Professional Documents

Culture Documents

Problem Statement

Uploaded by

Udhbhav AryanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem Statement

Uploaded by

Udhbhav AryanCopyright:

Available Formats

Problem Statement:

The Traditional Absorption Costing method used at the Classic Pen Company was supposed to be an

inaccurate representation of the product cost and return of sales. As it operates with a single cost

centre i.e. based on a single driver, to allocate overhead costs, it could lead to product cost

distortion. Even if it used multiple cost centres, it could still encounter severe distortions in reported

product cost. As all pens have roughly the same complexity, each pen would require similar number

of machine hours and direct labour hours to produce. Therefore, on a per unit basis, high volume

standard black and blue pens would require about the same amount of direct labour cost as the low

volume red and purple colour pens. Therefore, the traditional costing method would report identical

product costs for all products, whether standard or speciality, irrespective of their product volumes.

This leads to the cost distortion.

The assessment of profitability of each pen has to be carried out based on the cost of each activity

with resources to all pens, standard or speciality, based on actual consumption by each. In addition

to this, assessment of viability of introducing new speciality coloured pens has to be done.

Purpose statement:

The costs and profits of existing pen lines are to be analysed on the basis of more accurate activity

based costing (ABC). This will help in identifying actual price incurred by each pen and thereby

eliminating those which are unprofitable. Moreover, the comparison of the costs and profits of

activity based costing and tradition absorption costing can be carried out.

Scope:

Traditional absorption costing helps to determine the overall profitability or efficiency of the

manufacturing system but does not provide the real cost of discrete product units. Activity based

costing emulates the functioning of the firm and adds to strategic decision-making processes. In

large firms which deal with multi-product operations, conventional overhead allocation methods like

traditional absorption costing may produce ambiguous results. As a result of this, absorption costing

is more appropriate for small enterprises and firms with homogeneous products or services. Activity

based costing, however, can be applied to the case of multiproduct-operations like manufacturing of

different colour pens by a firm.

Limitations:

It is very difficult to identify all the activities that influence product cost as some overhead costs like

the salary of chief executive are impossible to segregate on the per-product usage basis. Moreover,

this process is costly as well as time consuming as it might require division of costs into several

groups to represent the many activities and requires updating on regular basis. Also, traditional

activity based costing systems do not generally take into account the capacity issues and assume

that all resources are fully engaged at 100 percent in an activity. This makes redeployment analysis

difficult. We have to consider time-driven activity based costing if capacity is a major variable to be

looked into. In addition to these, activity based costing time and again brushes against the corporate

culture by proposing organizational change. Employees may openly question ABCs value, think if

their jobs are at risk, and work against its implementation. Change management is critical in any ABC

implementation.

You might also like

- Chapter 15 Exam Questions - 8th EdDocument8 pagesChapter 15 Exam Questions - 8th EdUdhbhav AryanNo ratings yet

- Chapter 14 Exam Questions - 8th EdDocument11 pagesChapter 14 Exam Questions - 8th EdUdhbhav Aryan100% (1)

- Assignment 2 CarZumaDocument4 pagesAssignment 2 CarZumaUdhbhav AryanNo ratings yet

- Cadbury V 1.0Document6 pagesCadbury V 1.0Udhbhav AryanNo ratings yet

- Mckinsey & Co. Managing Knowledge and LearningDocument15 pagesMckinsey & Co. Managing Knowledge and LearningVibhorSrivastava100% (1)

- UNIDO Guide To Suppler DevelopmentDocument44 pagesUNIDO Guide To Suppler DevelopmentUdhbhav AryanNo ratings yet

- Avantgarde Case StudyDocument7 pagesAvantgarde Case StudyUdhbhav AryanNo ratings yet

- MPX ManualDocument230 pagesMPX ManualUdhbhav AryanNo ratings yet

- FM Assignment1 Group9Document3 pagesFM Assignment1 Group9Udhbhav Aryan100% (1)

- Strauss & Corbin'a Approach Example VGDocument7 pagesStrauss & Corbin'a Approach Example VGUdhbhav AryanNo ratings yet

- The PeopleSoft ContestDocument9 pagesThe PeopleSoft ContestUdhbhav AryanNo ratings yet

- SBI: Organizational Design and Technology: Project ProposalDocument4 pagesSBI: Organizational Design and Technology: Project ProposalUdhbhav AryanNo ratings yet

- Kellogg Consulting ClubDocument12 pagesKellogg Consulting ClubCaroline KimNo ratings yet

- ONMITELDocument5 pagesONMITELUdhbhav AryanNo ratings yet

- Strategy and Society: The Link Between Competitive Advantage and Corporate Social ResponsibilityDocument23 pagesStrategy and Society: The Link Between Competitive Advantage and Corporate Social ResponsibilityUdhbhav AryanNo ratings yet

- Huella Online Travel Group-7Document10 pagesHuella Online Travel Group-7Udhbhav AryanNo ratings yet

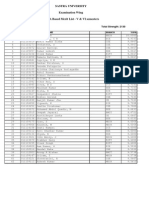

- Downloads News 2010 Aug Dean List 2 V & VI SEMESTERDocument1 pageDownloads News 2010 Aug Dean List 2 V & VI SEMESTERUdhbhav AryanNo ratings yet

- WECDocument4 pagesWECUdhbhav AryanNo ratings yet

- Tribes and Mentoring ArticleDocument20 pagesTribes and Mentoring ArticleUdhbhav AryanNo ratings yet

