Professional Documents

Culture Documents

Annual Report of Reliance General Insurance As On 2010

Uploaded by

bhagathnagarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annual Report of Reliance General Insurance As On 2010

Uploaded by

bhagathnagarCopyright:

Available Formats

S.No.

Form No Description

1 NL-1-B-RA Revenue Account

2 NL-2-B-PL Profit & Loss Account

3 NL-3-B-BS Balance Sheet

4 NL-4-PREMIUM SCHEDULE Premium

5 NL-5-CLAIMS SCHEDULE Claims Incurred

6 NL-6-COMMISSION SCHEDULE Commission

7 NL-7-OPERATING EXPENSES SCHEDULE Operating Expenses

8 NL-8-SHARE CAPITAL SCHEDULE Share Capital

9 NL-9-PATTERN OF SHAREHOLDING SCHEDULE Pattern of Shareholding

10 NL-10-RESERVE AND SURPLUS SCHEDULE Reserves and Surplus

11 NL-11-BORROWING SCHEDULE Borrowings

12 NL-12-INVESTMENT SCHEDULE Shareholders

13 NL-13-LOANS SCHEDULE Loans

14 NL-14-FIXED ASSETS SCHEDULE Fixed Assets

15 NL-15-CASH AND BANK BALANCE SCHEDULE Cash and Bank Balance

16 NL-16-ADVANCES AND OTHER ASSETS SCHEDULE Advances & Other Assets

17 NL-17-CURRENT LIABILITIES SCHEDULE Current Liabilities

18 NL-18-PROVISIONS SCHEDULE Provisions

19 NL-19-MISC EXPENDITURE SCHEDULE Misc Expenditure

20 NL-20-RECEIPTS AND PAYMENT SCHEDULE Receipts & Payment Statement

21 NL-21-STATEMENT OF LIABILITIES Statement of Liablities

22 NL-22-GEOGRAPHICAL DISTN OF BSNS Geographical Distribution of Business

23 NL-23-REINSURANCE RISK CONCENTRATION Reinsurance Risk Concentration

24 NL-24-AGEING OF CLAIMS Ageing of Claims

25 NL-25-CLAIMS DATA Claims Data

26 NL-26-CLAIMS INFORMATION Claims Information

27 NL-27-OFFICE OPENING Office Opening

28 NL-28-STATEMENT OF ASSETS Statement of Investment of Assets

29 NL-29-DEBT SECURITIES Debt Securities

30 NL-30-ANALYTICAL RATIOS Analytical Ratios

31 NL-31-RELATED PARTY TRANSACTIONS Related Party Transanctions

32 NL-32-PRODUCT INFORMATION Product Information

33 NL-33-SOLVENCY MARGIN Solvency

34 NL-34-BOD Board of Directors & Management

35 NL-35-NPAs NPAs

36 NL-36-YIELD ON INVESTMENTS Yield on Investment

37 NL-37-DOWN GRADING OF INVESTMENTS Downgrading of Investment

38 NL-38-BSNS RETURNS ACROSS LOB Quarterly Business Returns for different line of business (Premum amount and number of policies)

39 NL-39-RURAL AND SOCIAL SECTOR OBLIGATIONS Rural & Social Sector Obligations

40 NL-40-CHANNEL WISE PREMIUM Business Acquisition through different channels

41 NL-41-GRIEVANCE DISPOSAL Grievance Disposal

Disclosures - NON- LIFE INSURANCE COMPANIES

Reliance General Insurance Company Limited

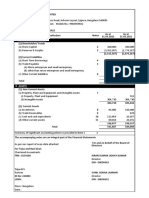

FORM NL-1-B-RA

RELIANCE GENERAL INSURANCE COMPANY LIMITED

Registration No. and Date of Registration with the IRDA: Regn. No. 103 dated 23.10.2000

REVENUE ACCOUNT FOR THE YEAR ENDED March 31, 2010 - Fire Insurance Business

Particulars Schedule FOR THE YEAR

ENDED MARCH 31,

2010

FOR THE YEAR

ENDED MARCH 31,

2009

(Rs.000) (Rs.000)

1 Premiums earned (Net) NL-4-Premium

Schedule

407,430 415,146

2 Profit/ Loss on sale/redemption

of Investments

13,374 12,684

3 Others (to be specified) - -

4 Interest, Dividend & Rent Gross 59,250 57,460

TOTAL (A) 480,054 485,290

1 Claims Incurred (Net) NL-5-Claims

Schedule

317,232 288,940

2 Commission NL-6-Commission

Schedule

(141,866) (148,091)

3 Operating Expenses related to Insurance

Business

NL-7-Operating

Expenses Schedule

114,870 163,441

4 Premium Deficiency - -

TOTAL (B) 290,236 304,290

Operating Profit/(Loss) from

Fire/Marine/Miscellaneous Business

C= (A - B)

189,818 181,000

APPROPRIATIONS

Transfer to Shareholders Account

Transfer to Catastrophe Reserve

Transfer to Other Reserves (to be

specified)

TOTAL (C)

Schedules referred to above, significant accounting policies and notes to accounts form an integral

part of the Financial Statements.

PERIODIC DISCLOSURES

FORM NL-1-B-RA

RELIANCE GENERAL INSURANCE COMPANY LIMITED

Registration No. and Date of Registration with the IRDA: Regn. No. 103 dated 23.10.2000

REVENUE ACCOUNT FOR THE YEAR ENDED March 31, 2010 - Marine Insurance Business

Particulars Schedule FOR THE YEAR

ENDED MARCH 31,

2010

FOR THE YEAR

ENDED MARCH

31, 2009

(Rs.000) (Rs.000)

1 Premiums earned (Net) NL-4-Premium

Schedule

179,990 151,073

2 Profit/ Loss on sale/redemption

of Investments

2,837 3,430

3 Others (to be specified) - -

4 Interest, Dividend & Rent Gross 12,570 15,537

TOTAL (A) 195,397 170,040

1 Claims Incurred (Net) NL-5-Claims

Schedule

178,105 184,906

2 Commission NL-6-Commission

Schedule

(5,319) 1,046

3 Operating Expenses related to Insurance

Business

NL-7-Operating

Expenses Schedule

48,175 72,194

4 Premium Deficiency (25,400) 25,400

TOTAL (B) 195,561 283,546

Operating Profit/(Loss) from

Fire/Marine/Miscellaneous Business

C= (A - B)

(164) (113,506)

APPROPRIATIONS

Transfer to Shareholders Account

Transfer to Catastrophe Reserve

Transfer to Other Reserves (to be

specified)

TOTAL (C)

Schedules referred to above, significant accounting policies and notes to accounts form an

integral part of the Financial Statements.

PERIODIC DISCLOSURES

FORM NL-1-B-RA

RELIANCE GENERAL INSURANCE COMPANY LIMITED

Registration No. and Date of Registration with the IRDA: Regn. No. 103 dated 23.10.2000

REVENUE ACCOUNT FOR THE YEAR ENDED March 31, 2010 - Miscellaneous Insurance Business

Particulars Schedule FOR THE YEAR

ENDED MARCH 31,

2010

FOR THE YEAR

ENDED MARCH 31,

2009

(Rs.000) (Rs.000)

1 Premiums earned (Net) NL-4-

Premium

Schedule

13,405,064 13,322,422

2 Profit/ Loss on sale/redemption

of Investments

173,479 161,389

3 Others - Exchange Gain/(Loss) 1,180 320

4 Interest, Dividend & Rent Gross 768,561 731,082

TOTAL (A) 14,348,284 14,215,213

1 Claims Incurred (Net) NL-5-Claims

Schedule

11,361,605 10,262,723

2 Commission NL-6-

Commission

Schedule

(204,691) (168,412)

3 Operating Expenses related to Insurance

Business

NL-7-

Operating

Expenses

Schedule

4,643,285 5,174,786

4 Premium Deficiency - -

TOTAL (B) 15,800,199 15,269,097

Operating Profit/(Loss) from

Fire/Marine/Miscellaneous Business C=

(A - B)

(1,451,915) (1,053,884)

APPROPRIATIONS

Transfer to Shareholders Account

Transfer to Catastrophe Reserve

Transfer to Other Reserves (to be

specified)

TOTAL (C)

Schedules referred to above, significant accounting policies and notes to accounts form an

integral part of the Financial Statements.

PERIODIC DISCLOSURES

FORM NL-2-B-PL

RELIANCE GENERAL INSURANCE COMPANY LIMITED

Registration No. and Date of Registration with the IRDA: Regn. No. 103 dated 23.10.2000

PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED March 31, 2010

Particulars SCHEDULE FOR THE YEAR

ENDED MARCH

31, 2010

FOR THE YEAR

ENDED MARCH

31, 2009

(Rs.000) (Rs.000)

1 OPERATING PROFIT/(LOSS)

(a) Fire Insurance 189,818.00 181,000.10

(b) Marine Insurance (164.00) (113,506.37)

(c ) Miscellaneous Insurance (1,451,915.00) (1,053,883.60)

2 INCOME FROM INVESTMENTS

(a) Interest, Dividend & Rent Gross 395,473.00 396,038.66

(b) Profit on sale of investments 105,803.00 91,031.63

Less: Loss on sale of investments (16,537.00) (3,604.45)

3 OTHER INCOME (To be specified)

Profit / (Loss) on Sale of Assets (209.00) (1,734.89)

Miscellaneous Income 13,750.00 6,868.89

TOTAL (A) (763,981.00) (497,789.04)

4 PROVISIONS (Other than taxation)

(a) For diminution in the value of investments - -

(b) For doubtful debts - -

(c) Others (to be specified) (137,600.00) -

5 OTHER EXPENSES

(a) Expenses other than those related to Insurance Business (3,889.00) (3,893.00)

(b) Bad debts written off - -

(c) Others (To be specified) - -

TOTAL (B) (141,489.00) (3,892.60)

Profit Before Tax (905,470.00) (501,681.64)

Provision for Taxation

(a) Current Tax - -

(b) Deferred Tax 401,200.00 -

(c ) Fringe Benefit Tax - (21,500.00)

Profit After Tax (504,270.00) (523,181.64)

APPROPRIATIONS

(a) Interim dividends paid during the year - -

(b) Proposed final dividend - -

(c) Dividend distribution tax - -

(d) Transfer to any Reserves or Other Accounts (to be

specified)

- -

Balance of profit/ loss brought forward from last year (1,654,654.00) (1,131,471.68)

Balance carried forward to Balance Sheet (2,158,924.00) (1,654,654.32)

Significant accounting policies and notes to accounts form an integral part of the Financial Statements.

