Professional Documents

Culture Documents

Iphone 5 VCM

Uploaded by

Jennifer JohnsonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Iphone 5 VCM

Uploaded by

Jennifer JohnsonCopyright:

Available Formats

www.morganmarkets.

com

Global Equity Research

11 September 2012

Global Technology

The J.P. Morgan View on iPhone 5 Implications: Get

Ready for a Major 12-18 Month Upgrade Cycle

Globa Technology

Mark Moskowitz

AC

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

J.P. Morgan Securities LLC

Philip Cusick, CFA

AC

(1-212) 622-1444

philip.cusick@jpmorgan.com

J.P. Morgan Securities LLC

Rod Hall, CFA

AC

(1-415) 315-6713

rod.b.hall@jpmorgan.com

J.P. Morgan Securities LLC

Christopher Danely

AC

(1-415) 315-6774

chris.b.danely@jpmorgan.com

J.P. Morgan Securities LLC

Harlan Sur

AC

(1-415) 315-6700

harlan.sur@jpmorgan.com

J.P. Morgan Securities LLC

JJ Park

AC

(822) 758-5717

jj.park@jpmorgan.com

J.P. Morgan Securities (Far East) Ltd, Seoul

Branch

Gokul Hariharan

AC

(852) 2800-8564

gokul.hariharan@jpmorgan.com

J.P. Morgan Securities (Asia Pacific) Limited

Masashi Itaya

AC

(81-3) 6736 8633

masashi.itaya@jpmorgan.com

JPMorgan Securities Japan Co., Ltd.

Hannes Wittig

AC

(44-20) 7134-4926

hannes.c.wittig@jpmorgan.com

J.P. Morgan Securities plc

James R. Sullivan, CFA

(65) 6882-2374

james.r.sullivan@jpmorgan.com

J.P. Morgan Securities Singapore Private

Limited

See page 36 for analyst certification and important disclosures, including non-US analyst disclosures.

J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the

firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in

making their investment decision.

This report presents the collective J.P. Morgan technology and communications

research views on the sector and stock implications of the imminent iPhone 5

launch. We believe that the iPhone 5 will be revolutionary in form factor and

software capabilities, contributing to a major upgrade cycle over the next 12-18

months. The iPhone 5 stands to create winners and losers across the technology

food chain and in the handset market. Our research indicates that supply chain

constraints related to 28nm chips and in-cell displays are easing, which should

make for a fast, far reaching ramp, potentially impacting carriers designs on

slowing upgrade rates to protect margin.

Handset and PC sector implications. We expect the iPhone 5s battery

performance, screen size, and form factor thickness to sidestep the battery

hog and pocket hog labels of other LTE-based smartphones, likely hurting

market share ambitions of other handset makers. Meanwhile, we think that a

more user-friendly LTE-based device in the form of iPhone 5 stands to sustain

the land grab of smartphones taking IT dollars from PCs, dampening PC-related

growth prospects at Dell, Hewlett-Packard, and other PC makers.

Semiconductor sector implications. We believe the iPhone 5 launch

represents one of the few secular growth stories for semiconductors in 2H12.

Within our large-cap semiconductor space, strong demand forecasts for the

iPhone 5 should benefit Apple-levered analog names including Analog Devices,

Fairchild, and Avago. From a SMid semiconductor perspective, we believe the

iPhone 5 launch will likely spur another strong product cycle for connectivity

providers, Broadcom and Peregrine Semiconductor. Qualcomm should also

benefit from increased modem shipments. Conversely, we believe a strong

iPhone and iPad upgrade cycle is a likely negative for PC names such as Intel

and AMD due to cannibalization of PC demand.

Component/technology enabler sector implications. We expect strong

demand related to iPhone 5 launch to benefit key Apple supply chain names in

Asia-based supply chain, including LG Display (In-cell panels), Samsung

Electronics (AP, mDRAM), LG Innotek (Camera module), and SEMCO

(MLCC). In the context of Paul Costers Applied Tech coverage universe, one

stock stands to benefit: Omnivision. In contrast, the introduction of native

mapping and TBT navigation on iOS 6 on the iPhone 5 stands to be a mild

negative for TeleNav, TeleCommunication Systems, and Garmin.

Wireless carrier sector implications. In the U.S., we expect upgrades to

increase in the near term as a result of the iPhone 5, likely pressuring carriers'

margin profiles. Longer term, we expect the iPhone 5 to accelerate the already

begun upgrade cycle to 4G (LTE) for the U.S. wireless carriers from handset

bases dominated by 3G handsets today. As relates to European telecom

services, it is yet unclear how disruptive the iPhone 5 will be in European

markets, mainly because it is not yet known whether the device will support

European LTE frequencies. In any case, we do not think it will be as disruptive

as in the U.S.

2

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

Table of Contents

Overview................................................................................... 3

Key Points on Apples iPhone 5 ............................................. 3

Broader Implications of iPhone 5 ........................................... 7

U.S. IT Hardware..................................................................... 11

Communications Equipment & Data Networking................ 17

Internet .................................................................................... 18

U.S. Semiconductors............................................................. 20

U.S. SMid Semiconductors.................................................... 22

Asia Technology Hardware................................................... 23

Asia Semiconductors.............................................................24

Asia Electronic Components Sector.....................................25

Applied & Emerging Technologies.......................................27

U.S. Telecom Services ...........................................................28

European Telecom Services..................................................31

Asian Telecom Services ........................................................34

Software Technology.............................................................35

In addition to the analysts on the

cover page, the following analysts

also contributed to this report.

Doug Anmuth

AC

(1-212) 622-6571

douglas.anmuth@jpmorgan.com

Paul Coster, CFA

AC

(1-212) 622-6425

paul.coster@jpmorgan.com

Sterling Auty, CFA

AC

(1-212) 622-6389

sterling.auty@jpmorgan.com

J.P. Morgan Securities LLC

3

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

Overview

This report presents the collective J.P. Morgan technology and communications

research views on the sector and stock implications of the imminent iPhone 5 launch.

We believe that the iPhone 5 will be revolutionary in form factor and software

capabilities, contributing to a major upgrade cycle over the next 12-18 months. The

iPhone 5 stands to create winners and losers across the technology food chain and in

the handset market. Our research indicates that supply chain constraints related to

28nm chips and in-cell displays are easing, which should make for a fast, far

reaching ramp, potentially impacting carriers designs on slowing upgrade rates to

protect margin.

Key Points on Apples iPhone 5

iPhone 5 will be disruptive, driving a major upgrade cycle

Our assumption is that the iPhone 5 will be considered disruptive in terms of form

factor and software capabilities, likely driving a major upgrade cycle over the next

12-18 months. The step-function from iPhone 4 to iPhone 4S was evolutionary at

best, rendering the current product set nearly two year old, allowing the competition

to bridge the gap. We think the gap widens after the September 12 announcement, in

favor of Apple. As a result, the iPhone 5 stands to have an impact on the technology

food chain, handset market, and wireless carrier market. These topics are discussed

throughout this report.

Why we think the iPhone 5 will be revolutionary?

We believe the iPhone 5 device and related iOS 6 software upgrades will reaffirm

Apple's position as a leader in the smartphone competitive landscape. In the below

table (Table 1), we detail our assumptions for the incremental design changes for the

iPhone 5, as compared to its predecessor, the iPhone 4S. We consider many of the

changes to be more significant in nature, versus the previous upgrade of the iPhone

product line (iPhone 4 to 4S).

Table 1: J.P. Morgan Comparison of Expected Features - iPhone 5 versus iPhone 4S

iPhone 5 iPhone 4S Incremental

U.S. subsidized price (16GB) $199 $199 Value to consumer given the richness of the upgrade

Display 4" Retina 3.5" Retina Closes the gap with other smartphone comparables

Cellular connectivity LTE/World Phone World Phone Faster cellular-based data

Processor A6 Dual Core A5 Faster data and lower power consumption

Operating System iOS 6 iOS 5 3D maps, Passbook, FaceTime over cellular, and better

China-related compatibility. Over 200 new features in total

Size and Weight 15% thinner, taller but with

same width, lighter vs. 4S

NA Wow factor, prestige

Back Aluminum and glass, unibody Glass Wow factor, prestige

Accessories New headphones and dock

connector

Headphones - Wow factor, prestige. Connector - Allows for

thinner form factor

NFC (Near Field Communication) None None No impact

Source: J.P. Morgan estimates; company data.

