Professional Documents

Culture Documents

A Cost Benefit Analysis of Two Alternative Traffic Lights Systems For The Colourful City of Zamzam

Uploaded by

Ngabirano B. JuliusOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Cost Benefit Analysis of Two Alternative Traffic Lights Systems For The Colourful City of Zamzam

Uploaded by

Ngabirano B. JuliusCopyright:

Available Formats

A Cost Benefit Analysis of Two Alternative Traffic

Lights Systems for the Colourful City of Zamzam

Alexious Machimbirike

Submitted to the

Institute oI Graduate Studies and Research

In Partial IulIilment oI the Requirements Ior the Degree oI

Master oI Science

in

Banking and Einance

Eastern Mediterranean University

May 2012

Gazimagusa North Cyprus

Approval oI the Institute oI Graduate Studies and Research

ProI. Dr. Elvan Yilmaz

Director

I certiIy that this thesis satisIies the requirements as a thesis Ior the degree oI Master

oI Science in Banking and Einance.

Assoc. ProI. Dr. Salih Katircioglu

Chair, Department oI Banking and Einance

We certiIy that we have read this thesis and that in our opinion it is Iully adequate in

scope and quality as a thesis Ior the degree oI Master oI Science in Banking and

Einance.

ProI. Dr. Glenn P. Jenkins

Supervisor

Examining Committee

1. ProI. Dr. Glenn P. Jenkins

2. Assoc. ProI. Hatice P Jenkins

3. Assoc. ProI. Dr. MustaIa Besim

iii

ABSTRACT

Zamzam InIrastructure Bank has been approached by the country`s third largest city to

Iinance the upgrading and expansion oI its traIIic lights system. Since the project is

social in nature, the Bank intends to justiIy the borrowing on the basis oI ColourIul

City`s ability to service the loan Irom its consolidated cash Ilows. A pre-requisite

however, is the need to conIirm the project`s socio-economic viability through

economic cost beneIit analysis. The Bank assessed and is satisIied with council`s ability

to pay the loan.

This thesis examines the merits oI undertaking project on the basis oI its economic and

social impacts as well as choosing a cost eIIective option oI procuring it. The project

can be procured through Solar Powered or Alternative Current (AC) Powered traIIic

lights both with twelve hour battery backup. In undertaking cost beneIit analysis

reliance was placed on, amongst other inIormation sources, traIIic studies, traIIic

counts, accident statistics, power outage statistics and cloud cover statistics obtained

Irom relevant institutions as well as case studies on BLEG Electricity Project and

Kampala Hilton Hotel Project. The economic analysis showed that the AC powered

option is more cost eIIective as it has a higher Economic Net Present Value oI $5.1

million when compared to $4.7 million Ior solar power option. All road users, heavy

vehicles users, light vehicles users and Government beneIit Irom project in that ranking

order. Risk analysis shows that project is not sensitive to power cuts, cloud cover and

battery liIe. Although sensitive to annual growth in traIIic and minimum wage rate, the

risk parameters do not pose a signiIicant threat to the economic viability oI the project.

Keywords: ColourIul city, traIIic lights project, stakeholders, risks.

iv

Z

Zamzam altyapi bankasina lkenin en byk nc sehri taraIindan traIik isiklari

sisteminin yenilenmesi ve genisletilmesi iin yaklasilmistir. Bu sosyal bir proje

olmasina ragmen banka bu renkli sehrin konsolide nakit akimlarinin aldiklari krediyi

karsilamada yeterli oldugunu dogrulamak istemistir. Bu nedenle ncelik, Iayda-

maliyet analiziyle projenin geerliligini onaylamaktir. Banka, konseyin krediyi geri

deyebilirligini degerlendirip, yeterli buldu.

Bu tez projenin sosyal ve ekonomik etkilerine bakarak uygun maliyetli seeneklerle

uygulanmasini inceler. Bu proje 12 saat yedek g destekli gnes enerjili veya gl

alternatiI akimli traIik isiklariyla uygulanabilir. Eayda-maliyet analizleri yapilirken

kullanilan kaynaklar, traIik alismalari, kaza statistikleri, elektrik kesintisi

statistikleri ve bulut statistikleri ilgili kurumlardan elde edilmistir. Ekonomik

analizler gl alternatiI akim seeneginin gnes enerjisi seeneginden daha Iaydali

oldugunu ekonomik net bugnk degerlerini karsilastirarak ortaya koymustur. Gl

alternatiI akimin ekonomik net bugnk degeri $5.1 milyon Dolar`ken gnes

enerjisinin ekonomik net bugnk degeri $4.7 milyon bulunmustur. Risk analizleri

projenin elektrik kesintilerine, bulutlara ve pil mrne duyarli olmadigini

gstermistir. Proje traIikteki yillik gelismeye ve minimum crete duyarli olmasina

ragmen risk Iaktrleri projenin ekonomik geerliligine tehdit olusturmamaktadir.

Anahtar Kelimeler: Renkli Sehir, traIik isiklari projesi, paydaslar, riskler

v

ACKNOWLEDGEMENTS

I am most grateIul to ProIessor Dr Glenn P. Jenkins Ior not only his guidance and

encouragement but also his inspirational writings which provide the theoretical

underpinning to this thesis. I will Iorever be thankIul to him Ior introducing me to the

Integrated Investment Appraisal Methodology as well as having Iaith in me to excel

both academically and proIessionally.

I acknowledge the valuable support and personalised attention oI Assoc. ProIessor Dr

Hatice Jenkins and Assoc. ProIessor Dr Cahit Adaoglu without which it would not have

been possible to reach the thesis stage.

My appreciation also goes to colleagues I have worked with as Iaculties members on

Queens University`s Programme on Investment Appraisal and Risk Analysis who

helped enrich my understanding oI the Integrated Investment Appraisal methodology.

OI particular mention are Aygul OzbaIli, Stephen Zhanje, Bahman Kashi, Berkan

Tokar Sener Salci , Tumani Dembajang and Salahi Pehlivan.

Lastly but not least, I thank my employers, IDBZ, Ior accommodating my studies

during a demanding period Ior the Bank and my Iamily Ior their unwavering support.

