Professional Documents

Culture Documents

Monroe School District Funding

Uploaded by

Debra KolrudCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Monroe School District Funding

Uploaded by

Debra KolrudCopyright:

Available Formats

9/14/14 11:34 PM WA State Budgets

Page 1 of 2 http://fiscal.wa.gov/FRViewer.aspx?Rpt=K12WSFDistrict

District Monroe View Report

1 of 1 Find | Next

Workload/Staffing/Finance

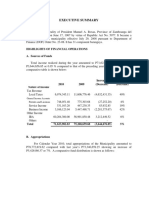

Monroe School District

District

Budgeted

SY2008-09 SY2009-10 SY2010-11 SY2011-12 SY2012-13 SY2013-14

Total FTE Enrollment (1) 7,490 7,675 7,559 7,314 6,986 6,873

Special Education Percentage (2) 8.52 % 8.84 % 9.82 % 10.85 % 11.69 % 11.37 %

Free and Reduced Lunch Percentage (9) 22.23 % 23.49 % 26.78 % 34.74 % 34.33 % 33.70 %

Certificated Administrative Staff (03) 26.0 25.8 25.0 22.6 21.7 23.0

Certificated Instructional Staff (03) 369.7 372.2 369.1 355.1 347.3 348.2

Classified Staff (03) 195.2 189.0 187.9 154.2 185.6 186.9

Total Staff 590.9 587.0 582.1 531.8 554.6 558.0

FTE Enrollment per Staff

Certificated Administrative Staff (03) 288.1 297.4 302.4 323.9 321.8 298.8

Certificated Instructional Staff (03) 20.3 20.6 20.5 20.6 20.1 19.7

Total Certificated Staff (3) 18.9 19.3 19.2 19.4 18.9 18.5

Classified Staff (03) 38.4 40.6 40.2 47.4 37.6 36.8

Staff per Thousand FTE Enrollment

Certificated Administrative Staff 3.5 3.4 3.3 3.1 3.1 3.3

Certificated Instructional Staff 49.4 48.5 48.8 48.5 49.7 50.7

Classified Staff 26.1 24.6 24.9 21.1 26.6 27.2

Total Staff 78.8 76.4 76.9 72.7 79.3 81.1

Total General Fund Revenues 64,177,730 65,229,166 66,047,589 64,001,596 63,435,507 67,413,608

Total State General Fund Revenues (4) 44,750,152 45,897,489 44,668,357 44,304,140 44,139,869 48,243,762

State Special Education Revenues (5) 3,520,554 3,499,665 3,833,163 4,171,193 4,423,896 4,270,639

State Student Achievment Revenues (5) 2,464,483 196,794

Total Federal General Fund Revenues (6) 6,302,760 4,579,223 5,737,232 3,165,069 2,874,640 2,654,254

Local Taxes (7) 10,304,785 12,129,309 13,186,049 14,260,470 14,545,411 14,148,508

Other Revenues (10) 2,820,034 2,623,145 2,455,950 2,271,917 1,875,587 2,367,084

Total General Fund Expenditures (8) 63,655,589 63,806,648 65,088,157 63,259,384 63,646,500 67,411,700

Total Fund Balance 3,507,374 4,575,138 5,389,325 6,131,536 5,920,543 5,833,444

% of Total Revenues 5.47 % 7.01 % 8.16 % 9.58 % 9.33 % 8.65 %

% of Total Exenditures 5.51 % 7.17 % 8.28 % 9.69 % 9.30 % 8.65 %

Unreserved, Undesignated Fund Balance 2,746,026 3,874,946 296,793 380,202 1,096,316 1,908

