Professional Documents

Culture Documents

Lecture18 Safeway Case

Uploaded by

goot110 ratings0% found this document useful (0 votes)

64 views13 pagesAccounting Safeway

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAccounting Safeway

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

64 views13 pagesLecture18 Safeway Case

Uploaded by

goot11Accounting Safeway

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 13

Safeway Lease Case page 1 of 13

Safeway Inc. Annual Report 2004

Leases

Please refer to the 2004 financial statements of Safeway Inc. and Footnote E. on Lease Obligations.

Assume that there were no business acquisitions, business divestitures, impairments or FCTAs

associated with Safeways leases during 2004.

1. What is the total book value of Safeways obligations under capital leases reported

on the balance sheet as of fiscal year-end 2004?

Place your answer to this question here $

2. What is the net book value of Safeways property under capital leases reported on

the balance sheet as of fiscal year-end 2004?

Place your answer to this question here $

3. What was the average aggregate interest rate that Safeway was paying on its capital

leases as of the end of 2004?

Place your answer to this question here

Safeway Lease Case page 2 of 13

4. (6 pts) Record all transactions Safeway expects to make in 2005 related to all of the

capital and operating leases that they have outstanding as of fiscal year-end 2004.

Assume that amortization expense for property under capital leases is the same in

fiscal year 2005 as it was in fiscal year 2004. Also assume that your answer to

Question #3 is the interest rate used to compute interest expense on capital leases.

Account Debit Credit

Safeway Lease Case page 3 of 13

5. What was the new obligation for capital leases entered into in 2004?

Place your answer to this question here $

6. What was the historical cost (i.e., gross book value) of the capital lease assets retired

in 2004?

Place your answer to this question here $

Safeway Lease Case page 4 of 13

7. Refer to the operating lease payments shown in the Lease Obligation footnote.

Assume that all the lease payments in 2005 and beyond will be made at the end of

the year. Assume that the entire $2,778.6 payment scheduled for thereafter will

be paid at the end of 2010.

Ignore your answer to the previous question and assume that Safeways

interest rate on its leases is 10%, compounded annually.

If these operating leases had been treated as capital leases, by how much would

Safeways total debt be greater as of the end of 2004?

Place your answer to this question here

Safeway 2004 Financial Statements page 5 of 13

Safeway Inc.

Safeway Inc. ("Safeway" or the "Company") is one of the largest food and drug retailers in North

America, with 1,802 stores at year-end 2004.

Safeway 2004 Financial Statements page 6 of 13

--------------------------------------------------------------------------------

Consolidated Statements of Operations

SAFEWAY INC. AND SUBSIDIARIES

52 Weeks 53 Weeks 52 Weeks

2004 2003 2002

---------- ---------- ----------

(In millions, except per-share amounts)

Sales and other revenue $ 35,822.9 $ 35,727.2 $ 34,917.2

Cost of goods sold (25,227.6) (25,003.0) (23,920.8)

---------- ---------- ----------

Gross profit 10,595.3 10,724.2 10,996.4

Operating and administrative expense (9,422.5) (9,421.2) (8,760.8)

Goodwill impairment charges -- (729.1) (1,288.0)

---------- ---------- ----------

Operating profit 1,172.8 573.9 947.6

Interest expense (411.2) (442.4) (430.8)

Other income, net 32.3 9.6 15.5

---------- ---------- ----------

Income before income taxes and cumulative effect of accounting change 793.9 141.1 532.3

Income taxes (233.7) (310.9) (660.4)

---------- ---------- ----------

Income (loss) before cumulative effect of accounting change 560.2 (169.8) (128.1)

Cumulative effect of accounting change -- -- (700.0)

---------- ---------- ----------

Net income (loss) $ 560.2 $ (169.8)$ (828.1)

