Professional Documents

Culture Documents

Captive Service Cost Savings Control

Uploaded by

Nidhi NarainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Captive Service Cost Savings Control

Uploaded by

Nidhi NarainCopyright:

Available Formats

Captive Service is a portion of Business Process Outsourcing where an organization will use a

wholly owned subsidiary instead of a Third Party Vendor. The benefit of doing such an

arrangement would be to leverage the cost savings of using offshore resources, while

maintaining complete control over process and delivery. The costs of such an arrangement are

generally higher than using a vendor.

[1]

Captive Service Units have been in the media lately because of large financial firms tied to

the Subprime mortgage crisis. Many of the firms had captive service units and as they file for

bankruptcy, these units are being sold separately. Specifically, Lehman

Brothers, Citigroup, AIG and Merrill Lynch all have captive units that are being considered or

have already been sold off.

A shared services center a center for shared services in an organization is the entity

responsible for the execution and the handling of specific operational tasks, such as

accounting, human resources, payroll, IT, legal, compliance, purchasing, security. The shared

services center is often a spin-off of the corporate services to separate all operational type of

tasks from the corporate headquarters, which has to focus on a leadership and corporate

governance type of role. As shared services centers are often cost centers, they are quite cost-

sensitive also in terms of their headcount, labour costs and location selection criteria.

A shared service is an accountable entity within a multi-unit organization tasked with supplying

the business unit, respective divisions and departments with specialized services (finance, HR

transactions, IT services, facilities, logistics, sales transactions) on the basis of a service level

agreement (SLA) with a costs charge out on basis of some type and system of transfer price.

[1]

Shared service centers are deployed for a variety of reasons:

[2]

to reduce costs of decentralization, to increase the quality and professionalism of

support processes for the business,

to increase cost flexibility for supporting services,

to create a higher degree of strategic flexibility.

Reported cost reductions of costs of services organized in shared service center are as high as

70% of the original costs, but average about 50%.

Shared service centers are not to be confused with corporate staff departments. Different from

staff departments, shared service centers have measurable outputs (by quantity and quality),

with costs per unit of service provided. Tasks not organized in shared service centers include

corporate control, corporate legal, management development policy, IT-governance and other

support typical for the statutory duties of the executive board.

Shared services training:

Many organizations in private and public sectors use a competency-based training course to

identify and fill skill gaps. The SSO Pro course is one that looks to do that with an industry-

relevant certification.

http://www.outsourcing-law.com/sourcing-models/wholly-owned-operating-subsidiary-

captive-or-shared-services-center/

Wholly-Owned Operating Subsidiary (Captive or Shared Services Center)

Absolute Control. An enterprise may choose to establish a wholly-owned subsidiary to

perform particular services for all corporate affiliates. Such an enterprise is often referred to as

a captive or a shared services center. The enterprise controls all aspects of operations and

is able to integrate the back-office operations with its front-office customer-facing business.

Costs. The shared service or captive model has certain inefficiencies due to size and

structure.

Costs. The enterprise customers sole control causes some inefficiency and higher costs,

assuming demand for services is constant or at least predictable. By choosing a shared-

service model, the enterprise does not have any third party to share in investment in

capital equipment or operating overheads (such as high bandwidth telecom, fixed costs

of personnel who cannot be redeployed if the demand for services fluctuates). In the

case of a classic outsourcing, the service provider may quickly and easily redeploy the

work force. In the case of a wholly-owned subsidiary, redeployment may be difficult,

requiring potentially unneeded cross-training or one-time retraining, assuming new

tasks can be found. If service demand declines, the captive shared-service center may

need to terminate employees, with possible added costs of severance that an

outsourcer could avoid redeployment.

Taxation. As affiliates of the customer, each shared service center is subject to transfer

pricing rules of each jurisdiction where the customer, its affiliates and the shared service

center conduct their business. Under the OECD model income tax treaty, this might not

result in significant additional costs. However, not all countries have OECD-type bilateral

income tax treaties and not all bilateral treaties are interpreted in the same manner. In

particular, for example, the U.S.-India Double Income Tax convention has an unusual

definition of permanent establishment that tends to allow Indian tax authorities to

attribute more income to an Indian service center.

Human Resource Management. The career path of employees in a captive is more

restricted than the career path for employees of an outsourcing service provider. In a

captive, there is only one customer. In an outsourcing service provider, there are many

customers, and a promising individual can find more new opportunities for

advancement than in a captive. For this reason, attrition rates may be higher in a

captive, resulting in higher costs of replacement and inefficiencies during more frequent

replacement.

Benefits. Of source, the benefits of a shared-service model may be significant, depending on the

outsourced business processes and core business. With the flexibility of controlling its

workforce, the enterprise can redeploy its shared service centers personnel to new tasks

without having to go through the sometimes cumbersome, sometimes contentious process of

change control with a third-party supplier.

Regional Service Delivery Centers. Multinational enterprises may have several such captives,

one in each region, to perform services on a continuous 24/7 basis. Such multiple regional

captives serve functions of redundancy and handing off the baton at the moment when one

centers day ends and anothers day starts.

Exit Strategy. The enterprise may choose to sell or spin-off the captive entity to a service

provider to recoup its investment and achieve a profit, to achieve competitive pricing and to

divest a non-core operation. Such sales enable service providers to enlarge their portfolio of

service specialties and territorial footprint. Spin-offs have created a number of new service

providers.

http://www.bpmwatch.com/captive-call-centers/

Captive Call Centers in India

A company that wants to outsource work to India will either have to hire services of third-

party call centers or set up captive centers in India. There is the option of combining both these

aspects as well.

