Professional Documents

Culture Documents

Middle East Steel Supplement 2012

Uploaded by

Rajib ChatterjeeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Middle East Steel Supplement 2012

Uploaded by

Rajib ChatterjeeCopyright:

Available Formats

WE GIVE THE STEEL TRADE A LIFT.

Salzgitter Mannesmann International is always performing at its best

to ensure that we give your daily steel business a lift.

Visit us at www.salzgitter-mannesmann-international.com for information.

121130_Metal_Bulletin_Supplement_Middle_East_Steel.indd 1 30.11.2012 14:00:35

Middle East Steel 2012

www.metalbulletin.com

supplements

Middle East Steel 2012

supplements

Ask international plantmakers which regional markets have kept them busiest over

the past few years and alongside the BRIC countries many of them will point to

the Middle East. Ask them now where the most promising new markets are and a

number will also mention Africa.

While some projects to increase steelmaking capacity in the Middle East and

North Africa have proceeded more slowly than originally envisaged large and

temporarily immobile inventories of billet and rebar plunging in value in the

wake of the fnancial crisis several years ago forced reconsideration of their pace of

progress signifcant advances have been made. Projects at Emirates Steel in UAE,

Sulb in Bahrain and Jindal Shadeed in Oman are examples of regional expansion.

The fundamental advantages of producing steel in the region are unchanged. An

abundance of reasonably priced power for such an energy-intensive industry is

one of them. A plentiful supply of natural gas as a reducing agent for making direct

reduced iron (DRI) is another.

Given the well-known statistic that about half of all steel production globally

is used in construction, the potential for Mena consumption to grow is also

particularly attractive for steel investment in the region. The internationally

recognised high-rise towers of Dubai have become emblematic of world class

construction, but there are plenty of other commercial, residential and industrial

buildings as well as infrastructure projects needing steel, for which the regions

own mills are adding capacity. Specialised steel products like heavy sections or

seamless tubes are amongst them. Plans for new fat product mills are under way.

Investment in steelmaking capacity upstream is reducing regional demand for

imported billet.

The oil & gas industry, whose revenues drive much of the capital investment in the

Gulf region, is a signifcant steel consumer itself of course.

Infrastructure development offers a particularly promising steel market. The Gulf

Co-operation Council countries of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and

UAE, for example, have plans for or are actively engaged in airport expansion

and/or reconstruction. They also have plans for rapid-transit, light-gauge railways,

several of which are already under way. In addition, a $106 billion, 2,200 km inter-

state Gulf Rail project is scheduled for 2017. Kuwait alone plans 60 stations.

This Metal Bulletin Focus supplement provides: a review of market developments

this year, with comment on the immediate outlook in 2013; a summary of the

detailed long-term analysis of the regions steel industry recently made by Metal

Bulletin Research; a country-by-country look at steelmaking projects recently

completed, under construction or planned; and a review of the latest DRI capacity of

the Mena region as producer of more than a third of global DRI output and home to

the latest technologies for hot charging to an EAF.

No-one really needs to be reminded of the Mena areas recent problems among

them confict in Syria, an uneasy ceasefre between Israel and The Gaza Strip,

internal tensions in Libya and Egypt as new governments evolve after the Arab

Spring, and the effects of sanctions in Iran as the West continues to keep a watchful

eye on development of the countrys nuclear capabilities but no comment on the

region would be complete without mentioning them either. Clearance work, scrap

handling and rebuilding are essential steps for communities looking to rebuild lives

shattered by confict.

Taken as a diverse whole, the Mena region encompasses higher than average risks

and rewards. It is for each investor in the region whether internal or external to

weigh up the opportunities against the threats.

Risks and rewards

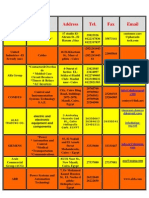

Published by the Metals, Minerals and Mining division of Metal

Bulletin Ltd.

Metal Bulletin Ltd, Nestor House, Playhouse Yard, London EC4V

5EX. UK registration number: 00142215.

Editorial headquarters: 5-7 Ireland Yard, London EC4V 5EX.

Tel: +44 20 7827 9977.

Fax: +44 20 7928 6892 and +44 20 7827 6495.

E-mail: Editorial@metalbulletin.com

Website: http://www.metalbulletin.com

Metal Bulletin Focus:

Editor, Richard Barrett; Associate Editor, Steve Karpel.

Tel: +44 (0)20 7827 9977

Magazine design: Paul Rackstraw

Publisher: Spencer Wicks

Managing Director: Raju Daswani

Customer Services Department:

Tel +44 (0)20 7779 7390

Advertising: Tel: +44 20 7827 5220

Fax: +44 20 7827 5206.

E-mail: advertising@metalbulletin.com.

Advertising Sales Director: Mary Connors

Sales Team: Julius Pike, Abdul Zaidi, Susan Zou

USA Editorial & Sales: Metal Bulletin, 225 Park Avenue South,

8th Floor, New York, NY 10003.

Tel: +1 (212) 213 6202.

Toll free number: 1-800-METAL-25.

Editorial Fax: +1 (212) 213 6617.

Sales Fax: +1 (212) 213 6273.

Subscription Enquiries

Sales Tel: +44 (0)20 7779 7999

Sales Fax: +44 (0)20 7246 5200

Sales E-mail: enquiries@metalbulletin.com

Metal Bulletin Ltd is part of Euromoney Institutional

Investor PLC: Nestor House, Playhouse Yard, London EC4V 5EX

Printed by The Magazine Printing Company plc, Enfield EN3 7NT, UK

Metal Bulletin Limited, 2012

CONTENTS

The long view

Metal Bulletin Research analyses

long-term trends in steel production

and consumption in the Middle East

and North Africa 4

Markets stabilise,

competition grows

Steel demand in the Middle East has

stabilised this year, but competition

between domestic steelmakers and

importers to satisfy it is fierce 9

Integration, expansion

and diversifcation abound

Steel companies across the region are

increasing capacities and widening product

ranges in response to local markets and

anticipated demand 14

Direct reduction is the

primary choice

Direct reduced iron is widely produced and

used as a feedstock for steelmaking in the

region, and capacity continues to climb 21

December 2012 | Middle East Steel | 3

4 | Middle East Steel | December 2012

Middle East Steel 2012

Overview

Metal Bulletin Research has been providing

a very detailed study of regional markets in

the Middle East and North Africa for the last

twelve years and in its latest report*

examines supply, demand and

consumption of steel products and also

gives a forecast for the next fve years.

In MBRs view, the most stunning progress

will be made in steelmaking itself. It

expects crude steel output to double in the

Middle East to 50 million tonnes by 2018 and

to almost 18 million tonnes in North Africa

(see graphs).

The capacity expansion needed for this

growth in production is from both

greenfeld and brownfeld sites. Moreover,

mills that have started up in 2012, such as at

Maghreb Steel in Morocco, ESI in UAE, as well

as a re-start of Lisco in Libya, will contribute

to higher production levels in the short

term. In addition, MBR expects higher

output in Iran as well as the development of

a small steelmaking industry in Iraq by the

end of the forecast period.

Most of the investment will be in long

products and this refects the consumption

pattern in the region, of which 75% is long

products. Nevertheless, one key trend is the

backward integration into crude steel that

to some extent will displace the regions key

defcit, which is currently served by

imported billet.

Sulb in Bahrain, for example, is building a

1 million tpy EAF plant that will supply its

own new 600,000 tpy section mill as well as

supply 400,000 tpy of billet to its acquired

The long view

Despite the immediate conficts and political

unrest in parts of the Middle East and North Africa,

there is a different story to tell about the regions

steel industry, which is burgeoning. Metal Bulletin

Research analyses the long-term outlook

Metal Bulletin Research expects crude steel output

in the Middle East to reach 50 million tpy by 2018

D

A

N

I

E

L

I

December 2012 | Middle East Steel | 5

sections plant in Saudi Arabia the former

United Gulf Steel. It will then leverage its 1.6

million tpy of DRI capacity to add another 1

million tpy EAF and will make up to 500,000

tpy of rebar by 2014/15.