Highlights include a larger 4-inch display and LTE network connectivity. We expect

the device to be slightly thinner, lessening the potential of the new device being

4

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

considered a pocket hog. We also believe the spatial alignment of the battery,

across a longer plane, will provide for improved battery life without compromising

the pursuit of a sleeker form factor. Lastly, with over 200 new features and

improvements to the iPhone operating system, iOS 6, we think that the Apple stands

to optimize the overall experience for the user beyond just focusing on the physical

device features. We discuss this software-led optimization in the next paragraph.

iOS 6 stands to advance Apples role in software-driven services

In our view, two big iOS 6 advancements are Passbook and Maps. We think that

these software-driven services stand to augment the end users experience and

underscore Apples increasing impact on the digital life. In our view, Passbook is the

precursor to what we have referred to previously as iPay for mobile payments.

Lastly, we think that FaceTime over cellular and its integration across the iPhone,

iPad, and Mac is a positive. All of these factors should provide a good set up for high

customer interest in the iPhone 5 device.

Passbook

Passbook is a new feature, which acts as a repository for bar-coded tickets and

coupons, such as airline boarding passes, movie tickets, and Starbucks cards.

Passbook allows consumers to store and access electronic versions of tickets and

merchant cards in one place. Passbook also is dynamic meaning that it can alert

consumers of flight delays or if a merchant is in close proximity, for example.

While early, we believe Passbook could be a precursor to an Apple-driven mobile

payments service, which we have discussed in prior reports. Recall, we believe

Apple could potentially introduce what we have dubbed iPay whereby Apple users

pay for goods and services using NFC technology embedded in an iPhone or iPad as

part of a mobile payment platform. Of note, as illustrated in Table 1 above, we do not

currently believe that NFC will be incorporated into the iPhone 5. Rather, we expect

the functionality and usability of Passbook to further evolve over time, and NFC

capabilities to be incorporated into future iterations of the iPhone and iPad.

In our view, Passbook is more about retaining the users dependence on the iPhone

for optimized experiences versus incremental monetization. Indeed, we think that

Apple likely faces a major uphill battle in grabbing a financial piece of the mobile

payment market. Payment network incumbents are not likely to cede share to Apple.

Plus, unless Apple is willing to provide its users credit, Apple is not taking on any

financial risk as opposed to the credit card companies running the legacy payment

networks at most retail outlets.

Maps

Another key feature with iOS 6 is Maps, built by Apple with technology from the

recent acquisitions of Placebase, Poly9, and C3 Technologies. The new Apple Maps

application replaces Google Maps in iOS devices. The product works with Siri to

offer voice turn-by-turn navigation. In addition, the new application incorporates 3D

Flyover, which allows users to see places in highly detailed 3D rendering. Apple

Maps also incorporates Yelp to provide listings for over 100 million local businesses.

We believe Apples ability to create such a software-driven service demonstrate its

increasing role on augmenting the end users digital life.

5

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

Siri

Another plus with iOS 6 is that Siri will support iPad. Moreover, Apple has been

increasing its advertisements of celebrity figures relying on Siri. In our view, the

message is that Siri 2.0 will usher in a more consistent, reliable, and expanded user

experience. To point, recall from the June WWDC event that Siri was highlighted as

being part of Apples natively-designed Maps, supporting voice turn-by-turn driving

direction, and that within the next 12 months, Siri will be the backbone for Eyes

Free service integrating Siri and Maps into automobiles. Apple has highlighted

several auto makers working with Apple on Eyes Free, including Audi, BMW,

Chrysler, GM, Honda, Jaguar, Land Rover, Mercedes, and Toyota.

Low smartphone penetration rate globally points to a multiplier effect

Beyond Apples market share opportunities within the smartphone market, we think

there is also plenty of headroom for growth for the total smartphone market, too.

This creates a unique opportunity for Apple, as the iPhone could be a beneficiary of a

growth multiplier effect one part from market share gains within the smartphone

market and a second part from smartphone market gaining share within the handset

market overall. A bigger, stronger Apple stands to impact a wide array of component

suppliers and carriers, in our view.

We expect smartphone adoption to remain brisk for the remainder of C2012 and into

C2013. Below in Table 2, we illustrate J.P. Morgan worldwide iPhone unit sales

estimates, versus our smartphone and handset unit sales estimates. As shown below,

we expect smartphone unit growth of 30% YoY to significantly outpace that of

handset growth of 6%. Meanwhile, we expect iPhone unit growth of 30% YoY in

C2013. Our estimate points to over 50% handsets worldwide to be sold in C2013 are

to be smartphones. In addition, we expect overall iPhone penetration of the handset

market to likely to be only in the high-single digits. In our view, the analysis points

to upside potential for our iPhone estimates, given the relative higher estimated

growth of the smartphone market combined with the iPhones low penetration

overall.

Table 2: J.P. Morgan Estimates for iPhone, Smartphone and Handset Unit Sales

units, 000s

C2010 C2011 C2012E C2013E

iPhone units (JPMe) 47,487 93,102 130,321 169,424

YoY Growth 96% 40% 30%

Smartphone units (JPMe) 298,847 471,743 668,043 868,717

YoY Growth 58% 42% 30%

Handset units (JPMe) 1,427,000 1,578,632 1,577,810 1,671,742

YoY Growth 11% 0% 6%

iPhone % of smartphone 16% 20% 20% 20%

Smartphone % of handset 21% 30% 42% 52%

iPhone % of handset 3% 6% 8% 10%

Source: J.P. Morgan estimates. Smartphone and handset market estimates courtesy of J.P. Morgan analyst Rod Hall.

We believe the smartphone market has multi-year expansion opportunities ahead

given its low penetration worldwide. In our view, it is inevitable that the growth of

smartphones will slow down and reach saturation at some point. However, we do not

think the event is likely to be a near to mid-term event. As smartphones gain more

functionality at a lower cost, their pervasiveness stands to increase.

6

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

As a sanity check, we believe comparison against the penetration of handsets and

PCs worldwide offers a good perspective. Worldwide smartphone market penetration

is well below that of handsets and PCs. As shown in Table 3 below, current

smartphone penetration rates are below that of PC and handset markets across the

world. In addition, we believe there is likely to be a couple years before market

saturation occurs in smartphones. Therefore, smartphones likely have at least three

more years of above-market growth potential before there is potential for growth

headwinds due to saturation of the market, in our view.

Table 3: Smartphone vs. Handset and PC Penetration Rates by Region

C2009 C2010 C2011 C2012 C2013 C2014

Asia/Pacific Smartphone penetration 2% 3% 6% 9% 12% 16%

Handset penetration 37% 43% 49% 54% 57% 58%

PC penetration 9% 11% 12% 14% 16% 19%

Eastern Europe Smartphone penetration 3% 5% 8% 13% 20% 27%

Handset penetration 94% 99% 101% 101% 102% 102%

PC penetration 22% 24% 27% 30% 35% 40%

Latin America Smartphone penetration 2% 4% 8% 13% 18% 22%

Handset penetration 67% 71% 76% 78% 79% 80%

PC penetration 20% 22% 26% 30% 35% 40%

Middle East & Africa Smartphone penetration 2% 2% 4% 5% 7% 10%

Handset penetration 36% 40% 45% 47% 49% 50%

PC penetration 4% 5% 5% 6% 7% 9%

North America Smartphone penetration 23% 33% 46% 62% 77% 88%

Handset penetration 109% 113% 115% 114% 114% 113%

PC penetration 92% 98% 103% 106% 110% 112%

Western Europe Smartphone penetration 18% 32% 44% 60% 77% 90%

Handset penetration 126% 128% 130% 131% 131% 131%

PC penetration 62% 68% 72% 76% 80% 83%

Japan Smartphone penetration 26% 24% 31% 43% 52% 56%

Handset penetration 86% 91% 97% 102% 107% 110%

PC penetration 60% 62% 65% 67% 68% 69%

Worldwide Smartphone penetration 4% 7% 10% 15% 20% 24%

Handset penetration 53% 58% 62% 66% 68% 68%

PC penetration 18% 20% 22% 24% 26% 29%

Source: Gartner and J.P. Morgan estimates.

