Professional Documents

Culture Documents

Matt Cleary 20120508 - Comment PDF

Uploaded by

Joe YW Chou0 ratings0% found this document useful (0 votes)

68 views10 pagesApple has quietly begun to make the transition to application processors manufactured using Samsung's 32nm process technology. We believe that only Intel, TSMC and Samsung have a viable shot at being selected as its next foundry partner.

Original Description:

Original Title

matt cleary 20120508_Comment.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentApple has quietly begun to make the transition to application processors manufactured using Samsung's 32nm process technology. We believe that only Intel, TSMC and Samsung have a viable shot at being selected as its next foundry partner.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

68 views10 pagesMatt Cleary 20120508 - Comment PDF

Uploaded by

Joe YW ChouApple has quietly begun to make the transition to application processors manufactured using Samsung's 32nm process technology. We believe that only Intel, TSMC and Samsung have a viable shot at being selected as its next foundry partner.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 10

Foundry Sector Update

Apple's next foundry partner

For sales & dealing

Tel: +886-2-2547-8881

P

r

i

m

a

s

i

a

Primasia Securities Company Ltd.

Taiwan

May 8, 2012

TSMC

Ticker: 2330 TT

Price: NT$84.4

UMC

Ticker: 2303 TT

Price: NT$14.75

SMIC

Ticker: 981 HK

Price: HK$0.39

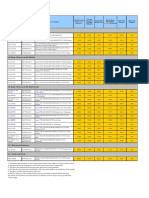

Top 10 foundries

Top 10 smartphone vendors

Source: IC Insights, IDC

Matt Cleary

Tel: +886-2-2547-8878

mattcleary@primasia.com

Best of frenemies: Apple has very quietly begun to make the transition to

application processors (APUs) manufactured using Samsung's 32nm process

technology, focusing attention on the question of what Apple's foundry strategy

is likely to be as settlement talks between the two litigants draw near. We

believe Apple's move away from package-on-package will make it easier to

migrate away from Samsung, while Apple's recent moves to diversify its other

suppliers shows the intent to do the same with its foundry business.

Intel offers the dilemma of conversion: Intel's status as the only

chipmaker with FinFETs makes it an enticing potential partner for Apple, whose

products would gain a battery life edge over rival devices. However, in order to

use Intel's process, Apple would need to make wholesale changes to its iOS in

order to accommodate Intel's strict no-ARM policy while maintaining software

compatibility. This would be very resource-intensive for Apple, and could

alienate both customers and app developers if anything went wrong.

A5 APUs made on 32nm beginning to appear: Certain iPad 2 models have

begun to appear equipped with APUs made on Samsung's new 32nm process

technology. Look for Apple to expand the use of 32nm process to the rest of its

APU line as the year progresses. However, Samsung's 28nm process is not a

linear shrink version of 32nm, and thus we doubt that Apple will go through the

trouble of re-designing its APUs to use Samsung's 28nm process.

It's a three-horse race: We believe that only Intel, TSMC and Samsung have

a viable shot at being selected as Apple's next foundry partners. UMC clearly

lacks the scale and leading-edge process level in order to compete in this league,

while GlobalFoundries probably still has to prove itself following the public

divorce from AMD. TSMC is pulling out all the stops in order to win Apple's

business, including hiring teams of IC design and system level engineers,

accelerating its 20nm process development and possibly pulling in its FinFET

introduction from 14nm to 20nm.

The game is TSMC's to losein 2014: Given the competitive conflicts with

Samsung and the broader engineering challenges that would be triggered by a

move to Intel, it seems most likely that TSMC will have the inside track to

become Apple's next foundry partneronce TSMC gets 20nm up and running.

The broader question will be whether Apple will prove lucrative enough as a

customer to justify all of these efforts.

-45

-15

15

45

9

12

15

18

May-11 Sep-11 Dec-11 May-12

2303 United Microelec.

Rel. to Taiex

Base Period: 06-May-11'

%

NT$

-30

10

50

50

75

100

May-11 Sep-11 Dec-11 May-12

2330 TSMC

Rel. to Taiex

Base Period: 06-May-11'

%

NT$

10

30

50

70

90

Jan-03 Feb-06 Mar-09 May-12

NT$

TSMC trailing PB band

3.7 x

3.1 x

2.5 x

2.0 x

1.4 x

0

10

20

30

40

Jan-03 Feb-06 Mar-09 May-12

NT$

UMC trailing PB band

1.8 x

1.4 x

1.1 x

0.8 x

0.4 x

Foundry Sector Update

8 May 2012 2

Foundry Update

With Apple quietly introducing 32nm parts into its products, patent

infringement suit settlement talks between Apple and Samsung set to begin in

a few weeks, and the next generation of iPhone likely coming out later this

year, Apple 's most contentious supplier relationship has come back into focus.

In particular, speculation has been on the rise about whether Apple will

continue to have its biggest rival in tablets and smartphones make the

processors for its own devices. In this report we read the tealeaves and

explain why we believe that Apple will migrate at least some of its application

processor (APU) foundry to TSMC, but not until the 20nm node.

