Professional Documents

Culture Documents

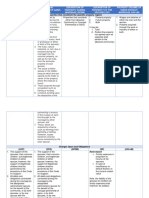

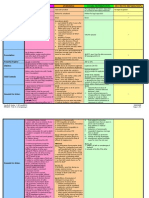

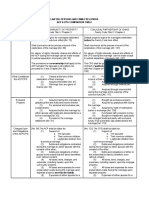

Matrix of Property Regime

Uploaded by

alyssamaesanaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Matrix of Property Regime

Uploaded by

alyssamaesanaCopyright:

Available Formats

ABSOLUTE COMMUNITY

REGIME

CONJUGAL PARTNERSHIP

OF GAINS

ABSOLUTE SEPARATION

PROPERTY REGIME OF

UNIONS WITHOUT

MARRIAGE

DEFINITION

A system of property relation

that treats properties acquired

by the spouses during their

marriage as jointly owned.

It is that formed by a husband

and his wife whereby they

place in a common fund the

fruits of their separate

property, and the income from

their work or industry, the

same to be divided between

them equally upon the

dissolution of the marriage or

the partnership.

The matrimonial property

regime agreed upon in the

marriage settlement by the

future spouses whereby

each spouse shall own,

dispose of, possess,

administer, and enjoy his or

her own separate estate and

earnings without the consent

of the other, with each

spouses proportionately

bearing the family expenses.

The property relations of

the parties during the

period of cohabitation:

a. Without the benefit of

marriage or when the

marriage is void, or

b. When one or both

partners are not

capacitated to marry,

as when one (or both)

has an existing or prior

marriage which has

not been

annulled/declared

void.

BASIS

Based essentially on mutual

trust and confidence between

the spouses and fosters

oneness and unity between

them. This is in fact the

tradition and custom among

the great majority of Filipinos

and this is the reason why the

Family Code adopts this

system instead of the

conjugal partnership of gains,

The capital or properties of

the spouses are kept

separate and distinct from the

benefits acquired by them

during the marriage. This

constitutes an insurmountable

obstacle to the presumption

of solidarity between the

spouses

Based on distrust

which is taken from Spanish

law.

ESTABLISHMENT

The default property regime

of the spouses.

When it has been agreed

upon in the marriage

settlement.

When it has been agreed

upon in the marriage

settlement.

GOVERNING RULES

The rules governing co-

ownership shall apply in all

matters not provided for in the

Family Code.

The conjugal partnership shall

be governed by the rules on

the contract of partnership in

all that is not in conflict with

what is expressly determined

in this Chapter or by the

spouses in their marriage

settlements.

Art. 143. Should the future

spouses agree in the

marriage settlements that

their property relations

during marriage shall be

governed by the regime of

separation of property, the

provisions of this Chapter

shall be suppletory.

a. The rul es of co-

ownershi p govern

the propert y

relationship of these

couples.

b. The special co-

ownership only covers

property acquired by

both parties through

their actual joint

contribution of money,

property or industry.

This is very similar to

an ordinary

partnership.

EFFECT

Parties deemed as co-owners

of properties they both own at

the time of the celebration of

marriage and those acquired

thereafter.

Parties retain ownership over

their respective properties.

All property acquired during

the marriage, whether the

acquisition appears to have

been made, contracted or

registered in the name of one

or both spouses, is presumed

Each spouse shall own,

dispose of, possess,

administer and enjoy his or

her own separate estate,

without need of the consent

of the other.

to be conjugal unless the

contrary is proved.

COMMENCEMENT

At the precise moment the

marriage is celebrated and

any stipulation allowing for

the commencement of such

system at a later time shall be

considered as void.

It begins at the precise

moment when the marriage is

celebrated, exactly like in

absolute community of

property.

If the future spouses failed to

choose the system of

complete separation

of properties in their

marriage settlements, it is

still possible for them to be

governed by this regime

during their marriage by

going to court for a judicial

order.

