Professional Documents

Culture Documents

Buffer Transparent Term Sheet - Series A

Uploaded by

leowid1Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Buffer Transparent Term Sheet - Series A

Uploaded by

leowid1Copyright:

Available Formats

Buffer term sheet - Series A_(palib2_7088552_3).

DOC

TERM SHEET

FOR SERIES A PREFERRED STOCK FINANCING OF

BUFFER, INC.

This Term Sheet summarizes the principal terms of the Series A Preferred Stock Financing of

Buffer, Inc., a Delaware corporation (the Company). In consideration of the time and expense

devoted and to be devoted by the Investors with respect to this investment, the No

Shop/Confidentiality provisions of this Term Sheet shall be binding obligations of the Company

whether or not the financing is consummated. No other legally binding obligations will be created

until definitive agreements are executed and delivered by all parties. This Term Sheet is not a

commitment to invest, and is conditioned on the completion of due diligence, legal review and

documentation that is satisfactory to the Investors. This Term Sheet shall be governed in all

respects by the laws of Delaware.

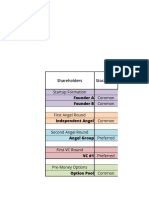

Offering Terms

Closing Date: As soon as practicable following the Companys acceptance of this

Term Sheet and satisfaction of the Conditions to Closing (the

Closing).

Investors: Collaborative Fund: $1,500,000.

Other investors reasonably acceptable to Collaborative Fund:

$2,000,000

Amount Raised: $3,500,000. Of such amount, $2,500,000 shall be used by the

Company to repurchase Common Stock from the Founders and early

team members following the Closing.

Valuation: The per share purchase price for the Series A Preferred (the

Original Purchase Price) is based upon a fully-diluted

post-money valuation of $60,000,000 (including an available

employee pool representing 12.5% of the fully-diluted post-money

capitalization).

CHARTER

Dividends: The Series A Preferred will carry an annual 9% cumulative dividend

payable upon a liquidation or redemption. For any other dividends

or distributions, participation with Common Stock on an

as-converted basis.

Liquidation Preference:

In the event of any liquidation, dissolution or winding up of the

Company, the proceeds shall be paid as follows:

First pay one times the Original Purchase Price plus accrued

dividends on each share of Series A Preferred and Series AA

Buffer term sheet - Series A_(palib2_7088552_3).DOC

Preferred (collective, the Preferred) (or, if greater, the amount that

the Preferred would receive on an as-converted basis). The balance

of any proceeds shall be distributed pro rata to holders of Common

Stock.

A merger or consolidation (other than one in which stockholders of

the Company own a majority by voting power of the outstanding

shares of the surviving or acquiring corporation) and a sale, lease,

transfer, exclusive license or other disposition of all or substantially

all of the assets of the Company will be treated as a liquidation event

(a Deemed Liquidation Event), thereby triggering payment of

the liquidation preferences described above. The Investors'

entitlement to their liquidation preference shall not be abrogated or

diminished in the event part of the consideration is subject to escrow

in connection with a Deemed Liquidation Event.

Voting Rights: The Series A Preferred shall vote together with the Common Stock

on an as-converted basis, and not as a separate class, except as

required by law. The Companys Certificate of Incorporation will

provide that the number of authorized shares of Common Stock may

be increased or decreased with the approval of a majority of the

Preferred and Common Stock, voting together as a single class, and

without a separate class vote by the Common Stock.

