Professional Documents

Culture Documents

India R&D Captives

Uploaded by

Manu RakeshCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

India R&D Captives

Uploaded by

Manu RakeshCopyright:

Available Formats

Engineering R&D : Advantage India

Zinnov

No part of it may be circulated, quoted, or reproduced for distribution without prior written approval from Zinnov

Agenda

Global R&D Outlook

India Product Engineering Landscape

India Captive Centers: Story of Resurgence

India Service Provider: Consolidating Growth

1

2

3

4

Product Engineering in India: The Way Forward 5

The markets across various verticals are increasingly shifting towards emerging

economies

Automotive

While the sales in North America and

Asia grew significantly, Europe

continued to witness a decrease in

automotive sales owing to European

debt crisis

Aerospace

Europe are the leading markets

currently, By 2030, regions outside

Europe and North America are

expected to own about half the

commercial aircraft in service

Computer Hardware and Storage

US and China amongst the fastest

growing nations in this segment. The

market expected to hit USD 220+ Billion

by 2016

Medical Devices

One of the fastest growing vertical

segment globally owing to increased

governmental spend in healthcare and

also increased instances of lifestyle

diseases

Consumer Electronics

The market is expected to reach over

USD 1.3 trillion dominated by US and

China

Industrial Automation

The United States and Chinese markets are

expected to be the powerhouses

driving 9.5 percent growth in the global

industrial automation market

Emerging geographies are expected to

grow at an average of 10-15 percent Year-

on-Year

Semiconductor

South east Asian countries will

dominate the semiconductor industry

in future as Asia accounts for more

than 50% of the market. Growing

technological advancements has

spurred demand

ISV

Post the recession in 2009, software

segment is poised to witness

a higher growth. The markets for both

enterprise and software have witnessed

significant growth

Telecom

The industry is witnessing de-regulation

in some of the worlds largest telecom

markets like India and China fueling

further growth prospects for the

industry

Key Market

Trends

This has created an increased focus on R&D in these high growth markets with US

and Europe still dominating the R&D spend

North America

Japan

Europe

20%

32%

35%

RoW*

13%

Verticals

% Contribution

of North

America to R&D

ISV 35%

Semiconductor 23%

Automotive 17%

Telecom 13%

Aerospace 9%

Others 3%

Verticals

% Contribution

of Europe to

R&D

Automotive 54%

Telecom 20%

Aerospace 10%

Semiconductor 7%

ISV 5%

Others 4%

Verticals

%

Contribution

of Japan to

R&D

Automotive 49%

Consumer

Electronics

43%

Semiconduct

or

8%

R&D Spend Across Geographies

Top five R&D Spenders

from North America

Microsoft

Intel

General Motors

IBM

Cisco Systems

Verticals

%

Contribution

of RoW to

R&D

Consumer

Electronics

35%

Semiconductor 31%

Telecom 28%

Others 5%

Note: * Rest of world

Source: Zinnov Research & Analysis, Annual reports

Top five R&D Spenders

from Europe

Volkswagen

Daimler

Nokia

Robert Bosch

Ericsson

Top five R&D Spenders

from Japan

Honda Motor

Panasonic

Nissan Motor

Sony

Canon

Top five R&D Spenders

from rest of world

Samsung

Huawei Technologies

Hyundai Motors

ZTE

LG

11%

16%

3%

Indicates Increase in R&D Spend in FY 2011 over FY

2010

X%

Indicates % contribution of a region to overall R&D

