14) will be returned and this sum

with the sign minus will appear in column AM; 2) that the initial inventory will be sold at the end of the period (at

purchase prices). As a result, this will increase sales in the last month (cell AM20). In row 16 Bank funding

changes in 0

th

month loan sum should be written with sign minus, but further loan payments should be written

with sign plus.

Current costs (rows 39-52): if data are written in a light blue color, it is possible to change them manually. Data

written in a dark blue color are calculated automatically, according to assumptions (see worksheet

"Assumptions");

In cells B30:35 show the markup for each product group the average percentage that is added to COGS in order

to create the sales price. You should take into account discounts that the shop may be giving to its clients and

adjust the markup downwards accordingly.

It is possible to change scenarios (which are described in worksheet Scenarios) in cell B64 by clicking on this

cell and choosing scenario from the validation list.

If the Break-even scenario is chosen, go to Solver worksheet.

Assumptions

Scenarios

Solver

Instructions Totals

This is the main worksheet, which contains table with the main calculations for the investment project. In this worksheet

such indicators as NPV and ROI are calculated:

PV (Present value) - The current worth of a future sum of money or stream of cash flows given a specified rate of return.

Future cash flows are discounted at the discount rate, and the higher the discount rate, the lower the present value of the

future cash flows.

NPV (Net Present Value) The difference between the present value of cash inflows and the present value of cash

outflows. NPV is used in capital budgeting to analyze the profitability of an investment or project. If NPV > 0, it is worth

investing in the project, and it will bring you at least the expected return. If NPV < 0, you should not invest in this

project.

ROI (Return on Investment) the percentage income that you get on your investment.

Type a start date in cell B65 and interest rate per annum (WACC or desired return on your investment) in cell

B63. The higher is interest rate per annum, the lower is NPV.

The model assumes that all investments are made in the 0th month, but the new shop starts working in the next (1

st

) month.

If you need to project for a longer period before the opening to make investments - you can order a customization of the

model by contacting us at info@cfotemplates.com.

Make a list of investments in appropriate table (rows 5-16) and put the appropriate amounts for each position.

The model foresees: 1) that at the end of the period guarantee deposit (row 14) will be returned and this sum

with the sign minus will appear in column AM; 2) that the initial inventory will be sold at the end of the period (at

purchase prices). As a result, this will increase sales in the last month (cell AM20). In row 16 Bank funding

changes in 0

th

month loan sum should be written with sign minus, but further loan payments should be written

with sign plus.

Current costs (rows 39-52): if data are written in a light blue color, it is possible to change them manually. Data

written in a dark blue color are calculated automatically, according to assumptions (see worksheet

"Assumptions");

In cells B30:35 show the markup for each product group the average percentage that is added to COGS in order

to create the sales price. You should take into account discounts that the shop may be giving to its clients and

adjust the markup downwards accordingly.

It is possible to change scenarios (which are described in worksheet Scenarios) in cell B64 by clicking on this

cell and choosing scenario from the validation list.

If the Break-even scenario is chosen, go to Solver worksheet.

NPV of the project and necessary funds are illustrated graphically in worksheet NPV chart.

Necessary funds - project cash balance. If it is negative then it shows the amount that should be invested by the

owners.

If you need to make more changes in assumptions or scenarios, proceed to appropriate

worksheet.

The model provides calculations for 3-year investment (36 months). If you need longer period, you

can order a customization of the model by contacting us at info@cfotemplates.com.

Nov 12 Dec 12 Jan 13 Feb 13 Mar 13 Apr 13 May 13

10 11 12 13 14 15 16

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0 0 0 0 0 0 0

1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000

0 0 0 0 0 0 0

0 0 0 0 0 0 0

0.00 0.00 0.00 0.00 0.00 0.00 0.00

Instructions Totals

This is the main worksheet, which contains table with the main calculations for the investment project. In this worksheet

such indicators as NPV and ROI are calculated:

PV (Present value) - The current worth of a future sum of money or stream of cash flows given a specified rate of return.

Future cash flows are discounted at the discount rate, and the higher the discount rate, the lower the present value of the

future cash flows.

NPV (Net Present Value) The difference between the present value of cash inflows and the present value of cash

outflows. NPV is used in capital budgeting to analyze the profitability of an investment or project. If NPV > 0, it is worth

investing in the project, and it will bring you at least the expected return. If NPV < 0, you should not invest in this

project.

ROI (Return on Investment) the percentage income that you get on your investment.

Type a start date in cell B65 and interest rate per annum (WACC or desired return on your investment) in cell

B63. The higher is interest rate per annum, the lower is NPV.

The model assumes that all investments are made in the 0th month, but the new shop starts working in the next (1

st

) month.