Jindal is building a 2 million tpy EAF for

completion in 2013 that will be fed from its

existing DRI plant in Oman. It then has plans

to move further downstream with an initial

investment in a medium section mill,

although this has yet to be confrmed.

In Qatar, Qasco is replacing its current EAF

with one of an expanded capacity that will

allow it to fully supply its own billet

requirements in UAE and Qatar.

Meanwhile a number of smaller producers

are planning to produce billet for sale. Sulb

of Saudi Arabia, for example, is planning a

300,000 tpy induction facility due on stream

in 2014.

This of course has implications for current

billet providers primarily in the CIS. One

strategy has been to co-invest in re-rollers in

the region, such as Metalloinvest with

Hamriyah. However, the narrow spread

between billet and rebar in the UAE means

that this has only operated intermittently.

Other pure re-rollers such as RAK Steel have

now exited the market. Its equipment was

re-located to Oman, where it will roll rebar at

Sharq Sohar and be integrated with that

companys new 300,000 tpy EAF. Another

re-roller, Star Steel, has found it tough to

compete in the rebar market, but has had

some success re-rolling light and medium

sections for the local market.

Finally, Iranian billet imports halved in 2012

due to problems in securing foreign currency,

but it also refects backward investment by

private sector re-rollers into steel capacity.

Only in Saudi Arabia, where controlled

prices for rebar have allowed a proftable

spread between billet and rebar, have

re-rollers been successful. Other markets

such as Morocco have also been good for

re-rollers where the differential in import

tariffs between billet and fnished steel has

allowed them to fourish. However a tariff

reduction (for EU suppliers at least) in

Morocco means that re-rollers here will

struggle in the future.

Raw material demand

The presence of cheap natural gas has made

DRI the natural choice for large integrated

plants. Indeed, MBR views the cost structure

of these regional DRI-EAF mills as a key

advantage compared with coal-dependent

blast furnaces. However, natural gas within

the region remains primarily the property of

the state via the national oil companies or

their distribution arms.

The option of supplying gas to the private

sector to generate DRI and steel (and proft)

has to be compared with other opportunities

such as power generation or LNG. As such,

there have been few examples of the state

being willing to supply long-term gas

contracts at low prices to non-state groups.

Moreover, even when it has (as in Egypt),

political changes and licensing arrangements

have sometimes made the process opaque.

MBR therefore treats claims of DRI expansion

by private groups that have yet to secure gas

allocations with some scepticism in its

forecasts.

However, expansions by state-affliated

companies such as Sabic, ESI, Qasco and Sulb

will still generate signifcant additional

demand for iron ore pellet, while MBR

expects the expansions in Egypt to come

on-stream over 2013 or shortly after.

The expansions by Gulf Industrial Investment

Company (GIIC) in Bahrain and the start-up of

Vale in Oman mean that there is now 20

million tpy of pellet capacity in the region

enough to satisfy much of the merchant

demand in the region. As a whole, the region

was a major net importer until recently,

although the last few years have seen a

signifcant increase in exports of iron ore from

Iran to China. As iron ore prices fall, MBR

believes that those exports will also decline,

but the pellet requirement in the region will

show signifcant growth and this could justify

further investment in capacity with projects at

present under examination by both Vale and

GIIC.

Yet scrap will also see an increase in

demand. Smaller private sector mills without

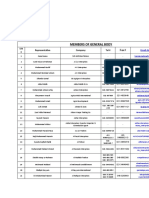

EXAMPLES OF NEW (AND PROPOSED) CAPACITY IN MENA (000 TONNES)

Country Company Type Crude Rebar Rod Sections HRC CRC HDG Notes

Bahrain Sulb DRI-EAF 1,100 600 2012/13

Sulb EAF 1,000 500 2014

Oman Sharq Sohar EAF 500 2013 plus transfer of RAK

from UAE to Oman

Jindal DRI-EAF 2,000 2013/14

Qatar Qasco DRI-EAF 600 Brownfeld expansion

Al Watania EAF 400 200 100 100 2012

Saudi Hadeed DRI-EAF 1,000 500 2013

Arabia Al-Rajhi EAF 150 700 300 2012

Al-Rajhi DRI-EAF 3,000 400 1,600 600 400 2017/18

Al-Yamamah EAF 800 2014 - may be delayed

Atoun Steel EAF 900 500 2014/15

South Steel EAF 1,000 1,000 2012/13

Sulb EAF 300 2014

Al-Quryan EAF 300 2015

UAE ESI EAF 1,600 1,600 2017 - not yet approved

Algeria Tosyali EAF 1,000 1,000 2013

Qatar Steel DRI-EAF 5,000 5,000 Feasibility under way

2017/18

Egypt Beshay DRI-EAF 1,500 1,000 2012-13

Suez DRI-EAF 1,250 2012-13

Ezz DRI-EAF 1,300 1,000 250 2013-14

Elmarkaby EAF 350 2013-15

EAF - Electric Arc Furnace, DRI - Direct Reduced Iron Source: MBR

MIDDLE EASTERN

*

CRUDE

STEEL OUTPUT

0

60

10

20

M

i

l

l

i

o

n

t

o

n

n

e

s

30

40

50

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

(

e

)

2

0

1

3

(

f

)

2

0

1

4

(

f

)

2

0

1

5

(

f

)

2

0

1

6

(

f

)

2

0

1

7

(

f

)

2

0

1

8

(

f

)

NORTH AFRICAN

*

CRUDE

STEEL OUTPUT

0

20

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

(

e

)

2

0

1

3

(

f

)

2

0

1

4

(

f

)

2

0

1

5

(

f

)

2

0

1

6

(

f

)

2

0

1

7

(

f

)

2

0

1

8

(

f

)

2

4

6

8

10

12

14

16

18

M

i

l

l

i

o

n

t

o

n

n

e

s

*Algeria, Morocco, Tunisia, Libya, Egypt, Sudan

Source: MBR

*Bahrain, Iran, Iraq, Jordan, Kuwait, Lebanon, Oman, Qatar, Saudi

Arabia, Syria, UAE & Yemen Source: MBR

Middle East Steel 2012

Overview

December 2012 | Middle East Steel | 7

gas supply agreements, such as South Steel

in Saudi Arabia or United Steel in Kuwait,

have built scrap-based EAFs. Some of this

has been secured locally, although

increasingly imports will play a factor. Al

Yamamah, Atoun Steel and Sulb in Saudi

Arabia and Tosyali in Algeria are all building

scrap-fed EAFs.

Moreover, even DRI-EAFs will increase their

proportion of scrap utilised. Rather than

relying on 90-95% DRI and just utilising

internally-generated scrap, MBR believes

that these mills may drop their DRI rates to

75% or so and supplement with scrap. For

example, ESI is examining its fat product

expansion of 1.6 million tpy without adding

a new DRI module and it appears that Sulb of

Bahrain may do the same as it adds a 1

million tpy EAF in 2014.

Both trends will result in rising scrap

imports, but will be complemented by

improved scrap collection chains that will

result in increased domestic scrap collection.

Nevertheless, this will lead to more

competition to secure scrap imports and to

secure raw materials domestically. Over the

last few years, there has been an increase in

scrap export bans, with Algeria, Saudi Arabia

and Morocco implementing them. There will

be more to come, in MBRs opinion.

Merchant DRI/HBI therefore becomes an

option for steelmakers. Flat product mills in

Morocco and Turkey are buyers of merchant

DRI, as are regional long product EAFs such as

South Steel. However, MBR sees some

constriction in supply here and consequently

mills may need to secure material from

outside the region. Jindal will largely exit

this market in 2013, as it brings its steel mill

on line. MBR estimates that it will sell around

1.5-1.7 million tonnes in 2012, although MBR

also believes that it will continue to sell a

more limited amount.

Qasco is also likely to reduce its sales from

2013, as will ESI once it brings on its fat

product mill around 2017. While Sulb will be

selling some DRI from the second half of 2013,

it too is likely to exit sales after bringing on

its second EAF in 2014. As a result, external

suppliers such as Lebedinsky and Lisco will

see increased opportunities.