We concede our method of determining overall smartphone penetration could be

viewed as flawed. In Table 3 above, we utilized the total population of each region as

the unit of comparison when determining the overall penetration rate of the devices

installed base. In many regions, 100% penetration is likely unachievable due to

various reasons, including the inability or lack of interest in possessing such a device.

In an effort to alleviate this potential concern, we present a separate analysis method

below, which results in a similar conclusion. As show in Table 4 and Table 5 below,

a different way of analyzing various smartphone penetration rates is through direct

comparison of the installed bases of handsets and PCs. In our view, if an individual is

capable (and willing) to possess either a PC or smartphone, there is a higher

likelihood that same consumer would be interested in owning a smartphone as well.

In Table 4 below, we illustrate the ratio of smartphones to handset installed base

worldwide, by region. Over time, we expect this ratio to rise as increasing

7

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

penetration of smartphones cannibalize the handset installed base. As shown, there is

still plenty of room for continued above handset market growth. We anticipate

overall smartphone penetration into the handset installed base to be less than 40% in

C2014. We believe this dynamic indicates plenty of headroom for above-handset

market growth for smartphones. Even so, we anticipate the smartphone market in

more developed regions of the world to saturate in the next 3-5 years.

Table 4: Smartphone/Handset Installed Base Ratio by Region

C2009 C2010 C2011 C2012 C2013 C2014

Asia/Pacific 0.04 0.07 0.12 0.17 0.22 0.27

Eastern Europe 0.03 0.05 0.08 0.13 0.19 0.27

Latin America 0.03 0.06 0.11 0.17 0.22 0.28

Middle East & Africa 0.04 0.06 0.08 0.11 0.15 0.21

North America 0.21 0.29 0.40 0.55 0.67 0.78

Western Europe 0.14 0.25 0.34 0.46 0.59 0.68

Japan 0.30 0.26 0.32 0.42 0.48 0.51

Worldwide 0.08 0.11 0.17 0.23 0.29 0.36

Source: Gartner and J.P. Morgan estimates.

In Table 5 below, we illustrate the estimated ratio of smartphone to PC installed base

worldwide, by region. As mentioned earlier, we believe a consumer capable of

owning a personal computer will likely also be able and willing to purchase a

smartphone. For this particular analysis, we expect the ratio to rise to greater than

one over time. Reason being is that many households may have only one PC, while

multiple members of a household may own smartphones, in our view.

Table 5: Smartphone/PC Installed Base Ratio by Region

C2009 C2010 C2011 C2012 C2013 C2014

Asia/Pacific 0.18 0.27 0.46 0.63 0.76 0.85

Eastern Europe 0.14 0.21 0.30 0.43 0.57 0.68

Latin America 0.09 0.18 0.32 0.44 0.51 0.56

Middle East & Africa 0.38 0.48 0.69 0.86 1.01 1.17

North America 0.25 0.33 0.45 0.59 0.70 0.78

Western Europe 0.29 0.47 0.62 0.80 0.97 1.08

Japan 0.44 0.39 0.48 0.64 0.75 0.81

Worldwide 0.23 0.33 0.48 0.63 0.75 0.84

Source: Gartner and J.P. Morgan estimates.

Broader Implications of iPhone 5

Handset and PC sector implications

We expect the iPhone 5s battery performance, screen size, and form factor thickness

to sidestep the battery hog and pocket hog labels of other LTE-based

smartphones, likely hurting market share ambitions of other handset makers.

Meanwhile, we think that a more user-friendly LTE-based device in the form of

iPhone 5 stands to sustain the land grab of smartphones taking IT dollars from PCs,

which stands to dampen the PC-related growth prospects at Dell and Hewlett-

Packard and other PC makers.

Overall, we believe that our total smartphone estimates already account for an iPhone

driven volume ramp in H212. We are currently forecasting 24% 2H/1H growth in

smartphone shipments in H212 (28% H/H in H211). We see limited impact on the

overall handset market from the possible launch of a new iPhone, due to its small

8

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

market share (just 6% in Q212). We are already forecasting sequential growth of 3%

and 9% in the overall handset market in Q312 and Q412, respectively.

Supply of Qualcomms 28nm chips is generally viewed as one of the key risks to

high-end smartphone industry growth in H212. However, in our 28nm chip

supply/demand analysis published on 8 June we concluded that Qualcomm should be

able to meet 28nm chip demand from Apple up to about 40m iPhone 5 units. At

present our Apple analyst, Mark Moskowitz, estimates that iPhone 5 shipments are

likely to be around 25m units in the December quarter well below QCOMs ability

to supply 9x15 modem chips. This means that there is plenty of room for upside to

QCOM shipments should the iPhone 5 outpace current market sales expectations.

Semiconductor sector implications

Despite macro headwinds weighing on semiconductor demand, we believe the

iPhone 5 launch represents one of the few secular growth stories for the sector in

2H12. Within our U.S. large-cap semiconductor space, strong demand forecasts for

the iPhone 5 should benefit Apple-levered analog names including Analog Devices,

Fairchild, and Avago. Qualcomm should also benefit from increase shipments of its

next generation 28nm modem chips. We believe most of the analog suppliers have

low single digit dollar content exposure to iPhone 5 and have implied the levering to

the product roll out in the September guidance commentary. Conversely, we believe

a strong iPhone and iPad upgrade cycle is a likely negative for PC names such as

Intel and AMD due to cannibalization of PC demand and lack of exposure to the

iPhone/iPad.

From a U.S. SMid semiconductor perspective, we believe the iPhone 5 launch will

likely spur another strong product cycle for connectivity providers, Broadcom and

Peregrine Semiconductor. Both companies are already major suppliers of chip

solutions into the current generation iPhone 4S and iPad 3 and we believe that they

have been designed into the iPhone 5 as well.

Other component and technology enabler sector implications

We expect strong demand and expectation toward iPhone 5 launch to benefit key

Apple supply chain names in Asia-based supply chain, including LG Display (In-cell

panels), Samsung Electronics (AP, mDRAM), LG Innotek (Camera module), and

SEMCO (MLCC). However, as Apple diversifies its key component supply (NAND

Flash and mDRAM) into non-Korean suppliers, magnitude of benefit from iPhone 5

launch to Samsung Electronics and SEMCO shall be smaller given increasing

internal component consumption on back of strong Samsung smartphone

momentum. On the other hand, we believe that high-levered Apple supply names like

LG Display and LG Innotek should benefit more given relatively higher earnings

exposure to iPhone demand.

Design change beneficiaries typically derive the most benefit from new iPhone

launches in the supply chain. In the iPhone 5, we believe the key winners from

iPhone 5 design change should be (1) Hon Hai group / Fanuc due to move to metal

Unibody casings, (2) LGD / Sharp (once yield issues are overcome) due to use of in-

cell touch panels (3) Murata due to move to LTE (higher number of MLCCs and

increased demand for RF front end modules, (4) Samsung for Application processors

(5) TSMC (and potentially UMC) for LTE baseband chips at 28nm.

9

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

As relates to Asia electronic components, we expect particularly strong benefits for

high-frequency components. We expect the new iPhone to support LTE and therefore

have 50% more FDD bands than the existing model. Combined with volume growth

for the phone itself, we expect this to drive substantial growth in volume for high-

frequency components and in sales for Murata Mfg., Taiyo Yuden, TDK, the three

Japanese passive component makers involved in high-frequency parts including

duplexers and band-pass filters. The fact that there are few Asian competitors in

these areas suggests that Japanese companies could readily benefit from market

expansion. We think passive component makers could also benefit from the shift

toward higher added value in mainstay MLCCs.