If you need to project for a longer period before the opening to make investments - you can order a customization of the

model by contacting us at info@cfotemplates.com.

Make a list of investments in appropriate table (rows 5-16) and put the appropriate amounts for each position.

The model foresees: 1) that at the end of the period guarantee deposit (row 14) will be returned and this sum

with the sign minus will appear in column AM; 2) that the initial inventory will be sold at the end of the period (at

purchase prices). As a result, this will increase sales in the last month (cell AM20). In row 16 Bank funding

changes in 0

th

month loan sum should be written with sign minus, but further loan payments should be written

with sign plus.

Current costs (rows 39-52): if data are written in a light blue color, it is possible to change them manually. Data

written in a dark blue color are calculated automatically, according to assumptions (see worksheet

"Assumptions");

In cells B30:35 show the markup for each product group the average percentage that is added to COGS in order

to create the sales price. You should take into account discounts that the shop may be giving to its clients and

adjust the markup downwards accordingly.

It is possible to change scenarios (which are described in worksheet Scenarios) in cell B64 by clicking on this

cell and choosing scenario from the validation list.

If the Break-even scenario is chosen, go to Solver worksheet.

Instructions Totals

This is the main worksheet, which contains table with the main calculations for the investment project. In this worksheet

such indicators as NPV and ROI are calculated:

PV (Present value) - The current worth of a future sum of money or stream of cash flows given a specified rate of return.

Future cash flows are discounted at the discount rate, and the higher the discount rate, the lower the present value of the

future cash flows.

NPV (Net Present Value) The difference between the present value of cash inflows and the present value of cash

outflows. NPV is used in capital budgeting to analyze the profitability of an investment or project. If NPV > 0, it is worth

investing in the project, and it will bring you at least the expected return. If NPV < 0, you should not invest in this

project.

ROI (Return on Investment) the percentage income that you get on your investment.

Type a start date in cell B65 and interest rate per annum (WACC or desired return on your investment) in cell

B63. The higher is interest rate per annum, the lower is NPV.

The model assumes that all investments are made in the 0th month, but the new shop starts working in the next (1

st

) month.

If you need to project for a longer period before the opening to make investments - you can order a customization of the

model by contacting us at info@cfotemplates.com.

Make a list of investments in appropriate table (rows 5-16) and put the appropriate amounts for each position.

The model foresees: 1) that at the end of the period guarantee deposit (row 14) will be returned and this sum

with the sign minus will appear in column AM; 2) that the initial inventory will be sold at the end of the period (at

purchase prices). As a result, this will increase sales in the last month (cell AM20). In row 16 Bank funding

changes in 0

th

month loan sum should be written with sign minus, but further loan payments should be written

with sign plus.

Current costs (rows 39-52): if data are written in a light blue color, it is possible to change them manually. Data

written in a dark blue color are calculated automatically, according to assumptions (see worksheet

"Assumptions");

In cells B30:35 show the markup for each product group the average percentage that is added to COGS in order

to create the sales price. You should take into account discounts that the shop may be giving to its clients and

adjust the markup downwards accordingly.

It is possible to change scenarios (which are described in worksheet Scenarios) in cell B64 by clicking on this

cell and choosing scenario from the validation list.

If the Break-even scenario is chosen, go to Solver worksheet.

NPV of the project and necessary funds are illustrated graphically in worksheet NPV chart.

Necessary funds - project cash balance. If it is negative then it shows the amount that should be invested by the

owners.

If you need to make more changes in assumptions or scenarios, proceed to appropriate

worksheet.

The model provides calculations for 3-year investment (36 months). If you need longer period, you

can order a customization of the model by contacting us at info@cfotemplates.com.

Jun 13 Jul 13 Aug 13 Sep 13 Oct 13 Nov 13 Dec 13

17 18 19 20 21 22 23

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0 0 0 0 0 0 0

1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000

0 0 0 0 0 0 0

0 0 0 0 0 0 0

0.00 0.00 0.00 0.00 0.00 0.00 0.00

Jan 14 Feb 14 Mar 14 Apr 14 May 14 Jun 14 Jul 14

24 25 26 27 28 29 30

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0 0 0 0 0 0 0

1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000

0 0 0 0 0 0 0

0 0 0 0 0 0 0

0.00 0.00 0.00 0.00 0.00 0.00 0.00

Aug 14 Sep 14 Oct 14 Nov 14 Dec 14 Jan 15 Corrections

31 32 33 34 35 36 36

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00

0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00

0.00

0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00

0 0 0 0 0 0 0

1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000

0 0 0 0 0 0 0

0 0 0 0 0 0 0

0.00 0.00 0.00 0.00 0.00 0.00 0.00

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

NPV chart

NPV plan Necessary funds

Project NPV 0

Break-even 0%

Break-even scenario - Solver solution Instructions Solver

To use solver:

Click on the cell C4;

Go Data -> Solver ( if there is no Solver, go File -> Options -> Add-ins -> Choose Solver Add-in and press

Go below -> Choose Solver Add-in again and press OK);

In the Solver table click Solve and after model makes its calculations, choose Keep solver solution and

click OK;

Other calculations will be made automatically.

