Professional Documents

Culture Documents

VC Handbook 2014

Uploaded by

rashidnyouOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VC Handbook 2014

Uploaded by

rashidnyouCopyright:

Available Formats

Handbook on

Venture Capital

An Entrepreneur's guide to

Early Stage Funding

Private Company

Financials, Transactions,

Valuations

July 2014

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

VE NT UR E

INTELLIGENCE

3

5

Venture Capital Investor landscape in India

An Interview with Sarath Naru,

Managing Partner, Ventureast.

Venture Debt: A Catalyst for Growth

Entrepreneur Interview:

Gaurav Jain of Mast Kalandar

Negotiating Term Sheets - Legal Issues

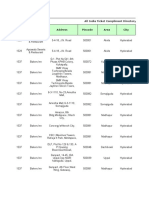

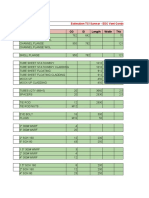

Venture Capital Investor Directory

7

9

10

13

16

18

25

26

29

34

36

Table of Contents

- Accelerators

- Incubators

- Angel Investors

- Seed Funds

- VC Firms

- SME Investors

- Social VC / Impact Investors

IIM-A

NCL Pune

NSRCEL

SINE

Landscape of Venture Capital

Investors in India

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Chennai Angels

Hyderabad Angels

Indian Angel Network

Mumbai Angels

Blume Ventures

India Innovation Fund

Orios Venture Partners

Seedfund

Ventureast

YourNest Angel Fund

Incubators

Angel

Networks

Seed

Level Funds

VC Funds

Early Stage

Accel India

Footprint Ventures

IDG Ventures India

Inventus Capital

Nexus Ventures

Sequoia Capital India

Ventureast

Typical Investment

< Rs.50 Lakhs

Typical Investment

Rs.50 Lakhs - 2 Crores

Typical Investment

Rs.50 Lakhs - 2 Crores

Typical Investment

Rs.2 - 10 Crores

Accelerators

500 Startups

Angel Prime

GSF Accelerator

Canaan Partners

Helion Ventures

Kalaari Capital

Nexus Ventures

SAIF

Sequoia Capital India

Ventureast

VC Funds

Growth Stage

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

PE Investors

SME Focused

Aquarius

Abraaj Group

Avigo Capital

Bessemer

Gaja Capital

Headland Capital

IFC

IFCI Ventures

Lighthouse Funds

Mayfield

NEA

Zephyr Peacock

Landscape of Venture Capital Investors in India

Typical Investment

Rs.10 - 25 Crores

Typical Investment

Rs.25 - 100 Crores

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

SARATH NARU,

Managing Partner, Ventureast

What is it that excites you about working in the

Venture Capital industry?

There is a wealth of entrepreneurial talent

available in India and its exciting to see how

venture capital makes so many dreams come true. The last five years has

witnessed the emergence of a rich, vibrant startup ecosystem across the

country in both metros as well as Tier 2 cities. And there is more to look

forward to!

As a VC investor, what do you look for in an entrepreneur?

On the top line, we look for entrepreneurs with an almost unwavering

passion and sense of urgency - we call it "fire in the belly". But along with

this comes the attitude and practical skills needed to make things

happen. These entrepreneurs have given up their cushy corporate jobs

to build a company from scratch. And most important of all, they should

have deep domain expertise, and must have been there and done

that because passion alone is no substitute for knowledge and

experience.

Luckily for us, the founders of our investee companies are also the type I

would go out for a drink with, especially after a heated argument!

What is your investment philosophy?

At Ventureast, we are a bunch of people who are passionate about

building businesses, and partnering with companies.

We are a multi-stage investor, with a penchant for early. A majority of

Ventureasts investments go into financing companies with business

models which are being adapted to meet Indias needs.

We partner with businesses which have the ability to scale up rapidly, led

by solid founding teams. We scout for startups where we can add value,

beyond capital. We never hesitate to roll up our sleeves and get in the

trenches when a company calls for it.

Can you elaborate on how else you add value to investee

companies?

Our involvement typically comes in at three different levels. The first is

with the cash flow, and helping raise third party debt/equity financing.

The second area is operational support, which involves marketing, MIS

and Financial systems development. The third area is strategy and

talent. We help our investee companies with hiring talent, identifying

experts as consultants, strategic planning at the Board level, forging

business alliances, and acquiring customers.

Which are your target segments and most attractive sectors as of

now?

We are open to investing in any innovation-driven business in a rapidly

growing sector. Innovation neednt be only in terms of technology but

could also be in the business model, and we are currently seeing a

combination of both in sectors like healthcare, retail, financial services,

internet commerce and cleantech.

We look out keenly for differentiation. Regardless of the stage or sector,

we have specialized funds led by teams with extensive operational

experience.

Simply looking at how our investments have evolved over the years-

starting with port management services and dairies in the late 1990s,

biotech and drug discoveries in the early part of the millennium to the

recent IT/ITeS, quick service restaurants, internet commerce etc.-

shows how nimble and adaptable we have been to the changing

entrepreneurial landscape in India.

What is your advice to entrepreneurs?

This is a great time to be an entrepreneur. There is money available for

new disruptive ideas and business models in the form of incubators,

venture capital funds and private equity investors.

At the end of the day, its all about execution. An entrepreneur must

essentially focus on one idea, and execute it against all odds.

KUMAR RANGARAJAN,

Co-founder & Chief Ion, Little Eye Labs

(now a part of Facebook)

"Ive recently had a chance to speak with

many startups and the one thing that I realize

which made a big difference for us is in finding

an investor like Ventureast, who is more of a mentor and friend.

In my mind, you were like a co-founder, because I felt the team

took a deep interest in what we were doing and guided us and

that made a huge difference, much beyond just the monetary

short-term gains. Team Ventureasts expertise was especially

useful while closing the deal. Its the faith you had in us,

irrespective of the outcome, which we truly appreciate.

MEENA GANESH,

CEO & Managing Director, Portea Medical

The team at Ventureast has been excellent

in providing us with strategic inputs,

excellent contacts for South East Asia and in

the US, as well as providing good day to day

support on investor related approvals and activities. Since we

were starting a new business in healthcare, we wanted in

addition to just a financial investor someone who can help us in

the healthcare sector. VEs dedicated life sciences fund and the

focus on the sector , experts in the field amongst their team was

critical for us as we needed ready introductions and plug-ins into

the ecosystem.

ENTREPRENEURS SPEAK

An Interview with Ventureast

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

VENTURE CAPITAL INTERVIEW:

PRAKASH PRABHU,

Founder, Atyati

(acquired by Genpact in 2012)

Its not easy to build an organisation and

sustain it. The real value comes in when you

are down and the company isnt performing as

per expectations. Its important to get the right investor partner;

someone who believes in the long term; and rolls up their sleeves

to pitch in beyond capital to help the company. Ventureast has

been supportive, professional, and good in dealing above the

board.

Ventureast is one of Indias longest-standing venture capital

institutions. Investing in pioneering sectors since the mid-90s,

Ventureast has enabled over 80 seed, early and growth stage

businesses in a broad array of sectors including technology, life

sciences and clean environment.

The Ventureast credo simply put is, We Differentiate, You Win.

Backing this is a team and network with deep expertise in

domains ranging from semi-conductors to drug discovery, from

infrastructure to consumer goods, from clean tech to mobility,

thus bringing together the widest capability in the country.

The Ventureast family of funds - Ventureast Proactive Fund,

Ventureast Life Fund and Ventureast Tenet Fund feature a wide

investor base consisting of institutional investors from across the

world. The Ventureast portfolio features market-leading

companies like Indias largest parking management company,

Indias largest ethnic fast food chain, Indias first and unique low-

cost ATM, and Indias largest organic foods company.

VENTUREAST - A BRIEF PROFILE

Venture Debt

A Catalyst for Growth

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

It is common belief that debt for an early stage company or a startup

is not feasible. The risks appear simply too high. Startups have no

reliable cash flows, tangible collateral, or track records to support loan

repayment which inevitably leads to the conclusion that the funding

needs of a young, albeit high- growth company should only be met

through equity from promoters who seek to bootstrap their

companies or external investors in the form of risk capital. Certainly

over time, a number of methods and sources have arisen to fund

startups including individual angel investors, seed investing groups

and venture capital funds. Conventional wisdom however, does not

explain the global emergence of a niche industry of venture lenders

that lend profitably to startups. Venture debt forms a significant part

of the overall venture capital market and in more developed markets

like the US, venture debt constitutes an estimated 8-10% of the total

venture capital market.

