Professional Documents

Culture Documents

Does Building Green Create Value?

Uploaded by

Natalia Armenta0 ratings0% found this document useful (0 votes)

28 views4 pagesThe number of certified buildings in Canada has continued to grow steadily since 2000. Around the world, exponential growth is forecasted for LEED certified and "LEED like" buildings over the next two decades. The effect of LEED rating / level on AV and MV is based on level of geographic aggregation.

Original Description:

Original Title

View

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe number of certified buildings in Canada has continued to grow steadily since 2000. Around the world, exponential growth is forecasted for LEED certified and "LEED like" buildings over the next two decades. The effect of LEED rating / level on AV and MV is based on level of geographic aggregation.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views4 pagesDoes Building Green Create Value?

Uploaded by

Natalia ArmentaThe number of certified buildings in Canada has continued to grow steadily since 2000. Around the world, exponential growth is forecasted for LEED certified and "LEED like" buildings over the next two decades. The effect of LEED rating / level on AV and MV is based on level of geographic aggregation.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

www.lhsbc.

com | May 2013

Does Building Green Create Value?

By Gil Yaron, LL.M, LL.B, BA&Sc and Melissa Noel, MBA, BSc

Light House Sustainable Building Centre Society, Vancouver, BC

The number of certified buildings in Canada has

continued to grow steadily since 2000, despite the

recent downturn in the North American real estate

market. Outside of the United States, Canada has

the largest number of LEED certified buildings in the

world, with 3,768 projects certified as of 2011

(Watson, 2011). A 2008 study found the reported

dollar value of non-residential LEED projects in

Canada represented 13% of total non-residential

permit values (Leslie, 2008). Around the world,

exponential growth is forecasted for LEED certified

and LEED like buildings over the next two decades

(see Figure 1). Experts also estimate an additional

30% of green buildings are currently being built to

LEED standard, but are not being registered or

certified. In the wake of strong market activity, the

question now is whether building green translates

into tangible value for property owners and

developers.

Studies Show the Benefits of Building

Green

There is growing evidence to suggest that improved

performance and market recognition associated with

green certification increases the value of a building.

A recent study published by Singapores Building &

Construction Authority and the National University of

Singapore found renovated commercial buildings to

be more energy efficient with higher valuations

attributable to lowered operating expenses

(Marusiak, 2012). The literature also suggests that a

buildings performance and green building

certification impact its assessed value (AV) and

market value (MV). One study that encompassed all

buildings in the United States over 50,000 square

feet found that LEED certification has a positive

effect on market values and assessed values

(Dermisi, 2009). Specifically:

ENERGY STAR designation increases AV and

MV substantially.

The effect of LEED rating/level on AV and MV is

based on the level of geographic aggregation.

LEED-Existing Building (EB) Gold has a strong

positive effect on AV, while LEED-EB at the

Silver level has a similar effect on both AV and

MV.

LEED New Construction (NC) at the Gold level

has a strong positive effect on MV

LEED Core & Shell (CS) at the Gold and Silver

levels almost doubles that effect on AV when

making adjustments for building location.

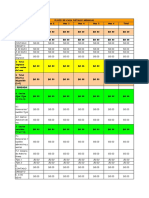

Figure 1: Current and Projected Cumulative LEED

and LEED-Like Square Footage Globally

(US, Canada, India & Italy)

What is a Carbon Neutral Building

2 www.lhsbc.com | May 2013

Using sophisticated statistical techniques to ensure

comparability between green and conventional

properties, another recent survey of more than

26,000 US office buildings certified through LEED or

Energy Star found they sell for a premium of about

13 per cent. However, the study noted that the

buildings efficiency is the ultimate determinant in

these calculations, not the fact that the building is

certified. (Eichholtz P., 2010). Premiums of 5.3% for

Energy Star certified buildings and 9.9% for LEED-

certified buildings were also observed in a similar

study (Miller, 2008 citing Miller, J ay and Florance,

2008).