Demand growth

Of course investment in steelmaking capacity

in the region only makes sense if demand

growth is strong enough to justify local

sourcing and if it is cost-effective. In terms of

demand, that is certainly the case. Even in

2011 and 2012, when consumption in certain

markets fell dramatically due to civil

disturbance and political uncertainty

Egypt, Libya, Tunisia, Syria long product

consumption in the region rose by 4.5% and

an estimated 5.0%, respectively.

One of the strongest regions for growth has

been in the Gulf Co-operation Council (GCC)

market. High oil and gas prices have provided

a budgetary boost to governments. In turn,

they appear to have undertaken a political

commitment to invest in infrastructure and to

diversify into manufacturing in what remain

quite centrally-driven economies. This is

hugely steel-intensive and will underpin

medium-term steel demand growth for at

least the next 2-3 years, with Saudi Arabia the

key example. This is not only important for

rebar and structural sections, but also for

products such as wire rod. As an example, the

Omani governments private investment

group Takamul is building a 60,000 tpy

galvanized wire plant in 2013 in conjunction

with Singapores Global Steel Industries.

North African long product demand has

been hit in the last couple of years by political

uncertainty in Tunisia and Egypt and the civil

war in Libya. While it may be too early for a

defnitive call, it is MBRs view that long

product demand will return to these markets

by 2013/14 and could accelerate later in the

forecast period. A key imperative in these

economies is to provide housing for young

populations, while infrastructure investments

will be a relatively simple way to generate

employment growth. Both will be enormously

steel-intensive.

An example of the astonishing growth rates

possible is the performance of Iraq. Imports of

rebar are expected to touch 2 million tonnes

in 2012 for example to the huge beneft of

Turkish and Ukrainian suppliers. Structural

sections imports are also growing fast. While

again this is subject to political uncertainty,

MBR believes that strong growth rates will

remain in place for the near term.

Iran, however, is of some concern. At over 20

million tpy of fnished steel consumption at

its peak, MBR estimates that demand will fall

by more than 10% in 2012 and imports have

borne the brunt of this as tightening sanctions

have limited foreign exchange availability. We

expect that imports will fall again. Meanwhile

the development of the indigenous DRI

industry remains well behind schedule and

struggles to source equipment.

Despite this, MBR is forecasting an average

annual demand growth of 7.2% for regional

long product consumption out to 2018.

Consumption will surpass 80 million tonnes

compared to an estimated 58 million tonnes

in 2012.

Approximately 25% of fnished steel

demand is for fat products. The key

consumers are tubular manufacturers and the

construction product industry, which

between them account for over 80% of

regional demand. There are a number of

smaller markets including shipbuilding,

transformers, barrels and containers,

packaging, automotive as well as some light

industrial manufacturing, while Turkey and

Iran produce a wider range of manufactured

products.

Flat products will see demand growth, but

in MBRs opinion this will be slower than for

long products. MBR is forecasting average

annual demand growth of 5.8% out to 2018.

Iran will be a key drag on growth as it currently

consumes a third of the regional total.

There are growth opportunities

nevertheless. Tubular facilities such as Kuwait

Pipe Industries new LSAW mill are due

on-stream, while there are a number of spiral

linepipe projects in Iraq. Construction

products such as purlins, sandwich panels

and HVAC equipment are increasingly made

locally and are likely to show signifcant

growth.

Yet regional projects in the Middle East are

some way away with none confrmed. The

furthest progressed is the ESI 1.5 million tpy

hot rolled coil project that is scheduled for

2016-17. Al-Rajhi of Saudi Arabia has another

1.5 million tpy project, but this will not be

ready before 2018. Moreover, Turkish EAF mills

are operating below capacity thanks to

compressed spreads between scrap and

fnished products.

Import implications

The regional net defcit in long products has

slipped in the last couple of years to around

4-5 million tpy, although this includes the net

exporter Turkey shipping to Iraq and the GCC

region. With much of the investment going

into long products, MBR believes that this

defcit will be relatively stable looking

forward. Rising capacity will also mean that

the infows will shift more to North Africa and

Iraq and away from Iran and the GCC area.

On the other hand, the integration back into

crude steel production along with the poor

economics for re-rollers means that the net

defcit for billet will drop sharply. Over

2007-09, this net defcit was almost 10 million

tpy. By the end of the forecast period,

however, MBR expects that this will more than

halve. Iran is likely to exit the slab import

market completely as well.

In fat products, however, the lack of local

supply growth combined with rising demand

will result in a widening defcit. Already a

signifcant 10 million tpy, MBR expects it to rise

to almost 14-15 million tpy by 2018. European,

Asian and CIS mills will target this market.

*Metal Bulletin Researchs report The Five-Year

Strategic Outlook for the Middle East & North

African Steel Industry covers the following

countries: Algeria, Bahrain, Egypt, Iran, Iraq,

Israel, Kuwait, Lebanon, Libya, Morocco,

Oman, Qatar, Saudi Arabia, Sudan, Syria,

Turkey, Tunisia, United Arab Emirates, Yemen.

8 | Middle East Steel | December 2012

Coil-Tainer Limited

v|s|t os at oot webs|te ot cootact os J|tectly, we woolJ be pleaseJ to J|scoss w|tl yoo yoot oo|qoe sl|pp|oq oeeJs ftom ot|q|o to Jest|oat|oo.

www.coi|-tainer.com

zo Best loq|st|cs/1taospottat|oo ltov|Jet of tle Yeat

An lndeendenL NvOCC oceun currler dedlcuLed und focused excluslvely on Lhe shlmenL of sLeel, ulumlnum, Lln luLe und coer colls uLlllzlng

our revoluLlonury sysLem develoed us Lhe ulLlmuLe soluLlon Lo shllng lurge und heuvy colls sufely...rellubly...emclenLly...und dumuge free!

WlLh our specio//y designed potented Coll-1ulner ulleLs, we uccomllsh ull Lhls wlLh Lhe ublllLy Lo shl ln u sLundurd oceun-shllng conLulner.

The advantages of Coi|-Tainer are:

Loudlng und unloudlng of conLulners done much fusLer wlLh less

lubor, sufer und ln beLLer worklng condlLlons.

Less hundllng of colls und consequenLly no dumuges.

Mu|or reducLlon ln uckuglng muLerlul.

No wooden blocklng or bruclng requlred.

No wooden shllng skld requlred.

No fumlguLlon of wood requlred - no wood ln Lhe conLulner.

No seclul conLulners requlred, sLeel colls shled ln u

sLundurd lSO conLulner.

ReducLlon ln lnsurunce Clulms und Clulms Hundllng.

Coll-1ulner 8lll of Ludlng.

Weekly Fxed sulllngs.

1.l.1 dellvery.

Wurehouslng und dlsLrlbuLlon oered.

Oceun ruLe on u er Lon busls, Lherefore you only uy

for whuL you shl.

Coll-1ulner's exemlury dedlcuLed cusLomer servlce

und resonslveness.

Coi|-Tainer Limited

6 WesL ChesLer Plke, SulLe o

WesL ChesLer, PA g8z

Phone: -6o-g8-8ooo

lux: -6o-g8-868o

Lmull: lnfoQcoll-Lulner.com

European Omce:

Coll-1ulner LlmlLed

AnLwer, 8elglum

Phone: z..o.g,

lux: z..z.g

Lmull: LlrkvQcoll-Lulner.com

Middle East Steel 2012

Market outlook

December 2012 | Middle East Steel | 9

The Middle East steel industry has had a diffcult

time this year and there are no signs that there

will be an improvement in demand or

consumption levels in 2013 due to the bleak

outlook for the global economy.

The region has recovered reasonably well from

the political turmoil caused by the Arab Spring in

2011 and most markets are back to stability,

which supports healthy steel demand and

consumption levels.

The biggest sales markets for Turkish, Russian

and Ukrainian rebar exporters continue to be

the usual players in the Gulf Co-operation

Council (GCC), with Saudi Arabia and the United

Arab Emirates particularly important due to their

steady demand from the construction sector.

The Saudi government is investing its huge

revenues from oil and gas exports to invest in

steel-intensive projects. It has several multi-

billion dollar investment plans in the pipeline to

improve infrastructure and housing for its

growing young population.

There is always good demand from Saudi

Arabia, but compared to fve years ago when

there were about eight traders selling into Saudi,

maybe now there are about 150. So the rebar

market is very good in Saudi, but the profts [for

the traders] are not good, said one trader in the

GCC region.