% of Total Revenues 4.28 % 5.94 % 0.45 % 0.59 % 1.73 % 0.00 %

% of Total Expenditures 4.31 % 6.07 % 0.46 % 0.60 % 1.72 % 0.00 %

Dollars per FTE Enrollment

Total General Fund Revenues 8,569 8,499 8,738 8,751 9,080 9,808

Total State General Fund Revenues (4) 5,975 5,980 5,909 6,058 6,318 7,019

Total Federal General Fund Revenues (6) 841 597 759 433 411 386

Local Taxes (7) 1,376 1,580 1,744 1,950 2,082 2,059

Other Revenues (10) 377 342 325 311 268 344

Total Expenditures 8,499 8,313 8,611 8,649 9,110 9,808

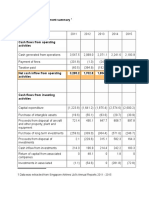

Sources: OSPI F195/F196 School Apportionment and Financial Services (SAFS) reports, unless noted:

(1) Enrollment from OSPI Apportionment, exclude Summer Skills Centers, Institutions, and pre-K Special Ed;

SY 2013-14 are year-to-date data as of January 2014.

(2) Special Education percentages from OSPI Report 1220.

(3) FTE Staff from OSPI S275 reports; "Total Staff" displayed excludes extracurricular, substitutes, and on-leave staff (which average 170 FTEs statewide since SY

1995-96).

(4) Total State General Fund Revenues includes both State General Purpose (codes 3000s, excl. Timber Excise Tax) and State Special Purpose Revenues (codes

4000s).

(5) Special Education Revenues (revenue code 4121) and Student Achievement Revenues (revenue code 4166) are part of Total State General Fund Revenues.

(6) Total Federal General Fund Revenues includes both Federal General Purpose (codes 5000s) and Federal Special Purpose Revenues (codes 6000s).

(7) Includes: Local Property Tax, Sale of Tax Title Property, Local In-Lieu-of Taxes, County Administered Forests, Other Local Taxes, and Timber Excise Tax.

(8) Includes only K-12 General Fund; excludes Capital Projects, Debt Service, Transportation Vehicle, Associated Student Body, Bond, and Trust funds.

(9) Free and Reduced Lunch Percentage from OSPI Apportionment; data correspond to reports on web site

http://www.k12.wa.us/ChildNutrition/FreeReducedDistrict.aspx

9/14/14 11:34 PM WA State Budgets

Page 2 of 2 http://fiscal.wa.gov/FRViewer.aspx?Rpt=K12WSFDistrict

http://www.k12.wa.us/ChildNutrition/FreeReducedDistrict.aspx

(10) Other Revenues include Local Nontax, Other Financing Sources, and Revenues from other school districts, agencies, and associations.

Data for SY 2013-14 exclude budget extensions.

Source: fiscal.wa.gov - K12WSFDistrict 1

9/14/2014 11:03:39 PM

You might also like

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Washington State Fiscal Information Office Report On Monroe School District FundingDocument2 pagesWashington State Fiscal Information Office Report On Monroe School District FundingDebra KolrudNo ratings yet

- City of Windsor Capital Budget Documents For 2013.Document362 pagesCity of Windsor Capital Budget Documents For 2013.windsorstarNo ratings yet

- MSD 2011/12 Preliminary BudgetDocument123 pagesMSD 2011/12 Preliminary BudgetDebra KolrudNo ratings yet

- Final Budget Edition: Estimated Impacts of 2009-11 Proposed Budget(s) On State RevenuesDocument4 pagesFinal Budget Edition: Estimated Impacts of 2009-11 Proposed Budget(s) On State RevenuesJay WebsterNo ratings yet

- LAUSDFirstInterimFinancial2011 12 OcrDocument77 pagesLAUSDFirstInterimFinancial2011 12 OcrSaveAdultEdNo ratings yet

- WBC 5yr SummaryDocument2 pagesWBC 5yr SummaryPaskalis GlabadanidisNo ratings yet

- Maruti Suzuki, 1Q FY 2014Document16 pagesMaruti Suzuki, 1Q FY 2014Angel BrokingNo ratings yet

- 10 - Sum of Revs, Exp, and FBDocument5 pages10 - Sum of Revs, Exp, and FBFecund StenchNo ratings yet

- P Data Extract From World Development IndicatorsDocument15 pagesP Data Extract From World Development IndicatorsLuiz Fernando MocelinNo ratings yet

