Professional Documents

Culture Documents

QSPM of Starbucks

Uploaded by

basasmarieOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QSPM of Starbucks

Uploaded by

basasmarieCopyright:

Available Formats

QSPM of Starbucks

QSPM

Ratings: (0)|Views: 1,390 |Likes: 22

Published by hannah_kris05

See more

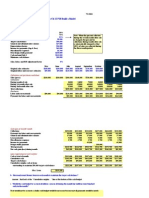

7. Hot Doughnuts sign encouragespeople outside the store to make unimpulse purchase.0.07 4 0.28 3

0.21 3 0.21

W

EAKNESSES

1.

Return on equity assets andinvestments all negative; Skills of management is questionable.0.10 3 0.30 2

0.20 2 0.202.

Management states in struggling onhow to make the store profitable.0.08 3 0.24 2 0.16 3 0.243.

Product line slow to expand withnothing draw in health conciouscustomer.0.04 - - - - - -4.

Lack of advertisement in areas thewhere stores are located.0.03 2 0.06 2 0.06 2 0.065.

Single product focus; no other standout product0.04 - - - - - -6.

Competing against Starbucks andDunkin Donuts beverages. 0.04 2 0.08 1 0.04 2 0.087.

Shareholders have not receiveddividends recently. Stock price instate flux.0.08 - - - - - - -

TOTAL

1.00

3

.64

3

.12

2.91

4. Distinctive Company storesandConcentrate solely on buildingfranchisevia "hot shop" stores5.

continue slow and steadygrowth of company store andfranchise business.KEY FACTORS

OPPORTUNITIES

W

eights AS TAS AS TAS1. Industry stock price are improving 0.044 0.16 4 0.162.

Dunkin Donuts does not have hot doughnuts to sell.0.053 0.24 3 0.243.

Starbucks lacks a diversified and distinctive pastry line.0.11- - - -

4. Asian love sweets and are open to trying foreign foods. 0.061 0.06 1

0.065. Families crave convenience because of busy lifestyles. 0.09- - - -6.

Many children loves sweet treats0.04- - - -7.

South America, Africa and south Asia are markets toconquer0.074 0.28 2 0.14

THREATS

1.

People are becoming more health conscious, which doesnot bode well for high-sugar, high-fat

threats.0.091 0.09 1 0.092.

Dunkin Donuts presently dominates the doughnut marketdomestically and internationally.0.101 0.10 1

0.103.

Starbucks has approximately 25 times the amount of stores worldwide that krispy kreme donut

has.0.071 0.07 1 0.074.

Cultural differences among countries make operations anddoughnut consumption varied, which

makes thingsdifficult to control0.04- - - -5.

Lower price is offered by the other doughnut producingfirms than that of Krispy Kreme donuts.0.081

0.08 1 0.086.

Shareholders may sell Krispy Kreme Donut stock for lack of returns and dividends compared to other

similar firms inthe industry.0.081 0.08 1 0.08

7.

Restricted Cash flow from banks and massive layoffs havestifled the world economy decreasing

discretionaryincome.0.05- - - -

1.00

STRENGTHS

1. High quality douhgnuts with strong visual of a - - - -2. Krispy kreme has a

unique brand and variety of

freshlymade doughnuts. 0.09 2 0.18 1 0.093. Krispy Kreme has a high capacity to make 4000-

10000doughnuts daily.0.09 1 0.09 1 0.094. Krispy Kreme can offer customer to watch

product beingmade at the doughnut theater.0.08 1 0.08 1 0.085. Consistent Expansion; Exposure in

10 foreign countrieswith an on-going development of 200 additional stores inthe Middle East, Hong

Kong, Macau, Tokyo, the Philippinesand Indonesia 0.08 - - - -6. Vertical integreation helps the quality

of the product.0.08 - - - -7. Hot Doughnuts sign encourages people outside the storeto make un impulse

purchase.0.07 3 0.21 1 0.07

W

EAKNESSES

1.

Return on equity assets and investments all negative; Skillsof management is questionable.0.10 1 0.10 1

0.102.

Management states in struggling on how to make thestore profitable.0.08 1 0.08 1 0.083.

Product line slow to expand with nothing draw in healthconcious customer.0.04 - - - -4.

Lack of advertisement in areas the where stores arelocated.0.03 1 0.03 1 0.035.

Single product focus; no other stand out product0.04 - - - -6.

Competing against Starbucks and Dunkin Donutsbeverages.0.04 1 0.04 1 0.047.