An Overview What and Why?

Collateral and even personal guarantees from promoters to over

collateralize the loan. In contrast, venture lenders seek to understand

the enterprise value of a company and assess how that will grow in order

to gauge how a companys cash flows will evolve to repay the debt. A

solid VC investor base, an experienced management team and a

credible business plan are all drivers of strong enterprise value and

factors that a venture lender would consider when making an

assessment.

Venture Debt in the Indian context

Venture debt is still in its nascent stage in India. High growth, innovative

Indian companies do not have many alternatives for capital other than

raising equity. Banks have had limited exposure to startup companies.

The small ticket size of loans and high cost of servicing them limits the

ability of banks to spend the effort to understand startups. While several

banks in India have set up a focus on SMEs, they generally do not extend

relationship coverage to startup companies until they mature and turn

profitable.

While banks may eventually get comfortable, their credit appetite using

traditional methods of credit evaluation tends to be marginal and

suboptimal from the borrowers perspective. Therefore, traditional

bank financing is rarely available in this segment without severe

limitations on the use of funds and without a high collateral cover or

personal pledge and guarantees, owing to which startups are virtually

ignored by banks in India. Consequently, the demand for growth capital

by early stage companies significantly outpaces supply. SVB India views

this as a critical gap in the venture ecosystem in India and works to

bridge the gap through its venture lending program that ensures

companies have access to appropriately structured risk capital at all

stages of their development.

Uniqueness of SVBs Venture Lending approach in

India

SVBs model of venture debt in India is different from the traditional

models of venture debt in other global markets like the US, Europe and

Israel. This stems from the differences in the investing thesis employed

by venture capital investors in India as compared with the approach in

global markets. VCs in global markets have traditionally invested in

technology companies that have significant intellectual property (IP)

assets. In contrast, VC investments in India are more broad-based along

business models ranging from technology to fast food and branded

retail to e-commerce. This is where the knowledge and experience of

the senior team at SVB India translates into a material advantage.

While the lack of IP might make it difficult for traditional venture lenders

to lend to most Indian startups, SVB understands that Indian companies

have varied bases of value creation with different growth dynamics and

inflection points. Factors such as gaining a first mover advantage,

having a strong distribution network, building a unique process, or

developing a recognizable brand confer relatively stronger competitive

advantages than purely developing IP assets in a disaggregated and

geographically diverse market as India. The SVB team has been able to

understand those dynamics and has built a unique framework to

evaluate loan requests, and structure and monitor deals effectively. In

essence, the lending proposition works very much in the same way; just

tweaked a little to take advantage of the wide canvas of opportunities

that India offers.

But what financial motivations could possibly make it worthwhile for

these venture lenders to lend to risky startups? Although the risk of

lending to startups is generally high, the credit risk can be mitigated

under certain circumstances. The extent to which the risk is mitigated is

highly dependent on the lenders skill and understanding of such

circumstances. Traditional lenders look for companies with historic

profitability, established cash flows and tangible assets that can serve as

Venture debt extends the liquidity runway of a company which

improves the chances of achieving more than just one

milestone in the extended time frame and of raising the next

The debt can be used to finance the companys growth and capital

expenditure requirements including accelerating product development

or making key hires enabling venture capital equity to be reserved for

funding other business critical activities. Venture debt is valuable not

only to startups but also to high growth profitable companies that fail to

attract conventional debt financing because their cash flow, asset

values, or end-use do not support typical underwriting standards. The

structures of venture debt solutions are aligned to fit the profile of the

company and its specific requirement.

Venture Debt means any form of debt financing provided to a company

that is still dependent on venture capital financing to fund its operations.

It is a source of capital which augments a companys equity raise with a

comparatively less dilutive buffer of cash that can support a companys

growth and extend its liquidity runway. A venture loan while cheaper

than equity, does not try to replace equity.

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

done in India, SVBs venture debt offering has allowed many startups to

minimize dilution while raising alternative forms of capital that is also

advantageous in terms of achieving a more efficient capital structure a

mix of equity and debt. Many of the companies in our portfolio have

been successful in reducing their overall cost of capital by availing

multiple debt infusions over time. With so many years of presence in the

entrepreneurial and venture capital ecosystem in India, SVB is well

positioned to support disruptive innovation in the increasing number of

investor-backed companies across stages and sectors.

The core instrument is a medium term loan ranging from Rs.3 Cr to

Rs.25 Cr depending on the stage of the company and nature of the

requirement. Interest rates are fixed for the tenor of the loan and are

priced competitively compared with rates that SME companies can

usually obtain from banks. A small equity kicker enables additional

contingent upside returns, if the company does well and provides some

additional returns on a portfolio basis to compensate for the higher risk.

SVB does not mandate any particular end use for the funds and it can be

utilized in any form such as accelerating product development, key hires,

expanding to a new market, making acquisitions, operational working

capital or even refinancing. While SVB does not take board seats on its

portfolio companies, the team is always willing to leverage its

experience and SVBs global network encompassing a large number of

early to growth stage companies as well as investors to assist their clients

as and when required in their business or strategic pursuits.

Management Outlook About SVB India Finance and Key Terms

SVB India Finance was started in Mumbai in 2008 and is positioned as

India's first and only specialty lending business targeting high growth

entrepreneurial companies in India backed by top-tier venture capital

and private equity investors. Across more than 60 loan transactions

Vivek Subramanyam

(CEO, iCreate Software)

Chetan Kulkarni

(CEO, Vizury)

We are pleased in partnering with a leading global player focused on the

start-up ecosystem such as SVB. Their understanding of the unique

requirements of start-ups translates to flexible products that meet the

venture debt funding requirements and are structured in a mutually

beneficial manner.

We are very pleased with our recent engagement with SVB India

Finance. The alacrity of their team, the level of attention and care given

to us and the process of securing debt funding were all remarkable.

Venture debt has been established to be a useful tool for high growth

tech startups globally but in India the utility of this product extends to

growth stage companies as well as non tech sectors, as seen from our

experience over the last few years. This is also a sign of the Indian

venture ecosystem evolving further with differentiated avenues of

capital becoming available to fund the ever growing needs of high

potential startups, in tandem with the emerging green shoots in the

overall macro environment.

India is an exciting market for us to be in with strong emerging grass-

roots entrepreneurship and growing sources of innovation capital. Our

approach in the market goes further than just providing venture loans to

young VC-backed companies. Our relationship with Angel forums and

initiatives like the HALO Report for India provide us with ways to get

more involved with the emerging startup ecosystem in this market

Ajay Hattangdi,

CEO & Managing Director, India

Vinod Murali,

Managing Director

VENTURE DEBT A CATALYST FOR GROWTH

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

GAURAV JAIN

Co-founder & CEO of Mast Kalandar

Funding: Mast Kalandar, a chain of quick service

restaurants (QSR) serving North Indian cuisine, has

raised over Rs.45 crore in venture capital funding

(starting in July 2008) from Footprint Ventures and

Helion Ventures. The company had also raised venture

debt from SVB India and a strategic investment from the Salarpuria

Group.

Venture Intelligence: You had started Mast Kalandar after working

for a few years in the IT industry. Why did you choose to go for VC

funding as the preferred form of financing for your venture?

Gaurav Jain: We were clear right at the beginning that we wanted to

grow rapidly. So, we had two options - one is the franchising route and

the other is VC investment. The franchising route comes with its own

disadvantages, whereas the VC route brings with it not only the money

but also other benefits.

VI: What are the other benefits that your VC investors have

brought to the table for Mast Kalandar?

GJ: Right from advising on the business strategy and business plan to

things like recruiting the right people into the company and connecting

us to the right consultants and professionals (for design, marketing,

social media, etc.) and other companies which might be good partners,

our VCs have been instrumental in a lot of things.

VI: What was your experience in meeting and pitching your

proposal to VC investors in the early phase?

GJ: When we raised our first round, QSR was not such a hot sector for

VC investments as it is today. We got introduced to the investors

through some common business acquaintances. We were lucky in that

the investors were also willing to look at this space and we did not have

to go through an elaborate fund raising exercise. They liked the business

and we liked the people behind the capital.

VI: What would your advice be to other entrepreneurs who are

considering VC financing? Is there anything specific you would add

for startups in the QSR sector?