Protective Provisions: So long as shares of Series A Preferred are outstanding, in addition

to any other vote or approval required under the Companys Charter

or Bylaws, the Company will not, without the written consent of the

holders of at least 60% of the Companys Series A Preferred, either

directly or by amendment, merger, consolidation, or otherwise:

(i) liquidate, dissolve or wind-up the affairs of the Company, or

effect any merger or consolidation or any other Deemed

Liquidation Event; (ii) amend, alter, or repeal any

provision of the Certificate of Incorporation or Bylaws;

(iii) create or authorize the creation of or issue any other

security convertible into or exercisable for any equity

security, having rights, preferences or privileges senior to

or on parity with the Series A Preferred, or increase the

authorized number of shares of Series A Preferred; (iv)

purchase or redeem or pay any dividend on any capital

stock prior to the Series A Preferred, other than stock

repurchased from former employees or consultants in

connection with the cessation of their

employment/services, at the lower of fair market value or

cost; or (v) create or authorize the creation of any debt

security if aggregate indebtedness would exceed

$500,000; (vi) create or hold capital stock in any

Buffer term sheet - Series A_(palib2_7088552_3).DOC

subsidiary that is not a wholly-owned subsidiary or

dispose of any subsidiary stock or all or substantially all

of any subsidiary assets; or (vii) engage in any

transactions with affiliates.

Optional Conversion: The Series A Preferred initially converts 1:1 to Common Stock at

any time at option of holder, subject to adjustments for stock

dividends, splits, combinations and similar events and as described

below under Anti-dilution Provisions.

Anti-dilution Provisions: In the event that the Company issues additional securities at a

purchase price less than the current Series A Preferred conversion

price, such conversion price shall be adjusted in accordance with a

broad based weighted average formula.

The following issuances shall not trigger anti-dilution adjustment:

(i) securities issuable upon conversion of any of the Series A

Preferred, or as a dividend or distribution on the Series A

Preferred; (ii) securities issued upon the conversion of any

debenture, warrant, option, or other convertible security; (iii)

Common Stock issuable upon a stock split, stock dividend, or

any subdivision of shares of Common Stock; and (iv) shares of

Common Stock (or options to purchase such shares of Common

Stock) issued or issuable to employees or directors of, or

consultants to, the Company pursuant to any plan approved by

the Companys Board of Directors and at least 60% of the Series

A Preferred.

Mandatory Conversion: Each share of Series A Preferred will automatically be converted

into Common Stock at the then applicable conversion rate in the

event of the closing of a underwritten public offering with a price of

five times the Original Purchase Price (subject to adjustments for

stock dividends, splits, combinations and similar events) and gross

proceeds to the Company of not less than $40 million (a QPO), or

(ii) upon the written consent of the holders of 60% of the Series A

Preferred.

Redemption Rights: Unless prohibited by Delaware law governing distributions to

stockholders, the Series A Preferred shall be redeemable at the

option of holders of 60% of the Series A Preferred commencing any

time after the five year anniversary of the closing at a price equal to

the Original Purchase Price plus all accrued but unpaid dividends.

Redemption shall occur in three equal annual portions. Upon a

redemption request from the holders of 60% of the Series A

Preferred, all Series A Preferred shares shall be redeemed (except

Buffer term sheet - Series A_(palib2_7088552_3).DOC

for any Series A holders who affirmatively opt-out).

STOCK PURCHASE AGREEMENT

Representations and

Warranties:

Standard representations and warranties by the Company.

Conditions to Closing: Standard conditions to Closing, which shall include, among other

things, satisfactory completion of financial and legal due diligence,

qualification of the shares under applicable Blue Sky laws, the filing

of a Certificate of Incorporation establishing the rights and

preferences of the Series A Preferred, and an opinion of counsel to

the Company.

Counsel and Expenses: Company counsel to draft Closing documents which shall be based

as closely as possible on the National Venture Capital Association

forms located at www.nvca.org (provided, however, that Company

has existing Series AA Preferred Stock). Company to pay all legal

and administrative costs of the financing at Closing, including

reasonable fees (not to exceed $25,000) and expenses of Investor

counsel.

INVESTORS RIGHTS AGREEMENT

Registration Rights: Customary Registration Rights.

Management and Information

Rights:

A Management Rights letter from the Company, in a form

reasonably acceptable to the Investors, will be delivered prior to

Closing to each Investor that requests one.

