Professional Documents

Culture Documents

Professional Practice Sample of Tutorial Answer

Uploaded by

ElaineSaw0 ratings0% found this document useful (0 votes)

399 views5 pagesProfession Practice

Conveyancing

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentProfession Practice

Conveyancing

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

399 views5 pagesProfessional Practice Sample of Tutorial Answer

Uploaded by

ElaineSawProfession Practice

Conveyancing

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

Tutorial 4 Question 3 (Adapted from CLP 2007)

J is the registered proprietor of a certain piece of property. He created a

Third party charge in favour of Grand Bank Bhd. (GBB) to secure a loan

granted to Contractors Sdn. Bhd.(CSB). CSB defaulted in the loan

repayments and GBB commenced proceedings for an Order of Sale. The

Summons was duly served on J. There were some adjournments of the

hearing of the Summons. At the last adjourned hearing J was absent

because GBB did not serve the notice of the adjourned hearing on him. The

Order for Sale was granted by the Court.

The auction was carried out and K was the successful bidder. The property

was subsequently registered in Ks name. Some months later J applies to

Court to declare the Order of Court a nullity and the Court grants the

application.

Both GBB and K are unhappy with the decision and wish to appeal.

Advise GBB and K on the viability of the appeal.

The main issue would be whether GBBs failure in serving notice on

informing J of the adjourned hearing entitled J to set aside the order for

sale.

O.83 r.2(4) of the Rules of Court 2012 clearly requires the chargee

plaintiff, ie. GBB, to serve a written notice on J to inform him of the adjourned

hearing not less than 2 clear days before the day fixed for the hearing.

GBB failed to comply with this rule. Thus, the effect of non-compliance

will be discussed in the following cases.

In the case of Asia Commercial Finance (M) Bhd. v. Kimden Housing

Development Sdn. Bhd,

1

an order for sale over property charged to the

plaintiffs was granted in the absence of the defendants, at an adjourned

1

[1993] 1 MLJ 283

hearing. Subsequent to the order for sale, the defendants were wound-up in

pursuance of a winding-up petition. The private liquidator, who took over from

the provisional liquidator in June 1992, applied on behalf of the

defendants, inter alia, to set aside the order for sale on the ground of errors in

the affidavits filed in support and non-compliance with the existing rules and

regulations in the foreclosure application.

The High Court held that the non- compliance with O.83 r.2(4) entitled

the defendants to have the order for sale set aside as of right, ex debito justitiae.

The right to have a judgment set aside ex debito justitiae relates to the judgment

having been obtained irregularly, which might involve the deprivation of the

rights of one party of being heard. The setting aside order need not have any

terms whatsoever attached thereto, nor is the defendant required to disclose that

he has a defence on merits or that there is an arguable or triable issue.

In the current case, J was deprived of his rights to be heard for lack of

knowledge as pertaining to when is the next hearing date. His right to be

informed of the adjourned hearing date was not affected by his absence at the

first hearing. It should be the duty of the charge plaintiff, not the Court, to

inform the chargor defendant of the adjourned date.

In the case of Muniandy Thamba Kaundan & Anor V. Development &

Commercial Bank Berhad & Anor,

2

neither of the chargors were served with

notice of the adjourned hearing dated 29 January 1992 when the ex-parte orders

were made. Before the learned Judge, the chargors argued that the non-service

of notice had resulted in a breach of natural justice contrary to O.83 r.2(4) of

the Rules of the High Court 1980 (RHC), by reason which the ex parte orders

were rendered null and void. The Federal Court held that the failure on the part

of the chargees to notify the chargors of the date of the adjourned hearing was

of such fundamental importance that it must render each of the ex-parte orders

2

[1996] 2 CLJ 586

obtained a nullity. The defect is so fundamental as to entitle the chargors to

have the judgment avoided and set aside as of right.

O.83 has a common law content which means that the Order is merely a

statutory enunciation of the fundamental rule of natural justice as expressed in

the maxim audi alteram partem, so that the obligation to serve notice of the

adjourned hearing of the originating summons remained even if O.83 r.2(4) did

not apply.

In the case of Malayan Banking Bhd v. Pk Rajamani & Anor,

3

the facts

are similar to the current case whereby in the alleged case, the defendant is the

registered proprietor of a piece of property ('the said property') which was

charged to the plaintiff as security for a loan granted to a third party. The third

party defaulted in his loan repayment which resulted in foreclosure proceedings

being commenced against the said property. There was a postponement of

hearing and no notice of the postponement was served by the plaintiff on the

defendant. An Order for Sale was made in the absence of the defendant and the

property was sold off.