GJ: VCs are generally industry agnostic and their approach is not very

different to a company in QSR or any other sector. Having said that, the

person making the investment needs to have an overall understanding

of the sector he/she is going to invest in. The end motive may be the

returns, but if a person doesnt understand retail or QSR, he/she will not

be able to do justice in terms of meeting the expectations of the

company. When you are getting an investment, you should do a

thorough research of the person who would represent the VC firm (in

your company) and ensure that he/she understands the space. That is a

key thing. Second, the person should be someone that you would be

able to get along with well. If that relationship angle is missing, sooner

or later it is not going to give a good feeling and you will have issues

cropping up.

VI: Mast Kalandar has also used the initial advantage of raising VC

funding to then raise venture debt from SVB. Can you share some

highlights on that?

GJ: We went the venture debt route when we wanted to extend our

runway (before diluting more equity). Once we raised another equity

round, we chose to return that capital. We found the venture debt

option to be a good one to exercise at that point as the cost of debt

made sense and it helped us build more value in the company.

Interview with Gaurav Jain,

Co-founder & CEO of Mast Kalandar

Negotiating term sheets

- Legal Issues

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

The fact that convertible debentures, while in the unconverted state,

rank as debt; and in that form, rank higher than the holders of equity

shares in the queue of persons eligible to receive distributions (in the

event of the company being wound up), are factors that funds take into

account.

What rights can the instrument have? Note that shares with

differential voting rights (DVR Shares) cannot be freely issued by

6

companies, without complying with certain conditions. In this context,

the Liquidation Preference clause assumes significance. In jurisdictions

like the United States, where (comparative to India) companies can be

wound up or liquidated relatively quickly, the term liquidation

preference is used to imply that in the event the company is liquidated

or sold, i.e., an exit event is created, the fund would first get its returns

(1x, 2x, etc.) before the founders get their share. However, the use of

this term in the Indian context gives rise to some confusion (since the

word liquidation suggests dissolution of the company, the process for

which is prescribed under the Indian company law). The Indian

company law also prescribes the manner in which available moneys

7

must be paid out , and hence, any contractually agreed clauses on the

manner in which moneys must be distributed upon winding-up may not

be given effect to by courts. The better expression is, therefore, a

'distribution preference' arising upon the occurrence of a 'liquidity'

event, namely, a transaction that realizes the 'value' of the company,

typically, in cash (although a share or stock deal is not ruled out, except

that achieving it is a regulatory challenge). Note however that there is

no contractual restriction on agreeing as to how moneys must be

distributed in case of other exit events such as sale to a third party (who

may be a strategic or financial investor), as long as applicable exchange

control and taxation laws are complied with.

To avoid confusion in the Indian context, it is important to perhaps

separate the Liquidation preference clause into two distinct strands

one, what happens in case of winding up under the Indian company law,

and two, what happens in case of an exit or liquidity event.

Unfortunately, it is not unusual to see the terms 'liquidity' and

'liquidation' being (incorrectly) used interchangeably.

Exit provisions. Commonly used exit provisions include initial public

offering, strategic sale, buy-back, and put / call options. Put / call

options have received some welcome regulatory sanction recently. Over

the last few years, the put option and call option have been in the eye

of a regulatory storm in India. This is because the Reserve Bank of India

(RBI) considered these options as granting foreign investors

guaranteed returns, giving the investment instrument debt-like

features, as opposed to equity. The Securities Exchange Board of India

(SEBI) considered that all options must only be exchange-traded and

8

cannot be off-exchange, contractually agreed between parties. The

RBI has, in January 2014, allowed issuance of equity shares and

compulsorily and mandatorily convertible preference shares and

debentures containing an optionality clause, but without any option /

right to exit at an assured price, to a person resident outside India. These

Overview of main provisions in Term Sheets

Term sheet, non-binding term sheet, indicative term sheet, Letter of

Intent, Head of Terms, Memorandum of Understanding, Non-

binding MOU are commonly heard terms in the private equity / venture

capital world. This article will look at commonly encountered issues in

negotiating, and the issue of the enforceability of, these documents in

the Indian context.

Simply put, a Term Sheet, by whatever name called, and whether a

simple 2-pager, or a detailed tome, is a document that sets out key

financial, protective and governance terms of a proposed investment by

1

a VC or a PE fund in a company looking for investment. What they all

usually have in common is the understanding that they are not binding

2

until the execution of definitive documentation. Typically, the financial

provisions covered in a Term Sheet are the proposed investment

amount, valuation of the company, type of investment instrument, and

a timeline for the investor's exit, together with indicative exit

3

mechanisms. Governance terms and protective provisions include the

composition of the board of directors, a lock-in over the founders

shares, and sometimes, detailed provisions governing share transfers.

Protective provisions will seek to safeguard the funds investment in

several ways, for example, the right to receive detailed information

about the companys financial health (including management

information system reports and unaudited monthly financial

statements). The right to veto certain actions, and anti-dilution rights in

future financing rounds, are also commonly seen.

Financial provisions

What instrument? Once the parties have agreed on the valuation of

the company, the next question is as to what kind of investment

instrument is desired. Available options are equity shares, preference

4

shares, and convertible instruments. Note that in case of investments

5

by non-resident funds, all shares must be fully paid-up , and the price

per share must be above the fair value arrived at in accordance with

prescribed methods. Several factors influence the funds choice of

instrument. The principal one is how the fund envisions its role in the

company. Funds which want to have a hands-on, operational role in the

day-to-day affairs of the company may choose large or controlling

stakes of above 50% of the equity shareholding. Funds for which the

investment is a purely financial one may choose convertible instruments.

1. For a detailed analysis of private equity fund formation and transactions in India, please see

http://www.samvadpartners.com/wp-content/uploads/2013/06/Getting-The-Deal-

Thr ough- I ndi a - Pr i v a t e - E qui t y- 2012- Fund- For ma t i on- Cha pt e r. pdf .

http://www.samvadpartners.com/wp-content/uploads/2013/06/Getting-The-Deal-

Through-India-Private-Equity-2012-Transactions-Chapter.pdf

2. Typically, a share subscription or purchase agreement and a shareholders agreement.

3. Including initial public offers (IPO), strategic sale, 'put option,' 'call option' among

others. The 'Liquidation Preference' clause is also a significant one.

4. Such as convertible debentures or preference shares. Also, convertible instruments must

be fully and mandatorily convertible in order to be reckoned as equity. Partly convertible or

non-convertible instruments would be reckoned as debt and subject to the more onerous

rules applicable to external commercial borrowings.

5. Partly paid instruments are not allowed for FDI, except with prior approval of the

Government.

Negotiating term sheets

- Legal Issues

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Enforceability of Term Sheets in India

There have not been significant judicial pronouncements on the

12

question of enforceability of a venture capital term sheet. To

summarise, term sheets are preliminary agreements, evidencing an

intention of the parties to enter into a contract at a future date. Such

agreements to agree are not enforceable under both English and

Indian law, although, there may be exceptions depending on the facts

and circumstance of each case, the conduct and the intention (whether

express or implied) of the parties to create legal relations. Whether or

not a term sheet is binding on the parties depends on the provisions

contained therein. Therefore, the parties must employ a clear and

unambiguous language to avoid disputes. Certain clauses like

Exclusivity, Confidentiality and No-Shop, and the related Dispute

Resolution provisions, must be expressly stated to be valid and binding,

independently of whether or not the deal goes ahead with the execution

of definitive documentation. Importantly, clauses dealing with costs or

fees, and who is to bear them, whether or not the deal goes through,

must also be clearly indicated to be binding, so as to avoid unpleasant

shocks later. The concept of break-fees and its payment, is another

clause, that must be made so binding irrespective of deal closure.

instruments are viewed as eligible instruments to be issued to a person

resident outside India by an Indian company, subject to certain terms

and conditions.

Governance Terms

Board and Shareholder meetings. Funds would want a say in the way

the company is run, on certain important items, at least, and will

typically nominate at least 1 director to the companys board, coupled

with a list of items on which the board cannot proceed unless such

nominee director has consented. This list is typically replicated at the

shareholder level as well, such that no resolution can be passed by the

shareholders in general meeting on the specified list of matters, unless

the fund, as a shareholder has consented (whether at the shareholders

meeting, through its authorized representative, or through a separate

9

written consent). While most funds seek to nominate a director(s) on

the companys board, there has been a rise in the trend where certain

funds prefer to appoint an observer on the companys board instead

of a director.

