Professional Documents

Culture Documents

Discounted Dividend Valuation US

Uploaded by

ch_yepCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Discounted Dividend Valuation US

Uploaded by

ch_yepCopyright:

Available Formats

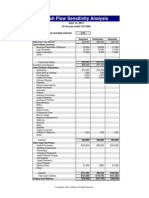

D Current dividend per share, $ 0.

00

r stock Cost of equity (Opportunity cost), % 0.00%

g long-term Long-term dividend growth rate, % 0.00%

g short-term Short-term dividend growth rate, % 0.00%

n short-term Length of short-term period, years 0

g mid-term Mid-term dividend growth rate, % 0.00%

n mid-term Length of mid-term period, years 0

Stock value 0.00

Number of Shares 0

Company value 0.00

r f Risk-free interest rate, % 0.00%

r m Market risk, % 0.00%

stock Beta of a stock 0.0000

r stock Cost of equity (Opportunity cost) 0.00%

1

2

3 Time Dividends PV

4 1 0.00 0

5 2 0.00 0

6 3 0.00 0

7 4 0.00 0

8 5 0.00 0

9 6 0.00 0

10 7 0.00 0

8 0.00 0

9 0.00 0

10 0.00 0

Cost of Equity (Opportunity Cost) Calculator - CAPM

Data Input

10

Number of periods

Discounted Dividend Valuation

Results

Manual Model Type Go back to Inputs

Model Type

One-Stage Go to table

r

stock

Calculation Method

0.00% Manual

Growth Rate Drop

Instantly

10

Number of periods

Go back to Inputs

Instructions

This is a discounted dividend valuation model. This model will help you to calculate a fair price for the stock,

taking into account various parameters.

Template is based on Dividend Discount Model (DDM). DDM is a procedure for valuing the price of a stock by

using predicted dividends and discounting them back to present value. The idea is that if the value obtained

from the DDM is higher than what the shares are currently trading at, then the stock is undervalued.

Template provides an opportunity to choose between four different model types: One-Stage model, Two-

Stage model, Three-Stage model and Manual model. Further you can find description for each model type:

1) One-Stage or Gordon Growth model: assumes that dividends grow indefinitely at a constant rate.

2) Two-Stage model: two common versions of the two-stage DDM exist. The first model assumes a

constant growth rate in each stage, as 15% in stage one and 7% in stage two (Instant growth rate

drop). The second model assumes a declining dividend growth rate in stage one followed by a fixed

growth rate in stage two (Gradual growth rate drop).

3) Three-Stage model: there are also two popular versions of this type of model. In the first version,

the company is assumed to have a constant dividend growth rate in each of the three stages. For

example, Stage 1 could assume 20% growth for 3 years, Stage 2 could have 10% growth for four

years, and Stage 3 5% growth rate thereafter (Instant growth rate drop). In the second version, in

the middle (second) period, the growth rate is assumed to decline linearly (Gradual growth rate

drop).

4) Manual model: in this model you should manually put a dividend per share for a certain number of

years. After you put these values, model will calculate dividend cash flow and discount it back to

present value, thus defining a stock value.

Key terms for this template:

D Current dividend per share in $

r stock Cost of equity (Opportunity cost) or Expected rate of return on a certain asset in %

g Dividend growth rate in %. There can be g short-term, g mid-term, and g-long-term, depending on

model type chosen.

n Length of the period in years. There can be n short-term and n mid-term, depending on model

type chosen.

To start working with this template:

Choose the appropriate model type from the drop-down list in cell H3;

Type data required in table Data Input;

r stock this rate can be defined in two ways. The first option is to write this value manually in cell D6.

The second option is to calculate this rate, using Capital Asset Pricing Model (CAPM). If you want to

calculate the rate, using this model, chosse CAPM from the drop-down list in cell H6 (otherwise leave

this cell Manual).

After CAPM is chosen in cell H6, additional table Cost of Equity (Opportunity Cost) Calculator - CAPM

appears. Fill in the table with appropriate values:

r f is the risk-free rate of interest (in %) such as interest arising from government bonds

r m - the expected market rate of return in %;

stock - the sensitivity of the expected asset returns to the expected market returns.