Studies also show that the rate of return on

investment is higher for green building upgrades. A

survey conducted by the Building Owners &

Managers Association (BOMA International), US

Green Building Council, and the Real Estate Forum

found that 65% of respondents acknowledged a 5%

increase in their ROI compared to the year before,

as a result of green building investments (Burr,

2008).

These studies are often dismissed in Canada for a

variety of reasons. Most studies consider American

building inventory, making them inapplicable to

Canadian markets. Others are discounted because

they take a snapshot of the market and do not

account for changes over time. Furthermore,

anecdotal industry experience suggests that even if

savings are realized on green buildings through

reduced construction costs, long-term operational

efficiencies, higher market values and leasing rates,

these savings may be offset by increased property

taxes resulting from higher assessed property

values.

Sustainability in Building Valuations

Part of the problem is that current valuation and

appraisal techniques do not address the issue of

sustainability in buildings. In 2007, representatives

from nations around the world signed the Vancouver

Valuation Accord -- an agreement to address the

interrelationship between sustainability and value.

The Accord was a recognition of the absence of

sustainability indicators in the valuation and

appraisal of buildings. Since that time, academics,

governments, investors and industry have continued

to wrestle with the question of whether, and to what

degree, green buildings are worth more than

conventional buildings and to address gaps in

current appraisal and valuation techniques to better

account for sustainability elements (Lorenz, 2011).

Capturing the Value in Green Buildings

The investment potential associated with green

building, particularly building retrofits, in North

America is staggering. According to one recent study

by the Deutsche Bank, the United States alone

offers a $279 billion dollar investment opportunity

with resulting energy savings over 10 years totaling

more than $1 trillion based on an average 30%

efficiency gain. The commercial real estate sector is

estimated to offer $72 billion of investment potential

alone (DBCCA, 2012).

Investors, owners and property managers are

starting to explore the value of certified buildings

through concepts such as risk, life cycle costing, and

operational efficiency. A recent report from the

Institutional Investors Group on Climate Change

(IIGCC)

1

sets out the increasing trend amongst

institutional investors to consider sustainability and

ESG (environmental, social and governance)

indicators in regard to the risk and potential

performance of their real estate portfolios (IIGCC,

2013). An American survey of 718 executives in

architecture, construction, real estate consulting,

corporate owner-occupants, developers, engineers,

real estate owners, corporate tenants and real estate

service providers found that fifty-six percent of

executives said their companies were extremely or

very committed to following environmentally-

sustainable practices in their operations, citing

energy efficiency, ongoing operations and

maintenance costs and building value as the primary

reasons for incorporating green features into a

construction project (see Figure 2). However,

despite this commitment, the survey found only 48%

would seek LEED certification, down from 53% in

2010 and 61% in 2008, which begs the question

whether certification itself, or simply the inclusion of

green features, enhances the value of a sustainably-

built building (Turner Construction, 2012).

1

Institutional Investors Group on Climate Change (IIGCC) is a

forum for collaboration on climate change for European investors.

It provides investors with a platform to encourage public policies,

investment practices, and corporate behaviour that address long-

term risks and opportunities associated with climate change.

IIGCC currently has over 80 members, including some of the

largest pension funds and asset managers in Europe,

representing around 7.5trillion in assets.

3 www.lhsbc.com | May 2013

Figure 2: Importance of sustainability factors when evaluating green building features (2012).

3

The Green Building Valuation Report

To address the gaps in the research around building

valuation, Light House is initiating a first-of-its-kind

Green Building Valuation Report for the Canadian

market starting in 2013. The annual report will track

and compare key financial indicators for green

certified and conventional commercial buildings in

seven major Canadian cities, including market value,

assessed value, leasing rates and operating costs.