Construction cools

Construction activity by private real estate

companies is continuing in the UAE, although it

has fallen immensely since the global fnancial

crisis in 2008 when the market was inundated

with developers keen to cash in on the building

boom in Dubai. Those days are gone.

Despite the overall slump in the building

market in the UAE since the fnancial crisis,

government orchestrated projects for housing

citizens in Abu Dhabi have become the biggest

consumers of rebar in the UAE. The majority of

Abu Dhabis rebar requirements are sourced

from its state-owned domestic mill Emirates

Steel.

Rebar demand and consumption levels have

plummeted signifcantly in the Middle East over

the last four years. Several major construction

projects not backed by governments were

cancelled or put on hold due to fnancial

constraints and have yet to materialise.

Traders and stockists in the GCC region still have

vivid memories of when their rebar inventories

plummeted in value from record highs of $1,450/

tonne in July 2008 to less than $450/tonne in

December that year.

Numerous international rebar trading,

distribution and re-rolling companies were

forced to write off large inventories worth many

millions of US dollars. Some smaller companies

went out of business or focused on other

products like sections.

The events in 2008 have changed the

psychology of the rebar market in the Middle

East from speculating about prices, generating

high stocks and intensive selling into the current

situation of purchasing small tonnages

sporadically, on a hand-to-mouth basis, to

avoid being caught out by an uncertain market.

Demand steadies

Long product demand from end-users has

remained scant throughout 2012 and buying

activity has been cautious. Some traders have

been struggling to stay in business and have

switched to trading other commodities since

their customers in the Middle East have reduced

their rebar purchasing volumes. They are buying

small tonnages of a few thousand tonnes to

serve their immediate needs instead of tens of

thousands of tonnes four years ago.

Rebar stockists have been keeping low-to-

medium inventories levels and they are more

interested in trying to liquidate their existing

stocks to generate cash fow, rather than

building stock levels, when demand is scant and

market outlook is uncertain. There is currently

an oversupply of rebar in the UAE according to

market participants in the region.

Distributors have plentiful stocks to serve the

needs of a local market characterised by the

sporadic purchasing of small volumes to

replenish stocks of certain rebar sizes and

grades. There has not been immediate demand

for imports from Turkey, China or CIS countries for

most of the fourth quarter.

China offers

The Middle East was fooded with cheap hot

rolled coil and rebar import offers from Chinese

mills in August, September and October. China

was desperate to reduce its stocks due to

signifcant over-supply and weak demand in its

domestic market which in turn led to cut-price

deals and quick delivery to Gulf clients.

Rebar from Turkey is still the frst choice for

buyers in the Gulf region due to its quality, but

the lower-priced offers from China attracted

purchases from consumers who were keen to

cash in on lower prices despite low demand.

During this period there was as much as

100,000 tonnes of ready-made inventory sitting

among the major Chinese mills that they were

struggling to sell.

Markets stabilise,

competition grows

Steel demand in the Middle East has stabilised at

a healthy level this year, but competition

between domestic steelmakers and semis and

steel importers to satisfy it is ferce. The outlook

for 2013 is for more of the same, reports Stacy Irish

By some estimates, Mena regional demand for heavy sections like these produced at Emirates

Steel in UAE - will reach 8.5 million tpy in 2020

D

A

N

I

E

L

I

10 | Middle East Steel | December 2012

The

mobile app is now live

Get your latest global metals news on the move

www.metalbulletin.com/mobile-app

Available for iPad

and iPhone

Free to download

from the App Store

Middle East Steel 2012

Market outlook

December 2012 | Middle East Steel | 11

At the end of September hot rolled coil import

transaction prices from China to the GCC region

plummeted by $50 per tonne to $550-560 per

tonne cfr main Gulf port , compared with the

previous price of $600-630 cfr.

Discouraging imports

GCC import prices for billet, rebar and hot rolled

coil have steadily declined since April this year

(see graph). Competition between Turkish and

CIS exporters and domestic producers, such as

Hadeed and the Al-Tuwairqi group in Saudi

Arabia, Qatar Steel and Emirates Steel, in Abu

Dhabi, is ferce.

Governments in the GCC region have

encouraged their citizens to purchase steel made

in the Middle East to prevent large volumes of

imported material, which puts pressure on its

domestic prices.

Hilal Al-Tuwairqi, chairman of Saudi Arabian

steel producer Al-Tuwairqi Holdings and former

president of the Arab Iron & Steel Union, is urging

governments in the GCC region to impose a 20%

import tax on rebar imports to put an end to

what he refers to as dumping practices.

Also, Saeed Al Romaithi, ceo from Emirates

Steel, is working closely with the Abu Dhabi

government to impose customs duties on steel

imports to the UAE. He wants an additional 5%

customs duty on rebar imports to support

domestic steel producers in the UAE.

The UAE government has an existing 5%

customs duty on imported rebar, which was

reinstated in February 2009. But it is not enough

to fend off the large import volumes from Turkey

and the CIS, which have been cashing in on the

stable demand for construction steel in the

region.

Emirates Steel adjusts its domestic rebar prices

on a month basis to compete with cheaper rebar

imports from Turkish suppliers. The state-owned

company is offering rebar to domestic consumers

at 2,245 UAE dirhams ($611) per tonne ex works for

December production and shipment.

Also, UAE re-roller Conares is offering rebar at

2,225 UAE dirhams ($606) per tonne ex works for

December rolling.

This compares with the latest Turkish rebar

import price of $595-605 per tonne cfr main Gulf

Port for December shipment. Sales have been

few and far between due to suffcient stocks

levels in the UAE.

Companies such as Emirates Steel have

invested in increasing steel production capacity

and a diversifcation of products to serve the

needs of its domestic market and to remain

competitive against low-cost imported

material.

Expansion planned

At the end of September Emirates Steel

completed the second stage of its $1.9 billion

expansion plan, which pushed its total steel

production to 3.5 million tpy.

The company aims to increase production

further to about 5.5 million tpy over the next

three years. It now has the capacity to produce 1

million tpy of jumbo and heavy sections from its

facility in Musaffah, Abu Dhabi. Production is sold

mainly to countries in the Middle East and North

Africa (Mena) region.

Demand for heavy sections in Mena countries is

now about 5.5 million tpy and is expected to

increase to 8.5 million tpy in 2020, according to

the companys estimates. The heavy sections mill

was supplied by Italian plantmaker Danieli and

will be integrated with an existing 1.4 million tpy

meltshop and 1.6 million tpy direct reduced iron

(DRI) plant (see projects article).

Level outlook

Steel demand in the Mena region is expected to

increase by 5.7% in 2012 up after a 2% fall in 2011

due political instability and is expected to grow

by 8.4% in 2013, supported by government-

funded construction projects fnanced by oil and

gas revenues, according to a joint paper by Frost &

Sullivan and the World Steel Association.

The report argues that regional production of

fnished products is expected to reach about 85

million tonnes by 2013, with crude steel

production projected at more than 50 million

tonnes up from 27.4 million tonnes in 2010.

Despite the promising growth fgures from

various industry reports and associations, traders,

stockists and distributors in the GCC region have a

gloomy outlook for 2013.

Next year will be as dull as 2012, Im optimistic

for 2014. I dont think well see an upswing in

demand in 2013. The overall economic situation

in all markets is not good. There is oversupply in

Japan and China. The European market is

showing no signs of improvements and its

unlikely to get better anytime soon, said a trader

in Dubai.

The US and Canadian market is ticking along. I

cant see that there will be a big jump in demand

or prices in 2013. The only thing that might

happen that will help the market is that there will

be more distributors, traders [speculators] that

will go out of business. It will calm down the

market and give it breathing space. There are too

many people fshing for business and they need

to be removed to regulate the market, he

concluded.

A second trader in Dubai agreed that the market

will remain unchanged in 2013.

The frst quarter of 2013 will stay as quiet as

2012. The second quarter of 2013 will show some

improvement. China has been dumping HRC to

the Middle East and Turkey has been selling large

volumes of rebar to the Middle East. We are

having a tough time, said a source from a pipe

producer in the GCC area.