It is to be contemplated that the notice requirement as set out in O.83

r.2(4) of the Rules of High Court 1980 is mandatory. It is the duty of the

plaintiff not the Court to inform the defendant of the date of the adjourned

hearing. The failure on the part of the plaintiff to comply with the requirements

of this Order amounted to the deprivation of the defendant's fundamental right

to be heard. The Order for Sale was therefore and irregularity which the

defendant is entitled to set aside as of right.

Therefore, it is to be argued that a purchaser in good faith and for

valuable consideration would have an equity over the said property. The

3

[1997] 3 CLJ SUPP 353

intervener has none because his equity has been tarnished. The sale of the said

property by way of public auction ought to be set aside even though the

certificate of sale had been issued.

In the alleged case, the purchaser was an intervener but not a bona fide

purchaser. The auction sale was finalized after the bid of only one bidder (the

intervener) at just RM1,000 - above the reserved price when the other bidders

(who had paid the auction deposits) surprisingly refrained from making any bid.

The court found it to be a farce on public auction.

Hence, based on the above cases, GBBs failure in serving notice on

informing J of the adjourned hearing shall entitle J to set aside the order for sale

as J was able to show that to grant the application would be contrary to some

rule of law or equity [Murugappa Chettiar v Letchumanan Chettiar

4

] since

GBBs failure to inform was contrary to O.83 r.2(4). Therefore, apparently,

GBB and Ks appeal may not succeed.

However, based on the facts that J only applied to court to set aside the

order for sale after some months from the date of registration by K in Ks name,

it can be presumed that J is caught under O.42 r.13 of the Rules of Court 2012

which requires him to apply to court to set aside or vary the order within 30

days after the receipt of the order by him. Hence, the trial judge had erred in

allowing Js application since Js application is time barred. Therefore, GBB

and Ks appeal may be successful.

The next issue is whether K has an equity in the property.

In the case of Malayan Banking Bhd V. Pk Rajamani & Anor,

5

it was

held that purchaser in good faith and for valuable consideration would have an

equity in the said property whereas the intervener has none because his equity

has been tarnished. Hence, if K is a purchaser in good faith and for valuable

4

[1938] 1 LNS 42

5

[1997] 3 CLJ SUPP 353

consideration, he is entitled to seek for equitable remedy. Ks appeal may be

viable.

In conclusion, by relying on O.42 r.13 of the Rules of Court 2012, K

and GBB could appeal to the court to set aside the order granted in favour of J

on the ground that the court had failed to observe the limitation period imposed

under O.42 r.13 by allowing Js application to set aside the order for sale after

30 days from the receipt of the order or judgment by him.

You might also like

- Land Law Case StudyDocument4 pagesLand Law Case StudyMorgan Phrasaddha Naidu PuspakaranNo ratings yet

- Question 4Document3 pagesQuestion 4Helena KohNo ratings yet

- Amalgamated Steel Mills BHD V Ingeback (M) SDN BHD 2 - MLJ - 374, - (1990) - 2 - MLJ - 374Document16 pagesAmalgamated Steel Mills BHD V Ingeback (M) SDN BHD 2 - MLJ - 374, - (1990) - 2 - MLJ - 374Wong Sien YenNo ratings yet

- Datuk Jagindar Singh & Ors V Tara Rajaratnam, (1983) 2Document18 pagesDatuk Jagindar Singh & Ors V Tara Rajaratnam, (1983) 2ainur syamimiNo ratings yet

- Contributory Negligence and Quantum of Damages in Road Accident CaseDocument59 pagesContributory Negligence and Quantum of Damages in Road Accident CaseFatin Hamraa100% (1)

- 2020 TOPIC 3 - Authority of Advocates Solicitors 11 MarchDocument24 pages2020 TOPIC 3 - Authority of Advocates Solicitors 11 Marchمحمد خيرالدينNo ratings yet

- Bandar Builder Sdn. BHD PDFDocument5 pagesBandar Builder Sdn. BHD PDFthe humansNo ratings yet

- Striking Out Pleadings Under Order 18 Rule 19Document6 pagesStriking Out Pleadings Under Order 18 Rule 19Audrey LimNo ratings yet

- Anna Jong Yu Hiong V Government of SarawakDocument6 pagesAnna Jong Yu Hiong V Government of SarawakRijah WeiweiNo ratings yet

- EVIDENCE LAW CASE REVIEWDocument11 pagesEVIDENCE LAW CASE REVIEWbachmozart123No ratings yet

- Tutorial 1Document1 pageTutorial 1Nerissa ZahirNo ratings yet

- Boustead TradingDocument18 pagesBoustead TradingChin Kuen Yei100% (1)

