Professional Documents

Culture Documents

OS 20070501 May 2007

Uploaded by

elsaordunaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

OS 20070501 May 2007

Uploaded by

elsaordunaCopyright:

Available Formats

With offshore operations moving to

deeper fields, remote locations and

heavier oil, the ability to process fluids

at the seabed can radically change the

profitability of your fields.

Next Generation Subsea from FMC

Technologies makes it possible to

separate oil, gas, water and sand at the

seafloor, without the cost of lifting

all fluids to the surface. Subsea

processing, gas compression and

boosting enable efficient transfers of

hydrocarbons over greater distances,

eliminating the need for offshore

platforms in some fields.

The reality? You can boost production

and ultimate recovery rates from

existing fields and achieve the profit-

able development of new ones.

To learn more, visit Booth 1941 at

OTC. www.fmctechnologies.com

Enabling a New Reality

in Offshore Production

Next Generation Subsea

For more information, circle number 106

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

Superior Energy Services 1105 Peters Road Harvey, LA 70058 Phone: 504-362-4321 Fax: 504-362-4966 www.superiorenergy.com

A VIrrIrQ CIIfeIU GtreteQy

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

_______________

May 2007

Time-lapse 4D seismic FPSO report CGG/Veritas interview LWD vs. wireline logs

Houston London Paris Stavanger Aberdeen Singapore Moscow Baku Perth Rio de Janeiro Lagos Luanda

World Trends and Technology for Offshore Oil and Gas Operations

International

E&P report:

Region-by-region review & forecast

I

N

S

I

D

E

:

D

e

e

p

w

a

t

e

r

R

e

c

o

r

d

s

&

C

o

n

c

e

p

t

s

P

o

s

t

e

r

Innovative jackup

develops Caspian eld

For continuous news & analysis

www.offshore-mag.com

First DP FPU for GoM

For navigation instructions please click here

For navigation instructions please click here

Search Issue Next Page Contents Zoom In Zoom Out

Search Issue Next Page Contents Zoom In Zoom Out

Click here

to access

Supplement

Scorpion

Drilling | Evaluation | Completion | Production | Intervention

From routine to extreme.

When a client needed reliable drilling

data under extreme conditions in the

Gulf of Mexico, we delivered and set

a world record in the process.

To reach a record offshore depth of 34,189

feet at 30,000 psi, you need the most

advanced and dependable technology,

deployed by seasoned professionals who

consistently perform under pressure.

At Weatherford, we combine a commitment

to bringing you the industrys fastest, most

reliable LWD and MWD systems with an

approach geared to providing precisely the

expertise and services you need.

From high-end applications to everyday

situations, our complete suite of drilling

services is on hand to help you accurately

and efficiently place and evaluate formations,

reach targets, and keep drilling time and

costs to a minimum.

So, whatever your scenario, our standards

stay as high as ever.

To find out more about how our portfolio

of directional drilling, rotary steerable

services and drilling with casing services

can help you, visit www.weatherford.com

or contact your Weatherford representative.

All Around You.

2006 Weatherford International Ltd. All rights reserved. Incorporates proprietary and patented Weatherford technology.

For more information, circle number 1

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

At 3,048 m (10,000 ft.)

water depth, its no

time to experiment.

Its time to deliver.

At Aker Kvaerner Subsea, we

understand that to perform in todays

high-pressure, ultra-deepwater

production environments, you

need technology and experience.

Aker Kvaerner subsea trees,

controls, umbilicals and service

personnel are performing reliably

in many of the worlds largest

deepwater projects and our global

installed base continues to grow.

Aker Kvaerner knows that deepwater

production projects require innovative

solutions that exceed customers

needs. Our customer-centric approach

ensures that operators requirements are

metfrom concept through life-of-field.

So when youre planning your next

deepwater project, call Aker Kvaerner

for the right subsea solutions. Take a

deeper look visit the Subsea portion

of the Aker Kvaerner website.

Uncharted depths...not anymore

www.akerkvaerner.com

Copyright 2006. All rights reserved.

part of the Aker group

For more information, circle number 2

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

For more information, circle number 3

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

Offshore (ISSN 0030-0608) is published monthly by PennWell, 1421 S. Sheridan Road, Tulsa, OK 74112. Periodicals class postage paid at Tulsa, OK, and additional offces. Copyright 2007 by

PennWell. (Registered in U.S. Patent Trademark Offce.) All rights reserved. Permission, however, is granted for libraries and others registered with the Copyright Clearance Center, Inc. (CCC),

222 Rosewood Drive, Danvers, MA 01923, Phone (508) 750-8400, Fax (508) 750-4744 to photocopy articles for a base fee of $1 per copy of the article plus 35 per page. Payment should be

sent directly to the CCC. Requests for bulk orders should be addressed to the Editor. Subscription prices: US $ 83.00 per year, Canada/Mexico $ 109.00 per year, All other countries $138.00

per year (Airmail delivery: $193.00). Worldwide digital subscriptions: $83 per year. Single copy sales: US $7.50 per issue, Canada/Mexico $9.50 per issue, All other countries $11.50 per issue.

Return Undeliverable Canadian Addresses to: P.O. Box 122, Niagara Falls, ON L2E 6S4. Back issues are available upon request. POSTMASTER send form 3579 to Offshore, P.O. Box

3200, Northbrook, IL 60065-3200. To receive this magazine in digital format, go to www.omeda.com/os. Standard Mail A enclosed version P3.

International Edition

Volume 67, Number 5

May 2007

C ON T E N T S

E-TECHNOLOGY

Delivering the digital oileld: Access, timeliness among keys ................................ 54

The digital oileld is all about enhancing asset value and optimizing operations, production, and

reserves through application of information technology and practices.

DRILLING & COMPLETION

New impact technology could revolutionize wireline logging .................................. 56

Since the introduction of slickline technology for wellbore intervention, there has been a need

for a measurement device that can determine not only the strain on the wire, but the forces ap-

plied to the toolstring.

High-resolution LWD image logs versus wireline image logs .................................. 62

Today, high-resolution logging while-drilling (LWD) images are available, and they offer

information in real time, as well as the opportunity to acquire time-lapse information through

re-logging while tripping.

Oil-based mud imaging tool meets challenges ......................................................... 68

Improved oil and synthetic based drilling uids (muds) have been developed and are being used

to drill wells in hostile environments where high pressures, high temperatures, thick shales, and

shale sloughing are encountered.

PRODUCTION

Shah Deniz in full ow following complex platform set-down ................................ 70

Production is building at Shah Deniz in the Azeri sector of the Caspian. Under the rst phase of

the BP-operated development, nine wells will deliver up to 900 MMscf/d of gas and 58,000 b/d

of condensate.

$38 billion to go to oating production during 2007-2011 ....................................... 74

Recent years have seen a rapid expansion of the worlds FPSO eet, prompted in part by an in-

creased demand for drilling units that has reduced the number of semisubmersible rigs available

for conversion to production platforms.

Developing the right concept for offshore developments ...................................... 80

Selecting the right concept for producing an offshore eld can have a major impact on the suc-

cess of the project. In light of that fact, the conceptual phase needs to be scrutinized thoroughly.

Providing answers for un-testable wells .................................................................. 84

Well testing has been a critical step in well evaluation since the 1920s. It has always been the rst

real measurement of reservoir volumetrics and potential performance.

Full load test addresses concerns over Kashagan H

2

S gas compression ................ 90

Enhanced oil recovery (EOR) methodologies face increasingly extreme challenges when

handling gas streams characterized by high levels of contamination, as is the case with the giant

Kashagan oileld development offshore Kazakhstan.

SUBSEA

Worlds rst subsea processing system headed for Norway ................................... 92

The nal weld has been made on the separation unit for the worlds rst commercial subsea

processing unit bound for the North Seas Statoil-operated Tordis eld. Installation is scheduled

for the third quarter of this year.