- July 2011 Financial Report for St. Vincent Building and Loan AssociationDocument17 pagesJuly 2011 Financial Report for St. Vincent Building and Loan Associationmarlynrich3652No ratings yet

- 06 Financial HighlightsDocument1 page06 Financial HighlightsKhaira UmmatienNo ratings yet

- Airline AnalysisDocument20 pagesAirline Analysisapi-314693711No ratings yet

- Borongan City Executive Summary 2016Document14 pagesBorongan City Executive Summary 2016Jessa Nicole MortaNo ratings yet

- FY11 Fluvanna County BudgetDocument1 pageFY11 Fluvanna County BudgetbrothamelNo ratings yet

- DepEd ES2015Document14 pagesDepEd ES2015Leo Glen FloragueNo ratings yet

- Fnsinc602 - Assessment 1Document14 pagesFnsinc602 - Assessment 1Daranee TrakanchanNo ratings yet

- Executive Summary of Municipality's Financial OperationsDocument7 pagesExecutive Summary of Municipality's Financial OperationsJ JaNo ratings yet

- Appendix 7 Financials: Income StatementDocument9 pagesAppendix 7 Financials: Income StatementHamza MalikNo ratings yet

- Key RatiosDocument2 pagesKey RatiosKhalid MahmoodNo ratings yet

- 5.4 Balance Sheet Analysis of Non Financial Companies: (Listed at KSE)Document9 pages5.4 Balance Sheet Analysis of Non Financial Companies: (Listed at KSE)herenasir4uNo ratings yet

- The FY 2011 Expenditure Program: General IntroductionDocument6 pagesThe FY 2011 Expenditure Program: General IntroductionKharen SanchezNo ratings yet

- Financial Report Summary for Board of TrusteesDocument39 pagesFinancial Report Summary for Board of TrusteesAraceli MelendezNo ratings yet

- Davao City Executive Summary 2014Document6 pagesDavao City Executive Summary 2014Cristina ChiNo ratings yet

- Supreme Infrastructure: Poised For Growth BuyDocument7 pagesSupreme Infrastructure: Poised For Growth BuySUKHSAGAR1969No ratings yet

- FY16 Working Budget Summary 7-21-15Document2 pagesFY16 Working Budget Summary 7-21-15DPMartinNo ratings yet

- Bharti Airtel: Concerns Due To Currency VolatilityDocument7 pagesBharti Airtel: Concerns Due To Currency VolatilityAngel BrokingNo ratings yet

- Mothersum Standalone Results Q3 FY2012Document4 pagesMothersum Standalone Results Q3 FY2012kpatil.kp3750No ratings yet

- Msil 4Q Fy 2013Document15 pagesMsil 4Q Fy 2013Angel BrokingNo ratings yet

- Katzie First Nation - Financial Statements 2013Document32 pagesKatzie First Nation - Financial Statements 2013Monisha Caroline MartinsNo ratings yet

- Maydolong Executive Summary 2014Document8 pagesMaydolong Executive Summary 2014JunreÿNo ratings yet

- Fy 2011 Besf Form No. 1Document12 pagesFy 2011 Besf Form No. 1lazylawstudentNo ratings yet

- KPMG Budget BriefDocument52 pagesKPMG Budget BriefAsad HasnainNo ratings yet

- Revenue Table - Sept 14Document1 pageRevenue Table - Sept 14daggerpressNo ratings yet

- 2011 Results Presentation SlidesDocument56 pages2011 Results Presentation SlidesTarun GuptaNo ratings yet

- Chapter 4 Analysis of Components of Receipts and Expenditure of Report No 20 of 2018 Compliance of The Fiscal Responsibility andDocument10 pagesChapter 4 Analysis of Components of Receipts and Expenditure of Report No 20 of 2018 Compliance of The Fiscal Responsibility andanimeshtechnosNo ratings yet

- Summit Bank Annual Report 2012Document200 pagesSummit Bank Annual Report 2012AAqsam0% (1)