The move away from Samsung is inevitable

First off, we think that Apple's intention to ultimately migrate away from

Samsung as its mobile processor foundry should not be doubted. Apple

undoubtedly sees Samsung as its greatest rival and is no doubt keenly aware

that relying on Samsung to fab its APU represents a serious disclosure of IP

and a major competitive risk. While Apple's sourcing decisions of late have not

all pointed to a diversification away from Samsung, many of them have.

1

Moreover, the risk to Apple of sourcing components such as LCDs from

Samsung carries a far lower risk profile than depending on Samsung for its

next generation of applications and graphics processing. Thus, we believe that

Apple remains highly motivated to migrate away from Samsung's foundry

service when practicable.

Samsung's 32nm is the next step

However, it does not appear that now is a very practicable time to switch

foundries. Firstly, Apple has already begun to use Samsung's new 32nm

process node for the A5 processor in its iTV and iPad 2 products

2

. Apple's

strategy here seems to be to try out Samsung's newest logic node on a small

scale, without risking its ability to ramp up volumes in much higher volume,

strategically critical iPhone and iPad lines. Given that Apple has undertaken

the redesign, process characterization and design verification expenses

necessary to use Samsung's 32nm, it would obviously make sense for Apple to

amortize these expenses over as many products as practicable. Most likely,

this will mean migrating its iPhone and iPad processors to that 32nm node as

its next step. Not only would Apple then be able to claim further speed and

battery life benefits to help justify consumers upgrade decisions, but it would

also lower its die costsall while continuing to leverage the gate-first design

experience that the company has gained while working with Samsung.

1

Apple has been using more memory products from Hynix and Toshiba, and had reportedly been

working very closely with Sharp for the high-resolution display in the new iPad before yield

problems forced Apple to source from Samsung instead.

2

Apple has quietly begun using A5 processors made using Samsung's 32nm process in the

WiFi-only version of its iPad 2. Meanwhile, the A5 processor in the new iTV is similar to the A5s

used in the iPad 2 and Phone 4S, except that it is made on a 32nm process and has one of its two

application cores disabled.

Foundry Sector Update

Matt Cleary 3

Phase-out of PoP package gives Apple flexibility

One of the big APU changes which occurred with the launch of the A5X

processor was the move away from the package-on-package (PoP)

configuration used in prior A5 variants, whereby a DRAM package was

mounted directly on top of the APU. Of course this PoP architecture offers

extremely high performance, in the form of excellent APU-memory

communication, due to both the large number of interconnects that such an

architecture allows, as well as the short lengths of such interconnects.

However, Apple made the move away from PoP with the introduction of the

third-generation iPad, and put the two DRAM dies directly on the

motherboardalthough directly opposite where the A5X APU is mounted. This

configuration enables Apple to maintain relatively short interconnect length

and a high interconnect density, while also enabling Apple to avoid the costly

yield losses inherent in such a complex packaging type as PoP.

However, the move away from PoP also provides Apple a great deal of new

flexibilitylatitude which may signal the company's strategic intent. First off,

by separating the DRAM and the APU, Apple gives itself the flexibility to source

its DRAM from vendors other than Samsungsomething that Apple appears

to be doing more of. Secondly, the move away from Samsung's PoP

architecture enables Apple to consider foundry partners which might not have

the same level of multi-die packaging capabilities in house. The overall effect

is to reduce the risk profile of any switch in foundry suppliers. Thus, while the

move away from PoP may have brought cost benefits for Apple, we believe

that this was part of a broader strategic move to prepare for an eventual move

away from Samsung as a foundry vendor.

Gate-last and FinFET transitions ahead

Although the shrink from 45nm to 32nm appears to be going smoothly for

Apple, the next step is not going to be quite as trivial. Samsung (which, like

GlobalFoundries has based its advanced logic process on IBM's Common

Platform technology) has a 28nm process on its technology roadmap.

However, while this 28nm process was originally intended to be a linear

shrink

3

from Samsung's 32nm process, industry sources tell us that this

proved impossible. It is unclear how extensive the re-design requirements

would be in order to port a complex design like Apple's A5 processor from

Samsung's 32nm process to its forthcoming 28nm process, we believe that

this will not be trivial. Nonetheless, doing so would undoubtedly be far easier

than redesigning the A5 to use a gate-last 28nm process, such as TSMC's. Still,

the re-design work necessary to use Samsung's 28nm process could prove to

be a transition point, where it might make sense for Apple to reassess its

options.

3

A linear shrink node is a semiconductor process technology where designs of a larger scale

process node can be very simply scaled down and fabricated using the same circuit layout. Linear

shrinks enable chipmakers to lower chip costs by reducing the size of the semiconductor die

without extensive re-working of the design.

Foundry Sector Update

8 May 2012 4

Beyond the 28nm node, Apple will undoubtedly face a major re-design effort,

regardless of which foundry it chooses. For one thing, all of the major

foundries use gate-last transistor architectures for their 20nm process nodes.