vi

TABLE OF CONTENTS

ABSTRACT............................ iii

Z................................ iv

ACKNOWLEDGEMENTS...................... v

LIST OE TABLES........................... ix

LIST OE EIGURES......................... xi

LIST OE ABBREVIATIONS...................... xii

1 INTRODUCTION........................ 1

1.1 Zamzam Economy Overview................. 1

1.2 InIrastructure and Transport Sector Overview........... 2

1.2.1 InIrastructure Sector..................... 2

1.2.1.1 Status oI InIrastructure in Zamzam............ 3

1.3 Transport InIrastructure in ColourIul City .............. 3

1.3.1 General Condition Assessment oI Roads............. 4

1.3.2 Signalized Intersections .................... 4

1.4 Concept oI the Project...................... 5

1.4.1 The Project ........................ 5

1.4.2 The Sponsor........................ 5

1.4.3 The Einancier...................... 6

2 INVESTMENT RATIONALE AND PROJECT SCOPE 8

2.1 Project Objectives....................... 8

2.2 Investment Rationale..................... 8

2.3 Project Scope......................... 11

vii

2.4 Project Roll Out Plan..................... 11

2.4.1 Technology Choice.................... 11

2.4.2 Einancing and Procurement ................. 12

2.4.3 Installation oI TraIIic Lights................ 13

3 METHODOLOGY.......................... 14

3.1 Integrated Project Appraisal................... 14

3.2 Objectives oI Einancial Analysis................. 17

3.3 Objectives oI Economic Analysis ................ 18

3.4 Objectives oI Stakeholder Impact Assessment........... 19

3.5 Objectives oI Sensitivity Analysis............... 20

3.6 Objectives oI Risk Analysis.................. 20

3.7 Model Overview...................... 20

4 EINANCIAL ANALYSIS..................... 23

4.1 Scope oI Einancial Analysis................... 23

4.2 Model Assumptions and Parameters........................ 26

4.2.1 Project Timing...................... 26

4.2.2 Investment Costs..................... 26

4.2.2.1 Dismantling Old Structures............... 26

4.2.2.2 Civil Works ..................... 27

4.2.2.3 Cabling & Eitting Accessories.............. 27

4.2.2.4 New TraIIic Heads.................... 27

4.2.2.5 Transport and Installation................. 27

4.2.3 Operating Costs...................... 28

4.2.3.1 Without Project ..................... 29

viii

4.2.3.2 With Project ...................... 30

4.2.4 Tax and Economic Depreciation, InIlation and Discount Rates... 32

4.2.4.1 Tax and Economic Depreciation............. 32

4.2.4.2 InIlation and Discount Rates ............... 33

4.2.5 Project Einancing, residual Values and Conversion....... 33

4.2.5.1 Project Einancing.................... 33

4.2.5.2 Conversion........................ 34

4.2.6 Technical Data and Parameters ................ 34

4.2.6.1 Power Cuts Ior 2010.................. 34

4.2.6.2 Cloud Cover Ior ColourIul City............... 35

4.2.7 InIlation and Price Index ................... 36

4.3 Results oI Einancial Analysis................... 36

4.3.1 Without Project Scenario.................. 36

4.3.1.1 Equity Holder`s (Owner`s) Point oI View........... 36

4.3.2 With Project Scenario................... 40

4.3.2.1 Option A- Solar Powered with 12 hour Backup Battery..... 40

4.3.2.1.1 Investment Costs and Loan Schedule ............ 40

4.3.2.1.2 Equity Holder`s (Owner`s) Point oI View........ 41

4.3.2.2 Option B- AC Powered with 12 hour Backup Battery..... 45

4.3.2.2.1 Investment Costs and Loan Schedule........... 45

4.3.2.2.2 Equity Holder`s (Owner`s) Point oI View......... 46

4.3.3 Conclusion........................ 51

5 ECONOMIC ANALYSIS..................... 51

5.1 Scope oI Economic Analysis .................... 51

ix

5.2 Taxes and Import Duty, National parameters and Economic ...... 53

5.2.1 Taxes and Import Duty.................. 53

5.2.2 National Parameters.................... 53

5.2.2.1 Economic Cost oI Capital (EOCK)............ 53

5.2.2.2 Eoreign Exchange Premium (EEP)............. 54

5.2.2.3 Shadow Price Ior Non-tradable Outlays (SPNTO)....... 54

5.2.3 Economic Data and Parameters................ 54

5.2.3.1 Economic Opportunity Cost oI Labour ........... 54

5.2.3.2 Non Tradable Data ................... 54

5.2.3.3 Transport and Handling Assumptions........... 55

5.2.3.4 Motor Vehicle Euel and Maintenance Cost Data ....... 55

5.2.3.5 Motor Vehicle Type and Passenger Data........... 57

5.2.3.6 Motor Vehicle Repair Costs................ 57

5.2.3.7 Medical Costs..................... 58

5.2.3.8 Statistical Value oI LiIe.................. 58

5.2.3.9 Intersections/Junctions.................. 60

5.2.3.9.1 Coping Cost oI Time Delays at TraIIic Intersections... 61

5.2.3.9.2 TraIIic Data Per Intersection............. 62

5.2.3.9.3 Value oI Time Parameters-Heavy Trucks......... 65

5.3 TraIIic and Time Delay Projection.................. 66

5.3.1 Projection oI Annual TraIIic per Intersection......... 66

5.3.2 Projection oI Annual Time Delays Per Intersection........ 73

5.4 Estimation oI Economic Conversion Eactors........... 79

5.4.1 Conversion Eactor Ior Euel.................. 79

x

5.4.2 Conversion Eactor Ior Imported Capital Items......... 79

5.4.3 Conversion Eactor Ior Major Maintenance Materials....... 80

5.4.4 Conversion Eactor Ior O&M Materials............. 81

5.4.5 Conversion Eactor Ior Tradable Services........... 81

5.4.6 Conversion Eactor Ior Labour................. 82

5.4.7 Conversion Eactor Ior Non Tradable InIrastructure and Civil Works... 82

5.4.8 Summary oI Conversion Eactors................ 85

5.5 Projection oI Economic BeneIits................. 86

5.5.1 Value oI Time Savings................... 86

5.5.1.1 Value oI Time Savings ................... 86

5.5.1.2 With Project Option A (Solar Power)............ 87

5.5.1.3 With Project Option B (AC Power)............ 89

5.5.2 Value oI Euel Cost Savings.................. 96

5.5.2.1 Without Project.................... 96

5.5.2.2 With Project Option A (Solar Power)............ 96

5.5.2.3 With Project Option B (AC Power)............ 96

5.5.3 Value oI Vehicle Maintenance Cost Savings........... 101

5.5.3.1 Without Project.................... 101

5.5.3.2 With Project Option A (Solar Power)............ 101

5.5.3.3 With Project Option B (AC Power)............. 101

5.5.4 Value oI Reduction in Accident Costs............. 106

5.5.4.1 Without Project.................... 106

5.5.4.2 With Project Option A (Solar Power)............ 106

5.5.4.3 With Project Option B (AC Power)............. 106

xi

5.6 Economic Resource Elow Statement................ 109

5.6.1.1 Without Project ..................... 109

5.6.1.2 With Project Option A (Solar Power)........... 114

5.6.1.2 With Project Option B (AC Power)............ 118

6 STAKEHOLDER IMPACT ASSESSMENT................ 122

6.1 Scope oI Stakeholder Impact Assessment.............. 122

6.2 IdentiIication oI Project Externalities.............. 122

6.2.1.1 With Project Option A (Solar Power)........... 124

6.2.1.2 With Project Option B (AC Power)............. 128

6.2.1.3 Conclusion ....................... 132

7 RISK ANALYSIS............................... 129

7.1 The Risk Analysis Process.......................... 129

7.1.1 IdentiIication oI Risk Variables............... 133

7.1.2 Probability Distributions oI Selected Variables......... 133

7.1.3 Interpretation oI Risk Results ............... 134

7.2 Sensitivity Analysis....................... 134

7.2.1 Annual Growth in TraIIic................. 134

7.2.2 Minimum Wage Rate................... 136

7.2.3 Cloud Cover........................ 138

7.2.4 Power Cuts Days in Year................... 140

7.2.5 Power Cuts oI More than 12 Hours.............. 142

7.2.6 Battery LiIe......................... 144

7.3 Interpretation oI Results oI Risk Analysis Sensitivity Analysis .......... 146

7.3.1 Optimizing Project PerIormance................ 146

xii

8 CONCLUSION......................... 147

REEERENCES.......................... 149

xiii

LIST OF TABLES

Table 1: Existing Signalised Intersections......... 5

Table 2: Investment Costs................ 22

Table 3: Operating Costs-Without Project.......... 29

Table 4: Operating Costs-With Project............ 31

Table 5: Power Cuts Ior 2010............... 34

Table 6: Cloud Cover Eor 2009 and 2010.......... 35

Table 7: Cash Elow Statement-Without Project......... 37

Table 8: Investment Costs-Solar Power Option......... 39

Table 9: Loan Schedule- Solar Power Option.......... 40

Table 10: Cash Elow Statement-Solar Power Option....... 42

Table 11: Investment Costs- AC Power Option......... 44

Table 12: Loan Schedule-AC Power Option........... 45

Table 13: Cash Elow Statement- AC Power Option....... 47

Table 14: Economic Opportunity Cost oI Labour ......... 52

Table 15: Non Tradable Data................. 53

Table 16: Transport and Handling Assumptions......... 53

Table 17: Motor Vehicle Euel and Maintenance Cost Data..... 54

Table 18: Motor Vehicle Type and Passenger Data....... 55

Table 19: Motor Vehicle Repair Costs............. 56

Table 20: Medical Costs .................. 56

Table 21: Statistical Value oI LiIe-TraIIic Accidents....... 58

Table 21: Intersections/ Junctions............... 59

xiv

Table 23: Coping Cost oI Time Delays at TraIIic Intersections... 60

Table 24: TraIIic Data Per Intersection............. 61

Table 25: Value oI Time Parameters-Heavy Trucks........ 63

Table 26: Projection OI Annual TraIIic Per Intersection........................ 65

Table 27: Projection OI Annual Time Delays Per Intersection......................... 74

Table 28: Economic Value and Conv. Eactor Ior Euel........ 80

Table 29: Economic Value & Conv. Eactor Ior Imported...... 81

Table 30: Economic Value & Conv. Eactor Ior Major....... 81

Table 31: Economic Value & Conv. Eactor On O&M......... 82

Table 32: Economic Value & Conversion Eactor On Tradable..... 82

Table 33: Conversion Eactor Ior Labour.............. 83

Table 34: Conversion Eactor & Economic Value OI Non-Tradable........ 84

Table 35: Summary OI Conversion Eactors............ 86

Table 36: Value OI Time Savings ($ Thousands)....................................... 90

