Professional Documents

Culture Documents

Adjusting Entries

Uploaded by

aleemuddinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adjusting Entries

Uploaded by

aleemuddinCopyright:

Available Formats

ArabBritishAcademyforHigherEducation.

www.abahe.co.uk

1

Adjusting Entries

Adjusting entries are journal entries made at the end of the accounting period to allocate

revenue and expenses to the period in which they actually are applicable. Adjusting

entries are required because normal journal entries are based on actual transactions, and

the date on which these transactions occur may not be the date required to fulfill the

matching principle of accrual accounting.

The two major types of adjusting entries are:

Accruals: for revenues and expenses that are matched to dates before the

transaction has been recorded.

Deferrals: for revenues and expenses that are matched to dates after the

transaction has been recorded.

Accruals

Accrued items are those for which the firm has been realizing revenue or expense without

yet observing an actual transaction that would result in a journal entry. For example,

consider the case of salaried employees who are paid on the first of the month for the

salary they earned over the previous month. Each day of the month, the firm accrues an

additional liability in the form of salaries to be paid on the first day of the next month, but

the transaction does not actually occur until the paychecks are issued on the first of the

month. In order to report the expense in the period in which it was incurred, an adjusting

entry is made at the end of the month. For example, in the case of a small company

accruing $80,000 in monthly salaries, the journal entry might look like the following:

Date Account Titles & Explanation Debit Credit

9/30 Salary expense 80,000

Salaries payable 80,000

Salaries accrued in September,

to be paid on Oct 1.

In theory, the accrued salary could be recorded each day, but daily updates of such

accruals on a large scale would be costly and would serve little purpose - the adjustment

only is needed at the end of the period for which the financial statements are being

prepared.

ArabBritishAcademyforHigherEducation.

www.abahe.co.uk

2

Some accrued items for which adjusting entries may be made include:

Salaries

Past-due expenses

Income tax expense

Interest income

Unbilled revenue

Deferrals

Deferred items are those for which the firm has recorded the transaction as a journal

entry, but has not yet realized the revenue or expense associated with that journal entry.

In other words, the recognition of deferred items is postponed until a later accounting

period. An example of a deferred item would be prepaid insurance. Suppose the firm

prepays a 12-month insurance policy on Sep 1. Because the insurance is a prepaid

expense, the journal entry on Sep 1 would look like the following:

Date Account Titles & Explanation Debit Credit

9/1 Prepaid Expenses 12,000

Cash 12,000

12-month prepaid insurance policy.

The result of this entry is that the insurance policy becomes an asset in the Prepaid

Expenses account. At the end of September, this asset will be adjusted to reflect the

amount "consumed" during the month. The adjusting entry would be:

Date Account Titles & Explanation Debit Credit

9/30 Insurance Expense 1,000

Prepaid Expenses 1,000

Insurance expense for Sep.

This adjusting entry transfers $1000 from the Prepaid Expenses asset account to the

Insurance Expense account to properly record the insurance expense for the month of

September. In this example, a similar adjusting entry would be made for each subsequent

month until the insurance policy expires 11 months later.

Some deferred items for which adjusting entries would be made include:

Prepaid insurance

Prepaid rent

Office supplies

Depreciation

Unearned revenue

ArabBritishAcademyforHigherEducation.

www.abahe.co.uk

3

In the case of unearned revenue, a liability account is credited when the cash is received.

An adjusting entry is made once the service has been rendered or the product has been

shipped, thus realizing the revenue.

Completing the Adjusting Entries

To prevent inadvertent omission of some adjusting entries, it is helpful to review the ones

from the previous accounting period since such transactions often recur. It also helps to

talk to various people in the company who might know about unbilled revenue or other

items that might require adjustment

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Print - Udyam Registration Certificate AnnexureDocument2 pagesPrint - Udyam Registration Certificate AnnexureTrupti GhadiNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Chapter 7 Variable CostingDocument47 pagesChapter 7 Variable CostingEden Faith AggalaoNo ratings yet

- Is Pakistan Ready for Fintech GrowthDocument32 pagesIs Pakistan Ready for Fintech GrowthHaidar MustafaNo ratings yet

- ItlDocument9 pagesItlStephen BridgesNo ratings yet

- Asset Requisition Form: A. Requesting PersonDocument1 pageAsset Requisition Form: A. Requesting PersonaleemuddinNo ratings yet

- INKP - Annual Report - 2018 PDFDocument225 pagesINKP - Annual Report - 2018 PDFKhairani NisaNo ratings yet

- DEBTOR CONFIRMATION TEMPLATE INSTRUCTIONSDocument4 pagesDEBTOR CONFIRMATION TEMPLATE INSTRUCTIONSaleemuddinNo ratings yet

- Navi Mumbai MidcDocument132 pagesNavi Mumbai MidcKedar Parab67% (15)

- 6.3-5 - Preventive Maintenance Inspection FormDocument3 pages6.3-5 - Preventive Maintenance Inspection FormaleemuddinNo ratings yet

- How To Start An Independent School (And Keep It Going) : Philosophy of EducationDocument2 pagesHow To Start An Independent School (And Keep It Going) : Philosophy of EducationaleemuddinNo ratings yet

- Printing Request Form: A. Requesting PersonDocument1 pagePrinting Request Form: A. Requesting PersonaleemuddinNo ratings yet