An invaluable resource to the Canadian building

construction and real estate sectors, the Green

Building Valuation Report will provide longitudinal

trends analysis based on Canadian market data to

better assess the value of the nations green building

inventory. The study will consider the value of

building certification and provide ongoing

assessment of the ability of property appraisal and

valuation techniques to capture the value of high

performing buildings.

About Light House Research Services

Light House is dedicated to advancing green

building and the sustainable infrastructure and

economic systems into which green buildings are

intrinsically integrated. Light House projects cut

across all scales of building and development, from

buildings to regions, and across the residential,

institutional, commercial, and industrial sectors. We

provide research, advisory and project management

services to businesses, policy makers and the real

estate and construction industries. These are part of

the full-suite of other services that we offer, including

sustainable land use planning, policy, facilitation,

rating system documentation, energy audits and

post-occupancy evaluations.

___________________

3

Source: Turner Construction, 2012

What is a Carbon Neutral Building

4 www.lhsbc.com | May 2013

References

Burr, A. (2008, December 5). Studies Suggest More

Gains for Green Building in 2009. CoStar Group.

Retrieved from

http://www.costar.com/News/Article/Studies-

Suggest-More-Gains-for-Green-Building-in-

2009/108106

DBCCA. (2012). United States Building Energy

Efficiency Retrofits: Market Sizing and Financial

Models. The Rockefeller Foundation and DB Climate

Change Advisors. Deutsche Bank Group.

Dermisi, S. V. (2009). Effect of LEED Ratings and

Levels on Office Property Assessed and Market

Values. JOSRE , 1 (1), 24-47.

Eichholtz P., K. N. (2010). The Economics of Green

Building. Escholarship .

IIGCC. (2013). Protecting Value in Real Estate:

Managing investment risks from climate change.

Institutional Investor Group on Climate Change.

Leslie, M. (2008, Summer). The Green Building

Market in Canada: Non-Residential Advances.

Ontario Roofing News (34), pp. 1-11.

http://www.eco-business.com/news/properly-pricing-

green-buildings/

Lorenz, D. A. (2011). Sustainability and property

valuation: Systematisation of existing approaches

and recommendations for future action. Journal of

Property Investment & Finance, 29 (6), 644-676.

Marusiak, J . (2012). Properly pricing green buildings.

Retrieved from

Miller, N. S. (2008). Does Green Pay Off? Journal

of Real Estate Portfolio Management , 14 (4), 385-

399.

Turner Construction. (2012). 2012 Green Building

Barometer. Turner Construction.

Watson, R. (2011) 2011 Green Building Market and

Impact Report.

For more information about

Light Houses research services,

contact

Gil Yaron

Director, Special Projects &

Partnerships

778.668.3675

gil@lhsbc.com

You might also like

- Chapter 10 - Economics of GR - 2016 - LEED v4 Practices Certification and AccrDocument44 pagesChapter 10 - Economics of GR - 2016 - LEED v4 Practices Certification and AccrTrần Khắc ĐộNo ratings yet

- Literature ReviewDocument26 pagesLiterature Reviewdahblessed17No ratings yet

- Fuerst Mcallister Green Noise or Green ValueDocument40 pagesFuerst Mcallister Green Noise or Green ValueCUNY BPLNo ratings yet

- Economic Returns To Energy-Efficient Investments in The Housing Market: Evidence From SingaporeDocument36 pagesEconomic Returns To Energy-Efficient Investments in The Housing Market: Evidence From SingaporeOtto LpNo ratings yet

- First green building Commerzbank TowerDocument4 pagesFirst green building Commerzbank TowerSwatee SinghalNo ratings yet

- Does Green Pay Off?: Nmiller@sandiego - EduDocument21 pagesDoes Green Pay Off?: Nmiller@sandiego - EduNatalia ArmentaNo ratings yet

- Certifying Green Buildings in China LEED vs. 3 StarDocument9 pagesCertifying Green Buildings in China LEED vs. 3 StarSara_ParkerNo ratings yet

