Professional Documents

Culture Documents

The US Mobile App Report

Uploaded by

nicholasdeleoncirca0 ratings0% found this document useful (0 votes)

161 views18 pagesThe+US+Mobile+App+Report

Original Title

The+US+Mobile+App+Report

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe+US+Mobile+App+Report

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

161 views18 pagesThe US Mobile App Report

Uploaded by

nicholasdeleoncircaThe+US+Mobile+App+Report

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 18

PAGE 1

The U.S. Mobile App Report

T U.S.

Mobil App

Repor

PAGE 2

Introduction

It wasnt too long ago when the desktop computer was

the dominant online platform and the central hub for all the

consumers digital activities. But with the proliferation of

smartphones, soon followed by the tremendous success of the

tablet, mobiles rise has been swift and unrelenting. Last year

saw the U.S. become a multi-platform majority, a signicant

milestone in which the majority of digital consumers used both

desktop and mobile devices every month. Around the same time,

mobile rst surpassed desktop in terms of total digital media

engagement. And nally, just this year another key milestone was

reached the app majority where now the majority of all

digital media time spent occurs on mobile apps.

PAGE 3

The U.S. Mobile App Report

While the meteoric growth of apps transpired quickly, this

shouldnt come as too much of a surprise. After all, apps are

the fuel that is driving mobiles growth and where most of the

devices utility comes from. They allow you to perform tasks such

as hailing a cab, checking the weather, posting a Facebook

status, streaming music, watching videos, and so much more.

Without apps, smartphones and tablets are merely shells like

a beautifully designed car equipped with every feature you could

want, but without any gas in the engine.

But despite the fact that engagement is now higher on apps

than on desktop and mobile browser, they have not attracted

the advertising dollars its audience warrants. Like any emerging

advertising medium, it takes time for the ad buying and selling

infrastructure to develop. The good news is that, throughout the

history of media, dollars eventually follow eyeballs, which means

that the future of the mobile app economy is very bright.

PAGE 4

Total U.S. digital media time spent has jumped 24 percent in the past year,

driven by a surge in mobile app usage, which increased 52 percent. While

mobile usage has been growing fast, it has not come at the expense of desktop

computer usage, which still managed to grow by 1 percent.

The strong growth in mobile app usage has propelled it to take over the majority

of digital media time spent at 52 percent. Total mobile activity including mobile

browser usage recently eclipsed 60 percent, as desktop now accounts for the

remaining 40 percent.

Apps drive the vast majority of media consumption activity on mobile devices,

accounting for approximately 7 out of every 8 minutes. Smartphones have a

slightly higher percentage of app activity as compared to browser at 88 percent

vs. 82 percent on tablets.

1

Te Mobile Landscape

Digital Time Spent Growth Driven by Apps

Source: comScore Media Metrix Multi-Platform & Mobile Metrix, U.S., June 2013 - June 2014

Mobile Web

Mobile App

Desktop

Jun 2013 Jun 2014

1,400

1,200

1,000

800

600

400

200

0

+17%

+24%

+52%

+1%

M

i

n

u

t

e

s

(

B

i

l

l

i

o

n

s

)

PAGE 5

The U.S. Mobile App Report

Mobile App vs. Browser Splits

Source: comScore Mobile Metrix, U.S., Age 18+, June 2014

Share of U.S. Digital Media Time Spent by Platform

Source: comScore Media Metrix Multi-Platform & Mobile Metrix, U.S., March 2013 - June 2014

Browser

App

Smartphone Tablet

12%

88%

18%

82%

Desktop

Mobile

Mobile App

65%

60%

55%

50%

45%

40%

35%

30%

Mar 2013 Jun 2013 Sep 2013 Dec 2013 Mar 2014 Jun 2014

53%

40%

47%

40%

60%

52%

PAGE 6

More than one-third of all U.S. smartphone owners download at least one

app per month. The average smartphone user within this segment downloads

three apps per month, meaning that the average among the entire smartphone

population comes out to slightly more than one. Moreover, the total number of

app downloads is highly concentrated within a small segment of the smartphone

population, with the top 7 percent of owners accounting for nearly half of all

download activity in a given month.