Table 37: Value OI Euel Cost Savings ($ Thousands)................................ 97

Table 38: Value OI Vehicle Maintenance Cost Saving............................... 102

Table 39: Value OI Reduction In Accident Costs....................................... 105

Table 40: Economic Resource Elow Statement ($ Thousands).................... 111

Table 41: Economic Resource Elow Statement (With Project)..................... 115

Table 42: Economic Resource Elow Statement (Without Project)..... 118

Table 43: Allocation OI Externalities, 2011............ 127

Table 44: Allocation OI Externalities, 2011 ( US $ Thousands)...... 131

Table 45: Sensitivity test: annual growth in traIIic.......... 135

Table 46: Sensitivity Test: Minimum Wage Rate.......... 137

xv

Table 47: Sensitivity Test: Cloud Cover............... 139

Table 48: Sensitivity Test: Power cuts-Days............. 141

Table 49: Sensitivity Test: Power Cuts................ 143

Table 50: Sensitivity Test: Battery LiIe (Hrs)............. 145

xvi

LIST OF FIGURES

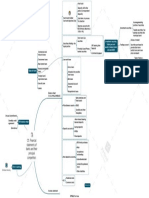

Eigure 1: Overview oI the Integrated Appraisal Approach.......... 22

xvii

LIST OF ABBREVIATIONS

ADCR Annual Debt Coverage Ratio

C Cash Ilow in year t

CIE Cost, Insurance and Ereight

CSCE Commodity SpeciIic Conversion Eactor

d* Average eIIective rate oI Indirect Taxes

DSCR Debt Service Capacity Ratio

ED Exercise Duty

EIRR Economic Internal Rate oI Return

ENPV Economic Net Present Value

EOCK Economic Opportunity Cost oI Capital

EOCL Economic Opportunity Cost oI Labor

Ext Externalities

EEP Eoreign Exchange Premium

EIRR Einancial Internal Rate oI Return

ENPV Einancial Net Present Value

ID Import Duty

IRR Internal Rate oI Return

NPV Net Present Value

Pi Market price oI input

Pj Market price oI input j

Pm Market Price

PV Present Value

xviii

r Discount rate

SPNTO Shadow Price oI Non-Tradable Outlays

VAT Value Added Tax

1

Chapter 1

1 INTRODUCTION (Style 1)

1.1 Zamzam Economy Overview

Since the turn oI the century, Zamzam`s Gross Domestic Product (GDP) Iell by a

cumulative 40 between 2000 and 2007 and plunged a Iurther 14 in 2008.

InIlation is estimated to have peaked at 500 billion percent in September 2009, while

Ioreign currency reserves amounted to $6 million against a Ioreign debt oI $6 billion.

Humanitarian aid Ior 2008 amounted to $490 million against a background oI

estimated 90 unemployment levels. The IreeIall in economic perIormance was

largely attributed to political challenges, poor policy environment, government

controls, droughts and measures to address social inequalities through the provision

oI basic and social services at the expense oI production.

The signing oI a political agreement amongst previously antagonistic parties and the

Iormational oI a Government oI National Unity (GNU) in 2009 ushered in a new era

oI political stability. The new government introduced a multicurrency system where

the local currency was replaced with the United States dollar, the British Pound and

the Euro. Government also instituted an economic revival plan which, amongst other

things, introduced cash budgeting. A return to macro-economic stability was

characterized by a halt in the hyper inIlationary trend, increased capacity utilization

and positive growth in GDP. InIlation Iell to -7.7 in 2009, closed at xxx and is

expected to reach 4.5 in December 2011. Capacity utilization increased Irom 10-

2

30 to 30-50 Ior the period 2009/2010. Real GDP grew by 5.7 in 2009, 8.1 in

2010 and is projected to increase to 9.3 in 2011. In its Medium Term Plan (2010-

2015) and other policy pronouncements, Government identiIied and prioritized

inIrastructure maintenance, rehabilitation and expansion as a critical enabler to

economic development.

1.2 Infrastructure and Transport Sector Overview

1.2.1 Infrastructure Sector

Calderon and Leipziger in their study oI 'The EIIects oI InIrastructure Development

on Growth and Income Distribution in Chile concluded that GDP growth is

positively aIIected by the stock oI inIrastructure assets, and income inequality

declines with higher inIrastructure quantity and quality. The World Bank asserts that

an adequate supply oI inIrastructure services is an essential ingredient Ior

productivity and growth.

InIrastructure development give rise to new investment opportunities and so pave the

way to Iurther economic development. ThereIore, inIrastructure investments lead to

mobilization oI latent resources and promotion oI general economic development.

The role oI inIrastructure in economic development is epitomized by the Iact that in

China the massive inIrastructure investment is contributing directly to the overall

improvement oI national competitiveness and business investment climate. The

recent emergence oI China as the world Iactory would not be possible without a

range oI new economic inIrastructure services in place. This shows that

inIrastructure development improves the country`s competitiveness aiding local

industry and attracting Ioreign direct investment. InIrastructure development is an

integral part oI China`s export-led growth strategy.

3

1.2.1.1 Status of Infrastructure in Zamzam

According to the UNDP (2009), in the 1980s and into the 1990s, it was viewed that

there was adequate investment in Zamzam`s inIrastructure and that it was well

maintained. The supply oI inIrastructure services was thereIore considered adequate

to support productive sector investments and provide relatively high coverage oI the

needs oI, at least, the urban dwellers. However there were some gaps with regards to

InIormation Communication Technology (ICT) inIrastructure. The inIrastructure has

however signiIicantly deteriorated over the past decade.

1.3 Transport Infrastructure in Colourful City

ColourIul City, the capital and administrative centre oI Wasu Province, is located in

the eastern part oI Zamzam. The city lies a Iew kilometres Irom the Zamzam border

with Mapata, approximately 262 kilometres south-east oI Hasleep, the capital city

oI Zamzam. The national census conducted in 1992 gave a population oI 131 000

and 1 600 000 Ior the city and province respectively. The current population Ior

ColourIul City is estimated at anything between 180 000 and 250 000.

In 2010, ColourIul City engaged ABC Engineering Consultants to identiIy the

transport inIrastructure development requirements oI the City as part oI its greater

integrated development plan. The scope oI the study included but was not limited to

conduction a condition assessment oI current transport inIrastructure, road network

master planning to Iacilitate and ensure Iuture mobility in the city by considering the

current 1992-2001 master plan as well as envisaged Iuture developments, traIIic

modeling to assess both the current traIIic conditions, as well as predicted Iuture

traIIic conditions, a needs assessment based on discussions with City oIIicials and

4

omnibus operators, comments on proposed bypass road, project identiIication and

prioritisation and high level cost estimate Ior the proposed projects.

1.3.1 General Condition Assessment of Roads

SurIaced roads in the older part oI the city show distress in the Iorm oI excessive

cracking, local deIormation, edge deIormation, edge breaks and in some instances

the Iormation oI potholes. Some oI the surIaced roads in the newer part oI the City

such as Silver Avenue are in total disrepair and will have to be completed

reconstructed. InsuIIicient drainage and block drainage is a huge concern while

some oI the surIaced roads were constructed too narrow and need to be widened. In

most instances the road markings on the surIaced road are not visible any more.

Directional and road signage is very limited and not standard and speed humps are

not property marked by means oI road markings and road signs.

1.3.2 Signalized Intersections

The condition oI 7 signalized intersections is summarized in the table 1 below. The

table shows that 3 signalised intersection are not operational while the remaining 4

are working but with visually poor conditions. The study also showed that traIIic on

16 additional intersections justiIies installing traIIic lights.

5

Table 1: Existing Signalized Intersections

Signalized Intersection Condition

Blue & Green Street Not operational

Red & Blue Street Working, but is visually in a poor

condition

White & Black Road Working, but is visually in a poor

condition

Brown Road & Yellow Street Working, but is visually in a poor

condition

White & Blue Street Working, but is visually in a poor

condition

White Street & Orange Avenue Not operational

Brown Road & Yellow Road Not operational

1.4 Concept of the Project

1.4.1 The Project

The traIIic lights project is one oI the short term quick-hit projects aimed at kick

starting a programme to maintain, rehabilitate and expand ColourIul City`s

dilapidated transport inIrastructure aIter years oI under investment and neglect. The

project entails replacing malIunctioning traIIic lights at 7 existing intersections and

installing new lights at 16 additional intersections.