After these values are typed, r stock will be calculated automatically and used to define the stock value.

If youve chosen Two-Stage or Three-Stage model type in cell H3, you can choose the type of the growth

rate drop from the drop-down list in cell H9. Both types are described at the beginning of the

instructions. Depending on the type, additional rows in Data Input table will appear. Fill them with

appropriate values.

If youve chosen Manual model type in cell H3, you can click on the cell Go to Table that will appear in

cell J3. You should choose the appropriate number of years for calculation from the drop-down list in cell

E33. After that, type the dividend per share for each period in table Manual Model Type. After you type

values, click on the cell Go back to Inputs to return to the beginning of the worksheet.

After all values are put into appropriate tables, stock value will be calculated automatically in cell D16.

You can also enter the number of shares in cell D17, and template will automatically calculate the

company value (multiplying stock value by the number of shares).

To start working with this template:

Choose the appropriate model type from the drop-down list in cell H3;

Type data required in table Data Input;

r stock this rate can be defined in two ways. The first option is to write this value manually in cell D6.

The second option is to calculate this rate, using Capital Asset Pricing Model (CAPM). If you want to

calculate the rate, using this model, chosse CAPM from the drop-down list in cell H6 (otherwise leave

this cell Manual).

After CAPM is chosen in cell H6, additional table Cost of Equity (Opportunity Cost) Calculator - CAPM

appears. Fill in the table with appropriate values:

r f is the risk-free rate of interest (in %) such as interest arising from government bonds

r m - the expected market rate of return in %;

stock - the sensitivity of the expected asset returns to the expected market returns.

After these values are typed, r stock will be calculated automatically and used to define the stock value.

If youve chosen Two-Stage or Three-Stage model type in cell H3, you can choose the type of the growth

rate drop from the drop-down list in cell H9. Both types are described at the beginning of the

instructions. Depending on the type, additional rows in Data Input table will appear. Fill them with

appropriate values.

If youve chosen Manual model type in cell H3, you can click on the cell Go to Table that will appear in

cell J3. You should choose the appropriate number of years for calculation from the drop-down list in cell

E33. After that, type the dividend per share for each period in table Manual Model Type. After you type

values, click on the cell Go back to Inputs to return to the beginning of the worksheet.

After all values are put into appropriate tables, stock value will be calculated automatically in cell D16.

You can also enter the number of shares in cell D17, and template will automatically calculate the

company value (multiplying stock value by the number of shares).

Instructions

This is a discounted dividend valuation model. This model will help you to calculate a fair price for the stock,

taking into account various parameters.

Template is based on Dividend Discount Model (DDM). DDM is a procedure for valuing the price of a stock by

using predicted dividends and discounting them back to present value. The idea is that if the value obtained

from the DDM is higher than what the shares are currently trading at, then the stock is undervalued.

Template provides an opportunity to choose between four different model types: One-Stage model, Two-

Stage model, Three-Stage model and Manual model. Further you can find description for each model type:

1) One-Stage or Gordon Growth model: assumes that dividends grow indefinitely at a constant rate.

2) Two-Stage model: two common versions of the two-stage DDM exist. The first model assumes a

constant growth rate in each stage, as 15% in stage one and 7% in stage two (Instant growth rate

drop). The second model assumes a declining dividend growth rate in stage one followed by a fixed

growth rate in stage two (Gradual growth rate drop).

3) Three-Stage model: there are also two popular versions of this type of model. In the first version,

the company is assumed to have a constant dividend growth rate in each of the three stages. For

example, Stage 1 could assume 20% growth for 3 years, Stage 2 could have 10% growth for four

years, and Stage 3 5% growth rate thereafter (Instant growth rate drop). In the second version, in

the middle (second) period, the growth rate is assumed to decline linearly (Gradual growth rate

drop).

4) Manual model: in this model you should manually put a dividend per share for a certain number of

years. After you put these values, model will calculate dividend cash flow and discount it back to

present value, thus defining a stock value.

Key terms for this template:

D Current dividend per share in $

r stock Cost of equity (Opportunity cost) or Expected rate of return on a certain asset in %

g Dividend growth rate in %. There can be g short-term, g mid-term, and g-long-term, depending on

model type chosen.

n Length of the period in years. There can be n short-term and n mid-term, depending on model

type chosen.