- Sustainability 14 08808 v2Document23 pagesSustainability 14 08808 v2Yves LionelNo ratings yet

- Opportunities & Challenges of Green BuildingDocument2 pagesOpportunities & Challenges of Green BuildingW0219877No ratings yet

- Csem WP 192: Piet Eichholtz, Nils Kok and John M. QuigleyDocument41 pagesCsem WP 192: Piet Eichholtz, Nils Kok and John M. QuigleygenusenergyNo ratings yet

- Green and Smart Buildings - Jadhav, N.Y PDFDocument7 pagesGreen and Smart Buildings - Jadhav, N.Y PDFKireina fadhilla100% (1)

- Some Buildings Not Living Up To Green LabelDocument3 pagesSome Buildings Not Living Up To Green LabelHumberto Diaz CidNo ratings yet

- Green Building - LEEDDocument46 pagesGreen Building - LEEDHadee SaberNo ratings yet

- Socioeconomic Attributes - Relationship To Green Commercial OfficeDocument24 pagesSocioeconomic Attributes - Relationship To Green Commercial OfficeNadia SalsabilaaNo ratings yet

- Jurnal Konstruksi BerkelanjutanDocument10 pagesJurnal Konstruksi BerkelanjutanSalsabila ramadhantiNo ratings yet

- Papers/Reed International Rating Tools PDFDocument16 pagesPapers/Reed International Rating Tools PDFAnonymous 6cQRWqNo ratings yet

- Leveraging Cloud-Bim For Leed Automation: Itcon Vol. 17 (2012), Wu and Issa, Pg. 367Document18 pagesLeveraging Cloud-Bim For Leed Automation: Itcon Vol. 17 (2012), Wu and Issa, Pg. 367LeonardoEscalonaSalasNo ratings yet

- Vol III Article3 Green Building ServicesDocument21 pagesVol III Article3 Green Building ServicesAqeel TariqNo ratings yet

- SITESv2 Rating SystemDocument42 pagesSITESv2 Rating SystemjuruterasamNo ratings yet

- Risks Associated in Implementation of Green Buildings - Mokhtar-Azizi-fassman-wilkinsonDocument10 pagesRisks Associated in Implementation of Green Buildings - Mokhtar-Azizi-fassman-wilkinsonLee FelixNo ratings yet

- Pages 1-24 From Green Building and LEED Core Concepts GuideDocument24 pagesPages 1-24 From Green Building and LEED Core Concepts GuideNashz PasiaNo ratings yet

- Cba SDocument13 pagesCba Sapi-251739584No ratings yet

- What Are The Types of Greenhouse Gases?: O Carbon Dioxide (CO2), O Methane (CH4), O Nitrous Oxide (N2O)Document12 pagesWhat Are The Types of Greenhouse Gases?: O Carbon Dioxide (CO2), O Methane (CH4), O Nitrous Oxide (N2O)balsamNo ratings yet

- Cleaner Energy - Green Building Standards: Issue PrimerDocument5 pagesCleaner Energy - Green Building Standards: Issue Primervrsub80No ratings yet

- Water Supply and Waste Management Asgment 7Document8 pagesWater Supply and Waste Management Asgment 7Harshit AroraNo ratings yet

- The Economic Feasibility To Reducing Energy Use inDocument28 pagesThe Economic Feasibility To Reducing Energy Use inDalal KhNo ratings yet

- KB ThinkGreenDocument3 pagesKB ThinkGreenJDBEngineeringNo ratings yet

- Green Building Valuation From A Valuers' Perspective: Articles You May Be Interested inDocument8 pagesGreen Building Valuation From A Valuers' Perspective: Articles You May Be Interested inManasa MuthammaNo ratings yet

- Ffice Buildings: A Polish Perspective: Trends, Costs, and Benefits of Green Certification of ODocument17 pagesFfice Buildings: A Polish Perspective: Trends, Costs, and Benefits of Green Certification of OhestyNo ratings yet