1.4.2 The Sponsor

ColourIul City is Zamzam`s third largest city and gateway to the nearest port in

Baura, Mapata. The City Council is the promoter and owner oI the project and has

approached Zamzam InIrastructure Bank to Iinance the capital requirements oI the

project whilst it will meet the operational and other costs required. Council has

6

pledged to meet loan repayments Irom its consolidated revenues as well as leverage

on its balance sheet.

1.4.3 The Financier

Zamzam InIrastructure Bank was set up by Government in 2005 to mobilize

Iinancial and other resources Ior inIrastructure development in Zamzam. The Bank is

owned by Government and multilateral development agencies such as European

Investment Bank, DEG oI Germany and AIDB amongst others. The DEI`s enabling

act stipulates that it should lend to commercially viable projects with demonstrable

development impact. Eor this reason, the DEI has traditionally shied away Irom

social projects, including those with perceived signiIicant development impact. Over

the years the institution has been roundly criticised Ior this approach on the basis that

it was not being relevant to its mandate. As a result, the Board and management

recently decided to consider Iinancing social projects in those cases where borrowing

entities are able to service debt Irom their consolidated revenues and have a balance

sheet strong enough to give comIort to the lenders. In this regard special

arrangements such as ring Iencing speciIic revenue streams and/or requesting real

estate security would be entered into with the borrowing entities. This approach was

endorsed by shareholders on the understanding that investment justiIication would be

based on economic and social impacts oI chosen projects. Since this project is oI a

social nature and does not generate cash inIlows, lending will be based on strength oI

the city`s balance sheet as well as its consolidated cash Ilows. The DEI has assessed

and is satisIied with council`s ability to pay the loan.

Erom the point oI view oI the DEI, this cost beneIits analysis is meant to justiIy

implementing the project on basis oI net economic beneIits to be realised; compare

7

suitability oI two alternative technologies proposed Ior project procurement; use

resultant economic cost beneIit analysis model to assist the City adjudicate tenders

Ior the assignment. In this regard analysis results will also be used to advise the City

on technical and Iinancial speciIication to Iorm part oI Request Ior Proposal (REP)

documents.

Although this is beyond the scope oI this study, the Bank also intends to use the

model to assess the impact oI the traIIic lights project on other related transport

projects Ior the city as well as to assist with timing oI implementation oI these

projects so as to avoid economic and social costs associated with traIIic delays. This

is particularly important to obtain the sign oII Irom the Board as the traIIic lights

project should not be looked at in isolation oI the City`s overall transport and traIIic

management challenges. The analysis will assist the Council and the DEI to plan

their project preparation and packing as well as resource mobilisation work Ior

related projects. Please note however, that the impacts oI related projects are not

Iactored in the economic resource Ilow statements.

8

Chapter 2

INVESTMENT RATIONALE AND PRO1ECT SCOPE

2.1 Project Objectives

To reduce economic and social costs associated with the malIunctioning and

inadequate traIIic lights by rehabilitating and installing new traIIic lights in and

around ColourIul City`s central business district (CBD).

2.2 Investment Rationale

TraIIic in the city is expected to increase signiIicantly due to a combination oI

Iactors. Eirstly, the city plans to increase the current land bank area oI 16 700

hectares (ha) to 101 150ha to provide Ior an estimated population oI 800 000 in

2045. Over 100 000 housing units will have to be constructed to support the increase

in population oI which approximately 20 000 have already been planned Ior in

suburbs which include, but are not limited to, Borderline East, Elora Extension,

Mount Hill, Mountain Rise, Alex Estate, Chinya Gejo North & South, Danga, and

Mhuru amongst others. Secondly the EBC border post with Mapata is located in a

Ireight zone which links routes between countries in Central AIrica and the port oI

Baura. The port has recently been upgraded and is expected to attract Ireight

movement that previously used other harbours such as Duba. Based on this and plans

to make the border a One Stop Border Post (OSBP), it is anticipated that Ireight

movement will increase signiIicantly in Iuture. According to traIIic studies

conducted by ABC Engineers in 2010, seventy (70) oI heavy vehicles crossing the

9

border post are heading Ior (and coming Irom) Hasleep. In the absence oI a bypass

road to the border post, it is interesting to note that these trucks have to pass through

the central business district. Thirdly, huge deposits oI diamonds were recently

discovered in the Ngoda area oI Wasu province resulting in increased mining and

related activities. This, coupled with a recovering economy which grew 8 in 2010

and is projected to grow by 9.3 in 2011, is expected to result in increased

commercial and related traIIic in the City. The traIIic is thereIore projected to grow

by a conservative 6 per annum which is the regional average Ior central and

southern AIrica countries.

The City`s road transport inIrastructure is, however, currently run down and Iailing

to cope with increasing traIIic due to years oI under investment. Eor instance, its

traIIic lights system (over 30 years old) is way past its economic liIe oI IiIteen (15)

years and is more oIten than not down. In addition, the system no longer enjoys back

up spares support, uses energy consuming incandescent lights, is not centrally

controlled and each control unit (at each traIIic light controlled intersection) requires

reprogramming aIter every power outage. Only seven intersections have installed

traIIic lights whilst a traIIic study recently concluded by ABC Engineering

Consultants indicates that sixteen additional intersections are overdue Ior traIIic

lights installation. Historic records oI power cuts obtain Irom Zamzam Power Utility

indicate that power outages occur in thirty two (32) percent oI the days oI the year

and average nine (9.2) hours each.

The constant malIunctioning oI traIIic lights system is costly to the City Council,

industry and the motoring public in terms oI increased Iuel consumption, repairs and

10

maintenance costs and potential revenue lost through traIIic Ilow delays and

accidents. Residents oI ColourIul City have raised their concerns about traIIic delays

during council`s consultative meetings and in writing. Key stakeholders such as the

Commuter Omnibus Association and the police have expressed their displeasure with

the current state oI the city council`s traIIic management system. The Association

operates thirteen (13) urban routes and Iour (4) peri-urban routes. Major urban routes

include City to Saku, City to Chikan (1,2 and 3), City to Elora, City to Mary , City to

Eern Valley, City to Danga, and City to EBP whilst peri-urban routes include City to

Chigodo, City to Zimu, City to Penha and City to ColourIul University. Members oI

the association were not only experiencing time delays at traIIic controlled

intersections but also deliberately avoiding roads where traIIic lights are

malIunctioning, a situation which increases the distance covered by each bus on any

given day and congestion on alternative routes. The eIIect oI the route diversion is

increased operational costs due to motor vehicle wear and tear. Expert opinion Irom

the Automobile Association indicates that vehicles consistently exposed to traIIic

delays (moving at idling to stop speed) are subject to increased maintenance costs oI

approximately twenty (20) percent. In addition a stationary vehicle at a traIIic

controlled intersection consumes an average oI 100 milliliters oI Iuel per minute.

Senior police oIIicials interviewed conIirmed that oIIicers are deployed to man

intersections when traIIic lights malIunction and increased accidents on intersections

where there are no traIIic lights and those where traIIic lights are not Iunctioning.

The wide gap between current and projected traIIic on the one hand and existing

inadequate and malIunctioning traIIic lights inIrastructure on the other gives rise to

11

high economic and social costs associated with time delays at intersections. This

project aims to reduce these costs.

2.3 Project Scope

The project entails replacing existing incandescent traIIic light signals at seven (7)

intersections with solar powered Light Emitting Diode (LED) traIIic lights as well as

installing additional traIIic lights oI the same technology at sixteen (16) new

intersections over a period oI three years. The incandescent traIIic lights currently in

use, at thirty years, are not only way past their useIul liIe oI IiIteen years and

outdated in terms oI technology but also pose a great challenge in terms oI

maintenance due to lack oI replacement parts. As a result, the traIIic lights are out oI

order most oI the time, a challenge exacerbated by intermittent power outages. Each

time there is a power blackout, the traIIic lights have to be manually re-programmed

when electricity supply is restored thereby increasing maintenance costs. The project

is expected to cost US$1.7 million. This amount will be used Ior dismantling old

structures ($50,000), Civil Works ($47,061), Cabling & Eitting Accessories

($440,500), purchase oI new traIIic heads ($1,071,338), transportation & installation

($78,813) and contingency ($12, 289). The Project will take three years to complete.

2.4 Project Roll Out Plan

2.4.1 Technology Choice

ColourIul City proposes to install solar powered hybrid traIIic lights system that

utilises LED (Light Emitting Diodes) in place oI electric bulbs. The traIIic lights use

solar power backed by batteries. Electrical power will enhance reliability through

continuous supply oI power in the event oI total loss oI solar and battery power. The

solar powered hybrid traIIic lights components include underground AC cables,

concrete cast bases/Ioundations, signal poles, signal heads, panels and controllers.