INTERNATIONAL REPORT

GoM to see $7 billion

in deepwater drilling ....................... 34

The US Minerals Management Service

estimates undiscovered Gulf of Mexico

reserves at 50 Bboe. Estimated capex

for 2007 of $7 billion for deepwater

developments alone will contribute to

uncovering new GoM reserves.

North Sea holds steady ................... 38

Though there has been resurgence in

E&P in the UK North Sea, there is

some skepticism about whether the

level of investment will continue. High

rig rates and a lack of new tax incen-

tives could cause companies to rein in

their drilling plans.

International investment

pours into Africa .............................. 42

Billions of dollars in international in-

vestment have owed into West Africa

in the last few years, expanding explo-

ration drilling and moving a number of

world-class elds into production.

Caspian elds boost

regional production ......................... 46

Shah Deniz, one of the largest oil and

gas elds in the world at an estimated

1.5-3 Bbbl of oil and 50-100 bcm of

gas, came onstream last December.

Spending for upstream and midstream

development is expected to exceed $3

billion.

Growing economies

stimulate Asia-Pacic E&P ............. 50

Exploding economies in China, India,

and much of Southeast Asia are creat-

ing an increase in oil and gas demand.

The region is expected to lead the

world in of fshore spending in 2008.

Celebrating Over 50 Years of Trends, Tools, and Technology

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

World-class communications

anywhere in the world.

R E L I A B I L I T Y TO T H E E X T R E M E

www. Ca p Ro c k . c o m

With its advanced, global

satellite network, CapRock

Communications delivers

business-grade communications

to virtually any point on Earth.

No matter how far offshore or

how challenging the environment,

youll get the same quality

communications that youd find

in your corporate headquarters.

Available as a standard service

package or a custom-developed

network, CapRock satellite

solutions include telephone,

fax, e-mail, Internet, video and

secure networking. Thanks to

more than 25 years of experience,

world-leading reliability and

global satellite coverage, we

bring the services youve come

to expect to places you wouldnt

expect to find them.

Secure Corporate Access

Broadband Internet

Digital Telephony

Real-time Video

CapRock Communications, Inc. 2007.

All rights reserved.

For more information, circle number 4

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

______________________

6 Of fshore May 2007 www.offshore-mag.com

CONSTRUCTION & INSTALLATION

Helix to deploy rst ship-shaped DP FPU in Gulf of Mexico .................................... 97

Helix Energy Solutions is about to launch the rst ship-shaped, disconnectable, dynamically

positioned (DP), oating production unit in the GoM. The vessel will be used to exploit marginal

deepwater oil and gas prospects.

Jumbo Shipping exes muscles with all-in-one concept .................................... 102

The Netherlands-based Jumbo Shipping has completed a full years work with its J1800-class

Jumbo Javelin and Fairpartner DP-2, heavy-lift, transportation, and installation vessels, the rst

two of four vessels planned for the class.

Hull strength, fatigue analysis critical during design/conversion phase ............... 106

Structural issues reported on both purpose-built FPSOs and conversions after entering service

reveal the importance of hull strength and fatigue verication during the design/conversion

stage.

TRANSPORTATION & LOGISTICS

High-pressure exible pipe, the next frontier ......................................................... 110

Development of high pressure reservoirs over the past few years, with more expected in the

future, and the maturity of the spar platform concept for development of such reservoirs, has

increased the need for high pressure pipes.

Post.

Search.

Work!

PennTech

Thousands of new industry

jobs (Apply for free!)

Condential resume posting

available

E-mail job alerts for instant

notication of the latest postings

Salary Wizards (Are you getting

paid enough?)

Redening job search

for Engineers like you!

Post your prole today:

www.PennTechJOBS.com

International Edition

Volume 67, Number 5

May 2007

COVER: Superior Energy Services

200-ft class vessels, M/V Superior Inter-

vention and M/V Superior Excellence are

working as a duel vessel, multi-service

package in 72-ft of water in the Gulf

of Mexico Matagorda Island area. The

vessels are performing coiled tubing/ni-

trogen stimulation with electric wireline,

which stimulates depleting wells, maxi-

mizing well life. One vessel completed

hook-up and construction on the caisson

while the other vessel completed the

wells. This saved the operator on rig

time. The vessels are capable of working

in water depths to 145 ft. Photo taken by

Glen Clark.

102

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

_____

WaveCall Series: Systems from

10 to 60 inches provides voice

and data services in all the most

popular cruising spots.

Coastal Series Satellite TV:

18, 24and 30systems that

simply outperform the competition

in open water tests. Period.

The 04 Series

features 30 to 50 systems

with an industry-first touch

screen control.

Sea Tel, Inc. 925.798.7979 www.seatel.com Sea Tel Europe +44 2380 671155

Dont wait! The new 06 series from Sea Tel delivers

high-speed data, voice, video conferencing and virtual

networks - all at broadband speed, no matter what the conditions.

Tired of waiting for downloads at sea? Imagine Internet connectivity offshore the same as

you get on shore - always on, lightning fast and multiple users. WaveCall 4006 and 6006

give you blazingly fast inbound and outbound speeds for downloading large files,

streaming video, voice, video teleconferencing or simply surfing the web. With coverage

from North to South America, Northern Europe to the Med, and now in the Far East,

the 06 series is from the name you trust Sea Tel. Affordable broadband Internet-at-Sea

.

Work without the wait.

WaveCall

6006:

Look to the leader. Look to Sea Tel.

A Cobham Company

2

0

0

7

S

e

a

T

e

l

,

I

n

c

.

For more information, circle number 5

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

GEOLOGY & GEOPHYSICS

Newly merged seismic

super-group plans global expansion ............ 116

It is eight months since CGG and Veritas announced

their intention to merge, creating the worlds largest

seismic group. Of fshore asked CGGVeritas Christophe

Pettenati-Auziere, President, Geophysical Services, for

a progress report.

Time-lapse seismic swaths prove

cost-effective alternative to full-eld 4D ....... 120

With careful planning, time-lapse seismic technol-

ogy (4D) swaths can be a cost-effective alternative to

full-eld 4D seismic acquisition for structurally simple

elds and are important in Shells North Sea 4D strategy.

NOIA SUPPLEMENT

Offshore energy education must begin with the public and politicians ................ 130

Over the past 25 years, if one thing has proven true its that one Presidential Administration can-

not change our dependence on imported oil. Today, the United States continues to import 60% of

our oil and were more dependent on sources from the Middle East than we ever have been.

The rst step toward energy independence? .......................................................... 134

As I watched the Presidents State of Union address in January, I was struck that he, like Presi-

dents before him, was making a promise for energy independence. In more than 20 of the last 34

State of Union addresses since 1973, Presidents have tried to x the nations energy problems.

FRANCE SUPPLEMENT

Buoyant French contractors open to global business opportunities ..................... 148

Submarine ber-optic and DC power solution for ultra-long tieback .................... 150

Cryogenic oating exibles widen options for LNG transfer .................................. 152

Construction specialists seeking further alliance opportunities ........................... 154

Test loop assesses feasibility of deepwater subsea separation ............................ 156

DENMARK REPORT

Denmark promoting its skills in oating production, decommissioning ............... 159

Flexible riser passes tensile, fatigue tests .............................................................. 160

Ramboll assessing Russian pipeline impact ........................................................... 162

SWEDEN

Sweden technology proles ..................................................................................... 163

SURVIVING

ENERGY

PRICES

By Peter C. Beutel

Understand why, when, and

how to use different instruments

to hedge

Develop a sense of the forces

that affect price and how to

master them

Learn to interpret price charts

quickly

Quickly master trading jargon

Peter C. Beutel is president of

Cameron Hanover, an energy

risk management firm in New

Canaan, Connecticut. Beutel has

been quoted by every major wire

service and financial publication,

including Dow Jones, Associated

Press, Reuters, Bloomberg, The

Wall Street Journal, The New York

Times, Business Week, Money,

Fortune, and USA Today. He has

been seen regularly as a trading

and energy price consultant on

CNN, CNBC, ABC, CBS, NBC,

and Bloomberg, and heard on

radio stations across the U.S.