COVERAGE

Art. 91. Unless otherwise

provided in this Chapter or in

the marriage settlements, the

community property shall

consist of all the property

owned by the spouses at the

time of the celebration of the

marriage or acquired

thereafter.

1. Those acquired by

onerous title during the

marriage at the expense

of the common fund,

whether the acquisition be

for the partnership, or

for only of the spouses;

2. Those obtained from the

labor, industry, work or

profession of either

or both of the spouses;

3. The fruits, natural

industrial, or civil, due or

received during the

marriage from the

common property, as well

1. Wages and

sal ari es of ei ther

the man and the

woman

2. Propert y acqui red

through the work

or i ndustry of

ei ther or both

as the net fruits from the

exclusive property of each

spouse;

4. The share of either

spouse in the hidden

treasure which the law

awards to the finder or

owner of the property

where the treasure is

found;

5. Those acquired through

occupation such as fishing

or hunting;

6. Livestock existing upon

the dissolution of the

partnership in excess

of the number of each kind

brought to the marriage by

either spouse; and

7. Those, which are acquired

by chance, such as

winnings from gambling or

betting. However, losses

therefrom shall be borne

exclusively by the

loser-spouse.

EXCLUSIVE PROPERTIES

1. Property acquired during

the marriage by gratuitous

title by either spouse and

the fruits as well as the

income thereof, if any,

unless it is expressly

provided by the donor,

testator, or grantor that

they shall form part of the

community property.

2. Property for personal and

exclusive use of either

spouse. However, jewelry

shall form part of the

community property.

3. Property acquired before

the marriage by either

spouse who has legitimate

descendants by a former

marriage and the fruits as

well as the income, if any,

of such property.

1. That which is brought to

the marriage as his or her

own;

2. That which each acquires

during the marriage by

gratuitous title;

3. That which is acquired by

right of redemption, by

barter or by exchange with

property belonging to only

one of the spouses; and

4. That which is purchased

with exclusive money of

the wife or of the husband.

ADMI NISTRATION

Administration and enjoyment

of the community property

shall belong to both spouses

jointly.

The administration and

enjoyment of the conjugal

partnership shall belong to

both spouses jointly.

Parties are free to manage

their respective properties

without interference of the

other.

DONATION

Neither spouse may donate

any community property

without the consent of the

other.

Neither spouse may donate

any conjugal partnership

property without the consent

of the other.

Parties are free to donate

without interference of the

other.

DISSOLUTION

What is divided equally

between the spouses or their

heirs upon the dissolution and

liquidation of the community

property is the net remainder

of the properties of the

absolute community, so that it

may happen that a piece of

land owned by either spouse

before the marriage, being

the only property left after the

dissolution of the absolute

community, would be divided

between the spouses or their

heirs.

In the conjugal partnership of

gains, however, the separate

properties of the spouses are

returned upon the dissolution

of the partnership, and only

the net profits of partnership

are divided equally between

the spouses or their heirs.

LIQUIDATION

It is easier to liquidate the

absolute community property

because the net remainder of

the community properties is

just divided between the

spouses or their heirs.

The exclusive properties of

the parties will have to be

identified and returned, and

sometimes, this identification

is very difficult.

CHARGES AND OBLIGATIONS

Art. 94. The absolute

community of property shall

be liable for:

(1) The support of the

spouses, their common

children, and legitimate

children of either spouse;

however, the support of

illegitimate children shall be

governed by the provisions of

this Code on Support;

(2) All debts and obligations

contracted during the

marriage by the designated

administrator-spouse for the

benefit of the community, or

by both spouses, or by one

spouse with the consent of

the other;

(3) Debts and obligations

contracted by either spouse

without the consent of the

other to the extent that the

family may have been

benefited;

(4) All taxes, liens, charges

and expenses, including

major or minor repairs, upon

the community property;

(5) All taxes and expenses for

Art. 122. The payment of

personal debts contracted by

the husband or the wife

before or during the marriage

shall not be charged to the

conjugal properties

partnership except insofar as

they redounded to the benefit

of the family.