In the context of Paul Costers Applied Tech coverage universe, one stock stands to

benefit from imminent Apple product introductions, including the iPhone 5 launch:

Omnivision. In contrast, the introduction of native mapping and TBT navigation on

iOS 6 on the iPhone 5 stands to be a mild negative for TeleNav (TNAV/N),

TeleCommunication Systems (TSYS/OW), and Garmin (GRMN/UW).

Wireless carrier sector implications

In the U.S., in the near term, we expect the iPhone 5 to drive higher than expected

upgrades in 3Q12 and 4Q12. We recently raised our upgrade rate for Verizon to

8.0% from 6.8%, AT&T to 8.0% from 6.3% and Sprint to 10.0% from 9.0%. In all

we now expect 9.2m iPhone sales in 3Q12, up from 7.3m previously (when we had

expected a 4Q versus late 3Q launch) and 7.5m in 2Q12. We estimate 12.8m iPhone

unit sales in 4Q12 versus the 13.1m estimate for 4Q11, when the iPhone 4S was

launched. The higher upgrade rates pressures margins for the wireless carriers and

we expect more downside risk to margins in 3Q and 4Q as iPhone 5 sales ramp.

Longer term, in the U.S., we expect the iPhone 5 to accelerate the already begun

upgrade cycle to 4G (LTE) for the U.S. wireless carriers from handset bases

dominated by 3G handsets today. Verizon is the largest U.S. carrier with LTE at

230m covered pops, followed by AT&T at ~80m and Sprint only covers a few

markets. We believe Verizon and the other carriers are eager to migrate customers

from loaded 3G networks to 4G networks to take advantage of relatively empty

networks as well as lower cost and more data efficient LTE.

As relates to European telecom services, it is yet unclear how disruptive the iPhone 5

will be in European markets, mainly because it is not yet known whether it will

support European LTE frequencies. In any case we do not think it will be as

disruptive as in the U.S., given:

The iPhone accounts for only about half of the proportion of smartphones sold in

Europe compared to the U.S.

European markets have not displayed extreme margin seasonality in recent years

European LTE deployments are much less advanced than in the U.S. Only the

Scandinavian markets and Germany have seen substantial LTE at this stage

Unlike in the U.S. where T-Mobile is the big exception, most operators support the

iPhone

10

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

The iPhone accounts for only about half of the proportion of smartphones sold in

Europe compared to the U.S. According to ComTech data, in the quarter leading up

to June 2012 iOS accounted for 37% of smartphones sold in the U.S., but only 26%

in the UK, 20% in Italy, 17% in Germany, 15% in France, and 3% in Spain.

11

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

U.S. IT Hardware

iPhone 5 to Sustain Apples Above-Peer Growth Potential; Handset/PC Makers to Be Hurt

Sector Implications

iPhone 5: Boon for Apple, Thorn for Handset and PC Makers

Our assumption is that the iPhone 5 will be revolutionary in terms of form factor and

software capabilities, driving a major upgrade-cycle over the next 12-18 months. We

expect the new device to sustain Apples above-peer growth potential and be an

incremental thorn for handset and PC makers. We expect the iPhone 5s battery

performance, screen size, and form factor thickness to sidestep the battery hog and

pocket hog labels of other LTE-based smartphones, likely hurting other handset

makers. Meanwhile, we think that a more user-friendly LTE-based device in the form

of iPhone 5 stands to sustain the land grab of smartphones taking IT dollars from

PCs, which stands to dampen the PC-related growth prospects at Dell and Hewlett-

Packard and other PC makers.

Table 6: Apple J.P. Morgan New vs. Old iPhone Estimates (as of September 5)

Units in 000s

C2012E C2013E

Sep-Q Dec-Q Mar-Q Jun-Q Sep-Q Dec-Q

NEW iPhone estimates 24,206 45,023 43,582 39,922 39,323 46,597

OLD iPhone estimates 22,775 39,377 37,841 34,625 35,525 44,229

Source: J.P. Morgan estimates.

On September 5, we raised our iPhone quarterly unit estimates, as detailed in the

above table (Table 6). As stated often throughout the year, we believe that

smartphones and tablets are grabbing increasing share of IT dollars, specifically

hurting the PC market. We expect the iPhone 5 to be a negative catalyst for the PC

market, as the form factor and software enhancements of the new smartphone stand

to drive end users to refresh their smartphone before considering a refresh of their PC

device.

Stock Implications

As for stock implications, we focus squarely on Apple. In our coverage list, we do

not expect any positive derivative plays. Instead, we expect the PC-related stocks to

be hurt, as the iPhone 5 stands to increase end user's interest in refreshing

smartphones prior to their PCs.

We are not too worried about supply constraints weighing on the iPhone 5 ramp

Our research indicates that Apple still faces supply constraints, but that the company

should be able to sidestep the constraints more than previously anticipated. The

trouble spots remain 1) 28nm chip shortages and 2) in-cell display shortages, but we

do not expect the hurdles to be as high as previously feared. Our assumption remains

that approximately 50-60% of iPhone units in the Dec-Q will be iPhone 5-related,

with the contribution increasing in 1H C2013. We expect the iPhone 5 to face some

gross margin headwinds in the initial stages of the launch, followed by gradual

increases in product gross margin as manufacturing yields improve.

Mark Moskowitz

AC

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

Anthony Luscri

(1-415) 315-6702

anthony.s.luscri@jpmorgan.com

Mike Kim

(1-415) 315-6755

mike.j.kim@jpmorgan.com

J.P. Morgan Securities LLC

12

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

Ability to absorb product cyclicality should improve over the next 12-18 months

In our view, Apple has become the leader of the mobility age from a device and

content perspective. With its optimized smartphone, tablet, and notebook PC form

factors, complemented by its iTunes/App Store ecosystem, the company single-

handily has disrupted the technology playing field. With the exception of the recent

June quarter, over the past 7-8 years, Apple has been able to avoid operating

volatility due to product cyclicality. To avoid further volatility and for the stock to

remain upward biased, we think it is important for the iPhone 5 and iPad mini to

construct a multi-quarter adoption period, which we expect to manifest.

Apple needs to reassert its ability to absorb the volatility associated with product

cycle-driven cyclicality, in our view. Based on our estimates, the iPhone and the iPad

segments now make up 60% and 20% of Apples quarterly gross profit dollars

respectively. The two product lines now comprise approximately 70% of total

revenue. The increased contribution from these segments increases the risk for

product cycle driven volatility. For the stock to remain upward biased, we think the

two most important questions are 1) can Apple sustain its significant iPhone

momentum and 2) can the iPad exhibit a similar phenomenon? We think if the

answers to both questions are yes, then there is significant upside to the stock.

Alternatively, if the answer is yes to only one of the two, then we think the stock

should still perform well.

The issue comes if both the iPhone 5 and iPad mini are unable to construct a multi-

quarter adoption period. In such a case, there is increasing risk for greater operating

volatility a couple quarters after launch. If these next two product launches are not

successful on the adoption front, we think that investors could be concerned that

Apple is losing its ability to sustain its technology leadership over the competition.

There are potential offsets to absorb new product cyclicality, though, in the form of

more concentrated efforts in mobile payments, social media, and television. In our

view, these new opportunities could help Apple to restore its ability to absorb new

product cyclicality. We detail these potential opportunities, as well as Apples

ongoing smartphone and tablet growth potential in greater detail later in this report.

Do not be alarmed by any near-term selling pressure in the stock

In recent years, the lead-up to a major product launch has resulted in shares of Apple

appreciating only to trade flat or down in the days immediately following the launch

(see Table 7). Following the potential iPhone 5 and iPad mini launches, we

recommend that investors take advantage of any near-term selling pressure. As the

below table illustrates, in the 30 days following a major launch, Apples stock has

more than recovered from any post-launch trading pressure.

13

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

Table 7: Apple Stock Price Performance Pre and Post Product Announcements

Trading performance based on % return

Stock Price Performance

Announcement Pre-Announcement Post Announcement

Date Stock Price 30 Days 7 Days 30 Days

Original iPad 1/27/2010 $207.88 (1.8%) (4.2%) (1.6%)

iPhone 4 6/7/2010 $250.94 6.4% 1.3% 3.1%

Verizon iPhone announcement 1/11/2011 $341.64 6.2% (0.3%) 3.8%

iPad 2 3/2/2011 $352.12 3.8% 0.1% (2.1%)

iPhone 4S 10/4/2011 $372.50 (0.4%) 7.5% 8.2%

iPad 3 3/7/2012 $530.69 14.4% 11.1% 19.9%

iPhone 5 * TBD $662.74 9.2%

Average: 5.4% 2.6% 5.2%

Source: Bloomberg and company reports.