Americans have a difcult time living without their mobile devices, as evidenced

by the vast majority of consumers using apps on their smartphones and tablets

nearly every day. More than half (57 percent) of smartphone users accessed

apps every single day of the month, while 26 percent of tablet users did so. A

full 79 percent of smartphone users accessed apps at least 26 days per month,

while 52 percent of tablet users did so.

A staggering 42 percent of all app time spent on smartphones occurs on the

individuals single most used app. Nearly three out of every four minutes of app

usage occurs on one of the individuals top 4 apps.

2

App User Habits

Smartphone Users Number of App Downloads Per Month

Source: comScore MobiLens, U.S., Age 18+, 3 Month Average Ending June 2014

0 Apps

Any Apps

1 App

2 Apps

3 Apps

4 Apps

5-7 Apps

8+ Apps

8.4%

8.9%

6.2%

3.7%

4.8%

2.4%

65.5% 34.5%

PAGE 7

The U.S. Mobile App Report

Share of Time Spent on Apps Across Ranks

Source: comScore Custom Analytics, U.S., Age 18+, June 2014

1 2 3 4 5 6 7 8 9 10 11+

12%

1% 1%

2% 2%

3%

4%

6%

10%

17%

42% 45%

40%

35%

30%

25%

20%

15%

10%

5%

0%

Individuals Top Ranked App by Usage

Number of App Usage Days Per Month

Source: comScore Custom Analytics, U.S., Age 18+, June 2014

Smartphone Tablet

100%

80%

60%

40%

20%

0%

30 Days

26-29 Days

21-25 Days

16-20 Days

1-15 Days

57%

23%

111%

5%

5%

26%

27%

119%

13%

16%

PAGE 8

The median iPhone app user earns $85,000 per year, which is 40 percent more

than the median Android phone user with an annual income of $61,000. On

average, iPhone users engage with their smartphone apps for nine more hours in

a given month than Android users.

Android ranks as the top smartphone operating system with 83.8 million

U.S. smartphone subscribers, approximately 16.4 million more than Apples

iOS platform. Due to Androids fragmented ecosystem of original equipment

manufacturers (OEMs) running its software, Apple remains the largest

smartphone OEM with 67.4 million owners and 100 percent of the iOS market.

iOS users skew younger than their Android counterparts across the smartphone

and tablet segments. 43 percent of iPhone users are between the ages of 18-34

as compared to 39 percent of Android phone users. In addition, 57 percent of

iPad users are under age 45 as compared to 53 percent of Android tablet users.

3

App Usage by Platform

iPhone Android Phone

62.6

Total App Users (MM)

76.1

40

Median Age

40

$85,000

Median Income

$61,000

64

Average Hours per App User

55

Top Line Platform Stats for App Usage

Source: comScore Mobile Metrix, U.S., Age 18+, June 2014

PAGE 9

The U.S. Mobile App Report

Mobile Platform App Audience Breakouts by Age

Source: comScore Mobile Metrix, U.S., Age 18+, June 2014

Apple Android

100,000

80,000

60,000

40,000

20,000

0

100%

14%

8%

12%

12%

54%

Other

HTC

Motorola

LG

Samsung

Apple

67.4 MM

83.8 MM

iPhone Android Phone iPad Android Tablet

100%

80%

60%

40%

20%

0%

Persons: 55+

Persons: 45-54

Persons: 35-44

Persons: 25-34

Persons: 18-24

20%

23%

20%

16%

21%

16%

23%

16%

22%

19%

20%

14%

24%

14%

19%

17%

26%

12%

22%

12%

20%

19%

28%

Market Share of OEMs by Smartphone Platform

Source: comScore MobiLens, U.S., Age 18+, 3 Month Average Ending June 2014

PAGE 10

A majority of mobile app engagement comes from only a select few categories,

with Social Networking, Games and Radio contributing nearly half of the total time

spent on mobile apps. The strength of these categories highlights that mobile

devices are more heavily used for entertainment and communication than their

desktop counterparts.