- Green Building Value For Municipalities: CanadaDocument35 pagesGreen Building Value For Municipalities: Canadanepe25No ratings yet

- Green Building RatingsDocument20 pagesGreen Building Ratingsdivyendu shekharNo ratings yet

- 1 s2.0 S0095069618304029 MainDocument18 pages1 s2.0 S0095069618304029 MainShafi S.No ratings yet

- Today's Green Building Market: News Record-ENR)Document14 pagesToday's Green Building Market: News Record-ENR)asdlibyaNo ratings yet

- A Business Plan For Sustainable Modular HomesDocument13 pagesA Business Plan For Sustainable Modular Homesshaf0% (1)

- Analysis of Green Building Certification System For Developing G-SEEDDocument9 pagesAnalysis of Green Building Certification System For Developing G-SEEDPEng. Tech. Alvince KoreroNo ratings yet

- ASSESSING LEED AS A GREEN RATING SYSTEM Final ResearchDocument12 pagesASSESSING LEED AS A GREEN RATING SYSTEM Final ResearchSaii NagpureNo ratings yet

- Leed Report SuhaibDocument63 pagesLeed Report SuhaibSuhaib HasanNo ratings yet

- 1 s2.0 S136403211730847X MainDocument8 pages1 s2.0 S136403211730847X Main20073 MORI VIRAJSINH SVNITNo ratings yet

- Reep Rew009 PDFDocument18 pagesReep Rew009 PDFThabaswini SNo ratings yet

- Joulnal Review of Green Building Demand Factors For MalaysiaDocument8 pagesJoulnal Review of Green Building Demand Factors For MalaysiaNueh KimonNo ratings yet

- Green Building Rating Systems: The High Performance PortfolioDocument4 pagesGreen Building Rating Systems: The High Performance PortfoliocutegumaNo ratings yet

- CITIES, TOWNS, AND SUBURBS: Toward Zero-Carbon Buildings by Hillary BrownDocument14 pagesCITIES, TOWNS, AND SUBURBS: Toward Zero-Carbon Buildings by Hillary BrownPost Carbon InstituteNo ratings yet

- Green Building RatingDocument16 pagesGreen Building RatingakhilNo ratings yet

- Sustainable Real Estate Development Thesis PDFDocument4 pagesSustainable Real Estate Development Thesis PDFWhereToBuyResumePaperLosAngeles100% (2)

- LEED Benefits and AdvantagesDocument2 pagesLEED Benefits and AdvantagesAnonymous 6cQRWqNo ratings yet

- Friends of Benchmarking Second Year White PaperDocument11 pagesFriends of Benchmarking Second Year White PaperNancy AndersonNo ratings yet

- Study On The Relative Importance of Green BuildingDocument10 pagesStudy On The Relative Importance of Green BuildingRed JumperNo ratings yet

- HowOttawaCanEncourageGreenerBuildingPractices March2009Document12 pagesHowOttawaCanEncourageGreenerBuildingPractices March2009TrevorHacheNo ratings yet

- ASHRAE, USGBC, and Green Design: Zineb Bouzoubaa Josh SaxtonDocument20 pagesASHRAE, USGBC, and Green Design: Zineb Bouzoubaa Josh SaxtonNaomi SaxtonNo ratings yet

- Zero-energy buildings challenges and control interfaces in low-carbon housingDocument9 pagesZero-energy buildings challenges and control interfaces in low-carbon housingquality assuranceNo ratings yet

- ARCH 4263 Sustainable Design Methods: Dr. Khandoker Mahfuz Ud DarainDocument13 pagesARCH 4263 Sustainable Design Methods: Dr. Khandoker Mahfuz Ud Darainsadid sakibNo ratings yet