PERIODIC DISCLOSURES

FORM NL-3-B-BS

RELIANCE GENERAL INSURANCE COMPANY LIMITED

Registration No. and Date of Registration with the IRDA: Regn. No. 103 dated 23.10.2000

BALANCE SHEET AS AT 31ST MARCH 2010

Schedule As At 31-03-10 As At 31-03-09

(Rs.000) (Rs.000)

SOURCES OF FUNDS

SHARE

CAPITAL

NL-8-Share Capital

Schedule

1,152,239 1,130,811

SHARE APPLICATION MONEY PENDING

ALLOTMENT

RESERVES AND SURPLUS NL-10-Reserves and

Surplus Schedule

8,918,392 6,839,821

FAIR VALUE CHANGE ACCOUNT (88,817) (695,844)

BORROWINGS NL-11-Borrowings

Schedule

-

TOTAL 9,981,814 7,274,788

APPLICATION OF FUNDS

INVESTMENTS NL-12-Investment

Schedule

16,566,610 13,639,726

LOANS NL-13-Loans Schedule 300,627 300,627

FIXED ASSETS NL-14-Fixed Assets

Schedule

475,067 643,735

DEFERRED TAX ASSET 409,735 8,535

CURRENT ASSETS

Cash and Bank Balances NL-15-Cash and bank

balance Schedule

824,256 1,142,390

Advances and Other Assets NL-16-Advancxes and

Other Assets Schedule

7,423,960 5,594,945

Sub-Total (A) 8,248,216 6,737,335

CURRENT LIABILITIES NL-17-Current

Liabilities Schedule

11,025,054 8,809,835

PROVISIONS NL-18-Provisions

Schedule

7,152,311 6,899,989

DEFERRED TAX LIABILITY - -

Sub-Total (B) 18,177,365 15,709,824

NET CURRENT ASSETS (C) = (A - B) (9,929,149) (8,972,489)

MISCELLANEOUS EXPENDITURE (to the extent NL-19-Miscellaneous - -

DEBIT BALANCE IN PROFIT AND LOSS

ACCOUNT

2,158,924 1,654,654

TOTAL 9,981,814 7,274,788

CONTINGENT LIABILITIES

Particulars As At 31-03-10 As At 31-03-09

(Rs.000) (Rs.000)

Partly paid-up investments - -

Claims, other than against policies, not acknowledged

as debts by the company

- -

Underwriting commitments outstanding (in respect of

shares and securities)

- -

Guarantees given by or on behalf of the Company - -

Statutory demands/ liabilities in dispute, not provided

for

10,224 32,077

Reinsurance obligations to the extent not provided for

in accounts

- -

Others (to be specified) - -

TOTAL 10,224 32,077

Schedules referred to above, significant accounting policies and notes to accounts form an integral

part of the Financial Statements.

PERIODIC DISCLOSURES

FORM NL-4-PREMIUM SCHEDULE

RELIANCE GENERAL INSURANCE COMPANY LIMITED

Registration No. and Date of Registration with the IRDA: Regn. No. 103 dated 23.10.2000

PREMIUM EARNED [NET]

Particulars FOR THE YEAR

ENDED MARCH 31,

2010

FOR THE YEAR

ENDED MARCH 31,

2009

(Rs.000) (Rs.000)

Premium from direct business written # 19,796,515 19,148,849

Service Tax

Adjustment for change in reserve for unexpired risks

Gross Earned Premium

19,796,515 19,148,849

Add: Premium on reinsurance accepted 1,762,584 1,604,363

Less : Premium on reinsurance ceded 7,271,879 6,757,604

Net Premium 14,287,220 13,995,608

Adjustment for change in reserve for unexpired risks (294,736) (106,968)

Premium Earned (Net) 13,992,484 13,888,641

* - Including Indian Motor Third Party Insurance Pool Transactions

(Refer note no. 19 in schedule 17 of notes to accounts)

PERIODIC DISCLOSURES

# - Includes premium reversal arising out of cancellation pertaining to previous years

amounting to Rs 81,242/- thousands.

RELIANCE GENERAL INSURANCE COMPANY LIMITED

FORM NL-5 - CLAIMS SCHEDULE

CLAIMS INCURRED [NET] (Rs. In '000)

Particulars

Financial

year

ending

Claims Paid from

direct business

written

Claims Paid

on reinsurance

Accepted

Claims Recovered

on reinsurance

ceded

Net Claims Paid

(3+4-5)

Outstanding

Claims on

31-03-2010 *

Outstanding

Claims on

31-03-2009

Net Claims Incurred

(6+7-8)

1 2 3 4 5 6 7 8 9

Fire Mar-10 779,642 16,363 532,948 263,057 274,149 219,974 317,232

Mar-09 1,057,877 8,110 769,226 296,761 219,974 227,794 288,940

Marine Cargo Mar-10 307,107 - 159,218 147,889 76,795 75,291 149,393

Mar-09 280,953 - 139,413 141,540 75,291 41,592 175,239

Marine Hull Mar-10 65,515 - 41,692 23,823 15,178 10,289 28,712

Mar-09 2,699 - 2,316 383 10,289 1,004 9,667

Marine Total Mar-10 372,622 - 200,910 171,712 91,973 85,580 178,105

Mar-09 283,652 - 141,729 141,923 85,580 42,596 184,906

Motor OD Mar-10 5,883,217 - 631,663 5,251,554 1,322,896 908,000 5,666,450

Mar-09 5,325,981 - 917,280 4,408,701 908,000 722,591 4,594,110

Motor TP Mar-10 2,123,632 - 1,356,838 766,794 6,373,689 4,465,492 2,674,991

Mar-09 630,921 - 262,825 368,096 4,465,492 2,238,767 2,594,821

Motor Total Mar-10 8,006,849 - 1,988,501 6,018,348 7,696,585 5,373,492 8,341,441

Mar-09 5,956,902 - 1,180,105 4,776,797 5,373,492 2,961,358 7,188,931

Employer's Liability Mar-10 21,217 - 2,820 18,397 17,982 17,828 18,551

Mar-09 30,922 - 5,152 25,770 17,828 7,082 36,516

Public Liability Mar-10 6,867 - 2,167 4,700 8,117 23,197 (10,380)

Mar-09 8,294 - 1,659 6,635 23,197 712 29,120

Engineering Mar-10 471,490 23 372,168 99,345 136,831 90,703 145,473

Mar-09 406,991 45 319,290 87,746 90,703 50,256 128,192

Aviation Mar-10 125,740 - 84,287 41,453 27,820 20,290 48,983

Mar-09 1,103 - 889 214 20,290 200 20,305

Personal Accident Mar-10 320,845 - 217,628 103,217 50,753 49,594 104,376

Mar-09 317,181 - 215,189 101,992 49,594 24,888 126,698

Health Mar-10 2,635,351 - 288,956 2,346,395 580,990 358,671 2,568,714

Mar-09 2,856,611 - 426,821 2,429,790 358,671 247,899 2,540,562

Other Misc. Mar-10 337,878 - 206,645 131,233 89,673 76,458 144,448

Mar-09 334,493 - 156,861 177,632 76,458 61,692 192,399

Misc Total Mar-10 11,926,237 23 3,163,172 8,763,088 8,608,751 6,010,234 11,361,605

Mar-09 9,912,497 45 2,305,966 7,606,576 6,010,234 3,354,087 10,262,723

Total MAR'10 13,078,501 16,386 3,897,030 9,197,857 8,974,872 6,315,787 11,856,942

Total MAR'09 11,254,026 8,155 3,216,921 8,045,260 6,315,787 3,624,478 10,736,569

* - Including Indian Motor Third Party Insurance Pool Transactions (Refer note no. 19 in schedule 17 of notes to accounts)

RELIANCE GENERAL INSURANCE COMPANY LIMITED

FORM NL-6-COMMISSION SCHEDULE

(Rs. In '000)

RELIANCE GENERAL INSURANCE COMPANY LIMITED

Particulars

Financial year

ending

Commission paid

on direct

business written

Brokerage paid

on direct

business

Commission paid

on reinsurance

accepted

Commission

received from

reinsurance

ceded

Net commission

(3+4+5-6)

1 2 3 4 5 6 7

Fire Mar-10 18,557 31,073 3,479 194,975 (141,866)

Mar-09 17,008 41,805 4,752 211,656 (148,091)

Marine Cargo Mar-10 5,076 7,762 248 17,764 (4,678)

Mar-09 7,347 16,837 114 20,760 3,538

Marine Hull Mar-10 41 1,802 5 2,489 (641)

Mar-09 49 2,585 13 5,139 (2,492)

Marine Total Mar-10 5,117 9,564 253 20,253 (5,319)

Mar-09 7,396 19,422 127 25,899 1,046

Motor OD Mar-10 35,137 124,881 - 174,539 (14,521)

Mar-09 58,185 123,780 - 169,134 12,831

Motor TP Mar-10 - - - 31,695 (31,695)

Mar-09 - - - 24,040 (24,040)

Motor Total Mar-10 35,137 124,881 - 206,234 (46,216)

Mar-09 58,185 123,780 - 193,174 (11,209)

Employer's Liability Mar-10 990 2,764 - 1,396 2,358

Mar-09 1,260 2,518 - 1,657 2,121

Public Liability Mar-10 248 2,259 - 13,078 (10,571)

Mar-09 537 4,182 6 12,834 (8,109)

Engineering Mar-10 6,513 34,725 1,718 191,710 (148,754)

Mar-09 8,305 41,820 565 269,386 (218,696)

Aviation Mar-10 136 2,498 4,709 1,771 5,572

Mar-09 330 179 141 3,338 (2,688)

Personal Accident Mar-10 6,330 8,307 25 60,123 (45,461)

Mar-09 6,052 19,609 51 60,477 (34,765)

Health Mar-10 26,450 89,077 191 45,250 70,468

Mar-09 75,369 112,968 - 70,075 118,262

Other Misc. Mar-10 9,980 7,010 5 49,082 (32,087)

Mar-09 8,547 25,930 2 47,807 (13,328)

Misc Total Mar-10 85,784 271,521 6,648 568,644 (204,691)

Mar-09 158,585 330,986 765 658,748 (168,412)

Total MAR'10 109,458 312,158 10,380 783,872 (351,876)

Total MAR'09 182,989 392,213 5,644 896,303 (315,457)

(Rs. In '000)

Break-up of the

expenses (Gross)

incurred to procure

business to be

furnished as per

details indicated

below:

FOR THE

YEAR ENDED

MARCH 31,

2010

FOR THE YEAR

ENDED MARCH

31, 2009

Agents 92,282 113,554

Brokers 312,158 392,213

Corporate Agency 17,176 69,435

Referral - -

Others (pl. specify) - -

TOTAL (B) 421,616 575,202

RELIANCE GENERAL INSURANCE COMPANY LIMITED

FORM NL-7-OPERATING EXPENSES SCHEDULE

OPERATING EXPENSES RELATED TO INSURANCE BUSINESS (Rs. In '000)

Particulars

FOR THE YEAR

ENDED MARCH

31, 2010

FOR THE YEAR

ENDED MARCH

31, 2009

1 Employees remuneration & welfare benefits 1,035,742 1,498,194

2 Company's contribution to Provident fund and others 54,435 52,512

3 Travel, conveyance and vehicle running expenses 43,306 95,439

4 Rents, rates & taxes 341,193 403,409

5 Repairs 127,535 176,379

6 Printing & Stationery 566,108 552,002

7 Communication expenses 137,676 207,645

8 Postage expenses 636,066 604,621

9 Legal & professional charges 151,664 193,911

10 Directors' Sitting fees 500 520

11 Auditors remuneration

a. Audit fees 2,150 1,900

b. Tax Audit fees 350 300

c. Certification Fees 85 75

12 Advertisement and Publicity 71,036 132,543

13 Interest and Bank Charges 31,975 31,852

14 Entertainment expenses 1,205 3,880

15 Office maintenance expenses 99,053 135,489

16 Office management expenses 953,752 872,547

17 Recruitment & Training expenses 13,399 21,343

18 Depreciation 316,437 229,256

19 Subscriptions and membership fees 23,790 16,083

20 Coinsurance Expenses (net) 14,162 7,858

21 Sales & Distribution expenses - -

22 Loss minimisation expenses - -

23 Miscellaneous expenses 188,600 176,556

TOTAL 4,810,219 5,414,314

Allocation:

Fire Revenue Account 114,870 163,441

Marine Revenue Account 48,175 72,194

Miscellaneous Revenue Account 4,643,285 5,174,786

Expenses not relating to Insurance Business taken in Profit & Loss A/c 3,889 3,893

RELIANCE GENERAL INSURANCE COMPANY LIMITED

FORM NL-8-SHARE CAPITAL SCHEDULE

SHARE CAPITAL

Particulars As at 31-03-2010 As at 31-03-2009

(Rs.000). (Rs.000).