Any Major Investor will be granted access to Company facilities and

personnel during normal business hours and with reasonable

advance notification. The Company will deliver to such Major

Investor (i) annual and quarterly financial statements, and other

information as determined by the Board; and (ii) thirty days prior to

the end of each fiscal year, a comprehensive operating budget

forecasting the Companys revenues, expenses, and cash position on

a month-to-month basis for the upcoming fiscal year. A Major

Investor means any Investor who purchases at least $250,000 of

Series A Preferred.

Right to Participate Pro Rata in

Future Rounds:

All Major Investors shall have a pro rata right, based on their

percentage equity ownership in the Company (assuming the

conversion of all outstanding Preferred Stock into Common Stock

and the exercise of all options outstanding under the Companys

stock plans), to participate in subsequent issuances of equity

securities of the Company (excluding those issuances listed at the

end of the Anti-dilution Provisions section of this Term Sheet. In

Buffer term sheet - Series A_(palib2_7088552_3).DOC

addition, should any Major Investor choose not to purchase its full

pro rata share, the remaining Major Investors shall have the right to

purchase the remaining pro rata shares.

RIGHT OF FIRST REFUSAL/CO-SALE AGREEMENT

Right of First Refusal/

Right of Co-Sale

(Take-Me-Along):

Company first and Investors second (to the extent assigned by the

Board of Directors,) will have a right of first refusal with respect to

any shares of capital stock of the Company proposed to be

transferred by all current and future holders of greater than 1% of

Company Common Stock (assuming conversion of Preferred Stock

and whether then held or subject to the exercise of options), with a

right of oversubscription for Investors of shares unsubscribed by the

other Investors. Before any such person may sell Common Stock,

he will give the Investors an opportunity to participate in such sale

on a basis proportionate to the amount of securities held by the seller

and those held by the participating Investors.

VOTING AGREEMENT

Board of Directors: The Series A Preferred shall not have a director. Collaborative Fund

shall have the right to designate one non-voting observer to attend

all meetings of the Board and committees.

OTHER MATTERS

No Shop/Confidentiality: The Company agrees to work in good faith expeditiously towards a

closing. The Company and the Founders agree that they will not,

for a period of 30 days from the date these terms are accepted, take

any action to solicit, initiate, encourage or assist the submission of

any proposal, negotiation or offer from any person or entity other

than the Investors relating to the sale or issuance, of any of the

capital stock of the Company and shall notify the Investors promptly

of any inquiries by any third parties in regards to the foregoing. The

Company will not disclose the terms of this Term Sheet to any

person other than officers, members of the Board of Directors and

the Companys accountants and attorneys and other potential

Investors acceptable to Collaborative Fund, as lead Investor, without

the written consent of the Investors.

Buffer term sheet - Series A_(palib2_7088552_3).DOC

EXECUTED as of September 26, 2014.

BUFFER, INC.

By:

Name: Joel Gascoigne

Title: CEO

COLLABORATIVE II, L.P.

By: Collab GP II, LLC

Its: General Partner

By:

Craig Shapiro

Managing Director

You might also like

- How YOU can find Venture Capital: A story of how I did it - and so can youFrom EverandHow YOU can find Venture Capital: A story of how I did it - and so can youNo ratings yet

- Sample Investment Term SheetDocument10 pagesSample Investment Term SheetBrrrody100% (2)

- Term Sheet Series A Template 1Document11 pagesTerm Sheet Series A Template 1David Jay Mor100% (1)

- TechStars Bridge Term Sheet-2Document3 pagesTechStars Bridge Term Sheet-2Josh WestermanNo ratings yet

- Term SheetDocument3 pagesTerm SheetSam AltmanNo ratings yet

- Draft Term Sheet for Angel Seed RoundDocument7 pagesDraft Term Sheet for Angel Seed RoundSiddharth SrinivasanNo ratings yet

- Sample Investment AgreementDocument4 pagesSample Investment AgreementJeyaramNo ratings yet