ISBN 1-59370-042-3 $69.00

Hardcover 195 Pages

February 2005

Order Today!

Toll-free: 1-800-752-9764

Intl: +1-918-831-9421

Online: PennWellBooks.com

NEW!

International Edition

Volume 67, Number 5

May 2007

D E P A R T M E N T S

Comment ............................................. 10

Data ..................................................... 12

Global E&P .......................................... 14

Offshore Europe .................................. 18

Gulf of Mexico ..................................... 20

Subsea/Surface Systems ................... 24

Vessels ................................................ 26

Drilling & Production .......................... 30

Geosciences ........................................ 32

Business Briefs ................................. 164

Advertisers Index ............................. 167

Beyond the Horizon .......................... 168

116

8 Of fshore May 2007 www.offshore-mag.com

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

Setting the Standard

for Safety, Service, and Solutions...

www.irtools.com

USA, CANADA & LATIN AMERICA

Ingersoll Rand

2724 Sixth Avenue South

Seattle, WA 98134 - USA

Tel: + 1 206 624 0466

Fax: + 1 206 624 6265

EUROPE, MIDDLE EAST & AFRICA

Ingersoll Rand

529, Avenue Roger Salengro

59450 Sin Le Noble, FRANCE

Tel: + 33 3 27 93 08 08

Fax: + 33 3 27 93 08 19

Certicate No. FM53539 Certicate No. QUAL/1991/309e

BS EN ISO 9001:2000

CERTIFIED

ISO 9001

CERTIFIED

ASIA PACIFIC

Ingersoll Rand SEA Pte. Ltd.

42 Benoi Road

Jurong, SINGAPORE 629903

Tel: + 65 6861 1555

Fax: + 65 6862 1373

2007 Ingersoll-Rand Company Limited

Visit us at the

Offshore Technology Conference (OTC)

April 30 - May 3, 2007 Houston, TX

Reliant Stadium, Booth 10645

For over 100 years Ingersoll Rand

has been providing safe, reliable and cost effective solutions

for the most demanding applications in the world.

With over half a million winches and hoists sold we are committed

to providing application, engineering and service support throughout your

equipments entire life cycle.

R

Safety

Engineering and design departments with over 200 years of combined experience

ISO certied manufacturing facilities

ABS and DNV type approved products

R

Service

ISO certied factory service centers with on-site

engineering support and test facilities

Global network of licensed service centers

Offshore certied technicians

R

Solutions

Winches to 50,000 lbs (22,727 kg) Man Rider

and utility versions available

Hoists to 200 metric tons

Low headroom BOP handling systems

Explosion proof hoists and winches

For more information, circle number 6

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

International E&P report

This issue features our annual International Report a complete roundup of offshore

exploration and production activity worldwide.

As she does every May, International Editor Judy Maksoud takes a re-

gion-by-region look at what has occurred in the last 12 months. She brings

you up to date on discoveries, eld developments, and new exploration

plans. As a veteran of this type of research, analysis, and reporting, Mak-

soud presents a lively, fact-lled review and forecast from West Africa to

the Gulf of Mexico, the North Sea to South America, and the Asia-Pacic to

offshore Canada. She covers the globe.

As you might expect to nd, a lot has happened in the last 12 months, and a lot more

is on the horizon. For the latest and the soon-to-be-expected, dont miss this annual fea-

ture. The 12-page special report begins on page 34.

TPG 500 moves outside North Sea

Production is building at Shah Deniz in the Azeri sector of the Caspian. Under the

rst phase of the BP-operated development, nine wells will deliver up to 900 MMcf/d of

gas and 58,000 b/d of condensate. All production is being exported through parallel sea

lines to a terminal in Sangachal, on the shore of Azerbaijan.

The wells are being drilled from a three-legged TPG 500 jackup platform, supplied

and installed by the projects main engineering contractor, Technip. Shah Deniz is the

third application of this proprietary design, the forerunners being BPs Har-

ding and Totals Elgin/Franklin in the North Sea.

In his feature on the development of Shan Deniz, Jeremy Beckman, Edi-

tor, Europe, talks with the project decision-makers about how and why the

concept was chosen. His report on their selection process and how the eld

was developed begins on page 70.

Helix to deploy rst ship-shaped DP FPU in Gulf of Mexico

As Managing Editor David Paganie points out in his feature on Helix

Energy Solutions, operators in the Gulf of Mexico continue to nd new ways

of dealing with challenging eld development and operational conditions.

Helix is about to launch the rst ship-shaped, disconnectable, dynami-

cally positioned (DP), oating production unit in the GoM. The vessel will

be used to exploit marginal deepwater oil and gas prospects.

The company also is managing a separate set of challenges at the instal-

lation site, where it continues to clear wreckage of the Typhoon TLP. Helixs oating

production unit (FPU), Helix Producer I (HPI), will be installed on the old Typhoon eld,

renamed Phoenix, in Green Canyon block 237 in 640 m (2,100 ft) of water.

In this Offshore exclusive report, Helix Executive Vice President and COO Bart

Heijermans discusses the decision behind the concept selection and the investments

upside potential, beginning on page 97.

Time-lapse seismic swaths prove cost-effective

With careful planning, time-lapse seismic technology (4D) swaths can be a cost-effec-

tive alternative to full-eld 4D seismic acquisition for structurally simple elds and are

important in Shells North Sea 4D strategy.

Thats the conclusion of a team of authors from Shell UK. The authors include Jon

Brain, Peter Grant, Rob Staples, and Erik Tijdens.

As they explain, the portfolio approach to 4D swath acquisition successfully acquired

time-lapse seismic data over four North Sea elds at low cost with minimal preparation.

In the case of Nelson and Guillemot elds, processed results support current business

activities. For Scoter and Cook elds, the results are less convincing. In all cases, valu-

able information was acquired.

Keys to technical success, they say, are out-of-plane geological dips, which result in

imaging errors and serious 4D non-repeatability. See their entire analysis beginning on

page 120.

10 Of fshore May 2007 www.offshore-mag.com

To respond to articles in Of fshore, or to of fer articles for publication, contact the editor by email

(eldonb@pennwell.com) or fax (1-713-963-6296).

COMMENT

Eldon Ball Houston

PennWell

1700 West Loop South, Suite 1000, Houston, TX 77027 U.S.A.

Tel: (01) 713 621-9720 Fax: (01) 713 963-6296

PRESIDENT,

PETROLEUM GROUP

Michael Silber

msilber@pennwell.com

VICE PRESIDENT and

GROUP PUBLISHER

John Royall

johnr@pennwell.com

SALES

WORLDWIDE SALES MANAGER

HOUSTON AREA SALES

David Davis davidd@pennwell.com Tel: (713) 963-6206

Bailey Simpson baileys@pennwell.com

CUSTOM PUBLISHING

Roy Markum roym@pennwell.com

Tel: (713) 963-6220

PRODUCTION MANAGER

Rae Lynn Cooper raec@pennwell.com

Tel: (918) 831-9143 Fax: (918) 831-9415

CIRCULATION MANAGER

Emily Haugsand emilyh@pennwell.com

Tel: (918) 832-9311 Fax: (918) 831-9482

SUBSCRIBER SERVICES

Contact subscriber services for address changes

Tel: (847) 559-7501 Fax: (847) 291-4816

Email: os@omeda.com

PETROLEUM EVENTS

Eldon Ball (Houston) eldonb@pennwell.com

Niki Vrettos (London) nikiv@pennwell.com

Frances Webb (London) francesw@pennwell.com

Gail Killough (Houston) gailk@pennwell.com

EDITORIAL ADVISORY BOARD

Luke R. Corbett, Anadarko

David J. Greer, Shell International E&P

Jack B. Moore, Cameron Corp.