- 2006 To 2008 Blance SheetDocument4 pages2006 To 2008 Blance SheetSidra IrshadNo ratings yet

- Total Expenditure of Ministries and Departments 2006-2007 BudgetDocument6 pagesTotal Expenditure of Ministries and Departments 2006-2007 BudgetDivya PunjwaniNo ratings yet

- Chap-1 7Document3 pagesChap-1 7Sandesh KingerNo ratings yet

- Exhibit 2 Amazon Financials, 2006-2017 (Millions USD) : Fiscal Year 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017Document1 pageExhibit 2 Amazon Financials, 2006-2017 (Millions USD) : Fiscal Year 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017AviralNo ratings yet

- Results Came in Line With Our Estimates. We Are Upgrading Our Recommendation To BUYDocument9 pagesResults Came in Line With Our Estimates. We Are Upgrading Our Recommendation To BUYÁngel Josue Aguilar VillaverdeNo ratings yet

- COA Audit On DOH For 2020 (Executive Summary)Document11 pagesCOA Audit On DOH For 2020 (Executive Summary)VERA FilesNo ratings yet

- IRRI AR 2013 Audited Financial StatementsDocument62 pagesIRRI AR 2013 Audited Financial StatementsIRRI_resourcesNo ratings yet

- Budget at A GlanceDocument2 pagesBudget at A Glancefaysal_duNo ratings yet

- BUY Bank of India: Performance HighlightsDocument12 pagesBUY Bank of India: Performance Highlightsashish10mca9394No ratings yet

- General Fund Expenditures by Object and StaffingDocument15 pagesGeneral Fund Expenditures by Object and StaffingStatesman JournalNo ratings yet

- Exchequer Final Statement March 2012Document5 pagesExchequer Final Statement March 2012Politics.ieNo ratings yet

- City of Charlottesville, Virginia City Council Agenda: Agenda Date: Action RequiredDocument12 pagesCity of Charlottesville, Virginia City Council Agenda: Agenda Date: Action RequiredreadthehookNo ratings yet

- Executive Summary 2020Document4 pagesExecutive Summary 2020Heljohn LedresNo ratings yet

- Seminole County Public Schools Budget Work SessionDocument9 pagesSeminole County Public Schools Budget Work SessionWekivaPTANo ratings yet

- Vertical Analysis FS Shell PHDocument5 pagesVertical Analysis FS Shell PHArjeune Victoria BulaonNo ratings yet

- 5 Year Cash FlowDocument5 pages5 Year Cash FlowRith TryNo ratings yet

- Save-A-Life Foundation (SALF) IL/federal Grants Spreadsheet by Lee Cary, 7/19/10Document3 pagesSave-A-Life Foundation (SALF) IL/federal Grants Spreadsheet by Lee Cary, 7/19/10Gordon T. PrattNo ratings yet

- Philippine Charity Sweepstakes Office Executive Summary 2013Document6 pagesPhilippine Charity Sweepstakes Office Executive Summary 2013Den Mark AngudongNo ratings yet

- Financial StatementsDocument20 pagesFinancial Statementswilsonkoh1989No ratings yet

- Revenue Table - Dec 14 FinalDocument1 pageRevenue Table - Dec 14 FinaldaggerpressNo ratings yet

- Pilipinas Shell Petroleum Corporation (SHLPH)Document2 pagesPilipinas Shell Petroleum Corporation (SHLPH)Jo CadizNo ratings yet

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsFrom EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsNo ratings yet

- Seattle Police Report During BLM RiotDocument5 pagesSeattle Police Report During BLM RiotDebra KolrudNo ratings yet

- July Letter To Legislators PDFDocument2 pagesJuly Letter To Legislators PDFDebra KolrudNo ratings yet

- Monroe School District Policy 3241Document3 pagesMonroe School District Policy 3241Debra KolrudNo ratings yet

- Everett School District Building Student CapacityDocument1 pageEverett School District Building Student CapacityDebra KolrudNo ratings yet