iPhone users spend a greater share of their app time consuming media, with

General News, Radio, Photos, Social Networking and Weather ranking as the

highest indexing categories on Apples iOS smartphone platform. In contrast,

Android phone users spend a greater share of their time in the Search and Email

categories due to the strong native presence of Google Search and Gmail on

the platform.

Consumers use different devices depending on the digital task they are trying to

accomplish, the type of media content they seek to engage with, and their physical

location at the time of consumption. Some categories such as Radio, Maps and

Instant Messengers achieve much higher reach on mobile, while others such as

Search and News reach a greater percentage of the audience on desktop.

5%

4%

4%

5%

8%

16%

25%

34%

Share of Mobile App Time Spent

Source: comScore Mobile Metrix, U.S., Age 18+, June 2014

Social Networking

Games

Radio

Multimedia

Retail

Instant Messengers

Photos

All Others

4

App Category Usage

PAGE 11

The U.S. Mobile App Report

Top Indexing App Categories by Smartphone Platform

Source: comScore Mobile Metrix, U.S., Age 18+, June 2014

155

149

141

123

117

General News

Radio

Photos

Social Networking

Weather

Retail

TV

Games

Search/Navigation

Android iOS

120

141

144

168

185

0 10 20 30 40 50 60 70 80 90 100

100

90

80

70

60

50

40

30

20

10

0

Mobile Skew

Desktop Skew

Radio

Games

Multimedia

Social Networking

Retail

Search/Navigation

General News

Sports

Health

Banking

Maps

Weather

Photos

Instant Messengers

Percent Audience Reach on Desktop and Mobile App by Category

Source: comScore Media Metrix & Mobile Metrix, U.S., June 2014

P

e

r

c

e

n

t

R

e

a

c

h

o

n

M

o

b

i

l

e

A

p

p

Percent Reach on Desktop

PAGE 12

The ranking of top apps is dominated by app constellations of some of the

largest digital media brands; specically, Facebook, Google, Apple, Yahoo,

Amazon and eBay. These six brands account for 9 of the top 10 most used apps,

16 of the top 25, and 24 of the top 50.

Facebook is the #1 app in both audience size and share of time spent among

each of the different demographic segments broken out, highlighting the breadth

and depth of its popularity and importance to the mobile media landscape.

Across all age segments, the most time is spent on leisure-oriented apps in

the Social Networking, Entertainment and Messaging categories. The younger

the age segment the higher the concentration of this activity, while older age

segments also allocate their time to more functional apps, such as Mail and

Maps, in addition to Games.

5

Top Apps

PAGE 13

The U.S. Mobile App Report

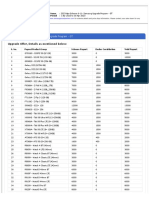

Top 25 Mobile Apps by Unique Visitors (000)

Source: comScore Mobile Metrix, U.S., Age 18+, June 2014

115,370

83,392

72,245

70,163

69,000

64,485

60,320

46,637

42,070

42,069

40,544

39,210

36,071

34,702

29,993

28,821

27,615

26,469

26,454

24,586

22,194

18,849

18,372

17,599

17,225

YouTube

Google Play

Google Search

Pandora Radio

Google Maps

Gmail

Apple Maps

Yahoo Stocks

iTunes Radio/iCloud

Facebook Messenger

Yahoo Weather Widget

The Weather Channel

Google+

Netix

Snapchat

Amazon Mobile

eBay

Skype

Shazam

Yahoo Mail

Kik Messenger

PAGE 14

14.8%

9.1%

6.6%

5.2%

3.4%

2.9%

2.5%

2.4%

2.3%

1.9%

Share of Mobile App Time Spent

Source: comScore Mobile Metrix, U.S., June 2014

Pandora Radio

YouTube

Snapchat

Kik Messenger

Facebook Messenger

Netix

Ifunny :)