Shareholders have not received dividends recently. Stockprice in state flux. 0.08 - - - -

TOTAL

1

1.97

1.6

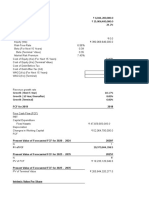

7. Hot Doughnuts sign encouragespeople outside the store to make unimpulse purchase.0.07 4 0.28 3

0.21 3 0.21

W

EAKNESSES

1.

Return on equity assets andinvestments all negative; Skills of management is questionable.0.10 3 0.30 2

0.20 2 0.202.

Management states in struggling onhow to make the store profitable.0.08 3 0.24 2 0.16 3 0.243.

Product line slow to expand withnothing draw in health conciouscustomer.0.04 - - - - - -4.

Lack of advertisement in areas thewhere stores are located.0.03 2 0.06 2 0.06 2 0.065.

Single product focus; no other standout product0.04 - - - - - -6.

Competing against Starbucks andDunkin Donuts beverages. 0.04 2 0.08 1 0.04 2 0.087.

Shareholders have not receiveddividends recently. Stock price instate flux.0.08 - - - - - - -

TOTAL

1.00

3

.64

3

.12

2.91

4. Distinctive Company storesandConcentrate solely on buildingfranchisevia "hot shop" stores5.

continue slow and steadygrowth of company store andfranchise business.KEY FACTORS

OPPORTUNITIES

W

eights AS TAS AS TAS1. Industry stock price are improving 0.044 0.16 4 0.162.

Dunkin Donuts does not have hot doughnuts to sell.0.053 0.24 3 0.243.

Starbucks lacks a diversified and distinctive pastry line.0.11- - - -

4. Asian love sweets and are open to trying foreign foods. 0.061 0.06 1

0.065. Families crave convenience because of busy lifestyles. 0.09- - - -6.

Many children loves sweet treats0.04- - - -7.

South America, Africa and south Asia are markets toconquer0.074 0.28 2 0.14

THREATS

1.

People are becoming more health conscious, which doesnot bode well for high-sugar, high-fat

threats.0.091 0.09 1 0.092.

Dunkin Donuts presently dominates the doughnut marketdomestically and internationally.0.101 0.10 1

0.103.

Starbucks has approximately 25 times the amount of stores worldwide that krispy kreme donut

has.0.071 0.07 1 0.074.

Cultural differences among countries make operations anddoughnut consumption varied, which

makes thingsdifficult to control0.04- - - -5.

Lower price is offered by the other doughnut producingfirms than that of Krispy Kreme donuts.0.081

0.08 1 0.086.

Shareholders may sell Krispy Kreme Donut stock for lack of returns and dividends compared to other

similar firms inthe industry.0.081 0.08 1 0.08

7.

Restricted Cash flow from banks and massive layoffs havestifled the world economy decreasing

discretionaryincome.0.05- - - -

1.00

STRENGTHS

1. High quality douhgnuts with strong visual of a - - - -2. Krispy kreme has a

unique brand and variety of

freshlymade doughnuts. 0.09 2 0.18 1 0.093. Krispy Kreme has a high capacity to make 4000-

10000doughnuts daily.0.09 1 0.09 1 0.094. Krispy Kreme can offer customer to watch

product beingmade at the doughnut theater.0.08 1 0.08 1 0.085. Consistent Expansion; Exposure in

10 foreign countrieswith an on-going development of 200 additional stores inthe Middle East, Hong

Kong, Macau, Tokyo, the Philippinesand Indonesia 0.08 - - - -6. Vertical integreation helps the quality

of the product.0.08 - - - -7. Hot Doughnuts sign encourages people outside the storeto make un impulse

purchase.0.07 3 0.21 1 0.07

W

EAKNESSES

1.

Return on equity assets and investments all negative; Skillsof management is questionable.0.10 1 0.10 1

0.102.

Management states in struggling on how to make thestore profitable.0.08 1 0.08 1 0.083.

Product line slow to expand with nothing draw in healthconcious customer.0.04 - - - -4.

Lack of advertisement in areas the where stores arelocated.0.03 1 0.03 1 0.035.

Single product focus; no other stand out product0.04 - - - -6.

Competing against Starbucks and Dunkin Donutsbeverages.0.04 1 0.04 1 0.047.