spend

5%

Automotive and Industrial Automation giants lead the global R&D investment

Automotive

Aerospace

Consumer

Electronics

Semiconductor

Medical

Devices

Telecom ISV

Company %

Toyota Motor 6%

Volkswagen 16%

General Motors 17%

Daimler 17%

Honda Motor 7%

Company %

Boeing -5%

EADS 7%

Finmeccanica -3%

United Technologies 18%

Rockwell Collins 24%

Company %

Panasonic -2%

Samsung Electronics 11%

Sony 1%

Canon 1%

FUJIFILM 4%

Company %

Abbott 11%

Medtronic 1%

Boston Scientific -5%

St. Jude Medical 12%

Stryker 17%

Company %

Nokia 0%

Cisco Systems -6%

Ericsson 4%

Huawei

Technologies

42%

Alcatel-Lucent -8%

Company %

Microsoft 8%

IBM 4%

Google 37%

Oracle 0%

SAP 9%

Company %

Intel 27%

Samsung 7%

STMicroelectronics 0%

Toshiba 1%

Broadcom 13%

R&D Spend Increase of Key Companies Across Verticals, FY 2012

Note: % Indicates growth in R&D investments YoY.

Source: Zinnov Research & Analysis, Annual reports

Industrial

Automation

Company %

Siemens 8%

Mitsubishi Electric 11%

ABB 27%

Danaher 32%

Schneider Electric 20%

11%

3%

-3%

8%

12% 5%

11%

15%

Energy efficiency and convergence are the major areas of focus for most R&D

organizations across various verticals

Automotive

Aerospace

Consumer Electronics

Computer Peripherals

Semiconductor

Medical Devices

Telecom

ISV

1

2

3

4

5

6

7

8

Industrial Automation

8 9

Key Technology Focus Areas

Energy Efficiency, Automotive Electronics

Green Energy, Integrated Avionics, Higher Electronics Content

Connectivity, Device convergence, Digitization

Application Optimized Storage, Miniaturization, Energy Efficiency

Optoelectronics, Sensors/MEMs

Homecare Solutions, Medical robotics, Wearable Technologies

Redesign for cloud, Mobile Use, Complex Data Analytics, Context Aware,

Vertical Market Specialization

Sustainability, Industrial Automation 2.0, Safety

Note:

Source: Zinnov Research & Analysis

Mobile-Cloud Convergence, Device & Network Convergence

Agenda

Global R&D Outlook 1

India Product Engineering Landscape

India Captive Centers: Story of Resurgence

India Service Provider: Consolidating Growth

2

3

4

Product Engineering in India: The Way Forward 5

India is the leading offshore destination in delivering engineering and R&D

services with a 22% market share

13

14.7

42

FY2011 FY2012 FY2020 E

Overall Product Engineering Growth Rate( In USD Billions)

Service Provider Growth Rate( In USD Billions) Captive Center Growth Rate( In USD Billions)

4.689

5.439

FY2011 FY2012

8.343

9.261

FY2011 FY2012

Note:

Source: Zinnov Research & Analysis

MNC Captive centers continue to drive the India product engineering growth story

S

e

m

i

c

o

n

d

u

c

t

o

r

T

e

l

e

c

o

m

A

u

t

o

m

o

t

i

v

e

A

e

r

o

s

p

a

c

e

C

o

m

p

u

t

i

n

g

S

y

s

t

e

m

s

C

o

n

s

u

m

e

r

E

l

e

c

t

r

o

n

i

c

s

M

e

d

i

c

a

l

D

e

v

i

c

e

s

I

S

V

(

O

S

P

D

)

79%

50%

69%

24%

74%

68%

65%

70%

21%

50%

31%

76%

26%

32%

35%

30%

Captive Split Service Provider Split

Captive Vs. Service Provider Split Across Verticals

Note:

Source: Zinnov Research & Analysis

Talent, Business and Technology imperatives will drive future growth across most

verticals

Semiconduc

tor

11%

Telecom

19%

Automotive

8%

Aerospace

4%

Computing

Systems

7%

Consumer

Electronics

6%

Others*

10%

Medical

Devices/Hea

lthcare

3%

ISV(OSPD)

32%

Vertical wise Revenue Distribution FY 2012

Product Engineering

Note:

Source: Zinnov Research & Analysis

Globalization

Drivers

2011 2020 E

Talent

Business

Technology

Drivers for Globalization of Product

Engineering to India

Talent- Availability, Quality, Scalability

Business- Costs, Risk Mgmt., Market/Customer

Technology-Innovation, Technology Trends

Agenda

Global R&D Outlook 1

India Product Engineering Landscape

India Captive Centers: Story of Resurgence

India Service Provider: Consolidating Growth

2

3

4

Product Engineering in India: The Way Forward 5

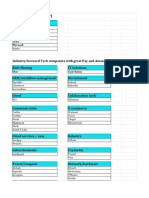

Over the last two years there has been a resurgence in the number of engineering

R&D captives centers setup in India

Semiconduct

or

9%

Telecom

17%

Automotive

6%

Aerospace

2%

Computing

Systems

5%

Consumer

Electronics

4%

Others*

10%

Medical

Devices/Heal

thcare

6%

ISV(OSPD)

41%

836

874

FY2011 FY2012

Growth in the Number of Captives, FY 2011 Split of Captives in India Based on Vertical 2012

Note:

Source: Zinnov Research & Analysis

ISV segment posted a smart growth owing to the entry of new players and also

headcount ramp up in existing captive centers

0.656

0.146

0.595

0.718

0.997

0.315

1.347

2.692

0.765

0.165

0.666

0.81

1.1

0.397

1.38

3.168

Automotive Aerospace Consumer

Electronics

Computer

Peripherals &

Storage

Semiconductor Medical Devices Telecom ISV

Captive Revenue Growth Rates-Vertical Wise( In USD Billion)

17%

13%

12%

13%

10%

26%

2%

18%

Note:

Source: Zinnov Research & Analysis

Large Medical device manufacturers are looking at India to establish their regional

R&D center for emerging markets

3

0

2

0

2

2

5

5

12

8

Automotive

Aerospace

Consumer Electronics

Computer Peripherals &

Storage

Industrial Automation

Semiconductor

Medical Devices

Telecom

ISV

Others

No. of New Captives Added in 2011

New Captives

Large Captives

Walmart, Open solutions

Paypal, Fidelity, GE Energy

Faurecia, Peugeot, CASKA

STEC, Silicon Image

Panasonic, Hitachi

Ricoh, Medline

Ruckus Wireless, Fluk networks,

Posedge

Linkedin, Zynga, Facebook, ORCC

Momentive, Hysitron

Bosch, Volkswagen, GM

Honeywell, GE, EADS,Boeing

Samsung, LG, Toshiba, Philips,

Sony

IBM, NetApp, Symantec, EMC

Schneider Electric, GE, Siemens

Intel, ST Microelectronics, TI,

AMD

Microsoft, Oracle, SAP Labs

Huawei, Nokia Siemens, Ericsson

Huawei, Nokia Siemens, Ericsson

Note:

Source: Zinnov Research & Analysis

Medical Device

While ISV is the most mature vertical in the India captive landscape, medical

devices space is rapidly gaining traction

Mature

ISV

Telecom

Industrial Automation

Rapidly Growing Emerging Vertical Nascent Vertical

Competency

C

a

p

t

i

v

e

P

r

e

s

e

n

c

e

Semiconductor

Vertical Maturity Levels- Captives

Size of Bubble Indicates

Headcount

Automotive

Consumer Electronics

Computer Peripherals

and Storage

Aerospace

Note:

Source: Zinnov Research & Analysis

Many companies have started their core research teams operating from India

Note:

Source: Zinnov Research & Analysis

Focus Areas:

Composite material design

Electromagnetic analytics

Nondestructive evaluation technology

Focus Areas:

Abrasives / adhesives

Coatings

NVH materials

Focus Areas:

High performance computing

Avionics

Structures

Focus Areas:

Smart system modeling

Vehicle structure and safety

Chemical reaction modeling

Focus Areas:

Next generation magnetic sensors

Image analysis and computer vision

Intelligent vehicle technologies

Focus Areas:

Manufacturing technologies

Communication technologies

Robotics

Focus Areas:

Decentralized energy systems

Embedded systems

S.M.A.R.T.* technologies

Focus Areas:

Healthcare systems and technologies

Energy and lighting

Consumer lifestyle technologies

Snapshot of core research by MNC R&D centers in India

GE

Honeywell

General Motors

Philips

EADS

Siemens

3M

ABB

Key Captive Trends

Increased ownership of global products

Transitioning to play the role of multi function centers

Co-creating innovations with service providers

Creating COEs to build products for local and global markets

Increased decision making in global sourcing initiatives

Shift in talent model from designation based to role based

Note:

Source: Zinnov Research & Analysis

Agenda

Global R&D Outlook 1

India Product Engineering Landscape

India Captive Centers: Story of Resurgence

India Service Provider: Consolidating

Growth

2

3

4

Product Engineering in India: The Way Forward 5

Product Engineering in telecom and ISV segment continues to be the mainstay for

Indian service providers

0.297

0.454

0.234 0.23

0.243

0.167

1.312

1.128

0.347

0.512

0.32

0.286

0.293

0.211

1.399

1.328

Automotive Aerospace Consumer

Electronics

Computer

Peripherals &

Storage

Semiconductor Medical Devices Telecom ISV

FY 2011 FY 2012

Service Provider Growth Rates-Vertical Wise

17%

13%

37%

24%

21%

7%

18%

26%

Note:

Source: Zinnov Research & Analysis

India service providers have deep competencies in software product development

and embedded development which have variety of applications across verticals

Mature

Telecom

Transport

Aerospace

Industrial Automation

Rapidly Growing Emerging Vertical Nascent Vertical

Competency

S

e

r

v

i

c

e

P

r

o

v

i

d

e

r

P

r

e

s

e

n

c

e

Automotive

Vertical Maturity Levels-Service Providers

Size of Bubble Indicates

Headcount

ISV

Consumer Peripherals

and Storage

Semiconductor

Medical Devices

Note:

Source: Zinnov Research & Analysis

Service providers have moved beyond certifications and are focused on building

competencies which will differentiate them in the market place

Automotive

Aerospace

Consumer

Electronics

Computer Peripherals

and Storage

Industrial Automation

Semiconductor

Medical Devices

Telecom

ISV

University GDFs* MNC Partners Certifications

Note: GDF( Global Development Forums)

Source: Zinnov Research & Analysis

Key Service Provider Trends

Note:

Source: Zinnov Research & Analysis

Shifting focus from traditional PES to Products and Platforms

Working closely with startups as innovation partners

Increasingly engaging with MNC Captive Centers in India

Building strong ecosystem partnerships with universities, global

development forums and MNCs

Working not just as product development partners but also as Go-To

Market partners with MNCs

Increasing investment in domain/vertical specific infrastructure and COEs

Key Service Provider Trends

Note:

Source: Zinnov Research & Analysis

Global R&D Outlook 1

India Product Engineering Landscape

India Captive Centers: Story of Resurgence

India Service Provider: Consolidating Growth

2

3

4

Product Engineering in India: The Way

Forward

5

The Road Ahead

Note:

Source: Zinnov Research & Analysis

Product Engineering Services expected to outpace the IT growth rate

Service providers will grow faster in volume and capability as compared to captive

centers

As relationships mature, service providers and their customers will enter into pricing

models that are based on market outcomes

As the thin line of difference between CIO and CTO is beginning to fade, service

providers are increasingly pitching fully loaded service offerings to the end clients