Hugh ODonnell, Saipem

Bruce Crager, INTEC Engineering

James K. Wicklund, Spinnerhawk Capital Management

CORPORATE HEADQUARTERS

PennWell; 1421 S. Sheridan Rd., Tulsa, OK 74112

Member

All Rights reserved

Offshore ISSN-0030-0608

Printed in the U.S.A. GST No. 126813153

CHAIRMAN:

Frank T. Lauinger

PRESIDENT/CHIEF EXECUTIVE OFFICER:

Robert F. Biolchini

CHIEF FINANCIAL OFFICER:

Mark C. Wilmoth

Publications Mail Agreement Number 40052420

GST No. 126813153

POSTER EDITOR/TECHNICAL ADVISOR

E. Kurt Albaugh. P.E. kurt.albaugh@bhpbilliton.com

EDITOR-EUROPE

Jeremy Beckman (jeremyb@pennwell.com)

P.O. Box 32911, London SW19 5WL UK

Tel: +44 208 946 7783 Fax: +44 208 946 1543

CONTRIBUTING EDITORS

Nick Terdre (Norway)

David Shields (Mexico)

Peter Howard Wertheim (Brazil)

Gurdip Singh (Singapore)

EDITOR-IN-CHIEF

Eldon R. Ball

eldonb@pennwell.com

TECHNOLOGY EDITOR

Gene Kliewer

genek@pennwell.com

MANAGING EDITOR

David Paganie

davidp@pennwell.com

DRILLING & PRODUCTION EDITOR

Frank Hartley

frankh@pennwell.com

INTERNATIONAL EDITOR

Judy Maksoud

judym@pennwell.com

PRESENTATION EDITOR

Josh Troutman

josht@pennwell.com

Maksoud

Beckman

Paganie

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

HALLIBURTON

Drilling, Evaluation

and Digital Solutions

2007 Halliburton. All rights reserved.

the LOGIQ

Platform

Gone are the days when you had to choose between precision

and reliability. Halliburtons LOGIQ

TM

platform for openhole

and cased-hole wireline logging services is the industry

breakthrough that delivers it all. Encompassing advanced

downhole logging tools, a higher data rate telemetry

system and our powerful PC-based LOGIQ surface system,

it also features a dramatic reduction in the length and

weight of downhole tools without penalty in temperature

or pressure rating specifications. And with that shorter logging

tool string comes a much lower potential for sticking. All this

with superior service quality.

Halliburton Wireline and Perforating Services.

All things considered, the logical choice. For the rest of

the story, visit us at www.halliburton.com/wireline.

Unleash the energy.

Now you get laboratory

precision and rock-solid

reliabilityno compromise.

For more information, circle number 7

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

GLOBAL DATA

GoM drilling permits issued

D

r

i

l

l

i

n

g

p

e

r

m

i

t

s

100

90

80

70

60

50

40

30

20

10

0

Dec.

66

Mar.

64

Feb.

68

Sept.

55

Oct.

50

Nov.

53

Jan.

53

Source: US Minerals Management Service

US GoM

39 (0)

87 (0)

Floaters

Jackups

North Sea

40 (0)

35 (0)

East

Atlantic

Mex GoM

5 (0)

31 (0)

S. Asia

8 (+1)

32 (+2)

SE Asia

20 (-1)

37 (0)

Far East

3 (0)

16 (0)

M. East

1 (0)

91 (-3)

W. Africa

28 (+1)

26 (0)

L. America

29 (0)

15 (0)

Source: Rigzone.com

3 (+2)

0 (-4)

Active rig eet, April 2007

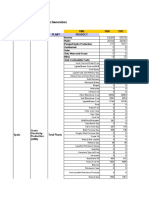

This month Infeld Systems comments on projects planned and

considered for development between 2007 and 2011. Asia is again

strong in the total number of foating platforms planned up until

2011, with 23% of the world totals followed by Africa and Latin

America with 19% and 17%, respectively.

Regionally, in terms of reserves coming onstream, the global

picture is dominated unsurprisingly by the Middle East with 39%

of world totals, but is most remarkably followed by the three

strong growth areas: Asia, Africa, and Latin America with 17%,

11%, and 11%, respectively.

12 Of fshore May 2007 www.offshore-mag.com

Worldwide offshore summary of projected field developments 2007-2011 WWW.INFIELD.COM, OTC STAND #2599

World Total 1,180 290 187,009 56,552 2,685 33 116 21 10 38 1,032 49 51 64,670 3,092

R

e

g

i

o

n

N

o

.

s

h

a

l

l

o

w

-

w

a

t

e

r

f

i

e

l

d

s

(

<

3

0

0

m

)

S

h

a

l

l

o

w

-

w

a

t

e

r

r

e

s

e

r

v

e

s

(

M

M

b

o

e

)

N

o

.

d

e

e

p

w

a

t

e

r

f

i

e

l

d

s

(

>

3

0

0

m

)

D

e

e

p

w

a

t

e

r

r

e

s

e

r

v

e

s

(

M

M

b

o

e

)

N

o

.

s

u

b

s

e

a

w

e

l

l

s

N

o

.

F

P

S

O

s

N

o

.

F

P

S

s

N

o

.

T

L

P

s

N

o

.

s

p

a

r

s

N

o

.

p

i

l

e

d

s

t

r

u

c

t

u

r

e

s

N

o

.

o

t

h

e

r

f

l

o

a

t

e

r

s

N

o

.

o

t

h

e

r

f

i

x

e

d

s

t

r

u

c

t

u

r

e

s

N

o

.

g

r

a

v

i

t

y

-

b

a

s

e

d

s

t

r

u

c

t

u

r

e

s

R

i

g

i

d

f

l

o

w

l

i

n

e

s

(

k

m

)

F

l

e

x

i

b

l

e

f

l

o

w

l

i

n

e

s

(

k

m

)

Gulf of Mexico day rates

Month/Year Minimum Average Maximum

Drillship

April 2006 $0 $216,401 $289,900

May 2006 $182,000 $233,650 $289,900

June 2006 $182,000 $234,139 $289,900

July 2006 $182,000 $234,483 $289,900

Aug 2006 $182,000 $234,513 $289,900

Sept 2006 $182,000 $240,482 $301,700

Oct 2006 $190,900 $244,660 $301,700

Nov 2006 $190,900 $244,683 $301,700

Dec 2006 $190,900 $244,256 $301,700

Jan 2007 $190,900 $243,583 $295,200

Feb 2007 $190,900 $250,162 $301,700

Mar 2007 $190,900 $250,683 $301,700

Jackup

April 2006 $52,000 $112,531 $170,000

May 2006 $52,000 $117,137 $195,000

June 2006 $65,000 $118,373 $195,000

July 2006 $65,000 $117,830 $195,000

Aug 2006 $65,000 $118,113 $185,000

Sept 2006 $65,000 $114,252 $185,000

Oct 2006 $0 $111,298 $175,000

Nov 2006 $0 $108,806 $185,000

Dec 2006 $0 $102,596 $185,000

Jan 2007 $0 $100,126 $185,000

Feb 2007 $0 $100,470 $185,000

March $0 $97,993 $185,000

Semi

April 2006 $62,000 $202,968 $400,000

May 2005 $62,000 $206,706 $400,000

June 2006 $0 $205,178 $400,000

July 2006 $0 $205,419 $385,500

Aug 2006 $0 $222,278 $385,500

Sept 2006 $0 $223,483 $385,500

Oct 2006 $95,000 $241,484 $385,500

Nov 2006 $102,000 $243,823 $385,500

Dec 2006 $102,000 $247,670 $425,000

Jan 2007 $102,000 $271,540 $435,000

Feb 2007 $82,000 $269,991 $468,000

March 2007 $82,000 $278,438 $468,000

Source: Rigzone.com * Undergoing hurricane repairs.

For details on region

by region offshore activity,

see the E&P analysis

starting on page 34.

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

________

Count on Solar

systems and experience.