* Stock price is as of September 10, 2012. Stock price performance is since August 1, 2012.

Unprecedented break-out in the stock has been driven by the iPhone

It is no secret that a resolute focus on both innovation and design has helped Apple

cement its leadership in offering user-friendly, content-driven device experiences. A

critical driver to Apples success has been the company's focus on owning the

hardware and software platforms. Plus, Apple steadily has become tightly integrated

with the supply chain, due to 1) its above-market growth attributes and 2) strategic

investments in the capital equipment footprints of key suppliers. All of these factors

have combined to propel Apples growth trajectory above its end markets.

Key growth drivers include 1) Apples low market penetration rates in smartphones

and tablets, 2) a lower-priced iPad, 3) Apples role in enabling the burgeoning social

media/networking adoption curve, 4) potential entry into mobile payments, and 5)

potential TV market entry down the road. In total, we believe that these drivers can

sustain the relative outperformance of Apples operating model and stock, as

illustrated in the below figure (Figure 1).

It is important to note that the unprecedented break-out in Apples stock price has

been driven primarily by the iPhones success in both revenue and profit

contribution. Apples stock is up 443%since the release of iPhone 2G version on

June 29, 2007, versus the S&P 500s decline of 5%. As shown below, other

significant events include the introduction of the iPad on April 3, 2010 and the

anticipation of, and the official announcement of the dividend and buyback program

on March 19, 2012.

14

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

Figure 1: Apple Stock Price versus Major Product Introductions

Source: Capital IQ, J.P. Morgan, Company data.

As illustrated in Figure 2 below, the success of the iPhone, and to a lesser extent the

iPad, have made the Mac and iPod less significant contributors to Apples model.

Since the introduction of iPhone in Apples third fiscal quarter of 2007, the segment

has grown to over 60% of total gross profit dollars, based on our estimates. In

addition, the iPad has risen to over 20% of gross profit contribution since its

introduction in the third fiscal quarter of 2010, based on our estimates. The

unprecedented growth of these two product offerings has benefitted the overall

model, but the mix shift towards these two product lines, as a percentage of total

revenue and profits, has also increased the risk of higher operating volatility.

As the iPod and Mac business lines continue to fade as major contributors to the

overall revenue and profit profile, the Apple model of tomorrow has a higher risk of

reverting to its early 2000s profile. Here, product cycle operating volatility was the

norm. If the next two product launches (iPhone 5 and iPad mini) are not successful

on the adoption front, we think that investors could be concerned that Apple is losing

its ability to sustain its technology leadership over the competition. There are

potential offsets, though, in the form of potential entry into mobile payments and

television, as well as more concentrated efforts in social media/networking.

$0

$100

$200

$300

$400

$500

$600

$700

$800

iPad 3G

iPad 4G

iPod

Apple TV

iPhone 2G

iPod Touch

iPhone 3G

and AppStore

iPad WiFi

MacBook

MacBook Pro

MacBook Air

iTunes

15

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

Figure 2: Apple - Gross Profit Contribution by Product

Gross profit as a % of total, fiscal quarters

Source: Company reports and J.P. Morgan estimates.

As shown in Figure 3 below, Apples revenue contribution by product mix tells a

similar story. Since the beginning of fiscal 2012, the iPhone and iPad have

contributed approximately 50% and 20% of revenue, respectively. Meanwhile, the

iPod and Mac have each decreased to less than approximately 15% of revenue

contribution respectively.

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2

Q

0

1

4

Q

0

1

2

Q

0

2

4

Q

0

2

2

Q

0

3

4

Q

0

3

2

Q

0

4

4

Q

0

4

2

Q

0

5

4

Q

0

5

2

Q

0

6

4

Q

0

6

2

Q

0

7

4

Q

0

7

2

Q

0

8

4

Q

0

8

2

Q

0

9

4

Q

0

9

2

Q

1

0

4

Q

1

0

2

Q

1

1

4

Q

1

1

2

Q

1

2

iPod and Peripherals

Mac

iPad

iPhone

16

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

Figure 3: Apple - Revenue Contribution by Product

Revenue contribution as a % of total, fiscal quarters

Source: Company reports and J.P. Morgan estimates.

We continue to expect a September product announcement related to the new iPhone

5, followed by volume ramp in the last 10 days of the month. Previously, we had

expected volume ramp to being in the month of October. In addition, we expect an

iPad mini product to be released this fall, with sales volume beginning in early

October.

If the iPhone 5 is indeed a game changer, as is widely expected, we think that the

device can solidify the iPhones revenue contribution at greater than 50% of total

within the Apple model. Interestingly, this same dynamic occurred in 2006 with the

iPod. Soon thereafter, Apple followed with the introduction of the iPhone, a product

release which entered Apple into an entirely new product vertical of smartphones. In

our view, the likely permanency of the iPhone at greater than 50% of revenue could

signal another major product segment introduction is around the corner. We believe

such a release would be an effort to mitigate product cycle driven volatility and to

drive future revenue growth in the model.

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2

Q

0

1

4

Q

0

1

2

Q

0

2

4

Q

0

2

2

Q

0

3

4

Q

0

3

2

Q

0

4

4

Q

0

4

2

Q

0

5

4

Q

0

5

2

Q

0

6

4

Q

0

6

2

Q

0

7

4

Q

0

7

2

Q

0

8

4

Q

0

8

2

Q

0

9

4

Q

0

9

2

Q

1

0

4

Q

1

0

2

Q

1

1

4

Q

1

1

2

Q

1

2

iPod and Peripherals

Mac

iPad

iPhone

17

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

Communications Equipment & Data Networking

Estimates Already Account for iPhone Driven Volume Ramp

Sector Implications

We believe that our total smartphone estimates already account for an iPhone driven

volume ramp in H212. We are currently forecasting 24% H/H growth in smartphone

shipments in H212 (28% H/H in H211). We see limited impact on the overall

handset market from the possible launch of a new iPhone, due to its small market

share (just 6% in Q212). We are already forecasting sequential growth of 3% and

9% in the overall handset market in Q3 and Q4, respectively.

Supply of Qualcomms 28nm chips is generally viewed as one of the key risks to

high-end smartphone industry growth in H212. However, in our 28nm chip

supply/demand analysis published on 8 June we concluded that Qualcomm should be

able to meet 28nm chip demand from Apple up to about 40m iPhone 5 units. At

present our Apple analyst, Mark Moskowitz, estimates that iPhone 5 shipments are

likely to be around 25m units in the December quarter well below QCOMs ability

to supply 9x15 modem chips. This means that there is plenty of room for upside to

QCOM shipments should the iPhone 5 outpace current market sales expectations.

Reminiscent of two years ago we believe there is some possibility that numerous new

iPhone 5s could pressure existing LTE signaling networks creating some additional

spend for companies like Ericsson.

Stock implications

Potential Winners

Qualcomm is the most exposed stock in our coverage to the new iPhone. We are

currently forecasting 23m Q/Q MSM unit growth in the December quarter for the

company. Ericsson might also have an outside chance of benefitting from signaling

overload in the LTE network.

Potential Losers

We believe NOK is the most negatively exposed name in our coverage to the new

iPhone. NOK plans to launch its new Lumia 920 and Lumia 820 phones in almost

the same time frame as the iPhone 5. RIM is also potentially exposed in early 2013

as they roll out their new BB10 devices/platform.