- Malaysian Finance Company Default Judgment Set AsideDocument12 pagesMalaysian Finance Company Default Judgment Set AsideSeng Wee TohNo ratings yet

- Kabra HoldingsDocument9 pagesKabra Holdingsnur syazwinaNo ratings yet

- Interpleader Proceedings Order 17 ROC 2012Document2 pagesInterpleader Proceedings Order 17 ROC 2012Raider50% (2)

- Malayan Law Journal Reports 1995 Volume 3 CaseDocument22 pagesMalayan Law Journal Reports 1995 Volume 3 CaseChin Kuen YeiNo ratings yet

- United Asian BankDocument11 pagesUnited Asian BankIzzat MdnorNo ratings yet

- Winding Up and Bankruptcy PDFDocument21 pagesWinding Up and Bankruptcy PDFSShikoNo ratings yet

- Dream Property SDN BHD V Atlas Housing SDN BHDDocument49 pagesDream Property SDN BHD V Atlas Housing SDN BHDHermione Leong Yen KheeNo ratings yet

- Kathiravelu Ganesan & Anor v. Kojasa Holdings BHDDocument9 pagesKathiravelu Ganesan & Anor v. Kojasa Holdings BHDNuna ZachNo ratings yet

- Shalini P Shanmugam & Anor V Marni Bte AnyimDocument7 pagesShalini P Shanmugam & Anor V Marni Bte AnyimAfdhallan syafiqNo ratings yet

- Law of Tort IIDocument15 pagesLaw of Tort IIIzzat Emir HakimiNo ratings yet

- PP V Audrey Keong Mei ChengDocument4 pagesPP V Audrey Keong Mei Chengsiti atikahNo ratings yet

- Adequacy of ConsiderationDocument3 pagesAdequacy of ConsiderationMohamad Alif Idid50% (2)

- The Malayan Law Journal ArticlesDocument16 pagesThe Malayan Law Journal ArticlesRima PammusuNo ratings yet

- Land Law Assignment Group 4Document14 pagesLand Law Assignment Group 4NUR QISTINA AISYAH MOHD NAZARONo ratings yet

- Chan Kok Suan-InjunctionDocument6 pagesChan Kok Suan-InjunctionUmmi IsmailNo ratings yet

- CASE - Araprop V LeongDocument29 pagesCASE - Araprop V LeongIqram MeonNo ratings yet

- Prosecution's Appeal Against AcquittalDocument9 pagesProsecution's Appeal Against AcquittalPrayveen Raj SchwarzeneggerNo ratings yet

- Preliminary MattersDocument15 pagesPreliminary MattersKhoo Chin Kang0% (1)

- Petrodar Operating Co LTD V Nam Fatt Corp BDocument19 pagesPetrodar Operating Co LTD V Nam Fatt Corp Bf.dnNo ratings yet

- Tutorial 11Document2 pagesTutorial 11ShereenNo ratings yet

- Golden Approach SDN BHD V Pengarah Tanah DanDocument9 pagesGolden Approach SDN BHD V Pengarah Tanah DanIqram MeonNo ratings yet

- Chapter 19 Rescission 6 Dec 2013 Now For LectureDocument31 pagesChapter 19 Rescission 6 Dec 2013 Now For LectureHui Yin ChinNo ratings yet

- CLJ 1992 3 611Document9 pagesCLJ 1992 3 611Angel RenaNo ratings yet

- Industrial Court AwardDocument23 pagesIndustrial Court AwardmafNo ratings yet

- Duties of A Lawyer Lecture Notes 3 PDFDocument12 pagesDuties of A Lawyer Lecture Notes 3 PDFSaidatulnajwaNo ratings yet

- 6 Registration & IndefeasibilityDocument108 pages6 Registration & IndefeasibilityJayananthini Pushbahnathan100% (1)

- Lim Kit Siang V Datuk DR Ling Liong Sik & orDocument7 pagesLim Kit Siang V Datuk DR Ling Liong Sik & orSuki WenNo ratings yet

- Contract Ii Case Review (Condition)Document9 pagesContract Ii Case Review (Condition)khairiah tsamNo ratings yet

- CIMB Bank v. AmBank: Chargee Protected by Land Code's IndefeasibilityDocument40 pagesCIMB Bank v. AmBank: Chargee Protected by Land Code's IndefeasibilityEden YokNo ratings yet

- Tutorial Case Equitable Assignment & Bare TrustDocument28 pagesTutorial Case Equitable Assignment & Bare TrustFarhan KamarudinNo ratings yet