When youre hundreds of miles out and a storms in the forecast, offshore is a tough place to work. But Solar equipment is

tougher. All of our turbine-driven generators, compressors and pumps are certified for rugged offshore applications. These

durable, reliable machines can take a pounding and keep on producing. So you get maximum uptime and productivity.

Youll also get our skilled people and proven experience. Solar offshore installations are producing results around the world,

including in the North Sea, the Gulf of Mexico, and off the coasts of West Africa and Brasil. Whether you have fixed leg or floating

production systems, weve designed our packages to meet your needs. And well be there to keep you up and running with the

industrys best service and support.

Thats why so many offshore operations rely on Solar, for everything from equipment to construction to asset management.

For more details, contact Solar Turbines at 1-619-544-5352 or visit www.solarturbines.com.

2002

Solar Turbines Incorporated

No land in sight?

No problem.

For more information, circle number 8

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

Asia-Pacic

Malaysias deepwater continues to draw international operators.

In late March, BHP Billiton Ltd. and Petronas Carigali Sdn. Bhd.

committed $156.4 million to explore ultra-deepwater blocks N and Q in

1,600-2,800 m (5,249-9,186 ft) water depths.

The spending includes $144 million to shoot 1,500 sq km (579 sq mi)

of 3D seismic and to drill four wells in the 3,910-sq-km (1,510-sq-mi)

block N. The companies have earmarked $12.4 million for 800 sq km

(309 sq mi) of 3D seismic on the 4,748-sq-km (1,833-sq-mi) block Q.

The work is expected to take seven years to complete. The area is

thought to be similar to the deepwater discoveries of Kikeh, Malikai,

Gumusut Kakap, and Ubah.

CNOOC Ltd. is still drilling exploration wells in Chinas Bohai

Bay. Late in March, the company made an independent discovery in

the Yellow River Mouth Sag.

Discovery well Bozhong (BZ) 28-2 E-1, south of structure BZ 28-2E

in the Yellow River Mouth Sag, penetrated oil pay zones with total thick-

ness of 35 m (115 ft) and gas sections of 35 m (115 ft). The well was

drilled to a TD of 2,575 m (8,448 ft) in 20 m (66 ft) water depth.

During the drillstem test, the well owed at an average rate of

1,600 b/d of oil from the oil zones via 7.14-mm (0.28-in.) and 14.29-

mm (0.56-in.) chokes and 10 MMcf/d of gas via 15.08-mm (0.59-in.)

choke.

BZ 28-2E lies between the BZ 28-1 and BZ 28-2S oil elds.

Since 2006, CNOOC Ltd. has made four discoveries in the Yellow

River Mouth Sag of Bohai Bay, says Zhu Weilin, vice president of

the company and general manager of the exploration department.

We hope to develop a large-scale cluster of oil and gas elds in the

future.

Niko Resources Ltd. made three new discoveries in two blocks

off Indias east coast in March. Wells KG-D6-Q1 and KG-D6-P2 are

in block D6 in the Krishna-Godavari basin.

The KG-D6-Q1 well is 15 km (9.3 mi) southwest of the AA-1 gas dis-

covery. The KG-D6-P2 well is 6 km (3.7 mi) west of the P1 gas discov-

ery. The KG-D6-Q1 well encountered pay zones in the distal part of

the earlier established channel levee systems in the KG D6 block. Data

obtained from logging and modular dynamic testing (MDT) prove the

presence of hydrocarbons.

Well KG-D6-P2 encountered two gas bearing zones, both of them

channel fan complexes. Data obtained from logging and MDT corrob-

orates the presence of hydrocarbons. These two wells demonstrate

the continued high prospectivity of the block, the company says.

Nikos third discovery is in block NEC-25. Well NEC-25-A5 lies in

the Mahanadi basin 12 km (7.5 mi) northwest of the earlier natural

gas discovery NEC-25-A1 (Dhirubhai 9). The recent well, Dhirubhai

32, is the seventh consecutive discovery in this block. Commerciality

is under evaluation, Niko says.

Americas

Canadian Superior Energy Inc. is moving the Kan Tan IV semi-

submerisble to Trinidad. Maersk Contractors, a part of A.P. Moller -

Maersk A/S will manage the drilling rig, which is owned by Sinopec

Star Petroleum Co. Ltd. of Beijing, China.

The Kan Tan IV has been undergoing a $60-million ret in Browns-

ville, Texas. The rig is scheduled to begin drilling on Canadian Superi-

ors Victory prospect on Intrepid block 5(c).

Canadian Superior has contracted the Kan Tan IV to drill a three-

well program on separate large natural gas prospects: Victory,

Bounty, and Endeavour, approximately 97 km (60 mi) off the east

coast of Trinidad.

As with any major construction and refurbishment program

of this nature, the rig refurbishment has taken longer than we and

Maersk and Sinopec had originally planned, but I am pleased to say

that we are very close now, Mike Coolen, Canadian Superior presi-

dent and COO, says.

The rig was being towed to the port of Chaguaramas in Trinidad to

load supplies and nalize drilling preparations before moving to the

rst drilling location, Victory-1. Canadian Superior expected the rst

well on the Intrepid block to be spudded by the end of April.

Awards are being made for work on the Deep Panuke gas project off-

shore Nova Scotia.

Intec Engineering and alliance partner IMV Projects Atlantic

have landed a contract for subsea and pipeline design. Front-end

engineering and design (FEED) work will support project sanction,

which is expected before the end of the year. The FEED work will

also lead to bid packages for the subsea and pipeline contracts.

Intec plans to assign a subsea/pipeline engineer to EnCanas ofce

in Halifax as part of the clients integrated project management team.

Mediterranean

In mid-March ONGC Videsh Ltd. signed an agreement to operate

in deepwater offshore Libya. The company signed an exploration

and production-sharing agreement (PSA) with National Oil Corp. of

Libya for contract area 43. The PSA was part of the countrys re-

cently concluded third bid round.

The contract area consists of four blocks with a total area of 7,449

sq km (2,876 sq mi) in the Cyrenaica offshore area of the Mediterra-

nean Sea. The block boundaries extend from the coastline to a water

depth of about 2,200 m (7,218 ft).

OVLs work program includes acquiring 1,000 km (621 mi) of 2D

seismic data and 4,000 sq km (1,544 sq mi) of 3D data, as well as drill-

ing an exploratory well during the ve-year exploration phase of the

contract. About two-thirds of the contract area has sparse coverage of

2D seismic data. There is also a shallow-water exploration well that es-

tablished the presence of hydrocarbons at the southwest boundary.

Libya is reportedly planning to hold another bidding round later

this year to develop onshore and offshore gas elds. The round will

GLOBAL E&P

Judy Maksoud Houston

14 Of fshore May 2007 www.offshore-mag.com

0 31

Miles

0 50

Km

Block Q

Block N

Indian Ocean

South China Sea

BORNEO

(Kalimantan)

SARAWAK

BRUNEI SABAH

PALAWAN

SINGAPORE

M A L A Y S I A

I N D O N E S I A

S

U

M

A

T

R

A

MALYSIA

V

I

E

T

N

A

M

Area shown

BHP Billiton Ltd. and Petronas Carigali Sdn. Bhd. committed $156.4 mil-

lion to explore ultra deepwater blocks N and Q offshore Malaysia.

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

For more than 60 years, KBR has made it possible

for our clients to execute some of the most complex

ofshore projects in the world.

From concept through execution, KBR delivers the

engineering and project management expertise for

ofshore production facilities, fxed and foating

platforms, pipelines and subsea solutions for today

and beyond.

To learn more, contact us at ofshore@kbr.com or

visit www.kbr.com.

2007 KBR. All Rights Reserved. KA445

Visit us at OTC

in Booth No. 3353

For more information, circle number 9

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

include 10-15 blocks.

Libya has an estimated 100 Bbbl of oil reserves and is looking to

nearly double production in the next ten years.

Middle East

Qatar Gas Transport Co. Ltd. (Nakilat) has signed an agreement

with Keppel Offshore & Marine Ltd. subsidiary KS Investments Ltd.

to jointly develop a world-class shipyard facility in the Port of Ras

Laffan, Qatar.