Thank You

69 "Prathiba Complex", 4th 'A' Cross,

Koramangala Ind. Layout

5th Block, Koramangala

Bangalore 560095

Phone: +91-80-41127925/6

11, Paras Downtown Centre, Golf

Course Road, Sector 53

Gurgaon 122002

Phone: +91-124- 4378211/13

575 N. Pastoria Ave

Suite J

Sunnyvale

CA 94085

Phone: +1-408-716-8432

21, Waterway Ave,

Suite 300

The Woodlands

TX 77380

Phone: +1-281-362-2773

info@zinnov.com

www.zinnov.com

@zinnov

You might also like

- GIC Report 2018Document20 pagesGIC Report 2018Sangeetha PNo ratings yet

- Nasscom Bain Gics in India Get Ready For The Future - Apr 2017 PDFDocument24 pagesNasscom Bain Gics in India Get Ready For The Future - Apr 2017 PDFKrishnaNo ratings yet

- Hyderabad Captive Centres Sub 300Document4 pagesHyderabad Captive Centres Sub 300issglobalNo ratings yet

- NASSCOM-Zinnov-GCCs 3.0-Final-May 2019Document93 pagesNASSCOM-Zinnov-GCCs 3.0-Final-May 2019deepak162162No ratings yet

- India Captives and Offshoring Analysis PDFDocument12 pagesIndia Captives and Offshoring Analysis PDFVivek GandhiNo ratings yet

- Nasscom Ansr GCC Report WebDocument44 pagesNasscom Ansr GCC Report Websaif1112No ratings yet

- Gics-In-India Getting Ready For The Digital WaveDocument81 pagesGics-In-India Getting Ready For The Digital Wavevasu.gaurav75% (4)

- Captives in India Complete ReportDocument97 pagesCaptives in India Complete ReportVishalDogra0% (6)

- Captives in India Complete ReportDocument13 pagesCaptives in India Complete ReportNidhi100% (2)

- List of Key GICs by Sector and LocationDocument49 pagesList of Key GICs by Sector and Locationdebojyoti91% (35)

- NASSCOM Captivating Captives InfocusDocument3 pagesNASSCOM Captivating Captives InfocusSundararaman ViswanathanNo ratings yet

- Indian CaptiveDocument3 pagesIndian CaptiveAvinEbaneshNo ratings yet

- India Callcentre ListDocument77 pagesIndia Callcentre ListRasi chowNo ratings yet

- List of Nasscom Registered Companies in North IndiaDocument11 pagesList of Nasscom Registered Companies in North IndiaSoftProdigy100% (2)

- Top 3 Content Moderation Companies in USADocument9 pagesTop 3 Content Moderation Companies in USAhitesh guptaNo ratings yet

- India GCC H1CY23 Trends - v2Document54 pagesIndia GCC H1CY23 Trends - v2Bisen VikasNo ratings yet

- List of Nasscom MembersDocument2 pagesList of Nasscom Memberssubhash160850% (6)

- HR ContactsDocument4 pagesHR ContactsRam Avtar GuptaNo ratings yet

- Captive Centre Setup in Vietnam PDFDocument113 pagesCaptive Centre Setup in Vietnam PDFsongaonkarsNo ratings yet

- SAP CompaniesDocument42 pagesSAP Companiesaruvindhu50% (2)

- Captive Service Cost Savings ControlDocument18 pagesCaptive Service Cost Savings ControlNidhi Narain100% (2)

- IndiaCaptivating GCC Report NLBServices VF Dec7 2022Document31 pagesIndiaCaptivating GCC Report NLBServices VF Dec7 2022utkarsh.akgNo ratings yet

- Top companies in Bangalore with addresses and contactsDocument31 pagesTop companies in Bangalore with addresses and contactsSampreeth KumarNo ratings yet

- 100 - Top Product Based CompaniesDocument3 pages100 - Top Product Based CompaniesDina DiarNo ratings yet

- List of Indian CompaniesDocument66 pagesList of Indian Companiescharle1989No ratings yet

- Top 330 Indian IT CompaniesDocument33 pagesTop 330 Indian IT CompaniesSivakumar Subramaniam100% (1)