To start working with this template:

Choose the appropriate model type from the drop-down list in cell H3;

Type data required in table Data Input;

r stock this rate can be defined in two ways. The first option is to write this value manually in cell D6.

The second option is to calculate this rate, using Capital Asset Pricing Model (CAPM). If you want to

calculate the rate, using this model, chosse CAPM from the drop-down list in cell H6 (otherwise leave

this cell Manual).

After CAPM is chosen in cell H6, additional table Cost of Equity (Opportunity Cost) Calculator - CAPM

appears. Fill in the table with appropriate values:

r f is the risk-free rate of interest (in %) such as interest arising from government bonds

r m - the expected market rate of return in %;

stock - the sensitivity of the expected asset returns to the expected market returns.

After these values are typed, r stock will be calculated automatically and used to define the stock value.

If youve chosen Two-Stage or Three-Stage model type in cell H3, you can choose the type of the growth

rate drop from the drop-down list in cell H9. Both types are described at the beginning of the

instructions. Depending on the type, additional rows in Data Input table will appear. Fill them with

appropriate values.

If youve chosen Manual model type in cell H3, you can click on the cell Go to Table that will appear in

cell J3. You should choose the appropriate number of years for calculation from the drop-down list in cell

E33. After that, type the dividend per share for each period in table Manual Model Type. After you type

values, click on the cell Go back to Inputs to return to the beginning of the worksheet.

After all values are put into appropriate tables, stock value will be calculated automatically in cell D16.

You can also enter the number of shares in cell D17, and template will automatically calculate the

company value (multiplying stock value by the number of shares).

To start working with this template:

Choose the appropriate model type from the drop-down list in cell H3;

Type data required in table Data Input;

r stock this rate can be defined in two ways. The first option is to write this value manually in cell D6.

The second option is to calculate this rate, using Capital Asset Pricing Model (CAPM). If you want to

calculate the rate, using this model, chosse CAPM from the drop-down list in cell H6 (otherwise leave

this cell Manual).

After CAPM is chosen in cell H6, additional table Cost of Equity (Opportunity Cost) Calculator - CAPM

appears. Fill in the table with appropriate values:

r f is the risk-free rate of interest (in %) such as interest arising from government bonds

r m - the expected market rate of return in %;

stock - the sensitivity of the expected asset returns to the expected market returns.

After these values are typed, r stock will be calculated automatically and used to define the stock value.

If youve chosen Two-Stage or Three-Stage model type in cell H3, you can choose the type of the growth

rate drop from the drop-down list in cell H9. Both types are described at the beginning of the

instructions. Depending on the type, additional rows in Data Input table will appear. Fill them with

appropriate values.

If youve chosen Manual model type in cell H3, you can click on the cell Go to Table that will appear in

cell J3. You should choose the appropriate number of years for calculation from the drop-down list in cell

E33. After that, type the dividend per share for each period in table Manual Model Type. After you type

values, click on the cell Go back to Inputs to return to the beginning of the worksheet.

After all values are put into appropriate tables, stock value will be calculated automatically in cell D16.

You can also enter the number of shares in cell D17, and template will automatically calculate the

company value (multiplying stock value by the number of shares).

Andrew Grigolyunovich, CFA

AG Capital

www.cfotemplates.com

Instructions

This is a discounted dividend valuation model. This model will help you to calculate a fair price for the stock,

taking into account various parameters.

Template is based on Dividend Discount Model (DDM). DDM is a procedure for valuing the price of a stock by

using predicted dividends and discounting them back to present value. The idea is that if the value obtained

from the DDM is higher than what the shares are currently trading at, then the stock is undervalued.

Template provides an opportunity to choose between four different model types: One-Stage model, Two-

Stage model, Three-Stage model and Manual model. Further you can find description for each model type:

1) One-Stage or Gordon Growth model: assumes that dividends grow indefinitely at a constant rate.

2) Two-Stage model: two common versions of the two-stage DDM exist. The first model assumes a

constant growth rate in each stage, as 15% in stage one and 7% in stage two (Instant growth rate

drop). The second model assumes a declining dividend growth rate in stage one followed by a fixed

growth rate in stage two (Gradual growth rate drop).

