Professional Documents

Culture Documents

Burning Dollars Top Five Trends in US Telecom Spend

Uploaded by

guptaneelCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Burning Dollars Top Five Trends in US Telecom Spend

Uploaded by

guptaneelCopyright:

Available Formats

white paper

Burning Dollars

Top Five Trends in US Telecom Spend

Telecom costs are among the largest

operating expenses for organizations

worldwide. Yet, theyre often the

most inconsistently managed.

So it comes as no surprise that

businesses increasingly feel they

need to scrutinize these expenses as

one area of potential drastic costcutting. Exactly how and where do

organizations currently spend their

dollars, and what does the future

hold in terms of broader market

movements such as enterprise

mobility and the rise of bring your

device (BYOD) strategies?

Dimension Data, a global provider

of Communications Lifecycle

Management and other ICT services,

recently analyzed information

collected from its database of clients

in the US over the last three years,

in order to identify these top five

trends in telecom spend.

white paper | Burning Dollars: Top Five Trends in US Telecom Spend

Contents

Trend 1: Businesses burn dollars unnecessarily on variable costs

01

Average cost of data downloads almost doubles as volume increases

02

Device upgrades and replacements need careful management

02

Increase in data costs

02

Growth in average total costs higher for employee-owned devices

02

Variable costs offer a major cost-cutting opportunity

02

Trend 2: Tablets are king

03

High uptake of tablets driven by individuals rather than employers

03

Trend 3: Businesses love the iPhones

04

Trend 4: Mobile users surf the web for business purposes too

04

Trend 5: Unlimited data plans arent going away soon

04

Wrapping it all up

04

white paper | Burning Dollars: Top Five Trends in US Telecom Spend

Fixed costs

Variable costs

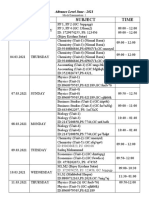

The tables below give a breakdown of

average corporate-liable invoice spend and

employee-owned device invoice spend from

2010 to 2012.

2010 2010%

2011 2011%

2012 2012%

in USD

Base of

invoice

spend

in USD

Base of

invoice

spend

in USD

Base of

invoice

spend

Avg voice cost

42.44

39%

45.00

40%

44.22

38%

Avg data cost

30.85

28%

32.21

29%

36.55

32%

Avg msg cost

7.81

7%

9.08

8%

9.33

8%

Avg tax cost

4.92

5%

5.23

5%

5.79

5%

Avg occ cost

0.08

0%

0.87

1%

(0.35)

0%

Avg 1x other cost

6.74

6%

3.12

3%

3.92

3%

Avg download cost

3.41

3%

3.03

3%

3.06

3%

Avg special feature cost

7.36

7%

7.72

7%

7.51

7%

Avg directory assist cost

5.55

5%

5.60

5%

5.41

5%

Total

109.16

111.86

115.44

Employee-owned device invoice spend*

2010 2010%

Fixed costs

As with many other business expenses,

telecom costs are on the rise. Gaining

better visibility of all expenses is the first

step towards savings. By analyzing the

breakdown of costs across all invoices

which includes corporate liable invoices and

employee-owned device invoices a few

telling trends have come to light.

Corporate-liable invoice spend

Variable costs

Trend 1:

Businesses burn dollars

unnecessarily on variable costs

2011 2011%

2012 2012%

in USD

Base of

invoice

spend

in USD

Base of

invoice

spend

in USD

Base of

invoice

spend

Avg voice cost

43.28

41%

49.50

40%

51.09

41%

Avg data cost

31.17

30%

36.21

29%

35.02

28%

Avg msg cost

8.89

8%

9.70

8%

7.98

6%

Avg tax cost

6.15

6%

6.60

5%

7.07

6%

Avg occ cost

(0.11)

0%

2.18

2%

2.72

2%

Avg 1x other cost

6.14

6%

3.53

3%

3.11

3%

Avg download cost

1.98

2%

4.68

4%

4.51

4%

Avg special feature cost

2.47

2%

6.29

5%

6.37

5%

Avg directory assist cost

5.22

5%

5.57

4%

5.51

4%

Total

105.19

124.26

123.38

*Note: download cost referenced in the above tables represent all data capable device types.

01

white paper | Burning Dollars: Top Five Trends in US Telecom Spend

Average cost of data

downloads almost doubles as

volume increases

Over the last three years, the average

consumption of the data downloads for

voice devices has nearly doubled per user.