12

Each system operates independently and is controlled by a Programmable Logic

Controller (PLC). Remote monitoring is provided via a GPRS link, and various

Iorms oI alarms exist, Ior instance an alarm SMS is sent to designated cell phone

number as well as a web application Irom which the module can be monitored. The

expected service liIe oI this technology is twenty Iive (25) years. Spare parts can be

obtained at short notice Irom vendors in South AIrica. The three main advantages oI

LED`s are improved visibility, longer shelI liIe and lower energy costs.

The City, however, wishes to determine whether it is cost eIIective to use solar

powered traIIic lights with battery backup as compared to AC powered with battery

backup.

2.4.2 Financing and Procurement

Based on quotations received by the City Irom interested suppliers, the project will

require approximately US$1.7 million. Einancing and procurement are however

subject to tender and cost variations are thereIore expected. AIter securing Iinance

Irom the Bank, the City plans to issue a tender Ior bids Irom interested suppliers.

Council procurements do not go through the State Procurement Board and in this

regard, no undue delays are expected. Tenders oI a similar nature take up to sixty

(60) days. The economic cost beneIit analysis model is expected to inIorm some oI

the tender speciIications to be included in the Request Ior Proposals (REP) such as

maintenance cost, power usage oI the traIIic system, back up service, training oI city

engineers and liIe oI backup battery amongst others. It is also anticipated that the

economic cost beneIit model will be used to evaluate the tenders.

13

2.4.3 Installation of Traffic Lights

A total oI twenty three (23) programmed LED traIIic light signals will be installed by

the City`s electrical department which will also be responsible Ior maintaining them.

Actual works Ior the seven intersections with existing traIIic lights entail dismantling

old structures and replacement oI traIIic heads and controllers. With respect to the

sixteen new intersections, civil works will be undertaken, cables and accessories laid

and LED matrix signal heads as well as the controller installed. The project will take

three years to complete.

14

Chapter 3

METHODOLOGY

3.1 Integrated Investment Appraisal

This thesis is based on the investment appraisal methodology developed by Jenkins

and Harberger (Jenkins & Harbereger, 2002). The methodology entails the Iinancial,

economic, distributive and risk analysis oI the traIIic lights project in order to not

only assess the long term viability and sustainability oI economic and social beneIits

associated with the project but also choose between two competing technologies Ior

procuring the project. The integrated investment appraisal technique simpliIies the

decision making as it reconciles the Iinancial perIormance, the economic outcome

and the distributive impacts oI the project in one analytical Iramework in a consistent

and logical manner. Another distinct advantage oI this tool is its ability to

accommodate a cost beneIit analysis oI two competing technologies in the same

analytical Iramework.

The Iirst building block oI the integrated analysis, Iinancial analysis, normally seeks

to determine the Iinancial viability oI the project Irom the investor and lenders points

oI view. It projects the annual Iinancial cash Ilows oI the traIIic lights project

denominated in deIault domestic (United States Dollars) currency over the liIe oI the

project and determines whether the resultant net cash Ilows discounted at the

opportunity cost oI capital yield positive Iinancial net present values Ior the investor

and acceptable debt service ratios Ior the lender(s). In this particular case, it is known

15

that the project does not generate direct revenue inIlows Ior debt service and that

lending will be based on the strength oI the City`s consolidated cash Ilows and

balance sheet. It is also known that such an assessment analysis was done

independent oI this analysis and established the City`s credit worthiness Ior

accessing the required $1.7 million to undertake the project. In this regard, the

Iinancial analysis was conducted as a necessary building block to the economic and

distributive analysis oI the two alternative technologies. This however, does not take

anything away Irom the tool`s ability to assess Iinancial viability and the ability to

service debt as it basically comes to the same conclusion that in its own right the

project is not Iinancially viable Irom investors and lenders points oI view. Investment

decision will thereIore be guided by net economic and social beneIits to be realized

by the project, cost eIIectiveness oI technology to be adopted and the ability oI the

City to service debt Irom its consolidated cash Ilows. This thesis Iocuses on creating

a basis Ior deciding whether or not to undertake the project on the basis oI the

economic and social beneIits to be delivered and determining most cost eIIective

technology to adopt.

The second building block oI an Integrated Investment Appraisal, Economic

Analysis, aims to optimize the use oI the country`s scarce resources. It provides a

methodological Iramework Ior estimating the true economic cost and beneIits oI the

project. The economic resource Ilow statement is derived Irom the Iinancial cash

Ilows oI the project and the net resource Ilows are discounted at the Economic

Opportunity Cost oI Capital (EOCK) to establish project`s economic Ieasibility. The

necessary adjustments are made to the Iinancial values in order to arrive at the

economic shadow values Ior the costs and beneIits oI the project.

16

The third building block is the Distributive Analysis which considers how

externalities are shared among the diIIerent stakeholders aIIected by the project. The

economic externalities are computed as the diIIerence between Iinancial and

economic values. The net present value oI externalities are subsequently computed

and allocated amongst project stakeholders to determine who gains or losses Irom the

implementation oI the traIIic lights project.

In the real world, the actual outcome oI the Iinancial, economic, and distributive

analysis vary Irom projected outcomes due to uncertainty involved in the projection

oI Iuture values oI project parameters. This uncertainty creates risks, which may

aIIect the choice oI technology and the allocation oI externalities to various

stakeholders diIIerently. Sensitivity analysis is the Iirst step in risk analysis used to

identiIy critical risk variables whose likely variation impacts on project outcomes.

The Integrated Investment Appraisal analytical tool allows Ior risk analysis to be

conducted on identiIied risk variables to determine the degree oI riskiness oI the

identiIied variables to the project outcomes. Various computer based soItware, such

as Crystal Ball`s Monte Carlo Risk Simulation, can be used in this regard and guide

the craIting oI risk mitigation measures to reduce and/or eliminate the risks created.

In this study however, risks analysis ends with the sensitivity analysis as not much

beneIit can be derived Irom Iull risk analysis given that project outcomes are not

highly sensitive to variations in the risk variables. EIIective decisions can thereIore

be made on the basis oI the Iinancial, economic, distributive and risk (sensitivity

analysis only) analysis oI the project.

17

3.2 Objectives of Financial Analysis

The Iinancial analysis oI a project determines whether the project is Iinancially

sustainable. It is a cornerstone oI any capital investment project (Glenn P Jenkins et

al (March 2005), Integrated Investment Appraisal-Concepts and Practices). Glenn P

Jenkins et al advanced persuasive arguments Ior conducting Iinancial analysis on

public sector projects such as this one. Eor instance, he argues that it is important to

realize that Ior certain projects it is essential to estimate their Iinancial proIitability.

However, to ensure that the project is Iinancially sustainable, it is necessary to

analyze the year-by-year cash Ilows. He Iurther states that conducting a Iinancial

appraisal oI public-sector projects is directly related to understanding oI the

distributional impacts oI the project. In this regard a Iinancial analysis is a necessary

pre-requisite to economic, distributive and risk analysis oI a project. Another

important consideration is to ensure the availability oI Iunds to Iinance the project

through its investment and operational phases.

The Iinancial analysis oI ColourIul City traIIic lights is mainly used as a building

block to the integrated investment appraisal oI the project given that the City`s

(sponsor/investor) investment decision will be based on economic and social beneIits

oI project and the cost eIIectiveness oI technology to be used. In addition to the

economic and stakeholder viability, Zamzam InIrastructure Bank`s lending decision

will also be based on the City`s overall Iinancial position and ability to service debt

as opposed to project cash Ilows.

Chapter 4 is devoted to the Iinancial analysis oI the proposed traIIic lights project.

18

3.3 Objectives of An Economic Analysis

The main objective oI an economic evaluation oI the project is to estimate the real

economic value oI the project`s net beneIits to the society as a whole, and to assess

whether the resources employed in the traIIic lights project are used eIIiciently. The

net present value oI the net economic beneIits will indicate whether the net economic

beneIits oI the project, measured in terms oI the base year, are greater than zero, that

is, whether the project is a net contribution to Zamzam`s welIare.