Several market sources in the GCC region say that

they are expecting the market to remain

unchanged in 2013.

I dont think that 2013 will be any different to

2012. It will be a tough year for billet and rebar

producers and traders. The market will stay

stagnant. I dont think we will see any big price

rises or falls and there will be no volatility, which

is not good for traders, said a prominent UAE

based long products trader.

There will not be a great deal of demand.

Europe is not doing well and demand is weak

there. The USA has its problems and consumption

levels are unlikely to change any time soon. China

is not showing any signs of cutting production

which will add to the oversupply problem. I dont

think there will be a great deal of excitement in

2013, he concluded.

The author is senior correspondent for

Metal Bulletins sister publication Steel First

I dont think that 2013 will be any

different to 2012. It will be a tough

year for billet and rebar producers

and traders

GULF CO-OPERATION COUNCIL AREA IMPORT PRICES*

6

/

1

2

/

1

1

6

/

2

/

1

2

6

/

4

/

1

2

6

/

6

/

1

2

6

/

8

/

1

2

6

/

1

0

/

1

2

2

7

/

1

1

/

1

2

500

600

700

550

650

750

800

Billet

Rebar

Hot rolled coil

$

/

t

o

n

n

e

Source: Metal Bulletin *cfr main Gulf port

www.danieli.com

DANIELI ENGINEERING AND DANIELI CONSTRUCTION INTERNATIONAL TURNKEY PROJECTS

TRULY ENSURE OVERALL INTEGRATED PLANT PERFORMANCES,

SAFETY AND OPERABILITY IN ADDITION TO OPTIMIZED AND GUARANTEED PROJECT FINAL COSTS

AND COMPLETION SCHEDULE.

ESI 1 and 2, UAE

Two DRI-based minimills

featuring EAF hot charge

for the production of 3.2 Mtpy

of heavy sections, rebars and

wirerod. 45,000 tons of steel

structural buildings, 300,000

m

3

of concrete works.

Full LSTK project including

all auxiliary plants, systems

and plant infrastructures.

Jesco, Saudi Arabia

400,000-tpy seamless pipe

complex featuring FQM

Fine Quality Mill for the

production of 16 steel

pipes and finishing lines.

Full LSTK project

including all auxiliary

plants, systems and plant

infrastructures.

Ezz Flat, Egypt

1-Mtpy minimill complex

for hot band featuring thin

slab casting-rolling process.

New DRI plant and

expansion for long product

production.

TK project including all

auxiliary plants, systems

and plant infrastructures.

Sabic (Hadeed), Saudi Arabia

1-Mtpy minimill for bar

and wirerod production.

New meltshop and rolling

mill expansion (second

rolling mill).

Full LSTK project including

all auxiliary plants, systems

and plant infrastructures.

DANIELI TURNKEY PROJECTS

SINGLE-POINT RESPONSIBILITY

FOR A RELIABLE SCHEDULE

AND COST CONTROL

Four main references out of total 134, worldwide

Turnkey plants

and Systems Engineering

Turnkey construction,

Erection and Systems Engineering

Danieli Headquarters

33042 Buttrio (Udine) Italy

Tel (39) 0432.1958111

DCI_TK plants_418_274_MB_Layout 1 29/11/12 14.42 Pagina 1

www.danieli.com

DANIELI ENGINEERING AND DANIELI CONSTRUCTION INTERNATIONAL TURNKEY PROJECTS

TRULY ENSURE OVERALL INTEGRATED PLANT PERFORMANCES,

SAFETY AND OPERABILITY IN ADDITION TO OPTIMIZED AND GUARANTEED PROJECT FINAL COSTS

AND COMPLETION SCHEDULE.

ESI 1 and 2, UAE

Two DRI-based minimills

featuring EAF hot charge

for the production of 3.2 Mtpy

of heavy sections, rebars and

wirerod. 45,000 tons of steel

structural buildings, 300,000

m

3

of concrete works.

Full LSTK project including

all auxiliary plants, systems

and plant infrastructures.

Jesco, Saudi Arabia

400,000-tpy seamless pipe

complex featuring FQM

Fine Quality Mill for the

production of 16 steel

pipes and finishing lines.

Full LSTK project

including all auxiliary

plants, systems and plant

infrastructures.

Ezz Flat, Egypt

1-Mtpy minimill complex

for hot band featuring thin

slab casting-rolling process.

New DRI plant and

expansion for long product

production.

TK project including all

auxiliary plants, systems

and plant infrastructures.

Sabic (Hadeed), Saudi Arabia

1-Mtpy minimill for bar

and wirerod production.

New meltshop and rolling

mill expansion (second

rolling mill).

Full LSTK project including

all auxiliary plants, systems

and plant infrastructures.

DANIELI TURNKEY PROJECTS

SINGLE-POINT RESPONSIBILITY

FOR A RELIABLE SCHEDULE

AND COST CONTROL

Four main references out of total 134, worldwide

Turnkey plants

and Systems Engineering

Turnkey construction,

Erection and Systems Engineering

Danieli Headquarters

33042 Buttrio (Udine) Italy

Tel (39) 0432.1958111

DCI_TK plants_418_274_MB_Layout 1 29/11/12 14.42 Pagina 1

14 | Middle East Steel | December 2012

Middle East Steel 2012

Project review

Algeria

ArcelorMittal Annaba, Algerias sole steel

producer, is undergoing a $500 million

investment to increase its steelmaking capacity

from 1 million to 1.4 million tpy by 2014. This will

involve blast furnace relining, revamping the

sinter plant and installing a new coke battery.

The expansion will focus on long products,

although the company makes a wide range of

products including hot-rolled and cold-rolled

sheet and coil, hot-dip galvanized coil, tinplate,

and OCTG/tube and pipe. Commissioning is

expected from 2013.

With the government investing in several large

infrastructure and housing projects, local steel

demand is being boosted, attracting the

attention of other steelmakers.

Qatar Steel is studying the possibility of

establishing a 2.5 million tpy rebar mill in

Algeria. A new government-owned joint

venture between Qatar Steel and Qatar Mining

called Qatar Steel International has been

formed, which will have a 39% stake in the

plant, with the Algerian government holding

the remaining 61%.

It is envisaged that the plant will initially

produce 2.5 million tpy of rebar and then later

double capacity with the addition of 2.5 million

tpy of fat-rolled products, a Qasco spokesman

told Metal Bulletin in July.

Bahrain

Since construction is one of the biggest areas of

activity in the Middle East, it is not surprising to

fnd further investments in the types of steel

required in this sector. Although there are many

regional bar and light section producers, heavy

sections and beams have been absent from the

product mix until recently. This gap is now being

flled by Emirates Steel in the UAE, which started

up its 1 million tpy heavy sections mill in January,

and now the United Steel Company (Sulb) in

Bahrain is commissioning its 850,000 tpy beams

and sections mini-mill.

Sulb is owned 51% by the Gulf United Steel

Holding Company (Foulath) and 49% by

Japanese heavy sections producer Yamato

Kogyo. Foulath is also the sole owner of the two

Gulf Industrial Investment Co iron ore pelletizing

plants which are adjacent to the Sulb steel mill

at the Hidd Industrial Area. These pelletizing

plants, of total capacity 11 million tpy, will supply

a 1.5 million tpy Midrex DRI plant, which will in

turn provide feedstock for Sulbs 850,000 tpy

EAF.

The Sulb mini-mill comprises a 120-tonne

ultra-high-power EAF and ladle furnace. The

bloom/beam blank caster was originally

designed for three strands, but was upgraded to

four strands some six months after ordering. The

heavy section mill has an initial capacity of

600,000 tpy and will eventually be capable of 1

million tpy, says Foulath. The mill is said to be

highly fexible in terms of product mix and sizes,

and the line is designed for programme changes

in just 20 minutes. SMS Concast supplied the

meltshop and SMS Meer the rolling mill.

Integrated from iron ore pellets to fnished

products, Sulb will be the lowest-cost producer

of its type in the world, the company claims,

and when fully operational will replace about

14% of the medium and heavy beams being

imported into the Middle East.