- A Guide To Venture Capital Term SheetsDocument22 pagesA Guide To Venture Capital Term Sheetsmlieberman0% (10)

- Term Sheet With AnnotationDocument8 pagesTerm Sheet With Annotationapi-3764496100% (1)

- Top Ten Term Sheet TricksDocument25 pagesTop Ten Term Sheet TrickslancertwiastNo ratings yet

- VC Term SheetDocument9 pagesVC Term Sheetapi-3764496100% (2)

- Founder Stock Purchase Agreement-Template-1Document10 pagesFounder Stock Purchase Agreement-Template-1David Jay Mor100% (2)

- Sample Liquidation Preference SpreadsheetDocument3 pagesSample Liquidation Preference SpreadsheetYokum100% (15)

- Negotiating The Term SheetDocument21 pagesNegotiating The Term SheetDaniel100% (6)

- Convertible Note Term Sheet-1Document1 pageConvertible Note Term Sheet-1Josh WestermanNo ratings yet

- Founders AgreementDocument10 pagesFounders AgreementZc100% (2)

- Startup Cap Table ModelDocument16 pagesStartup Cap Table ModelGiff Constable100% (2)

- Convertible Note Bridge Financing Term SheetDocument2 pagesConvertible Note Bridge Financing Term Sheetwchiang1226No ratings yet

- Cap Table and Returns TemplateDocument5 pagesCap Table and Returns TemplateDean Dorrell100% (1)

- Anti-Dilution Calculation (English Version)Document12 pagesAnti-Dilution Calculation (English Version)api-3764496100% (3)

- Cap Table and Returns TemplateDocument5 pagesCap Table and Returns TemplatedeepaknadigNo ratings yet

- Sample Post-Financing Cap TableDocument2 pagesSample Post-Financing Cap TablejamesfjensenNo ratings yet

- Founders AgreementDocument1 pageFounders AgreementScott RutherfordNo ratings yet

- Initial Cap Table Sample For Early Stage StartupDocument1 pageInitial Cap Table Sample For Early Stage StartupjamesfjensenNo ratings yet

- Founders Agreement Template - 1Document5 pagesFounders Agreement Template - 1David Jay Mor100% (5)

- Liquidation Preference Calculation (English Version)Document4 pagesLiquidation Preference Calculation (English Version)api-376449667% (3)

- Term Sheet EquityDocument8 pagesTerm Sheet EquitygargramNo ratings yet

- Understanding Valuation: A Venture Investor's PerspectiveDocument5 pagesUnderstanding Valuation: A Venture Investor's Perspectiveapi-3764496100% (2)

- Raising Seed Capital: Steve Schlafman (@schlaf) RRE VenturesDocument82 pagesRaising Seed Capital: Steve Schlafman (@schlaf) RRE Venturesrezurekt100% (2)

- Convertible Note Term Sheet Word TemplateDocument3 pagesConvertible Note Term Sheet Word TemplateGFSDGDSFGNo ratings yet

- TechstarsDocument4 pagesTechstarsfirstroundts100% (1)

- Convertible NoteDocument7 pagesConvertible NoteLegal Forms100% (2)

- Form Founders AgreementDocument7 pagesForm Founders AgreementjinNo ratings yet

- Founders Term SheetDocument4 pagesFounders Term Sheetcoxaqui0% (1)

- Convertible Promissory Note Template 1Document6 pagesConvertible Promissory Note Template 1David Jay Mor100% (5)

- Seed Funding Guide PDFDocument24 pagesSeed Funding Guide PDFGaurav TekriwalNo ratings yet

- SPAC LBO Structuring Model - 1Document7 pagesSPAC LBO Structuring Model - 1www.gazhoo.com100% (1)

- FounderAgreement StartupsDocument7 pagesFounderAgreement StartupsOnline Seller67% (6)