Neither shall the fines and

pecuniary indemnities

imposed upon them be

charged to the partnership.

However, the payment of

personal debts contracted by

either spouse before the

marriage, that of fines and

indemnities imposed upon

them, as well as the support

of illegitimate children of

either spouse, may be

enforced against the

partnership assets after the

responsibilities enumerated in

the preceding Article have

been covered, if the spouse

who is bound should have no

exclusive property or if it

should be insufficient; but at

the time of the liquidation of

Both spouses shall bear the

family expenses in

proportion to their income,

or, in case of insufficiency or

default thereof, to the current

market value of their

separate properties.

The liabilities of the spouses

to creditors for family

expenses shall, however, be

solidary.

mere preservation made

during marriage upon the

separate property of either

spouse used by the family;

(6) Expenses to enable either

spouse to commence or

complete a professional or

vocational course, or other

activity for self-improvement;

(7) Antenuptial debts of either

spouse insofar as they have

redounded to the benefit of

the family;

(8) The value of what is

donated or promised by both

spouses in favor of their

common legitimate children

for the exclusive purpose of

commencing or completing a

professional or vocational

course or other activity for

self-improvement;

(9) Antenuptial debts of either

spouse other than those

falling under paragraph (7) of

this Article, the support of

illegitimate children of either

spouse, and liabilities

incurred by either spouse by

reason of a crime or a quasi-

delict, in case of absence or

the partnership, such spouse

shall be charged for what has

been paid for the purpose

above-mentioned. (163a)

insufficiency of the exclusive

property of the debtor-

spouse, the payment of which

shall be considered as

advances to be deducted

from the share of the debtor-

spouse upon liquidation of the

community; and

(10) Expenses of litigation

between the spouses unless

the suit is found to be

groundless.

If the community property is

insufficient to cover the

foregoing liabilities, except

those falling under paragraph

(9), the spouses shall be

solidarily liable for the unpaid

balance with their separate

properties.

RULES IN GAME OF CHANCE

Art. 95. Whatever may be lost

during the marriage in any

game of chance, betting,

sweepstakes, or any other

kind of gambling, whether

permitted or prohibited by

law, shall be borne by the

loser and shall not be

charged to the community but

any winnings therefrom shall

form part of the community

property.

Art. 123. Whatever

may be lost during the

marriage in any game of

chance or in betting,

sweepstakes, or any other

kind of gambling whether

permitted or prohibited by

law, shall be borne by the

loser and shall not be

charged to the conjugal

partnership but any

winnings therefrom shall

form part of the conjugal

partnership property.

TERMINATION

Art. 99. The absolute

community terminates:

(1) Upon the death of either

spouse;

(2) When there is a decree of

legal separation;

(3) When the marriage is

annulled or declared void; or

(4) In case of judicial

separation of property during

the marriage under Article

134 to 138.

Art. 126. The conjugal

partnership terminates:

(1) Upon the death of either

spouse;

(2) When there is a decree of

legal separation;

(3) When the marriage is

annulled or declared void; or

(4) In case of judicial

separation of property during

the marriage under Articles

134 to 138

The co-ownership cannot

be terminated until the

cohabitation is also

terminated.