Redesigning its A5 processor for a gate-last process would require a major

commitment of design resources on Apple's partanalogous to taking an

architect's design for a house and re-working the designs so that the house

hangs from an overhead structure rather than sitting on the ground. In

addition to the gate first-to-gate last transition, the move to beyond 28nm

may well require Apple to begin using new FinFET transistors

4

. Intel is already

using FinFETs in its new 22nm products, and has made no secret of its

aspirations to secure Apple's mobile processor business. At the same time,

TSMC has begun to hint that FinFETs could be pulled forward from its

previously-stated launch at the 14nm node to the 20nm node. Meanwhile,

Samsung, IBM and GlobalFoundries have all previously said that FinFETs will

arrive with their 14nm process generations. Thus, whichever foundry Apple

chooses, the company faces a very significant re-design in preparation for the

move to a gate-last architecture beyond 28nm. At this juncture, it would also

most likely make sense for Apple to undertake the transition from planar to

FinFET transistors. Given these two different transitions, this would be the

junction at which it would cause the least design disruption to switch

foundries.

Intel wants to be Apple's next foundry

One potentially attractive foundry option for Apple would be to have its chip

made by Intel. Given that Intel already has a gate-last process using FinFET

transistor architecture in mass production at the 22nm node, Apple could

position itself very competitively by using Intel as a foundry. However, as we

detailed in our recent report on Intel's foundry aspirations, Apple's use of Intel

would be problematic on a number of fronts. First and most importantly, Intel

would refuse on philosophical grounds to make any product based on an ARM

processor core. As all of Apple's mobile processors have thus far been based

on ARM architecture, this dictate from Intel would trigger not just a massive

chip re-design around Intel's X86 Atom core. It would also require Apple to

re-write a great deal of its iOS mobile device operating system in order to

ensure that the large body of existing iOS applications would be compatible

with both Apple's new devices and its legacy applications.

4

Also referred to as 3D transistors or Tri-gate transistors, FinFET transistors are unlike traditional

planar transistors in that they are effectively turned up on their edge. Whereas planar transistors

are thin gate structures lying flat and regulating the flow of electronics through the underlying

silicon substrate, FinFETs incorporate a thin, tall silicon structure with a controlling gate draped

over the top of it. While FinFETs are far more difficult to fabricate than planar transistors, they

have advantage is that they leak far less current and are easier to control than planar transistors

of comparable size.

Foundry Sector Update

Matt Cleary 5

One potential benefit of a move to use Intel and its X86 architecture might be

that Apple could unify its iOS mobile operating system and the OS operating

system which it uses in its Mac and MacBook lines of computers. However,

such a move could orphan the half million iOS applications already in use,

alienating both users and software developers in the process. Moreover, while

the added silicon horsepower that Apple would gain from a move to the 22nm

node would take the company's smartphones and tablets closer to the point

where they could run the same desktop applications that OS offers, it is far

from clear that these systems would be ready overall to make this leap in

performance.

But maintaining a separate iOS amidst any shift to Intel foundry would also be

fraught with risk for Apple. Throwing out the existing APU design and

undertaking major surgery on iOS would require a tremendous amount of

engineering and software work and would involve not just changes to the

operating system, but also trigger hardware changes to subsequent iPads,

iPhones, iTVs and iPods beyond the APU.

Proponents would argue that Apple had overcome a similar challenge

previously when they migrated to the X86 architecture from the PowerPC in

their computer lineup. However, systems experts tell us that that transition

was much easier because very little computation work was done by the

peripheral chips on those Mac/MacBook boardsi.e. the chips other than the

CPU. This centralization of computational effort made it very easy to virtualize

the PowerPC operations within the new X86-based OS. Apple's current lineup

does not have their computational functionality so narrowly centralized within

their APUs, and thus rely much more heavily from various codecs, touchpad

controllers, display controllers, GSM/3G/WiFi/WLAN coprocessors, and so on.

This distributed workload would make emulation virtually impossible, and

necessitate nearly a ground-up rebuild of iOS.

Such a rebuild would be very risky for Apple from a compatibility standpoint. It

is not difficult to imagine how compatibility problems with the half million iOS

apps currently in the iStore could seriously damage Apple's hard-fought

reputation for seamless software operation. We believe that it would not make

sense for Apple to take on these risks for the benefit of using Intel's 22nm

technology. This conclusion is further supported by the fact that Apple is

happily leading the tablet and smartphone markets without APUs made on

leading-edge process nodes. If Apple can compete effectively with chips made

on a 45nm process, why would it undertake such an outsized risk? Finally, we

doubt that Apple's new CEO would feel comfortable undertaking such risky

chip and operating system transitions simultaneously. Given Tim Cook's

background in supply chain management, we dont believe that his expertise

would inspire in him the confidence to risk the company in this way.

Consequently, we believe that a change of course by Apple to use Intel as its

foundry would be very unlikely.

Foundry Sector Update

8 May 2012 6

A Samsung-Intel split would make no sense

One analyst was widely quoted in recent weeks predicting that Apple would

split its APU foundry between Samsung and Intel. However, this prediction

failed to explain whether Apple would use an ARM core or Atom. Obviously it

wouldnt make sense for Apple to use botha strategy that would embody

much of the compatibility risk explained above, while simultaneously giving up

most of the economies of scale which Apple's processor strategy has

heretofore been based on. Thus, any strategy that had Apple splitting its

foundry business between Samsung and Intel would necessarily require the

wholesale move to an Atom core, as well as Intel granting Samsung a license

to make chips using the X86 architecture. We believe that this latter factor

would be a deal breaker for Intel. Moreover, we very much doubt that Intel

would accommodate any deal whereby it won only part of Apple's mobile

processor business. We believe that the organizational upheaval that the

introduction of a large foundry business would create at Intel would only

make sense to Intel if it were guaranteed 100% of Apple's mobile processor

business. Otherwise, Intel would have a very hard time justifying the potential

risk and margin dilution to shareholders. Thus, we conclude that it would be

nigh impossible for Apple to split its APU business between Samsung and

Intel.