- Founders' Agreement for PROJECT NAMEDocument5 pagesFounders' Agreement for PROJECT NAMEZeeJohn123100% (2)

- Square's Pitch DeckDocument20 pagesSquare's Pitch Deckapi-204718852100% (12)

- Basic Term SheetDocument6 pagesBasic Term SheetDheeraj MalhotraNo ratings yet

- SAFE Note Post MoneyDocument6 pagesSAFE Note Post MoneySumit AggarwalNo ratings yet

- Convertible Debt Term Sheet SummaryDocument3 pagesConvertible Debt Term Sheet SummaryholtfoxNo ratings yet

- Equity Investment Agreement Template PDFDocument11 pagesEquity Investment Agreement Template PDFKevin J. Hammond100% (2)

- Cap TableDocument1 pageCap TabledarescribdNo ratings yet

- Post Money Safe User GuideDocument31 pagesPost Money Safe User GuideabermejoNo ratings yet

- Term Sheet for Potential Equity Investment in TextcentricDocument6 pagesTerm Sheet for Potential Equity Investment in TextcentricRecklessgod100% (1)

- Understanding Venture Capital Term SheetsDocument56 pagesUnderstanding Venture Capital Term SheetsninjaGuiden100% (17)

- Joint Venture AgreementDocument12 pagesJoint Venture AgreementPeter K Njuguna100% (1)

- Convertible Note Term SheetDocument2 pagesConvertible Note Term SheetVictorNo ratings yet

- Call Option Agreement SummaryDocument3 pagesCall Option Agreement SummaryMa. Angelica de Guzman100% (1)

- Entity Start-Up ChecklistDocument9 pagesEntity Start-Up Checklistsatva89% (9)

- Founders Pocket Guide Cap TableDocument10 pagesFounders Pocket Guide Cap TableVenkatesh Mahalingam100% (1)

- Collection of Pitch Decks From Venture Capital Funded StartupsDocument22 pagesCollection of Pitch Decks From Venture Capital Funded StartupsAlan Petzold50% (2)

- Founder Share Purchase and Vesting Agreement SummaryDocument15 pagesFounder Share Purchase and Vesting Agreement SummaryIafrawNo ratings yet

- ABS Term Sheet MasterDocument8 pagesABS Term Sheet MasterTae Suk ChangNo ratings yet

- Term Sheet - Series A - Template 6Document9 pagesTerm Sheet - Series A - Template 6Stephanie LimNo ratings yet

- Sample Term SheetDocument8 pagesSample Term SheetAnonymous 4rMVkArNo ratings yet

- Founder Friendly Standard Term Sheet 20200925aDocument6 pagesFounder Friendly Standard Term Sheet 20200925aAnne YipNo ratings yet

- Eventcombo - Series A Term Sheet - DraftDocument4 pagesEventcombo - Series A Term Sheet - DrafteduNo ratings yet

- Chapter 4-Art of WarDocument3 pagesChapter 4-Art of WarMaria Gracia MolinaNo ratings yet

- Affordable Lawn Care Financial StatementsDocument8 pagesAffordable Lawn Care Financial StatementsTabish TabishNo ratings yet

- Economics 102 Orange Grove CaseDocument21 pagesEconomics 102 Orange Grove CaseairtonfelixNo ratings yet

- Syllabus Consumer BehaviorDocument3 pagesSyllabus Consumer BehaviorDeepti ChopraNo ratings yet

- Western Regional OTB Audit 1Document18 pagesWestern Regional OTB Audit 1Sean MickeyNo ratings yet

- Basic Banking Tools and VocabularyDocument1 pageBasic Banking Tools and Vocabularyperrine11No ratings yet

- Yawa Final Najud Ni Chap 1-8Document76 pagesYawa Final Najud Ni Chap 1-8Karljefferson BalucanNo ratings yet

- Ajayr ResumeDocument2 pagesAjayr ResumeAjay YadavNo ratings yet

- Goodwill Questions and Their SolutionsDocument13 pagesGoodwill Questions and Their SolutionsAMIN BUHARI ABDUL KHADER100% (7)