1 Authorised Capital

20,00,00,000 Equity Shares of Rs.10 each 2,000,000 2,000,000

2 Issued Capital

115,223,941 Equity Shares of Rs.10each

(Previous year 11,30,81,084 Equity Shares)

1,152,239 1,130,811

3 Subscribed Capital

115,223,941 Equity Shares of Rs.10each

(Previous year 11,30,81,084 Equity Shares)

1,152,239 1,130,811

4 Called-up Capital

115,223,941 Equity Shares of Rs.10each

(Previous year 11,30,81,084 Equity Shares)

1,152,239 1,130,811

Less : Calls unpaid - -

Add : Equity Shares forfeited (Amount

originally paid up)

- -

Less : Par Value of Equity Shares bought

back

- -

Less : Preliminary Expenses - -

Expenses including commission or

brokerage on

- -

Underwriting or subscription of shares - -

TOTAL 1,152,239 1,130,811

Note: Of the above 110,929,269 shares are held by Holding Company, Reliance

Capital Limited (previous year 108,786,412 Equity shares).

RELIANCE GENERAL INSURANCE COMPANY LIMITED

FORM NL-9-PATTERN OF SHAREHOLDING SCHEDULE

SHARE CAPITAL

PATTERN OF SHAREHOLDING

[As certified by the Management]

Shareholder

Number of

Shares

% of Holding Number of

Shares

% of Holding

Promoters -

Holding Company - Indian 110,929,269 96% 108,786,412 96%

Holding Company - Foreign -

Others

Reliance General Insurance

Employees Benefit Trust

4,294,672 4% 4,294,672 4%

TOTAL 115,223,941 100% 113,081,084 100%

As at 31-03-2009 As at 31-03-2010

RELIANCE GENERAL INSURANCE COMPANY LIMITED

FORM NL-10-RESERVE AND SURPLUS SCHEDULE

RESERVES AND SURPLUS

Particulars As at 31-03-2010 As at 31-03-2009

(Rs.000). (Rs.000).

1 Capital Reserve - -

2 Capital Redemption Reserve - -

3 Share Premium 8,918,392 6,839,821

General Reserves - -

Less: Debit balance in Profit and Loss Account - -

Less: Amount utilized for Buy-back - -

5 Catastrophe Reserve - -

6 Other Reserves (to be specified) - -

7 Balance of Profit in Profit & Loss Account - -

TOTAL 8,918,392 6,839,821

4

RELIANCE GENERAL INSURANCE COMPANY LIMITED

FORM NL-11-BORROWINGS SCHEDULE

BORROWINGS

Particulars As at 31-03-2010 As at 31-03-2009

(Rs.000). (Rs.000).

1 Debentures/ Bonds - -

2 Banks - -

3 Financial Institutions - -

4 Others (to be specified) - -

TOTAL - -

RELIANCE GENERAL INSURANCE COMPANY LIMITED

FORM NL-12-INVESTMENT SCHEDULE

INVESTMENT

Particulars AS AT 31-03-2010 AS AT 31-03-2009

(Rs.000). (Rs.000).

LONG TERM INVESTMENTS

1 Government securities and Government guaranteed bonds including

Treasury Bills

3,563,948 3,219,330

2 Other Approved Securities 1,342,781 554,112

3 Other Investments

( a) Shares - -

(aa) Equity 975,335 470,445

(bb) Preference - -

( b) Mutual Funds - -

(c) Derivative Instruments - -

(d) Debentures/ Bonds 2,025,963 2,486,581

(e) Other Securities (to be specified) - -

(f) Subsidiaries - -

(g) Investment Properties-Real Estate - -

4 Investments in Infrastructure and Social Sector 2,287,788 3,048,417

5 Other than Approved Investments 87,388 101,240

SHORT TERM INVESTMENTS

1 Government securities and Government guaranteed bonds including

Treasury Bills

301,255 673,069

2 Other Approved Securities 68,111 -

3 Other Investments

(a) Shares - -

(aa) Equity - -

(bb) Preference - -

(b) Mutual Funds 760,000 563,000

(a) Derivative Instruments - -

(b) Debentures/ Bonds 3,344,157 2,174,818

(c) Other Securities (to be specified) - -

(d) Subsidiaries - -

(e) Investment Properties-Real Estate - -

4 Investments in Infrastructure and Social Sector 1,007,125 298,714

5 Other than Approved Investments 802,759 50,000

TOTAL 16,566,610 13,639,726

Notes :

1. The market value of all investments as at 31st March, 2010 is Rs. 16,475,150 thousands (previous year Rs.

13,688,922 thousands)

2. Government Securities includes Rs. 104,894 thousand as at 31st March, 2010 (previous year Rs. 108,463

thousands), deposit u/s 7 of the Insurance Act, 1938.

3. All the above investments are performing assets.

RELIANCE GENERAL INSURANCE COMPANY LIMITED

FORM NL-13-LOANS SCHEDULE

LOANS

Particulars AS AT 31-03-2010 AS AT 31-03-2009

(Rs.000). (Rs.000).

1 SECURITY-WISE CLASSIFICATION

Secured

(a) On mortgage of property - -

(aa) In India - -

(bb) Outside India - -

(b) On Shares, Bonds, Govt. Securities - -

(c) Others (to be specified) - -

Unsecured 300,627 300,627

TOTAL 300,627 300,627

2 BORROWER-WISE CLASSIFICATION

(a) Central and State Governments - -

(b) Banks and Financial Institutions - -

(c) Subsidiaries - -

(d) Industrial Undertakings - -

(e) Others - Trustees of Reliance General

Insurance Employees Benefit Trust

300,627 300,627

TOTAL 300,627 300,627

3 PERFORMANCE-WISE CLASSIFICATION

(a) Loans classified as standard - -

(aa) In India 300,627 300,627

(bb) Outside India - -

(b) Non-performing loans less provisions - -

(aa) In India - -

(bb) Outside India - -

TOTAL 300,627 300,627

4 MATURITY-WISE CLASSIFICATION

(a) Short Term - -

(b) Long Term 300,627 300,627

TOTAL 300,627 300,627

RELIANCE GENERAL INSURANCE COMPANY LIMITED

FORM NL-14-FIXED ASSETS SCHEDULE

FIXED ASSETS

(Rs.000)

Description

As at

01-04-09

Additions

Deductions/A

djustments

As at

31-03-10

As at 01-04-09 For the year

Deductions/

Adjustment

As at

31-03-10

As at

31-03-10

As at

31-03-09

Furniture & Fittings

91,445 33 534 90,944 40,633 9,188 217 49,604 41,339 50,812

Leasehold Improvements

76,742 - - 76,742 19,353 37,042 - 56,395 20,347 57,389

Information Technology Equipment

300,200 648 36,248 264,600 171,380 49,434 27,708 193,106 71,494 128,820

Intangible Asset (Computer Software)

351,538 151,446 - 502,984 167,446 190,098 - 357,544 145,440 184,092

Vehicles

22,895 - 916 21,979 13,285 2,396 541 15,141 6,838 9,610

Office Equipment

231,860 7,512 11,572 227,799 65,364 26,893 7,432 84,824 142,976 166,496

Plant & Machinery

12,340 - 747 11,593 1,967 1,387 138 3,215 8,378 10,373

Capital WIP

36,143 55,300 53,189 38,254 - - - - 38,254 36,143

Total

1,123,163 214,939 103,206 1,234,895 479,428 316,437 36,036 759,827 475,067 643,735

Previous Year

846,813 339,271 62,921 1,123,163 263,602 246,289 30,463 479,428 643,735 583,211

Gross Block Depreciation Net Block

RELIANCE GENERAL INSURANCE COMPANY LIMITED

FORM NL-15-CASH AND BANK BALANCE SCHEDULE

CASH AND BANK BALANCES

Particulars AS AT 31-03-2010 AS AT 31-03-2009

(Rs.000) (Rs.000)

1 Cash (including cheques, drafts and

stamps)

28,694 17,650

2 Bank Balances

(a) Deposit Accounts - -

(aa) Short-term (due within 12

months)

- -

(bb) Others - -

(b) Current Accounts 795,562 372,977

(c) Others - Cheque in Transit - 724,022

(d) Others - Cash in Transit - 27,741

3 Money at Call and Short Notice

(a) With Banks - -

(b) With other Institutions - -

4 Others (to be specified) - -

TOTAL 824,256 1,142,390

Balances with non-scheduled banks

included in 2 and 3 above

- -

RELIANCE GENERAL INSURANCE COMPANY LIMITED

FORM NL-16-ADVANCES AND OTHER ASSETS SCHEDULE

ADVANCES AND OTHER ASSETS

Particulars AS AT 31-03-2010 AS AT 31-03-2009

(Rs.000). (Rs.000).

ADVANCES

1 Reserve deposits with ceding companies - -

2 Application money for investments - -

3 Prepayments 182,054 43,038

4 Advances to Directors/Officers - -

5 Advance tax paid and taxes deducted at

source (Net of provision for taxation)

85,139 70,335

6 Rental deposits 189,557 182,382

7 Advances to Staff 728 9,471

8 Unutilised Service Tax Credit 21,063 57,485

9 Other Advances 296,407 685,715

10 Provision (137,600) -

TOTAL (A) 637,348 1,048,426

OTHER ASSETS

1 Income accrued on investments 387,690 384,379

2 Outstanding Premiums - 11,119

3 Agents Balances 1,817 -

4 Foreign Agencies Balances - -

5 Due from other entities carrying on

insurance business

6,397,105 4,151,021

(including reinsurers)

6 Due from subsidiaries/ holding - -

7 Deposit with Reserve Bank of India - -

[Pursuant to section 7 of Insurance Act,

1938]

8 Others - ERF Investment in Fixed

Deposit with Banks

- -

TOTAL (B) 6,786,612 4,546,519

TOTAL (A+B) 7,423,960 5,594,945

RELIANCE GENERAL INSURANCE COMPANY LIMITED

FORM NL-17-CURRENT LIABILITIES SCHEDULE

CURRENT LIABILITIES

Particulars AS AT 31-03-2010 AS AT 31-03-2009

(Rs.000). (Rs.000).