The central tool in an economic analysis is the project`s statement oI economic costs

and beneIits. This statement is generated by converting the Iinancial values oI the

project`s Iinancial cash Ilow into the economic values by using the commodity

speciIic conversion Iactors (CSCE). The Iinancial value oI any good or service used

or produced by the project is multiplied by the corresponding CSCE to obtain its

economic value. Commodity SpeciIic Conversion Eactors (CSCE) indicate the

premium that must be added or the discount that must be subtracted to reIlect

diIIerences between Iinancial and economic values. These diIIerences arise Irom

market distortions such as subsidies, Ioreign exchange premium and impact oI taxes.

In addition to determining whether the project is worth undertaking Irom an

economic point oI view, the analysis also assists in selecting the technology which

yields greater economic beneIits Ior the traIIic lights project.

Chapter 5 attempts to deal with the various aspects oI the economic analysis.

19

3.4 Objectives of Distributive Analysis

It is important Ior the sustainability oI the project over time to identiIy the winners

and losers and how much they would gain and lose as a result oI the project

implementation. The purpose oI distributive analysis is to see iI the groups who were

targeted to receive beneIits as a result oI the project will actually receive them as

well as to ensure that no speciIic group is subjected to an undue burden as a result oI

a project. The magnitude oI any burden can be measured by the NPV oI the

incremental net cash Ilows that are expected to be realized by that group. Among the

main stakeholders aIIected by a public project are generally the project`s suppliers,

consumers, project competitors, labor, and the government. The impact on

government is mainly externalities generated through taxes and subsidies.

In the case oI the traIIic lights project, a distributive analysis is undertaken Ior the

two technology options. The main objective being to identiIy the externalities created

by the project and evaluate the impact oI these externalities on the key stake holder`s

oI the project. Chapter 6 discusses the modeling oI the externalities Ilows and the

computation oI their net present value as well as the reconciliation between the

Iinancial and economic analysis.

3.5 Objectives of Sensitivity Analysis

The sensitivity tests are perIormed on the Iinancial, economic and distributive results

in order to asses the degree oI vulnerability oI the project to various exogenous

variables. The tests are used to detect the crucial project`s variables, that the project

owners or the government may redesign, iI needed, in order to improve the

perIormance oI the project. The main objective oI the sensitivity analysis is to

identiIy the critical project variables and to evaluate the uncertainties associated with

20

these variables. It also helps to understand the sources oI the risks created by these

uncertainties that aIIect the Iinancial and economic outcome oI the project.

3.6 Objectives of Risk Analysis

AIter identiIying these critical variables, a risk analysis is then carried out. Its main

objective is to assess the degree oI risk ness oI these variables to the project`s

outcomes and also help in Iinding the appropriate mitigation measures to reduce the

risk exposure.

3.7 Model Overview

The cost beneIit analysis model oI ColourIul City TraIIic Lights project was

developed using mathematical and logical Iormulas to manipulate given and

estimated technical, Iinancial and economic parameters in order to predict project

outcomes. In this regard, MicrosoIt Excel spreadsheet processor was used and project

outcomes in critical decision areas such as economic and stakeholder viability as

well as risk predicted. All assumptions on the project are provided in the table oI

parameters. Subsequent tables in the model contain Iormulas that reIer to

assumptions in the table oI parameters.

In addition, all the relationships among the tables presented in the model are a set oI

links expressed in Iormulas constructed in such a way that any change in the basic

parameters is automatically reIlected in all consequent Iormulas and the project`s

outcomes. Eigure 1 provides an overview oI the steps taken in the integrated

investment appraisal oI the traIIic lights project, and show the tables used in the

model.

21

F

I

N

A

N

C

I

A

L

A

N

A

L

Y

S

I

S

Table 1: Project Parameters

Tables I - X

TABLE 2

INELATION AND PRICE INDICES

TABLE 3

TRAEEIC AND TIME DELAY

PROJECTION

TABLE 4

CASH ELOW STATEMENT:

COUNCIL`S PERSPECTIVE-W/O PRJT

TABLE 5

INVESTMENT COSTS-W/PRJT A

TABLE 6

LOAN SCHEDULE

TABLE 7:

C/ELOW STATEMENT: COUNCIL`S

PERSPECTIVE

TABLE 8

INVESTMENT COSTS-W/PRJT B

TABLE 9

LOAN SCHEDULE

TABLE 10

CASH ELOW STATEMENT-COUNCIL`S

PERSPECTIVE

22

E

C

O

N

O

M

I

C

A

N

A

L

Y

S

I

S

D

I

S

T

R

I

B

U

T

I

V

E

A

N

A

L

Y

S

I

S

S

E

N

S

I

T

I

V

I

T

Y

A

N

A

L

Y

S

I

S

Eigure 1: Overview oI the Integrated Appraisal Approach.

TABLES 11: TABLE OE CONVERSION EACTORS

TABLES 12: PROJECTION OE ECONOMIC

BENEEITS

TABLES 13: SUMMARY OE ECONOMIC

CONVERSION EACTORS

TABLES 14: ECONOMIC RESOURCE ELOW

STATEMENT- WITHOUT PROJECT

TABLES 17: STATEMENT OE EXTERNALITIES-

WITH PROJECT-OPTION A

TABLES 18: RECONCILIATION OE EINANCIAL,

ECONOMIC & EXTERNALITIES

TABLES 23-28: EINANCIAL AND ECONOMIC

SENSITIVITY ANALYSIS

TABLES 15: ECONOMIC RESOURCE ELOW

STATEMENT- WITH PROJECT-OPTION A

TABLES 16: ECONOMIC RESOURCE ELOW

STATEMENT- WITH PROJECT-OPTION B

TABLES 19: ALLOCATION OE EXTERNALITIES

TABLES 20: STATEMENT OE EXTERNALITIES-

WITH PROJECT-OPTION B

TABLES 21: ECONOMIC RESOURCE ELOW

STATEMENT- WITH PROJECT-OPTION B

TABLES 22: ALLOCATION OE EXTERNALITIES

23

Chapter 4

FINANCIAL ANALYSIS

4.1 Scope of Financial Analysis

The Integrated Investment Appraisal methodology allows Ior an interrogation oI the

project Irom two alternative viewpoints, that is, total investment or banker`s point oI

view and equity (owner`s) point oI view.

The total investment perspective excludes any external sources oI Iinance into the

cash Ilows oI the project and assesses ability oI Iinancial receipts generated Irom

operations to suIIiciently cover investments and operations expenditures oI the

project as well as provide suIIicient return. It is also known as the banker`s point oI

view as it enables bankers to ascertain iI net cash Ilows are suIIicient to cover the

project`s interest and loan obligations. However, in this case loan cash Ilows are

excluded Irom the model as debt service will not be based on the perIormance oI the

project, but on strength oI ColourIul City`s balance sheet and consolidated revenues.

It is given that ColourIul City passed this debt service ability test.

The cash Ilow statement prepared Irom the equity or owner`s point oI view is

developed in a similar Iashion to the cash Ilow statement Irom the total investment

point oI view. However, they include receipts oI the loan as an inIlow and all

subsequent repayments oI the loan and interest as expenditures. This aspect is a

24

distinguishing Iactor between the cash Ilow statement Irom the equity point oI view

and total investment point oI view.

The evaluation criteria Ior assessing the project`s net worth to the owners is the Net

Present Value (NPV) and Internal Rate oI Return (IRR).The computation oI NPV

and IRR are based on the annual net cash Ilows aIter Iinancing Irom the real cash

Ilow statement Irom equity point oI view. The relevant discount rate is required rate

oI return on equity, in real terms. In this analysis, it was considered more convenient

to present the cash Ilows Irom the City Council`s (owner) point oI view. However,

since debt cash Ilows are not a Iactor in this project, there is practically no diIIerence

between the cash Ilows prepared Irom both total (banker`s) investment and equity

holder`s (owner`s) points oI view.

The Iinancial analysis considered three scenario viz. 'Without Project scenario,

'With Project- Option A (Solar Powered traIIic lights with battery backup) scenario

and 'With Project-Option B (AC Powered traIIic lights with Uninterrupted Power

Supply (UPS) battery backup) scenario. An important element in the investment

appraisal is to examine the incremental impact oI the project; that is, the net Iinancial

receipts or net Iinancial cash Ilows (or net economic beneIits) with the project in

excess oI the net Iinancial receipts or net Iinancial cash Ilows (or net economic

beneIits) without the project (Glenn P Jenkins et al (March 2005), Integrated

Investment Appraisal-Concepts and Practices). Glenn P Jenkins et al argue that it

should be noted that the 'without project situation does not mean that nothing is

done to the current situation iI the project is not undertaken. It simply implies that the

situation goes on as usual into the Iuture, but no major capital expenditures are made

25

in the activity. In this context, one should conceptualize two states oI nature: one

with the project and the other without the project. The Iormer identiIies the revenues

and expenditures associated with the case in which the project is undertaken, while

the latter reIers to the on-going revenues and expenditures that would prevail even iI

the project was not undertaken. In comparison, a project usually involves incremental

net expenditures in the construction phase Iollowed by incremental net receipts in the

operating phase. An incremental net cash Ilow (or net economic resource Ilow) reIers

to the net cash Ilow (or net economic beneIits) that occur with a project less the net

cash Ilow (or net economic beneIits) that would have occurred in the absence oI the

project. Setting the problem up in this way, we can identiIy the additional net cash

Ilow that is expected to arise as a result oI a project and the corresponding change in

economic well-being that is attributed to it.