TSMC widely fingered as Apple's next foundry

While a number of journalists and analysts have predicted that TSMC will win

Apple's foundry business at either the 28nm or 20nm nodes, similar

predictions were rife ahead of the A5's launch. One would be correct in

wondering why TSMC didnt win Apple's A5 business, and whether the

foundry giant stands a better chance of winning the contract to build Apple's

processor business this time around.

First, we believe that Apple's decision not to choose TSMC as its foundry

vendor for the A5 generation did not hinge on any single factor. Rather, we

believe that factors like cost, power consumption, IP entanglements and

re-design workload were all part of Apple's decision to stay with

Samsungnot to mention the complex customer-supplier-rival politics of the

Samsung-Apple relationship. We do believe that TSMC was very much in the

running, as Apple's engagement with TSMC went so far as to include test

wafer production. But in the end, we believe that these factors were pivotal in

Apple's decision to stay with Samsung:

Power consumption: We believe that TSMC's test chips did not match

the power efficiency of Samsung's, a factor that most likely involved not

just the power consumed by the APU, but by the system as a whole.

Given its experience in handsets, Samsung was most likely able to

leverage its knowledge of systems to gain an edge in non-APU power

consumption.

Foundry Sector Update

Matt Cleary 7

Die size: We believe that TSMC's test chips were larger than Samsung's.

Here again, Samsung's experience in ARM-based ASICs design most

likely gave it an edge in terms of the non-core design library, and the

degree to which these elements could be integrated while still

minimizing die size. As die size is directly correlated with chip cost,

Samsung also won on this measure.

IP entanglements: Despite its flexibility to use the same ARM core

with most any foundry, we believe that Apple would have found it

technologically and legally difficult to replace the non-core design IP

that Samsung had provided in the A4 generation

5

. In some

ARM-based chips, these non-core design elements account for more

than three quarters of the chip's total transistors.

Design workload: As wed asserted above, a move by Apple to use

TSMC's 28nm process technology would have Apple to migrate from a

gate-first architecture on the A4 to a gate-last architecture on the A5.

This alone would have been a great deal of workeven for a dedicated

IC design company, let alone a system company like Apple. However,

the replacement and optimization of the non-core IP elements on the

chip would have added greatly to the effort that would have been

needed in order for Apple to migrate to TSMC at the 28nm node.

Clearly there were a range of issues that would have made it difficult and/or

risky for Apple to migrate to TSMC for the A5. At the same time, we believe

that the marginal risk to Apple (in terms of potential IP loss or strategic

disclosure) of keeping its foundry business with Samsung would have been

relatively moderate in the A4 to A5 transition, given that the primary change

was simply an increase in the number of cores. Balanced against the litany of

risks involved with moving to TSMC and the management changes happening

at Apple during this timeframe, it's not terribly surprising that Apple chose to

maintain its foundry strategy of using Samsung.

5

It is important to remember that Apple's mobile processor progression started with using

standard Samsung APUs, and then migrating to an Apple-branded device (the A4) which was

largely designed by Samsung's ASICs design team. Samsung's central role in the A4's design

obviously meant that use of Samsung's IP and cell library was quite intensea factor that would

have made it difficult and legally complex for Apple to migrate quickly to use another foundry.

This would have been the case even more so because of the relative immaturity of the IP library

offerings for TSMC's 28nm processes at that point in time.

Foundry Sector Update

8 May 2012 8

TSMC is pulling out all the stops

Despite losing out to Samsung for the A5, we believe that TSMC is going to

great lengths to try and win Apple's A6 business. First, we believe that TSMC

has gone on a hiring spree, adding a great deal of design talent in both Taiwan

and Silicon Valley. This talent will be employed both in building up TSMC's IP

design library, enhancing its system-level know-how, and extending its SoC

design integration capabilities. Moreover, we suspect that TSMC's recent

pull-in of 20nm R&D, and ambiguity about whether or not it will pull FinFETs in

to the 20nm node are likely a reaction to either Apple's wishes or the fact that

Intel is currently offering its FinFET 22nm architecture to Apple. Finally,

TSMC's efforts to build advanced 2.5D and 3D packaging capabilities in house

can easily be seen as a response to Samsung's own very advanced, in-house

packaging resources. While all of these moves would no doubt appeal to

TSMC's other leading-edge clientele, the combined result of these moves at a

time when 28nm production is still quite challenging tends to support the view

that TSMC would very much like to win the next round.

and is likely to win at the 20nm node

We believe that all the available evidence points to TSMC winning Apple

foundry business at some point, given:

Apple's fractious relationship with Samsung

The challenges to Apple of moving from an ARM core to an Atom core

The logic of Apple staying with Samsung for the 32nm node, and

How that logic changes due to the design challenges beyond 32nm

However, it clearly doesnt make sense for Apple to get involved with TSMC at

the 28nm node. First off, TSMC does not have anywhere near enough 28nm

capacity available to accommodate a meaningful portion of Apple's wafer

demand. But secondly, TSMC's 28nm node wouldnt offer sufficient benefits

over Samsung's 32nm process to justify the re-design work involved. Thus,

we would expect to see Apple continue to make linear shrinks of its current A5

products on Samsung's 32nm process. The calculus changes however once

TSMC's 20nm process is ready. While there is a chance that Apple could be

enticed to use Samsung's 28nm node, the fact that this is not a linear-shrink

node means that the move from 32nm to 28nm within Samsung would not be

trivial. Moreover, the payoff in terms of die size, speed and power

consumption may not justify the cost and effort. Thus, we believe that Apple's

foundry business is TSMC's to lose, once it has its 20nm process up and

running.

Foundry Sector Update

Matt Cleary 9

We do not see either GlobalFoundries or UMC having any realistic chance at

this business. GlobalFoundries would most likely have or be happy to build

sufficient capacity to accommodate Apple's wafer demand. Moreover,

GlobalFoundries (like Samsung) is a licensee of the IBM-led Common Platform

process technology, and thus could provide Apple with a relatively easy

second source for Samsung-produced products. However, we suspect that

GlobalFoundries will need to again prove itself following the very public

challenges that have played out between it and AMD. Moreover, we believe

that Apple is not interested in second-sourcing nearly as much as it is

interested in extricating itself from its foundry reliance on Samsung. Moreover,

we doubt that Apple would leave Samsung to enter another sole-source

relationship with GlobalFoundriesagain for reasons of risk management. In

the case of UMC, we doubt that the company has either the advanced-node

timing or mass production capacity on leading nodes that Apple would look for

in its next foundry partner.

Thus, it really is a three-horse race between the world's three biggest

chipmakers: Intel, Samsung and TSMC. In the case of Intel, Apple would gain

access to the world's most advanced process technology and gain an instant

power efficiency advantage over every other player in the smartphone and

tablet markets. However, Apple would need to bend over backwards in order

to accommodate Intel's staunch devotion to the X86 architecture. In the case

of Samsung, Apple would enjoy continuity until it comes time to migrate to the

20nm nodeat which point the re-design efforts would be nearly as great as

they would be to go to any other foundry vendor. Moreover, Apple would

continue to be dependent on its biggest rival, and would continue to give its

rival early information about its processor strategy, cost and unit volumes.

Given these conflicts, we believe that TSMC offers Apple the most attractive

risk-reward proposition.

Perhaps the natural follow-up question would then be whether winning

Apple's foundry business would indeed be worth all of the effort. After all,

Apple's reputation as a highly demanding client far exceeds any evidence that

it is a highly lucrative client. This of course will come largely down to wafer

pricing at the point when Apple commits to bring its business over to TSMC,

and which party needs the other more. This will most likely not be a question

that we can answer before 2014.

Primasia research is available on Bloomberg (PRMA <go>), firstcall.com, factset.com and at www.primasia.com.

Please see the last page of this report for important disclaimers.

For sales & dealing

Tel: +886-2-2547-8881

Contact information

Primasia Securities Ltd.

3F, No. 99 Hu-Hsin North Road, Taipei, 10595 Taiwan

International Sales

Michael McGregor, VP

+886-2-2547-8881 MichaelMcGregor@primasia.com

Research

Matt Cleary, Head of Research

+886-2-2547-8878 MattCleary@primasia.com

Kai Chen, CFA, CPA

+886-2-2547-8885 KaiChen@primasia.com

Filia Lin

+886-2-2547-8879 FiliaLin@primasia.com

James Martin, CFA

+886-2-2547-8866 JamesMartin@primasia.com

Jason Skinner

+886-2-2547-8886 JasonSkinner@primasia.com

Freddy Yam

+886-2-2547-8876 FreddyYam@primasia.com

Please visit our Bloomberg research page at PRMA <GO>

Disclaimers

Information presented in this paper was obtained or derived from sources Primasia Co., Ltd. believes to be reliable, but Primasia makes no representations

as to their accuracy or completeness. Primasia accepts no liability for loss arising from the use of the material presented in this report. Primasia is under no

obligation to ensure that such other reports are brought to the attention of any recipient of this report. Primasia research reports are issued to professional

institutional investors only and are intended to serve as reference only. Primasia research reports are not to be considered as an offer or the solicitation of

an offer to sell or to buy securities or other financial instruments. Primasia will not treat recipients as its customers by virtue of their receiving the report.

Primasia Co. Ltd. (or one of its affiliates) may from time to time perform investment banking or other services or solicit investment banking or other business

for any company mentioned in this report. Primasia, its directors, connected parties, employees and/or persons associated with any of them may as at this

date or from time to time have interests in or interest in the acquisition or disposal of (including underwriting commitments) the securities or class of

securities mentioned in this report.

Primasia research reports are distributed in the United States only to Major U.S. Institutional Investors (as defined in Rule 15a-6 under the Securities

Exchange Act of 1934, as amended (the "Act") and SEC staff interpretations thereof). All transactions by a US person in the securities mentioned in this

report must be effected through a registered broker-dealer under Section 15 of the Act. Primasia is registered to conduct a securities business in Taiwan but

is not registered as, or an affiliate of, a U.S. broker-dealer.