1 Agents Balances 765 2,219

2 Balances due to other insurance

companies

214,175 117,618

3 Deposits held on re-insurance

ceded

- -

4 Premiums received in advance 206,141 463,701

5 Unallocated Premium - -

6 Sundry creditors 792,841 938,120

7 Due to subsidiaries/ holding

company

- -

8 Claims Outstanding

(Includes claims related to

IMTPIP of Rs. 4,865,963 (Rs.

2,792,214). Refer note no.19)

8,974,872 6,315,788

9 Due to Officers/ Directors - -

10 Others - Environmental Relief

Fund Payable

133 9

11 Others - Premium Deficiency - 25,400

12 Others - Temporary Bank

Overdraft as per books of accounts

836,127 946,980

TOTAL 11,025,054 8,809,835

RELIANCE GENERAL INSURANCE COMPANY LIMITED

FORM NL-18-PROVISIONS SCHEDULE

PROVISIONS

Particulars AS AT 31-03-2010 AS AT 31-03-2009

(Rs.000). (Rs.000).

1 Reserve for Unexpired Risk 7,124,658 6,829,922

2 For taxation (less advance tax paid and

taxes deducted at source)

- -

3 For proposed dividends - -

4 For dividend distribution tax - -

5 Others - Provision for Leave Encashment 27,653 70,067

6 Reserve for Premium Deficiency - -

TOTAL 7,152,311 6,899,989

RELIANCE GENERAL INSURANCE COMPANY LIMITED

FORM NL-19 MISC EXPENDITURE SCHEDULE

MISCELLANEOUS EXPENDITURE

(To the extent not written off or adjusted)

Particulars AS AT 31-03-2010 AS AT 31-03-2009

(Rs.000). (Rs.000).

1 Discount Allowed in issue of shares/

debentures

- -

2 Others (to be specified) - -

TOTAL - -

RELIANCE GENERAL INSURANCE COMPANY LIMITED

FORM NL-20-RECEIPT AND PAYMENTS SCHEDULE

(Rs. In '000)

Particulars

Cash and cash equivalents at the beginning of the year 195,409 (562,086)

Cash flows from operating activities :

Direct Premiums received 19,629,825 19,391,542

Payment to re-insurers, net of commissions and claims (2,773,157) (2,732,285)

Payment to co-insurers, net claims recovery (235,595) (482,221)

Direct Claims Paid (13,078,500) (11,254,025)

Direct Commission / Brokerage Payments (424,869) (575,074)

Payment of other operating expenses (4,264,029) (4,624,053)

Preliminary and pre-operating expenses - -

Deposits, Advances, and Staff loans 131,205 (395,565)

Income tax paid (Net) (10,387) (3,030)

Wealth tax paid (27) (89)

Other Receipts/payments 14,931 7,191

Cash flow before extraordinary items (1,010,605) (667,610)

Cash flow from extraordinary operations - -

Cash flow from operating activities (1,010,605) (667,610)

Cash flows from investing activities :

Purchase of investments (Net) (26,509,508) (12,668,744)

Sale of investment (including gain/loss) 25,803,372 12,831,481

Purchase of fixed Assets (214,939) (339,272)

Proceeds from sale of fixed assets 66,961 30,724

Rent/ Interest/ Dividends received 943,667 955,669

Investment in money market instruments and in liquid

mutual funds (Net)

(1,382,339) (980,858)

Repayment received - -

Loan Given - (300,627)

Expenses related to investments (3,889) (3,893)

Net Cash flow from investing activies (1,296,675) (475,520)

Cash flows from financing activities :

Proceeds from issuance of share capital 2,100,000 1,900,627

Proceeds from borrowings - -

Repayment of borrowings - -

Interest/ Dividend Paid - -

Cash flow from financing activities 2,100,000 1,900,627

Cash and cash equivalents at the end of the year

including Bank Overdraft

(11,869) 195,409

* Cash and cash Equivalent at the end of period:

Cash & Bank balance as per schedule 824,256 1,142,390

Less: Temporary book over draft as per schedule (836,127) (946,981)

Cash and Cash Equivalent at the end of period (11,871) 195,409

Registration No and Date of Registration with the IRDA : Regn. No. 103 dated 23.10.2000

RECEIPTS AND PAYMENTS ACCOUNT FOR THE PERIOD ENDED 31st March, 2010

Current Year Previous Year

Insurer: Reliance General Insurance Company Ltd Date:

(Rs in Lakhs)

Sl.No. Particular

Reserves for

unexpired risks

Reserve for

Outstanding

Claims

IBNR Reserves Total Reserves

Reserves for

unexpired

risks

Reserve for

Outstanding

Claims

IBNR Reserves Total Reserves

1 Fire 1,680.00 2,442.13 299.36 4,421.49 2,402.00 2,037.65 162.08 4,601.73

2 Marine

a Marine Cargo 680.00 638.47 129.47 1,447.94 1,033.00 467.51 285.40 1,785.91

b Marine Hull 60.00 143.17 8.61 211.78 101.00 98.88 4.00 203.88

3 Miscellaneous

a Motor 55,036.58 65,949.14 11,016.70 132,002.42 50,077.22 46,016.62 7,718.31 103,812.15

b Engineering 2,100.00 1,294.17 74.14 3,468.31 1,300.00 807.02 100.00 2,207.02

c Aviation 100.00 273.20 5.00 378.20 32.00 200.91 2.00 234.91

d Liabilities 440.00 157.55 103.44 700.99 197.00 129.75 102.22 428.97

e Rural Insurance 130.00 160.94 - 290.94 229.00 160.02 - 389.02

f Others 1,320.00 922.50 320.82 2,563.32 1,978.00 512.89 765.90 3,256.79

4 Health Insurance 10,463.09 2,861.35 2,948.54 16,272.98 13,814.28 1,183.55 2,403.16 17,401.00

5 Total Liabilities 72,009.67 74,842.62 14,906.08 161,758.37 71,163.51 51,614.81 11,543.07 134,321.38

* Motor IBNR reserve does not inclide that relating to Motor Third Party Pool.

PERIODIC DISCLOSURES

FORM NL-21: Statement of Liabilities

As At 310309

31-Mar-10

As At 310310

Statement of Liabilities

FORM NL-22 Geographical Distribution of Business

Insurer: Reliance General Insurance Company Ltd Date: 31-Mar-10

GROSS DIRECT PREMIUM UNDERWRITTEN FOR THE FY: 09-10

(Rs in Lakhs)

For the yr Prev Yr For the yr Prev Yr

For the

yr Prev Yr

For the

yr Prev Yr For the yr Prev Yr For the yr Prev Yr For the yr Prev Yr For the yr Prev Yr

For the

yr Prev Yr

For the

yr Prev Yr For the yr Prev Yr For the yr Prev Yr

For the

yr Prev Yr

For the

yr Prev Yr For the yr Prev Yr For the yr Prev Yr

Andhra Pradesh 536 577 86 59 11 100 105 68 1,124 2,356 12,060 11,472 69 101 41 29 - - - - 530 407 1,322 1,289 - - - - 209 252 16,093 16,711

Assam 88 38 8 17 - - - - 26 12 1,911 2,189 3 2 0 1 - - - - 4 3 16 2,770 - - - - 32 9 2,087 5,041

Bihar 20 13 0 1 - - - - 4 2 1,441 1,232 1 0 0 0 - - - - 2 3 13 16 - - - - 46 8 1,527 1,274

Chandigarh 471 264 18 29 - - - - 16 2 2,030 2,014 0 2 2 1 - - - - 32 39 119 183 - - - - 69 401 2,757 2,937

Chattisgarh 21 9 3 5 - - 9 - 4 5 1,282 1,296 8 12 - - - - - - 45 30 9 15 - - - - 16 3 1,396 1,375

Delhi 1,882 1,651 374 333 54 65 73 9 1,195 1,907 14,691 11,704 111 108 639 903 - - - - 213 267 2,637 2,445 - - - - 701 474 22,571 19,865

Goa 5 11 1 (1) 13 10 - - 5 8 322 367 2 0 0 0 - - - - 0 1 15 28 - - - - 4 3 368 429

Gujarat 1,463 1,763 175 298 1 14 - (25) 401 640 7,142 7,604 143 155 26 24 - - - - 165 223 2,449 3,890 - - - - 859 1,225 12,824 15,812

Haryana 291 574 34 101 - 29 - - 853 1,036 9,011 7,149 17 18 40 98 - - - - 149 205 964 2,107 - - - - 704 1,069 12,064 12,385

Himachal Pradesh 20 2 0 0 - - - - 3 2 627 193 2 1 - 1 - - - - 0 0 1 2 - - - - 54 2 707 204

Jammu & Kashmir 26 12 (1) 2 - - - - 4 2 793 703 2 6 - 0 - - - - 0 1 11 14 - - - - 69 35 905 775

Jharkhand 36 21 22 19 - - - - 88 79 1,229 1,828 4 5 13 - - - - - 91 48 43 30 - - - - 38 19 1,565 2,050

Karnataka 340 301 75 90 2 3 - - 137 151 8,804 6,748 11 12 22 20 - - - - 276 293 3,198 5,927 - - - - 162 139 13,028 13,684

Kerala 129 112 9 11 4 2 - - 68 61 9,572 7,012 7 9 6 6 - - - - 50 48 454 566 - - - - 55 50 10,353 7,876

Madhya Pradesh 78 41 17 42 - - - - 58 46 1,879 1,825 2 5 0 2 - - - - 6 19 108 135 - - - - 48 14 2,196 2,127

Maharashtra 5,891 5,479 1,058 1,240 115 240 3,843 1,021 4,845 3,694 17,409 15,959 159 181 262 549 - - - - 67 896 5,406 7,121 - - - - 1,737 1,840 40,793 38,219

Orissa 84 57 6 13 - - - - 61 95 1,609 1,823 1 2 0 0 - - - - 4 4 15 39 - - - - 66 4 1,848 2,038

Puducherry 2 2 - 0 - - - - - 0 275 286 - 0 - - - - - - - 1 1 4 - - - - 0 1 277 295

Punjab 217 307 56 86 - - - - 38 52 4,396 4,396 7 6 8 4 - - - - 24 38 347 491 - - - - 128 110 5,221 5,489

Rajasthan 96 153 42 53 - - - - 41 95 5,000 4,121 10 8 0 1 - - - - 1,381 1,210 79 1,219 - - - - 107 14 6,758 6,874

Tamil nadu 319 572 322 438 22 - - - 261 279 8,267 7,062 31 28 19 22 - - - - 114 259 5,276 1,154 - - - - 87 175 14,716 9,987

Uttar Pradesh 394 363 68 99 - - 31 27 170 397 11,500 9,708 16 22 62 32 - - - - 19 67 517 805 - - - - 147 148 12,925 11,668

Uttarakhand 11 17 3 4 - - - - 4 11 1,145 856 2 2 - - - - - - 1 31 31 55 - - - - 8 2 1,204 977

West Bengal 1,537 1,343 356 282 6 14 - 2 980 993 9,475 8,937 72 138 40 56 - - - - 231 117 843 778 - - - - 238 735 13,779 13,396

Grand Total 13,957 13,684 2,733 3,223 228 477 4,061 1,101 10,388 11,923 131,871 116,482 681 825 1,183 1,749 - - - - 3,406 4,210 23,875 31,082 - - - - 5,583 6,733 197,965 191,488