3) Three-Stage model: there are also two popular versions of this type of model. In the first version,

the company is assumed to have a constant dividend growth rate in each of the three stages. For

example, Stage 1 could assume 20% growth for 3 years, Stage 2 could have 10% growth for four

years, and Stage 3 5% growth rate thereafter (Instant growth rate drop). In the second version, in

the middle (second) period, the growth rate is assumed to decline linearly (Gradual growth rate

drop).

4) Manual model: in this model you should manually put a dividend per share for a certain number of

years. After you put these values, model will calculate dividend cash flow and discount it back to

present value, thus defining a stock value.

Key terms for this template:

D Current dividend per share in $

r stock Cost of equity (Opportunity cost) or Expected rate of return on a certain asset in %

g Dividend growth rate in %. There can be g short-term, g mid-term, and g-long-term, depending on

model type chosen.

n Length of the period in years. There can be n short-term and n mid-term, depending on model

type chosen.

To start working with this template:

Choose the appropriate model type from the drop-down list in cell H3;

Type data required in table Data Input;

r stock this rate can be defined in two ways. The first option is to write this value manually in cell D6.

The second option is to calculate this rate, using Capital Asset Pricing Model (CAPM). If you want to

calculate the rate, using this model, chosse CAPM from the drop-down list in cell H6 (otherwise leave

this cell Manual).

After CAPM is chosen in cell H6, additional table Cost of Equity (Opportunity Cost) Calculator - CAPM

appears. Fill in the table with appropriate values:

r f is the risk-free rate of interest (in %) such as interest arising from government bonds

r m - the expected market rate of return in %;

stock - the sensitivity of the expected asset returns to the expected market returns.

After these values are typed, r stock will be calculated automatically and used to define the stock value.

If youve chosen Two-Stage or Three-Stage model type in cell H3, you can choose the type of the growth

rate drop from the drop-down list in cell H9. Both types are described at the beginning of the

instructions. Depending on the type, additional rows in Data Input table will appear. Fill them with

appropriate values.

If youve chosen Manual model type in cell H3, you can click on the cell Go to Table that will appear in

cell J3. You should choose the appropriate number of years for calculation from the drop-down list in cell

E33. After that, type the dividend per share for each period in table Manual Model Type. After you type

values, click on the cell Go back to Inputs to return to the beginning of the worksheet.

After all values are put into appropriate tables, stock value will be calculated automatically in cell D16.

You can also enter the number of shares in cell D17, and template will automatically calculate the

company value (multiplying stock value by the number of shares).

If you wish to change something in this template, just order customization to your

needs at info@cfotemplates.com.

To order customization:

Think about changes that need to be made to your new template;

Send your requests and other comments to info@cfotemplates.com.

We will estimate the number of hours needed to customize your template and

we will send you a price quote.

Proceed to customization link at www.cfotemplates.com/Customization.htm.

To start working with this template:

Choose the appropriate model type from the drop-down list in cell H3;

Type data required in table Data Input;

r stock this rate can be defined in two ways. The first option is to write this value manually in cell D6.

The second option is to calculate this rate, using Capital Asset Pricing Model (CAPM). If you want to

calculate the rate, using this model, chosse CAPM from the drop-down list in cell H6 (otherwise leave

this cell Manual).

After CAPM is chosen in cell H6, additional table Cost of Equity (Opportunity Cost) Calculator - CAPM

appears. Fill in the table with appropriate values:

r f is the risk-free rate of interest (in %) such as interest arising from government bonds

r m - the expected market rate of return in %;

stock - the sensitivity of the expected asset returns to the expected market returns.

After these values are typed, r stock will be calculated automatically and used to define the stock value.

If youve chosen Two-Stage or Three-Stage model type in cell H3, you can choose the type of the growth

rate drop from the drop-down list in cell H9. Both types are described at the beginning of the

instructions. Depending on the type, additional rows in Data Input table will appear. Fill them with

appropriate values.

If youve chosen Manual model type in cell H3, you can click on the cell Go to Table that will appear in

cell J3. You should choose the appropriate number of years for calculation from the drop-down list in cell

E33. After that, type the dividend per share for each period in table Manual Model Type. After you type

values, click on the cell Go back to Inputs to return to the beginning of the worksheet.