Pandora Radio

YouTube

Netix

Facebook Messenger

Skype

Gmail

Google Maps

Age 18-24

Age 25-34

18.5%

7.5%

3.6%

2.7%

2.6%

2.5%

1.6%

1.3%

1.2%

1.2%

PAGE 15

The U.S. Mobile App Report

16.3%

4.0%

2.5%

1.6%

1.5%

1.3%

1.1%

1.1%

1.0%

0.9%

18.4%

4.1%

3.6%

2.5%

1.5%

1.4%

1.2%

1.2%

1.2%

1.1%

Pandora Radio

Facebook Messenger

YouTube

Netix

Viggle

Gmail

Candy Crush Saga

Facebook Messenger

Pandora Radio

YouTube

Yahoo Mail

Skype

Words With Friends (Free)

Solitaire by Mobilityware

Google Maps

Age 35-54

Age 55+

PAGE 16

WANT TO KNOW MORE ABOUT HOW, WHEN AND WHERE YOUR AUDIENCES

ARE ENGAGING WITH YOUR CONTENT AND CAMPAIGNS?

COMSCORE CAN GIVE YOU A TOTAL VIEW OF THE CONSUMER, HELPING YOU MAKE

SMARTER BUSINESS DECISIONS AND DISCERN THE TRUE VALUE OF MEDIA.

CONTACT US TODAY TO LEARN MORE.

PAGE 17

The U.S. Mobile App Report

STAY CONNECTED

www.facebook.com/comscoreinc

Follow us @comscore

www.linkedin.com/company/comscore

www.youtube.com/user/comscore

2014 comScore, Inc.

comScore, Media Metrix Multi-Platform, Mobile Metrix, MobiLens and Media Metrix, are the trademarks of comScore, Inc.

All other trademarks are the property of their owners. For information about the proprietary technology used in comScore products, please

refer to http://www.comscore.com/About_comScore/Patents.

PAGE 18

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Martin Criminal ComplaintDocument5 pagesMartin Criminal Complainttom clearyNo ratings yet

- FTC DirectvDocument17 pagesFTC DirectvnicholasdeleoncircaNo ratings yet

- Driskell V HomosexualsDocument7 pagesDriskell V Homosexualspatrickranderson4785No ratings yet

- Pacquiao LawsuitDocument10 pagesPacquiao LawsuitnicholasdeleoncircaNo ratings yet

- DCCoA 14-1242Document22 pagesDCCoA 14-1242tmocarskyNo ratings yet

- Ulbricht New Trial RejectedDocument1 pageUlbricht New Trial RejectednicholasdeleoncircaNo ratings yet

- Aereo Bankruptcy ApprovedDocument2 pagesAereo Bankruptcy ApprovednicholasdeleoncircaNo ratings yet

- A123 v. Apple Drafting SettlementDocument2 pagesA123 v. Apple Drafting SettlementDavid HolleyNo ratings yet

- Federal Communications Commission DA 15-563Document19 pagesFederal Communications Commission DA 15-563nicholasdeleoncircaNo ratings yet

- 2d Cir. Ruling: NSA Bulk Collection of American's Phone Records UnlawfulDocument112 pages2d Cir. Ruling: NSA Bulk Collection of American's Phone Records UnlawfulLeakSourceInfoNo ratings yet

- Wireless-Networks-Wp Extending Lte Advanced To Unlicensed Spectrum 1142014Document12 pagesWireless-Networks-Wp Extending Lte Advanced To Unlicensed Spectrum 1142014nicholasdeleoncircaNo ratings yet