- July Letter To Legislators From Senator John BraunDocument2 pagesJuly Letter To Legislators From Senator John BraunDebra KolrudNo ratings yet

- Miller V Monroe School District Federal ComplaintDocument46 pagesMiller V Monroe School District Federal ComplaintDebra KolrudNo ratings yet

- Resources and Contacts For Chain Lake-MSDDocument3 pagesResources and Contacts For Chain Lake-MSDDebra KolrudNo ratings yet

- July Letter To LegislatorsDocument2 pagesJuly Letter To LegislatorsDebra KolrudNo ratings yet

- Resolution 6 2013Document2 pagesResolution 6 2013Debra KolrudNo ratings yet

- Wac 392-400-510Document1 pageWac 392-400-510Debra KolrudNo ratings yet

- Monroe School Board - Serial Meeting?Document7 pagesMonroe School Board - Serial Meeting?Debra KolrudNo ratings yet

- Monroe School District Policy 3241Document3 pagesMonroe School District Policy 3241Debra KolrudNo ratings yet

- Monroe School District Sex Ed/HIVAIDS - Opt FormDocument1 pageMonroe School District Sex Ed/HIVAIDS - Opt FormDebra KolrudNo ratings yet

- 2013/14 Washington State Test Scores Comparison of Elementary SchoolDocument2 pages2013/14 Washington State Test Scores Comparison of Elementary SchoolDebra KolrudNo ratings yet

- Special Education Citizen Complaint (Secc) No. 13-72 Procedural HistoryDocument21 pagesSpecial Education Citizen Complaint (Secc) No. 13-72 Procedural HistoryDebra KolrudNo ratings yet

- Washington State Report Card ComparisonDocument2 pagesWashington State Report Card ComparisonDebra KolrudNo ratings yet

- Monroe School District Facebook GroupDocument22 pagesMonroe School District Facebook GroupDebra KolrudNo ratings yet

- Washington State Report CardDocument1 pageWashington State Report CardDebra KolrudNo ratings yet

- Neighborhood Watch From Snohomish County SheriffDocument24 pagesNeighborhood Watch From Snohomish County SheriffDebra Kolrud100% (1)

- Coastal Community BankDocument3 pagesCoastal Community BankDebra KolrudNo ratings yet

- Email About Healthy Youth SurveyDocument1 pageEmail About Healthy Youth SurveyDebra KolrudNo ratings yet

- Coastal Community BankDocument3 pagesCoastal Community BankDebra KolrudNo ratings yet

- Washington Risk PoolDocument87 pagesWashington Risk PoolDebra KolrudNo ratings yet

- It's Perfectly NormalDocument2 pagesIt's Perfectly NormalDebra KolrudNo ratings yet

- Public School Directors Denied The Ability To Communicate With Their Own District Attorney!!Document4 pagesPublic School Directors Denied The Ability To Communicate With Their Own District Attorney!!Debra KolrudNo ratings yet

- Everett School District - Levy ProjectionDocument4 pagesEverett School District - Levy ProjectionDebra KolrudNo ratings yet

- It's Perfectly NormalDocument1 pageIt's Perfectly NormalDebra KolrudNo ratings yet

- Washington Risk PoolDocument87 pagesWashington Risk PoolDebra KolrudNo ratings yet

- Monroe School District Washington State Auditor Report - 2 FindingsDocument6 pagesMonroe School District Washington State Auditor Report - 2 FindingsDebra KolrudNo ratings yet

- INKP - Annual Report - 2018 PDFDocument225 pagesINKP - Annual Report - 2018 PDFKhairani NisaNo ratings yet

- CareEdge Ratings Update On Tyre IndustryDocument5 pagesCareEdge Ratings Update On Tyre IndustryIshan GuptaNo ratings yet

- Quiz #3 Q1) Q2) : Qandeel Wahid Sec BDocument60 pagesQuiz #3 Q1) Q2) : Qandeel Wahid Sec BMuhammad AreebNo ratings yet