Captive call centers are basically call centers that are operated by a company to service their

own clients and not the clients of other companies. In the past few years, captive centers in

India have seen tremendous changes with some of them closing down and several other new

ones opening up.

India Home To MNC R&D Centers And Captive Units

Nasscom reports one-third of Indias $70 billion (Rs 380,000 crore) software export revenue

comes from R&D centres and captives of multinational firms.

India has 700 captive units of which 70 were setup in 2012.

Should You Setup A Captive Unit

Few questions that you need to dwell upon before deciding on starting your own center are:

1. Is it a one one-off outsourcing assignment or a long term assignment?

2. How much flexibility do you want for future downsizing or expansion?

3. Are you using any proprietary technologies? If so, captive could be better.

4. Do you want to control the day to day operation?

5. Is it better to build a captive centre from scratch or acquire one?

Some of the captive centers in India are listed below.

1. Accenture: The captive center of Accenture is located in Bangalore. The company is a

consulting, technology services as well as anoutsourcing company. They have

collaborated with clients to transform them into high-performance businesses.

2. American Express: American Express or AmEx is a company that offers global financial

services and has set up captive centers in India at Delhi and Gurgaon. The company

specializes in credit card, travelers cheque and charge card businesses.

3. BA Continuum India Private Ltd, founded in 2003 and operating from Hyderabad,

provides BPM solutions for the Bank of America branches in the banks various business

aspects such as consumer banking, small business banking, cards services, investment

management, global wealth management etc.

4. British Airways: British Airways caters to global clientele offering extensive route

network all over the world connecting several centrally-located networks. The captive

centers have employees managing error handling, passenger accounting as frequent

flier miles.

5. DELL International Services: This is the services and support division of the multinational

company which has a strong presence in India catering to PC customers. This division

has operations in Chandigarh, Hyderabad and Bangalore in India.

6. D-Link: D-Link India Ltd. is a subsidiary of D-Link Corporation. The networking company

is one the largest of its kind in India engaged in distribution and marketing of

networking products.

7. Deutsche Network Services Pvt Ltd (dNETS) functions as a part of Deutsche Bank, based

in Whitefield, Bangalore, and works on cash management and payment processing. The

business and private clients corporate division of Deutsche bank caters to financial

services and branch banking to self employed clients, medium and small customers

businesses as well as private customers across the world.

8. Fidelity Investments in Gurgaon has Europe and UK contact center and operations and

have professionals who provide customer services and operational services to investors

in Europe and UK. The Asset Management Company of Fidelity also offers customer

care.

9. GE Capital Service based in Gurgaon is a finance provider. The company also leverages

the global knowledge of TE in order to offer smart financial solution that helps in the

growth of the companys local customers.

10. Global e-Business Operations Pvt., Ltd. is a business processoutsourcing company (BPO)

founded in 2000 with their office at Bangalore. The company is a subsidiary of Hewlett-

Packard (HP) Europe BV. The company offers integrated services in human resource,

decision support, supply chain management, finance and accounting as well as business

analytics.

11. HSBC Electronic Data Processing India Pvt. Ltd., with service centers in Bangalore,

Hyderabad, Vishakhapatnam and Kolkata. The company offers global resourcing in India.

HSBC Global Resourcing is an integral part of the international strategy of HSBC. The

company serves as the largest, banking and financial and captive services offshoring

organization across the world.

12. JP Morgan: It was in 2003 that the major bank in US set up captive centers in

Technopolis Knowledge Park in Mumbai and MindSpace in Malad. The unit is

responsible for transaction processing for financial services, investment management

and investment banking as well as research activities. Another similar unit was set up in

Bangalore in 2004. The company set up their fourth global center in Hyderabad as well.

13. Morgan Stanley Advantage Services: This is a company that is fully owned by Morgan

Stanley and was incorporated in Mumbai in 2003. The company offers support services

to institutional securities businesses of Morgan Stanley world-wide. A host of specialist

services from IT development and financial modeling to research is provided by the

company.

14. Prudential Process Management Services is a subsidiary of prudential Plc which is wholly

owned. In India the company is based in Mumbai operating out of two sites with an

employee base of over 1200. The PPMS provides knowledge services, customer services,

human resources, information technology and risk management.

15. Sitel India is the second largest center of the company offshore. Established in 2000, the

companys locations in India are at Gurgaon, Mumbai, Chennai and Hyderabad. The

company services clients in diverse domains such as technology, financial services,

manufacturing, media and entertainment, communication, travel etc.

16. Visual Graphics Computing Services India has two offices in India in Trivandrum and

Chennai. The company is a fully owned McKinsey & Company subsidiary. The company

is responsible for the production and design of visual communication materials such as

charts, graphics, onscreen animated presentations, multi-media products, overhead

transparencies etc for the global offices of McKinsey.

17. Citibank has over 900 professionals who work at the banks centers of excellence located

in Bangalore, Chennai, Mumbai and Gurgaon. They handle critically sensitive projects in

transaction services, consumer banking, investment banking and risk management. The

banks operations have been planned to expand to Mumbai as well, considering the

financial talent pool available there.

18. Allstate Solutions Private Ltd. in Bangalore is a subsidiary which is fully owned by

Allstate Corporation. The company provides BPO solutions and software development

services to support Allstate Corporation. The Bangalore center was opened in Dec 12,

2012 and has hired more than 60 people and has plans of hiring more than 1700

employees in IT in the coming two or three years.