- HR DataDocument6 pagesHR DataRajat Arora0% (1)

- Company Name HR Name: Infosys LTDDocument4 pagesCompany Name HR Name: Infosys LTDprasant samantarayNo ratings yet

- BPO Inida2Document60 pagesBPO Inida2Rasi chowNo ratings yet

- Vendor Caliing (Login Above 50)Document40 pagesVendor Caliing (Login Above 50)vikasNo ratings yet

- List of Top IT Services Companies in India (1001-5000) : Company Name IndustryDocument8 pagesList of Top IT Services Companies in India (1001-5000) : Company Name IndustrymukmukNo ratings yet

- Global In-House Centers (GIC) Benchmarking Study 2015-Key TakeawaysDocument9 pagesGlobal In-House Centers (GIC) Benchmarking Study 2015-Key TakeawaysSadagopan Raghavan TNo ratings yet

- Ramesh India Captive ListDocument32 pagesRamesh India Captive ListOnkar Shinde86% (7)

- Company DataDocument6 pagesCompany Datadasari_reddyNo ratings yet

- Attendee List PDFDocument38 pagesAttendee List PDFAnusha BhatNo ratings yet

- CXO - VPTechnology - India - ContactsDocument108 pagesCXO - VPTechnology - India - ContactsKishore Anantaraju33% (3)

- Global Captive Centers IndiaDocument2 pagesGlobal Captive Centers IndiaSai PratapNo ratings yet

- Master HRDocument1,030 pagesMaster HRpawan ishraNo ratings yet

- NASSCOM Bigdata Conference - Attendee-ListDocument38 pagesNASSCOM Bigdata Conference - Attendee-ListVinodhNo ratings yet

- 50 Fintech Companies IndiaDocument4 pages50 Fintech Companies IndiaMohit0% (1)

- HR DetailsDocument48 pagesHR DetailsMadhu shreeNo ratings yet

- HR Heads All India 16170Document36 pagesHR Heads All India 16170Yohithasweety Soumya0% (1)

- Bangalore It Company List 23-09-02Document55 pagesBangalore It Company List 23-09-02Vemmaiah BhanuprakashNo ratings yet

- Batch 8-500-IT Head DatabaseDocument98 pagesBatch 8-500-IT Head DatabaseMahendra PatilNo ratings yet

- List of 400+ Indian CompaniesDocument42 pagesList of 400+ Indian CompaniesSuchdeo KapilNo ratings yet

- Chennai BPO CompaniesDocument5 pagesChennai BPO CompaniesMikey MessiNo ratings yet

- Chennai - Bpo Company - 450Document44 pagesChennai - Bpo Company - 450shivamNo ratings yet

- HR Email IDSDocument1,038 pagesHR Email IDSRam Avtar Gupta100% (2)

- List of BPO Companies in India - 1300Document24 pagesList of BPO Companies in India - 1300bhavikNo ratings yet

- Top Indian BPO Companies ListDocument3 pagesTop Indian BPO Companies ListMovin MenezesNo ratings yet

- Simulasi Soal Kelompok 1Document37 pagesSimulasi Soal Kelompok 1Fachrul Rozie Yudha Gunawan100% (1)

- Comapnies List of NIT JamshedpurDocument56 pagesComapnies List of NIT Jamshedpurdeepu4303No ratings yet

- Bangalore BPO2Document87 pagesBangalore BPO2GayathriNo ratings yet

- Data 2Document6 pagesData 2abhinash biswal0% (1)

- Discussed ListDocument27 pagesDiscussed ListranjithattipellyNo ratings yet

- Electronics: Industry Report, March 2013Document37 pagesElectronics: Industry Report, March 2013IBEFIndiaNo ratings yet

- Engineering Services Outsourcing-The Next Frontier in Global SourcingDocument8 pagesEngineering Services Outsourcing-The Next Frontier in Global SourcingMadanagopal ManiNo ratings yet