- Homosexuality LawsuitDocument1 pageHomosexuality LawsuitnicholasdeleoncircaNo ratings yet

- Dhs EpicDocument21 pagesDhs EpicnicholasdeleoncircaNo ratings yet

- Ulbricht May 29Document1 pageUlbricht May 29nicholasdeleoncircaNo ratings yet

- Uber Lawsuit 04202015Document14 pagesUber Lawsuit 04202015nicholasdeleoncircaNo ratings yet

- NFB Uber LawsuitDocument28 pagesNFB Uber LawsuitnicholasdeleoncircaNo ratings yet

- Ceglia FB 042015Document9 pagesCeglia FB 042015nicholasdeleoncircaNo ratings yet

- Wilson North Carolina FCCDocument5 pagesWilson North Carolina FCCnicholasdeleoncircaNo ratings yet

- Ulbricht 04162015Document65 pagesUlbricht 04162015nicholasdeleoncircaNo ratings yet

- Q1 15 Earnings Letter Final TablesDocument11 pagesQ1 15 Earnings Letter Final TablesnicholasdeleoncircaNo ratings yet

- AT&T vs. FTCDocument23 pagesAT&T vs. FTCjbrodkin2000No ratings yet

- Amazon Sues Fake Product Review WebsitesDocument18 pagesAmazon Sues Fake Product Review WebsitesnicholasdeleoncircaNo ratings yet

- Ulbricht Rec. Doc. 226Document2 pagesUlbricht Rec. Doc. 226BrianNo ratings yet

- Gov Response For New DPR TrialDocument150 pagesGov Response For New DPR TrialnicholasdeleoncircaNo ratings yet

- 2015cybersanctions Eo RelDocument4 pages2015cybersanctions Eo RelnicholasdeleoncircaNo ratings yet

- RIAA 2014 ReportDocument4 pagesRIAA 2014 ReportnicholasdeleoncircaNo ratings yet

- EMI Summary Judgement Against GroovesharkDocument24 pagesEMI Summary Judgement Against GroovesharknicholasdeleoncircaNo ratings yet

- Sony Sells Half Olympus StakeDocument2 pagesSony Sells Half Olympus StakenicholasdeleoncircaNo ratings yet

- Class Action Lawsuit Filed Against Premera Blue CrossDocument33 pagesClass Action Lawsuit Filed Against Premera Blue CrossnicholasdeleoncircaNo ratings yet

- Case Management Conference Order in Reassigned CasesDocument11 pagesCase Management Conference Order in Reassigned CasesnicholasdeleoncircaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Review Tiktok 1573544803Document2 pagesReview Tiktok 1573544803Luxmi Devi8888No ratings yet

- Xiaomi: From Wikipedia, The Free EncyclopediaDocument18 pagesXiaomi: From Wikipedia, The Free EncyclopediaCris EzechialNo ratings yet

- Conduit User ManualDocument29 pagesConduit User ManualSamratNo ratings yet

- Iphone-12-07300291a-Repair-Internal View & Screw PositionDocument2 pagesIphone-12-07300291a-Repair-Internal View & Screw PositionAlfin BerutuNo ratings yet

- Marketing Capstone Samsung Mobiles - Note Series: Presented by Group-26 P.Murali - 035 Vipul - 068Document15 pagesMarketing Capstone Samsung Mobiles - Note Series: Presented by Group-26 P.Murali - 035 Vipul - 068Abhinav SinghNo ratings yet

- App Support For Linux Platforms Whitepaper November 2022Document12 pagesApp Support For Linux Platforms Whitepaper November 2022dragos.liaNo ratings yet

- Purple Screen On Phone - Google SearchDocument1 pagePurple Screen On Phone - Google SearchEiNo ratings yet

- School Messenger Parent FormDocument1 pageSchool Messenger Parent Formapi-294090423No ratings yet