Rod Hall, CFA

AC

(1-415) 315-6713

rod.b.hall@jpmorgan.com

J.P. Morgan Securities LLC

Joseph Park

(1-415) 315-6760

joseph.x.park@jpmorgan.com

J.P. Morgan Securities LLC

Ashwin Kesireddy

+1-415-315-6756

ashwin.x.kesireddy@jpmorgan.com

J.P. Morgan Securities LLC

Rajat Gupta

(91-22) 6157-3347

rajat.gupta@jpmchase.com

J.P. Morgan India Private Limited

18

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

Internet

iPhone 5 to Drive Incremental Mobile Usage, and Also Increase Competition for Internets

Sector Implications

iPhone 5 with iOS 6 to raise the bar in platform battle

We view the upcoming iPhone 5 release as a positive for the Internet space as it

continues to drive smartphone adoption contributing to incremental overall Internet

usage and time spent and greater eCommerce spending and search advertising. The

iPhone 5 is expected to ship with the new iOS 6, which we believe will provide

deeper integration with some online sites such as Facebook, Yelp, and OpenTable,

among others. Overall we believe the upcoming iPhone 5 and iOS 6 builds greater

functionality into the operating system and therefore raises the bar in the platform

battle with Google, Amazon, and other large Internet companies.

Stock Implications

Google (OW):

Googles Android and Apples iOS are currently the two leading smartphone

platforms. According to Gartner, Googles Android is the current leader in

smartphone penetration, with 64.1% share of smartphones in 2Q12 compared to

18.8% for Apples iOS. While there are several 4G Android devices in the

market, if the iPhone 5 were to be released with 4G/LTE capabilities, we believe

it is likely to help Apple continue to increase its market share as consumers'

appetite for data continues to increase. According to Cisco, the average

smartphone usage nearly tripled in 2011 to 150MB per month from 55MB in 2010,

and is forecasted to reach 2.6.GB by 2016.

Apple announced it plans to replace Googles Maps with an internally developed

maps product and no longer provide YouTube as a default apps beginning with the

launch of iOS 6. We think mobile usage of Google Maps along with related

advertising revenue is likely to be negatively impacted with the rollout of iOS 6 as

we think a significant portion of Google Maps users on mobile are on Apple devices.

We note that Google Maps will be available for download in the Apple App Store. In

contrast, we believe Google may have new monetization capabilities with YouTube

as a standalone app in the Apple App Store, which gives it the flexibility to be free of

restrictions that may be imposed on default installed apps. As a result, we believe

Google is likely to redesign the YouTube app and find ways to monetize it on iOS

devices, such as through pre-roll video ads. Though Apples moves away from

certain Google products have raised concerns with the possibility of changing its

default mobile search provider, we do not think this is likely to happen at this

time as we view Google to provide the best mobile search experience.

Facebook (OW):

At the WWDC 2012 in June, Apple announced a deep integration between iOS 6 and

Facebook. We expect this integration to be a significant driver of user

engagement as it lowers the barrier for iPhone and iPad users to post, update,

and check information on Facebook. Signing into Facebook accounts directly in

Apple iOS 6 allows for seamless content sharing from any interface on the iPhone

and iPad. While this may not drive direct revenue, we view any driver of

Douglas Anmuth

AC

(1-212) 622-6571

douglas.anmuth@jpmorgan.com

Kaizad Gotla, CFA

(1-212) 622-6436

kaizad.gotla@jpmorgan.com

Bo Nam

(1-212) 622-5032

bo.nam@jpmorgan.com

Shelby Taffer

(1-212) 622-6518

shelby.x.taffer@jpmorgan.com

J.P. Morgan Securities LLC

19

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

increased engagement and content to be beneficial to Facebooks user

engagement, which in turn should result in incremental advertising dollars. We

also note that Facebook launched an update to its iOS mobile apps (both

iPhone/iPad) on August 24. We believe completely re-writing the app from the

ground up to focus on speed is consistent with the company's focus on the user

experience.

eBay (OW):

Apple announced the launch of Passbook in iOS 6, an application that enables users

to easily store and access digital passes including boarding passes, tickets, store

cards, and coupons. We believe Passbook resembles a bar code-enabled form of an

early digital wallet. And even though Passbook does not appear to enable

transactions upon release, we believe it could become the basis for a digital

payments platform going forward. Apple has more than 400Mactive iTunes

accounts with credit cards and we believe Passbook could become more competitive

with eBays PayPal and other payments systems over time.

20

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

U.S. Semiconductors

iPhone 5 Likely to Benefit Select Analog Companies. Negative for PC Names

Sector Implications

Strong demand forecasts for the expected iPhone 5 roll out this month should benefit

Apple levered analog names in our universe that we believe include Analog Devices,

Fairchild, and Avago. We believe most of the analog suppliers have low single digit

dollar content exposure to iPhone 5 and have implied the levering to the product roll

out in the September guidance commentary. On the other hand, we believe that a

strong iPhone and iPad upgrade cycle is a likely negative for PC names such as Intel

and AMD due to cannibalization of PC demand.

Stock Implications

Analog Devices. We believe ADIs exposure to iPhone 5 is in the low single digits

dollars per iPhone, roughly in the $1.00-$2.00 range for the MEMS microphone and

possibly a controller. The company has a strong historical relationship with Apple,

as it is an existing supplier for the MEMS digital microphone and a touch screen

controller in the iPad2. In addition, ADI commented on the most recent earnings call

that consumer segment should see solid growth in FQ4 due to specific product cycles

which believe implies leverage to the iPhone 5 launch. Assuming a quarterly run rate

of roughly 20M iPhone 5 units over the next few quarters, this would equate into

roughly $20.0-$40.0 million/quarter in revenues or roughly 3%-5% of ADIs total

revenues. We estimate Apple overall could contribute mid single digits of ADIs

revenues once iPhone 5 is fully ramped.

Fairchild. We believe Fairchilds exposure to iPhone 5 is roughly in the $0.50 range

for the battery charger components that include a MOSFET and the controller.

Management commented on the most recent earnings call that mobile products were

below expectations in 2Q due to 28nm chipset shortages in the industry but should

drive solid growth in 2H12 which believe implies leverage to the iPhone 5 launch.

Assuming a quarterly run rate of roughly 20M iPhone 5 units over the next few

quarters, this would equate into roughly $10.0-$15.0 million/quarter in revenues or

roughly 3-4% of Fairchilds total revenues. We estimate Apple overall could

contribute mid single digits of Fairchilds revenues once iPhone 5 is fully ramped.

Avago. We believe Avagos exposure to iPhone 5 is roughly in the $2.00-$3.00

range for the FBAR PA Duplexer. Avago already supplies FBAR duplexers for the

CDMA version of iPhone4 and the iPhone 4S. Management commented on the

recent earnings calls that mobile and wireless segment was below expectations in

July due to 28nm chipset shortages talked about by Qualcomm but the shortages

should ease in 2H12 and drive solid growth afterwards. We believe these comments

imply leverage to the iPhone 5 launch. The company guided the mobile & wireless

segment to grow 20-30% in October while other segments remain flattish on a whole.

Assuming a quarterly run rate of roughly 20M iPhone 5 units over the next few

quarters, this would equate into roughly $40.0-$60.0 million/quarter in revenues or

roughly 8-10% of Avagos total revenues. We estimate Apple overall could

contribute close to 20% of Avagos revenues once iPhone 5 is fully ramped.

Chris Danely

AC

(1-415) 315-6774

chris.b.danely@jpmorgan.com

Shaon Baqui

(1-415) 315-6776

shaon.i.baqui@jpmorgan.com

Sameer Kalucha

(1-415) 315-6762

sameer.kalucha@jpmorgan.com

J.P. Morgan Securities LLC

21

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

Intel/AMD. We believe the strong growth of the iPad and iPhone coupled with the

slowdown in PC shipments is a negative for Intel and AMD as neither company has

any meaningful share in tablets or smartphones. We believe tablets and smartphones

continue to cannibalize PC shipments, driven by the success of the iPad/iPhone and

proliferation of low-cost Android-based devices. We note tablet shipments have

grown from only 7% of notebook shipments from in 2Q10 to roughly 51% of

notebook shipments during 3Q12E.

22

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

U.S. SMid Semiconductors

iPhone 5 Represents Another Strong Product Cycle for BRCM and PSMI

Sector Implications

Given the expected enthusiastic reception of the new iPhone 5, we believe its launch

will likely spur another strong product cycle for our Apple-exposed companies

Broadcom and Peregrine Semiconductor. Both companies are already major

suppliers of chip solutions into the current generation iPhone 4S and iPad 3 and we

believe that they have been designed into the iPhone 5 as well.