With the average corporate-liable download

spend per device as USD 3.94 per month

and nearing USD 50 annually, these charges

are easily dismissed by companies. However,

their threat is not only cost, but volume.

When comparing corporate-liable device

downloads to employee-owned device

downloads, the employee-owned falls

nearly 47% lower to only USD 2.10. Thus,

it is essential that corporate-liable device

downloads are managed to discern between

valid software (such as GPS) and abuse of

privileges (such as ringtones, songs, movies,

books and recurring subscriptions). These

small recurring charges can quickly spiral

out of control.

Device upgrades and replacements

need careful management

Another area in dire need of management

is device upgrades and replacement.

Annually, about of 29% of users either

replace or upgrade a device 1% of these

replacements are insurance replacements.

Through the management and reporting of

placed orders, we can distinguish between

necessary orders and simply a desire to

have the latest and greatest devices.

With carriers now providing users with the

option to buy down their upgrade eligibility

date, more users are ceasing the opportunity

to get a newer phone sooner, and at the

employers cost.

Increase in data costs

While voice costs have maintained an

average of about 40% of invoice cost, data

has grown 4% since 2010 to claim 32% of

all invoice costs 2012. The main reason for

this increase is the migration of users from

feature phones to smartphones.

Growth in average

total costs higher for

employee-owned devices

Theres also been an increase in the average

total cost of both corporate-liable and

employee-owned device invoices, but this

growth was greater for employee-owned

devices (15%) than for corporate-liable

(5%).Leading this upswing is voice with an

increase of almost USD 8 per plan. Data is

next with a near USD 4 increase. As more

enterprises turn to employee-owned devices,

ironically the data suggests that this may not

be the most cost-efficient solution because

the power to negotiate rate plan prices is

now at the individual level instead of the

corporate level.Thus, enterprises lose any

leverage to negotiate better pricing.

While voice costs

have maintained an

average of about

40% of invoice cost,

data has grown 4%

since 2010 to claim

32% of all invoice

costs 2012.

Variable costs offer a major

cost-cutting opportunity

Arguably the most compelling result,

however, came from comparing fixed costs

versus variable costs across all invoices. With

voice, data, messaging and tax making

up 83% of average invoice spend, the

remaining 17% is left to more variable

spend items such as downloads, special

features, directory assistance and one-time

charges. This presents a major cost-cutting

opportunity for organisations, as variable

costs can be more easily controlled than

fixed expenses.

Most corporate fixed plan costs are

negotiated and are therefore static for

the term of the contract. Variable costs

largely represent user preference and,

just like users, preferences vary. If one-time

downloads, recurring subscriptions, special

features, unnecessary insurance plans

and directory assistance are reported and

managed, user behaviors can be changed

Often these categories of spend are thought

of as small dollars and at only 17% of an

invoice this is a fair assessment. But 17%

of every billed mobility invoice does paint a

much different picture.

02

white paper | Burning Dollars: Top Five Trends in US Telecom Spend

Trend 2:

Tablets are king

Device type

2010

2011

Corporate-liable tablet

1%

23%

76%

75%

Employee-owned tablet

1%

18%

82%

81%

High uptake of tablets driven by

individuals rather than employers

As far as devices are concerned, tablets

seem to continue stealing the limelight, but

more so thanks to consumer interest than

corporate purchases. While tablets have

seen a 75% uptake from 20102012

indicating a dramatic increase in the

general popularity of these devices theyve

registered a much lower average annual

growth rate of 38% in terms of corporate

purchases. Where theres a higher BYOD

increase in tablet adoption, Dimension

Data believes individuals are bringing their

personal devices to work, which arent

funded by their employers.

2012 2010 to 2012 change

Smartphones which have a lower price

point and a multitude of free download

choices experienced an upswing in growth

entering 2012. Smartphones, the use of

which is on the rise, havent attracted

organizations completely yet due to security

concerns. However, its those same security

concerns that organizations may be passing

over on the way to employee-owned

devices as a solution.

As far as devices

are concerned,

tablets seem to

continue stealing

the limelight, but

more so thanks to

consumer interest

than corporate

purchases.