- Over-The-Top (OTT) Services: How Operators Can Overcome The Fragmentation of CommunicationDocument35 pagesOver-The-Top (OTT) Services: How Operators Can Overcome The Fragmentation of CommunicationlcardonagNo ratings yet

- Quezon City Real-Time Air Quality Index (AQI) & Pollution Report - Air MattersDocument1 pageQuezon City Real-Time Air Quality Index (AQI) & Pollution Report - Air MattersAvery CruzNo ratings yet

- HyperCube iOS InstructionsDocument11 pagesHyperCube iOS InstructionsDRCNo ratings yet

- Android EraserDocument1 pageAndroid EraserPahomieNo ratings yet

- How To Install: Cydia: Open Cydia and Click On Manage - Sources - Edit - Then Add SourceDocument3 pagesHow To Install: Cydia: Open Cydia and Click On Manage - Sources - Edit - Then Add SourceAmari HarrodsNo ratings yet

- Samsung Galaxy A3 (2017) - Full Phone SpecificationsDocument2 pagesSamsung Galaxy A3 (2017) - Full Phone SpecificationsHandisaputra LinNo ratings yet

- How To Format Symbian S60 PhonesDocument3 pagesHow To Format Symbian S60 Phonesjelenjek83No ratings yet

- Nokias Mobile Battery Drain ProblemDocument12 pagesNokias Mobile Battery Drain ProblemKnico PerezNo ratings yet

- Mário Erbolato Tec JornalismoDocument256 pagesMário Erbolato Tec JornalismoHugo NunesNo ratings yet

- A11yprovider LogDocument254 pagesA11yprovider LogLuis MenaNo ratings yet

- User-Agents Facebook-Messenger ApplicationDocument140 pagesUser-Agents Facebook-Messenger ApplicationGenivee BuensalidoNo ratings yet

- How to Find & Change Your IMEI Number (LegallyDocument3 pagesHow to Find & Change Your IMEI Number (Legallymilanwin7100% (1)

- AELogDocument1 pageAELogツTømy Gacha SPღNo ratings yet

- #Curso de Redação - Prof. Diego Pereira (2018) - 1Document818 pages#Curso de Redação - Prof. Diego Pereira (2018) - 1Digital 2018No ratings yet

- Akciovy Cennik Zariadeni K Programom Sluzieb T Pausal - 2020 - 07 - 10 PDFDocument2 pagesAkciovy Cennik Zariadeni K Programom Sluzieb T Pausal - 2020 - 07 - 10 PDFMarian ZatkoNo ratings yet

- List HP BaruDocument8 pagesList HP BaruCV. ARRODAH AdvertisingNo ratings yet

- 2023-Apr-Scheme 6-11 - Samsung Upgrade Program - GT - (000171169 - R 0) - SIEL-37856Document3 pages2023-Apr-Scheme 6-11 - Samsung Upgrade Program - GT - (000171169 - R 0) - SIEL-37856Sachin JindalNo ratings yet

- Smart Watches - Suggest KeywordDocument223 pagesSmart Watches - Suggest KeywordadeNo ratings yet

- How To Turn Off or Reboot Iphone 12 or Any Other IphoneDocument3 pagesHow To Turn Off or Reboot Iphone 12 or Any Other IphoneARIS TRIYNo ratings yet

- Nield, D. (2019, June 11) - Review: The Samsung Galaxy S10 Is A Flagship Phone Worthy of The TitleDocument2 pagesNield, D. (2019, June 11) - Review: The Samsung Galaxy S10 Is A Flagship Phone Worthy of The TitlelouieNo ratings yet

- Component Placing Layout Xperia Z1 Compact D5503, M51w PDFDocument2 pagesComponent Placing Layout Xperia Z1 Compact D5503, M51w PDFCelublack CkNo ratings yet

- Free Fifa 22 Coins Points Free ManualDocument2 pagesFree Fifa 22 Coins Points Free Manualapi-556698398No ratings yet