The equity holder`s point oI view evaluates the project as it is perceived by ColourIul

City, the project owners, and helps to determine whether the net cash Ilows oI the

project make them better or worse oII. Consequently, the City beneIits Irom the

residual or net cash Ilows aIter paying oII all other parties. It is important to note that

it is known Irom the onset that cash Ilow outcomes will be negative because oI the

absence oI direct cash inIlows associated with the project. This analysis was

thereIore done Ior the purposes oI Iacilitating economic and distributive analysis to

Iollow in chapters 5 and 6 which will Iorm the basis oI deciding whether or not to

proceed with the project.

The Iollowing sections provide a detailed explanations oI the model assumptions and

parameters under which the base case Iinancial model Ior the proposed traIIic lights

26

project was developed. It should be noted that all prices Iactored in the model are in

real prices. This is mainly because the impact oI inIlation on loan interest and

principal payments, tax depreciation, accounts receivables and payables and working

capital is considered immaterial Ior this analysis. This is because debt is excluded

Irom cash Ilows, the City is exempt Irom corporate tax and accounts receivable and

payable as well as working capital are tied to City`s consolidated cash Ilows.

4.2 Model Assumptions and Parameters

4.2.1 Project Timing

The traIIic lights project has a liIe span oI 10 years. The project commences in 2010,

is launched and starts operations in 2011 and winds up in year 2021. It is expected

that aIter year 2021 the system will be replaced by better technology available at that

time. The physical construction oI the project will be phased over 3 years with 10

intersections being completed in years 2011 and 2012 and remaining 3 intersections

being done in 2013. AIter year 2021, the project`s assets are assumed to be

liquidated.

4.2.2 Investment Costs

Two possible total investment outlays are considered Ior alternative technologies

proposed Ior the project and are both given in real terms (2010 prices). The outlays

comprise 5 categories to be expended in US dollars, the deIault currency Ior

Zamzam. The investment outlays and categories Ior 'With Project scenarios are

shown in table 2 below.

1.3.1 Dismantling Old Structures

The city plans to replace malIunctioning traIIic lights on 7 existing traIIic lights

controlled intersections with new ones. An estimated $50 000 is required to

27

dismantle existing old structures in 2011 Ior both technology options.

4.2.2.2 Civil Works

The total cost oI all civil works, irrespective oI the technology used, is $44 800

incurred over the three year construction period. OI this amount, $8 400 will be used

in 2011 and $28 000 and $8 400 in years 2012 and 2013 respectively.

4.2.2.3 Cabling & Fitting Accessories

Cabling and Iitting oI accessories will cost an estimated $410 000 Ior both options

broken down as $10 000 in 2011 and $200 000 each in years 2012 and 2013.

4.2.2.4 New Traffic Heads

The total capital cost Ior traIIic heads inclusive oI backup batteries is $1 035 000 and

$ 262 844 Ior Solar powered and AC powered traIIic lights procurement options

respectively. The investment cost will be spread over the three years as Iollows:

43 each in years 2011 and 2012 and the remaining 14 in 2013. This distribution

reIlects the installation oI new traIIic lights at 10 intersections each in years 2011 and

2012 and the balance oI 3 in 2013.

4.2.2.5 Transport and Installation

Transport and installation costs oI $75 000 will be evenly spread at $25 000 a year

over the three years oI investment Ior both options.

28

Table 2: Investment Costs (USD, Year 2010 Prices)

OPTION A: SOLAR POWERED WITH 12 HOUR BATTERY BACK UP

INVESTMENT COSTS (USD , Real 2010 Prices)

Year 2011 2012 2013 Total

Dismantling old structures 50,000 50,000

Civil Works 8,400 28,000 8,400 44,800

Cabling & Iitting accessories 10,000 200,000 200,000 410,000

New TraIIic Heads 450,000 450,000 135,000 1,035,000

Transport & Installation 25,000 25,000 25,000 75,000

Cost overrun Iactor -

Intersections Iully developed 10 10 3

OPTION B: AC POWERED WITH 12 HOUR UPS BACK UP

INVESTMENT COSTS (USD, Real Prices)

Year 2011 2012 2013 Total

Dismantling old structures 50,000 50,000

Civil Works 8,400 28,000 8,400 44,800

Cabling & Iitting accessories 10,000 200,000 200,000 410,000

NewTraIIic Heads 114,280 114,280 34,284 262,844

Transport & Installation 25,000 25,000 25,000 75,000

Cost overrun Iactor -

4.2.3 Operating Costs

Operational costs Ior the project are given in real terms Ior the 'Without Project and

'With Project scenarios and summarised in tables 3 and 4 below. The table oI

parameters outlines Iixed and variable costs assumptions Ior the project.

29

4.2.3.1 Without Project

With respect to Iixed operating costs, annual labour costs are estimated at $52 860

while operations and maintenance costs (O&M) average $2 484 per annum. Annual

general and administration costs are given as 5 oI labour and operations and

maintenance costs. No long term service agreements and other obligations are

envisaged. Annual variable costs comprise Iuel costs ($1 080) and electricity

consumed by each traIIic light controlled intersection ($768 per year). These

operational costs were based on historic records oI the City. According to the City`s

records, motor vehicle Iuel costs Ior trucks used to transport technicians to traIIic

light controlled intersections Ior repair & maintenance work and electricity

consumed by each traIIic light make up annual variable costs. It is important to point

out that whilst the annual operations and maintenance costs and Iuel costs appear too

low Ior this type oI project, they reIlect neglect and the general shortage oI spare

parts characteristic oI the years oI economic hardships.

Table 3: Operating Costs (USD, Year 2010 Prices)

OPERATING COSTS

Without Project

Fixed Costs

Labor 52,860 US$/Year

General & Admin (excluding VAT) 5 oI Labour O&M Costs

O&M 2,484 US$/Year

Long Term Service Agreement &

Others - US$/Year

Variable Costs

Euel Requirement Cost 1,080 US$/Year

Electricity consumed per intersection 768 US$/Year

LTSA and Other Variable Costs -

30

4.2.3.2 With Project

Two options are presented Ior the 'With Project scenario, namely, Solar powered

and AC powered options. The solar power option deIaults to stored battery power in

the event oI prolonged cloud cover and other obstacles and to AC power where

battery power is completely lost. The AC power option on the other hand deIaults to

Uninterrupted Power Supply battery backup in the event oI power loss. Eixed costs

Ior the 'With Project scenarios are similar to the 'Without Project scenario serve

Ior operations and maintenance costs which are estimated at 5 oI investment costs.

In addition, the solar powered option carries a unique assumption that annual

operations and maintenance costs reduce annually by 1 Irom year 2014. This is as a

result oI reduced costs oI spare parts and components due to massive research

currently being invested in this technology option. Variable costs are the same at $1

200 per year Ior Iuel and $154 in electricity consumed per year per intersection Ior

both 'With Project options. The 80 reduction in electricity consumption per year

per intersection when compared to 'Without Project scenario is due to the

replacement oI incandescent lights with power saving Light Emitting Diode (LED)

lighting system.

It should be noted that whilst the 'With Project scenarios cover 23 intersections

against the current 7 intersections Ior the 'Without Project scenario annual Iuel

requirement marginally go up Irom $1 080 (without project) to $1 200. This

represents Iuel consumed by vehicles used by technicians Ior routine and adhoc

maintenance work at traIIic controlled intersections. With the without project

scenario each traIIic controlled intersection has to be reprogrammed aIter every

31

power outage. Euel is consumed in visiting each site. With the project, savings will

be realised in this regard. This is explained by the Iact that the new technologies and

new equipment will result in less maintenance induced Iuel requirement Ior the

'With Project scenarios. Although electricity consumed per intersection assumption

oI $154 per year applies to both options oI 'With Project scenario, this cost will

only be partially incurred Ior the solar power option in rare occasions where solar

power is out due to prolonged cloud cover oI more than 12 hours and no AC power

back up is available due to power outages. There is electricity cost savings associated

with the solar option. The savings arise when solar power is used instead oI electrical

power. In the rare event that solar power is oII due to prolonged cloud cover,

electrical power back up is used. In this event, the project will consume electricity at

the same rate oI $154 per annum. No long term service and other obligations are

expected Ior the 'With Project scenarios.