Restrictions on Share Transfers. The ability to restrict the transfer of

shares in private companies is important from the investors point of

10

view. Typically, such investors would want to ensure that the founders

/ promoters of their investee company cannot unilaterally decide to

jump ship in the event the companys business is floundering

therefore, elaborate provisions governing the transfer of shares is

typically included in transaction documents and replicated in the articles

of association of the company. These include rights of tag-along,

drag-along, come along, rights of first offer and rights of first

refusal. While these rights are now fairly common in the industry, their

11

enforceability in court is yet to be tested.

6. For example, one of the key conditions is that the company have distributable profits in

the 3 financial years prior to the year in which DVR Shares are to be issued.

7. First, and paripassu,to secured creditors and workmen; thereafter to satisfy all other debts;

and only finally to shareholders (preference and equity, in that order).

8. For a detailed article on the subject, see http://www.siac.org.sg/index.php?

Option=com_content&View=article&id=406:enforceability-of-put-and-call-options -

in-india-in-the-current- regulatory-environment&catid=56:articles&Itemid=171

9. These rights carry greater weight in private companies, while in public and public listed

companies, the legal implications of these kinds of rights is very much a grey area. When

the question of whether these 'affirmative rights' or 'veto rights' amount to the fund

acquiring 'control' over the investee company for the purpose of the takeover regulations

came up before the SEBI, SEBI ruled in the affirmative. The Securities Appellate Tribunal

(SAT) reversed SEBI's order. The matter went up before the Supreme Court, but was

unfortunately settled before the Supreme Court could pass an order on the merits. The

Supreme Court did however expressly state that the SAT's ruling was not to be treated as

precedent. There is a likelihood that in the future a regulator or court could take the view

that funds enjoy 'control' over their investee companies, with attendant legal implications.

10. Shares or debentures or other interest of any member in a company are movable property

transferable in the manner provided by the articles of the Company. (S. 44, Indian

Companies Act, 2013). One of the important differences between private and public

companies in India is that a private company must by definition restrict the right to

transfer its shares. For public unlisted and listed companies, unfettered transferability of

shares is key.

11. This is important when one recalls that foreign investment rules are layered upon the

Indian company law. So, while the above rights may fall within the ambit of the Indian

company laws provided right to private companies to restrict the transferability of

shares, FEMA regulations still have to be considered. Therefore, a foreign investor may

not be able to enforce its drag right in FEMA-regulated sectors, unless the pricing

guidelines are complied with.

12. Although the question has come up several times before Indian courts in the commercial

contracts context.

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Samvad: Partners is a partner-led, solution-oriented law firm, formed by the merger of Narasappa, Doraswamy & Raja (NDR) and V Chambers

of Law. The Firm is committed to providing smart and quality legal advice to our clients; maintaining the highest levels of professional integrity; and

nurturing our lawyers in a work environment that motivates them to achieve and maintain the highest standards.

The Partners of the Firm Mr. Harish Narasappa, Ms. Neela Badami, Ms. Nivedita Nivargi, Ms. Poornima Hatti, Mr. Rohan K. George, Mr. Siddharth

Raja and Ms. Vineetha M. G. are leaders in their respective fields of practice. The majority of our Partners have a rich mix of domestic and

international experience, having worked in several legal and financial capitals around the world, including London, Hong Kong, Singapore,

Mumbai, New Delhi and the Hague. Our lawyers are truly international, with several being admitted to practice law in India, England & Wales and

New York, bringing with them a deep and diverse international perspective.

With offices in Bangalore, Chennai, Mumbai and New Delhi the Firms partners and the legacy firm NDR have regularly received the highest

accolades and ranking from our peers, including recognition in Chambers & Partners and Legal500, over the past few years.

DISCLAIMER: PLEASE NOTE THAT THE CONTENTS OF THIS ARTICLE ARE NOT MEANT TO BE A SUBSTITUTE FOR OBTAINING LEGAL ADVICE.

IT IS ONLY AN INTRODUCTION FOR INFORMATIONAL PURPOSES AND WE URGE YOU TO CONSULT YOUR LAWYERS FOR SPECIFIC

ADVICE.

NEELA BADAMI,

Partner

Neela Badami works primarily in the areas of

mergers & acquisitions, private equity & venture

capital, TMT, general commercial contracts and

public international law advisory.

Neela holds a B.A., B.L (Hons.) degree from the National Academy of

Legal Studies and Research (NALSAR) University of Law, Hyderabad

(2005, Gold Medallist). While at NALSAR, Neela represented India at

the Philip C. Jessup International Law Moot Court Competition (2004).

She holds an LL.M from the University of Michigan Law School, Ann

Arbor, U.S.A (2008, Michigan Grotius Scholar).

Prior to joining the Firm, Neela was an associate in the Capital Markets

Practice Group at AmarchandMangaldas, Mumbai. Neela has also

worked as a Law Clerk at the International Criminal Court in the Hague,

Netherlands (Legal Advisory Section, Office of the Prosecutor).

Neela stays connected to academia through both writing and teaching

engagements recently, she has taught a 1-credit elective course at her

alma mater, NALSAR, on Private Equity and Venture Capital

Transactions in India. She has been published nationally and

internationally. Neela serves as a member of the Native Speaker Board

advising the Goettingen Journal of International Law, as well as on the

Editorial Board of the Forum for International Criminal and

Humanitarian Law.

She can be reached at neela@samvadpartners.com

SINDHUSHRI BADARINATH,

Senior Associate

Sindhushri Badarinath works in the areas of private

equity / venture capital transactions, real estate

and general commercial law.

Sindhushri holds a B.B.A., LL.B. degree from Symbiosis Law School,

Pune (2009). She has also completed a diploma in international business

laws and corporate laws in India from Symbiosis International University

(formerly known as SIEC (Deemed) University). She is admitted to

practice law in India.

She has previously worked as an associate with Indus Law, Bangalore

and has handled matters relating to general commercial law and

employment / labour laws. She has worked on a variety of corporate

legal assignments for clients in ICT (information and communication

technology), healthcare, retail, and manufacturing sectors.

She can be reached at sindhushri@samvadpartners.com

Introduction and overview

Premium Listings

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

SVB India Finance Private Limited

www.svb.com/india

About the Firm:

Started in 2008, SVB India Finance Private Limited

is a subsidiary of Silicon Valley Bank. It is positioned

as India's first and only specialty lending business

targeting high growth entrepreneurial companies

in India backed by top-tier venture capital and

private equity investors. We have done over 60

transactions across sectors in India ranging from

technology, ecommerce, healthcare to QSR,

education etc. We offer multiple sources of diverse

debt capital including venture debt, acquisition

financing, growth capital and capex financing.

Office Address:

12th Floor, Express Towers

Nariman Point

Mumbai - 400021

Tel: +91 22 6744 6500

Fax: +91 22 6744 6565

Contact Persons

(Name, Designation, E-mail & Contact no.):

Sujana Ravishankar

Sravishankar@svb.com

Preferred Sectors:

Sector-agnostic

Investment Range:

Rs.3 Cr to Rs.25 Cr.

Select Transactions:

Applied Solar Technologies, Capillary Technologies, Faasos Food

Services, Indiahomes, iYogi Technologies, Manthan Software

Systems, Myntra, Prizm Payments, Snapdeal, Yatra.com

We are looking for:

We look for early to growth stage high potential companies that

have raised equity investment from top tier institutional Venture

Capital or Private Equity investors. Companies that have strong

management teams and robust investor support in addition to

significant IP or display of innovation form our target

addressable market.

Premium Listings

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Ventureast

www.ventureast.net

Ventureast is a pioneering Indian VC fund manager

with a rich history of investing in innovative

businesses across multiple sectors, and multiple

stages of a business - from seed and early to growth

stages. Patience and nerve, combined with a

wealth of operational experience and knowledge

gained by helping our investee partners

differentiate- this best defines Team Ventureast,

who is ever excited to join trailblazing

entrepreneurs in a shared journey of building a

great company.

Office Address:

Address: 5B,

Ramachandra Avenue,

Seethammal Colony, First Main Road,

Alwarpet,

Chennai 600 018,

Tamilnadu, India.

Tel: +91 44 2432 9864 / +91 44 2432 9863

I: 8-2-546, Plot No.140,

Sheesh Mahal, Road No. 7,

Banjara Hills,

Hyderabad-500 034,

Andhra Pradesh, India.