This agreement is a partnership between a major LNG transporter

and the global leader in ship repair, ship conversion, and construc-

tion of offshore drilling rigs.

The proposed shipyard will be part of the expansion of the Ara-

bian Gulf Port of Ras Laffan and is expected to begin operation in

2010.

The new facility will be suitable for repair and maintenance of

very large LNG carriers and a wide range of other vessels and the

conversion of tankers to FPSO and FSO vessels. The estimated cost

of the shipyard is approximately $450 million.

This business venture is in line with our Near Market, Near Cus-

tomer strategy to be close to our customers so that we can better

serve them, Tong Chong Heong, managing director/COO of Kep-

pel O&M, says.

Nakilat and KS Investments have agreed to form an 80/20 joint

venture company to manage the design, construction, and opera-

tion of the 43-hectare (106-acre) shipyard, which will be built on re-

claimed land. KS Investments will contribute $23 million for its 20%

interest in the joint venture.

The name of the JVC is Nakilat-Keppel Offshore & Marine Ltd.

Europe

Toreador Resources and TPAO each have reported Black Sea gas

discoveries.

Toreador found more gas in the Black Sea offshore Turkey.

The Guluc-1 well owed approximately 17 MMcf/d of gas. It was

drilled in a fault-separated prospect along the same trend as the Ak-

cakoca-3 and Akcakoca -4 wells in the deeper waters of the SASB

project area.

Turkish national oil company TPAO reportedly tested 6.8 MMcf/

d of gas at the Alapli-1 well northeast of the Akkaya eld and adja-

cent to the SASB area.

Africa

Most of the big West Africa news at the beginning of 2007 was

offshore Angola, but more recently, the spotlight has moved north

to Nigeria.

In late 3Q, Eni signed a production-sharing contract (PSC) with

Nigerian national oil company NNPC for the OPL 135 exploration

license. The area lies northeast of the Niger Delta near the Kwale/

Okpai treatment plants, operated by Eni.

The PSC has a duration of 25 years. The rst ve years will be de-

voted to the exploration phase, and the following 20 to development

and production, with a contractual option of putting gas discoveries

into production.

Through this acquisition, Eni plans to promote increasing involve-

ment of local companies in the domestic market, with the main ob-

jective of eliminating gas aring.

Eni will operate OPL 135 activities through NAOC. Eni has a 48%

stake in the block. Partners include Nigerian companies Global En-

GLOBAL E&P

Bergen | Kongsberg | Aberdeen | Houston

Our expertise in subsea

distribution technology

is your guarantee

www.bennex.no

2-JJ4" * JJJ6" * 3J8" * 5JJ6"

JJ4" * JJ8"

7JJ6" * * J"

JJJ6" 3J8"

42mm * 6mm 3J4" * 30mm

J-7J8" * J2mm * 3"

lnstruuentation & hydraulic Tubing for

C0FF0Sl0N & hl0h FFESSuFE

SUPER DUPLEX 2507

TuN0uM M0NEL

T301L T31L T317L

1/1"0 - 1"0 3uu0 - 12uu0

Cleaned & Capped Coils Metric

NAIINAL/INIE8NAIINAL 8ALE8.

1855 South 21th Street

Seattle, Washington uSA 98198

Fh. 1-20-821-7780 Fax. 1-20-878-2175

www.pacstainless.cou

Euail. sales@pacstainless.cou

SEATTLE h0uST0N AT0N F0u0E T0F0NT0 vANC0uvEF

P A C S T A I N L E S S L T O .

8erviog the IobaI iI aod

as Markets 8ioce 191

For more information, circle number 10

For more information, circle number 11

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

_____________

GLOBAL E&P

ergy Co. with 42% interest and BLJ En-

ergy with the remaining 10% interest.

Offshore Namibia, Tullow Oil is drill-

ing again on the potentially giant Kudu

gas eld.

Exploration and analysis to date sug-

gest reserves of at least 3 tcf, with poten-

tial for up to 9 tcf. The parts of the res-

ervoir drilled so far have achieved good

ows, but Tullow wants to test other sec-

tions in a different geological setting.

Depending on the outcome of the two-

well appraisal program, development could

be expanded from the present option of fu-

eling a gas-to-power project on the border

with South Africa, to an export project, pos-

sibly involving LNG.

Tullow is negotiating to bring in a po-

tential partner and expects to conclude ar-

rangements before drilling the rst well.

Central Europe/Caspian

Dragon Oil is embarking on a three-

rig development campaign in the Turk-

men sector of the Caspian Sea. The

project will involve deployment of one

jackup and two platform-based rigs.

The jackup will drill several wells from

the Lam A platform this year. The plat-

form-based rig CIS-1 is scheduled to arrive

onsite this spring. Meanwhile, Dragons

own platform-based Rig 40 is undergoing

refurbishment. Rig 40 is expected to begin

drilling in the spring as well.

In addition to the drilling program,

Dragon is planning a sustained program

of workovers through 2007.

Between 2007 and 2009, the company

plans to drill up to 25 development and

appraisal wells, subject to rig availability,

leading to a 25% year-on-year increase

in its crude production. Dragon also ex-

pects to spend around $500 million over

this period on new production platforms,

offshore facility upgrades, new pipelines,

and enhanced export capability.

5|mp||c|ty |n sofety

avoid accidents. keep cables and hoses out of haru's way

vould you like nore infornalion aboul CA8L5AF

and ils uses in naking your

workplace safer? Then conlacl veslnark BV. Tel. +31(033 461 43 44,

Fax +31(033 461 24 61, Enail weslnark@cablesafe.con, www.cablesafe.con

CA8L5AF

conlribules lo a safe workplace. l is easy lo suspend

cables, wires and hoses wilh lhe hooks sinple, effeclive Sshape. By

clearing up lhe workfloor lhe nunber of lripping accidenl is reduced, CBS

reporls a 21'' reduclion in induslrial accidenls in lhe workplace. vilh

CA8L5AF

you can creale a lidy, slruclured workplace. Thals safely.

' Tesl resulls by lhe Dulch CBS show lhal 21' of all induslrial accidenls are caused by lripping

lew 'luwirt|eJo||'

|uu|s olsu o.oilo|le

/.oilo|le ir cuauor] culuu|

orJ wit| cuauor] roae

Westmark BV

Stationsweg Oost 281D

3931 ER Woudenberg - Netherlands

Tel: +31.33.4614844 - Fax: +31.33.4612461

email: westmark@cablesafe.com

WestmarkUS

4212 San Felipe Rd. Suite 407

Houston, TX 77027

Tel: +1.832.242.5992

westmarkUS@sbcglobal.net

www.cablesafe.com

Houston Branch:

Westmark BV

Stationsweg Oost 281D

3931 ER Woudenberg - Netherlands

Tel: +31.33.4614844

Fax: +31.33.4612461

email: westmark@cablesafe.com

Intrepid Industries Inc.

2305 S. Battleground Road

La Porte, TX 77571-9475

Phone: +1 281 479-8301 Fax: +1 281 479-3453

E-Mail: sales@intrepidindustries.com

Web-site: www.intrepidindustries.com

MOLEC A.S.

Emma Hjorts Vei 74

1336 Sandvika Norway

Phone +47 67 15 11 57

Fax +47 67 15 33 49

www.cablesafe.com

For more information, circle number 12

0 124

15 E

35 S

30 S

25 S

20 S

15 S

15 E 20 E 25 E

20 E 25 E

0 200

Miles

Existing electrical grid

Km

Windhoek

Walvis Bay

Luderitz

Oranjemund

Orange

basin

KUDU

Luderitz

basin

Namibe

basin

1911

2814A

Cape Town

Koeberg nuclear station

Mossel bay

Bredasdorp basin

SOUTH AFRICA

NAMIBIA

BOTSWANA

ANGOLA ZAMBIA

Port Elizabeth

AFRICA

Area

shown

Tullow Oil is drilling again on the potential-

ly giant Kudu gas feld offshore Namibia.