Stock implications

BRCM: Apple is Broadcoms #1 customer, accounting for ~13-15% of total

revenues, with BRCM silicon (wireless connectivity, Ethernet controllers, touch

controllers, media processors, etc) utilized in most Apple products (iPhone, iPad,

MacBook Air, MacBook Pro, Apple TV, etc). We believe the breadth of

Broadcoms silicon in Apple products reflects the strength of the relationship

between the two companies. Apples iPhone and iPad products use Broadcoms

combo connectivity (WiFi, Bluetooth, FM) single-chip solution and touch screen

controllers. The current iPhone 4S uses Broadcoms BCM4330 combo connectivity

chip solution and we believe the iPhone 5 will utilize Broadcoms next generation

combo chip called the BCM4334. The iPad 3 also uses the BCM4330 combo chip

and two additional chips for the touch screen controller. We believe that the next

generation iPad 4 will use the BCM4334 or BCM4335 combo connectivity chips.

We estimate about $3.00 of Broadcom content per iPhone and ~$3.75 per iPad. We

remain Overweight on BRCM.

PSMI: We estimate that Apple is Peregrine Semiconductors largest end-customer

and will account for ~30-35% of PSMI's total revenues this year. PSMI is the sole

provider of RF antenna switches in the current iPhone 4S and we believe that one or

more of its antenna switch chips have been designed into the iPhone 5 and the

upcoming iPad 4. Peregrines antenna switch chips are also designed into the

Samsung Galaxy S3 and Galaxy Note as well. We believe that PSMI will continue

to be the RF antenna switch supplier of choice for Apple going forward due to the

performance (linearity, isolation, insertion loss), form-factor, and cost advantages of

Peregrines silicon-on-sapphire solution. We estimate that PSMI units shipped into

Apple will increase 182% in C2012 and 20% in C2013. We remain Overweight on

PSMI.

Harlan Sur

AC

(1-415) 315-6700

harlan.sur@jpmorgan.com

John S Ahn

(1-415) 315-6758

john.s.ahn@jpmorgan.com

Saqib Jalil

(1-415) 315-6761

saqib.jalil@jpmorgan.com

J.P. Morgan Securities LLC

23

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

Asia Technology Hardware

iPhone Implications

Sector Implications

Strong iPhone volume growth in next two quarters should help Greater China

Apple supply chain stocks. iPhone is typically higher margin product for most

Apple supply chain vendors. However, we see most Apple supply chain names

as trading Buys into the product launch since long-term earnings growth is

affected by continuous margin erosion as Apple puts more pressure on the

supply chain and tries to diversify supplier base.

With two previous generations of iPhone owners to target (4 and 4S),

replacement demand is likely to remain quite strong in the first few months due

to new industrial design and adoption of LTE, but sustainability of demand after

the first 2 quarters would be interesting to watch, given that there are no major

new carrier additions unlike iPhone 4S launch.

Stock implications

Design change beneficiaries typically derive the most benefit from new iPhone

launches in the supply chain. In the iPhone 5, we believe the key winners from

iPhone 5 design change should be (1) Hon Hai group / Fanuc due to move to

metal Unibody casings, (2) LGD / Sharp (once yield issues are overcome) due to

use of in-cell touch panels, (3) Murata due to move to LTE (higher number of

MLCCs and increased demand for RF front end modules, (4) Samsung for

Application processors, (5) TSMC (and potentially UMC) for LTE baseband

chips at 28nm.

Of these stocks, Hon Hai is our preferred pick, given iPhone margins are

typically much higher for Hon Hai compared to other Apple products. We

estimate iPhone to account for 35% of Hon Hais revenues in 4Q12 and hence

expect a meaningful pickup in OP margins in 3Q12 (up 60 bps).

Update on supply issues.

1. Display: In-cell yield bottlenecks have improved at LG Display in August

and the company appears hopeful of achieving optimum yields exiting

3Q12. Sharps situation however, appears to be uncertain. However, if

Japan display continues to ship and LGD improves the yields as expected by

the end of 3Q12, then the threat of a supply disruption in 4Q12 is likely to

be lower. Initial builds in 3Q12 however are still below plan, so initial

volumes available may be constrained post launch.

2. Casings: Casing supply is improving since Hon Hai appears to have excess

supply of CNC machines. While Jabil Green point yields are still lower than

optimum, we feel that this may not be a key bottleneck for the supply chain

in 4Q12.

Gokul Hariharan

AC

(852) 2800-8564

gokul.hariharan@jpmorgan.com

J.P. Morgan Securities (Asia Pacific)

Limited

Alvin Kwock

AC

(852) 2800-8533

alvin.yl.kwock@jpmorgan.com

J.P. Morgan Securities (Asia Pacific)

Limited

Ashish Gupta

(91-22) 6157-3284

ashish.b.gupta@jpmorgan.com

J.P. Morgan India Private Limited

24

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

Asia Semiconductors

iPhone 5 Likely to Benefit Select Analog Companies. Negative for PC Names

Sector Implications

We expect strong demand and expectation toward iPhone 5 launch should benefit

key Apple supply chain names in our universe which we believe include LG Display

(In-cell panels), Samsung Electronics (AP, mDRAM), LG Innotek (Camera module),

and SEMCO (MLCC). However, as Apple diversifies its key component supply

(NAND Flash and mDRAM) into non-Korean suppliers, magnitude of benefit from

iPhone 5 launch to Samsung Electronics and SEMCO shall be smaller given

increasing internal component consumption on back of strong Samsung smartphone

momentum. On the other hand, we believe that high-levered Apple supply names like

LG Display and LG Innotek should benefit more given relatively higher earnings

exposure to iPhone demand.

Stock Implications

Samsung Electronics

We estimate Samsungs exposure to Apple is in the high-single digit % of total

revenue. The company traditionally had strong relationship, but has gradually

lowered its supply portion of semiconductor component since 2011 as Apple

diversifies into multiple vendor and Samsung drops off less profitable business.

However, we find increasing internal component consumption to offset decline in

Apple supply. On the other hand, we view Samsungs smartphone shipment to be

relatively stable after iPhone 5 launch and expect new flagship smartphones (i.e.

Galaxy S III and Galaxy Note II) to sustain its strong momentum.

LG Display

We believe in-cell panel will provide meaningful opportunity for LGD. As the

company begins to ship in-cell display for iPhone 5 from August, we forecast its

sales momentum to return in 3Q12 and begin to accelerate in 4Q12. We estimate

total iPhone panel supply to meaningfully contribute to its total OP by 35% in 2012E

while sales contribution is 6%. Given the poor execution by Sharp, we believe LGD

can cement its position in Apples various products. Of note, LGD will do an all In-

cell process including lamination, which is a clearly differentiating factor.

LG Innotek

We view LG Innotek to be the key beneficiary among Korea downstream players

given its stable camera module supply to Apple as a top vendor with market share

~60%. As majority of shipments are skewed towards 4Q not only iPhone 5 but iPad

mini as well, we view traditional weak seasonality for 4Q will not be the case for

LGI this time. While we do not expect meaningful upside in ASP as products

supplied towards iPhone 5 and iPad mini remains the similar specification with

existing products, volume growth should suggest uptick in margin into 4Q.

JJ Park

AC

(822) 758-5717

jj.park@jpmorgan.com

Helaine Kang

(82-2) 758-5712

helaine.kang@jpmorgan.com

Jay Kwon

(91-22) 6157-3261

rahul.z.chadha@jpmorgan.com

J.P. Morgan Securities (Far East) Ltd,

Seoul Branch

Narci Chang

(866-2) 2725-9899

narci.h.chang@jpmorgan.com

J.P. Morgan Securities (Taiwan) Limited

Rahul Chadha

(91-22) 6157-3261

rahul.z.chadha@jpmorgan.com

J.P. Morgan India Private Limited

25

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

Asia Electronic Components Sector

Expecting 50% Increase in High-frequency Components

Sector Implications

We see upcoming smartphone models as key to any recovery in Japanese electronic

component makers profits. In particular, we expect the new iPhone to feature a

multimode, multiband design along with a thinner form factor for the first time in two

years. We also expect increasing app performance to drive increased functionality that

could offer business opportunities to electronic component makers (Figure 4).