You might also like

- Matrix of Property RegimeDocument4 pagesMatrix of Property RegimeVince Llamazares Lupango67% (3)

- Absolute Vs Conjugal Leg ResearchDocument10 pagesAbsolute Vs Conjugal Leg ResearchJeric ReiNo ratings yet

- ABSOLUTE COMMUNITY, CONJUGAL PARTNERSHIP, SEPARATION OF PROPERTYDocument7 pagesABSOLUTE COMMUNITY, CONJUGAL PARTNERSHIP, SEPARATION OF PROPERTYMarella GarciaNo ratings yet

- Conjugal Partnership of GainsDocument10 pagesConjugal Partnership of GainsMikee RañolaNo ratings yet

- Absolute Community of Property vs. Conjugal Partnership of GainsDocument7 pagesAbsolute Community of Property vs. Conjugal Partnership of GainsJill LeaNo ratings yet

- Property Relations Bet Hus&Wife - Aug2015Document15 pagesProperty Relations Bet Hus&Wife - Aug2015Krissa Jennesca TulloNo ratings yet

- COMPARISON OF PROPERTY REGIMESDocument5 pagesCOMPARISON OF PROPERTY REGIMESLimar Anasco Escaso100% (13)

- PFR Table of Property RegimeDocument9 pagesPFR Table of Property RegimeKara Russanne Dawang Alawas100% (1)

- Title IV - Property Relations Between Husband and WifeDocument42 pagesTitle IV - Property Relations Between Husband and WifeJohn WeeklyNo ratings yet

- SYSTEM OF PROPERTY REGIMES DURING MARRIAGEDocument10 pagesSYSTEM OF PROPERTY REGIMES DURING MARRIAGEYubert ViosNo ratings yet

- Property Relations Between Husband and Wife October 2018Document141 pagesProperty Relations Between Husband and Wife October 2018Diwa BelleNo ratings yet

- Comparative Tables For Property Regime (Block B) PDFDocument11 pagesComparative Tables For Property Regime (Block B) PDFReinier Jeffrey AbdonNo ratings yet

- Table - Property RegimesDocument17 pagesTable - Property RegimesEamydnic Yap0% (1)

- Property RegimesDocument3 pagesProperty RegimesJeremy Llanda100% (3)

- Absolute Community of Property VsDocument5 pagesAbsolute Community of Property VsTimothy Mark MaderazoNo ratings yet

- Everything you need to know about Philippine property regimesDocument2 pagesEverything you need to know about Philippine property regimesjade123_129No ratings yet

- PERSONS Marriage MatrixDocument6 pagesPERSONS Marriage Matrixsaintkarri100% (1)

- ACP Vs CPGDocument3 pagesACP Vs CPGSGT100% (4)

- Property RegimeDocument4 pagesProperty RegimeGregOrlandoNo ratings yet

- Similarities and Differences Between Conjugal Partnership and Absolute CommunityDocument1 pageSimilarities and Differences Between Conjugal Partnership and Absolute Communityanne50% (2)

- Property Relations, Termination of Marriage and SuccessionDocument23 pagesProperty Relations, Termination of Marriage and SuccessionSidNo ratings yet

- ACP Vs CPG Vs CSPDocument4 pagesACP Vs CPG Vs CSPMatthew Henry Regalado100% (1)

- Persons and Family Relations Case DoctrinesDocument39 pagesPersons and Family Relations Case DoctrinesMaria Diory Rabajante100% (5)

- Category Absolute Community of Property Conjugal Partnership of Gains Separation of PropertyDocument6 pagesCategory Absolute Community of Property Conjugal Partnership of Gains Separation of Propertyann laguardiaNo ratings yet

- Property Relations Between SpousesDocument17 pagesProperty Relations Between SpousesmmaNo ratings yet

- ACP Vs CPG Comparison Table D2020Document3 pagesACP Vs CPG Comparison Table D2020Karlo KapunanNo ratings yet

- Property Relations Between Husband and WifeDocument8 pagesProperty Relations Between Husband and WifejanetNo ratings yet

- Last Minute Pointers on Political and International LawDocument18 pagesLast Minute Pointers on Political and International LawJanice Alvarez Gacusan AbbasNo ratings yet

- PFR Table of Property RegimeDocument10 pagesPFR Table of Property RegimeArianne Grace AberdeNo ratings yet