After all values are put into appropriate tables, stock value will be calculated automatically in cell D16.

You can also enter the number of shares in cell D17, and template will automatically calculate the

company value (multiplying stock value by the number of shares).

If you wish to change something in this template, just order customization to your

needs at info@cfotemplates.com.

To order customization:

Think about changes that need to be made to your new template;

Send your requests and other comments to info@cfotemplates.com.

We will estimate the number of hours needed to customize your template and

we will send you a price quote.

Proceed to customization link at www.cfotemplates.com/Customization.htm.

You might also like

- LTGMPCv5 2 Sept2022Document179 pagesLTGMPCv5 2 Sept2022Behzad KhanNo ratings yet

- Evans Analytics2e PPT 12Document63 pagesEvans Analytics2e PPT 12hema100% (1)

- Heuristics - Dianogtics AnalyticsDocument68 pagesHeuristics - Dianogtics Analyticsnthieu0102No ratings yet

- JPMCredit Option Pricing ModelDocument8 pagesJPMCredit Option Pricing ModelsaikamathNo ratings yet

- Lab 1: Learning Spreadsheet SimulationDocument3 pagesLab 1: Learning Spreadsheet SimulationAbdu AbdoulayeNo ratings yet

- DDMDocument16 pagesDDMShwetabh SrivastavaNo ratings yet

- Appendix A - Users GuideDocument26 pagesAppendix A - Users Guideavinrawa4No ratings yet

- Steps to Analyze Sensitivity and Uncertainty in Geocellular ModelingDocument18 pagesSteps to Analyze Sensitivity and Uncertainty in Geocellular Modelinganima1982100% (2)

- Standardized CoefficientsDocument5 pagesStandardized CoefficientsCYNTHIA AGYEIWAA KUSINo ratings yet

- Functions in The MRP ListDocument7 pagesFunctions in The MRP ListAni MeniniNo ratings yet

- Event Driven ProgrammingDocument6 pagesEvent Driven ProgrammingMandeep SinghNo ratings yet

- WITS Global Tariff Cuts and Trade Simulator User GuideDocument10 pagesWITS Global Tariff Cuts and Trade Simulator User GuideanonymousninjatNo ratings yet

- Calculating CAGR in Excel: Method 1: Direct CalculationDocument3 pagesCalculating CAGR in Excel: Method 1: Direct CalculationRodrigo GarciaNo ratings yet

- Cmpg122. Exam 1st OppDocument8 pagesCmpg122. Exam 1st OppotheliamkhatshwaNo ratings yet

- Tableau short some notesDocument2 pagesTableau short some notesNAVIN VINODRAO CHOKHATNo ratings yet

- 03_05_Pricing+ProcedureDocument11 pages03_05_Pricing+ProcedureGina VanessaNo ratings yet

- Pareto Chart Visualizes Important ProblemsDocument6 pagesPareto Chart Visualizes Important ProblemsCarl So - FrdyNo ratings yet

- MLR - Bank Revenues PDFDocument18 pagesMLR - Bank Revenues PDFEdNo ratings yet

- Critical Level Pos - TEMPLATEDocument11 pagesCritical Level Pos - TEMPLATErazern46No ratings yet

- Detail Project Report SMDMDocument25 pagesDetail Project Report SMDMDeepak Padiyar100% (1)

- Life Cycle Costing Spreadsheet Instructions LCC Spreadsheet: Displayed in The Total Cost Chart BelowDocument8 pagesLife Cycle Costing Spreadsheet Instructions LCC Spreadsheet: Displayed in The Total Cost Chart BelowNESTOR DURANNo ratings yet

- Lift Chart (Analysis Services - Data Mining)Document5 pagesLift Chart (Analysis Services - Data Mining)vlaresearchNo ratings yet

- Pricing 2Document19 pagesPricing 2Raj KumarNo ratings yet

- Define Pricing ProcedureDocument3 pagesDefine Pricing Procedurecreater127abNo ratings yet

- Pricing procedure Steps SAP MMDocument4 pagesPricing procedure Steps SAP MMabhishekNo ratings yet