19. RBS Business Services Pvt. Ltd. is a part of the banks Business Services based in India,

offering services to different RBS group division globally. The company provides services

in different levels such as M&A advisory, credit trading, securities processing, balance

sheet preparation, voice-based processes, equity research etc.

http://www.bpotimes.com/efytimes/fullnewsbpo.asp?edid=16513

India Tops As Financial Services Outsourcing

Destination

More and more global investment banks are getting their number crunching

work done in India as it is a market that can offer mission critical as well as

complex function support services

EFY News Network

Wednesday, January 03, 2007: With the global acceptance of India

as a financial services outsourcing hub, major financial companies

are joining the offshoring bandwagon. Recently banking giant Credit

Suisse announced its plans to set up its centre of excellence in Pune

by January this year. Another US-based financial company State

Street is on the verge of setting up its support centre in Pune as

well. Gradually India is being seen as a market which can offer high-

end and mission critical support services. Functions being offshored

have graduated from the support functions such as F&A support and

voice based services to complex functions including financial

modeling, equity research support and portfolio tracking. In fact over

the last two years research and analytics has emerged as a service

area that has picked up steam.

With the growing maturity of vendors, functions with increasing complexity are being

offshored. For instance, Credit Suisse has tied up with Wipro to set up the COE, where the

vendor will provide the the necessary IT and basic operations support. State Street has a tie

up with Syntel.

More and more global investment banks are getting their number crunching work done in

India. Cost still remains the predominant driver for most of the global financial institutions

to outsource services to India. Companies have been able to realize cost savings to the tune

of 30-50 percent. According to a study conducted by NASSCOM, American BFS companies

saved $6 billion in the last four years by offshoring to India. Other crucial factors driving

offshoring to India include regulatory compliance requirements, large-scale availability of

skilled personnel, English speaking capabilities and favourable cultural issues.

They are doing that through different models of outsourcing that are in vogue currently in

the market. While captive and the third party models are being traditionally followed,

financial service companies are constantly experimenting with new models and their

innovations are likely to drive BPO sourcing as a whole in the country. The latest to emerge

is hybridisation of sourcing models that calls for multi-locational sourcing as well as

combination of captive, third party and joint venture sourcing models.

There are around 30 global financial service providers with captive set ups in India. These

include players like HSBC, AXA, Citigroup, Deutsche Bank and ABN Amro. Top tier

investment banks including Goldman Sachs, Lehman Brothers and UBS also have captive

centres in the country. Setting up of a captive centre and the related infrastructure and

manpower management involves significant financial outlay. Hence typically only the larger

players aggressively follow the captive model.

For many others, offshoring volumes are currently not large enough to make captives

viable. This springs opportunities for the third party service providers. There are more than

50 large and small third party players catering to the requirements of the BFS clients

globally. Some of the big players in the country include Genpact, IBM Daksh, ICICI

Onesource, WNS and Wipro BPO. There are some smaller niche service providers including

Amba Research, Irevna and Copal Partners that have captured the high-end research and

analytics work.

Going forward, global sourcing that follows a best-of-breed approach will find greater

acceptability as firms adopt a multiple-model, multiple-vendor and multiple-location

approach. Blended or hybrid models will be the preferred model for financial institutions.

With almost 50% of the worlds biggest banks in terms of asset size are offshoring to India,

the country remains the most preferred offshoring destination. However, India faces stiff

competition from emerging hubs in Asia Pacific and Eastern Europe. Despite such stiff

competition, India will retain its dominant position at least for the next couple of years.

http://www.sourcingnotes.com/content/view/50/73/

CAPTIVES OF BANKS - GOING THE THIRD-PARTY WAY?

Friday, 16 February 2007

Since the time American Express and Citigroup established captive centers in India two decades back, several global

financial conglomerates have made India their back office hub. Unlike other verticals such as airlines, healthcare and

telecom, banking and financial services (BFS) segment has seen a larger share of offshore captives.

Captive centers offer economies of scale and competitive advantage especially for companies that have very large

volume of work to be transferred offshore. Setting up of a captive center and the related infrastructure and manpower

management involves significant top management interest and financial outlay. Hence typically only the larger players

aggressively follow the model.

As the number of functions being offshored increases, the rationale for captives is becoming more attractive.

Corporations try to minimize cost and at the same time retain control over operations, which is important, given the

confidential nature of information.

Captive centers usually handle a wider range of processes with more complexity from their offshore centers.

Some of the major captive players are included in the table below:

Vendors Year established Services provided

ABN Amro 2002 IT and back office operations

American Express 1994 IT and transaction processing

Bank of America 2003 Transaction processing

Deutsche Bank 2002 Research and analytics, F&A

Citibank 1992

Transaction processing, research and

analytics

HSBC 2002

Electronic data processing, voice

based services, cash management

Standard Chartered 2002 IT, HR processes, F&A

UBS 2006

IT, transaction processing, research

and analytics

World Bank 2003

Research and analytics, transaction

processing

Source: ValueNotes Research

Captives offering services to third-party?

Lately, captives are seen to extend services to the third party client. Some of the captive centers such as HDPI (HSBC's

captive unit) and Scope International (Standard Chartered's captive center) are exploring the option of providing specific

services to other banks.

The rationale behind this to leverage their existing capabilities. In addition, some want to transform from a cost center to

a profit center. Captive centers have well laid out processes and have achieved maturity serving the global operations of

their parent companies. Having attained such experience and maturity, some of these captives believe they might be in

a good position to service third party clients.

Going forward

Though this trend of 'captives extending their services to third party clients' might intensify competition in the short run, it

is not likely to be a significant threat to established third party vendors. Captives of banks or financial institutions face a

disadvantage in terms of competing with their target clients - unless they are ready to alter their ownership structure.