---------- ---------- ----------

Safeway 2004 Financial Statements page 7 of 13

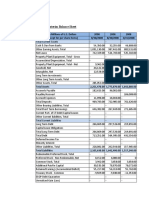

Consolidated Balance Sheets

SAFEWAY INC. AND SUBSIDIARIES

Year-end Year-end

2004 2003

--------- ---------

(In millions)

Assets

Current assets:

Cash and equivalents $ 266.8 $ 174.8

Receivables 339.0 383.2

Merchandise inventories, net of LIFO reserve of $48.6 and $63.8 2,740.7 2,642.2

Prepaid expenses and other current assets 251.2 307.5

--------- ---------

Total current assets 3,597.7 3,507.7

--------- ---------

Property:

Land 1,396.0 1,384.9

.

.

Property under capital leases 773.8 758.1

--------- ---------

15,042.7 14,024.8

Less accumulated depreciation and amortization (6,353.3) (5,619.0)

--------- ---------

Total property, net 8,689.4 8,405.8

Goodwill 2,406.6 2,404.9

Prepaid pension costs 321.0 418.7

Investments in unconsolidated affiliates 187.6 191.8

Other assets 175.1 167.8

--------- ---------

Total assets $15,377.4 $15,096.7

--------- ---------

Safeway 2004 Financial Statements page 8 of 13

--------------------------------------------------------------------------------

Consolidated Balance Sheets

SAFEWAY INC. AND SUBSIDIARIES

Year-end Year-end

2004 2003

--------- ----------

(In millions, except per-share amounts)

Liabilities and Stockholders' Equity

Current liabilities:

Current maturities of notes and debentures $ 596.9 $ 699.5

Current obligations under capital leases 42.8 50.5

Accounts payable 1,759.4 1,509.6

Accrued salaries and wages 426.4 406.0

Income taxes 270.3 134.0

Other accrued liabilities 696.3 664.7

--------- ----------

Total current liabilities 3,792.1 3,464.3

--------- ----------

Long-term debt:

Notes and debentures 5,469.7 6,404.0

Obligations under capital leases 654.0 668.3

--------- ----------

Total long-term debt 6,123.7 7,072.3

.

.

--------- ----------

Total liabilities 11,070.5 11,452.4

--------- ----------

Commitments and contingencies

Stockholders' equity:

Common stock: par value $0.01 per share; 1,500 shares authorized; 578.5 and 575.4 shares issued 5.8 5.8

Additional paid-in capital 3,373.1 3,334.6

Treasury stock at cost; 130.8 and 131.2 shares (3,879.7) (3,887.4)

Deferred stock compensation (15.2) (14.0)

Accumulated other comprehensive income 144.9 87.5

Retained earnings 4,678.0 4,117.8

--------- ----------

Total stockholders' equity 4,306.9 3,644.3

--------- ----------

Total liabilities and stockholders' equity $15,377.4 $15,096.7

Safeway 2004 Financial Statements page 9 of 13

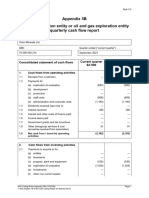

Consolidated Statement of Cash Flows

SAFEWAY INC. AND SUBSIDIARIES

52 Weeks

53 Weeks 52 Weeks

2004 2003 2002

--------- -------- ---------

(In millions)

Operating Activities:

Net income (loss) $ 560.2 $ (169.8)$ (828.1)

.

.

.

.

.

Depreciation and amortization 894.6 863.6 888.3

Deferred income taxes (29.2) (77.9) 64.9

.

.

