Professional Documents

Culture Documents

Thursday, February 6, 2014: Must Have Book For Subscribers

Uploaded by

chr_maxmannOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Thursday, February 6, 2014: Must Have Book For Subscribers

Uploaded by

chr_maxmannCopyright:

Available Formats

Published by Dynamic Traders Group, Inc, DynamicTraders.com, dt@dynamictraders.

com, 877-382-1618

The DT Stock and ETF Report is issued Monday-Thursday and Saturday. Reports are generally issued by 8PM, EST. Reports are

issued 48 weeks per year. There is one week off per calendar quarter. Copyright 2014, Dynamic Traders Group, Inc., Tucson, AZ.

(www.DynamicTraders.com). Trading stocks is risky. Past performance is no guarantee of future performance. Trade and invest at

your own risk. This information is supplied for the paid subscriber and may not be copied or distributed in any manner. Data

courtesy of Worden Brothers (www.worden.com).

Prepared by J aime J ohnson and Robert Miner

Thursday, February 6, 2014

Subscribers Guide (Updated July 2011)

A DT Daily Stock and ETF Report Subscribers Guide may be downloaded from the DT

Reports Subscribers Page. Log in to the Subscribers Page at

www.DynamicTraders.com Subscribers Tab Log In - click on My Products. Each

report is also uploaded to the Subscribers Page and may be accessed online

immediately after it is emailed.

Must Have Book For Subscribers

Every subscriber should have Roberts recent book, High Probability Trading Strategies.

This book is a step-by-step guide to all the trading strategies used with the DT Daily

Reports. You will learn about the Dual-Time-Frame-Momentum setups, Dynamic Time

and Price Targets and simplified E-Wave pattern analysis. More importantly, learn the

specific multiple unit, entry and exit strategies to take full advantage of the analysis and

trade recommendations in each report. Plus, book owners have a password protected

page on our new book blog where they can access the video trading tutorials. To order

High Probability Trading Strategies, go to www.HighProbabilityTradingStrategies.com.

DT Daily Stock and ETF Report Feb. 6, 2014

Copyright 2014, Dynamic Traders Group, Inc.

Page 2

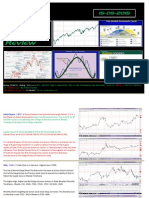

S&P Position

Probable Net Trend for the Next Few Trading Days

Dual Time Frame Momentum: With the (8) daily DTosc Bull, the net trend should be

sideways to up over the next few trading days. However, with the (13) 60M DTosc Bear, the

net trend should be sideways to down for several trading hours.

Pattern: Feb. 5 is a potential W.1 or A low.

Price: If a W.1 or A low is complete, the typical W.2 or B target is the 50% - 61.8% ret.

zone of the Jan. 15 Feb. 5 decline at 1788.25 1802.25.

Time: If a W.1 or A low is complete, the typical W.2 or B time target is the 38.2% - 61.8%

time ret. zone of the Jan. 15 Feb. 5 decline.

Summary: With the (8) daily DTosc Bull and a potential W.1 or A low complete, the net

trend should be sideways to up over the next few trading days.

DT Daily Stock and ETF Report Feb. 6, 2014

Copyright 2014, Dynamic Traders Group, Inc.

Page 3

General Market Trade Strategy Long

The General Market Trade Strategy is based on our assessment of the weekly trends usually defined by

the position of the weekly momentum.

With the (8) weekly DTosc BearOS and the (8) daily DTosc BullRev, a multi-week low should be at or

near completion, potentially a W.1 or A low.

For stocks and ETFs, only long positions should be considered in markets that have a stronger 4 wk ROC

(-1%) than the S&P. Their (8) weekly DTosc should be either BearOS or Bull and long positions may be

considered if their (8) daily DTosc is Bull or following an (8) daily DTosc BullRev made below the 50%

line of the oscillator range. If the daily DTosc has reached the OB zone, the immediate upside should be

more limited than those stocks where the daily DTosc is Bull and not in the OB zone.

S&P General Trade Strategy: A rally above todays high is a long trade set-up.

Gold and Bonds General Trade Strategies:

Bonds (TLT): (Protective buy-stop for short positions should be one tick above the Feb. 3 high.)

With the (8) weekly DTosc BullOB , a multi-week high should be at or near completion. However, with the

fast line of the (8) daily DTosc in the OS zone, a multi-day low should be near completion.