- Impacts of Green Certifications Ventilation and Office Types On Occupant Satisfaction With Indoor Environmental QualityDocument12 pagesImpacts of Green Certifications Ventilation and Office Types On Occupant Satisfaction With Indoor Environmental QualityMuniba AneesNo ratings yet

- SD 2064Document12 pagesSD 2064Bore Maati Boree MaatiNo ratings yet

- VCE Summer Internship Program 2021: Smart Task Submission FormatDocument5 pagesVCE Summer Internship Program 2021: Smart Task Submission FormatAlok Kumar sorenNo ratings yet

- Green Construction and LEED CertificationDocument15 pagesGreen Construction and LEED CertificationwriterlakshmivNo ratings yet

- Green Buildings: CT - LAKSHMANAN B.Arch., M.C.PDocument39 pagesGreen Buildings: CT - LAKSHMANAN B.Arch., M.C.Panup dhandaNo ratings yet

- LEED v4 Practices, Certification, and Accreditation HandbookFrom EverandLEED v4 Practices, Certification, and Accreditation HandbookRating: 4.5 out of 5 stars4.5/5 (3)

- Cristero War: Jump To Navigation Jump To SearchDocument46 pagesCristero War: Jump To Navigation Jump To SearchNatalia ArmentaNo ratings yet

- Manual de Costos - Materiales y Actividades para La Construcción ONDAC-2017 PDFDocument163 pagesManual de Costos - Materiales y Actividades para La Construcción ONDAC-2017 PDFNatalia ArmentaNo ratings yet

- Requerimientos ValuacionDocument3 pagesRequerimientos ValuacionNatalia ArmentaNo ratings yet

- ,,Document15 pages,,Natalia ArmentaNo ratings yet

- FizaDocument4 pagesFizaNatalia ArmentaNo ratings yet

- War of The Sicilian VespersDocument9 pagesWar of The Sicilian VespersNatalia ArmentaNo ratings yet

- AbstractDocument8 pagesAbstractNatalia ArmentaNo ratings yet

- HentaiDocument9 pagesHentaiNatalia Armenta100% (1)

- Bailes RegionalesDocument7 pagesBailes RegionalesNatalia ArmentaNo ratings yet

- Mony MonyDocument4 pagesMony MonyNatalia ArmentaNo ratings yet

- ArchivoDocument1 pageArchivoNatalia ArmentaNo ratings yet

- Color AmarilloDocument3 pagesColor AmarilloNatalia ArmentaNo ratings yet

- VRPPatch ReadmeDocument2 pagesVRPPatch ReadmeNatalia ArmentaNo ratings yet

- 2 Lvy L8 JEDm QCDocument424 pages2 Lvy L8 JEDm QCNatalia ArmentaNo ratings yet

- Changelog InstallerDocument5 pagesChangelog InstallerNatalia ArmentaNo ratings yet

- Copia de FLUJO de CAJA MENSUAL Formato PropuestoDocument6 pagesCopia de FLUJO de CAJA MENSUAL Formato PropuestoGustavo Alonso BerettaNo ratings yet

- Does Green Pay Off?: Nmiller@sandiego - EduDocument21 pagesDoes Green Pay Off?: Nmiller@sandiego - EduNatalia ArmentaNo ratings yet

- DWG TrueView DWG Convert Conversion ReportDocument1 pageDWG TrueView DWG Convert Conversion ReportCosmin CinciNo ratings yet

- DWG TrueView DWG Convert Conversion ReportDocument1 pageDWG TrueView DWG Convert Conversion ReportCosmin CinciNo ratings yet

- Tangible and Intangible Assets: IAS 16, IAS 38Document39 pagesTangible and Intangible Assets: IAS 16, IAS 38petitfmNo ratings yet

- History of HSBC in AsiaDocument35 pagesHistory of HSBC in AsiaMonir HosenNo ratings yet

- DocxDocument352 pagesDocxsino akoNo ratings yet

- Credit Ratings Provide Insight Into Financial StrengthDocument6 pagesCredit Ratings Provide Insight Into Financial StrengthvishNo ratings yet