Loss (gain) on property retirements 20.6 (13.4) 19.3

Changes in working capital items:

Receivables 46.3 56.6 (39.9)

Inventories at FIFO cost (61.9) 144.4 (107.7)

Prepaid expenses and other current assets 50.9 (72.8) 55.6

Income taxes 218.1 21.5 (90.7)

Payables and accruals 284.8 (412.7) (127.8)

--------- -------- ---------

Net cash flow from operating activities 2,226.4 1,609.6 2,034.7

--------- -------- ---------

Investing Activities:

Cash paid for property additions (1,212.5) (935.8) (1,467.4)

Proceeds from sale of property 194.7 189.0 113.2

Other (52.5) (48.2) (41.5)

--------- -------- ---------

Net cash flow used by investing activities (1,070.3) (795.0) (1,395.7)

--------------------------------------------------------------------------------

Safeway 2004 Financial Statements page 10 of 13

Consolidated Statements of Cash Flows

SAFEWAY INC. AND SUBSIDIARIES

52 Weeks 53 Weeks 52 Weeks

2004 2003 2002

--------- --------- ---------

(In millions)

Financing Activities:

Additions to short-term borrowings $ 11.2 $ 2.6 $ 1.4

Payments on short-term borrowings (1.5) (3.1) (3.5)

Additions to long-term borrowings 1,173.5 1,592.0 2,919.3

Payments on long-term borrowings (2,278.6) (2,331.0) (2,063.2)

.

.

.

--------- --------- ---------

Net cash flow used by financing activities (1,077.6) (724.0) (631.3)

--------- --------- ---------

Effect of changes in exchange rates on cash 13.5 8.2 (0.2)

--------- --------- ---------

Increase in cash and equivalents 92.0 98.8 7.5

Cash and Equivalents

Beginning of year 174.8 76.0 68.5

--------- --------- ---------

End of year $ 266.8 $ 174.8 $ 76.0

--------- --------- ---------

Other Cash Information:

Cash payments during the year for:

Interest $ 434.8 $ 464.2 $ 440.

Income taxes, net of refunds 43.8 361.6 686.2

Noncash Investing and Financing Activities:

Tax benefit from stock options exercised $ 17.4 $ 13.6 $ 29.2

Capital lease obligations entered into 35.9 113.2 174.9

Mortgage notes assumed in property additions 5.5 -- 5.9

Safeway 2004 Financial Statements page 11 of 13

Notes to Consolidated Financial Statements

SAFEWAY INC. AND SUBSIDIARIES

Note E: Lease Obligations

As of year-end 2004, future minimum rental payments applicable to non-cancelable

capital and operating leases with remaining terms in excess of one year were as

follows (in millions):

Operating

Capital

Leases Leases

-------- ---------

2005 $ 111.6 $ 405.9

2006 105.5 396.8

2007 102.4 380.9

2008 99.0 362.5

2009 96.0 328.3

Thereafter 902.1 2,778.6

-------- ---------

Total minimum lease payments 1,416.6 $ 4,653.0

---------

Less amounts representing interest (719.8)

--------

Present value of net minimum lease payments 696.8

Less current obligations (42.8)

--------

Long-term obligations $ 654.0

--------

Amortization expense for property under capital leases was $43.4 million in 2004,

$35.4 million in 2003 and $42.4 million in 2002. Accumulated amortization of property

under capital leases was $230.9 million at year-end 2004 and $181.6 million at year-

end 2003.

Safeway 2004 Financial Statements page 12 of 13

Note H: Taxes on Income

The components of income tax expense are as follows (in millions):

2004 2003 2002

------- ------ ------

Current:

Federal $ 153.5 $251.5 $470.0

State 25.7 51.8 63.6

Foreign 83.7 85.5 61.9

------- ------ ------

262.9 388.8 595.5

------- ------ ------

Deferred:

Federal (17.4) (48.5) 81.6

State (10.6) (24.5) (15.1)

Foreign (1.2) (4.9) (1.6)

------- ------ ------

(29.2) (77.9) 64.9

------- ------ ------

$233.7 $310.9 $660.4

------- ------ ------

Reconciliation of the provision for income taxes at the U.S. federal statutory income

tax rate to the Company's income taxes is as follows (dollars in millions):