TLT Sym

Weekly

DTOsc

(8)

Daily

DTOsc

(8)

4 Wk

ROC

Trade

Direction

Bonds: iShares Leman 20 Yr

Bond Fund ETF

TLT BullOB Bear 6.0% Short

Gold (GLD): (Protective buy-stop for short positions should be one tick above the Jan 29 high.)

With the (8) weekly DTosc Bear, a multi-week high should be at or near completion. However, with the (8)

daily DTosc Bull, the net trend should be sideways to up over the next few trading days.

Gold Sym

Weekly

DTOsc

(8)

Daily

DTOsc

(8)

4 Wk

ROC

Trade

Direction

SPDRs Gold Trust ETF GLD Bear Bull 0.7% -

Disclaimer:

Our analysis and recommendations are based strictly on the technical position of the stock or ETF.

Subscribers may want to check the fundamental position of the stock regarding reports or potential mergers

before considering a position.

DT Daily Stock and ETF Report Feb. 6, 2014

Copyright 2014, Dynamic Traders Group, Inc.

Page 4

Dual Time Frame Momentum Positions and 4 wk ROC

The following tables show the weekly and daily momentum positions and the 4 wk ROC of the markets

that fall under the scan criteria. Weekly momentum is determined by the (8) weekly DTosc position and

daily momentum is determined by the (8) daily DTosc position. All markets below have BearOS or Bull

weekly momentum and a stronger 4 wk ROC (-1%) than the S&P. Top component stocks have a

stronger 4 wk ROC (-1%) than both the S&P and their sector ETF 4 wk ROC. For more information,

review the new Subscribers Guide (revised J uly 2011). See Page 1 of this report for instructions on how

to download the Subscribers Guide.

Dual Time Frame Scan Results

Group: ETF Sector

Portfolio: ETF (Indexes)

Scan Template: Stock Report Scan 8 8

Date of Daily Scan:2/6/2014

Date of Weekly Scan:1/31/2014

Symbol Weekly Daily ROC 1

Trade

Direction

Group STD: SPY BearOS Bull -2.60% BullRev

Portfolio STD: SPY BearOS Bull -2.60% BullRev

DVY BearOS Bull -1.30% BullRev

IJR BearOS Bull -3.00% BullRev

IWN BearOS Bull -3.10% BullRev

QQQ BearOS Bull -0.40% Long

Dual Time Frame Scan Results

Group: ETF Sector

Portfolio: ETF (Sectors)

Scan Template: Stock Report Scan 8 8

Date of Daily Scan:2/6/2014

Date of Weekly Scan:1/31/2014

Symbol Weekly Daily ROC 1

Trade

Direction

Group STD: SPY BearOS Bull -2.60% BullRev

Portfolio STD: SPY BearOS Bull -2.60% BullRev

DVY BearOS Bull -1.30% BullRev

Continued on the next page.

DT Daily Stock and ETF Report Feb. 6, 2014

Copyright 2014, Dynamic Traders Group, Inc.

Page 5

Bullish Reversal Table

The markets below are from the tables above tha made an (8) daily DTosc BullRev in the lower of its

oscillator range today.

Dual Time Frame Scan Results

Daily Bull and Bear Reversals Only

Date of Daily Scan: 2/6/2014

Portfolio Symbol

Bull/Bear

Rev

ETF (Sectors) XLI BullRev

ETF (Indexes) SPY BullRev

ETF (Indexes) DVY BullRev

ETF (Indexes) IJR BullRev

ETF (Indexes) IWN BullRev

Featured Market Followup

The table below shows the featured stocks and ETFs from past Saturdays reports that we have been

following.

Featured

Market

Long/Short Entry Date Entry Price

Stop-Loss

should be no

further than:

TLT Short 2/6 106.99 109.35

GLD Short 1/31 119.59 122.52

Continued on the next page.

DT Daily Stock and ETF Report Feb. 6, 2014

Copyright 2014, Dynamic Traders Group, Inc.

Page 6

iShares Lehman 20 Yr. Bond Fund

Short positions triggered at todays open should have their protective buy-stops one tick above the Feb. 3

high.

Continued on the next page.

DT Daily Stock and ETF Report Feb. 6, 2014

Copyright 2014, Dynamic Traders Group, Inc.

Page 7

Freeport McMoran

The remaining short position stopped today for a profit. The entire short trade was profitable.

Continued on the next page.