While some banks and financial institutions might offer a few services to their peers, they will be unlikely to replicate the

Genpact (GECIS) success story.

Come June and Genpact becomes the third Indian BPO to get listed in the US. The company plans to raise $600

million from the IPO and will file an application to list its common shares under the symbol "G" on the NYSE. This will

be the biggest Indian BPO listing overseas.

WNS and EXL Service are the other two Indian BPOs listed on NYSE and NASDAQ respectively, while ETelecare

Global Solutions is the first Filipino BPO to list on NASDAQ.

From a captive outfit, Genpact has transformed itself into a leading third party service provider (WNS was also a

captive unit of British Airways) employing more than 28,000 people (as on December 2006) with FY06 revenues

reported at $613 million. While the company is positioned very strongly for growth, the key challenges will be

managing growth across destinations and reducing its dependence on the single key client GE (Genpact depends on

GE for around 74% of its revenues).

Genpact plans to use the proceeds from its IPO towards debt repayment (Genpact has around $230 million of long-

term and short-term debts), general corporate and working capital expenses and funding potential acquisitions.

The listing on foreign bourses is attracting large Indian BPO players. Other Indian BPOs exploring the listing route are

24/7 Customer, HCL BPO and Hexaware.

Name Verticals served Total

Manpower

Locations Revenues($

Mn)

IPO Size

($ Mn)

Genpact Banking & Finance,

Insurance,

Manufacturing,

Transportation &

Automotive

28,000 (India

19,700)

India

(Gurgaon,

Delhi,

Hyderabad,

Jaipur,

Bangalore,

Kolkata),

Mexico,

Romania,

Philippines,

China (Dalian,

Changchun,

Shanghai),

Hungary, USA

and UK

613 (Dec 31,

2006)

600

WNS Travel, Financial

Services, Insurance,

Healthcare, Professional

Services, Legal Services,

Manufacturing, Retail &

Logistics

14,000 (India

7,500)

India (Pune,

Nashik,

Gurgaon), Sri

Lanka, USA

219 (March 31,

2007)

255

EXL Insurance, Banking &

Financial Services,

Utilities, Healthcare &

Media

Approx 9,000 US (New York,

CA, New

Jersey), UK

(London),

India (Noida,

Gurgaon,

121.77 (Dec 31,

2006)

72

Pune),

Singapore

ETelecare

Global

Solutions

Consumer Electronics,

Telecommunications,

Financial Services,

Travel and Hospitality,

Media & Healthcare

Approx 10,000 Philippines, US 195 (Dec 31,

2006)

75

Source: ValueNotes Research

Why the foreign listing?

While a listing in an exchange abroad is an easier way of raising capital, it also provides a comfort level for the

investors and clients on the vendor companies.

Since most of the vendors cater to the US or European market, an international listing serves to build brand via

greater visibility and credibility. This provides the vendors with a good marketing presence too.

Most funding agencies (venture capitalists or private equity firms) are comfortable with international or US listings.

The listing signifies higher liquidity, lower perceived risks and better corporate governance norms.

Increasing investor interests in the fast-growing Indian outsourcing story have made foreign bourses highly

attractive for the promoters and private equity players to offload their stake. BPO companies getting listed in these

bourses have market capitalization multiple times (3 -5 times) their earnings.

Impressive investor response to the previous BPO issues has raised the comfort level of the aspiring BPO firms.

Both the EXL and WNS stocks are currently trading at premium, with their current P/E ratios hovering at 30 and 40

plus marks respectively.

Going Forward

While the larger BPOs are racing towards listing on NASDAQ / NYSE, several other vendors are eyeing acquisitions

in the US and UK. These acquisitions are primarily to acquire the marketing front-end as well as add to their clientele.

For instance Apollo Health Street, a healthcare BPO acquired a medical billing company in the US to complement its

capabilities. Aptara acquired US based Whitmont Legal Technologies, a leading litigation support and eDiscovery

services company. Infomedia bought a 100% stake in UK-based publishing BPO Keyword Group.

Either way, the BPO space is likely to witness more action, much to the delight of international investors and funding

agencies. But this also marks an opportunity-lost for the general Indian investors and the stock exchanges.

NICHE FOCUS BPOS: BURGEONING SIGNIFICANCE

Friday, 11 May 2007

With the rapid evolution of offshoring from process driven back-office jobs and call centers, to the much-talked-about

knowledge driven jobs, exciting times lie ahead for niche focused BPOs and KPOs.

With the rapid evolution of offshoring from process driven back-office jobs and call centers, to the much-talked-about

knowledge driven jobs, exciting times lie ahead for niche focused BPOs and KPOs. The high level of interest and

optimism in knowledge service companies or specialized BPOs is evident from the spate of recent M&A deals, some of

which appear hugely expensive:

Acquirer Company Acquired Segment Deal details

Ayala Corp Affinity Express

Document outsourcing,

embroidery design

100% stake for $28.6m

WNS Marketics

Research and data

analytics

100% stake for $65 mn.

WNS will pay $30 mn

towards the closing of

the deal along with $35

mn earn-out payment

over a period of 12

months

SPi Springfield

Revenue-cycle

management

100% acquisition for

$44m, with the potential

for future earn out

payments

Experian Group Hitwise

Internet marketing

intelligence

$240 m in cash

Mold-Tek Technologies

Cross Roads Detailing

Inc

Engineering and

detailing

100% acquisition for

$1.3m

Integreon CBF Group

Enterprise services to

law firms

100% stake for an

undisclosed amount

Quatrro BPO Solutions Scope eKnowledge Research

Buys out VC stake in

the company

Source: ValueNotes Research

The rising M&A activity reflects the eagerness of larger BPO companies to quickly complement/enhance specialist

capabilities, and thereby move up the value chain.