Shareholders have not received dividends recently. Stockprice in state flux. 0.08 - - - -

TOTAL

1

1.97

1.6

You might also like

- Tricia Haltiwinger The President of Braam Industries Has Been ExploringDocument1 pageTricia Haltiwinger The President of Braam Industries Has Been ExploringAmit PandeyNo ratings yet

- ManCon - Green Valley (Final Draft)Document13 pagesManCon - Green Valley (Final Draft)Jerome Luna Tarranza100% (1)

- Phelps IndustriesDocument6 pagesPhelps Industriesshik1712940% (1)

- Sombrero Case AnalysisDocument2 pagesSombrero Case AnalysisManaswini SharmaNo ratings yet

- YVCDocument2 pagesYVCnetterinder0% (1)

- CraddockDocument9 pagesCraddockSherl Bint IsmunNo ratings yet

- AVONDocument21 pagesAVONMuhammad DaudpotaNo ratings yet

- Combining MCC & IOSDocument11 pagesCombining MCC & IOSMargarethe GatdulaNo ratings yet

- 1 If You Were Kelly What Would You Tell TheDocument1 page1 If You Were Kelly What Would You Tell TheAmit Pandey100% (1)

- Blue Nile Diamond CaseDocument7 pagesBlue Nile Diamond CaseNiharika MondalNo ratings yet

- Tutorial - Cost Function-QDocument2 pagesTutorial - Cost Function-QNandiie50% (2)

- Assignment 5Document2 pagesAssignment 5NABILAH KHANSA 1911000089No ratings yet

- Abbas MCQDocument10 pagesAbbas MCQRUBAB IQBALNo ratings yet

- Kapil Sugars Dividend PolicyDocument2 pagesKapil Sugars Dividend PolicyJenish RanaNo ratings yet

- Econ7073 2021.S1Document76 pagesEcon7073 2021.S1RebacaNo ratings yet

- MGT 301 Term PaperDocument37 pagesMGT 301 Term PaperIshtiaq Ahmed Nishat0% (1)

- BUS324TEST1Document15 pagesBUS324TEST1mellisa samooNo ratings yet

- CiscoDocument80 pagesCiscoAnonymous fEViTz3v6No ratings yet

- Case Problem 3 Production Scheduling With Changeover CostsDocument3 pagesCase Problem 3 Production Scheduling With Changeover CostsSomething ChicNo ratings yet

- Chapter 7Document36 pagesChapter 7Mai PhamNo ratings yet

- Credit Assignment 1Document5 pagesCredit Assignment 1Marock Rajwinder0% (1)

- Assess Two Doll Projects' NPV, IRR for RecommendationDocument4 pagesAssess Two Doll Projects' NPV, IRR for RecommendationTushar Gupta100% (1)

- Q1. What Inference Do You Draw From The Trends in The Free Cash Flow of The Company?Document6 pagesQ1. What Inference Do You Draw From The Trends in The Free Cash Flow of The Company?sridhar607No ratings yet

- Room For ImprovementDocument5 pagesRoom For ImprovementSushil GhimireNo ratings yet

- Beta Management CompanyDocument8 pagesBeta Management Companymanishverma56470% (1)

- Student SpreadsheetDocument14 pagesStudent SpreadsheetPriyanka Agarwal0% (1)

- Managerial Finance Case Write UpDocument3 pagesManagerial Finance Case Write Upvalsworld100% (1)

- MashaweerDocument5 pagesMashaweerebruklcnNo ratings yet

- Cost of Capital-QnsDocument6 pagesCost of Capital-QnsHarmeet Singh AroraNo ratings yet

- Chapter 13: Leverage and Capital Structure (Continued) : Tutorial 6Document2 pagesChapter 13: Leverage and Capital Structure (Continued) : Tutorial 6musicslave96No ratings yet

- Group 5 - Sec G - KEY Case SubmissionDocument41 pagesGroup 5 - Sec G - KEY Case SubmissionPRIKSHIT SAINI IPM 2019-24 BatchNo ratings yet

- Harley DavidsonDocument8 pagesHarley DavidsonQuyen Tran ThaoNo ratings yet

- Vinacafe Bien Hoa Final ReportDocument24 pagesVinacafe Bien Hoa Final ReportQuang NguyenNo ratings yet

- Finance Minicase 1 Sunset BoardsDocument12 pagesFinance Minicase 1 Sunset Boardsapi-31397810480% (5)

- CT 4 Id 18241039Document3 pagesCT 4 Id 18241039SaKib AbdullahNo ratings yet

- Case 3 - Starbucks - Assignment QuestionsDocument3 pagesCase 3 - Starbucks - Assignment QuestionsShaarang BeganiNo ratings yet