- 6.3-4 - Clear Form For Assets PurchaseDocument3 pages6.3-4 - Clear Form For Assets PurchasealeemuddinNo ratings yet

- SF 5.6-3 CEO format rules letterDocument1 pageSF 5.6-3 CEO format rules letteraleemuddinNo ratings yet

- 6.3-4 - Clear Form For Assets PurchaseDocument3 pages6.3-4 - Clear Form For Assets PurchasealeemuddinNo ratings yet

- 6.3-1 - Item Request & Issue Form RV02Document1 page6.3-1 - Item Request & Issue Form RV02aleemuddinNo ratings yet

- Passport Request FormDocument1 pagePassport Request FormaleemuddinNo ratings yet

- 5.5-28 - Admin Department SurveyDocument2 pages5.5-28 - Admin Department SurveyaleemuddinNo ratings yet

- Deewan Sagar SiddiqueDocument210 pagesDeewan Sagar SiddiqueHafizAsrarAhmadNo ratings yet

- Duty Resume ReportDocument1 pageDuty Resume ReportaleemuddinNo ratings yet

- Ambil Ini Lagi (COA)Document15 pagesAmbil Ini Lagi (COA)Andris KefaNo ratings yet

- Ambil Ini Lagi (COA)Document15 pagesAmbil Ini Lagi (COA)Andris KefaNo ratings yet

- Standard CostingDocument73 pagesStandard Costingniteshm4uNo ratings yet

- 61 Unit Cost CalcsDocument18 pages61 Unit Cost CalcsSantosh ThakurNo ratings yet

- Basics of BudgetingDocument2 pagesBasics of BudgetingaleemuddinNo ratings yet

- Mintwise Regular Commemorative Coins of Republic IndiaDocument4 pagesMintwise Regular Commemorative Coins of Republic IndiaChopade HospitalNo ratings yet

- The Millennium Development Goals Report: United NationsDocument21 pagesThe Millennium Development Goals Report: United Nationshst939No ratings yet

- Monitoring Local Plans of SK Form PNR SiteDocument2 pagesMonitoring Local Plans of SK Form PNR SiteLYDO San CarlosNo ratings yet

- Economics ProjectDocument15 pagesEconomics ProjectAniket taywadeNo ratings yet

- 2nd Annual Latin America Rail Expansion SummitDocument16 pages2nd Annual Latin America Rail Expansion SummitenelSubteNo ratings yet

- Aec 2101 Production Economics - 0Document4 pagesAec 2101 Production Economics - 0Kelvin MagiriNo ratings yet

- Ch-3 Financial Market in BangladeshDocument8 pagesCh-3 Financial Market in Bangladeshlabonno350% (1)

- Samurai Craft: Journey Into The Art of KatanaDocument30 pagesSamurai Craft: Journey Into The Art of Katanagabriel martinezNo ratings yet

- ISLAMIYA ENGLISH SCHOOL MONEY CHAPTER EXERCISESDocument1 pageISLAMIYA ENGLISH SCHOOL MONEY CHAPTER EXERCISESeverly.No ratings yet

- Questionnaire Fast FoodDocument6 pagesQuestionnaire Fast FoodAsh AsvinNo ratings yet

- Rationale Behind The Issue of Bonus SharesDocument31 pagesRationale Behind The Issue of Bonus SharesSandeep ReddyNo ratings yet

- Oil Industry of Kazakhstan: Name: LIU XU Class: Tuesday ID No.: 014201900253Document2 pagesOil Industry of Kazakhstan: Name: LIU XU Class: Tuesday ID No.: 014201900253cey liuNo ratings yet

- 01 Fairness Cream ResearchDocument13 pages01 Fairness Cream ResearchgirijNo ratings yet

- Chapter 16 Planning The Firm's Financing Mix2Document88 pagesChapter 16 Planning The Firm's Financing Mix2api-19482678No ratings yet

- Internship Report On An Analysis of Marketing Activities of Biswas Builders LimitedDocument45 pagesInternship Report On An Analysis of Marketing Activities of Biswas Builders LimitedMd Alamin HossenNo ratings yet

- Manual Book Vibro Ca 25Document6 pagesManual Book Vibro Ca 25Muhammad feri HamdaniNo ratings yet

- Kobra 260.1 S4Document1 pageKobra 260.1 S4Mishmash PurchasingNo ratings yet

- Sample Project AbstractDocument2 pagesSample Project AbstractJyotiprakash sahuNo ratings yet

- Customer Master Data Views in CMDDocument22 pagesCustomer Master Data Views in CMDVasand SundarrajanNo ratings yet

- DCC 135Document193 pagesDCC 135Shariful IslamNo ratings yet

- AssignmentDocument1 pageAssignmentdibakar dasNo ratings yet

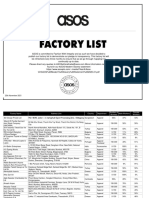

- ASOS Factory List November 2021 Final ListDocument45 pagesASOS Factory List November 2021 Final Listishika maluNo ratings yet

- DBBL (Rasel Vai)Document1 pageDBBL (Rasel Vai)anik1116jNo ratings yet

- 2020 Retake QuestionsDocument8 pages2020 Retake Questionsayy lmoaNo ratings yet

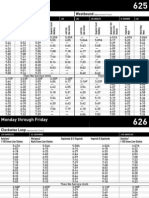

- LA Metro - 625-626Document4 pagesLA Metro - 625-626cartographicaNo ratings yet