DT Daily Stock and ETF Report Feb. 6, 2014

Copyright 2014, Dynamic Traders Group, Inc.

Page 8

Wal-Mart

The remaining short position stopped today for a profit. The entire short trade was profitable.

Continued on the next page.

DT Daily Stock and ETF Report Feb. 6, 2014

Copyright 2014, Dynamic Traders Group, Inc.

Page 9

SPYDERs

With the (8) daily DTosc BullRev, a rally above todays high is a long trade set-up. Protective sell-stops

should be placed one tick below the Feb. 5 low.

Continued on the next page.

DT Daily Stock and ETF Report Feb. 6, 2014

Copyright 2014, Dynamic Traders Group, Inc.

Page 10

Gold and XAU Stock General Trade Strategies

With the XAU (8) weekly DTosc BullOB and the (8) weekly DTosc BearRev, multi-week high should be

at or near completion. For XAU component stocks, only short positions should be considered in markets

that have a weaker 4 wk ROC (+1%) than the XAU. Their (8) weekly DToscs should be either BullOB or

Bear and short positions may be considered if their (13) daily DTosc is Bear or following a (13) daily

DTosc BearRev made above the 50% line of the oscillator range. If the daily DTosc has reached the OS

zone, the immediate downside should be more limited than those stocks where the daily DTosc is Bear

and not in the OS zone.

Dual Time Frame Scan Results

Group: XAU

Portfolio: XAU

Scan Template: Stock Report Scan 8 8

Date of Daily Scan:2/5/2014

Date of Weekly Scan:1/31/2014

Symbol Weekly Daily ROC 1

Trade

Direction

Group STD: XAU Bear BearOS 4.70% Flat

Portfolio STD: XAU Bear BearOS 4.70% Flat

KGC Bear Bull 1.60% Flat

NEM Bear Bull -9.70% Flat

SLW Bear Bull 2.80% Flat

You might also like

- The ETF Trader's HandbookDocument34 pagesThe ETF Trader's HandbookLast_Don100% (1)

- Pervertible Practices: Playing Anthropology in BDSM - Claire DalmynDocument5 pagesPervertible Practices: Playing Anthropology in BDSM - Claire Dalmynyorku_anthro_confNo ratings yet

- AndrewAziz-How To Day Trade For A Living AUDIOBOOK-FIGSDocument75 pagesAndrewAziz-How To Day Trade For A Living AUDIOBOOK-FIGSKhaja ShaikNo ratings yet

- Goldman Sachs US Options Research Weekly Options Watch Jan 16, 2013Document11 pagesGoldman Sachs US Options Research Weekly Options Watch Jan 16, 2013gneymanNo ratings yet

- How To Build An ETF Rotation Strategy With More Than 50 Percent Annualyzed ReturnsDocument3 pagesHow To Build An ETF Rotation Strategy With More Than 50 Percent Annualyzed ReturnsLogical Invest100% (1)

- Pivot StrategyDocument15 pagesPivot StrategyLászló Szikszai100% (1)

- Pivot Trading The Forex MarketsDocument29 pagesPivot Trading The Forex Marketszhaozilong67% (3)

- Structuring Your Novel Workbook: Hands-On Help For Building Strong and Successful StoriesDocument16 pagesStructuring Your Novel Workbook: Hands-On Help For Building Strong and Successful StoriesK.M. Weiland82% (11)

- A Global Market Rotation Strategy With An Annual Performance of 41.4 PercentDocument6 pagesA Global Market Rotation Strategy With An Annual Performance of 41.4 PercentLogical Invest100% (1)

- MGM Strategy Daily Insights on Sentiment, Flows and PositioningDocument13 pagesMGM Strategy Daily Insights on Sentiment, Flows and PositioningLuis DutraNo ratings yet

- Year 11 Physics HY 2011Document20 pagesYear 11 Physics HY 2011Larry MaiNo ratings yet

- ABC of ETFDocument24 pagesABC of ETFAJITAV SILUNo ratings yet

- ADRIAN MANZ First Hour Super StrategiesDocument37 pagesADRIAN MANZ First Hour Super StrategiesAnonymous LhmiGjO100% (4)

- Final - Real Estate Exchange Traded FundsDocument12 pagesFinal - Real Estate Exchange Traded FundsUrvisha Mistry100% (1)

- Global Supplier Quality Manual SummaryDocument23 pagesGlobal Supplier Quality Manual SummarydywonNo ratings yet