- Hexa Research IncDocument5 pagesHexa Research Incapi-293819200No ratings yet

- Automotive SystemsDocument30 pagesAutomotive SystemsTugui RazvanNo ratings yet

- Electronic Manufacturing IndustryDocument4 pagesElectronic Manufacturing IndustryGilbert G. Asuncion Jr.No ratings yet

- Deploying Cascade and Steel HeadsDocument26 pagesDeploying Cascade and Steel HeadsManu RakeshNo ratings yet

- Term 1 - MKTGDocument8 pagesTerm 1 - MKTGManu RakeshNo ratings yet

- Smart SB480 - BrochureDocument2 pagesSmart SB480 - BrochureManu RakeshNo ratings yet

- Terrific Performance. Compact Design.: More Productivity. Less HassleDocument2 pagesTerrific Performance. Compact Design.: More Productivity. Less HassleManu RakeshNo ratings yet

- KM 4820wDocument2 pagesKM 4820wManu RakeshNo ratings yet

- Bizhub Press c7000 c6000Document12 pagesBizhub Press c7000 c6000Manu RakeshNo ratings yet

- Juniper FirewallDocument20 pagesJuniper FirewallManu RakeshNo ratings yet

- AVerVision F30 BrochureDocument4 pagesAVerVision F30 BrochureManu RakeshNo ratings yet

- AVer PL-50Document2 pagesAVer PL-50Manu RakeshNo ratings yet

- E STUDIO18 (Lowres) 1Document2 pagesE STUDIO18 (Lowres) 1Manu RakeshNo ratings yet

- Algebra Cheat SheetDocument2 pagesAlgebra Cheat SheetDino97% (72)

- CAT Exam Paper IVDocument23 pagesCAT Exam Paper IVHaresh NandaNo ratings yet

- Brain Building Easy Games To Develop Your Problem Solving SkillsDocument90 pagesBrain Building Easy Games To Develop Your Problem Solving SkillsVarun AroraNo ratings yet

- 30-6-90 Template For SalesDocument1 page30-6-90 Template For SalesManu RakeshNo ratings yet

- ReadmeDocument2 pagesReadmeAnkit BansalNo ratings yet

- General Purchase Conditions (Revised) 21.06.06Document42 pagesGeneral Purchase Conditions (Revised) 21.06.06Manu RakeshNo ratings yet

- Stability Analysis of Boiling Water Nuclear Reactors Using Parallel Computing ParadigmsDocument46 pagesStability Analysis of Boiling Water Nuclear Reactors Using Parallel Computing ParadigmsManu RakeshNo ratings yet

- Silk RouteDocument26 pagesSilk Routekartik chopraNo ratings yet

- Ancient China-Shang and Zhou DynastiesDocument4 pagesAncient China-Shang and Zhou Dynastieslavender2x2No ratings yet

- List of Chinese rulersThis concise SEO-optimized title provides relevant keywords about the document topic . It indicates the document is a list of rulers of ChinaDocument70 pagesList of Chinese rulersThis concise SEO-optimized title provides relevant keywords about the document topic . It indicates the document is a list of rulers of ChinaShyamol BoseNo ratings yet

- I. Choose The Correct Answer by Crossing A, B, C, D, or E!Document4 pagesI. Choose The Correct Answer by Crossing A, B, C, D, or E!Ifa AfifudinNo ratings yet

- CHP 5 Adidas Vs Nike Competitor AnalysisDocument4 pagesCHP 5 Adidas Vs Nike Competitor AnalysisSanket Sourav BalNo ratings yet

- Huo Shen Pai Use of Fu ZiDocument28 pagesHuo Shen Pai Use of Fu ZipranajiNo ratings yet

- 2016 Edelman Trust Barometer Global Mounting Trust InequalityDocument9 pages2016 Edelman Trust Barometer Global Mounting Trust InequalityМарат КильмухаметовNo ratings yet