Tel: +91-40-2335 1044 / 45 / 46, 6551 0491

Level 1, am@10,

MB Towers,Road No. 10,

Banjara Hills,

Hyderabad- 500 034,India

Tel: +91-40-46464880

Contact Details:

Email: info@ventureast.net

Logo

Preferred Sectors:

Technology (Mobility, Cloud, Internet) and technology-enabled

(Education, Healthcare, Financial services, Cleantech and high-

impact, invention-based social businesses); Life science and

Clean Environment (drug discovery, pharmaceuticals,

manufacturing, infrastructure services, healthcare); Seed and

incubation stage businesses.

Some marquee investments:

Portea Medical, Bharat Light & Power; GoliVada Pav; Atyati;

Little Eye Labs; Sresta (24 Letter Mantra), Polygenta,

LoyltyRewardz; onemi

Premium Listings

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Kalaari Capital

www.kalaari.com

Kalaari is a leading India focused venture capital

fund, with a strong advisory team in Bangalore

investing in early-stage, technology-oriented

companies in India. We are passionate about

investing in entrepreneurs who are poised to be

tomorrow's global leaders. We seek companies that

are capturing new markets, providing innovative

solutions, and creating new wealth for India and

beyond.

Office Address:

Ground floor, Unit-2, Navigator Building

ITPB, Whitefield Road

Bangalore, Karnataka 560 066

Tel: +91 080 67159600

Contact Persons

(Name, Designation, E-mail & Contact no.):

Vani Kola; General Partner vani@kalaari.com

Rajesh Raju; General Partner rajesh@kalaari.com

Kumar Shiralagi; General Partner kumar@kalaari.com

Karthik N; CFO karthik@kalaari.com

Sampath P; Principal sampath@kalaari.com

Sumit Jain; Principal sumit@kalaari.com

Mandar D; Senior Associate mandar@kalaari.com

Vibhav V; Analyst vibhav@kalaari.com

Logo

Preferred Sectors:

Internet products and services Mobile and mobile enabled

technologies Enterprise software (IP led products, SaaS/Cloud)

Education

Investment Range:

$2M - $5M

Select Investments:

HandsFreeNetworks, Magzter, Myntra, Ovenfresh, Power2SME

Robosoft, Simplilearn, Snapdeal, Urban Ladder, Vyome

We are looking for:

We look for early stage companies that are technology-enabled

and have high potential to emerge as market leaders.

Companies that have strong management teams, targeting large

and growing markets through innovative and disruptive business

models, are ideal partners for Kalaari.

Directory Section - Active Accelerators

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Anil Joshi

500 Startups

www.500.co

Freemont Partners

Mumbai

www.freemontpartners.com

Angel Prime

Bangalore

www.angelprime.com

iAccelerator

Ahmedabad

www.iaccelerator.org

Kyron

Bangalore

www.kyron.me

The Startup Centre

Chennai

www.thestartupcentre.com

5ideas

Gurgaon

www.5ideas.in

GSF Accelerator

www.gsfindia.com

First Light Ventures

Mumbai

www.firstlight.vc

INFUSE Ventures

Ahmedabad

www.infuseventures.in

Microsoft Ventures Accelerator

Bangalore

www.microsoftventures.com

Startup Village

Kochi

www.startupvillage.in

Directory Section - Active Accelerators

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Anil Joshi

TLabs

www.venturenursery.com

Veddis Ventures

Gurgaon

www.veddis.com

VentureNursery

Mumbai

www.venturenursery.com

Directory Section - Active Incubators

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Mumbai Angels

Anil Joshi

Abiyan

Lucknow

T: 91 90053 72642

www.abhiyaniiml.com/node

Amity TBI

Noida

T: 91 120 465 9000

www.amity.edu/aii/

Bannari TBI

Sathyamangalam

T: 91 4295 226 322

www.bittbi.com

Centre for Entrepreneurship

Gurgaon

T: 91 124 234 3655

BEC STEP

Bagalkot

T: 91 8354 220 689

www.becbgk.edu/beckstep.html

BMInstitute of Engineering & Technology

Sonipat

T: 91 130 223 0563

www.bmiet.net

CIIE, IIM A

Ahmedabad

T: 91 79 6632 4201

www.ciieindia.org

Center for Entrepreneurship - SPJIMR

Mumbai

T: 91 22 2623 7454

www.spjimr.org/centre_entrepreneurship/home.asp

Centre for Biotechnology Incubator

Chennai

T: 91 98403 48173

D.K.T.E. Societys

Kolhapur

T: 91 230 242 1300

www.dktes.com

Amrita TBI

Kollam

T: 91 476 280 4523

www.amritatbi.com

All India Association of Industries

Mumbai

T: 91 22 2201 9265

www.aiaiindia.com

Listing of Active Incubators

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Mumbai Angels

Anil Joshi

EDC

Ambala

T: 91 1731 275 792

EDC

Radaur

T: 91 1732 277 314

EDC-Jawaharlal Nehru College

Pasighat

T: 91 368 222 2496

Entrepreneurship Development Institute

of India

Gandhinagar

T: 91 79 2396 9151

www.ediindia.org

EDC-SNIST

Hyderabad

T: 91 8415 223 001

E health-TBI

Bangalore

T: 91 80 2642 0001

www.ehealthtbi.com

GNEC-STEP

Ludhiana

T: 91 161 249 0339

www.gndec.ac.in

FMS,Entrepreneurship Cell

Delhi

T: 91 88009 49495

www.ecell-fms.org

Ekta Incubation Centre

Kolkata

T: 91 33 2367 3978

www.technologyembryo.com

HBTI-STEP

Kanpur

T: 91 512 256 2536

www.stephbti.org

EDC-Faraday Bicentanary Sciente Park

Guwahati

T: 91 361 260 6610

www.edccottoncollege.org

EDC

Bhavnagar

T: 91 278 242 9852

Listing of Active Incubators

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Mumbai Angels

Anil Joshi

ICICI KP

Hyderabad

T: 91 40 2348 0022

www.iciciknowledgepark.com

Incubation and Entrepreneurship centre,SRM

Chennai

T: 91 44 2474 2836

www.srmuniv.ac.in/incubation_entrepreneurship.php

Indian School of Business (ISB) - Wadhwani

Centre

Hyderabad

T: 9140 2318 7100

JSSATE STEP

Noida

T: 91 120 240 1484

www.jssstepnoida.org

International RCI Road-EDC

Hyderabad

T: 91 40 24457 1047

Innovation Centre

Manipal

T: 91 820 292 2323

www.manipal.edu

Krishna TBI

Ghaziabad

T: 91 120 267 5314

www.kiet.edu

KIITCIE

Bhubaneswar

T: 91 674 272 5466

www.kiitincubator.in

IT BHU, Varanasi

Varanasi

T: 91 542 236 8427

www.itbhu.ac.in

Kukhatapally-EDC

Hyderabad

T: 91 40 2305 2650

IndiaCo Ventures

Pune

T: 91 20 2551 3254

www.indiaco.com

ICRISAT

Hyderabad

T: 91 40 3071 3071

www.icrisat.org

Listing of Active Incubators

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Mumbai Angels

Anil Joshi

MICA

Ahmedabad

T: 91 2717 308 250

www.mica.ac.in/mode/home

NDBI

Ahmedabad

T: 91 79 2662 3692

www.ndbiindia.org

Netaji Subhash Institute of Technology

New Delhi

T: 91 11 2509 9050

www.nsit.ac.in

NSRCEL

Bangalore

T: 91 80 2699 3769

www.nsrcel.org

NIT

Calicut

www.nitc.ac.in

NITK-STEP

Surathkal

T: 91 824 247 5490

www.nitkstep.org

Periyar TBI

Vallam Thanjavur

T: 91 4326 264 520

www.periyartbi.org

Osmania University-EDC

Hyderabad

T: 91 40 2709 8254

www.uceou.edu

NMAM Institute of Technology

Nitte

T: 91 8258 281 263

PSG-STEP

Coimbatore

T: 91 422 436 3300

www.psgstep.org

NDRI

Karnal

T: 91 184 225 2800

www.karnal.gov.in/res_ndri.asp

MITCON

Pune

T: 91 20 2553 3309

www.mitconindia.com

Listing of Active Incubators

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Mumbai Angels

Anil Joshi

RTBI-IIT

Chennai

T: 91 44 6646 9872

www.rtbi.in

SIDBI IIT

Kanpur

T: 91 512 259 6646

www.iitk.ac.in/siic

SJCE STEP

Mysore

T: 91 821 254 8321

www.sjcestep.in

STEP-IIT

Roorkee

T: 91 1332 272 337

STEP

Bhopal

T: 91 755 405 1000

www.manit.ac.in

STEP-BIT

Ranchi

T: 91 651 227 544

www.bitmesra.ac.in

STEP-TIET

Patiala

T: 91 175 239 3011

www.nstedb.com/fsr-tbi09/STEP9/About.html

STEP-NSIC Technical Services Centre

Rajkot

T: 91 281 238 7613

STEP IIT

Kharagpur

T: 91 322 228 1090

www.stepiitkgp.in

STP

Pune

T: 91 20 2293 2644

www.stpp.soft.net

SINE

Mumbai

T: 91 22 2576 7072

www.sineiitb.org

Shriram Institute For Industrial Research

Delhi

T: 91 11 2766 7267

www.shriraminstitute.org

Listing of Active Incubators

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Mumbai Angels

Anil Joshi

Tamil Nadu Agricultural University (TNAU)