Fire Marine (Cargo) Personal Accident Medical Insurance All Other Miscellaneous Grand Total Engineering Motor

PERIODIC DISCLOSURES

Marine (Hull) Aviation

Overseas medical

Insurance Employer's Liab Public Liab Product Liab Other Liab

STATES

Crop Insurance

Insurer: Reliance General Insurance Co.Ltd Date:

(Rs in Lakhs)

S.No. Reinsurance Placements

No. of

reinsurers

Proportional

Non-

Proportional

Facultative

Premium ceded to

reinsurers / Total

reinsurance

premium ceded (%)

1 No. of Reinsurers with rating of AAA and above

11 1,677.96 62.48 684.47 4.90%

2 No. of Reinsurers with rating AA but less than AAA

24 34,795.17 1,996.89 1,765.09 77.91%

3 No. of Reinsurers with rating A but less than AA

93 2,811.26 234.21 4,153.10 14.55%

4 No. of Reinsurers with rating BBB but less than A

8 12.71 2.97 695.22 1.44%

5 No. of Reinsurers with rating less than BBB

0 0.00 0.00 0.00 0.00%

6 No. of Indian reinsurer other than GIC

10 0.00 0.00 595.98 1.20%

Total 146 39,297.09 2,296.55 7,893.85 100.00%

PERIODIC DISCLOSURES

3/31/2010

FORM NL-23 :Reinsurance Risk Concentration

Reinsurance Risk Concentration

Insurer: Reliance General Insurance Company Limited Date:

(Rs in Lakhs)

Line of Business

Total No. of

claims paid

Total amount

of claims paid

1 month 1 3 months 3 6 months 6 months 1 year > 1 year

1

Fire 833 304 221 201 72 1631 7,321.93

2

Marine Cargo 2575 421 191 147 84 3418 3,071.07

3

Marine Hull 5 1 1 2 0 9 655.06

4

Engineering 624 318 191 172 81 1386 4,714.90

5

Motor OD 173631 60884 13196 3522 1164 252397 58,898.84

6

Motor TP 29 135 425 1542 1598 3730 9,325.58

7 Health 57310

26633

6782 3123 1252 95101 25,173.19

8

Overseas Travel 144 464 367 198 49 1222 1,185.31

9

Personal 1350 650 284 83 94 2461 4,815.05

10

Liability 65 31 33 27 4 160 280.83

11

Crop 0 0 0 0 0 0 -

12 Miscellaneous 1353 620 217 102 39 2332 3,322.65

Ageing of Claims

Sl.No.

PERIODIC DISCLOSURES

No. of claims paid

FORM NL-24 : Ageing of Claims

31/03/2010

Insurer: Reliance General Insurance Company Limited Date: 31/03/10

No. of claims only

Sl. No. Claims Experience Fire

Marine

Cargo

Marine

Hull

Engineer

ing

Motor OD Motor TP Health

Overseas

Travel

Personal

Accident

Liability Crop Credit

Miscellan

eous

Total

1 Claims O/S at the beginning of the period 330 339 7 384 12205 13226 8958 228 340 115 554 36686

2 Claims reported during the period 2681 4283 27 2150 306381 11113 115396 1705 4396 395 6048 454575

3 Claims Settled during the period 1631 3418 9 1386 252397 3730 95101 1222 2461 160 2332 363847

4 Claims Repudiated during the period 716 144 8 132 7124 10524 16 1676 30 3445 23815

5 Claims closed during the period 549 380 23290 397 5863 141 170 101 30891

6 Claims O/S at End of the period 664 511 17 636 35775 20212 12866 554 599 150 724 72708

Less than 3months 255 227 6 288 26624 2388 8634 325 348 47 446 39588

3 months to 6 months 177 125 4 196 6204 2675 1450 84 196 32 124 11267

6months to 1 year 125 122 3 109 2856 4409 1225 122 55 32 102 9160

1year and above

107 37 4 43 91 10740 1557 23 39 52 12693

PERIODIC DISCLOSURES

FORM NL-25 : Quarterly claims data for Non-Life

Solvency for the year ended on 31st March 2010

Required solvency margin based on net premium and net incurred claims (Rs. in Lacs)

1 Fire 14,561.00 3,352.00 8,861.00 3,172.00 1,456.00 1,329.00 1,456.00

2 Marine Cargo 2,733.00 1,354.00 2,834.00 1,494.00 328.00 510.00 510.00

3 Marine Hull 228.00 52.00 427.00 287.00 23.00 86.00 86.00

4 Motor 131,871.00 110,031.00 93,754.00 83,414.00 22,006.00 25,024.00 25,024.00

5 Engineering 10,475.00 3,267.00 4,959.00 1,455.00 1,047.00 744.00 1,047.00

6 Aviation 4,061.00 189.00 2,437.00 490.00 406.00 366.00 406.00

7 Laibilities 1,864.00 856.00 (83.00) 82.00 280.00 86.00 280.00

8 Others 8,989.00 2,845.00 8,178.00 2,488.00 1,258.00 1,717.00 1,717.00

9 Health 23,875.00 20,926.00 28,792.00 25,687.00 4,185.00 7,706.00 7,706.00

Total 198,656.00 142,872.00 150,159.00 118,569.00 30,990.00 37,569.00 38,233.00

Note : Rural Insurance is included in the respective class of business.

PERIODIC DISCLOSURES

FORM NL-26 : CLAIMS INFORMATION - KG Table I

RSM-1 RSM-2 RSM

Gross

Premium

Net

Premium

Gross

incurred

claim

Net incurred

Claim

Item

No. Description

PREMIUM CLAIMS

Insurer : Reliance General Insurance Company Limited.

FORM NL-27 : Offices information for Non-Life

Insurer: Reliance General Insurance Company Limited Date: 3/31/2010

Sl. No.

1

2

3

Out of

approvals

of

previous

year

4

Out of

approvals

of this

year

5

6

7

8

9

No. of branches approved but not opend

No. of rural branches

No. of urban branches

0

0

200

200

No. of offices at the beginning of the year

No. of branches approved during the year

No. of branches closed during the year

No of branches at the end of the year

No. of branches opened during the year 0

0

0

PERIODIC DISCLOSURES

Number

200

0

Office Information

FORM NL-28-STATEMENT OF ASSETS - 3B

COMPANY NAME : RELIANCE GENERAL INSURANCE COMPANY LIMITED

CODE: 103

STATEMENT AS ON : 31.03.2010

STATEMENT OF INVESTMENT ASSETS (General Insurer, Re-Insurers)

(Business within India)

PERIODICITY OF SUBMISSION : QUARTERLY Rs. In Lakhs

NO PARTICULARS SCH AMOUNT

1 Investments 8 165,666.10

2 Loans 9 3,006.27

3 Fixed Assets 10 4,750.67

4 Current Assets

a. Cash & Bank Balance 11 8,242.56

b. Advances & Other Assets 12 78,336.95

5 Current Liabilities

a. Current Liabilities 13 (110,250.54)

b. Provisions 14 (71,523.11)

c. Misc. Exp not written off - 0.00

d. Debit balance of P&L A/c - 21,589.24

Application Of Funds as per Balance Sheet (A) TOTAL (A) 99,818.14

Less : OTHER ASSETS SCH AMOUNT

1 Loans (if any) 9 3,006.27

2 Fixed Assets (if any) 10 4,750.67

3 Cash & Bank Balance (if any) 11 8,242.56

4 Advances & Other Assets (if any) 12 78,336.95

5 Current Liabilities 13 (110,250.54)

6 Provisions 14 (71,523.11)

7 Misc. Expenses not written off - 0.00

8 Debit balance of P&L A/c - 21,589.24

TOTAL (B) TOTAL (B) (65,847.96)

Investment Assets As Per FORM 3B (A - B) 165,666.10

Balance FRSM

1

(a) (b) (c) d=(b+c) (e) (d + e)

1 Government Securities Not less than 20% 0.00 12,368.65 26,283.38 38,652.03 23.21% 0.00 38,652.03 37,244.94

2 Government Securities or Other Approved Securities (incl. (1) above) Not less than 30% 0.00 16,883.50 35,877.45 52,760.95 31.68% 0.00 52,760.95 51,367.40

3 Investment subject to Exposure Norms

1. Housing & Loans to SG for Housing and FFE, Infrastructure Investments Not less than 15% 0.00 14,242.08 30,264.42 44,506.51 26.72% (453.42) 44,053.08 44,336.93

2.Approved Investments 0.00 19,265.49 40,939.17 60,204.66 36.15% (254.07) 59,950.59 60,160.73

3.Other Investments (not exceeding 25%) 0.00 2,906.29 6,175.87 9,082.16 5.45% (180.68) 8,901.48 8,886.45

Total Investment Assets 100% 0.00 53,297.37 113,256.91 166,554.27 100.00% (888.17) 165,666.10 164,751.50

Note :

1 FRMS refers Funds representing Solvency margin

2 Pattern of Investment will apply only to SH funds representing FRSM

3 Book value shall not include funds beyond Solvency Margin

4 Other Investments are as permitted under Sec 27A(2) and 27B(3)

% Actual

Total

MARKET VALUE

FVC Amount Book Value (SH + PH)

Not exceeding 55%

PH

No 'Investment' represented as Reg. %

SH

FORM NL-29 Detail regarding debt securities

Insurer: Reliance General Insurance Company Ltd. Date: 3/31/2010

(Rs in Lakhs)

As at 31/03/2010

as % of total for

this class

as at 31/03/2009

Of the previous

year

as % of total for

this class

As at 31/03/2010

as % of total for

this class

as at 31/03/2009

Of the previous

year

as % of total for

this class

Break down by credit rating

AAA rated 74,885.35 48.88% 71,108.45 54.37% 74,416.06 48.29% 70,255.76 53.92%

AA or better 6,347.81 4.14% 9,477.33 7.25% 6,338.15 4.11% 9,434.21 7.24%

Rated below AA but above A - 0.00% 504.12 0.39% - 0.00% 500.00 0.38%

Rated below A but above B - 0.00% - 0.00% - 0.00% - 0.00%

Any other 71,967.40 46.98% 49,687.17 37.99% 73,360.95 47.60% 50,095.10 38.45%

BREAKDOWN BY

RESIDUALMATURITY

Up to 1 year 62,949.62 41.09% 37,792.47 28.90% 62,752.49 40.72% 37,596.01 28.86%

more than 1 yearand upto

3years

40,505.86 26.44% 40,607.46 31.05% 40,178.79 26.07% 40,021.52 30.72%

More than 3years and up to

7years

36,213.22 23.64% 23,507.43 17.98% 36,702.81 23.82% 23,568.33 18.09%

More than 7 years and up to

10 years

10,449.21 6.82% 26,701.00 20.42% 11,098.61 7.20% 26,779.91 20.55%

above 10 years 3,082.65 2.01% 2,168.70 1.66% 3,382.47 2.19% 2,319.29 1.78%

Breakdown by type of the

issurer

a. Central Government 37,244.94 24.31% 44,057.17 33.69% 38,652.03 25.08% 44,465.10 34.13%

b. State Government 14,122.46 9.22% - 0.00% 14,108.92 9.15% - 0.00%

c.Corporate Securities 101,833.16 66.47% 86,719.90 66.31% 101,354.21 65.77% 85,819.96 65.87%

Note

1. In case of a debt instrument is rated by more than one agency, then the lowest rating will be taken for the purpose of classification.