The authors certify that the views expressed in this research report accurately reflect each analyst's (s') personal views about the subject security (ies) and

issuer (s) and that no part of his / her compensation was, is, or will be, directly or indirectly, related to the specific view(s) expressed in this report.

Information, opinions and estimates contained in this report reflect a judgment at its original date of publication by Primasia and are subject to change

without notice. Investors should consider this report only as one factor in making an investment decision. This report may contain the addresses of

third-party websites. Primasia has no, and shall not accept, any responsibility for the content contained therein. Additional information is available upon

request. If this report is being distributed by a financial institution other than Primasia to U.S. investors, that financial institution is solely responsible for its

distribution. U.S. clients of that institution must contact that institution to effect a transaction in the securities mentioned in this report or require further

information. This report does not constitute investment advice by Primasia, and neither Primasia nor its officers, directors and employees accept any liability

whatsoever for any direct or consequential loss arising from the use of this report or its content.

Data and views presented in this document have not been reviewed by, and may not reflect information known to, professionals in other Primasia Securities'

business areas, including investment banking, derivatives, and fixed income. Primasia Securities is involved in many businesses that relate to companies

mentioned in this report. These businesses include specialized trading and other financial services. Primasia Securities may engage in securities

transactions in a manner inconsistent with the statements contained in this report. Past performance should not be taken as an indication or guarantee of

future performance, and no representation or warranty, express or implied, is made regarding future performance.

You might also like

- macOS Big Sur Demystified: Most Well-guarded Secrets to Crack macOS Big Sur to Pro Level RevealedFrom EverandmacOS Big Sur Demystified: Most Well-guarded Secrets to Crack macOS Big Sur to Pro Level RevealedNo ratings yet

- M1 Max and M1 Pro MacBook Pro User Manual: A Comprehensive Guide to Mastering the New M1 Max & M1 Pro MacBook Pro with Pictorial IllustrationsFrom EverandM1 Max and M1 Pro MacBook Pro User Manual: A Comprehensive Guide to Mastering the New M1 Max & M1 Pro MacBook Pro with Pictorial IllustrationsNo ratings yet

- Apple A9Document10 pagesApple A9Savithri NandadasaNo ratings yet

- Assignment 1 - Apple and Global Chip Shortage - Text and InstructionsDocument7 pagesAssignment 1 - Apple and Global Chip Shortage - Text and InstructionsUddishNo ratings yet

- Apple SuppliersDocument2 pagesApple SuppliersRANsquawkNo ratings yet

- Global Foundries Analysis by NomuraDocument62 pagesGlobal Foundries Analysis by NomuraSantosh KumarNo ratings yet

- Apple Iphone 6s A1688 Smartphone Chipworks Teardown Report BPT-1509-801 With CommentaryDocument68 pagesApple Iphone 6s A1688 Smartphone Chipworks Teardown Report BPT-1509-801 With Commentarysiev29No ratings yet

- Equity Research - TSMDocument5 pagesEquity Research - TSMMichael LinNo ratings yet

- Apple Iphone 7 TeardownDocument37 pagesApple Iphone 7 TeardownShahid AzizNo ratings yet

- MacBook Pro 15Document9 pagesMacBook Pro 15jdpardo100% (1)

- Trends in Telecommunications and Their Impact On VLSI and Their Impact On VLSIDocument26 pagesTrends in Telecommunications and Their Impact On VLSI and Their Impact On VLSIRani AngadiNo ratings yet

- Mte April2011webDocument23 pagesMte April2011webb_b_yNo ratings yet

- Inside The Apple Watch - Technical Teardown BlogDocument9 pagesInside The Apple Watch - Technical Teardown Blogdorian451No ratings yet

- Apple Iphone SE TeardownDocument15 pagesApple Iphone SE Teardowndorian451No ratings yet

- Chapter 01Document22 pagesChapter 01Waqar IshaqNo ratings yet

- Computer Products MAY13Document130 pagesComputer Products MAY13kleos70No ratings yet

- Review: Apple's New Mac Pro Is A Speed Demon: The Upgraded Mac Pro Pushes Apps To The LimitDocument3 pagesReview: Apple's New Mac Pro Is A Speed Demon: The Upgraded Mac Pro Pushes Apps To The LimitRosario PignatelliNo ratings yet

- Audio Connectivity Module: Jaguar S, X, XJDocument2 pagesAudio Connectivity Module: Jaguar S, X, XJДенис СухаревNo ratings yet

- White Paper: AP, Modem 1-Chip vs. 2-ChipDocument5 pagesWhite Paper: AP, Modem 1-Chip vs. 2-Chip임민섭No ratings yet

- Tuesday, April 2, 2019 WWW - Iiu.edu - PK 1Document22 pagesTuesday, April 2, 2019 WWW - Iiu.edu - PK 1mickyNo ratings yet

- IoT ExperimentDocument4 pagesIoT ExperimentProxyNo ratings yet

- Bahria University (Karachi Campus) : Midterm Examination - Fall 2020Document9 pagesBahria University (Karachi Campus) : Midterm Examination - Fall 2020Madiha FarhadNo ratings yet