Chennai

T: 91 422 661 1201

www.tnau.ac.in

TBI-Anna University

Chennai

T: 91 44 223 50772

www.annauniv.edu/act/cbt/index.htm

TBI-Indira Gandhi Institute of Technology

Delhi

T: 91 11 2659 1057

TBI BITS,

Pilani,

T: 91 1596 245073

www.bitspilani.ac.in/pilani/technologybusiness/

TechnologyBusinessIncubator

TBI Composites

Bangalore

T: 91 80 6599 7605

www.compositestechnologypark.com/

detailsofctp.htm

TBI Univ. of Delhi

Delhi

T: 91 11 2411 6559

www.nstedb.com/institutional/tbi-center.htm

TBI-ICT

Hyderabad

T: 91 40 2719 3030

TBI-UOH

Hyderabad

T: 91 40 2313 5000

TBI

Erode

T: 91 4294 226 650

www.tbi-kec.org

Technopark

Trivandrum

T: 91 471 270 0222

www.technoparktbi.org

The Lemelson Recognition & Mentoring

Programme

Chennai

T: 91 44 2257 8061

www.icandsr.iitm.ac.in

TeNeT

Chennai

www.tenet.res.in

Listing of Active Incubators

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Mumbai Angels

Thiagarajar College of Engineering (TCE)

Madurai

T: 91 452 248 2240

www.tce.edu

University of Kashmir

Srinagar

T: 91 94194 04789

TREC STEP

Tiruchirappalli

T: 91 431 250 0085

www.trecstep.com

Truesoft Ventures

www.truesoft.in

Visvesvaraya Technological University

Belgaum

T: 91 831 240 5453

Venture Centre NCL

Pune

T: 91 20 6401 1026

www.venturecenter.co.in

University Institute of Engineering &

Technology (UIET)

Kurukshetra

T: 91 1744 239 155

www.uietkuk.org

VIT-TBI

Vellore

T: 91 40 2313 5000

www.vittbi.com

Welding Research Institute

Tiruchirappalli

T: 91 431 2577820

Listing of Active Angel Investor Groups

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Tempus Capital

www.tempuscapital.in

C Cube Angels

www.ccubeangels.com

Hyderabad Angels

T: 91 40 6451 3397

www.hyderabadangels.in

Harvard Angels India

www.hbsalumniangels.com

/article.html?aid=137

Kutchi Angel Network

T: 91 98672 40320

kan.net.in

(Focused on Gujarat's Kutchi community)

Mumbai Angels

+91 22 2409 1676

www.mumbaiangels.com

Palaash Ventures

+91 11 48900000

www.palaashventures.com

Rajasthan Angel Investor Network (RAIN)

+91-98283 55513

www.rainjaipur.co.in

Sarthi Angels

+91-022-26528671-72

www.sarthiangels.com

SRI Capital

www.sricapital.com

Chennai Angels

www.thechennaiangels.com

Indian Angel Network

T: 91 11 4075 5713

www.indianangelnetwork.com

Listing of Active Seed Capital Investors

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Nexus Ventures

Nexus Ventures

Accel India

T: 91 80 4123 2551

www.accel.com

Angaros Capital

T: 91 40 4949 2000

www.angaroscapital.com

Atlas Ventures

T: 91 44 4211 0176

www.atlasadvisory.org

Anil Joshi

Anil Joshi

Epiphany Ventures

T: 91 22 2652 8635

www.epiphanyventures.in

Clarion Venture Partners

www.clarionvp.com

Indavest

T: 91 80 4148 3223

www.indavest.com

India Quotient

www.indiaquotient.in

Blume Ventures

www.blumeventures.com

Headstart Ventures

www.headstartventures.in

Das Star Ventures

T: 91 98844 22270

IncuCapital

T: 91 20 2556 0254

www.incucapital.com

IndusAge Partners

T: 91 44 4350 4050

www.indusage.com

Listing of Active Seed Capital Investors

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Jungle Ventures

T: 65 6423 9516

www.jungle-ventures.com

Ladderup

T: 91 22 4033 6363

www.ladderup.com

Nexus Ventures

T : 91 22 6626 0000

www.nexusvp.com

Orios VP

www.orios.gi

Singularity Ventures

www.singularityventures.in

Seedfund

T: 91 22 2490 2201

www.seedfund.in

KAE Capital

T: 91 22 2202 4184

www.kae-capital.com

My First Cheque

www.myfirstcheque.com

Navam Capital

T: 91 33 4025670

www.navamcapital.com

Mercatus Capital

T: +65 6776 7819

www.mercatus-capital.com

Ojas Venture Partners

T: 91 80 4061 0300

www.ojasventures.com

Seeders

www.seeders.in

Listing of Active Seed Capital Investors

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Unilazer Ventures

T: 91 22 61093730

www.unilazer.com

Ventureast Tenet

T: 91 44 2432 9864

www.ventureast.net

Spark Capital

T: 91 44 4344 0000

www.sparkcapital.in

YourNest Angel Fund

T: 91 124 404 2155

www.yournest.in

Viva Capital

T: 91 22 3953 0697

www.vivacapital.in

Zodius Capital

T: 91 22 22040537

www.zodius.com

Snow Leopard Technology Ventures

www.snowleopardtechventures.com

Listing of Active Venture Capital Investors

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Kalaari Capital

kolavani@kalaari.com

91 80 67159600

www.kalaari.com

Vani

Applied Ventures

T: 408-584-0663 (US)

www.appliedmaterials.com

Aarin Capital

T: 91 80 3078 9200

www.aarincapital.com

Artiman Ventures

T: 91 80 2509 1453

www.artimanventures.com

Accel India

T: 91 80 4123 2551

www.accel.com

Basil Partners

T: 91 22 6112 0901

www.basilpartners.com

Canbank Ventures

T: 91 80 2558 6506

www.canbankventure.com

Aspada Advisors

www.aspadainvestments.com

Canaan Partners

T: 91 124 430 1841

www.canaan.com

Listing of Active Venture Capital Investors

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Mumbai Angels

Sandeep Singhal

Headland Capital

T: 91 22 3953 7447

www.headlandcp.com

Helion Ventures

T: 91 80 4018 3333

www.helionvc.com

Footprint Ventures

T: 91 80 4110 1910

www.footprintventures.com

IDG Ventures India

T: 91 80 4043 4836

www.idgvcindia.com

Foundation Capital

T: 1 650 614 0500

www.foundationcapital.com

GVFL

T: 91 79 4021 3900

www.gvfl.com

Fulcrum Ventures

T: 91 22 4090 7385

www.fulcrumventureindia.com

Capital 18

T: 91 120 434 1818

www.capital18.com

Intel Capital

T: 91 80 2507 5000

www.intel.com/capital/india/default.htm

Infuse Ventures

T: 91 79 6632 4201

www.infuseventures.in

(Cleantech focused)