- Family Code ReviewerDocument65 pagesFamily Code Reviewerroansalanga96% (23)

- Nature of Legislative PowerDocument5 pagesNature of Legislative PowerChin T. OndongNo ratings yet

- I. Essay Questions. Do Not Repeat The Facts. A Yes or No Answer Without A Legal Basis Will Not Be Given Any PointDocument3 pagesI. Essay Questions. Do Not Repeat The Facts. A Yes or No Answer Without A Legal Basis Will Not Be Given Any PointLeonor LeonorNo ratings yet

- Matrix of Acp, CPG and Separation of PropertyDocument5 pagesMatrix of Acp, CPG and Separation of PropertyCristine Clea Cuadras100% (1)

- Property Relations Between Husband and Wife : What Is Marriage Settlement?Document8 pagesProperty Relations Between Husband and Wife : What Is Marriage Settlement?Memey C.No ratings yet

- Property Rights of Parties in Void UnionsDocument14 pagesProperty Rights of Parties in Void UnionsJona AddatuNo ratings yet

- Donations Propter NuptiasDocument3 pagesDonations Propter NuptiasBingkat MacarimbangNo ratings yet

- Persons and Family Relations NotesDocument52 pagesPersons and Family Relations NotesSai100% (1)

- Property RelationsDocument25 pagesProperty RelationsNimpa PichayNo ratings yet

- Penalties PDFDocument1 pagePenalties PDFTory WestmorelandNo ratings yet

- Rent Control Act limits increasesDocument3 pagesRent Control Act limits increasesizrah romatanNo ratings yet

- Requisites of Marriage and ExemptionsDocument28 pagesRequisites of Marriage and Exemptions黃诗玲No ratings yet

- Sample Questions of Persons and FRDocument2 pagesSample Questions of Persons and FRgaelanNo ratings yet

- PFR Notes PART 2Document11 pagesPFR Notes PART 2Hemsley Battikin Gup-ayNo ratings yet

- Para Sa PowerpointDocument22 pagesPara Sa PowerpointMemey C.No ratings yet

- Supreme Court case on ejectment and bankruptcy of a clinicDocument6 pagesSupreme Court case on ejectment and bankruptcy of a clinicCarla MartinezNo ratings yet

- Property RegimeDocument3 pagesProperty RegimeMissMsrhNo ratings yet

- ACP V CPGDocument2 pagesACP V CPGAnne100% (7)

- Property RegimeDocument13 pagesProperty RegimeVenus-Dominic CuetoandUntalascoNo ratings yet

- Bar Qs 1990 2015 Updated CRIMINAL LAWDocument101 pagesBar Qs 1990 2015 Updated CRIMINAL LAWmerren bloomNo ratings yet

- Distinctions Between DOMESTIC ADOPTION and ICADocument5 pagesDistinctions Between DOMESTIC ADOPTION and ICAKennerly Albert RosalesNo ratings yet

- Jurisdiction of SandiganbayanDocument2 pagesJurisdiction of SandiganbayanPaolo Tariman100% (1)

- Research Work 2Document8 pagesResearch Work 2Marc CosepNo ratings yet

- When Apply?: Difference of Conjugal Partnership From The System of Absolute CommunityDocument11 pagesWhen Apply?: Difference of Conjugal Partnership From The System of Absolute CommunityMemey C.No ratings yet

- Chapter 5 Gross Estate TaxDocument10 pagesChapter 5 Gross Estate TaxJohn Dominic Bobis ArtiagaNo ratings yet

- Conjugal Partnership of GainsDocument15 pagesConjugal Partnership of GainsCGNo ratings yet

- Conjugal Partnership of GainsDocument7 pagesConjugal Partnership of GainsKnotsNautischeMeilenproStundeNo ratings yet