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

Total pounces on Jura

Total is developing its Jura gas-conden-

sate eld in the northern North Sea, just

four months after its discovery. With re-

serves of over 170 MMboe, this appears to

be the UKs largest new eld development

since Nexens Buzzard.

For Total, the main motivation is maximiz-

ing throughput in its Alwyn Area infrastruc-

ture. Juras production will head through a

3-km (1.9-mi) pipeline to the Forvie North

subsea wellhead, itself connected to the Al-

wyn North processing platform. After com-

ing onstream in spring 2008, Juras output

should peak at 45,000 boe/d. Total plans fur-

ther exploration in this area on the Jura East

prospect.

In the UK central North Sea, Oilexco has

delivered yet another discovery with its sus-

tained drilling campaign, this time on the

Kildare prospect in block 15/26b. The Cana-

dian operator was awarded the acreage joint-

ly with Nexen under the UKs 23rd offshore

licensing round.

The semisubmersible Ocean Guardian drilled

the well to a TD of 14,330 ft (4,368 m), encoun-

tering 27.7 m (91 ft) of net pay in Upper Jurassic

sands. On test, the well owed 4,216 b/d of oil

and 3.1 MMcf/d of gas via a 64/64-in. choke.

The partners plan further drilling to appraise

the extent of the oil accumulation.

In the UKs southern gas basin, EnCore

Oil and Star Energy are considering the con-

version of three decommissioned elds for

use as a seasonal gas store. Esmond, Forbes

and Gordon were developed jointly by Ham-

ilton Oil. Esmond, the largest accumulation,

had original reserves of 250 bcf. Star plans

to acquire low density 3D seismic over the

three elds. According to EnCore CEO Alan

Booth, It has long been known that the UK

lags much of Europe in the provision of gas

storage. This project has the potential to

more than double the UKs gas storage ca-

pability.

However, according to a recent presen-

tation in London by Tullow Oil, storage

was not an issue this winter past, due to a

sudden inux of gas from new suppliers in

Norway and The Netherlands. More of a

concern was the resultant depression of UK

gas prices, although rates have risen since.

High rig rates also worried the companys

chief executive Aidan Heavey. In our view,

these are having a detrimental effect on the

mature parts of the UK North Sea, causing

some North American companies to scale

back their drilling plans, he said.

Hydro ups recovery target

Hydro has made a small oil discovery

southwest of its producing Grane eld in the

Norwegian North Sea. The semisubmers-

ible Transocean Winner found oil in Jurassic

sandstone, but only traces of hydrocarbons

in the primary Tertiary target.

In the Troll production license, Hydro

has agreed long-term contracts with Awilco

Offshore for two new rigs, to be built by

Yantai Rafes Shipyard in China. These

should start operating on Troll in 2009 and

2010. Each will drill development wells for

a period of at least ve years. Hydros latest

long-term plan for Troll involves increasing

oil recovery by 30% to over 2 Bbbl. So far,

113 wells have been drilled to drain the eld,

many of which are multilaterals with two

and six branches.

Hook Head awaits Petrolia

Providence Resources plans to re-explore

Marathons 1971 Hook Head discovery off

southern Ireland. The Dublin-based compa-

ny has secured the semisubmersible Petrolia

for a 50-day slot this summer to drill an ap-

praisal well on the structures crest.

Hook Head is a large, mid-basinal anti-

cline beneath 80 m (262 ft) of water in the

OFFSHORE EUROPE

Jeremy Beckman London

When you need dependable pump performance and

long service life, rely on Moyno progressing cavity

pumps to deliver consistently in a wide range of

upper- and lower-deck FPSO applications that include:

www.moyno.com

1-877-4UMOYNO

Whether your need is top-side or hull-side,

you can be sure that Moyno is always on

your side! Call Moyno today!

Desalter

LP and HP Flare

Closed Drain

Sludge Drain

Oily Bilge Water

Diesel Fuel

Generator Feed

Drilling Mud

Transfer

For more information, circle number 13

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

OFFSHORE EUROPE

North Celtic Sea basin. The discovery well logged around 100 ft (30

m) of hydrocarbons in ve Lower Cretaceous sandstone layers. An-

other Marathon well in 1975 successfully delineated more reserves

at the structures down-dip edge.

Providence newly acquired seismic puts the crest around 2 km

(1.2 mi) northwest of the 1971 well, and at a location 70 m (229 ft)

higher. The company believes in-place reserves could be around 70

MMbbl, or 250 bcf.

In St. Georges Channel, towards Wales, Providence has gained

an extension to its licensing option 05/3 from the Irish authorities

until end-September. The acreage contains the Apollo prospect, also

identied by Marathon in the 1990s following a 2D seismic survey.

New in-house mapping suggests Apollo may hold up to 300 MMbbl

in Lower Jurassic sands, with further upside in Upper Jurassic se-

quences. Marathons nearby Dragon discovery from 1994, off west

Wales, ow tested at 20 MMcf/d. Providence will use the extension

to conduct further subsurface work, and to seek farm-in partners.

Viking set to revive Peak

Lundin Petroleum is combining its UK and Norwegian North Sea

businesses into a new company, Viking Oil and Gas. Just over half of

Vikings shares will be offered to investors via a planned listing on

the Oslo Stock Exchange.

The new operation will be headquartered in Oslo, with a branch

in Aberdeen. With forecast production of over 20,000 boe/d this

year, it will rank in the top tier of Norwegian independents after

Statoil/Hydro. Lundin puts Vikings net proven and probable re-

serves at 96.6 MMboe, with 974 MMboe of net unrisked prospec-

tive resources.

Among its undeveloped properties are Peik, formerly operated

by Total, which straddles the UK/Norway North Sea median line.

Viking owns 50% of the Norwegian side, with further interests in

two blocks containing the UK section. Recently, Canadas Bow Val-

ley Energy farmed in to both sets of licenses.

The latter has become a specialist in cross-border projects in this

region, also involved in the current Enoch and Blane developments.

The company believes the partners will push for development to

start next year, via a subsea tieback to Alvheim or Heimdal on the

Norwegian side, or to Bruce or Beryl in UK waters. Another gas dis-

covery in block 9/10b West could also be factored in. Field analysts

ScanBoss put Peiks recoverable reserves at 20 MMboe.

Visit us at www.panduit.com/ss27

Contact Customer Service by email: cs@panduit.com

or by phone: 800-777-3300 and reference ad # ss27

PANDUIT offers the widest range of permanent identification solutions in the

industry to withstand the test of time and provide legibility in harsh environments.

PAN-STEEL

Stainless Steel Marker Plates, Tags, and Cable Ties

Available in a variety of styles and sizes for maximum application flexibility

Smooth surfaces and rounded edges protect the cable bundle and the installer

PAN-ALUM

Aluminum Marker Plates and Cable Ties

Lightweight, aluminum material is easy to handle for improved productivity

Five color options in addition to natural finish for quick visual identification

On-Site Custom Marking Tools

Portable, quick, and easy identification on demand

Metal embossing hand tool and tape system creates marker plates and tags

for low volume applications

Metal indenting machine is a durable bench top tool used to create marker

plates, tags, and ties for medium volume applications

PANDUIT Factory Custom Marking Service

Embossing and laser service speeds installation time and reduces labor costs

to create marker plates, tags, and ties for high volume applications

Rapid response, global service provides quick product availability worldwide

Use on-line order form at www.panduit.com/permanentID to select the proper

marker plate or tag for your application

Stainless Steel

Marker Plates, Tags,

and Cable Ties

Aluminum

Marker Plates and

Cable Ties

On-Site Custom

Marking Tools

For more information, circle number 14

Providences Hook Head feld offshore southern Ireland.