Egypt

Egypt is the home of Ezz Steel, the largest

independent steel producer in the Mena region

with a total capacity of 5.8 million tpy of

fnished steel, including 3.5 million tpy of long

and 2.3 million tpy of fat-rolled products.

The companys planned next stage of

investment is a 1.9 million tpy Energiron III DRI

module at its Ezz Flat Steel (EFS) plant, Ain

Sokhna, near Suez, to provide feedstock for both

the EFS mini-mill (which is also to be expanded

in capacity) and another group mini-mill at Ezz

Steel Rebars. Phase 2 involves erecting another

DRI module at the same site to supply the

Regional expansion and

diversification abound

Steel companies across the Middle East and North Africa are increasing

capacities and widening product ranges in response to local markets and

anticipated demand. Steve Karpel reviews projects that have come on stream

this year and what is moving through the pipeline for the near future

Suez Steels DRI-based steelmaking complex will feature a 1.95 million tpy Energiron module

feeding a 1.3 million tpy meltshop for long products

S

U

E

Z

S

T

E

E

L

December 2012 | Middle East Steel | 15

expanded EFS meltshop. The two new DRI

modules will reduce these steel plants

dependency on imported scrap.

The overthrow of the Mubarak regime in Egypt,

however, resulted in legal obstructions to these

investments arising from allegations that the

DRI construction licences were acquired from

the then-government illegally. Egypts Court of

First Instance annulled both licences in

September 2011, since when construction has

stopped, with the frst DRI plant 80% complete.

The court also annulled the DRI licences that had

been awarded at the same time (2008) to three

other Egyptian steelmakers, including Beshay

Steel and Suez Steel.

Ezz Steel announced last month that the court

had awarded a new licence on 14 November,

replacing the annulled one, to company

subsidiary Ezz Rolling Mills for the construction

of the DRI plant plus additional meltshop

facilities at Ain Sokhna. The licence terms require

a total payment of EGP 330 million over the next

six and a half years.

The licensing dispute has not affected the

normal operations of Ezz Steel, which reported a

10% increase in net sales in the frst half of 2012

to EGP 10.31 billion ($1.72 billion), although

Ebitda fell by 11% to EGP 1.1 billion.

A new licence was also awarded to Suez Steel

in mid-year. The steelmaker, a part of the Solb

Misr group, is building a 1.95 million py HYL/

Energiron DRI plant linked to a 1.3 million tpy

billet and beam blank meltshop.

The new integrated steel mill is almost

fnished, and is expected to start up early in

2013, bringing the companys steelmaking

capacity up to 2 million tpy. Products will supply

the Egyptian market, with any surplus billet

exported to the local region, says a spokesman.

Other investments in Egypt are proceeding.

Rebar roller Elmarakby Steel has ordered a

350,000 tpy meltshop from SMS Siemag to

produce 130 sq mm billet. This will supply its

240,000 tpy rolling mill in 6

th

of October City, with

excess billet to be sold on the market pending

the construction of a second rolling mill. The

meltshop is expected to start up by December

2013, fed by imported scrap.

Iraq

The steady rebuilding of Iraqs infrastructure has

meant a continuing focus on the basic industries

such as steel, cement and power, as well as its

dominant economic base oil and gas. One of

the major steel projects is by Iraqs Mass Global

Investment, which has been active in the

cement and power sectors with several plants

completed or in progress. Turning its attention

to steel, it is building a 1 million tpy mini-mill in

the north of the country (Kurdistan), which will

focus initially on rebar.

The mill, supplied by Danieli with power

supply by ABB, comprises a 120-tonne FastArc

EAF, a 120-tonne ladle furnace, a 5-strand

FastCast caster for 130 mm and 150 mm sq

billet, a 120 tph walking hearth furnace and a

650,000 tpy rolling mill for 10-32 mm diameter

deformed bars. The mill is scheduled to start up

in the second half of 2013, says Mass Global. The

company is also constructing another rolling

mill for small and medium sections, which is

expected to start in early 2014.

The EAF will be scrap-fed, but the company is

studying the possibility of building a DRI plant,

together with an iron ore pelletizing facility. It

also says that it plans to double the mini-mill

steel capacity eventually.

Indian pipemaker Jindal Saw has instigated a

$200 million project to build a new pipe mill in

Iraq, sited in a new industrial city outside Basra.

It will produce 300,000-350,000 tpy of

longitudinal submerged arc-welded pipe,

16-65in (406-1,651 mm) in diameter with wall

thickness up to 1in. It is planned to start up at

the end of 2013, while an anti-corrosion coating

line will commission earlier in the year.

Fully-owned by Jindal Saw, the company will

sell into Iraqs oil and gas transmission sector.

An expansion phase is also planned six months

after start-up with the introduction of hot

induction bending, and the company says it

intends to add spiral welded pipe as well at a

later stage.

Oman

One of the biggest planned investments in the

region is the Jindal Shadeed integrated steel mill

in Oman, which will eventually comprise a 7

million tpy iron ore pelletizing plant, a Midrex

DRI/HBI plant, a 2 million tpy meltshop and a

long products rolling mill.

Indias Jindal Steel & Power (JSPL) acquired the

Shadeed DRI project for $464 million in 2010, and

the 1.5 million tpy Midrex DRI/HBI module

started up at the end of that year. Prior to the

meltshop commissioning next year, Shadeed

has been exporting the HBI produced just over

1 million tonnes were sold last year.

JSPL is now engaged in expanding the project

at Sohar Industrial Port into a complete

steelmaking complex, and a 2.0 million tpy

meltshop is scheduled to commission in the

Assembling the 120 tonne EAF at United Steel Co, Bahrain (Sulb)

S

M

S

S

I

E

M

A

G

The Sulb mini-mill includes an effcient dedusting plant

S

M

S

S

I

E

M

A

G

a new Era in industrial drive solutions is dawning

As of June 1

st

we are part of the Nidec group, strengthening our market presence:

we are ready to help our customers form the future with precision and control.

110393-AnsaldoNidec215x280-Metals.indd 1 29-11-2012 12:55:06

Middle East Steel 2012

Project review

December 2012 | Middle East Steel | 17

fnal quarter of 2013. The Danieli-built meltshop

will be fed directly by hot DRI, and comprise a

150-tonne EAF, a 150-tonne ladle furnace, a

200-tonne twin-tank vacuum degasser, and a 2

million tpy 6-strand billet/bloom caster. The

associated infrastructure also includes an air

separation plant, a 4,800 cu metre/day

desalination plant and extensive port facilities.

The semis produced will be initially targeted

mainly at the Saudi market, as well as domestic

re-rollers supplying Omans infrastructure

projects. In time, however, it is planned that

much of the billet produced will be taken up by

a 1 million tpy rolling mill for rebar and merchant

bar, plus a seamless pipe mill, which are

expected to start around 2015. These represent a

$400 million investment, while the meltshop is

put at $475 million.

Jindal foresees the DRI plant expanding from

1.5 million to 5 million tpy over the next fve

years, which will be fed by a 7 million tpy iron

ore pelletizing plant now in the planning stage.

Like several steel mills in the region, Omans

Sohar Steel started out as a pure rolling mill for

rebar, and has since integrated back into

steelmaking. The rolling company, Sharq Sohar

Steel Rolling Mills (SSSRM), has a capacity for

300,000 tpy of 8-32 mm diameter rebar, which

can be epoxy coated. Sister company Sohar Steel

was built with a 36-tonne EAF and ladle furnace

feeding a 3-strand caster for 100, 120 and 130

mm sq billet. It can produce 250,000 tpy of

billet.

Sohar Steel is now being upgraded by Danieli

Centro Met with a 75-tonne FastArc EAF,

increasing steel output to 700,000 tpy. Danieli is

also supplying a 140-tonne teeming crane to

handle the larger tapping weights. The new

meltshop is due to start up in mid-2013.

The port of Sohar is developing into a focus for

steel products in the Gulf, with Al Jazeera Steel

Products also being established there. This

company buys billet and has four ERW

tubemaking lines with a total capacity of

300,000 tpy of international-standard tube

products with plain, threaded and coupled

ends. It also has three galvanizing lines for

corrosion-protected tube up to 219 mm

diameter.