- What Is The Role of Negotiation To Improve Coordination in An Organization?Document2 pagesWhat Is The Role of Negotiation To Improve Coordination in An Organization?Utheu Budhi SusetyoNo ratings yet

- MABE Reference Doc 1Document7 pagesMABE Reference Doc 1roBinNo ratings yet

- Butler Lumber CoDocument2 pagesButler Lumber Cokumarsharma123No ratings yet

- Chapter 22. Solution To CH 22 P18 Build A Model: Input DataDocument6 pagesChapter 22. Solution To CH 22 P18 Build A Model: Input DataCarol LeeNo ratings yet

- Problem Sheet II - Confidence Interval, Sample SizeDocument4 pagesProblem Sheet II - Confidence Interval, Sample SizeShamil MNo ratings yet

- 1Document8 pages1Snehak KadamNo ratings yet

- Lê Thanh Nhàn - SB01267 - Individual Assignment FIN202Document11 pagesLê Thanh Nhàn - SB01267 - Individual Assignment FIN202Thanh NhànNo ratings yet

- Final Draft - MFIDocument38 pagesFinal Draft - MFIShaquille SmithNo ratings yet

- MSL 711: Strategic Management: Newell Case Study AnalysisDocument3 pagesMSL 711: Strategic Management: Newell Case Study AnalysisAjay KaleNo ratings yet

- Twin Cities Bottling CompanyDocument9 pagesTwin Cities Bottling CompanyIshu SinglaNo ratings yet

- Anagene Case StudyDocument1 pageAnagene Case StudySam Man0% (3)

- Practical Financial Management Appendix BDocument16 pagesPractical Financial Management Appendix Bitumeleng10% (1)

- Conclusion: Topic-The Branding Logic Behind Google's Creation of AlphabetDocument7 pagesConclusion: Topic-The Branding Logic Behind Google's Creation of AlphabetAmrutha P RNo ratings yet

- SCM + Case Study #1 A Pain in The Supply ChainDocument5 pagesSCM + Case Study #1 A Pain in The Supply ChainLady RojasNo ratings yet

- Singapore Institute of Management: University of London Preliminary Exam 2020Document20 pagesSingapore Institute of Management: University of London Preliminary Exam 2020Kəmalə AslanzadəNo ratings yet

- Starbucks Case Analysis-Aditi NaiduDocument4 pagesStarbucks Case Analysis-Aditi NaiduaditinaiduNo ratings yet

- Case 75 The Western Co DirectedDocument10 pagesCase 75 The Western Co DirectedHaidar IsmailNo ratings yet

- Tax Rate Calculation and WACC for SignifyDocument9 pagesTax Rate Calculation and WACC for SignifyShivam GoelNo ratings yet

- Strategic ManagementDocument12 pagesStrategic ManagementEi AmiNo ratings yet

- Willison TowerDocument2 pagesWillison TowerOdiseGrembiNo ratings yet

- Wacc Mini CaseDocument12 pagesWacc Mini CaseKishore NaiduNo ratings yet

- Nike AnalysisDocument27 pagesNike Analysisriz4winNo ratings yet

- Krispy Kreme Doughnuts: Quantitative Strategic Plannning Matrix (QSPM)Document6 pagesKrispy Kreme Doughnuts: Quantitative Strategic Plannning Matrix (QSPM)hannah_kris05100% (1)

- Krispy Kreme Matrices-ReportsDocument14 pagesKrispy Kreme Matrices-ReportsAbid Stanadar100% (1)

- Practice Problem Set 5 With AnswersDocument7 pagesPractice Problem Set 5 With AnswersJoy colabNo ratings yet

- St. Vincent de Ferrer College Financial Management 2 Exam ReviewDocument4 pagesSt. Vincent de Ferrer College Financial Management 2 Exam ReviewNANNo ratings yet

- Robin Blackburn, Lucio Colletti, Eric J. Hobsbawm, Nicos Poulantzas, Gareth Stedman Jones - Ideology in Social Science-Vintage Books (1973)Document386 pagesRobin Blackburn, Lucio Colletti, Eric J. Hobsbawm, Nicos Poulantzas, Gareth Stedman Jones - Ideology in Social Science-Vintage Books (1973)Brandon HartNo ratings yet

- Chapter 6-Media DecisionsDocument22 pagesChapter 6-Media DecisionsVarun VKNo ratings yet