- Chapter 1-Introduction To Green BuildingsDocument40 pagesChapter 1-Introduction To Green Buildingsniti860No ratings yet

- Regenerative Braking SystemDocument27 pagesRegenerative Braking SystemNavaneethakrishnan RangaswamyNo ratings yet

- Memorandum of Agreement Maam MonaDocument2 pagesMemorandum of Agreement Maam MonaYamden OliverNo ratings yet

- NSE ProjectDocument24 pagesNSE ProjectRonnie KapoorNo ratings yet

- Edwin Vieira, Jr. - What Is A Dollar - An Historical Analysis of The Fundamental Question in Monetary Policy PDFDocument33 pagesEdwin Vieira, Jr. - What Is A Dollar - An Historical Analysis of The Fundamental Question in Monetary Policy PDFgkeraunenNo ratings yet

- CH North&south PDFDocument24 pagesCH North&south PDFNelson Vinod KumarNo ratings yet

- Lehman's Aggressive Repo 105 TransactionsDocument19 pagesLehman's Aggressive Repo 105 Transactionsed_nycNo ratings yet

- Practical IFRSDocument282 pagesPractical IFRSahmadqasqas100% (1)

- Shoppers Paradise Realty & Development Corporation, vs. Efren P. RoqueDocument1 pageShoppers Paradise Realty & Development Corporation, vs. Efren P. RoqueEmi SicatNo ratings yet

- Total Amount Due: P1,799.00: BIR CAS Permit No. 0415-126-00187 SOA Number: I000051735833Document2 pagesTotal Amount Due: P1,799.00: BIR CAS Permit No. 0415-126-00187 SOA Number: I000051735833Pia Ber-Ber BernardoNo ratings yet

- Cobrapost II - Expose On Banks Full TextDocument13 pagesCobrapost II - Expose On Banks Full TextFirstpost100% (1)

- CIR vs. First Express PawnshopDocument1 pageCIR vs. First Express PawnshopTogz Mape100% (1)

- Society in Pre-British India.Document18 pagesSociety in Pre-British India.PřiýÂňshüNo ratings yet

- OpTransactionHistoryTpr09 04 2019 PDFDocument9 pagesOpTransactionHistoryTpr09 04 2019 PDFSAMEER AHMADNo ratings yet

- Partnership Formation Answer KeyDocument8 pagesPartnership Formation Answer KeyNichole Joy XielSera TanNo ratings yet

- SHFL Posting With AddressDocument8 pagesSHFL Posting With AddressPrachi diwateNo ratings yet

- Impacts of Globalization on Indian AgricultureDocument2 pagesImpacts of Globalization on Indian AgricultureSandeep T M SandyNo ratings yet

- 2nd Annual Latin America Rail Expansion SummitDocument16 pages2nd Annual Latin America Rail Expansion SummitenelSubteNo ratings yet

- Partnership Dissolution and Liquidation ProcessDocument3 pagesPartnership Dissolution and Liquidation Processattiva jadeNo ratings yet

- Palo Leyte Palo Leyte: Table 1Document5 pagesPalo Leyte Palo Leyte: Table 1samson benielNo ratings yet

- Accounting Chapter 10Document4 pagesAccounting Chapter 1019033No ratings yet

- Currency and interest rate swaps explainedDocument33 pagesCurrency and interest rate swaps explainedHiral PatelNo ratings yet

- REFRIGERATORDocument2 pagesREFRIGERATORShah BrothersNo ratings yet

- Terms of TradeDocument3 pagesTerms of TradePiyushJainNo ratings yet

- India CementsDocument18 pagesIndia CementsNanditha SivadasNo ratings yet

- National Board of Examinations: Sr. No. No. para No. Topic Query / Suggestion Amendments, To Be Read AsDocument3 pagesNational Board of Examinations: Sr. No. No. para No. Topic Query / Suggestion Amendments, To Be Read AskrishnaNo ratings yet

- ProjectDocument17 pagesProjectfirman tri ajie75% (4)