03

white paper | Burning Dollars: Top Five Trends in US Telecom Spend

Trend 3:

Businesses love the iPhones

In terms of the type of mobile phone thats

most popular, its perhaps not surprising that

the Apple iPhones still remain the top choice

for corporate purchases, whereas the devices

of choice in the employee-owned arena are

smartphones. The appeal of the iPhone is

twofold: primarily, its the most secure device

available. But it also holds the perception of

being best in its class. Because iPhones have

the same operating system, albeit varying

versions, companies value its platform

stability. Such stability isnt necessarily

offered with other smartphones.

Trend 4:

Mobile users surf the web for

business purposes too

It would be incorrect to assume that all web

surfing on mobile devices is for personal or

entertainment purposes. On average across

the corporate websites polled, its clear that

the majority of visits to these sites were still

from non-mobile devices. However, its also

encouraging to note that an average of at

least 7% of visits to each site came from

mobile users (who didnt just stumble upon

the websites). The average duration of the

visits around two minutes showed that

the visitors lingered, which means they

were there for information-gathering or

business purposes.

CS / DDMS-1327 / 04/13 Copyright Dimension Data 2013

Trend 5:

Unlimited data plans arent

going away soon

Its true that were all making fewer mobile

phone calls, opting instead for cheaper text

or instant messages whenever possible. So,

with the transition of mobility voice minutes

into data, many have posed the question:

Are unlimited data plans going away?

Many carriers have now shied away from

unlimited data packages offered to the

public. So, its important to exploit this

opportunity while its still in the offering.

Regardless of that, its vital to note that

unlimited data availability remains a staple

of a well-negotiated enterprise contract.

Leveraging that component means

organizations arent kept at the mercy of

their employees usage.

Given these five

trends in US telecom

spend, its clear that

costs in this area

are bound to do

what most other

business expenses do:

increase.

Wrapping it all up

Given these five trends in US telecom spend,

its clear that costs in this area are bound to

do what most other business expenses do:

increase. Its important that organizations

start gaining a more detailed picture of

which telecom expenses burn dollars

unnecessarily. It impossible to manage what

you cant see. Only once such visibility has

been established often instantly, with the

help of an experienced communications

lifecycle management partner can

businesses begin to take simple measures to

stop the burn.

For further information visit: www.dimensiondata.com

04

Middle East & Africa

Algeria Angola

Botswana Congo Burundi

Democratic Republic of the Congo

Gabon Ghana Kenya

Malawi Mauritius Morocco

Mozambique Namibia Nigeria

Oman Rwanda Saudi Arabia

South Africa

Tanzania Uganda

United Arab Emirates Zambia

Asia

China Hong Kong

India Indonesia Japan

Korea Malaysia

New Zealand Philippines

Singapore Taiwan

Thailand Vietnam

Australia

Europe

Australian Capital Territory

New South Wales Queensland

South Australia Victoria

Western Australia

Belgium Czech Republic

France Germany

Italy Luxembourg

Netherlands Spain

Switzerland United Kingdom

For contact details in your region please visit www.dimensiondata.com/globalpresence

Americas

Brazil Canada Chile

Mexico United States

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Business Negotiation Skills v2Document14 pagesBusiness Negotiation Skills v2guptaneelNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- As 1463-1988 Polyethylene Pipe Extrusion CompoundsDocument6 pagesAs 1463-1988 Polyethylene Pipe Extrusion CompoundsSAI Global - APACNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Lorry AirBrakesDocument3 pagesLorry AirBrakesEnache CristinaNo ratings yet

- Slit LampDocument20 pagesSlit LampTricia Gladys SoRiano80% (5)

- Numerical Simulations of Piano StringsDocument7 pagesNumerical Simulations of Piano StringsMihai DincaNo ratings yet

- Comparisonofweldingeconomy Kehlnaht 12551752Document10 pagesComparisonofweldingeconomy Kehlnaht 12551752Asebaho BadrNo ratings yet

- Developments Advanced in Risk Analysis and Risk ManagementDocument42 pagesDevelopments Advanced in Risk Analysis and Risk ManagementguptaneelNo ratings yet

- Developments Advanced in Risk Analysis and Risk ManagementDocument42 pagesDevelopments Advanced in Risk Analysis and Risk ManagementguptaneelNo ratings yet

- Harvard 1 Sports NegotiationDocument12 pagesHarvard 1 Sports Negotiation091413071No ratings yet