- The Law On CONJUGAL PARTNERSHIP of GAINS of Properties in Simple Terms Shall Be Like ThisDocument6 pagesThe Law On CONJUGAL PARTNERSHIP of GAINS of Properties in Simple Terms Shall Be Like ThisfirstNo ratings yet

- Comparative Study On Property Regimes: Regime of Absolute Community of PropertyDocument5 pagesComparative Study On Property Regimes: Regime of Absolute Community of PropertyDah GeeNo ratings yet

- Conjugal PropertyDocument3 pagesConjugal PropertyMa Terresa TejadaNo ratings yet

- Distinction Between Absolute Community Property (Acp) and Conjugal Property of Gains (CPG)Document6 pagesDistinction Between Absolute Community Property (Acp) and Conjugal Property of Gains (CPG)Danielle Gumpad DolipasNo ratings yet

- 2nd Half Cases-Rulings OnlyDocument39 pages2nd Half Cases-Rulings OnlyalyssamaesanaNo ratings yet

- Cert of AppreciationDocument1 pageCert of AppreciationalyssamaesanaNo ratings yet

- Corporation Code Concept and Attributes of A CorporationDocument3 pagesCorporation Code Concept and Attributes of A CorporationalyssamaesanaNo ratings yet

- Comrev CasesDocument8 pagesComrev CasesalyssamaesanaNo ratings yet

- Manuel Vs PeopleDocument2 pagesManuel Vs PeoplealyssamaesanaNo ratings yet

- TARP Lettering-Bayanihan Sa Daan-11 Feb 2015Document4 pagesTARP Lettering-Bayanihan Sa Daan-11 Feb 2015alyssamaesanaNo ratings yet

- Bayanihan sa Daan Event Report Feb 2015Document5 pagesBayanihan sa Daan Event Report Feb 2015alyssamaesanaNo ratings yet

- Cert of AppreciationDocument1 pageCert of AppreciationalyssamaesanaNo ratings yet

- Banking Laws Deposit FunctionDocument1 pageBanking Laws Deposit FunctionalyssamaesanaNo ratings yet

- Family Relations Case Doctrines&DigestDocument37 pagesFamily Relations Case Doctrines&DigestalyssamaesanaNo ratings yet

- Torts Case Digests 10Document18 pagesTorts Case Digests 10alyssamaesanaNo ratings yet

- Torts Case Digests 9Document13 pagesTorts Case Digests 9alyssamaesanaNo ratings yet

- University of The East VsDocument1 pageUniversity of The East Vsmay_aliliNo ratings yet

- RA 6675 As Amended by RA 9700report1-8rev1Document56 pagesRA 6675 As Amended by RA 9700report1-8rev1alyssamaesanaNo ratings yet

- Time Filipino English English English Araling Panlipunan: Fc/HomeroomDocument1 pageTime Filipino English English English Araling Panlipunan: Fc/HomeroomDennis Orlando SangalangNo ratings yet

- Torts Case Digests 8Document19 pagesTorts Case Digests 8alyssamaesanaNo ratings yet

- Torts Case Digest 5Document13 pagesTorts Case Digest 5alyssamaesana100% (3)

- Torts Case Digests 7Document11 pagesTorts Case Digests 7alyssamaesanaNo ratings yet

- Vicarious liability of hotel manager for guest's negligenceDocument8 pagesVicarious liability of hotel manager for guest's negligencealyssamaesana100% (2)

- Torts Case Digest 5Document13 pagesTorts Case Digest 5alyssamaesana100% (3)

- Avatar Ltd 2009 EPS CalculationDocument4 pagesAvatar Ltd 2009 EPS CalculationchipsanddipsNo ratings yet

- 281 Kainantu Urban Local Level Government 281: Prepared By: Rosita Ben Tubavai A/financial ControllerDocument1 page281 Kainantu Urban Local Level Government 281: Prepared By: Rosita Ben Tubavai A/financial ControllerMichael MotanNo ratings yet