- Tutorial 12Document2 pagesTutorial 12Jia Hong0% (1)

- APPALASAMY BODOYAH v. LEE MON SENG (199) 3 CLJ 71Document15 pagesAPPALASAMY BODOYAH v. LEE MON SENG (199) 3 CLJ 71merNo ratings yet

- ADR - Case ReviewDocument3 pagesADR - Case ReviewImran ShahNo ratings yet

- Bankruptcy OrderDocument12 pagesBankruptcy OrderChee Fu100% (1)

- Esso Standard Malaya BHD V Southern Cross AirwaysDocument8 pagesEsso Standard Malaya BHD V Southern Cross AirwaysKitQian TanNo ratings yet

- Case ContractDocument2 pagesCase ContractTIong RanGers0% (3)

- Order 81 SummaryDocument2 pagesOrder 81 SummarySpecialist At Work100% (1)

- Cases On PupilsDocument4 pagesCases On PupilsSyarah Syazwan SaturyNo ratings yet

- Public Prosecutor V Mohamed Ezam Bin Mohd NoDocument14 pagesPublic Prosecutor V Mohamed Ezam Bin Mohd Nomykoda-10% (1)

- Financial AssistanceDocument6 pagesFinancial AssistanceNajmi ArifNo ratings yet

- Undertakings, EnforcementsDocument33 pagesUndertakings, EnforcementsZafry TahirNo ratings yet

- DR Shanmuganathan V Periasamy Sithambaram PillaiDocument35 pagesDR Shanmuganathan V Periasamy Sithambaram PillaidarwiszaidiNo ratings yet

- MBL Indiv - AssgmntDocument2 pagesMBL Indiv - AssgmntNurulhuda HanasNo ratings yet

- Henry Wong V John Lee & Anor (Appeal To FedeDocument5 pagesHenry Wong V John Lee & Anor (Appeal To Fedeahmad fawwazNo ratings yet

- Case Infra Elite V Pacific TreasureDocument19 pagesCase Infra Elite V Pacific TreasureIqram MeonNo ratings yet

- HONG LEONG FINANCE BHD V STAGHORN SDN BHDDocument18 pagesHONG LEONG FINANCE BHD V STAGHORN SDN BHDS N NAIR & PARTNERS NAIRNo ratings yet

- Uttam Galva Steels LTD Vs Bank of India and Ors 3DR080002COM676503Document4 pagesUttam Galva Steels LTD Vs Bank of India and Ors 3DR080002COM676503sssNo ratings yet

- 2024LHC802(1)Document10 pages2024LHC802(1)Raja Nouman ChibNo ratings yet

- S 16Document5 pagesS 16ElaineSawNo ratings yet

- CHAMBERING STUDENTS MODULESDocument18 pagesCHAMBERING STUDENTS MODULESElaineSawNo ratings yet

- Chan Beng TiowDocument6 pagesChan Beng TiowElaineSawNo ratings yet

- Division of Matrimonial Assets Case AnalaysisDocument5 pagesDivision of Matrimonial Assets Case AnalaysisElaineSaw100% (1)

- Slides 2 - UVT 2612 - Environmental LawDocument20 pagesSlides 2 - UVT 2612 - Environmental LawElaineSawNo ratings yet

- Arbitration Act 2005 (Act) Scope & Aplication - For LECTUREDocument52 pagesArbitration Act 2005 (Act) Scope & Aplication - For LECTUREianbackup503No ratings yet

- Dr. Manique Cooray MMU, MalaccaDocument7 pagesDr. Manique Cooray MMU, MalaccaElaineSawNo ratings yet

- 5 June 2014 Adr Lecture Now Concept of AdrDocument53 pages5 June 2014 Adr Lecture Now Concept of Adrianbackup503No ratings yet

- Murder Conviction Upheld by Malaysian Court of AppealDocument26 pagesMurder Conviction Upheld by Malaysian Court of AppealElaineSawNo ratings yet

- Pp-Strata Title 1Document8 pagesPp-Strata Title 1ElaineSawNo ratings yet

- Hart DevlinDocument334 pagesHart DevlinElaineSawNo ratings yet

- Non-compliance with Court Rules treated as IrregularityDocument6 pagesNon-compliance with Court Rules treated as IrregularityElaineSawNo ratings yet

- Karpal Singh CaseDocument11 pagesKarpal Singh CaseElaineSawNo ratings yet

- CorpoDocument2 pagesCorpoBerch MelendezNo ratings yet

- Curry v. McCanless, 307 U.S. 357 (1939)Document19 pagesCurry v. McCanless, 307 U.S. 357 (1939)Scribd Government DocsNo ratings yet