2004 2003 2002

------ ------ ------

Statutory rate 35% 35% 35%

Income tax expense using federal statutory rate$277.9 $ 49.4 $186.3

State taxes on income net of federal benefit 9.8 17.7 31.5

Nondeductible goodwill impairment -- 255.2 450.8

Equity earnings of foreign affiliates (1.5) 7.0 (2.7)

Charitable donations of inventory (9.8) (8.5) (7.4)

Affiliate's losses not currently benefitted 3.3 4.1 18.4

Tax settlements (40.0) (6.2) (19.2)

Other (6.0) (7.8) 2.7

------ ------ ------

$233.7 $310.9 $660.4

------ ------ ------

Safeway 2004 Financial Statements page 13 of 13

Significant components of the Company's net deferred tax liability at year-end were as

follows (in millions):

2004 2003

------ ------

Deferred tax assets:

Workers' compensation and other claims$201.1 $166.5

Reserves not currently deductible 95.1 66.3

Accrued claims and other liabilities 34.1 38.6

Employee benefits 56.7 24.6

Charitable contribution carryforwards 29.0 -

Operating loss carryforwards 74.4 66.3

Other assets 56.5 108.4

------ ------

546.9 470.7

------ ------

Valuation allowance (74.4) (66.3)

------ ------

$472.5 $404.4

Deferred tax liabilities:

Property $(514.6)$(440.4)

Prepaid pension costs (121.1) (176.5)

Inventory (193.9) (175.3)

Investments in foreign operations (123.6) (114.8)

------- -------

(953.2) (907.0)

------- -------

Net deferred tax liability (480.7) (502.6)

------- -------

Less: current liability (17.1) (80.7)

------- -------

Long-term portion $(463.6)$(421.9)

------- -------

You might also like

- BEMLDocument7 pagesBEMLdurgesh varunNo ratings yet

- Quarterly ResultsDocument1 pageQuarterly ResultsPriya SahniNo ratings yet

- Money ControlDocument2 pagesMoney ControlSudhir KumarNo ratings yet

- Fin 3Document5 pagesFin 3Mary DenizeNo ratings yet

- Part I Financial StatementDocument18 pagesPart I Financial Statementbebe143No ratings yet

- Document Incorporated by Reference EBI F Cial Statements 2007 2009-08-17Document80 pagesDocument Incorporated by Reference EBI F Cial Statements 2007 2009-08-17Megan KosNo ratings yet

- Final FA ProjectDocument28 pagesFinal FA Projectapi-19592137No ratings yet

- Go Digit General Insurance Limited Financials Income StatementDocument3 pagesGo Digit General Insurance Limited Financials Income StatementShuchita AgarwalNo ratings yet

- NIVS. 2009 SAIC Filing TranslatedDocument3 pagesNIVS. 2009 SAIC Filing Translatedwensley2001No ratings yet

- Sell Fast Household Appliances Financial Statements 2008Document21 pagesSell Fast Household Appliances Financial Statements 2008ashokawijesingheNo ratings yet

- Scotts Miracle-Gro (SMG) : Amounts in $ Millions 30-Sep-21 30-Sep-20 30-Sep-19Document4 pagesScotts Miracle-Gro (SMG) : Amounts in $ Millions 30-Sep-21 30-Sep-20 30-Sep-19Ridoy RiNo ratings yet

- DAMAC 2013 Signed Audited Financials Statements 1Document43 pagesDAMAC 2013 Signed Audited Financials Statements 1Jai GaneshNo ratings yet

- P&L Groupfit Insurence Brokers PVT LTDDocument2 pagesP&L Groupfit Insurence Brokers PVT LTDmadhusudhan N RNo ratings yet

- CPG Annual Report 2015Document56 pagesCPG Annual Report 2015Anonymous 2vtxh4No ratings yet

- Beijing Tongrentang Co LTD (600085 CH) - As ReportedDocument6 pagesBeijing Tongrentang Co LTD (600085 CH) - As ReportedWen Yau LeeNo ratings yet