Note 1: 'AAA rated' includes Securities having rating as P1+

Note 2: 'Any other' under 'Break down by credit rating' contains Liquid MFs / CBLO / GSec etc. It does not contain any Security which is rated below B

2. Market value of the securities will be in accordnace with the valuation method specified by the Authority under Accounting/ Investment regulations.

PERIODIC DISCLOSURES

Detail Regarding debt securities

MARKET VALUE Book Value

FORM NL-30 Analytical Ratios

Insurer: Reliance General Insurance Company Limited Date: 31-Mar-10

Sl.No. Particular For the Current Year

For the Previous

Year

1 Gross Premium Growth Rate 3% -2%

2 Gross Premium to shareholders' fund ratio 267% 341%

3 Growth rate of shareholders'fund 32% 16%

4 Net Retention Ratio 72% 73%

5 Net Commission Ratio -2% -2%

6 Expense of Management to Gross Direct Premium Ratio 26% 31%

7 Combined Ratio 92% 90%

8 Technical Reserves to net premium ratio 113% 94%

9 Underwriting balance ratio -16% -14%

10 Operationg Profit Ratio -6% -3%

11 Liquid Assets to liabilities ratio 44% 37%

12 Net earning ratio -4% -4%

13 Return on net worth ratio -7% -9%

14

Available Solvency margin Ratio to Required Solvency

Margin Ratio

1.70 1.59

15 NPA Ratio

Gross NPA Ratio 0% 0%

Net NPA Ratio 0% 0%

1 (a) No. of shares 115,223,941 113,081,084

2 (b) Percentage of shareholding (Indian / Foreign)

Indian 100% 100%

Foreign 0% 0%

3

( c) %of Government holding (in case of public sector

insurance companies)

0% 0%

4

(a) Basic and diluted EPS before extraordinary items (net of

tax expense) for the period (not to be annualized)

(4.46) (4.81)

5

(b) Basic and diluted EPS after extraordinary items (net of tax

expense) for the period (not to be annualized)

(4.46) (4.81)

6 (iv) Book value per share (Rs) 68.66 55.85

PERIODIC DISCLOSURES

Analytical Ratios for Non-Life companies

Equity Holding Pattern for Non-Life Insurers

FORM NL-30 Analytical Ratios

Insurer: Reliance General Insurance Company Limited Date: 31-Mar-10

Gross premium Growth

Rate Net Retention Ratio Net Commission Ratio

Underwriting Balance

Ratio

(Gross direct premium for

the current year divided by

the gross direct premium

for the previous year)

(Net premium divided by

gross direct premium)

(Gross Commission paid

net of reinsurance

commission divided by Net

premium for that segment)

(Underwriting profit divided

by net premium for the

respective class of

business)

Fire 2% 24% -42% 35%

2008-09 -4% 31% -35% 26%

Marine Cargo -15% 50% -3% -15%

2008-09 2% 55% 2% -56%

Marine Hull -52% 23% -12% -399%

2008-09 83% 17% -31% -83%

Motor 13% 83% 0% -13%

2008-09 -8% 86% 0% -11%

Employer Liability -17% 88% 4% 41%

2008-09 -4% 89% 3% -12%

Public Liability -32% 22% -41% 174%

2008-09 217% 20% -24% -27%

Engineering -13% 31% -46% 42%

2008-09 15% 18% -100% 108%

Aviation 269% 5% 30% -260%

2008-09 49% 6% -43% -261%

Personal Accident -19% 34% -40% 38%

2008-09 4% 37% -22% -11%

Health -23% 88% 3% -54%

2008-09 13% 89% 4% -35%

Other

Miscellaneous -17% 30% -19% 6%

2008-09 11% 26% -8% -27%

Total 3% 72% -2% -16%

2008-09 -2% 73% -2% -14%

Particulars

PERIODIC DISCLOSURES

FORM NL-31 : Related Party Transactions

Insurer: Reliance General Insurance Company Ltd Date: 31-Mar-10

(Rs in Lakhs)

S.No. Name of the Related Party Relationship Nature of transaction Current Year Previous Year

Share Capital Money Received

214.29 163.27

Share Premium Money Received

20,785.71 15,836.73

Premium 25.53 46.88

Claims 4.90 7.08

Software Purchased 375.94 28.79

Sale of Server 2.48 1.05

Reimbursements received for expenses

(Rent, Communication, Electricity)

30.79 10.39

Reimbursements paid for expenses (Rent,

Communication, Electricity, Professional

fees, Maintenance Charges)

489.06 597.78

Outstanding balance in CD A/c

0.50 0.75

Advisory fees - 5.98

Premium 115.06 68.52

Claims 1.62 1.65

Reimbursements received for expenses

(Rent, Communication, Electricity)

53.53 -

Outstanding balance in CD A/c

12.14 8.77

3 Reliance Capital Trustee Co Ltd Fellow Subsidiary

Premium 26.72 18.61

Premium 35.50 24.09

Foreign Currency Purchased

2.29 1.86

Foreign Currency Returned

0.85 -

Outstanding balance in CD A/c

5.18 -

Premium 0.22 0.45

Outstanding balance in CD A/c

0.15 0.25

Premium 87.64 123.55

Claims 0.23 0.24

7 Medybiz Pvt. Ltd

Fellow Subsidiary

Premium 0.28 0.35

Premium 7.82 15.81

Policy Management Paid 562.97 -

Claim Paid 0.12 -

Reimbursements received for expenses

(Rent, Maintenance)

12.28 10.76

Outstanding balance in CD A/c

3.81 1.47

Premium 2.96 2.17

Claims - 0.24

Outstanding balance in CD A/c

0.40 0.13

Premium 79.00 0.94

Claim 4.40 -

Reimbursements received for expenses

(Rent, Electricity)

59.89 55.62

Outstanding balance in CD A/c

5.91 16.98

11 Reliance Capital Partners Fellow Subsidiary

Premium 5.28 3.67

Premium 2.19 -

Outstanding balance in CD A/c

0.26 -

Remuneration 130.58 193.10

Premium 0.23 0.20

14 Independent Directors Sitting Fees 5.00 5.20

Note: Related Party relationship is as identified by the management and relied upon by the auditors.

PERIODIC DISCLOSURES

Related Party Transactions

1 Reliance Capital Ltd Holding company

2

Reliance Capital Asset Management

Ltd. Fellow Subsidiary

4 Reliance Money Express Ltd. Fellow Subsidiary

5 Reliance Equity Advisors India Ltd Fellow Subsidiary

6 Reliance Securities Ltd Fellow Subsidiary

8 Reliance Capital Services Pvt. Ltd Fellow Subsidiary

9 Reliance Equities International Pvt. Ltd Fellow Subsidiary

13 K.A. Somasekharan

Key Managerial

Personnel

10 Reliance Consumer Finance Pvt. Ltd. Fellow Subsidiary

12 Reliance Home Finance Fellow Subsidiary

FORM NL-32 Products Information

Insurer: Reliance General Insurance Company Limited Date: 31st March 10

List below the products and/or addons introduced during the period

Sl. No. Name of Product Co. Ref. No. IRDA Ref.no. Class of Business*

Category of

product

Date of

filing of

Product

Date IRDA

confirmed

filing/

approval

1 Reliance Commercial Vehicle Package PolicyAdd On MOT04

IRDA/F&U/AddOn

(Motor)/Reliance/09

Motor Internal Tariff 24Dec08 05May09

2 Reliance Private Car Package PolicyAdd On MOT02

IRDA/F&U/AddOn

(Motor)/Reliance/09

Motor Internal Tariff 16Dec08 05May09

3 Reliance Two Wheeler Package PolicyAdd On MOT03

IRDA/F&U/AddOn

(Motor)/Reliance/09

Motor Internal Tariff 24Dec08 05May09

4 Reliance FilmProtect Policy RGI MI 49 04/RD/RGICL/RFP/0809 Miscellaneous Individual 22Sep08 30Nov09

5 Reliance HealthWise Insurance Policy

RGICL / IRDA / 68

/ 2009

IRDA/NL/RGI/P/MISC(H)/1677/V.II/09

10

Miscellaneous Health 12Nov08 23Mar10

PERIODIC DISCLOSURES

Products Information

FORM NL-33 : SOLVENCY MARGIN - KGII

Insurer: Reliance General Insurance Company Limited

TABLE - II

Solvency for the Year ended on 31-03-2010

Available Solvency Margin and Solvency Ratio

(Rs. in Lacs)

Item Description Notes Amount

(1) (2) (3) (4)

1 Available Assets in Policyholders Funds (adjusted value 1 181,406.00

of Assets as mentioned in Form IRDA-Assets-AA):

Deduct:

2 Liabilities (reserves as mentioned in Form HG) 2 161,758.00

3 Other Liabilities (other liabilities in respect of 3 17,965.00

Policyholders Fund as mentioned in Balance Sheet)

4 Excess in Policyholders Funds (1-2-3) 1,683.00

5 Available Assets in Shareholders Funds (value of 4 66,000.00

Assets as mentioned in Form IRDA-Assets-AA):

Deduct:

6 Other Liabilities (other liabilities in respect of 5 2,814.00

Shareholders Fund as mentioned in Balance Sheet)

7 Excess in Shareholders Funds (5-6) 63,186.00

8 Total Available Solvency Margin [ASM] (4+7) 64,870.00

9 Total Required Solvency Margin [RSM] 38,233.00

10 Solvency Ratio (Total ASM/Total RSM) 1.70

Notes

1

2

3

4

5 Amount of other Liabilities arising in respect of policyholder's funds and as mentioned in the Balance Sheet.

PERIODIC DISCLOSURES

The Adjusted Value of Assets in respect of policyholders' funds as mentioned in Form IRDA-Assets-AA.

Amount of Total Liabilities as mentioned in Form HG.

Amount of other Liabilities arising in respect of policyholder's funds and as mentioned in the Balance Sheet.

Total Assets in respect of shareholder's funds as mentioned in Form IRDA-Assets-AA.

FORM NL-34

Insurer: Reliance General Insurance Co Ltd. Date: 31.3.2010

Sl. No. Name of person Role/designation Details of change in the period

1 Mr S.P. Talwar Director

2 Mr D Sengupta Director

3 Mr Rajendra Chitale Director

4 Mr Soumen Ghosh Director

5 Mr K.A.Somasekharan Executive Director & CEO Appointed w.e.f 24.10.2009

6 Mr Hemant jain CFO Redesignated as CFO w.e.f. 1.4.2010

7 Mr Krishna Cheemalapati CIO

8 Mr Sudarshanam Sundararajan Head ERCG

Key Pesons as defined in IRDA Registration of Companies Regulations, 2000

PERIODIC DISCLOSURES

: Board of Directors & Key Person

BOD and Key Person information

FORM NL-35-NON PERFORMING ASSETS-7A

COMPANY NAME : RELIANCE GENERAL INSURANCE COMPANY LIMITED Name of the fund : General Fund

CODE: 103

STATEMENT AS ON : 31.03.2010

Details Of Investment Portfolio

PERIODICITY OF SUBMISSION : QUARTERLY

%

Has there

been

revision?