NPV plan

Instructions Solver

To use solver:

Click on the cell C4;

Go Data -> Solver ( if there is no Solver, go File -> Options -> Add-ins -> Choose Solver Add-in and press

Go below -> Choose Solver Add-in again and press OK);

In the Solver table click Solve and after model makes its calculations, choose Keep solver solution and

click OK;

Other calculations will be made automatically.

Instructions Solver

To use solver:

Click on the cell C4;

Go Data -> Solver ( if there is no Solver, go File -> Options -> Add-ins -> Choose Solver Add-in and press

Go below -> Choose Solver Add-in again and press OK);

In the Solver table click Solve and after model makes its calculations, choose Keep solver solution and

click OK;

Other calculations will be made automatically.

You might also like

- 5 Year Financial PlanDocument29 pages5 Year Financial PlanFrankieNo ratings yet

- Food Court Business PlanDocument21 pagesFood Court Business Plansaurabh100% (2)

- Ver. Per Month USDocument30 pagesVer. Per Month USch_yepNo ratings yet

- Accounting KPI GuideDocument5 pagesAccounting KPI Guidech_yepNo ratings yet

- Fire Extinguisher Training Manual v2 1Document12 pagesFire Extinguisher Training Manual v2 1ch_yep100% (1)

- Sales KpisDocument8 pagesSales Kpisch_yepNo ratings yet

- What-If Analysis TemplateDocument18 pagesWhat-If Analysis TemplateorangotaNo ratings yet

- 5 Year Financial PlanDocument29 pages5 Year Financial PlanFrankieNo ratings yet

- Fire Extinguisher InstructionDocument1 pageFire Extinguisher Instructionch_yepNo ratings yet

- Discounted Dividend Valuation USDocument9 pagesDiscounted Dividend Valuation USch_yepNo ratings yet

- Financial KPIs SamplesDocument4 pagesFinancial KPIs Samplesch_yepNo ratings yet

- Sensitivity Analysis of ProfitDocument8 pagesSensitivity Analysis of Profitch_yepNo ratings yet

- Production KPIs Document Management Innovation Logistics WarehouseDocument15 pagesProduction KPIs Document Management Innovation Logistics Warehousech_yepNo ratings yet

- Cash Flow Sensitivity AnalysisDocument1 pageCash Flow Sensitivity Analysisch_yepNo ratings yet

- How To Identify Food Trends White PaperDocument11 pagesHow To Identify Food Trends White Paperch_yepNo ratings yet

- AccountsQ&a 2010Document36 pagesAccountsQ&a 2010ch_yepNo ratings yet

- ROI Calculator USDocument35 pagesROI Calculator USch_yepNo ratings yet

- 2011 MIR Asian Brochure Lo-ResDocument4 pages2011 MIR Asian Brochure Lo-Resch_yepNo ratings yet

- Payroll Calculator USDocument21 pagesPayroll Calculator USch_yepNo ratings yet

- Payroll Calculator USDocument21 pagesPayroll Calculator USch_yepNo ratings yet

- Market Your Idea White PaperDocument18 pagesMarket Your Idea White Paperch_yepNo ratings yet

- Ver. Per Month USDocument30 pagesVer. Per Month USch_yepNo ratings yet

- Registration checklist under Franchise ActDocument1 pageRegistration checklist under Franchise Actch_yep0% (1)

- Market Your Idea White PaperDocument18 pagesMarket Your Idea White Paperch_yepNo ratings yet

- Form Phm2 - Central KitchenDocument38 pagesForm Phm2 - Central Kitchench_yepNo ratings yet

- Accounting KPI GuideDocument5 pagesAccounting KPI Guidech_yepNo ratings yet

- Microsoft Academy Return On Investment (ROI) White Paper CalculatorDocument3 pagesMicrosoft Academy Return On Investment (ROI) White Paper Calculatorch_yepNo ratings yet

- Doing Cafe Business in ChinaDocument9 pagesDoing Cafe Business in Chinach_yepNo ratings yet

- Apology For Not Crediting PaymentDocument2 pagesApology For Not Crediting Paymentch_yepNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)