- Trading PlanDocument11 pagesTrading PlanFloraNo ratings yet

- ABnormal Returns With Momentum Contrarian Strategies Using ETFsDocument12 pagesABnormal Returns With Momentum Contrarian Strategies Using ETFsjohan-sNo ratings yet

- Evaluation of Evidence-Based Practices in Online Learning: A Meta-Analysis and Review of Online Learning StudiesDocument93 pagesEvaluation of Evidence-Based Practices in Online Learning: A Meta-Analysis and Review of Online Learning Studiesmario100% (3)

- FX - Tips & Trading Strategies for the Currency MarketDocument82 pagesFX - Tips & Trading Strategies for the Currency Marketvazeli200483% (6)

- FX Compass: Looking For Signs of Pushback: Focus: Revising GBP Forecasts HigherDocument25 pagesFX Compass: Looking For Signs of Pushback: Focus: Revising GBP Forecasts HighertekesburNo ratings yet

- Classwork Notes and Pointers Statutory Construction - TABORDA, CHRISTINE ANNDocument47 pagesClasswork Notes and Pointers Statutory Construction - TABORDA, CHRISTINE ANNChristine Ann TabordaNo ratings yet

- Live Trading Session With Rishikesh SirDocument6 pagesLive Trading Session With Rishikesh SirYash GangwalNo ratings yet

- Doubling Up On MomentumDocument48 pagesDoubling Up On MomentumcastjamNo ratings yet

- AQR Alternative Thinking 3Q15Document12 pagesAQR Alternative Thinking 3Q15moonNo ratings yet

- Dow TheoryDocument5 pagesDow TheoryChandra RaviNo ratings yet

- A Sleep Well Bond Rotation Strategy With 15 Percent Annualized Return Since 2008Document4 pagesA Sleep Well Bond Rotation Strategy With 15 Percent Annualized Return Since 2008Logical InvestNo ratings yet

- SG 6941 Fx360 Favourite Strategies AW4Document27 pagesSG 6941 Fx360 Favourite Strategies AW4Zac CheahNo ratings yet

- Enhancing FX Carry Trades With News AnalyticsDocument11 pagesEnhancing FX Carry Trades With News AnalyticstabbforumNo ratings yet

- Swedenborg's Formative Influences: Jewish Mysticism, Christian Cabala and PietismDocument9 pagesSwedenborg's Formative Influences: Jewish Mysticism, Christian Cabala and PietismPorfirio MoriNo ratings yet

- ! Sco Global Impex 25.06.20Document7 pages! Sco Global Impex 25.06.20Houssam Eddine MimouneNo ratings yet

- The ETF Book: All You Need to Know About Exchange-Traded FundsFrom EverandThe ETF Book: All You Need to Know About Exchange-Traded FundsNo ratings yet

- Application Performance Management Advanced For Saas Flyer PDFDocument7 pagesApplication Performance Management Advanced For Saas Flyer PDFIrshad KhanNo ratings yet

- ETF StrategiesDocument6 pagesETF StrategiesValery Scancella0% (1)

- Inner Circle Trader - TPDS 5Document18 pagesInner Circle Trader - TPDS 5Felix Tout Court100% (1)

- Lesson 12 Elements of A Concept PaperDocument4 pagesLesson 12 Elements of A Concept PaperTrending Now100% (2)

- DT Stock and ETF Report 1-9-2015Document20 pagesDT Stock and ETF Report 1-9-2015chr_maxmannNo ratings yet

- 2010, 4 - Oct, Monday: Must Have Book For SubscribersDocument11 pages2010, 4 - Oct, Monday: Must Have Book For Subscribersft1618No ratings yet

- Premarket DerivativesStrategist AnandRathi 30.11.16Document3 pagesPremarket DerivativesStrategist AnandRathi 30.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Today's Highlights - 07-20-11Document10 pagesToday's Highlights - 07-20-11timurrsNo ratings yet

- US Market Review For Oct 8 2014Document12 pagesUS Market Review For Oct 8 2014FusionIQNo ratings yet

- Market StrengthDocument7 pagesMarket Strengthsidd2208No ratings yet

- Today's Highlights - 06-20-11Document13 pagesToday's Highlights - 06-20-11timurrsNo ratings yet

- Table 1 - Recommended Etfs: Financial Products ResearchDocument3 pagesTable 1 - Recommended Etfs: Financial Products ResearchBobNo ratings yet