- Isbn6582-0 Ross ch24Document21 pagesIsbn6582-0 Ross ch24NurArianaNo ratings yet

- Qatar's 2nd International Environmental Exhibition and 8th Agricultural Exhibition Sponsorship PackagesDocument8 pagesQatar's 2nd International Environmental Exhibition and 8th Agricultural Exhibition Sponsorship PackagesKarenNo ratings yet

- Bankers Trust Case StudyDocument19 pagesBankers Trust Case StudySedeqha PopalNo ratings yet

- 6.1 The Game Plan 6.2 Entertainment and Sports Strategies 6.3 Mapping The PlanDocument59 pages6.1 The Game Plan 6.2 Entertainment and Sports Strategies 6.3 Mapping The Planangela_edelNo ratings yet

- Kellogg's Indian Case StudyDocument10 pagesKellogg's Indian Case StudySmruti RanjanNo ratings yet

- Exam Math Grade 7 - Chap 8 - 1Document2 pagesExam Math Grade 7 - Chap 8 - 1indahpriliatyNo ratings yet

- ALL Solved Data of FIN622 Corporate FinanceDocument69 pagesALL Solved Data of FIN622 Corporate Financesajidhussain557100% (1)

- 3-Strategies Spreads Guy BowerDocument15 pages3-Strategies Spreads Guy BowerNicoLazaNo ratings yet

- Strategic management-S/W PrintingDocument76 pagesStrategic management-S/W PrintingamirrajaNo ratings yet

- Clean Edge Razor Case StudyDocument14 pagesClean Edge Razor Case Studysmmnor100% (8)

- MF DoneDocument10 pagesMF DoneVIREN GOHILNo ratings yet

- OF Strategic Management ON: Corporate Strategy: H. Igor AnsoffDocument29 pagesOF Strategic Management ON: Corporate Strategy: H. Igor AnsoffBrilliant ManglaNo ratings yet

- Engaging in Influencer Marketing: Focusing On Tiktok PlatformDocument17 pagesEngaging in Influencer Marketing: Focusing On Tiktok PlatformRein MalabanaNo ratings yet

- Ifmr - PGP Batch 18 - Management Accounting Quiz 3 A. Choose The Correct Answer (1.25 Marks Each)Document2 pagesIfmr - PGP Batch 18 - Management Accounting Quiz 3 A. Choose The Correct Answer (1.25 Marks Each)Anu AmruthNo ratings yet

- Hostile TakeoverDocument4 pagesHostile TakeoverSaqib Kazmi100% (1)

- Module 10 Marketing Plan Tourism MarketingDocument55 pagesModule 10 Marketing Plan Tourism MarketingKim JosephNo ratings yet

- Chopra3 PPT ch14Document18 pagesChopra3 PPT ch14fahadNo ratings yet

- Analysis of India S National Competitive Advantage in ITDocument40 pagesAnalysis of India S National Competitive Advantage in ITkapildixit30No ratings yet

- Financial Markets: Hot Topic of The EconomyDocument8 pagesFinancial Markets: Hot Topic of The EconomyOtmane Senhadji El RhaziNo ratings yet

- TEA Industry: Presented By:-Janardhan Srinivasan Sushil Kamble Shilpa Gomase Prajakta Patil Sonal MoreDocument18 pagesTEA Industry: Presented By:-Janardhan Srinivasan Sushil Kamble Shilpa Gomase Prajakta Patil Sonal MoresaDA34No ratings yet

- Cash Grants ProposalsDocument41 pagesCash Grants ProposalsMuhammad AbdullahNo ratings yet

- Exercise - Dilutive Securities - AdillaikhsaniDocument4 pagesExercise - Dilutive Securities - Adillaikhsaniaidil fikri ikhsanNo ratings yet

- Breathes: Entrepreneurship and Innovation Strategy ProjectDocument26 pagesBreathes: Entrepreneurship and Innovation Strategy ProjectSaqib NaeemNo ratings yet

- Late Hull Delivery CompensationDocument13 pagesLate Hull Delivery CompensationAnonymous h4o5zvp4No ratings yet

- Faculty of Engineering and The Built Environment: Department of Building Science Study NotesDocument32 pagesFaculty of Engineering and The Built Environment: Department of Building Science Study NotesNeymar Monocles Jr.No ratings yet

- Different Types of Sales JobsDocument3 pagesDifferent Types of Sales Jobssachin patidarNo ratings yet