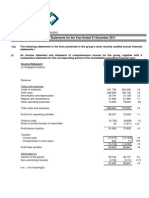

Figure 4: Sales Plan for Smartphone & Tablet-related Components by Company

100 million

Source: J.P. Morgan, Company data.

Stock implications

We expect particularly strong benefits for high-frequency components. We expect

the new iPhone to support LTE and therefore have 50% more FDD bands than the

existing model. Combined with volume growth for the phone itself, we expect this to

drive substantial growth in volume for high-frequency components and in sales for

Murata Mfg., Taiyo Yuden, TDK, the three Japanese passive component makers

involved in high-frequency parts including duplexers and band-pass filters. The fact

that there are few Asian competitors in these areas suggests that Japanese companies

could readily benefit from market expansion.

We think passive component makers could also benefit from the shift toward higher

added value in mainstay MLCCs. Improving smartphone performance requires that

capacitors have greater capacitance than previously while also being more compact

to ensure sufficient space for the phones battery. We expect capacitance to increase

to 0.22F from 0.1F for 0402-size MLCCs, to 2.2F from 1.0F for 0603-size, and

to 22F from 10F for 1005-size.

Potential Winners

Taiyo Yuden (6976), Murata Mfg. (6981)

Potential Losers

TDK (6762), Hirose Elec. (6806)

FY 2011 FY2012 YOY

CoE

Communication modules 1,339 2,000 49%

in which high frequency module 300 600 100%

Taiyo Yuden SAW Device 169 250 48%

TDK High Frequency components 607 800 32%

Semiconductor parts 1,534 1,800 17%

in which Cmos package for smartphone 80 160 100%

Ibiden FCCSP 248 325 31%

Ibiden PCB 328 445 36%

FPC 1,816 2,355 30%

in which FPC for mobile phone 708 990 40%

Others Taiyo Yuden Super High-end MLCC 80 240 200%

Minebea LED Back Light 270 480 78%

TDK Batteries 790 950 20%

Alps Elec. VCM 84 220 162%

Mitsumi Elec. VCM 83 194 134%

JAE Communication Connector 220 430 95%

Total 7,568 10,489 39%

requirement for

new device

NOK

High

Frequency

Components

Substrate

Thinner

Multi-mode

/Multi-band

Murata Mfg.

Kyocera

High

functionality

Masashi Itaya

AC

(81-3) 6736-8603

masashi.itaya@jpmorgan.com

JPMorgan Securities Japan Co., Ltd.

26

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

Figure 5: iPhones Shift to Multi-band/ Multi-mode

$ million

Source: J.P. Morgan based on company data.

Model iPhone iPhone3G iPhone3GS iPhone4 iPhone4S Next iPhone

launch Jun/2007 July/2008 Jun/2009 Jun/2010 Oct/2011 Sep/2012e

GSM Mode 850/900/1800/1900

UMTS Mode Band

Band

Band

Band

Band or

LTE Mode Band or

Total FDD bands Band

Band

Band

Band

Band or

Band or 1.5x

1.3x

27

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

Applied & Emerging Technologies

iPhone 5 Implications: Mixed

Sector Implications

iPhone 5: Good for One, Not So Good for Others

In the context of our Applied Tech coverage universe, one stock stands to benefit

from imminent Apple product introductions, including the iPhone 5 launch:

Omnivision. In contrast, the introduction of native mapping and TBT navigation on

iOS 6 on the iPhone 5 stands to be a mild negative for TeleNav (TNAV/N),

TeleCommunication Systems (TSYS/OW), and Garmin (GRMN/UW).

Stock Implications

The Good Omnivision (OVTI/OW) should benefit from Apples product

introductions this fall. With the introduction of second generation back-side

illumination (BSI) the firm is restored to a leadership position at the high end (5-

8MPx, HD Video, small form-factor) of the CIS market, as an alternative supplier to

Sony. Revenues are ramping dramatically (up ~70% in October quarter, we estimate)

to record levels and the firm is building BSI product to inventory in advance of one

or more Tier 1 OEM product launches (Apple iPad mini and iPhone 5 we believe).

Based on the firms incumbent role as a supplier of CIS chips for the iPad and front-

facing camera on the iPhone 4s, we believe OVTI is well positioned with Apple,

however it remains unclear whether OVTI has the prestigious back-facing slot on the

iPhone 5; which is hotly contested by Sony, we believe.

From an investment perspective, controversy centers largely on gross margins, which

have fallen to a record low 19% on the BSI-2 revenue ramp, however we believe this

is the trough now; a combination of scale and unit-based amortization of fixed cost

investment at wafer supplier TSMC should yield improving margins in the January

quarter, and gradual improvement towards 25% in CY13. We rate OVTI Overweight

and have a price target of $23.00 based on 13 times CY14 EPS. If OVTI is confirmed

in tear-down reports as winning the back-facing camera slot on the iPhone 5 (sole- or

dual-sourced), then the multiple could expand further.

The Not So Good Apple is introducing turn-by-turn (TBT) navigation and

mapping as native (and free) applications on the iPhone 5, displacing Google, and

adding to the disruption already taking place in the personal navigation device

(PND), navigation application and location-based service (LBS) markets. Apples

voice-based search, via Siri, and real-time navigation integrated with iOS, presents a

threat to incumbents in the SatNav/PND market (e.g. Garmin, Magellan, and

TomToms hardware business) as well as fee-earning network-hosted smartphone

solutions from companies like TeleNav and Networks in Motion

(TeleCommunication Systems).

Apple has stated that it is in discussions with major automobile OEMs regarding

integration of this handset-based solution into the car cockpit (leveraging

infotainment consoles or in-car audio systems), which sounds like a tangential

though not immediate threat for OEM suppliers like Garmin, TomTom, Delphi,

Harman and Bosch that currently supply infotainment solutions to the auto industry.

Paul Coster, CFA

AC

(1-212) 622-6425

paul.coster@jpmorgan.com

Mark Strouse, CFA

(1-212) 622-8244

mark.storuse@jpmorgan.com

Paul J Chung

(1-212) 622-5552

paul.j.chung@jpmorgan.com

J.P. Morgan Securities LLC

28

Global Equity Research

11 September 2012

Mark Moskowitz

(1-415) 315-6704

mark.a.moskowitz@jpmorgan.com

U.S. Telecom Services

iPhone 5 and Lower Priced 4S/4 Could Drive Higher 3Q Upgrade Rates and Lower Margins

Sector Implications

iPhone 5 Could Drive Higher Upgrades And Lower Margin

Near-term, we expect the iPhone 5 to drive higher than expected upgrades in 3Q12

and 4Q12. We recently raised our upgrade rate for Verizon to 8.0% from 6.8%,

AT&T to 8.0% from 6.3% and Sprint to 10.0% from 9.0%. In all we now expect

9.2m iPhone sales in 3Q12, up from 7.3m previously (when we had expected a 4Q

versus late 3Q launch) and 7.5m in 2Q12. We estimate 12.8m iPhone unit sales in

4Q12 versus the 13.1m estimate for 4Q11, when the iPhone 4S was launched. The

higher upgrade rates pressures margins for the wireless carriers and we expect more

downside risk to margins in 3Q and 4Q as iPhone 5 sales ramp.

Long-term, we expect the iPhone 5 to accelerate the already begun upgrade cycle to

4G (LTE) for the US wireless carriers from handset bases dominated by 3G handsets

today. Verizon is the largest US carrier with LTE at 230m covered pops, followed by

AT&T at ~80m and Sprint only covers a few markets. We believe Verizon and the

other carriers are eager to migrate customers from loaded 3G networks to 4G

networks to take advantage of relatively empty networks as well as lower cost and

more data efficient LTE.

Stock Implications

Verizon leads in LTE coverage and we expect aggressive migration push with

the iPhone 5

Verizon has about 40m smartphones in its subscriber base but only about 8m (20%)