- Consolidated Balance Sheet of Reliance Industries: - in Rs. Cr.Document58 pagesConsolidated Balance Sheet of Reliance Industries: - in Rs. Cr.rotiNo ratings yet

- Weighted ComaniesDocument58 pagesWeighted ComaniesrotiNo ratings yet

- FinanzasDocument12 pagesFinanzasYamilet Maria InquillaNo ratings yet

- Business Information Report: ReferenceDocument7 pagesBusiness Information Report: ReferenceAlina AlinaNo ratings yet

- Aleph FM.2009 12Document7 pagesAleph FM.2009 12hunegnaw aberaNo ratings yet

- 5 Year Financial PlanDocument20 pages5 Year Financial PlanNKITDOSHI100% (1)

- PNX Income Statement AnalysisDocument12 pagesPNX Income Statement AnalysisDave Emmanuel SadunanNo ratings yet

- Brown-Forman 1978 Financial Data ComparisonDocument10 pagesBrown-Forman 1978 Financial Data ComparisonLina XuNo ratings yet

- In Millions of Euros, Except For Per Share DataDocument33 pagesIn Millions of Euros, Except For Per Share DataGrace StylesNo ratings yet

- The Analysis of The Balance Sheet and The Income StatementDocument42 pagesThe Analysis of The Balance Sheet and The Income Statementdeepak_iitk_iimkNo ratings yet

- December 2006 P4 QuestionDocument11 pagesDecember 2006 P4 QuestionKrishantha WeerasiriNo ratings yet

- CapitaLand Limited SGX C31 Financials Income StatementDocument3 pagesCapitaLand Limited SGX C31 Financials Income StatementElvin TanNo ratings yet

- History of The CompanyDocument5 pagesHistory of The CompanyAkshata HadimaniNo ratings yet

- What You Will Learn in This ChapterDocument18 pagesWhat You Will Learn in This Chaptermuhammad raflyNo ratings yet

- Sunbeam Group AssignmentDocument9 pagesSunbeam Group Assignmentshubhangini SaindaneNo ratings yet

- 1.1 Sunpharma and Pfizer 1 2 3 4Document7 pages1.1 Sunpharma and Pfizer 1 2 3 4AnanthkrishnanNo ratings yet

- FY 2014 Consolidated Financial StatementsDocument99 pagesFY 2014 Consolidated Financial StatementsGrace StylesNo ratings yet

- Intel Corp Q4 Income StatementDocument99 pagesIntel Corp Q4 Income StatementArturo Del RealNo ratings yet

- Starbucks 2010 ExcerptsDocument7 pagesStarbucks 2010 ExcerptsRichard PillNo ratings yet

- ECO280 LastYear Quiz1Document4 pagesECO280 LastYear Quiz1görkem kayaNo ratings yet

- SEC Filings - Microsoft - 0001032210-98-000519Document18 pagesSEC Filings - Microsoft - 0001032210-98-000519highfinanceNo ratings yet

- 2017 Revenues 41,381 40,859: (In Millions of Euros, Except For Per Share Data)Document37 pages2017 Revenues 41,381 40,859: (In Millions of Euros, Except For Per Share Data)Cristina PascariNo ratings yet

- Milkfood Annual Report 2021Document108 pagesMilkfood Annual Report 2021Kamalapati BeheraNo ratings yet

- Ceat LTD (CEAT IN) - As ReportedDocument24 pagesCeat LTD (CEAT IN) - As ReportedAman SareenNo ratings yet

- Ecobank Ghana PLC: Un-Audited Financial Statements For The Six-Month Period Ended 30 June 2022Document8 pagesEcobank Ghana PLC: Un-Audited Financial Statements For The Six-Month Period Ended 30 June 2022Fuaad DodooNo ratings yet

- Unit 7Document29 pagesUnit 7FantayNo ratings yet

- Week 1 IntroductionDocument28 pagesWeek 1 IntroductionAbhijit ChokshiNo ratings yet