- Qing dynasty: The great empire of ChinaDocument56 pagesQing dynasty: The great empire of ChinaolympiaNo ratings yet

- SAE June2019Document47 pagesSAE June2019gustavogfpNo ratings yet

- Shanghai CitymapDocument1 pageShanghai CitymapOmerta SpiritNo ratings yet

- History of Tea 1886Document208 pagesHistory of Tea 1886Anonymous SXBBwb100% (1)

- Popular Culture and Globalisation in Japan Asia 39 S TransformationsDocument241 pagesPopular Culture and Globalisation in Japan Asia 39 S TransformationsBaron Lopez Fernando Juan100% (4)

- Quantifying Political Violence Across CivilizationsDocument40 pagesQuantifying Political Violence Across CivilizationsAarón Rodríguez100% (1)

- China's Pursuit of A New World Media OrderDocument52 pagesChina's Pursuit of A New World Media OrderJojje OlssonNo ratings yet

- Final Thesisbook Spring14 ZhangwneyiDocument84 pagesFinal Thesisbook Spring14 ZhangwneyiAnnezaNo ratings yet

- For Communism. Theses of The Il Manifesto GroupDocument33 pagesFor Communism. Theses of The Il Manifesto GroupFélix Boggio Éwanjé-ÉpéeNo ratings yet

- Proceedings of The Thirteenth Meeting of The Working Group On Human Resource Development (WGHRD-13)Document190 pagesProceedings of The Thirteenth Meeting of The Working Group On Human Resource Development (WGHRD-13)Asian Development Bank ConferencesNo ratings yet

- China Pyramids ArticleDocument40 pagesChina Pyramids ArticleElentarri100% (2)

- HR Previous Paper IBPS SODocument17 pagesHR Previous Paper IBPS SOdassreerenjiniNo ratings yet

- THE IMPORTANCE OF STUDYING ENGLISH TODAY Camelia Mariana GulerDocument4 pagesTHE IMPORTANCE OF STUDYING ENGLISH TODAY Camelia Mariana GulerpertaelenaNo ratings yet

- Tica Catalogo General - CompressedDocument23 pagesTica Catalogo General - CompressedVictor Hugo Oropeza MonjeNo ratings yet

- Shock Therapy in Poland: Perspectives After Five YearsDocument26 pagesShock Therapy in Poland: Perspectives After Five YearsSv. NeNo ratings yet

- Herrlee Glessner Creel - Origins of Statecraft in China - The Western Chou Empire v. 1 (1970, University of Chicago Press)Document291 pagesHerrlee Glessner Creel - Origins of Statecraft in China - The Western Chou Empire v. 1 (1970, University of Chicago Press)Maria nicklesNo ratings yet

- Researching The Translation of Chinese Political DiscourseDocument28 pagesResearching The Translation of Chinese Political DiscourseLucaW.TinnirelloNo ratings yet

- Biju JosephDocument12 pagesBiju JosephSarfaraj OviNo ratings yet

- The History of SilkDocument1 pageThe History of SilkZehranur QuliyevaNo ratings yet

- TOTs Tshirt SizesDocument5 pagesTOTs Tshirt SizesShaline TanNo ratings yet

- Greenport Shanghai Agropark Master Plan Provides Vision for Sustainable Metropolitan AgricultureDocument146 pagesGreenport Shanghai Agropark Master Plan Provides Vision for Sustainable Metropolitan AgricultureApriadi Budi RaharjaNo ratings yet

- China's Claim of Sovereignty Over Spratly and Paracel Islands: A Historical and Legal PerspectiveDocument23 pagesChina's Claim of Sovereignty Over Spratly and Paracel Islands: A Historical and Legal PerspectiveAlan GultiaNo ratings yet

- IB Farwa Sept 20 2023Document7 pagesIB Farwa Sept 20 2023Mubbashir Bin Abdul QayyumNo ratings yet