32

Table 4: Operating Costs (Usd, Year 2010 Prices)

With Project-OPTION A

Fixed Costs

Labor

General & Admin

(excluding VAT) 52,860 US$/Year

O&M 5 oI Labour O&M Costs

Annual reduction in

O&M costs( Irom year 3) 5 oI Investment Costs

Long Term Service Agreement &

Others 1 oI O&M costs

Variable Costs - US$/Year

Euel Requirement Cost

Electricity consumed per

intersection 1,200 US$/Year

LTSA and Other Variable Costs 154 US$/Year

-

With Project-OPTION B

Fixed Costs

Labor

General & Admin

(excluding VAT) 52,860 US$/Year

O&M 5 oI Labour O&M Costs

Long Term Service

Agreement & Others 5 oI investment costs

Variable Costs - US$/Year

Euel Requirement Cost

Electricity consumed per

intersection 1,200 US$/Year

LTSA and Other Variable Costs 154 US$/Year

-

4.2.4 Tax and Economic Depreciation, Inflation and Discount Rates

4.2.4.1 Tax and Economic Depreciation

The useIul economic liIe Ior cables and Iittings and traIIic heads is estimated at 25

years Ior both 'With Project options.

33

4.2.4.2 Inflation and Discount Rates

Annual inIlation rate is estimated at 4.5 whilst the required rate oI return on equity

is given as 15. It is important however to note that the model was constructed using

real Iigures. The inIlation rate was thereIore used to determine investment costs in

nominal terms and subsequently the loan requirement and resultant loan schedule in

nominal terms Ior illustration purposes only. The loan schedule was thereIore not

wired in the model.

4.2.5 Project Financing, Residual Values and Conversion

4.2.5.1 Project Financing

Although project Iinancing and the analysis thereoI was dealt with separately Irom

this economic cost beneIit analysis, the high level Iinancing arrangement is given Ior

inIormation purposes. The main objective oI the inIormation is to complete the

picture and put the model in context.

A composite loan Iacility will be established with Zamzam InIrastructure Bank under

both 'With Project scenarios Ior drawdown through annual sub loan Iacilities over

implementation period oI three years. The sub loans will have tenures oI 2 years with

1 year grace period on capital only and attract interest oI 18 per annum. The

composite loan Iacility will be $1 680 337 and $883 805 Ior solar and AC power

options respectively. The sub loan Iacilities will be 43 oI composite loan in years

2011 and 2012 and 14 oI composite loan Ior 2013 Ior both scenarios.

4.2.5.2 Residual Values

Residual values Ior solar power option are computed as $270 000 and $649 800 Ior

cables and Iittings and traIIic heads respectively. Cables and Iittings and traIIic head

residual values oI $270 000 and $165 020 respectively apply to AC power option.

34

4.2.5.3 Conversion

The conversion assumption is used to convert Iigures and values into thousands or

millions as applicable.

4.2.6 Technical Data and Parameters

4.2.6.1 Power Cuts for 2010

Zamzam`s power utility company provided electricity outage (power cuts) statistics

Ior the year 2010 Ior ColourIul City (See table 5 below). These indicate that power

was out Ior 118 oI the 365 days oI the year. OI the 118 days, 47 experienced power

outages oI more than the backup battery liIe oI 12 hours. On days experiencing

power outages oI more than 12 hours, the average duration oI the power outage was

15.4 hours. This thereIore means that, in the event oI continuous cloud cover causing

deIault to backup batteries, on average 3.4 hours would elapse aIter batteries have

run out and awaiting recharging by AC power. These historic statistics were used as

assumptions to predict Iuture outages and their impact on both the 'With and

'Without project scenarios in the model. Other power outage statistics given Ior

inIormation purposes but not used in the model are minimum and maximum daily

outages oI 0.1 hours and 18.7 hours respectively. The likelihood or probably oI

power outage in general and one which lasts Ior more than 12 hours is calculated as

32 and 13 respectively.

35

Table 5: Power Cuts Eor 2010: (Source: Power Utility)

DAYS IN YEAR

TTL

IN

YR

AV

AV.12

Hrs +

Total Powercut

6-

12h

+

12

hours

+ Hours Hours Hours

365 118 47 9.2 15.4 1140.6

Backup Battery Life 12 hrs

Average down time > 12

hours 3.4 hrs

Probability Powercut 32

Probability Powercut > 12

hours 13

4.2.6.2 Cloud Cover for Colourful City

The meteorology department provided cloud cover statistics Ior ColourIul City Ior

the years 2009 and 2010 (table 6). Taking averages Ior the two years the annual

average distribution oI bright sunshine, partly cloudy and cloudy days were

estimated at 42, 28 and 31 respectively. The cloud cover statistic oI 31 was

used as an assumption to predict Iuture occurrences oI cloud cover and their impact

on solar power option n the model. It is assumed that 60 oI cloudy days experience

continuous cloud cover oI more than 12 hours. Based on the above, the probability oI

continuous cloud cover oI more than 12 hours is 19 (60 x 31). Multiplying

probability oI cloud cover oI more than 12 hours and probability oI power outage oI

more than 12 hours gives probability oI experiencing the two outcomes at the same

time. This is estimated at 2.

36

Table 6: Cloud Cover ( Days In Year-Source: Met Dept)

YEAR 2009 2010 AVERAGE

Bright Sunshine 43 40 42

Partly Cloudy 27 28 28

Cloudy 30 32 31

Continuous cloud cover ~ 12 hours oI

cloudy days 60

Probability continuous cloud cover ~ 12 hours 19

Probability continuous cloud cover ~ 12 hours Probability

Powercut ~ 12 hours 2

4.2.7 Inflation and Price Index

The inIlation rate is assumed to be constant at 4.5 per annum giving rise to price

index which grows annually Irom 1 in 2011 to peak at 1.55 in 2021.

4.3 Results of Financial Analysis

4.3.1 Without Project Scenario

4.3.1.1 Equity Holder`s (Owner`s) Point of View

The without project scenario assumes that no investment is made in new technology

and that the current outdated and malIunctioning system remains in place. Table 7

presents a real cash Ilow statement Irom council or owner`s point oI view.

The project does not generate cash inIlows throughout the liIe oI the project. Cash

outIlows comprise investment and operating costs. Since there is no investment in

new technology, no investment costs arise. Eixed operating costs remain constant at a

total oI $58 111 per annum throughout the liIe oI the project. With respect to variable

operating costs, Iuel costs and electricity consumed remain constant at $1 080 and $5

376 per annum respectively. Each time there is power outage, the City incurs

37

additional maintenance costs due to the need to physically visit each oI the traIIic

lights controlled intersection to reprogramme control panels when electricity is

restored. The additional maintenance costs arising Irom the outages, such as Iuel &

transport costs and overtime wages, are computed as proportion oI average days in

year when outages are experienced (118) to total days in year (365) multiplied by

normal operations and maintenance costs Ior that year. These are however relatively

small and average $803 per annum Ior the liIe oI the project.

Due to the absence oI cash inIlows, net cash Ilows Ior the project are negative and

average $65 370 annually. Consequently, the project has a negative Net Present

Value (NPV) oI $393 448 using discount rate oI 15.

Table 7. Cash Ilow Statement: Council's Perspective, ($ Thousand Real)

Year 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

CASH INFLOWS

Direct Inflows 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

CASH OUTFLOWS

Investment Costs

Dismantling old structures 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Civil Works 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Cabling & Iitting accessories 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

New TraIIic Heads 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Transport & Installation 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Total Investment Costs 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Operating Costs

Fixed Operating Costs

Labor 52.9 52.9 52.9 52.9 52.9 52.9 52.9 52.9 52.9 52.9 52.9

General & Admin (excluding VAT) 2.8 2.8 2.8 2.8 2.8 2.8 2.8 2.8 2.8 2.8 2.8

O&M 2.5 2.5 2.5 2.5 2.5 2.5 2.5 2.5 2.5 2.5 2.5

Long Term Service Agreement & Others 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0