- Sample Option ContractDocument9 pagesSample Option ContractChris Ce100% (1)

- Symfonie P2P Lending FundDocument29 pagesSymfonie P2P Lending FundSymfonie CapitalNo ratings yet

- Redacted General Durable Poa, Executor & ArDocument5 pagesRedacted General Durable Poa, Executor & ArGreg GroeperNo ratings yet

- Borrowing CostDocument3 pagesBorrowing Costtyler1No ratings yet

- Financial Services Securitization Course OutlineDocument11 pagesFinancial Services Securitization Course Outlineyash nathaniNo ratings yet

- About IndustryDocument36 pagesAbout IndustryHardik AgarwalNo ratings yet

- pp08Document26 pagespp08chirag3110No ratings yet

- Questionnaire Oiuhd8uhwijdijuhwe8euh2wjen Merchant BankersDocument5 pagesQuestionnaire Oiuhd8uhwijdijuhwe8euh2wjen Merchant BankersGopi Krishna Reddy100% (1)

- Bankers Acceptance Document for Purchase FinancingDocument2 pagesBankers Acceptance Document for Purchase Financingcktee77No ratings yet

- Perpetual Bond Risks and ValuationDocument2 pagesPerpetual Bond Risks and Valuationbenjah2No ratings yet

- Case No. 16-cv-4014 CATERBONE v. The United States of America, Et - Al., COMPLAINT UPDATED December 20, 2016Document141 pagesCase No. 16-cv-4014 CATERBONE v. The United States of America, Et - Al., COMPLAINT UPDATED December 20, 2016Stan J. CaterboneNo ratings yet

- HBL Scheme For StaffDocument5 pagesHBL Scheme For Staffhimadri_bhattacharjeNo ratings yet

- 90 Union Bank V DBPDocument2 pages90 Union Bank V DBPluigimanzanaresNo ratings yet

- Bir Revenue RegulationDocument140 pagesBir Revenue RegulationMartin EspinosaNo ratings yet

- Exposing Mammon: Devotion To Money in A Market Society (Philip Goodchild)Document11 pagesExposing Mammon: Devotion To Money in A Market Society (Philip Goodchild)mrwonkishNo ratings yet

- Philippine Supreme Court Rules on Validity of Mortgage Contract ProvisionsDocument10 pagesPhilippine Supreme Court Rules on Validity of Mortgage Contract ProvisionsMarianne Shen PetillaNo ratings yet

- RRW 0004 20190725 (1) - 1Document18 pagesRRW 0004 20190725 (1) - 1Ali WaliNo ratings yet

- Financial Statements Guide: Trading, P&L & Balance Sheet ExplainedDocument35 pagesFinancial Statements Guide: Trading, P&L & Balance Sheet ExplainedBhavik Shah100% (1)

- GK Tornado Ibps Po Exams 2019 Eng 74Document180 pagesGK Tornado Ibps Po Exams 2019 Eng 74gottamshivaNo ratings yet

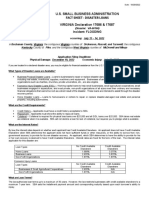

- U.S. Small Business Administration Fact Sheet - Disaster LoansDocument2 pagesU.S. Small Business Administration Fact Sheet - Disaster LoansNews 5 WCYBNo ratings yet

- Public-Private Partnership in Housing and Urban DevelopmentDocument46 pagesPublic-Private Partnership in Housing and Urban DevelopmentUnited Nations Human Settlements Programme (UN-HABITAT)100% (1)

- Suspensive Vs ResolutoryDocument14 pagesSuspensive Vs Resolutoryclifford tubanaNo ratings yet

- Commercial Credit Circuit: A Financial Innovation To Structurally Address Unemployment (2008)Document3 pagesCommercial Credit Circuit: A Financial Innovation To Structurally Address Unemployment (2008)tesasilvestre100% (1)

- Barops CivilDocument484 pagesBarops CivilJordan Tumayan100% (1)

- The Embarrassing Double Dipping DocketDocument3 pagesThe Embarrassing Double Dipping DocketHut Master100% (1)

- July Issue of Business 2 BusinessDocument20 pagesJuly Issue of Business 2 BusinessWest Central TribuneNo ratings yet

- What Is The Difference Between Commercial Banking and Merchant BankingDocument8 pagesWhat Is The Difference Between Commercial Banking and Merchant BankingScarlett Lewis100% (2)

- Teil - 17 - Foreclosure FraudDocument151 pagesTeil - 17 - Foreclosure FraudNathan BeamNo ratings yet