- Tender Document Warehouse (Financial)Document518 pagesTender Document Warehouse (Financial)Aswad TonTong100% (3)

- Trust Preferred CDOs A Primer 11-11-04 (Merrill Lynch)Document40 pagesTrust Preferred CDOs A Primer 11-11-04 (Merrill Lynch)scottrathbun100% (1)

- Aftermarket Magazine PDFDocument68 pagesAftermarket Magazine PDFEvgénios SangmorteyNo ratings yet

- Classification of AccountsDocument4 pagesClassification of Accountsvikas sunnyNo ratings yet

- PPR 218 Key Steps To Retirement Income PlanningDocument9 pagesPPR 218 Key Steps To Retirement Income PlanningMaria CeciliaNo ratings yet

- Loan Disbursement and Recovery Procedures of BKBDocument10 pagesLoan Disbursement and Recovery Procedures of BKBFarhanChowdhuryMehdiNo ratings yet

- 1) Abn Amro BankDocument7 pages1) Abn Amro BankAbhi MaheshwariNo ratings yet

- Fulton Iron Vs China BankiingDocument5 pagesFulton Iron Vs China BankiingMacris MallariNo ratings yet

- of Ratio AnalysisDocument9 pagesof Ratio AnalysisAkanksha Rani100% (1)

- Final Report Aman DwivediDocument48 pagesFinal Report Aman Dwivediaman DwivediNo ratings yet

- SP ProjectDocument14 pagesSP ProjectVyankatesh KarnewarNo ratings yet

- Supporting Papers For RetirementDocument5 pagesSupporting Papers For RetirementKatherine DahangNo ratings yet

- Acceptance&discharge-State Home Mortgage, Atlanta, GaDocument13 pagesAcceptance&discharge-State Home Mortgage, Atlanta, GaTiyemerenaset Ma'at El82% (17)

- Venture Capital: By: Soumya Mishra Roll: 14MBA021Document29 pagesVenture Capital: By: Soumya Mishra Roll: 14MBA021hhaiderNo ratings yet

- Deprival Value and Tobin's Q ExplainedDocument16 pagesDeprival Value and Tobin's Q ExplainedKartik Raj VarshneyNo ratings yet

- Real Estate Broker License RequirementsDocument42 pagesReal Estate Broker License RequirementsYamada KunNo ratings yet

- BITCOIN HALVING EXPLAINEDDocument11 pagesBITCOIN HALVING EXPLAINEDPieter SteenkampNo ratings yet

- CV JustDocument41 pagesCV JustArnel M. MapaNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal AdviceAartiNo ratings yet

- POST OFFICE ACCOUNT OPENINGDocument2 pagesPOST OFFICE ACCOUNT OPENINGRajdeep BanerjeeNo ratings yet

- Insurance Digest CaseDocument6 pagesInsurance Digest CaseDelbertBaldescoNo ratings yet

- EVN Jahresfinanzbericht 2011 12 deDocument95 pagesEVN Jahresfinanzbericht 2011 12 deLiv MariaNo ratings yet

- 1) SEBI Issue of Capital and Disclosure Requirements (ICDR) Regulations 2009Document12 pages1) SEBI Issue of Capital and Disclosure Requirements (ICDR) Regulations 2009Shasha GuptaNo ratings yet

- Upstream - Petroleum Economic AspectsDocument5 pagesUpstream - Petroleum Economic AspectsediwskiNo ratings yet

- HR QueriesDocument6 pagesHR Queriesfrancy_rajNo ratings yet

- PPE ACQUISITION COSTDocument4 pagesPPE ACQUISITION COSTsabina del monteNo ratings yet

- Tire City-Spread SheetDocument6 pagesTire City-Spread SheetVibhusha SinghNo ratings yet

- G Holdings Vs National Mines and Allied Workers UnionDocument1 pageG Holdings Vs National Mines and Allied Workers UnionKrizea Marie DuronNo ratings yet