Amount

Board

Approval Ref

Note:

1. Category of Investment (COI) shall be as per INV/GLN/001/2003-04

2. FORM 7A shall be submitted in respect of each fund

3. Classification shall be as per F & A-Circulars -169-Jan-07 Dt.24-01-07

Default

Principal

(Book Value)

Default

Interest

(Book Value)

Principal

Due from

COI

Company

Name

Instrument

Type

Interest Rate

---------------------------- NIL ---------------------------

Has there been

any principal waiver?

Classification

Provision

(%)

Provision

(Rs.)

Interest

Due from

Deferred

Principal

Deferred

Interest

Rolled

Over?

Total O/S

(Book value)

FORM NL-36-YIELD ON INVESTMENTS 1 NAME OF THE FUND : GENERAL FUND

Company Name : Reliance General Insurance Company Limited

Company Code : 103

Statement Date: As at 31.03.2010

STATEMENT OF INVESTMENT AND INCOME ON INVESTMENT Rs. in Lakhs

Periodicity of Submission: Quarterly

No. Category of Investment Cat. Code

Investment

Income on

Investment

Gross Yield

(%)

Net Yield

(%)

Investment

Income on

Investment

Gross

Yield

(%)

Net Yield

(%)

Investment

Income on

Investment

Gross Yield

(%)

Net Yield

(%)

1 CENTRAL GOVERNMENT SECURITIES

Central Government Bonds CGSB 35,051.87 608.76 1.70% 1.70% 35,051.87 2,924.21 8.05% 8.05% 31,124.09 4,931.18 12.56% 12.56%

Treasury Bills CTRB 2,489.77 28.07 0.97% 0.97% 2,489.77 210.73 3.89% 3.89% 6,730.69 25.16 4.31% 4.31%

Deposit under Section 7 of Insurance Act, 1938 CDSS 1,110.40 16.89 1.51% 1.51% 1,110.40 63.87 5.76% 5.76% 1,069.20 76.38 7.05% 7.05%

2

STATE GOVERNMENT / OTHER APPROVED SECURITIES /

OTHER GUARANTEED SECURITIES

State Government Bonds SGGB 7,476.81 60.52 1.66% 1.66% 7,476.81 79.33 4.09% 4.09% 0.00 0.00 0.00% 0.00%

Other Approved Securities (excluding Infrastructure

Investments)

SGOA 6,632.11 117.34 1.62% 1.62% 6,632.11 561.47 7.50% 7.50% 5,541.12 194.71 10.05% 10.05%

3

HOUSING & LOANS TO STATE GOVT. FOR HOUSING AND

FIRE FIGHTING EQUIPMENT

Bonds / Debentures issued by Authority constituted under

any Housing / Building Scheme approved by Central /

State / any Authority or Body constituted by Central /

State Act

HTDA 11,103.95 244.70 1.96% 1.96% 11,103.95 1,275.98 8.87% 8.87% 10,018.69 924.71 9.36% 9.36%

Bonds / Debentures issued by NHB / Institutions

accredited by NHB

HTDN 0.00 0.60 0.02% 0.02% 0.00 0.60 0.02% 0.02% 0.00 0.00 0.00% 0.00%

4 INFRASTRUCTURE / SOCIAL SECTOR INVESTMENTS

Infrastructure - PSU - Debentures / Bonds IPTD 20,366.60 434.60 2.06% 2.06% 20,366.60 2,043.37 11.21% 11.21% 20,793.45 1,539.08 9.27% 9.27%

Infrastructure - Other Corporate Securities - Debentures/

Bonds

ICTD 11,023.33 192.12 2.19% 2.19% 11,023.33 851.51 9.47% 9.47% 11,485.27 1,066.57 9.63% 9.63%

Infrastructure - PSU - CPs IPCP 0.00 0.00 0.00% 0.00% 0.00 19.06 0.81% 0.81% 0.00 0.00 0.00% 0.00%

Infrastructure - Other Corporate Securities - CPs ICCP 0.00 0.00 0.00% 0.00% 0.00 0.00 0.00% 0.00% 0.00 5.08 12.40% 12.40%

Infrastructure - Equity and Equity Related Instruments

(Promoter Group)

IEPG 152.96 0.00 0.00% 0.00% 152.96 0.00 0.00% 0.00% 87.30 0.38 0.22% 0.22%

Infrastructure - Corporate Securities - Equity shares-

Quoted

ITCE 1,064.64 0.00 0.00% 0.00% 1,064.64 (1.20) -0.20% -0.20% 624.27 6.87 0.49% 0.49%

Infrastructure - PSU - Equity shares - Quoted ITPE 341.60 1.80 0.35% 0.35% 341.60 21.98 4.49% 4.49% 481.00 8.50 0.72% 0.72%

5 APPROVED INVESTMENT SUBJECT TO EXPOSURE NORMS

PSU - Equity shares - Quoted EAEQ 1,568.33 27.83 1.71% 1.71% 1,568.33 456.75 24.37% 24.37% 1,279.96 63.05 1.99% 1.99%

Corporate Securities - Equity shares (Ordinary)- Quoted EACE 8,185.02 30.99 0.39% 0.39% 8,185.02 318.37 4.01% 4.01% 3,424.49 148.53 0.96% 0.96%

Corporate Securities - Bonds - (Taxable) EPBT 9,403.42 191.36 2.06% 2.06% 9,403.42 1,024.95 10.43% 10.43% 11,531.00 1,504.55 9.61% 9.61%

Corporate Securities - Debentures ECOS 13,596.58 308.88 2.32% 2.32% 13,596.58 1,311.30 10.00% 10.00% 13,293.21 1,370.03 9.90% 9.90%

Commercial Papers ECCP 7,360.18 10.02 1.87% 1.87% 7,360.18 101.77 7.59% 7.59% 1,410.85 50.73 8.77% 8.77%

Perpetual Debt Instruments of Tier I & II Capital issued by

PSU Banks

EUPD 0.00 (11.25) -5.17% -5.17% 0.00 0.72 -4.34% -4.34% 0.00 20.31 9.94% 9.94%

Perpetual Debt Instruments of Tier I & II Capital issued by

Non-PSU Banks

EPPD 0.00 0.00 0.00% 0.00% 0.00 13.04 2.52% 2.52% 998.46 83.79 10.13% 10.13%

CCIL - CBLO ECBO 0.00 0.81 0.14% 0.14% 0.00 (27.06) -0.37% -0.37% 0.00 5.49 6.06% 6.06%

Deposits - Deposit with Scheduled Banks, FIs, CCIL, RBI ECDB 5,000.00 17.26 0.35% 0.35% 5,000.00 17.26 0.35% 0.35% 0.00 0.00 0.00% 0.00%

Deposits - CDs with Scheduled Banks EDCD 7,237.07 90.33 1.36% 1.36% 7,237.07 532.03 7.62% 7.62% 9,361.78 50.02 7.73% 7.73%

Mutual Funds - Gilt / G Sec / Liquid Schemes EGMF 5,600.00 56.89 1.00% 1.00% 5,600.00 208.47 4.53% 4.53% 570.00 102.97 8.32% 8.32%

Mutual Funds - (under Insurer's Promoter Group) EMPG 2,000.00 12.58 0.59% 0.59% 2,000.00 91.21 3.71% 3.71% 5,060.00 75.78 8.24% 8.24%

6 OTHER THAN APPROVED INVESTMENTS

Liquid Mutual Funds OMLF 0.00 0.00 0.00% 0.00% 0.00 0.00 0.00% 0.00% 0.00 191.55 9.46% 9.46%

Equity Shares (incl. Equity related Instruments) -

Promoter Group

OEPG 0.00 0.00 0.00% 0.00% 0.00 0.72 0.57% 0.57% 69.84 0.30 0.24% 0.24%

Debentures OLDB 0.00 0.00 0.00% 0.00% 0.00 32.08 6.42% 6.42% 500.00 13.77 9.76% 9.76%

Mutual Funds - Debt / Income / Serial Plans / Liquid

Schemes

OMGS 7,200.00 56.03 0.94% 0.94% 7,200.00 154.31 3.24% 3.24% 0.00 4.69 7.27% 7.27%

Mutual Funds - (under Insurer's Promoter Group) OMPG 800.00 9.48 0.46% 0.46% 800.00 51.28 1.97% 1.97% 0.00 1.35 6.50% 6.50%

Equity Shares (incl Co-op Societies) OESH 238.40 0.00 0.00% 0.00% 238.40 (130.05) -26.26% -26.26% 145.31 1.24 0.21% 0.21%

Securitised Assets OPSA 663.08 11.68 1.75% 1.75% 663.08 50.34 7.01% 7.01% 797.26 60.21 7.18% 7.18%

Total 165,666.11 2,518.30 1.58% 1.58% 165,666.11 12,258.41 8.12% 8.12% 136,397.22 12,526.96 9.34% 9.34%

Note : The Yields given are absolute

Note: Category of Investment (COI) shall be as per Guidelines

1 To be calculated based on monthly or lesser frequency 'weighted Average' Investments

2 Yield netted for Tax

3 Form - 1 shall be prepared in respect of each fund.

Current Quarter Year to Date Previous Year 2008-09

FORM NL-37-DOWN GRADING OF INVESTMENT-2

COMPANY NAME: RELIANCE GENERAL INSURANCE COMPANY LIMITED

CODE : 103

STATEMENT AS ON : 31.03.2010

STATEMENT OF DOWN GRADED INVESTMENTS

PERIODICITY OF SUBMISSION : QUARTERLY Rs. In Lakhs

No. Name of the Security COI AMOUNT

DATE OF

PURCHASE

RATING AGENCY

ORIGINAL

GRADE

CURRENT GRADE

DATE OF

DOWNGRADE

REMARKS

A. DURING THE QUARTER

1

:

B. AS ON DATE

2

:

7.40% IOC 2015 EPBT 1,000.00 6-Sep-05 ICRA LAAA LAA+ 29-Nov-07

9.40% Tata Tea Ltd. 2010 ECOS 1,500.00 7-Nov-07 ICRA LAA+ LAA 21-Oct-08

9.50% Citi Financial Cons. Finance India Ltd. 2010 ECOS 1,000.00 15-Oct-07 CRISIL AAA AA+ 31-Dec-08

Note :

1 Provide details of Down Graded Investments during the Quarter

2 Investments Currently Upgraded, Listed as Down graded during earlier Quarter shall be deleted from the Cumulative listing

3 FORM-2 shall be presented in respect of each fund

4 Category of Investment (COI) shall be as per INV/GLN/001/2003-04

Name of Fund : General Fund

NIL

PERIODIC DISCLOSURES

FORM NL-38 FY 09 Business Returns across line of Business

Insurer: Reliance General Insurance Co Ltd 31-Mar-10

(Rs in Lakhs)