- Recr ListDocument1 pageRecr ListpenguinxxxxNo ratings yet

- Health OECDDocument61 pagesHealth OECDguptaneelNo ratings yet

- 105 Ict ContractsDocument33 pages105 Ict ContractsguptaneelNo ratings yet

- HiDocument1 pageHiguptaneelNo ratings yet

- Agile Project ManagementDocument41 pagesAgile Project Managementguptaneel100% (3)

- Project Synopsis: "Employee Motivation at Syndicate Bank"Document5 pagesProject Synopsis: "Employee Motivation at Syndicate Bank"SubhamSahaNo ratings yet

- Stress Amongst Healthcare Professionals and Migrant Workers During Covid-19 PandemicDocument6 pagesStress Amongst Healthcare Professionals and Migrant Workers During Covid-19 PandemicIJAR JOURNALNo ratings yet

- Practical Project Planning and Tracking Using Microsoft Project v2.7Document47 pagesPractical Project Planning and Tracking Using Microsoft Project v2.7Nelson Aguirre BravoNo ratings yet

- Mock Examination Routine A 2021 NewDocument2 pagesMock Examination Routine A 2021 Newmufrad muhtasibNo ratings yet

- OAF Hello Word Page PDFDocument20 pagesOAF Hello Word Page PDFNaveen KumarNo ratings yet

- Duplichecker Plagiarism Report 3Document3 pagesDuplichecker Plagiarism Report 3Mushfiqur RahmanNo ratings yet

- List of British StandardsDocument6 pagesList of British StandardsPankajNo ratings yet

- Role and Benefits of Sports Psychology For The Improvement of Performance of Sports PersonsDocument5 pagesRole and Benefits of Sports Psychology For The Improvement of Performance of Sports PersonsIJRASETPublicationsNo ratings yet

- Building Resilience Philippines Urban PoorDocument16 pagesBuilding Resilience Philippines Urban PoorYasmin Pheebie BeltranNo ratings yet

- VSP BrochureDocument33 pagesVSP BrochuresudhakarrrrrrNo ratings yet

- This Study Resource Was: Practice Questions and Answers Inventory Management: EOQ ModelDocument7 pagesThis Study Resource Was: Practice Questions and Answers Inventory Management: EOQ Modelwasif ahmedNo ratings yet

- ISO 9000 Audit Checklist for Quality Management SystemsDocument28 pagesISO 9000 Audit Checklist for Quality Management SystemsphilipalexjonesNo ratings yet

- Annexure - Subject Wise IBDP Grade BoundariesDocument4 pagesAnnexure - Subject Wise IBDP Grade BoundariesazeemNo ratings yet

- Adjustment: - Electronic Modulated Air SuspensionDocument2 pagesAdjustment: - Electronic Modulated Air SuspensionThar KyiNo ratings yet

- KTO12 Curriculum ExplainedDocument24 pagesKTO12 Curriculum ExplainedErnesto ViilavertNo ratings yet

- IEC 60793-1-30-2001 Fibre Proof TestDocument12 pagesIEC 60793-1-30-2001 Fibre Proof TestAlfian Firdaus DarmawanNo ratings yet

- English Test 03Document6 pagesEnglish Test 03smkyapkesbi bjbNo ratings yet

- Sae Technical Paper Series 2015-36-0353: Static and Dynamic Analysis of A Chassis of A Prototype CarDocument12 pagesSae Technical Paper Series 2015-36-0353: Static and Dynamic Analysis of A Chassis of A Prototype CarGanesh KCNo ratings yet

- Safety and Arming Device Timer 6-7-1976Document5 pagesSafety and Arming Device Timer 6-7-1976nguyenhNo ratings yet

- Beamware 2: Users ManualDocument14 pagesBeamware 2: Users ManualAdi FaizinNo ratings yet

- General Chemistry 2 - LAS 2 LEARNING CAPSULEDocument5 pagesGeneral Chemistry 2 - LAS 2 LEARNING CAPSULEMark RazNo ratings yet

- Jda Connects The Dots at Its 209821Document5 pagesJda Connects The Dots at Its 209821Gerardo LujanNo ratings yet

- Local Materials Used in Creating Art and TechniquesDocument29 pagesLocal Materials Used in Creating Art and TechniquesAnne Carmel PinoNo ratings yet

- 5 & 6 Risk AssessmentDocument23 pages5 & 6 Risk AssessmentAzam HasanNo ratings yet

- Book 3: The SiphonophoresDocument29 pagesBook 3: The SiphonophoresRaquel SilvaNo ratings yet