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

Marathon strikes oil

Marathon Oil Corp. hit pay with Droshky No. 1 in Green Canyon

block 244 in 2,900 ft (884 m) of water. The discovery well, drilled 137

mi (220 km) south-southwest of Venice, Louisiana, logged 250 ft (76

m) of net oil pay, according to Marathon.

The preliminary results suggest that the Droshky No. 1 is a com-

mercial discovery with development likely through the Troika Unit

infrastructure, which is 2 mi (3 km) from the Droshky well, says

Philip G. Behrman, Marathon senior vice president of Worldwide

Exploration.

Troika is a subsea eld in Green Canyon block 244 in 2,700 ft (823

m) of water. The eld produces through the Shell-operated Bullwinkle

platform.

At print, Marathon was drilling two sidetracks on Droshky to de-

termine the elds commercial extent.

Marathon holds a 100 % working interest in Droshky No. 1 and a

50 % interest in the Troika Unit.

Application led for LNG port off Florida

Hegh LNG AS subsidiary Port Dolphin Energy Llc. has led an

application with the US Coast Guard for approval to build and oper-

ate an LNG port 28 mi (45 km) off the west coast of Florida.

The proposed project consists of two submerged turret unloading

and mooring buoys to receive an average of up to 800 MMcf/d of

natural gas from LNG shuttle and regasication vessels (SRVs), and

a 42-mi (68-km) offshore pipeline to bring the natural gas from the

proposed terminal to Port Manatee in Tampa Bay. The port will have

a peak delivery capacity of 1.2 bcf/d.

This is an important milestone in Hegh LNGs effort to continue

the development of our SRV strategy, where we provide transport,

regasication, and market access for our customers, says Sveinung

Sthle, president and CEO of Hegh LNG AS.

Hegh LNG has two SRVs on order with Samsung Heavy Indus-

tries for delivery in 2009 and 2010 to serve Suez LNG Tradings

Neptune deepwater port, a similar offshore LNG terminal slated for

Massachusetts Bay, near Boston.

Deepwater contracts

BHP Billiton and Shell have awarded subsea contracts for the

Shenzi and Princess deepwater developments. BHP issued the Shenzi

contract to Saipem America Inc. The contracted workscope includes

transportation and installation of subsea equipment: installation of

three combined electro-hydraulic dynamic umbilicals; design, fabri-

cation, and testing of rigid subsea jumpers and nine suction piles; and

installation of 66 ying leads, three manifolds, and eight SCR spool

pieces on the Shenzi TLP.

Saipem will use a mix of construction vessels from its in-house

eet and outside contractors to complete the work between Febru-

ary and November 2008.

The company contracted Aker Marine Contractors Inc. to per-

form portions of the design and engineering work on Shenzi, includ-

ing use of the DP-3 BOA Sub C construction vessel.

The Shenzi eld is in Green Canyon blocks 609, 610, 653, and 654

in 4,400 ft (1,341 m) of water, approximately 120 mi (193 km) offshore.

Partners in the development include Hess Corp. and Repsol YPF.

Shell awarded the Princess contract to Technip. The contract covers

project management, engineering, fabrication, and installation of ow-

lines and steel catenary risers, and installation of pipeline-end-termina-

tions. Installation is scheduled for the fourth quarter of this year.

The Princess development comprises tieback of four subsea wa-

ter injection wells to the Shell-operated Ursa TLP moored in Missis-

sippi Canyon block 854 in 3,780 ft (1,152 m) of water.

GULF OF MEXI CO

David Paganie Houston

20 Of fshore May 2007 www.offshore-mag.com

Rendering of Hegh LNGs Port Dolphin Energy LNG facility, proposed for installation off the west coast of Florida.

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

Hurricanes Katrina and Rita created catastrophic damage

to over 100 platforms. An estimated 1000 wells were put out

of commission. Wellheads collapsed to the ocean oor, and

mangled casing strings were entangled with platform substruc-

ture. Well re-entry often seemed impossible. And wide-spread

environmental damage appeared imminent. There was no

ready-made solution for this uncommon occurrence.

Wood Group Pressure Control engineers responded, adapting

our surface casing connectors into an efcient, low-cost,

diver-assisted subsea de-completion system. In short order,

the design was prototyped, lab tested and placed into service.

Although hundreds of offshore wells have been controlled, work

employing this common-sense solution will continue for several

more years until all damaged wells are secure. Safety is essential.

Speed desirable. Reliability mandatory.

To learn more, visit our web site at

www.wgpressurecontrol.com

E-mail us at wgpc

@

woodgroup.com

or telephone +1 832.325.4200

Wood Group Pressure Control

Redening Surface Wellhead Technology

The LRC underwater

de-completion system

with removable control

module and weld-less

casing connection.

An uncommon problem.

A common-sense solution.

For more information, circle number 15

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

Previous Page Contents Zoom In Zoom Out Front Cover Search Issue Next Page

O

O

M S a

G

F

M S a

G

F

Technip in Houston will execute the contract;

Technip in Mobile, Alabama, will assemble the

pipe stalks, and pipelay vessel Deep Blue will de-

ploy the pipelines in a reel lay form.

Shell-operated Princess is a sub-salt accu-

mulation in Mississippi Canyon block 765 in

3,610 ft (1,100 m) of water.

Meanwhile, Aberdeen-based International Moor-

ing Systems (IMS), part of the Craig Group, is sup-

plying its H-link connectors to an unnamed operator

in the Gulf of Mexico, under contracts worth more

than 2 million ($4 million).

The 3-metric ton (3.3-ton) connectors allow

lengths of chain and mooring line to be grouped

together for anchoring oating production units

and semisubmersible rigs in deepwater.

According to IMS, the H-Link connectors

extend the life and integrity of mooring lines

and chain by avoiding the use of other chain

material as a binding and anchoring device,

which could cause abrasion leading to deterio-

ration reducing the life of the mooring line.

The connectors will be manufactured in the

UK for scheduled installation in the GoM this

year.

These new contracts show exactly why we

moved to invest in developing new technolo-

gies and equipment, as the industry looks to

install the latest systems to ensure its assets

and investments are protected in the GoM,

says Alan Duncan, IMS managing director.

Range sells

shallow water properties

Range Resources Corp. has sold its GoM properties to a private

company for $155 million.

The properties include Ranges interests in 37 platforms in water

depths ranging from 11 to 240 ft (3 to 73 m). At year-end 2006, Range

estimated the properties contained proved reserves of 40 bcfe.

The properties were not integral to our future growth, so we elected

to monetize them, says John Pinkerton, Range president and CEO.

Caesar backlog lling up

Helixs latest deepwater construction vessel, Caesar, will have

plenty of work lined up when it enters the companys active eet in

late-2007/early-2008. The $138-million vessel is undergoing conver-

sion at COSCO shipyard in Shanghai.

The company has secured one external contract and one in-house

commitment for the vessel in 2008. The outside job was awarded by

Murphy E&P Co. The operator issued a letter of intent to Helix for

installation work on the Thunder Hawk eld in Mississippi Canyon

block 736 in 6,100 ft (1,859 m) of water.

The contracted workscope includes installation of two 8-in. (203-

mm) owlines and two 12-in. (305-mm) export pipelines, with as-

sociated steel catenary risers and pipeline-end- terminations. The

work is scheduled for mid-2008.

The execution of the LOI for Thunder Hawk constitutes a major

milestone for Caesar and our company, says Bart Heijermans, Helix

executive VP and COO. We are very pleased with the level of inter-

est in the vessel and are condent that this asset will become a major

contributor to our company and the industry.

Caesar also is scheduled to install the owline for Helixs Noonan

discovery in Garden Banks block 506 in 2,700 ft (823 m) of water.

Installation is scheduled for the rst half of 2008.

Meanwhile, Helixs deepwater reel lay vessel, Intrepid, completed

installation of Shell Offshore Inc.s Crosby Pastel Pink pipe-in-pipe

(PIP) owline system. This project was the companys rst PIP sys-

tem that it constructed and installed, according to Helix.

The companys workscope included construction and installation