- Dividend Discount ModelDocument19 pagesDividend Discount Modelrajat vermaNo ratings yet

- Logistic Regression Model for Credit Risk AssessmentDocument17 pagesLogistic Regression Model for Credit Risk AssessmentZara BatoolNo ratings yet

- Final Project Part 2 DashboardDocument6 pagesFinal Project Part 2 DashboardZubair AhmadNo ratings yet

- Monte Carlo Simulation SetupDocument3 pagesMonte Carlo Simulation SetupProffNo ratings yet

- Pricing Procedure: Sap MMDocument8 pagesPricing Procedure: Sap MMPurushottam ShindeNo ratings yet

- CDO PricingDocument40 pagesCDO Pricingmexicocity78No ratings yet

- Time Series Smoothing Models 11Document1 pageTime Series Smoothing Models 11testNo ratings yet

- Chapter 6 Normal Distibutions: Graphs of Normal Distributions (Section 6.1 of UnderstandableDocument8 pagesChapter 6 Normal Distibutions: Graphs of Normal Distributions (Section 6.1 of UnderstandableAsiongMartinez12No ratings yet

- Pareto Chart ExplainedDocument6 pagesPareto Chart ExplainedKamalAfzalJarralNo ratings yet

- Equity ValuationDocument18 pagesEquity ValuationNaddieNo ratings yet

- Lesson 6 - PricingDocument13 pagesLesson 6 - PricingAnjo EllisNo ratings yet

- C Programming Beginners QuestionsDocument12 pagesC Programming Beginners QuestionsMuraliShiva0% (1)

- What Is Pricing ProcedureDocument6 pagesWhat Is Pricing ProcedureMayuri SrivastavaNo ratings yet

- Dividend Models Explained: Calculating Stock Value Using 3-Stage DCFDocument23 pagesDividend Models Explained: Calculating Stock Value Using 3-Stage DCFRavichandran RamadassNo ratings yet

- Capital Asset Pricing ModelDocument6 pagesCapital Asset Pricing ModelkelvinramosNo ratings yet

- Gemini Cut Plan v.X9 - User ManualDocument41 pagesGemini Cut Plan v.X9 - User ManualБоро КнежевићNo ratings yet

- Problem 1Document4 pagesProblem 1121090370No ratings yet

- Part 2 Unit 9 DebtopiaDocument35 pagesPart 2 Unit 9 DebtopiaqwertyuiopNo ratings yet

- SD Questions About Pricing ConditionDocument9 pagesSD Questions About Pricing ConditionAniruddha ChakrabortyNo ratings yet

- SunwayTes Management Accountant Topical QDocument8 pagesSunwayTes Management Accountant Topical QFarahAin FainNo ratings yet

- Using AZUREML to predict used car pricesDocument15 pagesUsing AZUREML to predict used car pricesTruc NguyenNo ratings yet

- Cost Behavior Analysis and UseDocument3 pagesCost Behavior Analysis and Usepablopaul56No ratings yet

- Free Options Trading Spreadsheet AnalyzerDocument28 pagesFree Options Trading Spreadsheet AnalyzerAmay MainakNo ratings yet

- COST PLANNINGDocument16 pagesCOST PLANNINGxxmisterioxxNo ratings yet

- Customer Master RecordsDocument3 pagesCustomer Master RecordsMaggi JohnNo ratings yet

- SolidWorks 2016 Learn by doing 2016 - Part 3From EverandSolidWorks 2016 Learn by doing 2016 - Part 3Rating: 3.5 out of 5 stars3.5/5 (3)

- Pricing Procedure in SAP MMDocument9 pagesPricing Procedure in SAP MMmohammed ahmedNo ratings yet

- 15 General Ledger Journals Create and Post A General Journal PDFDocument5 pages15 General Ledger Journals Create and Post A General Journal PDFmoon heizNo ratings yet

- Sd8-The Dividend Discount and Flows To Equity ModelsDocument7 pagesSd8-The Dividend Discount and Flows To Equity Modelsanah ÜNo ratings yet

- Computer Holiday Homework Class 10 ICSE 2023 - 24Document4 pagesComputer Holiday Homework Class 10 ICSE 2023 - 24꧁KAIF꧂ Ali KhanNo ratings yet