India Innovation Fund

T: 91 80 4335 6666

www.indiainnovationfund.in

Indus Balaji

T: 91-22-4069 4100

www.indusbalaji.com

Listing of Active Venture Capital Investors

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Mumbai Angels

Mumbai Angels

Sandeep Singhal

Lightbox

www.lightbox.vc

Kalaari Capital

T: 91 80 67159600

www.kalaaricapital.com

Jafco Asia

T: 65 6224 6383

www.jafcoasia.com

Lightspeed Ventures

T: 91 11 4980 0800

www.lightspeedvp.com

Kaizen PE

T: 91 22 6767 5757

www.kaizenpe.com

(Education Focused)

Matrix Partners India

T: 91 22 6768 0000

www.matrixpartners.in

Nexus Ventures

T: 91 22 6626 0000

www.nexusvp.com

Inventus Capital Partners

T: 91 80 41256747

www.inventuscap.com

Ojas Venture Partners

T: 91 80 4061 0300

www.ojasventures.com

Nokia Growth Partners

www.nokiagrowthpartners.com

Mumbai Angels

Norwest

T: 91 22 6150 1111

www.nvp.com

Nirvana Ventures

T: 91 22 2204 5519

www.nirvanaventures.in

Listing of Active Venture Capital Investors

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

SAIF Partners

Mobile: 91 98664 61770

www.sbaif.com

Saama Capital

T: 91 80 4112 8282

www.saamacapital.vc

Mumbai Angels

Omnivore Partners

T: 91 22 2519 4490

www.omnivore.vc

(Agri Business Focused)

Praefinium Partners

www.praefinium.com

Ru-Net Holdings (Russia)

T: 7 495 797 97 63

www.ru-net.ru/en

Qualcomm Ventures

T: 91 80 3984 1800

www.qualcomm.com

RVCF

T: 91 141 407 1680

www.rvcf.org

Reliance Technology Ventures

T: 91 22 3032 7399

www.relianceventure.com

Sequoia Capital India

T: 91 80 4124 5880

www.sequoiacap.com

SEAF

T: 91 98102 74483

www.seaf.com

SIDBI VC

T: 91 22 2204 3065

www.sidbiventure.co.in

Seedfund

T: 91 22 2490 2201

www.seedfund.in

Listing of Active Venture Capital Investors

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Mumbai Angels

Sandeep Singhal

Somerset Indus Capital

www.somersetinduscap.com

(Healthcare Focused)

Sonoma Management Partners

T: 91 20 4131 5656

www.sonomamgmt.com

Tiger Global

www.tigerglobal.com

Ventureast

T: 91 44 2432 9864

www.ventureast.net

Listing of Active SME Investors

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Mumbai Angels

Mumbai Angels

Sandeep Singhal

Aquarius

T: 91 80 4112 4880

www.aquarius.com.sg

Abraaj Group

T: 91 22 67 874 500

www.abraaj.com

Avigo Capital

T: 91 11 43683300

www.avigocorp.com

Access PE

T: 91 22 65154700

www.accesspe.in

Bessemer

T: 91 80 30829000

www.bvp.com

BanyanTree Finance

T: 91 22 6623 5555

www.banyantreefinance.com

Canbank Ventures

T: 91 80 2558 6506

www.canbankventure.com

EQ India

T: 91 22 66156300

www.eqindiaadvisors.com

IFCI Ventures

T: 91 11 4179 2800

www.ifciventure.com

Headland Capital

T: 91 22 3953 7447

www.headlandcp.com

Gaja Capital

T: 91 22 2421 2280

www.gajacapital.com

IFC

T: 91 11 4111 1000

www.ifc.org

Listing of Active SME Investors

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Mumbai Angels

Sandeep Singhal

Zephyr Peacock India

T: 91 80 4261 3300

www.zephyrpeacock.com

Kotak PE

T: 91 22 43360000

www.privateequityfund.kotak.com

Matrix Partners India

T: 91 22 6768 0000

www.matrixpartners.com

NEA

T: 91 80 67710801

www.nea.com

Lighthouse Fund

T: 91 22 4204 1000

www.lhfunds.com

Mayfield

T: 91 22 6627 3000

www.mayfield.com

Paracor India

T: 99670 59432

www.paracorcapitaladvisors.com

Vertex

T: 91 80 67590555

www.vertexmgt.com

Listing of Active Social Investors

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Mumbai Angels

Sandeep Singhal

BlueOrchard

T: 41 22 596 4777

www.blueorchard.com

Creation Investments

T: 1 312 784 3988

www.creationinvestments.com

Developing World Markets

T: 1 203 655 5453

www.dwmarkets.com

Dia Vikas Capital

T: 91 124 452 9500

www.dia-vikas.org

Acumen Fund

T: 91 22 6758 9365

www.acumenfund.org

Elevar Equity

T: 91 80 4335 6666

www.elevarequity.com

Bellwether

T: 91 40 6646 0505

www.bellwetherfund.com

Ennovent

www.ennovent.com

Sandeep Singhal

Aavishkaar

T: 91 22 4200 5757

www.aavishkaar.in

Accion International

T: 91 80 4112 0008

www.accion.org

Mumbai Angels

4B Capital

T: 91 80 0896 2828

www.4bcapital.com

Aavishkaar Goodwell

T: 91 22 4200 5757

www.aavishkaargoodwell.com

Listing of Active Social Investors

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Mumbai Angels Mumbai Angels

Mumbai Angels

Sandeep Singhal

Legatum

T: 971 4 317 5800

www.legatumcapital.com

Khosla Ventures

T: 91 80 4212 4272

www.khoslaventures.com

Insitor Fund

www.insitormanagement.com

Lok Capital

T: 91 124 470 9700

www.lokcapital.com

Intellecap Impact Investment Network

T: 91 40 4030 0200

www.i3n.co.in

Impact Investment Partners

www.impactinvestmentpartners.com

MI india

T: 91 124 452 9500

www.miindiacapital.org

Incofin

T: 91 44 26416624

www.incofin.be

Mumbai Angels

Gray Ghost Ventures

T: 1 678 365 4700

www.grayghostventures.com

IFMR Trust

T: 91 44 6668 7000

www.ifmrtrust.co.in

Mumbai Angels

IAN Impact

T: 91 11 4075 5713

www.indianangelnetwork.com

Grassroots Business Fund

T: 91 120 424 1000

www.gbfund.org

Listing of Active Social Investors

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

Song Investment Advisors

T: 91 40 2318 7241

www.songadvisors.com

Unitus

T: 91 80 4112 0008

www.unitus.com

Villgro

T: 91 44 6663 0400

www.villgro.org

Mumbai Angels

Omidyar Network

T: 91 22 6118 7300

www.omidyar.com

MicroVentures

T: 91 80 4095 7653

www.micro-ventures.in

MicroVest

T: 1 301 664 6680

www.microvestfund.com

Michael Dell Foundation

T: 91 11 41666300

www.msdf.org

VE NT UR E

INTELLIGENCE

Handbook on

Venture Capital

About Venture Intelligence

Venture Intelligence, a division of TSJ Media, is the leading provider of data on private company financials,

transactions and their valuations.

Our research is used extensively by PE/VC industry practitioners, Entrepreneurs, CXOs of large corporations,

financial and strategic investors, the media as well as government/regulatory agencies. Our customers include

leading PE / VC Firms, Limited Partners, Investment Banks, Law Firms, HR Services Firms, Corporations and

Consulting Firms.

Venture Intelligence products are a one point source for information and analysis on:

Private Equity, Venture Capital and M&A deals

Companies looking for investors and M&A deals

New Funds being raised

Our products include:

Databases

Private Company Financials

PE/VC Funding

M&A deals

Newsletters

Daily format for practitioners in the deal ecosystem

Weekly format for the convenience of entrepreneurs (complimentary)

Private Equity & Venture Capital Reports

Quarterly and Annual reports on PE & VC trends

Directories

Private Equity & Venture Capital Directory

Limited Partners Directory

Directory of Early Stage Investors (complimentary)

Investment Bank Directory (complimentary)

Conferences

Venture Intelligence conferences are a leading platform that bring together investors and entrepreneurs in a

focused manner that facilitates discussion and networking. Speakers at Venture Intelligence Conferences are

typically investors, entrepreneurs and CXO/Board-level executives from accomplished companies.

TSJ Media Pvt. Ltd.