- NTBCL Q1 FY2012 Financial ResultsDocument4 pagesNTBCL Q1 FY2012 Financial ResultsAlok SinghalNo ratings yet

- Chapter 11Document39 pagesChapter 11Muthia Khairani100% (1)

- ROE Disaggregation Exercise - P&GDocument3 pagesROE Disaggregation Exercise - P&GPepe GeoNo ratings yet

- Advanced Financial Management (Singapore) : Thursday 4 June 2009Document13 pagesAdvanced Financial Management (Singapore) : Thursday 4 June 2009Lim CZNo ratings yet

- September 2023 Quarterly Cash Flow ReportDocument6 pagesSeptember 2023 Quarterly Cash Flow ReportPhilip KennyNo ratings yet

- Ecobank Ghana PLC: Un-Audited Financial Statements For The Nine-Month Period Ended 30 September 2021Document8 pagesEcobank Ghana PLC: Un-Audited Financial Statements For The Nine-Month Period Ended 30 September 2021Fuaad DodooNo ratings yet

- Chap 011Document38 pagesChap 011Loser NeetNo ratings yet

- HONG FOK CORPORATION FULL YEAR FINANCIAL STATEMENTDocument8 pagesHONG FOK CORPORATION FULL YEAR FINANCIAL STATEMENTTheng RogerNo ratings yet

- Cash Flow Analysis Col Pal 13-07-2023Document17 pagesCash Flow Analysis Col Pal 13-07-2023RohitNo ratings yet

- Samsung Electronics interim consolidated statements of changes in equityDocument4 pagesSamsung Electronics interim consolidated statements of changes in equityMohammadNo ratings yet

- F9 June 2010 Q-4Document1 pageF9 June 2010 Q-4rbaambaNo ratings yet

- 12 Coca-Cola Item8Document62 pages12 Coca-Cola Item8prabhat127No ratings yet

- Trabajo de Contabilidad en InglesDocument5 pagesTrabajo de Contabilidad en Inglescarmen viquezNo ratings yet

- Accounting Clinic IDocument40 pagesAccounting Clinic IRitesh Batra100% (1)

- RCOM 4thconsoliated 09-10Document3 pagesRCOM 4thconsoliated 09-10Goutam YenupuriNo ratings yet

- Pt11. Equity AnalysisDocument20 pagesPt11. Equity AnalysisANASTASIA AMEILIANo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- EmotionDocument44 pagesEmotiongoot11No ratings yet

- Geol 130Document9 pagesGeol 130goot11No ratings yet

- Assignment #5: Currency Value FundDocument3 pagesAssignment #5: Currency Value Fundgoot11No ratings yet

- Case Book Wharton 2006Document43 pagesCase Book Wharton 2006zeronomity100% (9)

- International Financial Markets OptionsDocument65 pagesInternational Financial Markets Optionsgoot11No ratings yet

- Excel Shortcuts 2007Document2 pagesExcel Shortcuts 2007datacureNo ratings yet

- L&T AssignmentDocument5 pagesL&T AssignmentShankar SubramanianNo ratings yet

- ACCO 320 Midterm Exam ReviewDocument16 pagesACCO 320 Midterm Exam ReviewzzNo ratings yet

- IAS8-Summary Notes PDFDocument8 pagesIAS8-Summary Notes PDFWaqas Younas BandukdaNo ratings yet

- Csec Poa Handout 3Document32 pagesCsec Poa Handout 3Taariq Abdul-MajeedNo ratings yet

- Foreign Exchange and Foreign Trade in Al Arafah Islami Bank LTDDocument51 pagesForeign Exchange and Foreign Trade in Al Arafah Islami Bank LTDZunaid HasanNo ratings yet

- Business CombinationDocument7 pagesBusiness CombinationEmma Mariz GarciaNo ratings yet

- Chapter 4 - Accounting For DisbursementsDocument12 pagesChapter 4 - Accounting For DisbursementsErika Villanueva Magallanes0% (1)