Funding fast track growth

Traditionally, only a few VCs have been investing in niche BPO players due to concerns over scalability, the emergence

of good exit options has validated the bets of these few investors. As a result, VC investments are likely to rise

significantly in such companies, a sign of the recognition of growth opportunities in under-explored and emerging

segments and geographies. Some of the recent investments include:

Sequoia Capital, Silicon Valley Bank, Light Speed Venture have invested $10.5 million in TutorVista, which focuses on

online education and content.

Quattro BPO Solutions has invested in Annik Solutions, a market Research BPO, and in Scope e-knowledge a research

BPO.

Barings Equity partners has invested in Integra, a publishing BPO

Interestingly, some players in this game have been around for many years, and after years of relatively sedate, organic

growth, are experiencing a revival in their aspirations with the growing interest of VCs/private equity investors. For

instance, Integra a Pondicherry-based publishing BPO set up in 1994 recently took VC funding from Baring Private

Equity Partners to accelerate growth. As per Anu Sriram, Co-founder and Joint MD, Integra, "Integra started in a small

way 13 years ago, and has grown today to become a significant player in the e-publishing space. We are well positioned

to increase our market size and capitalize on the current success of our business."

Of course, in any such "gold rush", there are going to be many who stumble by the way side. And any number of "me-

toos" only intensify competitive pressures. More funding in a segment will create bigger competitors, and those without

the same kind of money clout may be unable to compete. Needless to say, players need to differentiate themselves, by

virtue of either unique specialization/capabilities, robust processes, technology or productized offerings. Those that can

succeed at this will continue to attract investors as well as buyers, while the rest may find no takers at any price!

https://research.everestgrp.com/Product/ERI-2010-2-R-0472/India-Captive-Market-Landscape-

Challenging-Common-Myths-and-Ch

India Captive Market Landscape: Challenging Common Myths and

Charting Future Role

October 2010

Introduction

India has a dominant share in the Global Sourcing industry. Captives constitute an important

segment of the India offshore services market. However, due to the recent economic crisis

and maturing supplier landscape, there is a perception that the model is under threat. Stated

reasons include captives are not delivering value and are significantly more expensive than

third-party suppliers.

At the same time, mature users of captives articulate their commitment to the captive model

and reinforce its importance in their sourcing strategy and portfolio. In addition, Everests

interactions with global sourcing offices of large companies and senior leaders in prominent

captives reveal imperatives underway to expand the role of captives and strengthen their

value proposition.

This research report provides an in-depth analysis of the captive landscape in India based on

Everests proprietary captive database, the industrys most comprehensive database on

captives. The report also challenges common myths associated with captives and provides

deep insights into their evolving role and value proposition.

This research report will assist companies considering setting up a captive center to

understand the role played by captives in sourcing portfolio design and provide an

opportunity to learn from the experience of other companies. It will also help existing

captives and their parent companies to assess their evolution and growth with respect to the

overall industry, and provide pointers towards optimizing value captured from captives and

offshoring programs. In case of service provider organizations, this research will provide an

education on key trends shaping the captive landscape, and enable contextualization and

identify implications.

Scope

This research report leverages Everests proprietary captive database, the industrys most comprehensive

database on captives. From an India standpoint, the database tracks offshore captives of 240 leading

companies (e.g., Forbes 2000, Fortune 500 companies) employing ~300,000 offshore FTEs. The analysis is based

on captives providing offshore delivery of global services, and excludes Shared service centers of companies

that serve the Indian domestic market

The report also draws on Everests deep experience in advising captives, global sourcing offices of leading

companies and private equity investors on diverse set strategic issues sourcing portfolio optimization, captive

benchmarking and performance improvement, optimize captive value proposition and value capture, mergers

& acquisitions, captive set-up support, etc

The data and Everests experience have been supplemented adequately by interactions with captives and

service providers on key topical themes of the study

This report is applicable to a broad set of stakeholders - buyers, service providers, captive organizations and

industry influencers (investors, industry bodies, etc)

Contents

This report analyzes the current captive landscape and key market trends , discusses the

evolving value proposition of captives amidst a dynamic global sourcing market, and

comments on the impact on sourcing portfolio design and optimization. Finally, the report

also provides detailed profile of the India captive landscape and trends in four key industry

verticals Banking, Financial Services, and Insurance (BFSI), Manufacturing, Distribution, and

Retail (MDR), Hi-tech, and Software.

The report concludes with a section on implications for key stakeholders, including early

adopters of offshoring, India captive centers, parents of existing captives, and service

providers. The implications are tailored to each of the segments outlined above to ensure

relevance.

http://blog.mancerconsulting.com/finance-shared-service-industry-in-india/

Finance Shared Service Industry In India

January 7, 2013 in Services

Shared Services Model

Large companies worldwide operating across various verticals such as IT, banking and insurance are increasingly

adopting shared service model. An effective shared services model blends the service quality of a decentralized

system and efficiency of a centralized environment.

Today the pressure to reduce costs while improving processes remains a top priority for a number of companies. In

this situation, outsourcing may not be the right option because of number of reasons like, regulatory environment,

availability of talent pool, criticality, lack of cost justification or competing business priorities. This system has lead to

the innovative shared services model where cost efficiency of outsourcing can be achieved while keeping the tight

control on confidentiality of critical matters.