83, Ground Floor, 3rd Street, Karpagam Avenue, R.A.Puram, Chennai-600 028 INDIA

Tel: +91 44 42185180 Email: Web: info@ventureintelligence.in www.ventureintelligence.in

You might also like

- HNIDocument5 pagesHNIAmrita MishraNo ratings yet

- Aibi Summit 2016Document48 pagesAibi Summit 2016Anonymous KRErbYM7No ratings yet

- Top 100 Indian Companies CEODocument5 pagesTop 100 Indian Companies CEOPadma KannanNo ratings yet

- Start Up Blue BookDocument40 pagesStart Up Blue BookVaishnav ParivarNo ratings yet

- TY B.tech (2016-17) Database.Document16 pagesTY B.tech (2016-17) Database.Mohit RajaiNo ratings yet

- Cancelled NBFCDocument336 pagesCancelled NBFCAANo ratings yet

- ECE Student Contact ListDocument9 pagesECE Student Contact ListMr.Md. GulzarNo ratings yet

- Business Women 2010Document1 pageBusiness Women 2010JayNo ratings yet

- Mysheet: Serial Number Resume Id Postal Address Telephone No. Mobile No. Date of Birth Email Name of The CandidateDocument14 pagesMysheet: Serial Number Resume Id Postal Address Telephone No. Mobile No. Date of Birth Email Name of The CandidateShikhar AgarwalNo ratings yet

- Rashmikant Swain Latest ResumeDocument3 pagesRashmikant Swain Latest Resumerashmi kant SwainNo ratings yet

- I: Inservice Candidate M: Minority CandidateDocument16 pagesI: Inservice Candidate M: Minority CandidateDevansh BhatnagarNo ratings yet

- University Roll Number Student Name GenderDocument24 pagesUniversity Roll Number Student Name Genderappu KandathilNo ratings yet

- 9d0t9 3000INC Rs.3000Document108 pages9d0t9 3000INC Rs.3000Murli MenonNo ratings yet

- Emerging Delivery Locations in India ReportDocument89 pagesEmerging Delivery Locations in India Reportrashmivikramb5255No ratings yet

- Reworked SSS Data For Self Finance Courses 2020-21Document74 pagesReworked SSS Data For Self Finance Courses 2020-21Akash NetkeNo ratings yet

- Unified License of Indian - IsP Authorization GrantedDocument138 pagesUnified License of Indian - IsP Authorization GrantedMikhail ChubaisNo ratings yet

- Indian Bloggers List 2Document6 pagesIndian Bloggers List 2Sermuga PandianNo ratings yet

- 4 Meo 1 Mifmh 0Document172 pages4 Meo 1 Mifmh 0Rashid AliNo ratings yet

- Iim Indore: Final Placement Report 2011 - 2013Document5 pagesIim Indore: Final Placement Report 2011 - 2013Abdal LalitNo ratings yet

- Infosys VJIT 080708Document46 pagesInfosys VJIT 080708Rama Krishna0% (1)

- Accident Insurance CoverDocument24 pagesAccident Insurance Coversantanu40No ratings yet

- List of StudentsDocument21 pagesList of StudentsFebinBaby GodisgoodNo ratings yet

- English Diary - 2022 MumbaiDocument158 pagesEnglish Diary - 2022 MumbaiSanthosh KumarNo ratings yet

- Gnitc - B.tech Dept - of EceDocument18 pagesGnitc - B.tech Dept - of EceAjay YadavNo ratings yet

- MCHI-CREDAI Property Expo Highlights Real Estate OpportunitiesDocument13 pagesMCHI-CREDAI Property Expo Highlights Real Estate OpportunitiesPallavi PatilNo ratings yet

- Sr. No. Pop-Sp Reg No POP-SP Name: Sheet1Document6 pagesSr. No. Pop-Sp Reg No POP-SP Name: Sheet1realhdxNo ratings yet

- CA FirmsDocument5 pagesCA FirmsbobbydebNo ratings yet

- Invest in Indian Startups - AngelListDocument51 pagesInvest in Indian Startups - AngelListSher Singh YadavNo ratings yet

- Job Consultant ListDocument11 pagesJob Consultant ListNimit MalhotraNo ratings yet

- Top Auditoriums, Banquet Halls, Clubs and Restaurants in DelhiDocument292 pagesTop Auditoriums, Banquet Halls, Clubs and Restaurants in DelhiPankaj ChaudharyNo ratings yet

- Loan Taken People in KeralaDocument9 pagesLoan Taken People in KeralaganeshkumarNo ratings yet

- Online Sellers OLX - 2.30 Lacs DataDocument9 pagesOnline Sellers OLX - 2.30 Lacs DataSajid Bhai ShaikhNo ratings yet

- Sno Manager Initials Ps Initials Covered by Key Account Id (As Per Budget Sheet)Document150 pagesSno Manager Initials Ps Initials Covered by Key Account Id (As Per Budget Sheet)anisNo ratings yet

- EPSMM-01 - Attendance UpdatedDocument6 pagesEPSMM-01 - Attendance UpdatedShrutika MathurNo ratings yet

- Pulkit PDF ResumeDocument1 pagePulkit PDF Resumepulkit agarwalNo ratings yet

- All India Ticket Compliment Directory Affiliate Outlet LocationsDocument136 pagesAll India Ticket Compliment Directory Affiliate Outlet LocationsSrinivas Chowdary ParimiNo ratings yet

- Intelligent Advisory Portfolios PDFDocument9 pagesIntelligent Advisory Portfolios PDFCASrinivasaRaoGuduruNo ratings yet

- 5shikhar 3041 To 3200 08 11 2017Document14 pages5shikhar 3041 To 3200 08 11 2017Shikhar AgarwalNo ratings yet

- Company - City Pincode Locality Sub - Localiaddress Building - Landmarksstdcode TelephoneDocument6 pagesCompany - City Pincode Locality Sub - Localiaddress Building - Landmarksstdcode Telephonedeva nesanNo ratings yet

- Contact details and addresses of CA firms and professionalsDocument86 pagesContact details and addresses of CA firms and professionalsnaniNo ratings yet

- AbcdDocument4 pagesAbcdDeepika SinghNo ratings yet

- Your Story Equity CompaniesDocument9 pagesYour Story Equity CompaniesArora YarnNo ratings yet

- 2b720725-7bc8-49e5-9508-e5f0e0085db8Document3 pages2b720725-7bc8-49e5-9508-e5f0e0085db8Ashish PatilNo ratings yet

- BIS Sample Database - IIIDocument2 pagesBIS Sample Database - IIIAarti IyerNo ratings yet

- Directors and Leaders ListDocument6 pagesDirectors and Leaders ListjaisuryabanerjeeNo ratings yet

- Consolidated FineSheet 14102015Document448 pagesConsolidated FineSheet 14102015shiva3107900% (1)

- List of Real Estate Agents with RERA Number in ThaneDocument12 pagesList of Real Estate Agents with RERA Number in Thanedarshan shettyNo ratings yet

- Tata Indicom COCO OutletsDocument30 pagesTata Indicom COCO OutletsShuie BlackNo ratings yet

- Flo Biz - Sample DeckDocument8 pagesFlo Biz - Sample DeckRishivanth ThulasiramanNo ratings yet

- BITS PSII-Sem2 2014 ResponsesDocument42 pagesBITS PSII-Sem2 2014 ResponsesTushar GuptaNo ratings yet

- Entertainment Associations in India: SN Name Year of Establish Ment President Address Contact No. E Mail IDDocument2 pagesEntertainment Associations in India: SN Name Year of Establish Ment President Address Contact No. E Mail IDRishit KapoorNo ratings yet

- Investor ListDocument1 pageInvestor ListAdrish MaityNo ratings yet

- AIESEC India Contact ListDocument2 pagesAIESEC India Contact ListHimanshu PatelNo ratings yet

- PR Agencies IndiaDocument45 pagesPR Agencies IndiaMadye MjNo ratings yet

- LIST OF CMA MEMBERS HOLDING CERTIFICATE OF PRACTICEDocument1,651 pagesLIST OF CMA MEMBERS HOLDING CERTIFICATE OF PRACTICEvishwas pandithNo ratings yet

- Alumnidirectory NewDocument41 pagesAlumnidirectory NewAnonymous RjIueYSlNo ratings yet

- VC Handbook 2012Document41 pagesVC Handbook 2012Sanjeev ChaudharyNo ratings yet

- Demystifying Venture Capital: How It Works and How to Get ItFrom EverandDemystifying Venture Capital: How It Works and How to Get ItNo ratings yet

- Entrepreneurs and Informal InvestorsDocument25 pagesEntrepreneurs and Informal InvestorsAnam Abdul QayyumNo ratings yet