- SOP - Front OfficeDocument114 pagesSOP - Front Officetomzayco100% (8)

- Analysis Laporan Keuangan PT Gajah TunggalDocument4 pagesAnalysis Laporan Keuangan PT Gajah TunggalBramastho PutroNo ratings yet

- Presentation 1 OishiDocument22 pagesPresentation 1 Oishiglenn langcuyanNo ratings yet

- Philippine Women's College of Davao Scholarship and Grant OpportunitiesDocument22 pagesPhilippine Women's College of Davao Scholarship and Grant OpportunitiesRowena JovalNo ratings yet

- The Strategy of International BusinessDocument68 pagesThe Strategy of International BusinessPrachi RajanNo ratings yet

- PCL - Boiler O&M - 20may19 PDFDocument3 pagesPCL - Boiler O&M - 20may19 PDFgopala krishnanNo ratings yet

- 04) City Government of San Pablo v. ReyesDocument2 pages04) City Government of San Pablo v. ReyesJosiah BagayasNo ratings yet

- Q 13-1 RELEVANT COST: A Cost That Differs BetweenDocument5 pagesQ 13-1 RELEVANT COST: A Cost That Differs Betweensiti nazirahNo ratings yet

- BSNL TM SalaryDocument1 pageBSNL TM SalaryDharmveer SinghNo ratings yet

- ControllingDocument27 pagesControllingArvin Delos ReyesNo ratings yet

- ADF Foods Limited - Report - 17th June 2008 - DhananjayanDocument2 pagesADF Foods Limited - Report - 17th June 2008 - Dhananjayanapi-3702531No ratings yet

- Mid Term Exam - MBA - Management Accounting - MBAT 202 - OnlineDocument2 pagesMid Term Exam - MBA - Management Accounting - MBAT 202 - OnlineDullStar MOTONo ratings yet

- Currency ConversionDocument33 pagesCurrency ConversionSruthi NairNo ratings yet

- Presentation ON International Cash Management: Submitted by Vandana Meena M.Ocm 2 YearDocument6 pagesPresentation ON International Cash Management: Submitted by Vandana Meena M.Ocm 2 YearpriyaNo ratings yet

- Auditing Inventory Management ProcessDocument51 pagesAuditing Inventory Management Processgilli1tr67% (3)

- Hilton Chapter 14 Adobe Connect LiveDocument18 pagesHilton Chapter 14 Adobe Connect LiveGirlie Regilme BalingbingNo ratings yet

- Tugas GSLC Corp Finance Session 17 & 18Document8 pagesTugas GSLC Corp Finance Session 17 & 18Javier Noel Claudio100% (1)

- HDFC Bank Limited: "Melioration in Asset Quality Marginal Compression in NIM Initiating Coverage With HOLD"Document18 pagesHDFC Bank Limited: "Melioration in Asset Quality Marginal Compression in NIM Initiating Coverage With HOLD"janu_ballav9913No ratings yet

- PGBP QuestionsDocument6 pagesPGBP QuestionsHdkakaksjsb100% (2)

- Application For Refund: Section 1 - Applicant InformationDocument3 pagesApplication For Refund: Section 1 - Applicant InformationDaniel Christian-Grafton HutchinsonNo ratings yet

- Limitation of LiabilityDocument2 pagesLimitation of Liabilityapi-143391423No ratings yet

- SAP - C - TFIN52 - 66 (SAP Certified Application Associate - Financial Accounting With SAP ERP 6.0 EHP4)Document16 pagesSAP - C - TFIN52 - 66 (SAP Certified Application Associate - Financial Accounting With SAP ERP 6.0 EHP4)Nahit100% (1)

- What Is The Accounting Cycle?: Financial Statements BookkeeperDocument4 pagesWhat Is The Accounting Cycle?: Financial Statements Bookkeepermarissa casareno almueteNo ratings yet