When it comes to choosing the right destination for shared service centers, India seems to be a preferred location

despite all cultural and infrastructural constraints. India has the largest number of shared services centers in the

world.

Talent Distribution in India

Choosing the right location for shared services centers is a strategic choice for the companies. Companies consider

factors like infrastructure, cost efficiency, talent availability and conduciveness on business environment. As per a

research by MANCER Consulting services, Delhi NCR has emerged as new destination for Finance Shared services

for top Global firms leaving Bangalore behind at second place. The MANCER research also states that tier 2 and tier

3 cities like Jaipur, Kochi and Coimbatore, are emerging as new preferred destinations for shared services centers.

Increasing cost of infrastructure and talent in metro cities is majorly driving this trend. Also state governments are

now formulating supportive policies which is encouraging global firms to set up their shared services centers in

second tier cities.

Shared Services Talent Distribution in India

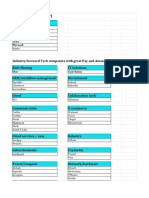

Major Shared Services Companies in India

City wise Distribution

Delhi/NCR Bangalore Chennai Hyderabad

Metlife GOSC Tesco Shared Services Maersk HSBC Global Resourcing

Barclays Shared Services ANZ Shell Deloitte

HSBC Global Resourcing Axa Business Services Ford Amazon

RBS Global Finance Services Target Corporation Logica UBS/Cognizant

American Express HP Flextronics Thomson Reuters

Bank of America Societe Generale HP Infotech Enterprise

Maquarie E&Y Global Shared Services HSBC Global Resourcing Invesco

Intercontinental Hotel Groups Amazon Olam Information Services Infor Global Solutions

OSC Exports Siemens Scope International Dr. Reddys Laboratories

Colt Thomson Reuters Barclays Shared Services CSC

Ameriprise Financials Logica Temenos India Electronic Arts

Hewitt Associates/Aon Timken Engineering Sitel Harsco

Agilent Technologies Oracle CSC ADP

Mercer DBOI Perot Systems/Dell Franklin Templeton

Fidelity Juniper Networks Agility Global Broadridge Financial

Citi Financials Honeywell Technology Sutherland EI DuPont

GE Capgemini World Bank Virtusa

Steria Accenture Phizer Google

XL Insurance GMR Siemens Intelligroup

British Telecom Unilever McKinsey Global F & A United Health Group

Serco Monsanto HOV Services Mumbai

Cargill India ADC/Tyco Electronics Pune DBOI

Whirpool Bechtel India Axa Business Services JP Morgan

Aircel Allied Worldwide Credit Suisse Citi Corp

CPA Global Ocwen Financial Maersk WNS

Keane India/NTT Data Mach India Tata Teleservices Crisil

Xchanging Glodman Sachs Swiss Re Aegis/Essar

DLF Dell Eaton Technologies Nomura

Nestle Grant Thornton Amdocs General Mills

Bharti Airtel Misys Software Solutions Atlas Novartis

Egon Zehnder Virtusa Mphasis Prudential

Aricent Infosys Avaya Morgan Stanley

Pernod Ricard(Seagrams) Symphony Services L&T Nestle

Vertax Cambridge Solutions Ltd Sungard Technologies Reliance

Ericsson Unisys Global Bank of New York Mellon

Fluor Corporation Ahmedabad Capita India

Religare Enterprises Vodafone SSC Trivandrum

Techbooks Future Knowledge Services RR Donnelley

Ranbaxy Adani Enterprise Ltd. E&Y Global Shared Services

KPMG Kochi/Cochin Jaipur

E&Y Global Shared Services Allianz DBOI

Advance Group EXL Coimbatore

British Council Management Sutherland Robert Bosch Engineering

Convergys ACS

Eigen Technical Services Williams Lea

Career Opportunities

Growth of shared services centers in India has created ample job openings for skilled professionals across various

disciplines. Highly sought after shared services change jobs frequently which leads to high attrition rates. As per

MANCER research attrition rates in smaller cities are lower as compared to that in metro cities. This is a major long

term benefit for the firms who open shared cervices centers in smaller cities. There are some core processes and

functions in shared cervices which require extensive customer interactions. This demands for cultural and linguistic

compatibility as well as excellent communication skills of employees.

Some of the areas in Finance Shared Services in which job opportunities are to surge are:

Accounts Payable

Accounts Receivable

General Ledger

Controllership

Financial Planning & Analysis/Management Reporting

Decision Support Management

Statutory/Regulatory Reporting

Internal Control

Product Control & Other Middle Office Work(in Investment Banking)

Transitions & Migrations

Process Excellence/Change Management/Transformation

Finance Tools and Systems

You might also like

- Report - Captive CenterDocument10 pagesReport - Captive CenterPratul MishraNo ratings yet

- Indian CaptiveDocument3 pagesIndian CaptiveAvinEbaneshNo ratings yet

- Nasscom Bain Gics in India Get Ready For The Future - Apr 2017 PDFDocument24 pagesNasscom Bain Gics in India Get Ready For The Future - Apr 2017 PDFKrishnaNo ratings yet

- BPO Inida2Document60 pagesBPO Inida2Rasi chowNo ratings yet

- Nasscom Ansr GCC Report WebDocument44 pagesNasscom Ansr GCC Report Websaif1112No ratings yet

- SAP CompaniesDocument42 pagesSAP Companiesaruvindhu50% (2)

- Global In-House Centers (GIC) Benchmarking Study 2015-Key TakeawaysDocument9 pagesGlobal In-House Centers (GIC) Benchmarking Study 2015-Key TakeawaysSadagopan Raghavan TNo ratings yet