- Attention Outgone StudentsDocument1 pageAttention Outgone StudentsUdhbhav AryanNo ratings yet

- Chandan KumarDocument2 pagesChandan KumarUdhbhav AryanNo ratings yet

- ActionverbsDocument2 pagesActionverbsapi-241737054No ratings yet

- Downloads News 2010 Aug Dean List 2 V & VI SEMESTERDocument1 pageDownloads News 2010 Aug Dean List 2 V & VI SEMESTERUdhbhav AryanNo ratings yet

- Tribes and Mentoring ArticleDocument20 pagesTribes and Mentoring ArticleUdhbhav AryanNo ratings yet

- Organic Agriculture and Food IndustryDocument8 pagesOrganic Agriculture and Food IndustryUdhbhav AryanNo ratings yet

- Chapter 14Document26 pagesChapter 14owaishazaraNo ratings yet

- Chan Mri Ud Appo: TotalDocument8 pagesChan Mri Ud Appo: TotalUdhbhav AryanNo ratings yet

- Histogarm EqDocument2 pagesHistogarm EqUdhbhav AryanNo ratings yet

- Grammar Googly 1Document6 pagesGrammar Googly 1Udhbhav AryanNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Sales in Course of Import and High Seas Sales Under CST ActDocument23 pagesSales in Course of Import and High Seas Sales Under CST ActAMIT GUPTANo ratings yet

- HSC Business Studies Topic 3 MarketingDocument27 pagesHSC Business Studies Topic 3 MarketingUttkarsh AroraNo ratings yet

- CIC Economic Significance of Meetings To US Economy Executive SummaryDocument40 pagesCIC Economic Significance of Meetings To US Economy Executive Summarydaniwu0704No ratings yet

- Vietnamese Businesses Opportunity and Challenges on AmazonDocument26 pagesVietnamese Businesses Opportunity and Challenges on AmazonPhương TrangNo ratings yet

- Unilever Job Application FormDocument9 pagesUnilever Job Application Form'Rizki Ekhy Fauzi'No ratings yet

- Marketing Practices in Nurjahan Edible OilDocument52 pagesMarketing Practices in Nurjahan Edible OilIstiak ThemoonNo ratings yet

- Analyzing Business MarketsDocument28 pagesAnalyzing Business MarketsAhmerNo ratings yet

- A Feasibility Study of A Telecom ProviderDocument9 pagesA Feasibility Study of A Telecom Providertramo123475% (4)

- Giordano Case Study FinalDocument14 pagesGiordano Case Study FinalPoraton Mamo67% (6)

- Coronel Vs CA Case DigestDocument2 pagesCoronel Vs CA Case DigestLoi Molina LopenaNo ratings yet

- AVEVA Group PLC: Results For The Year Ended 31 March 2017Document38 pagesAVEVA Group PLC: Results For The Year Ended 31 March 2017sennimalaiNo ratings yet

- HO1 - 1 Case Study Background - Go ManGo LTDDocument10 pagesHO1 - 1 Case Study Background - Go ManGo LTDLeenin DominguezNo ratings yet

- KidsDocument67 pagesKidsvicky18dNo ratings yet

- Accounting Principles Chapter 5Document42 pagesAccounting Principles Chapter 5Nazifa AfrozeNo ratings yet

- Oasis JuiceDocument26 pagesOasis JuiceSazawany SyazaNo ratings yet

- Multiple ChoiceDocument61 pagesMultiple ChoiceDenaiya Watton Leeh100% (7)

- Spouses Suntay vs Gocolay HLURB jurisdiction caseDocument2 pagesSpouses Suntay vs Gocolay HLURB jurisdiction caseTonifranz SarenoNo ratings yet

- Cost Allocation Joint Products and ByproductsDocument8 pagesCost Allocation Joint Products and ByproductsHendriMaulanaNo ratings yet

- Monetary Policy of IndiaDocument3 pagesMonetary Policy of IndiaBala SubramanianNo ratings yet

- MKT 621 Quiz Four FilesDocument4 pagesMKT 621 Quiz Four FilesImran RazaNo ratings yet

- Of Sales and Promotion GhariDocument67 pagesOf Sales and Promotion GharimanuNo ratings yet

- 17 Chap - Module 3 - Product LifecycleDocument7 pages17 Chap - Module 3 - Product LifecycleraisehellNo ratings yet

- Chapter 5 & 6 exercises solutionsDocument7 pagesChapter 5 & 6 exercises solutionsĐức TiếnNo ratings yet

- Court Rules in Favor of Heirs Seeking to Quiet TitleDocument2 pagesCourt Rules in Favor of Heirs Seeking to Quiet TitleRonald Alasa-as AtigNo ratings yet

- Customer Perception Towards Bajaj's VehiclesDocument85 pagesCustomer Perception Towards Bajaj's VehiclesЯoнiт Яagнavaи100% (1)

- Comparing Honda's Success in the US Motorcycle MarketDocument3 pagesComparing Honda's Success in the US Motorcycle MarketRiya3No ratings yet

- Appraising and Developing Yourself For An Entrepreneurial CareerDocument8 pagesAppraising and Developing Yourself For An Entrepreneurial CareerMaybelyn Umali Catindig100% (1)

- Receipt 2480 1594Document1 pageReceipt 2480 1594FRANK JOSE MARQUEZ GIRONNo ratings yet

- M&S's International Retailing StrategyDocument16 pagesM&S's International Retailing StrategypooniyaNo ratings yet

- AFC 2012 Sem 1Document8 pagesAFC 2012 Sem 1Ollie WattsNo ratings yet