Al Jazeera Steel has subsequently

commissioned a 300,000 tpy merchant bar mill

for producing angles, channels, squares, fats

and rounds. The company says it is exporting

products to 25 countries, including North

America, Europe and Australia.

Qatar

Qatar Steel (Qasco) started production in 1978 as

one of the frst DRI-based integrated

steelmakers in the Gulf, and has continued to

augment its capabilities, both in Qatar and also

elsewhere in the region: it established a

subsidiary rolling mill Qatar Steel Co FZE in

Dubai in 2003.

Last year the company awarded Siemens VAI a

contract to supply a new 1.1 million tpy billet

meltshop for its Mesaieed site, comprising a

110-tonne EAF, a 110-tonne ladle furnace, a

6-strand billet caster plus a new dedusting

plant and all auxiliary equipment. This new mill

is expected to go into operation in 2013.

The $250 million investment was originally

intended to replace the companys existing

meltshop in Mesaieed, but because of

increasing steel demand in the Gulf, it has been

decided to employ it as an additional facility,

with the original 95-tonne EAF and ladle

furnaces ordered also being enlarged to 110

tonnes. Qatar Steels current capacities are 2.4

million tpy of DRI/HBI, 1.9 million tpy of raw

steel, 1.8 million tpy of rebar and 0.3 million tpy

of wire rod.

Looking further afeld, Qatar Steel is also

studying the possibility of establishing a 2.5

million tpy rebar mill in Algeria (see earlier

section in article).

Saudi Arabia

The Kingdoms biggest steel company, Saudi

Iron & Steel Co (Hadeed) is continuing to invest

in new capacity to meet the needs of its

domestic market. A new 1 million tpy mini-mill

from Danieli is under construction at Al-Jubail,

consisting of a 150-tonne EAF, a 150-tonne ladle

furnace, a 6-strand caster for 130 mm and 150

mm sq billet, with materials handling for

ferro-alloys and cold DRI, and fume treatment

facilities.

A 120 tph walking beam furnace will charge

directly into an 18-stand wire rod rolling mill.

This rolling mill is being put together by

upgrading and augmenting an existing rolling

mill. The new wire rod mini-mill is in the fnal

stages of construction and is expected to start up

in the second quarter.

This investment will increase Hadeeds total

capacity to 6 million tpy, with long products

accounting for two-thirds of this. The new plant

will also make Hadeed self-suffcient in billet,

says Abdulaziz Al-Humaid, Hadeed chairman

and Sabic executive vp for metals: We import

400,000 tpy of billet, but we will substitute

these imports and produce about 4 million tpy

of both billet and fnished long products, he

says.

Alongside other grades, the new rolling mill

will produce high-carbon wire rod, which is

now imported. The Saudi market for this is

estimated at some 200,000 tpy.

Hadeed has fve DRI modules with total

capacity of about 5.4 million tpy. The company

uses a mix of DRI and scrap in its fve electric arc

furnaces; the ratio varies according to product,

but averages about 20% scrap, which is

imported. We import about 600,000 tpy of

scrap now, but when the new mini-mill starts

up, an additional 600,000 tpy of imported scrap

may be needed, Al-Humaid says, and points

out that most of Hadeeds products, 95-96%,

are sold to its domestic market.

Another Saudi steelmaker, Rajhi Steel,

commissioned a 1.0 million tpy high-speed bar

and rod mill in May at its site at Alkhumra, south

of Jeddah. It produces 10-40 mm diameter

debar, and 5.5-16.0 mm smooth and deformed

wire rod. In order to feed this mill, the

companys 0.85 million tpy meltshop here has

been upgraded to produce more billet, with a

200 tph walking beam reheat furnace connected

directly to the billet caster. All plant has been

Saudi Iron & Steels latest investment will make it self-suffcient in billet and introduce new long

product grades

S

A

B

I

C

Excellent engineering services stand out from the crowd

especially when it comes to intelligent revamps. Its about

nothing less than upgrading existing plants to meet future

market demands one of todays central challenges.

Thats where our whole wealth of experience comes in.

After all, our job is to help you increase your productivity

while improving quality. Equally signicant here is smart

planning, for instance taking advantage of scheduled main-

tenance stoppages and minimizing production losses.

Your bottom line: You save time and money.

Countless completed projects prove our quality and

reliability as a global specialist in metallurgical plant and

rolling mill technology.

Modernizations for quality and reliability

Boost productivity.

Cut costs.

SMS SIEMAG AG

Eduard-Schloemann-Strasse 4 Phone: +49 211 881- 0 E-mail: communications@sms-siemag.com

40237 Dsseldorf, Germany Fax: +49 211 881- 4902 Internet: www.sms-siemag.com

Modernisierung_209x274_e.indd 1 19.11.12 11:06

Middle East Steel 2012

Project review

December 2012 | Middle East Steel | 19

supplied by Danieli, which also designed a 4,000

HP 120 tph scrap shredder for the steelmaker.

The company has another 1 million tpy

mini-mill for Jeddah in the feasibility study

phase.

Sister company Rajhi Heavy Industry and

Indias state-owned Rashriya Ispat Nigam (RINL,

or Vizag Steel) are discussing the possibility of a

joint-venture 3 million tpy integrated DRI-fed

steel mill to be built in Saudi Arabia. The

$8 billion plant would take fve years to build,

and produce long and fat-rolled products.

ArcelorMittal and Saudi Arabias Al Tanmiah

Industrial and Commercial Investment Co plan to

commission their joint venture 600,000 tpy

seamless pipe plant in 2013. The $800 million

mill, based in Jubail Industrial City 2, will supply

its oil, gas and petrochemicals industries.

United Arab Emirates

One of the fastest-growing operations in the

region is Emirates Steel (ESI) of Abu Dhabi.

Starting out with a single 500,000 tpy rolling mill

commissioned in 2001, the company 100%

owned by Abu Dhabi Basic Industries Corp, a

subsidiary of General Holding Corporation has

subsequently pursued a policy of establishing

integrated DRI-fed mini-mills, and rolling a

widening range of products at its site in

Mussafah.

The phase 1 expansion, inaugurated in 2009,

comprised a 1.6 million tpy HYL/Energiron DRI

plant, a 1.4 million tpy meltshop and rolling mills

for rebar (0.62 million tpy) and wire rod (0.48

million tpy).

The phase 2 expansion commissioned in March

2011 consisted of another mini-mill of similar

size: a 1.6 million tpy Energiron DRI plant,

feeding a Danieli meltshop consisting of a

150-tonne FastArc EAF and a 5-strand

FastCast caster for billet, blooms and beam

blanks. The frst two expansion phases represent

a $2.45 billion investment, giving Emirates Steel a

nominal 3.2 million tpy of DRI capacity and 2.8

million tpy of steelmaking capacity, with 3

million tpy of rolling capacity.

The beam blanks from the second conticaster

are now feeding a 1 million tpy heavy sections

mill which was commissioned in January 2012

the frst such rolling mill in the region. The

blanks are reheated in a 250 tph walking beam

furnace. The $650 million Danieli heavy sections

mill produces parallel-fange beams, columns

and sheet piles with web depths up to 1,016 mm

and fange widths up to 419 mm, plus up to 430

mm parallel-fange channels, 250 mm angles,

750 mm U-sheet piles and 630 mm Z-sheet piles.

The heavy sections mill comprises a single

reversing stand breakdown mill and an

ultra-fexible reversing pre-fnishing/fnishing

mill made up of three coupled universal stands.

Auxiliary plant includes a gauge unit for

closed-loop control, cooling bed, in-line

straightener, cutting-to-length, automatic

stacking and collection.

Demand for medium and heavy sections will

be over 4 million tonnes this year in the Middle

East, with the UAE and Saudi Arabia the biggest

consumers, and demand for heavy sections in

the GCC region is expected to double by 2015.

Both of Emirates Steels DRI plants are now

being upgraded from 1.6 million to 2.0 million

tpy, which should be completed in 2013. The

corresponding meltshops are also being

expanded from 1.4 million to 1.7 million tpy. The

upgrades are being carried out by Danieli.