- #Apple #Intel #ReasonsDocument1 page#Apple #Intel #ReasonsDaksh AnejaNo ratings yet

- 8051 Microcontroller ThesisDocument5 pages8051 Microcontroller Thesisangelalovettsavannah100% (2)

- RANsquawk Preview - Apple Media Event 2014Document1 pageRANsquawk Preview - Apple Media Event 2014RANsquawkNo ratings yet

- Apple Ipod Nano 152-00-050928-NTdDocument75 pagesApple Ipod Nano 152-00-050928-NTdDimitar SimeonovNo ratings yet

- Final Draft Computer Organization AssigmentDocument10 pagesFinal Draft Computer Organization AssigmentkucingpakmanNo ratings yet

- Apple Vs DellDocument8 pagesApple Vs DellClark AngelNo ratings yet

- Intel: 14nm Atom Chip in 2014: May. 18, 2011 (5:32 Am) byDocument6 pagesIntel: 14nm Atom Chip in 2014: May. 18, 2011 (5:32 Am) bymarcher85No ratings yet

- Lightwave20141112 DLDocument18 pagesLightwave20141112 DLRaul Vargas MNo ratings yet

- eiCAB keynote overview of A&R TECH railway technologyDocument47 pageseiCAB keynote overview of A&R TECH railway technologyPankaj SethiaNo ratings yet

- What Is ABF PCBDocument4 pagesWhat Is ABF PCBjackNo ratings yet

- A13 Bionic ChipDocument12 pagesA13 Bionic ChipManikanta SriramNo ratings yet

- 2012 Nov 29 - 10 For '13Document54 pages2012 Nov 29 - 10 For '13alan_s1No ratings yet

- Apple - Away From IntelDocument3 pagesApple - Away From IntelCharles Ramirez Ausejo Jr.No ratings yet

- Dillien 2009Document3 pagesDillien 2009Ssr ShaNo ratings yet

- 2022 01 01macworldDocument102 pages2022 01 01macworldNomadNikNo ratings yet

- The Best Companies and The Reason Why The Company Is The BestDocument1 pageThe Best Companies and The Reason Why The Company Is The BestSalsalbila AzniNo ratings yet

- New Technologies That Will Change EverythingDocument6 pagesNew Technologies That Will Change EverythingHuda MughalNo ratings yet

- 1817-SanDiegoCPMTDL Lau AdvancedpackagingDocument111 pages1817-SanDiegoCPMTDL Lau AdvancedpackagingPiyush ParasharNo ratings yet

- CT049 3 1 OscaDocument41 pagesCT049 3 1 OscaAaditya Jha100% (1)

- Maths Predicts Earthquakes: Digikey - Co.UkDocument28 pagesMaths Predicts Earthquakes: Digikey - Co.UkstevesalmNo ratings yet

- Recent Advances in Microprocessor DesignDocument4 pagesRecent Advances in Microprocessor DesignAnonymous mRBbdopMKfNo ratings yet

- Machine Design 10 May 2012Document100 pagesMachine Design 10 May 2012Daniel Leal NevesNo ratings yet

- Smartphone GPUs & ProcessorsDocument9 pagesSmartphone GPUs & ProcessorswilisW7No ratings yet

- Winning With Power SystemsDocument25 pagesWinning With Power SystemstuancoiNo ratings yet

- BLOCK1Document1 pageBLOCK1Amin AzmiNo ratings yet

- Amd Vs Intel The Next Big Technology Leap: Students: Spirache Rares Alexandru Sava Alina PopaDocument7 pagesAmd Vs Intel The Next Big Technology Leap: Students: Spirache Rares Alexandru Sava Alina PopaRareş SpiracheNo ratings yet

- r1 Reflecting On The Strategy ProcessDocument3 pagesr1 Reflecting On The Strategy Processbibek mishraNo ratings yet

- 4 - Tech Hardware SectorDocument126 pages4 - Tech Hardware SectorgirishrajsNo ratings yet

- Individual Assignment OSCADocument7 pagesIndividual Assignment OSCACharlez BaeNo ratings yet

- Case Study Apple IncDocument9 pagesCase Study Apple Incanu1995100% (1)

- TechSmart 94, July 2011, Home Entertainment IssueDocument32 pagesTechSmart 94, July 2011, Home Entertainment IssueTS_MikeNo ratings yet

- Apple Macbook Pro 15.4" (2011) : (For Review Purposes, I Would Only Review The Base 15.4" 2.0 GHZ Quad-Core Model.)Document4 pagesApple Macbook Pro 15.4" (2011) : (For Review Purposes, I Would Only Review The Base 15.4" 2.0 GHZ Quad-Core Model.)Samson_Lam_9358No ratings yet

- New Holland LB 110 B PDFDocument5 pagesNew Holland LB 110 B PDFedergo21No ratings yet

- A Soc ControllerDocument11 pagesA Soc ControllerpaggyNo ratings yet

- AtomDocument14 pagesAtomAli MalikNo ratings yet

- Apple's Supply-Chain Secret: Hoard LasersDocument2 pagesApple's Supply-Chain Secret: Hoard LasersClaude PeñaNo ratings yet