- Insider Monkey HF Newsletter - May 2013Document92 pagesInsider Monkey HF Newsletter - May 2013rvignozzi1No ratings yet

- Dow Transports & Russell 2000 Are Lagging Versus Their 2011 Highs.Document5 pagesDow Transports & Russell 2000 Are Lagging Versus Their 2011 Highs.ValuEngine.comNo ratings yet

- Show NewsDocument2 pagesShow NewsGaurav GuptaNo ratings yet

- The S&P 500 Is Poised To Set A New 52-Week HighDocument5 pagesThe S&P 500 Is Poised To Set A New 52-Week HighValuEngine.comNo ratings yet

- Etps: Exchange Traded Funds Etps: Exchange Traded Funds: The Hottest Game in Town The Hottest Game in TownDocument9 pagesEtps: Exchange Traded Funds Etps: Exchange Traded Funds: The Hottest Game in Town The Hottest Game in Towngl620054545No ratings yet

- DailyFX Guide Fundamentals Breakout TradingDocument21 pagesDailyFX Guide Fundamentals Breakout TradingexercitusjesseNo ratings yet

- Technical Analysis Review: 2 Is NeutralDocument7 pagesTechnical Analysis Review: 2 Is NeutralajayvmehtaNo ratings yet

- HSBC Retail FundsDocument6 pagesHSBC Retail FundsFelipe PalmeiraNo ratings yet

- US Trading Note August 09 2016Document3 pagesUS Trading Note August 09 2016robertoklNo ratings yet

- 50 Hedge Fund HoldingsDocument41 pages50 Hedge Fund HoldingsLinette LopezNo ratings yet

- Today's Highlights - 07-04-11Document12 pagesToday's Highlights - 07-04-11timurrsNo ratings yet

- The Dow Is Between Its Quarterly Pivots at 12,478 and 12,796.Document5 pagesThe Dow Is Between Its Quarterly Pivots at 12,478 and 12,796.ValuEngine.comNo ratings yet

- Weekly Charts Are Negative and Not Yet OversoldDocument5 pagesWeekly Charts Are Negative and Not Yet OversoldValuEngine.comNo ratings yet

- Short-Term Trading Strategies for Upcoming WeekDocument4 pagesShort-Term Trading Strategies for Upcoming WeekSantosh RodeNo ratings yet

- 1 - Thread - How - To - Know - Thread - by - Rohaninvestor - Feb 12, 23 - From - RattibhaDocument7 pages1 - Thread - How - To - Know - Thread - by - Rohaninvestor - Feb 12, 23 - From - RattibhaYash SinghNo ratings yet

- Trading Ebook - Trading ForexDocument4 pagesTrading Ebook - Trading ForexpetefaderNo ratings yet

- Monthly Market, Sectoral and Stock Perspective - Technicals Dec 08, 2012Document5 pagesMonthly Market, Sectoral and Stock Perspective - Technicals Dec 08, 2012GauriGanNo ratings yet

- Today's Highlights - 07-13-11Document14 pagesToday's Highlights - 07-13-11timurrsNo ratings yet

- Monday's Highs Straddled 11,491 Dow and 1210.7 SPXDocument5 pagesMonday's Highs Straddled 11,491 Dow and 1210.7 SPXValuEngine.comNo ratings yet

- Eric Parnell Getting Defensive With Utilities, Consumer Staples, Precious Metals, TIPS, Agency MBS - SeekinDocument16 pagesEric Parnell Getting Defensive With Utilities, Consumer Staples, Precious Metals, TIPS, Agency MBS - Seekinambasyapare1No ratings yet

- Two Sectors With Relatively Low Volatility: April 7, 2020Document3 pagesTwo Sectors With Relatively Low Volatility: April 7, 2020puchooNo ratings yet

- Today's Highlights - 06-21-11Document14 pagesToday's Highlights - 06-21-11timurrsNo ratings yet

- Xtrades Members Select Weekend Analysis Report Part 1, 2, & 3Document9 pagesXtrades Members Select Weekend Analysis Report Part 1, 2, & 3Anonymous MulticulturalNo ratings yet

- Bonds Can Help Stock Investors Monitor Correction Risk - Seeking AlphaDocument7 pagesBonds Can Help Stock Investors Monitor Correction Risk - Seeking Alphaambasyapare1No ratings yet