- Perceptual Map Situation AnalysisDocument5 pagesPerceptual Map Situation AnalysisHerbert Ascencio0% (1)

- Predicting The Churn in Telecom IndustryDocument9 pagesPredicting The Churn in Telecom Industrystruggler17No ratings yet

- DamodaranDocument3 pagesDamodaranSuraj GuhaNo ratings yet

- Introduction to Dynamic Macroeconomic General Equilibrium ModelsFrom EverandIntroduction to Dynamic Macroeconomic General Equilibrium ModelsNo ratings yet

- 5 Year Financial PlanDocument29 pages5 Year Financial PlanFrankieNo ratings yet

- 2011 MIR Asian Brochure Lo-ResDocument4 pages2011 MIR Asian Brochure Lo-Resch_yepNo ratings yet

- 5 Year Financial PlanDocument29 pages5 Year Financial PlanFrankieNo ratings yet

- Food Court Business PlanDocument21 pagesFood Court Business Plansaurabh100% (2)

- How To Identify Food Trends White PaperDocument11 pagesHow To Identify Food Trends White Paperch_yepNo ratings yet

- Accounting KPI GuideDocument5 pagesAccounting KPI Guidech_yepNo ratings yet

- What-If Analysis TemplateDocument18 pagesWhat-If Analysis TemplateorangotaNo ratings yet

- Fire Extinguisher Training Manual v2 1Document12 pagesFire Extinguisher Training Manual v2 1ch_yep100% (1)

- Fire Extinguisher InstructionDocument1 pageFire Extinguisher Instructionch_yepNo ratings yet

- Sales KpisDocument8 pagesSales Kpisch_yepNo ratings yet

- Sensitivity Analysis of ProfitDocument8 pagesSensitivity Analysis of Profitch_yepNo ratings yet

- ROI Calculator USDocument35 pagesROI Calculator USch_yepNo ratings yet

- Ver. Per Month USDocument30 pagesVer. Per Month USch_yepNo ratings yet

- Financial KPIs SamplesDocument4 pagesFinancial KPIs Samplesch_yepNo ratings yet

- Cash Flow Sensitivity AnalysisDocument1 pageCash Flow Sensitivity Analysisch_yepNo ratings yet

- Production KPIs Document Management Innovation Logistics WarehouseDocument15 pagesProduction KPIs Document Management Innovation Logistics Warehousech_yepNo ratings yet

- ROI Calculator USDocument35 pagesROI Calculator USch_yepNo ratings yet

- Payroll Calculator USDocument21 pagesPayroll Calculator USch_yepNo ratings yet

- Ver. Per Month USDocument30 pagesVer. Per Month USch_yepNo ratings yet

- Market Your Idea White PaperDocument18 pagesMarket Your Idea White Paperch_yepNo ratings yet

- AccountsQ&a 2010Document36 pagesAccountsQ&a 2010ch_yepNo ratings yet

- Payroll Calculator USDocument21 pagesPayroll Calculator USch_yepNo ratings yet

- Microsoft Academy Return On Investment (ROI) White Paper CalculatorDocument3 pagesMicrosoft Academy Return On Investment (ROI) White Paper Calculatorch_yepNo ratings yet

- Market Your Idea White PaperDocument18 pagesMarket Your Idea White Paperch_yepNo ratings yet

- Form Phm2 - Central KitchenDocument38 pagesForm Phm2 - Central Kitchench_yepNo ratings yet

- Registration checklist under Franchise ActDocument1 pageRegistration checklist under Franchise Actch_yep0% (1)

- Doing Cafe Business in ChinaDocument9 pagesDoing Cafe Business in Chinach_yepNo ratings yet

- Accounting KPI GuideDocument5 pagesAccounting KPI Guidech_yepNo ratings yet

- Apology For Not Crediting PaymentDocument2 pagesApology For Not Crediting Paymentch_yepNo ratings yet

- Much About Ado MultipliersDocument1 pageMuch About Ado Multipliersleidy0529No ratings yet

- PIQ On Marketing & SalesDocument21 pagesPIQ On Marketing & SalesMathew AbrahamNo ratings yet