Without pausing for breath, Emirates Steel is

now planning phase 3 of its expansion,

announced in September 2011: this will mark a

move into fat-rolled products with a hot-rolled

coil mill, and a slab meltshop fed by another DRI

plant. The future production of plate is also

envisaged. This investment would add about 1.6

million tpy to the companys existing 3 million

tpy of steelmaking capacity. While still in the

planning stage, this next phase is likely to

commission from 2014 onwards.

Emirates Steels growing output and range of

products has increased its share of its domestic

market to 60%, the company stated last month,

with its steel output rising 33% year-on-year in

the frst three quarters. Around 70% of its

fnished products are sold on the domestic

market, with the rest exported.

Elsewhere in the UAE, Al Ghurair Steel, a

producer of pickled and oiled hot-rolled,

cold-rolled and galvanized sheet and coil, is

expanding its operations in Mussafah, Abu

Dhabi, to double galvanizing capacity to

400,000 tpy, and raise cold rolling capacity to the

same level from 250,000 tpy. This expansion is

expected to commission next year. The company

is owned 80% by the Al Ghurair Group and 20%

by Nippon Steel & Sumitomo Metal Corp of

Japan.

Capacities for value-added products such as

galvanized coil are rising

A

L

G

H

U

R

A

I

R

S

T

E

E

L

Breakdown mill at ESIs heavy section mill

D

A

N

I

E

L

I

Emirates Steels (ESIs) new conticaster produces beam blanks for the heavy sections mill

E

M

I

R

A

T

E

S

S

T

E

E

L

Real Innovation, Real Solutions

Real Progress.

Learn more at: www.midrex.com

2012 Midrex Technologies, Inc. All rights reserved.

These are our technologies,

these are our results.

While others boast of technical advancements, Midrex delivers real world results for the steel

industry. MIDREX Plants provide energy efciency and exibility, from natural gas to various

options for using coal, including gasiers, coke ovens or BOFs.

Steelmakers worldwide rely on Midrex.

Hot DRI for increased EAF

production & environmental

benets with multiple hot

DRI transport options

installed and proven

HBI with outstanding

chemical & physical quality

Modules operating more than

8,000 hours annually with

available capacity up to

2.5 MTPY

Coal-based DRI, HBI &

Hot DRI production via

and COREX/

MIDREX

pion

eerin

g

forward

-thin

kin

g

proven

Metal Bulletin full 10.12.indd 1 10/26/12 10:41 AM

Middle East Steel 2012

DRI

December 2012 | Middle East Steel | 21

The production of direct reduced iron, DRI, as

a feedstock for steelmaking continues to grow

in the Mena region. With its large gas reserves,

it is no surprise that this region is becoming a

particular focus for gas-based DRI

technologies such as Midrex and Energiron,

while India with its coal reserves is a rapidly-

growing centre for coal-based reduction.

The relative paucity of local steel scrap in

many Mena countries has been another

incentive to invest in DRI production, which,

when used in electric arc furnaces

sometimes combined with a proportion of

imported scrap is seen as the most

economic way to make steel.

Last year the Mena area produced over 25

million tonnes of DRI, out of a world total of

over 73 million tonnes. However, this Mena

volume represents nearly 45% of all

gas-based production, which amounted to

56 million tonnes last year, according to

Midrex.

The biggest DRI producer in the region is

Iran, an early developer and user of direct

reduction technology. Today, the country has

more projects in construction, including

Midrex process modules at Arfa Steel (0.8

million tpy) and a second module at Khorasan

Steel (0.8 million tpy) following the frst

module that started up in 2010. Another 0.8

million tpy plant using the Midrex process

started up recently at Iranian Ghadir Iron &

Steel (Igisco) in Yazd.

DRI technology has evolved so that many

steelmakers are now able to hot-charge the

material directly at 600C or higher into the

electric arc furnace. This saves energy and has

several benefts, says Midrex: an increase in

EAF productivity by 15-20%; reduced EAF

electricity requirements by 120-140 kWh/

tonne of steel; reduced electrode

consumption by 0.5-0.6 kg/tonne of steel;

and reduced EAF refractory consumption by

1.8-2.0 kg/tonne of steel.

Hot or cold

Increasingly fexible plants are also able to

produce either hot or cold DRI, or both

simultaneously, according to market or

production conditions. Some plants are also

designed to produce merchant hot briquetted

iron (HBI) as an alternative for any surplus

DRI.

Saudi Iron & Steel (Hadeed), for example,

now has fve Midrex DRI modules, the largest

of which is now producing 2 million tpy this

is hot-linked to an EAF. The company is now

revamping one of the modules in order to

increase its output, says Hadeed chairman

Abdulaziz Al-Humaid, although the

impending increase in steel capacity from its

new 1 million tpy billet mini-mill means that

the steelmaker will still have to raise its scrap

purchases to top up the DRI feed (see page 14).

In Egypt, the natural gas resources offshore

inspired an early use of DRI from the 1980s, to

feed electric steelmaking at the

then-Alexandria Iron & Steel, now EZDK, part

of the Ezz Steel group. The groups investment

in DRI has subsequently grown along with its

build-up of EAF capacity.

Most recently, subsidiary Ezz Rolling Mills

has been building a 1.9 million tpy HYL/

Energiron module at Ain Sokhna to feed both

Ezz Flat Steel (which is adding a 1.3 million tpy

meltshop) and other mini-mills in the group.

This module was about 80% complete when

an Egyptian court revoked the construction

licences in 2008. However, the issue was

resolved last month and the licence

re-awarded, so that construction can now

proceed.

Direct reduction is

the primary choice

A range of factors not least the cost-effective

local availability of natural gas has led to the

growing popularity of direct reduced iron as a

main feedstock for steelmaking in the Mena

region. Steve Karpel looks at the overall picture

and some recent investments

The Jindal Shadeed 1.5 million tpy Midrex reduction plant in Sohar, Oman, was the frst Hotlink

system for feeding hot DRI to an EAF when it started up last year

MIDREX REDUCTION WITH

HOTLINK

J

I

N

D

A

L

S

H

A

D

E

E

D

The Midrex process with Hotlink transfer of DRI

to the EAF

K

O

B

E

L

C

O

Middle East Steel 2012

DRI

22 | Middle East Steel | December 2012

This implies that the DRI licences for other

Egyptian steelmakers which were annulled at

the same time could also be re-awarded. One

of the projects was a 1.76 million tpy Midrex

plant for Egyptian Sponge Iron & Steel Co

(Esisco, owned by the Beshay group) in Sadat

City. Another project, for a 1.95 million tpy

Danieli/Tenova HYL/Energiron plant for Suez

Steel in Attaka, had its licence re-awarded in

mid-year, and a Suez Steel spokesman

expects both the DRI plant and new meltshop

to start up early in 2013. The latter module is

reported to be complete, and training of

personnel is under way.

Another DRI plant which is just about to

commission is the United Steel Company of

Bahrains 1.5 million tpy Midrex plant, which

will feed a meltshop with 0.8 million tpy

heavy sections rolling mill. Nameplate

capacities for DRI plants are often

conservative, and 51% owner Gulf United

Steel Holding Company (Foulath) states that

the module will actually be capable of

producing 1.8 million tpy. The plant has an

adjacent source of iron ore pellets from the

Gulf Industrial Investment Company (GIIC),

the 11.0 million tpy pelletizing company

which is wholly owned by Foulath.

Flexible facilities

A modern example of the fexible DRI

modules now being built are the two

Energiron plants that started up at Emirates

Steel, Abu Dhabi, in 2009 and 2011. These 1.6

million tpy modules can produce either cold

DRI or hot product charged directly to the

electric arc furnaces. They are now being

upgraded to 2 million tpy each, which should

be complete in 2013.

Cold DRI is stored in an open stockyard and

transferred to the meltshops by means of belt

conveyors. Hot DRI can be discharged at 700C

and sent directly to either the meltshop or

the cooler; the Energiron plant uses the

enclosed Hytemp

pneumatic transport for

handling hot DRI, developed jointly by

Danieli and Tenova HYL.

The direct reduction process uses a steam

reformer to convert natural gas into the

hydrogen and carbon monoxide reducing

agents, which reduce the iron oxide to

(impure) iron inside the reactor. In the

process, wet reformed gas is frst dried in a

quench tower and then injected into the

circuit, where it joins the recycled gas coming