- ETF Dividend Trading Strategies for Income and Capital GainsDocument7 pagesETF Dividend Trading Strategies for Income and Capital GainspankajpandeylkoNo ratings yet

- Technical Trend: (05 July 2011) Equity Market: India Daily UpdateDocument4 pagesTechnical Trend: (05 July 2011) Equity Market: India Daily UpdateTirthankar DasNo ratings yet

- DTStock Report Subscriber's Guide Sept 2014Document18 pagesDTStock Report Subscriber's Guide Sept 2014chr_maxmannNo ratings yet

- Canevaro, Thieves, Parent Abusers, Draft Dodgers... and HomicidesDocument24 pagesCanevaro, Thieves, Parent Abusers, Draft Dodgers... and Homicideschr_maxmannNo ratings yet

- Wade-Gery, Phoenix, Vol. 3, No. 3 PDFDocument14 pagesWade-Gery, Phoenix, Vol. 3, No. 3 PDFchr_maxmannNo ratings yet

- DTReport Gold Euro 10jan2015Document6 pagesDTReport Gold Euro 10jan2015chr_maxmannNo ratings yet

- What Is SovereigntyDocument20 pagesWhat Is Sovereigntysurraj1438No ratings yet

- Lanni, Verdict Most Just. The Modes of Classical Athenian JusticeDocument47 pagesLanni, Verdict Most Just. The Modes of Classical Athenian Justicechr_maxmannNo ratings yet

- DT Report AbbreviationsDocument2 pagesDT Report Abbreviationschr_maxmannNo ratings yet

- DT Reports Symbol Guide: Through Aug. 5, 2015: Index EtfsDocument6 pagesDT Reports Symbol Guide: Through Aug. 5, 2015: Index Etfschr_maxmannNo ratings yet

- Lanni, Social Norms in The Courts of Ancient AthensDocument46 pagesLanni, Social Norms in The Courts of Ancient Athenschr_maxmannNo ratings yet

- Andrews, Cleon's Hidden AppealsDocument18 pagesAndrews, Cleon's Hidden Appealschr_maxmannNo ratings yet

- Sundahl, The Living Constitution of Ancient Athens. A Comparative PerspectDocument44 pagesSundahl, The Living Constitution of Ancient Athens. A Comparative Perspectchr_maxmannNo ratings yet

- Westgate, The Greek House and The Ideology of CitizenshipDocument18 pagesWestgate, The Greek House and The Ideology of Citizenshipchr_maxmannNo ratings yet

- Sundahl, The Living Constitution of Ancient Athens. A Comparative PerspectDocument44 pagesSundahl, The Living Constitution of Ancient Athens. A Comparative Perspectchr_maxmannNo ratings yet

- Harris, The Rule of Law in Athenian Democracy. Reflections On The Judicial OathDocument20 pagesHarris, The Rule of Law in Athenian Democracy. Reflections On The Judicial Oathchr_maxmannNo ratings yet

- Cohen, Theft in Plato's Laws and Athenian Legal PracticeDocument23 pagesCohen, Theft in Plato's Laws and Athenian Legal Practicechr_maxmannNo ratings yet

- Robin Osborne, Urban Sprawl: What Is Urbanization and Why Does It Matter?Document16 pagesRobin Osborne, Urban Sprawl: What Is Urbanization and Why Does It Matter?Jesus MccoyNo ratings yet

- Cohen, The Athenian Law of AdulteryDocument19 pagesCohen, The Athenian Law of Adulterychr_maxmannNo ratings yet

- Bagnall Models EconomyDocument11 pagesBagnall Models EconomyAgustín SaadeNo ratings yet

- Whittaker, The Consumer City RevisitedDocument9 pagesWhittaker, The Consumer City Revisitedchr_maxmannNo ratings yet

- Whittaker, Do Theories of The Ancient City MatterDocument24 pagesWhittaker, Do Theories of The Ancient City Matterchr_maxmannNo ratings yet

- Westgate, The Greek House and The Ideology of CitizenshipDocument18 pagesWestgate, The Greek House and The Ideology of Citizenshipchr_maxmannNo ratings yet

- The Roman City As Articulated Through Terra SigillataDocument21 pagesThe Roman City As Articulated Through Terra Sigillatachr_maxmannNo ratings yet

- Roisman, Pistos Hetairos in The IliadDocument9 pagesRoisman, Pistos Hetairos in The Iliadchr_maxmannNo ratings yet