- India Callcentre ListDocument77 pagesIndia Callcentre ListRasi chowNo ratings yet

- Gics-In-India Getting Ready For The Digital WaveDocument81 pagesGics-In-India Getting Ready For The Digital Wavevasu.gaurav75% (4)

- List of Top IT Services Companies in India (1001-5000) : Company Name IndustryDocument8 pagesList of Top IT Services Companies in India (1001-5000) : Company Name IndustrymukmukNo ratings yet

- Captives in India Complete ReportDocument97 pagesCaptives in India Complete ReportVishalDogra0% (6)

- GIC Report 2018Document20 pagesGIC Report 2018Sangeetha PNo ratings yet

- NASSCOM Captivating Captives InfocusDocument3 pagesNASSCOM Captivating Captives InfocusSundararaman ViswanathanNo ratings yet

- Lead and MailDocument8 pagesLead and MailSTONNED.BEGINNING DJNo ratings yet

- India R&D CaptivesDocument25 pagesIndia R&D CaptivesManu Rakesh100% (1)

- Imp Contacts IIDocument2 pagesImp Contacts IIKhalid KhanNo ratings yet

- HR Head Database DelhiDocument12 pagesHR Head Database DelhisandeepNo ratings yet

- Captive Centre Setup in Vietnam PDFDocument113 pagesCaptive Centre Setup in Vietnam PDFsongaonkarsNo ratings yet

- 100 - Top Product Based CompaniesDocument3 pages100 - Top Product Based CompaniesDina DiarNo ratings yet

- IT Service Providers Contact ListDocument3 pagesIT Service Providers Contact ListsujitaNo ratings yet

- Virtual Offshore CaptiveDocument29 pagesVirtual Offshore CaptiveSrinivas ReddyNo ratings yet

- HR ListDocument153 pagesHR ListSohan Sikarwar100% (2)

- India Captives and Offshoring Analysis PDFDocument12 pagesIndia Captives and Offshoring Analysis PDFVivek GandhiNo ratings yet

- Company Profileof Nityo Infotech - Staffing Services 2012Document11 pagesCompany Profileof Nityo Infotech - Staffing Services 2012SandyNo ratings yet

- HR Database - BLR+CHN+MUMDocument1,036 pagesHR Database - BLR+CHN+MUMconsultvims100% (1)

- Bangalore STPI 100 NosDocument3 pagesBangalore STPI 100 Nosmurugesh18No ratings yet

- CIO ListDocument30 pagesCIO ListShivam GuptaNo ratings yet

- Shared Services India 2011Document30 pagesShared Services India 2011marcirobiNo ratings yet

- Consulting - BangaloreDocument28 pagesConsulting - BangaloreShaan BishtNo ratings yet

- IITM StartupDocument3 pagesIITM StartuppraneshNo ratings yet

- Top 3 Content Moderation Companies in USADocument9 pagesTop 3 Content Moderation Companies in USAhitesh guptaNo ratings yet

- Company Name HR Name: Infosys LTDDocument4 pagesCompany Name HR Name: Infosys LTDprasant samantarayNo ratings yet

- List of Companies Visited For Campus RecruitmentDocument6 pagesList of Companies Visited For Campus RecruitmentVenkatRaghavan100% (1)

- HR Detail-NitjsrDocument36 pagesHR Detail-NitjsrMakarand Patil0% (1)

- HR Detail PDFDocument1 pageHR Detail PDFanon_658260618No ratings yet

- Target ListDocument213 pagesTarget ListVivek sarmaNo ratings yet

- List of Nasscom Registered Companies in North IndiaDocument11 pagesList of Nasscom Registered Companies in North IndiaSoftProdigy100% (2)

- 50fintech Companies in IndiaDocument9 pages50fintech Companies in IndiaKarthikeyan GanesanNo ratings yet

- Geeta InstituteDocument7 pagesGeeta Institutesdureja03No ratings yet

- Database NewDocument20 pagesDatabase NewSarita KulkarniNo ratings yet

- Attmanirbhar Next Gen CompaniesDocument23 pagesAttmanirbhar Next Gen CompaniesShaikh Shanu0% (1)

- HR DatabaseDocument36 pagesHR Databaseprasath100% (1)

- HR - Data of IndiaDocument76 pagesHR - Data of IndiaAnshul Jaiswal50% (2)

- HR TOP DATA Converted by AbcdpdfDocument881 pagesHR TOP DATA Converted by Abcdpdfhafiz unawalaNo ratings yet

- HR HeadDocument42 pagesHR HeadDhananjayan GopinathanNo ratings yet

- SAMPLE HR Heads Directory IndiaDocument170 pagesSAMPLE HR Heads Directory Indiavidhya_jeeva0% (1)

- Attendee List PDFDocument38 pagesAttendee List PDFAnusha BhatNo ratings yet

- Comapnies List of NIT JamshedpurDocument56 pagesComapnies List of NIT Jamshedpurdeepu4303No ratings yet

- NASSCOM-Zinnov-GCCs 3.0-Final-May 2019Document93 pagesNASSCOM-Zinnov-GCCs 3.0-Final-May 2019deepak162162No ratings yet

- Retail CompaniesDocument9 pagesRetail CompaniesSheel ThakkarNo ratings yet

- S. No. CompanyDocument42 pagesS. No. CompanyVincsNo ratings yet

- IndiaCaptivating GCC Report NLBServices VF Dec7 2022Document31 pagesIndiaCaptivating GCC Report NLBServices VF Dec7 2022utkarsh.akgNo ratings yet