- 2 Market ProblemDocument30 pages2 Market ProblemAnalizaViloriaNo ratings yet

- Istiqlal Ramadhan Rasyid - 11180820000040 - Latihan Soal AKM 1Ch.5Document3 pagesIstiqlal Ramadhan Rasyid - 11180820000040 - Latihan Soal AKM 1Ch.5Istiqlal RamadhanNo ratings yet

- Chapter Two Strategy Formulation (The Business Vision, Mission, and Values)Document14 pagesChapter Two Strategy Formulation (The Business Vision, Mission, and Values)liyneh mebrahituNo ratings yet

- Project Mahindra & Mahindra Limited: Submitted by Dhruv Kumar 2K11B11 Submitted To DR - Prachee MishraDocument25 pagesProject Mahindra & Mahindra Limited: Submitted by Dhruv Kumar 2K11B11 Submitted To DR - Prachee MishraDhruv KumarNo ratings yet

- Comparison of Mission Statements Mission Accomplished Bicon Shanta BiotechDocument32 pagesComparison of Mission Statements Mission Accomplished Bicon Shanta BiotechRachael SookramNo ratings yet

- Job Ad DetailsDocument12 pagesJob Ad DetailsYudhaNo ratings yet

- Mps international Class 11 business studies CASE STUDIESDocument7 pagesMps international Class 11 business studies CASE STUDIESRaghav Kanoongo100% (1)

- Welcome: Export Credit Guarantee Corporation of India (ECGC) Policies and GuaranteesDocument23 pagesWelcome: Export Credit Guarantee Corporation of India (ECGC) Policies and GuaranteesVinoth KumarNo ratings yet

- Caterpillar Tractor Co. FinalDocument11 pagesCaterpillar Tractor Co. FinalSanket Kadam PatilNo ratings yet

- Cba 2008-2009 PDFDocument10 pagesCba 2008-2009 PDFjeffdelacruzNo ratings yet

- 10 - Chapter 2 - Background of Insurance IndustryDocument29 pages10 - Chapter 2 - Background of Insurance IndustryBounna PhoumalavongNo ratings yet

- Starbucks Success Built on Ethics and QualityDocument19 pagesStarbucks Success Built on Ethics and QualityReuben EscarlanNo ratings yet

- Unit 9: Entrepreneurship and Small Business ManagementDocument36 pagesUnit 9: Entrepreneurship and Small Business ManagementShahrear AbirNo ratings yet

- Restaurant Social Media Marketing PlanDocument8 pagesRestaurant Social Media Marketing PlanFarah Al-ZabenNo ratings yet

- Learning SolutionsDocument28 pagesLearning SolutionsSRAVANSUJA100% (1)

- Book - Influence by Robert B CialdiniDocument18 pagesBook - Influence by Robert B CialdiniEjaz Bashir0% (1)

- Morgan Stanley 2022 ESG ReportDocument115 pagesMorgan Stanley 2022 ESG ReportVidya BarnwalNo ratings yet

- Parties & Their Role in Project FinanceDocument15 pagesParties & Their Role in Project FinanceBlesson PerumalNo ratings yet

- Ohsms Lead Auditor Training: Question BankDocument27 pagesOhsms Lead Auditor Training: Question BankGulfam Shahzad100% (10)

- OneChicago Fact SheetDocument1 pageOneChicago Fact SheetJosh AlexanderNo ratings yet

- Aastha Sharma CVDocument1 pageAastha Sharma CVaasthaNo ratings yet

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- The Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessFrom EverandThe Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessNo ratings yet

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (34)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000From EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Rating: 4.5 out of 5 stars4.5/5 (86)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsRating: 5 out of 5 stars5/5 (24)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)

- Note Brokering for Profit: Your Complete Work At Home Success ManualFrom EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNo ratings yet