Premium No. of Policies Premium No. of Policies

1 Fire 13,957.33 42,033 13,683.83 35,313

2 Marine Cargo 2,733.43 23,245 3,223.19 23,394

3 Marine Hull 227.66 102 476.83 156

4 Motor 131,870.99 2,156,957 116,481.80 1,819,568

5 Engineering 10,387.54 5,383 11,922.90 6,236

6 Employer's Liability 680.95 4,103 825.08 4,490

7 Product Liab 71.10 70 111.11 16

8 Public Liab 242.14 454 308.11 494

9 Other Liab 870.10 1,305 1,330.04 290

10 Aviation 4,060.53 113 1,101.15 93

11 Personal Accident 3,405.97 54,570 4,209.51 31,746

12 Health 23,874.79 972,912 31,082.08 775,005

13 All Other Misc 5,582.62 75,326 6,732.86 32,327

Total 197,965.15 3,336,573 191,488.49 2,729,128

FY 0910 FY 0809

Business Returns across line of Business

Sl.No. Line of Business

FORM NL-39 Rural & Social Obligations (FY Returns) FY 10

Insurer: Reliance General Insurance Co Ltd Date: 31-Mar-10

(Rs in Lakhs)

Rural & Social Obligations (FY Returns)

Sl.No. Line of Business Particular

No. of Policies

Issued

Premium

Collected Sum Assured ++

Rural 1,568 725.81 854,352.72

Social

Rural 136 25.79 51,829.59

Social

Rural 8,507 3,781.42

Social

Rural 187,390 9,736.26 554,473.88

Social

Rural 229 135.10 117,263.24

Social

Rural 136 15.87 1,973.04

Social

Rural 3 2.97 2,090.24

Social

Rural 44 4.51 2,232.32

Social

Rural

Social

Rural 2,937 114.58 562,393.96

Social 62 943.05 6,091,760.83

Rural 9,339 3,537.94 937,823.88

Social

Rural 30,061 127.23 9,061,421.00

Social

Rural 5,316 116.31 144,099.96

Social 3,618 110.06 3,587.98

9 Aviation

2 Cargo & Hull

3 Motor TP

5 Engineering

6 Workmen's Compensation/Employer's Liability

12 Ov. Medical Insurance

13 All Other Miscellaneous

PERIODIC DISCLOSURES

FY 0910

1 Fire

4 Motor OD

11 Medical Insurance

8 Other Liability Cover

7 Public Liability

10 Personal Accident

FORM NL-40 Business Acquisition through different channels

Insurer: Reliance Genral Insurance Co Ltd Date: 31-Mar-10

(Rs in Lakhs)

1 Individual agents 221,973 10,866.83 176,954 7,977.03

2 Corporate AgentsBanks

3 Corporate Agents Others 1,341 135.32 31,231 3,189.33

4 Brokers 342,189 35,819.91 298,991 40,875.33

5 Micro Agents

6 Direct Business 2,740,476 150,445.81 2,168,747 137,920.18

7 Others 53,205 1,525.48

Total (A) 3,305,979 197,268 2,729,128 191,487.35

1 Referral (B) 30,594 697.31

Grand Total (A+B) 3,336,573 197,965.19 2,729,128 191,487.35

Note:

1. Premium means amount of premium received from business acquired by the source

2. No of Policies stand for no. of policies sold

PERIODIC DISCLOSURES

No. of

Policies * Premium

No. of

Policies * Premium Sl.No.

Business Acquisition through different channels

Channels

FY 0910 FY 0809

FORM NL-41 : GREIVANCE DISPOSAL

Insurer: Reliance General Insurance Company Limited Date: 31.03.2010

Fully

Accepted

Partial

Accepted

Rejected

1 Complaints made by customers

a) Sales Related 0 18 14 4

b) Policy Administration Related 0 63 55 7 1

c) Insurance Policy Coverage related 0 2 1 1 0

d) Claims related 0 166 67 82 17

e) others 0 39 12 23 4

d) Total Number 0 288 135 0 127 26

2 Duration wise Pending Status

Complaints

made by

customers

Complaints

made by

intermediaries

Total

a) Less than 15 days 4 4

b) Greater than 15 days 22 22

Total Number 26 0 26

Sl No. Particulars Opening

Balance *

Additions

PERIODIC DISCLOSURES

GRIEVANCE DISPOSAL

Complaints Resolved Complaints

Pending

You might also like

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Annual Report of Reliance General Insurance On 10-11Document49 pagesAnnual Report of Reliance General Insurance On 10-11bhagathnagarNo ratings yet

- Reliance General Insurance Company Limited: Disclosures - Non-Life Insurance CompaniesDocument48 pagesReliance General Insurance Company Limited: Disclosures - Non-Life Insurance CompaniesNeha A BirajdarNo ratings yet

- Beng Kuang Marine Limited: Page 1 of 10Document10 pagesBeng Kuang Marine Limited: Page 1 of 10pathanfor786No ratings yet

- Form NO. Description: Disclosures - LIFE INSURANCE COMPANIES-web-siteDocument72 pagesForm NO. Description: Disclosures - LIFE INSURANCE COMPANIES-web-siteVenkata ChalamNo ratings yet

- Commissioner of Taxation Annual ReportDocument89 pagesCommissioner of Taxation Annual ReportHenry DP SinagaNo ratings yet

- IFFCO TOKIO General Insurance Disclosures 1st April - 30th September 2017Document67 pagesIFFCO TOKIO General Insurance Disclosures 1st April - 30th September 2017Yadav Ka chhoraNo ratings yet

- 01 Public Dislosue On Website Q2 FY22-23Document74 pages01 Public Dislosue On Website Q2 FY22-23assmexellenceNo ratings yet

- Balance Sheet of HDFC STANDARD LIFE As at March 31 For Five YearsDocument7 pagesBalance Sheet of HDFC STANDARD LIFE As at March 31 For Five YearsNagendra PrasadNo ratings yet

- S.No. Form No DescriptionDocument43 pagesS.No. Form No DescriptionMohitNo ratings yet

- Form NO. Description: Disclosures - LIFE INSURANCE COMPANIES-web-siteDocument51 pagesForm NO. Description: Disclosures - LIFE INSURANCE COMPANIES-web-siteRamesh Kumar SNo ratings yet

- NTBCL Q1 FY2012 Financial ResultsDocument4 pagesNTBCL Q1 FY2012 Financial ResultsAlok SinghalNo ratings yet

- CA Final (New) - Risk Management - Mock Test Paper - Apr 2021 - Question PaperDocument10 pagesCA Final (New) - Risk Management - Mock Test Paper - Apr 2021 - Question PaperBijay AgrawalNo ratings yet

- Balance SheetDocument39 pagesBalance Sheetvinay_saraf100% (1)

- Up To The Quarter Ended Mar 2007 For The Corresponding Quarter of The Preceeding YearDocument48 pagesUp To The Quarter Ended Mar 2007 For The Corresponding Quarter of The Preceeding YearnaveensarathyNo ratings yet

- Apollo Ar19Document72 pagesApollo Ar19Wen Xin GanNo ratings yet

- P&L Fy21Document2 pagesP&L Fy21simoniuj2No ratings yet

- Awasr Oman Partners 2019Document44 pagesAwasr Oman Partners 2019abdullahsaleem91No ratings yet

- PwC-IFRS-FS-2020-IFRS - VN - Part 9Document15 pagesPwC-IFRS-FS-2020-IFRS - VN - Part 9Hung LeNo ratings yet

- UHBVN Executive Summary FY 2010-11Document46 pagesUHBVN Executive Summary FY 2010-11Neeraj KumarNo ratings yet

- Cash Flows Statement - Two ExamplesDocument4 pagesCash Flows Statement - Two Examplesakash srivastavaNo ratings yet

- Financials - IRDA - PD For June 17Document53 pagesFinancials - IRDA - PD For June 17mtashNo ratings yet

- Yanlord Land Third QTR and Nine Months Ended 30 Sep 09 Financial STMT Annc - 101109Document31 pagesYanlord Land Third QTR and Nine Months Ended 30 Sep 09 Financial STMT Annc - 101109WeR1 Consultants Pte LtdNo ratings yet

- FCMB Group PLC - Quarter 1 - Financial Statement For 2023 Financial Statements April 2023Document40 pagesFCMB Group PLC - Quarter 1 - Financial Statement For 2023 Financial Statements April 202381Clouds UniverseNo ratings yet

- Ratio Analysis of Bajaj AllianzDocument9 pagesRatio Analysis of Bajaj AllianzAkshat JainNo ratings yet

- Directors' Report: 1. Company PerformanceDocument57 pagesDirectors' Report: 1. Company PerformanceMUHAMMEDNo ratings yet

- Periodic Disclosures Form Nl-2-B-PlDocument1 pagePeriodic Disclosures Form Nl-2-B-PlNilesh DawandeNo ratings yet

- Dec09 Inv Presentation GAAPDocument23 pagesDec09 Inv Presentation GAAPOladipupo Mayowa PaulNo ratings yet

- Taxation: MD Mashiur Rahaman Robin KPMG-RRHDocument12 pagesTaxation: MD Mashiur Rahaman Robin KPMG-RRHZidan ZaifNo ratings yet

- Statement of Profit and LossDocument2 pagesStatement of Profit and LossradhikaNo ratings yet

- Statement of Profit and LossDocument2 pagesStatement of Profit and Lossradhika100% (1)

- United Bank Limited and Its Subsidiary CompaniesDocument15 pagesUnited Bank Limited and Its Subsidiary Companieszaighum sultanNo ratings yet

- Form Nl-1-B-Ra Periodic DisclosuresDocument1 pageForm Nl-1-B-Ra Periodic DisclosuresNilesh DawandeNo ratings yet

- Deleum Q2 2019Document43 pagesDeleum Q2 2019DiLungBanNo ratings yet

- Lloyds TSB Bank PLC: Report and Accounts 2008Document109 pagesLloyds TSB Bank PLC: Report and Accounts 2008saxobobNo ratings yet

- RMH Interim ResultsDocument37 pagesRMH Interim ResultsaalalalNo ratings yet

- HONG FOK CORPORATION FULL YEAR FINANCIAL STATEMENTDocument8 pagesHONG FOK CORPORATION FULL YEAR FINANCIAL STATEMENTTheng RogerNo ratings yet

- Finance Department Analysis of Dabur LimitedDocument15 pagesFinance Department Analysis of Dabur LimitedradhikaNo ratings yet

- TPI234444Document98 pagesTPI234444Jayarama RamNo ratings yet

- Profit&Loss 09 10Document1 pageProfit&Loss 09 10Rashmin TomarNo ratings yet

- Cash FlowDocument1 pageCash Flowpawan_019No ratings yet

- Annual Report 2019Document4 pagesAnnual Report 2019Rahman GafarNo ratings yet

- 8 Computation of Total Income - AY 2019 20Document1 page8 Computation of Total Income - AY 2019 20karthikkarunanidhi180997No ratings yet

- Awasr Oman and Partners SAOC - FS 2020 EnglishDocument42 pagesAwasr Oman and Partners SAOC - FS 2020 Englishabdullahsaleem91No ratings yet

- Rent-Way Rentavision Pro Forma Adjustments Pro FormaDocument6 pagesRent-Way Rentavision Pro Forma Adjustments Pro FormaBassoonDude05No ratings yet

- Bangladesh 2020-21 Budget at a GlanceDocument2 pagesBangladesh 2020-21 Budget at a GlanceMohammad AmjadNo ratings yet

- HKEX Interim ResultsDocument39 pagesHKEX Interim Resultsin resNo ratings yet