- iMac (M1 chip) User Guide 2021: The Complete Step By Step Reference Guide to Getting Started with the New 24 Inch iMac with Screenshots, Tips & Tricks, Magic Keyboard, Gestures, and MoreFrom EverandiMac (M1 chip) User Guide 2021: The Complete Step By Step Reference Guide to Getting Started with the New 24 Inch iMac with Screenshots, Tips & Tricks, Magic Keyboard, Gestures, and MoreNo ratings yet

- C7015-0020 - Ultra-Compact Industrial PC in IP65: Multi-Core Capability Directly at The MachineDocument3 pagesC7015-0020 - Ultra-Compact Industrial PC in IP65: Multi-Core Capability Directly at The MachineKrishnamurthy KulkarniNo ratings yet

- BX200 Series: Fanless, Atom BOX-PC SeriesDocument4 pagesBX200 Series: Fanless, Atom BOX-PC SeriesFelipe Raul Chumpitaz GNo ratings yet

- Operating Instructions: Device PlatformDocument64 pagesOperating Instructions: Device PlatformadamsNo ratings yet

- 16Q1 - IPC Product GuideDocument140 pages16Q1 - IPC Product GuideMonreal JoshuaNo ratings yet

- Intel-Nokia AllianceDocument18 pagesIntel-Nokia AllianceTedtenorNo ratings yet

- Laptop Prices in PakistanDocument2 pagesLaptop Prices in Pakistanm_bilalbaig248953No ratings yet

- Touch Sceen ARCHMI-712Document1 pageTouch Sceen ARCHMI-712Mr.Thawatchai hansuwanNo ratings yet

- DX DiagDocument10 pagesDX Diagاشرف البخيتيNo ratings yet

- ASUS Price ListDocument76 pagesASUS Price ListMeyrio SanderwykNo ratings yet

- Brosur DNH ComputerDocument2 pagesBrosur DNH Computeranon_796902No ratings yet

- 1-221214135445 Armor 3Document4 pages1-221214135445 Armor 3roverragzNo ratings yet

- Features: Tiny Gateway System With UP SquaredDocument2 pagesFeatures: Tiny Gateway System With UP SquaredAhmar Hayat KhanNo ratings yet

- 64CHVMS Manual v.2.0Document32 pages64CHVMS Manual v.2.0Pablo Javier PirchiNo ratings yet

- Shipping: Mitac PD14TI (Intel D2500HN) (Intel Atom 2x 1.86Ghz CPU) (FANLESS)Document2 pagesShipping: Mitac PD14TI (Intel D2500HN) (Intel Atom 2x 1.86Ghz CPU) (FANLESS)Nicodemo DatiNo ratings yet

- Asus Notebook PriceDocument2 pagesAsus Notebook PriceArachnid Louis MorganNo ratings yet

- LP Retail Jul-Acer WebDocument53 pagesLP Retail Jul-Acer Webahortiz78No ratings yet

- Intel Corporation - Desktop-Board-D2700mud-Innovatio-1215852Document5 pagesIntel Corporation - Desktop-Board-D2700mud-Innovatio-1215852CosminNo ratings yet

- Intel D25KTDocument2 pagesIntel D25KTJorge Alberto DiazNo ratings yet

- Intel Atom Procesador CaracteristicasDocument3 pagesIntel Atom Procesador CaracteristicasCgp SealNo ratings yet

- Sony Vaio Pricelist LatestDocument1 pageSony Vaio Pricelist LatestgcnlNo ratings yet

- HP Compaq Notebook Pricelist: Intel Core I3 380 (2.4Ghz) 3Gb 320 GB W7Hb WLBT 15.6" 512 MB GraphicsDocument14 pagesHP Compaq Notebook Pricelist: Intel Core I3 380 (2.4Ghz) 3Gb 320 GB W7Hb WLBT 15.6" 512 MB GraphicsXris Loidz GanadoNo ratings yet

- Actividad 2 de Informática de Vega LilianaDocument11 pagesActividad 2 de Informática de Vega LilianalilianavagaNo ratings yet

- Thundermatch Laptop Pricing List Page 1Document1 pageThundermatch Laptop Pricing List Page 1razzmentNo ratings yet

- Acer Aspire One D150 - COMPAL LA-4781P KAV10 - REV 1.0Document40 pagesAcer Aspire One D150 - COMPAL LA-4781P KAV10 - REV 1.0Hendrik Tri SasongkoNo ratings yet

- Advantech Automation Devices and Computing Star Product GuideDocument24 pagesAdvantech Automation Devices and Computing Star Product GuideQuantumAutomationNo ratings yet

- Jakarta Axioo Neon Specification PriceDocument6 pagesJakarta Axioo Neon Specification PricespermanikovNo ratings yet

- Schematic-X - Schematics DownloadDocument2 pagesSchematic-X - Schematics DownloadLutfi AzizNo ratings yet

- HP Notebook Price List August 2010Document5 pagesHP Notebook Price List August 2010ER RameshNo ratings yet

- Motherboard RusakDocument22 pagesMotherboard RusakElmaha Comp LhokseumaweNo ratings yet

- 1st and 2nd Generation AMD Embedded G-Series System-on-Chip (SOC)Document3 pages1st and 2nd Generation AMD Embedded G-Series System-on-Chip (SOC)Surya AdiNo ratings yet