- DISCOUNT (WWW - Freeupscmaterials.wordpress - Com)Document15 pagesDISCOUNT (WWW - Freeupscmaterials.wordpress - Com)k.palrajNo ratings yet

- Excerpt From The Solidarity Economy Alternative by Vishwas SatgarDocument38 pagesExcerpt From The Solidarity Economy Alternative by Vishwas SatgarSA Books100% (1)

- CH 9 Capital Asset Pricing ModelDocument25 pagesCH 9 Capital Asset Pricing ModelShantanu ChoudhuryNo ratings yet

- Real Estate MarketDocument39 pagesReal Estate MarketRathinder Rathi100% (1)

- Executive Summary SCIENCEDocument68 pagesExecutive Summary SCIENCEJyotishmoi BoraNo ratings yet

- Course 7Document36 pagesCourse 7mkinnetxNo ratings yet

- Slowotworstwo Kontekst Business 250 2Document16 pagesSlowotworstwo Kontekst Business 250 2a.strefnelNo ratings yet

- Chapter One: 1.1history of The OrganisationDocument23 pagesChapter One: 1.1history of The OrganisationchijoNo ratings yet

- IFM Course Plan 2017Document8 pagesIFM Course Plan 2017Eby Johnson C.No ratings yet

- LibroDocument212 pagesLibromiguelchp02No ratings yet

- The Democratic SocietyDocument11 pagesThe Democratic SocietyBernardo Cielo IINo ratings yet

- The Global Economy: Lesson 2Document4 pagesThe Global Economy: Lesson 2Reven Domasig TacordaNo ratings yet

- Political Economy of Trade and the Chiquita CaseDocument14 pagesPolitical Economy of Trade and the Chiquita CaseHenry ZhuNo ratings yet

- Guide To The Markets AsiaDocument87 pagesGuide To The Markets AsiaJavier Arles Lopez AstaizaNo ratings yet

- Review of Literature on EntrepreneurshipDocument5 pagesReview of Literature on EntrepreneurshipPamela GalangNo ratings yet

- Jindal Steel EIC AnalysisDocument5 pagesJindal Steel EIC AnalysisNavneet MakhariaNo ratings yet

- The Big Lie of Strategic PlanningDocument15 pagesThe Big Lie of Strategic Planningpgp000No ratings yet

- Chapter 9 Corporate Level StrategyDocument21 pagesChapter 9 Corporate Level Strategyabrar171No ratings yet

- The External Environment: Mcgraw-Hill/Irwin © 2005 The Mcgraw-Hill Companies, Inc., All Rights ReservedDocument40 pagesThe External Environment: Mcgraw-Hill/Irwin © 2005 The Mcgraw-Hill Companies, Inc., All Rights ReservedTanut VatNo ratings yet

- Seminar Assignments Multiple Choice Questions City Size Growth PDFDocument4 pagesSeminar Assignments Multiple Choice Questions City Size Growth PDFminlwintheinNo ratings yet

- Pub - Cooperative Sourcing Simulation Studies and Empiri PDFDocument483 pagesPub - Cooperative Sourcing Simulation Studies and Empiri PDFTanuj BhattacharyyaNo ratings yet

- Management Accounting: Level 3Document18 pagesManagement Accounting: Level 3Hein Linn KyawNo ratings yet

- A Project Report On Fundamental Analysis of Mahindra Amp Mahindra CompanyDocument114 pagesA Project Report On Fundamental Analysis of Mahindra Amp Mahindra CompanyamritabhosleNo ratings yet

- Cost Problem SetDocument2 pagesCost Problem SetRayNo ratings yet

- Public ChoiceDocument39 pagesPublic ChoiceRoberta DGNo ratings yet

- Chopra scm6 Inppt 01r1Document37 pagesChopra scm6 Inppt 01r1ArpitPatelNo ratings yet

- Expert Witness RG Harris Appendix 1 PB V TW TRO 28.nov.12Document26 pagesExpert Witness RG Harris Appendix 1 PB V TW TRO 28.nov.12MikeIsaacNo ratings yet

- Siapa Yang Diuntungkan Dari Perang Dagang-DikonversiDocument6 pagesSiapa Yang Diuntungkan Dari Perang Dagang-DikonversiDesty Monica KopalitNo ratings yet