- List of CioDocument80 pagesList of CioAYUSHI Tiwari73% (11)

- Campus Recruitment DataDocument2 pagesCampus Recruitment DataArc619No ratings yet

- Software & IT Service Catalog 2011Document360 pagesSoftware & IT Service Catalog 2011touhedurNo ratings yet

- Outsourcing Services (BPO Services) - Amicorp Delivers ResponsiveDocument6 pagesOutsourcing Services (BPO Services) - Amicorp Delivers ResponsiveAnusha VenkatNo ratings yet

- Attributes of Professional ServicesDocument5 pagesAttributes of Professional ServicesIngus KudaNo ratings yet

- BPO Industry GuideDocument12 pagesBPO Industry GuideArti RawatNo ratings yet

- Final Project On Outsourcing in IndiaDocument23 pagesFinal Project On Outsourcing in IndiaLaxman Zagge100% (3)

- Becg CecDocument25 pagesBecg CecZeel TamakuwalaNo ratings yet

- Week 1 - Answers Additional Exercises Week 1 - Answers Additional ExercisesDocument6 pagesWeek 1 - Answers Additional Exercises Week 1 - Answers Additional ExercisesDamien BeverdijkNo ratings yet

- Important Notes on Business CombinationsDocument10 pagesImportant Notes on Business CombinationsSajib Kumar DasNo ratings yet

- Jungheinrich Epc Spare Parts List Et v4!37!506!10!2023 2Document43 pagesJungheinrich Epc Spare Parts List Et v4!37!506!10!2023 2josephdavis171001fspNo ratings yet

- PO DETAILSDocument61 pagesPO DETAILSMaxie MoonNo ratings yet

- Board'S Report: To The Members, Review of OperationsDocument74 pagesBoard'S Report: To The Members, Review of OperationsSudha Swayam PravaNo ratings yet

- Investment Banking Research by ValueAddDocument10 pagesInvestment Banking Research by ValueAddValueadd ResearchNo ratings yet

- 10K 123106Document175 pages10K 123106anon-764084100% (2)

- 1 Life Insurance Companies Operating in IndiaDocument1 page1 Life Insurance Companies Operating in Indiayashika goyal DNo ratings yet

- CNX Nifty - Wikipedia, The Free EncyclopediaDocument5 pagesCNX Nifty - Wikipedia, The Free Encyclopediapriyansh priyadarshiNo ratings yet

- Wildwood Media List 9 9Document4 pagesWildwood Media List 9 9api-254328174No ratings yet

- SKL Frequent Flyer V3 October 2017 851291 en USDocument9 pagesSKL Frequent Flyer V3 October 2017 851291 en USEric SGNNo ratings yet

- MAS.M-1405 Cost of Capital Straight ProblemsDocument12 pagesMAS.M-1405 Cost of Capital Straight ProblemsralphalonzoNo ratings yet

- The World's Top 50 Banks and Institutions That No Longer ExistDocument1 pageThe World's Top 50 Banks and Institutions That No Longer Existnikkei225traderNo ratings yet

- The Hard Thing About Hard Things Horowitz en 21709Document7 pagesThe Hard Thing About Hard Things Horowitz en 21709Ricardo Caro100% (1)

- VNR VIGNANA JYOTHI INSTITUTE OF ENGINEERING & TECHNOLOGY PLACEMENT REPORT 2018-22 WITH OVER 2400 OFFERSDocument3 pagesVNR VIGNANA JYOTHI INSTITUTE OF ENGINEERING & TECHNOLOGY PLACEMENT REPORT 2018-22 WITH OVER 2400 OFFERSVadapalli Sai SowjanyaNo ratings yet

- VOIP Roaming Call PricesDocument83 pagesVOIP Roaming Call PricesVOIP RoamingNo ratings yet

- Corporations Equity MCQDocument10 pagesCorporations Equity MCQMagdy KamelNo ratings yet

- Shareholders' Equity - : Measure of The Consideration ReceivedDocument3 pagesShareholders' Equity - : Measure of The Consideration ReceivedChinchin Ilagan DatayloNo ratings yet

- Resolving business disputes through alternative meansDocument4 pagesResolving business disputes through alternative meansলীলাবতীNo ratings yet

- Empresas Que Cotizan en La BolsaDocument174 pagesEmpresas Que Cotizan en La Bolsasandra_maciasNo ratings yet

- Practice Exam 1 Financial Accounting 0Document13 pagesPractice Exam 1 Financial Accounting 0KatjiuapengaNo ratings yet

- Navana CNG Annual Report 2019Document147 pagesNavana CNG Annual Report 2019lerosadoNo ratings yet

- Indias Top 50 Best ItDocument14 pagesIndias Top 50 Best ItAnonymous Nl41INVNo ratings yet

- Financial Management: I. Concept NotesDocument6 pagesFinancial Management: I. Concept NotesDanica Christele AlfaroNo ratings yet

- Audit Report MIRA 2021FINALDocument59 pagesAudit Report MIRA 2021FINALJefri Formen PangaribuanNo ratings yet

- CORPORATION REVIEWER VillanuevaDocument142 pagesCORPORATION REVIEWER Villanuevabobbys88No ratings yet

- PSBank Home Loan - List Accredited DevelopersDocument2 pagesPSBank Home Loan - List Accredited DevelopersAlora Uy Guerrero0% (1)

- Joy StoryDocument1 pageJoy StoryMahesh RajuNo ratings yet

- ENRON Group1Document10 pagesENRON Group1Akanksha JaiswalNo ratings yet