- BDA Advises Quasar Medical On Sale of Majority Stake To LongreachDocument3 pagesBDA Advises Quasar Medical On Sale of Majority Stake To LongreachPR.comNo ratings yet

- Liquidity risk and core deposits in banksDocument1 pageLiquidity risk and core deposits in banksEvelyn RiesNo ratings yet

- Chapter 1-Introduction To Cost Accounting: Multiple ChoiceDocument535 pagesChapter 1-Introduction To Cost Accounting: Multiple ChoiceAleena AmirNo ratings yet

- Summar Training ReportDocument35 pagesSummar Training ReportSuruli Ganesh100% (1)

- Megaworld Corporation: Liabilities and Equity 2010 2009 2008Document9 pagesMegaworld Corporation: Liabilities and Equity 2010 2009 2008Owdray CiaNo ratings yet

- Management Accounting NotesDocument9 pagesManagement Accounting NoteskamdicaNo ratings yet

- Micro-Finance Management & Critical Analysis in IndiaDocument47 pagesMicro-Finance Management & Critical Analysis in IndiaSABUJ GHOSH100% (1)

- Ruling:: 2. REPUBLIC V. BAGTAS, 6 SCRA 262 (1962)Document16 pagesRuling:: 2. REPUBLIC V. BAGTAS, 6 SCRA 262 (1962)Bluebells33100% (2)

- Capital Requirements Directive - IVDocument99 pagesCapital Requirements Directive - IVMarketsWikiNo ratings yet

- Fairway Mortgage DocumentsDocument6 pagesFairway Mortgage DocumentsFairway Independent MortgageNo ratings yet

- SesesesesemmmmmemememememeDocument1 pageSesesesesemmmmmemememememeNorr MannNo ratings yet

- Review QuestionsDocument2 pagesReview QuestionsHads LunaNo ratings yet

- Assignment On:: Financial AnalysisDocument5 pagesAssignment On:: Financial AnalysisMd. Mustafezur Rahaman BhuiyanNo ratings yet

- List of OCNs and key indicators of their activity as of Dec 31, 2021Document20 pagesList of OCNs and key indicators of their activity as of Dec 31, 2021Dragomir MariusNo ratings yet

- Warehouse Line Operations: Titan Lenders CorpDocument13 pagesWarehouse Line Operations: Titan Lenders CorpNye LavalleNo ratings yet

- Tutsheet 7Document2 pagesTutsheet 7Vikas Kumar PooniaNo ratings yet

- Financial Statement Analysis of Poh Kong Holdings BerhadDocument13 pagesFinancial Statement Analysis of Poh Kong Holdings BerhadSHARIFAH BALQIS SYED ROSIDINNo ratings yet

- Strategic Cost ManagementDocument71 pagesStrategic Cost ManagementJamaica RumaNo ratings yet

- Choose Letter of The Correct Answer.Document3 pagesChoose Letter of The Correct Answer.Peng GuinNo ratings yet

- 4 Kpi For All ManagerDocument8 pages4 Kpi For All ManagernumlumairNo ratings yet

- Financial Planning, Tools EtcDocument31 pagesFinancial Planning, Tools EtcEowyn DianaNo ratings yet

- BookkeepingDocument14 pagesBookkeepingCristel TannaganNo ratings yet

- RAYMONDSDocument1 pageRAYMONDSsalman KhanNo ratings yet

- New Heritage Doll Company Case StudyDocument10 pagesNew Heritage Doll Company Case StudyRAJATH JNo ratings yet

- Guide To Retail Math Key Formulas PDFDocument1 pageGuide To Retail Math Key Formulas PDFYusuf KandemirNo ratings yet

- BRM v3-1 Taxonomy 20130615Document52 pagesBRM v3-1 Taxonomy 20130615kevinzhang2022No ratings yet