- Lesher, On Aristotelian Epistêmê As UnderstandingDocument11 pagesLesher, On Aristotelian Epistêmê As Understandingchr_maxmannNo ratings yet

- Scharle, Synchronic Justification For Aristotle's Commitment To Prime MatterDocument21 pagesScharle, Synchronic Justification For Aristotle's Commitment To Prime Matterchr_maxmannNo ratings yet

- 2009 - The Four Causes of Behavior Aristotle and Skinner - Álvarez PDFDocument13 pages2009 - The Four Causes of Behavior Aristotle and Skinner - Álvarez PDFFabián MaeroNo ratings yet

- Stokhof, Hand or Hammer. On Formal and Natural Languages in SemanticsDocument28 pagesStokhof, Hand or Hammer. On Formal and Natural Languages in Semanticschr_maxmannNo ratings yet

- Menn, The Editors of MetaphysicsDocument7 pagesMenn, The Editors of Metaphysicschr_maxmannNo ratings yet

- Plato As Architect of ScienceDocument36 pagesPlato As Architect of Sciencechr_maxmann100% (1)

- Multidimensional ScalingDocument25 pagesMultidimensional ScalingRinkiNo ratings yet

- Plo Slide Chapter 16 Organizational Change and DevelopmentDocument22 pagesPlo Slide Chapter 16 Organizational Change and DevelopmentkrystelNo ratings yet

- Dwnload Full Marriage and Family The Quest For Intimacy 8th Edition Lauer Test Bank PDFDocument35 pagesDwnload Full Marriage and Family The Quest For Intimacy 8th Edition Lauer Test Bank PDFrainbow.basque1cpq100% (10)

- First Preliminary Examination in Tle 8 - Mechanical DraftingDocument6 pagesFirst Preliminary Examination in Tle 8 - Mechanical DraftingNefritiri BlanceNo ratings yet

- Project Management-New Product DevelopmentDocument13 pagesProject Management-New Product DevelopmentRahul SinghNo ratings yet

- APPSC Assistant Forest Officer Walking Test NotificationDocument1 pageAPPSC Assistant Forest Officer Walking Test NotificationsekkharNo ratings yet

- Derivatives 17 Session1to4Document209 pagesDerivatives 17 Session1to4anon_297958811No ratings yet

- Simptww S-1105Document3 pagesSimptww S-1105Vijay RajaindranNo ratings yet

- Haryana Renewable Energy Building Beats Heat with Courtyard DesignDocument18 pagesHaryana Renewable Energy Building Beats Heat with Courtyard DesignAnime SketcherNo ratings yet

- ANA Stars Program 2022Document2 pagesANA Stars Program 2022AmericanNumismaticNo ratings yet

- Gambaran Kebersihan Mulut Dan Karies Gigi Pada Vegetarian Lacto-Ovo Di Jurusan Keperawatan Universitas Klabat AirmadidiDocument6 pagesGambaran Kebersihan Mulut Dan Karies Gigi Pada Vegetarian Lacto-Ovo Di Jurusan Keperawatan Universitas Klabat AirmadidiPRADNJA SURYA PARAMITHANo ratings yet

- Dr. Xavier - MIDocument6 pagesDr. Xavier - MIKannamundayil BakesNo ratings yet

- Hidaat Alem The Medical Rights and Reform Act of 2009 University of Maryland University CollegeDocument12 pagesHidaat Alem The Medical Rights and Reform Act of 2009 University of Maryland University Collegepy007No ratings yet

- Airforce Group Y: Previous Y Ear P AperDocument14 pagesAirforce Group Y: Previous Y Ear P Aperajay16duni8No ratings yet

- Centre's Letter To States On DigiLockerDocument21 pagesCentre's Letter To States On DigiLockerNDTVNo ratings yet

- Algebra Extra Credit Worksheet - Rotations and TransformationsDocument8 pagesAlgebra Extra Credit Worksheet - Rotations and TransformationsGambit KingNo ratings yet

- Hydrocarbon LawDocument48 pagesHydrocarbon LawParavicoNo ratings yet

- Gcu On Wiki PediaDocument10 pagesGcu On Wiki Pediawajid474No ratings yet

- Specification Table - Stocks and ETF CFDsDocument53 pagesSpecification Table - Stocks and ETF CFDsHouse GardenNo ratings yet

- The Secret Path Lesson 2Document22 pagesThe Secret Path Lesson 2Jacky SoNo ratings yet