Professional Documents

Culture Documents

Workshop On Crypto Ledgers and The Law PDF

Uploaded by

P2P FoundationOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Workshop On Crypto Ledgers and The Law PDF

Uploaded by

P2P FoundationCopyright:

Available Formats

Legal Workshop

on

Crypto-Equity & the Law

Study group on Legal, Social & Economic Aspects of Cryptoledger-based Technologies

at the Berkman Center for Internet & Society

A workshop examining the interplay between blockchain technologies including

distributed cryptoledger technology and existing legal infrastructure or regulatory

regimes. The workshop will gather a small group of lawyers and entrepreneurs involved in

the deployment of distributed cryptoledger-based applications in order to sketch out a

techno-legal framework that could resolve the issues that most of these applications are

currently facing, without hindering their distributed potential and decentralized character.

Convened by:

Primavera De Filippi, Berkman Center for Internet & Society

Joel Dietz, Swarm.fund

Locations:

Berkman Center for Internet & Society, 23 Everett Street, Cambridge, Massachusetts

Wasserstein Hall, Harvard Law School, 1585 Massachusetts Ave; Cambridge, Massachusetts

Dates:

January 16th (15:00-18:00): Open presentation on current regulatory framework (at HLS)

January 17th (9:00 - 18:00): Internal Workshop (private workshop at the Berkman Center)

January 18th (9:00 - 13:00): Internal Workshop (private workshop at the Berkman Center)

January 18th (14:00-18:00): Roundtable with regulators & policy makers (Berkman or HLS)

Objective:

The goal is to examine the current applications and potential opportunities of cryptoledger

technology to create policy recommendations outlining appropriate integrations to existing

legal infrastructure. Ideally, the document will contain a set of recommendations concerning

potential applications of distributed cryptoledger technology and how they can be regulated

within the existing legal framework, as well as recommendations with regard to different

areas that should either be better regulated or rather be left unregulated. The workshop

participants will also come up with potential recommendations (in the US context) to reform

existing laws or regulation that may prevent innovation around these technologies.

Questions to be addressed

Cryptoledgers provide a novel way of issuing secure and tradable tokens via a distributed

networks. Although sometimes described as cryptocurrency, implying that the use value of

the tokens is closest to currency, there are numerous other potential applications of these

tokens that range from stock equivalents to previously unimaginable forms.

Although often generally referred to as crypto-equity they can be divided into the

following categories:

(1) Shares in a project that serve as a function similar to stock, allowing participation in

the decision making and participation in financial upside (i.e. BitShares)

(2) Tokens which represent ownership in something other than a company, for example

intellectual property (i.e. CommonAccord)

(3) Product tokens which are redeemable for some product, perhaps one consumable in

the context of a decentralized technology (i.e. Ethereum)

(4) Access tokens which provide access to a particular set of benefits within a network,

similar to a membership (i.e. Swarm)

Because in some of the aforementioned cases there may be no necessary relation back to the

existing legal regimes (e.g. contract law, security law, etc), the context in which they operate

is currently outside the law which presents both problems and potential.

The legal system is currently lagging behind these technological developments and does not

properly account for the granularity of these cryptographic tokens, which currently stand in

the gray-area of the law. Legal uncertainty might dissuade people from adopting these

technologies, thus discouraging the deployment of new applications that could be highly

beneficial to society.

While the need for a legal reform is pressing, for the time being, it is important to understand

how we can benefit from the opportunities provided by cryptoledger-based technologies in a

way that remains compliant with the law.

The purpose of this workshop is to examine both the problems and potential of

cryptoledger-based applications from the standpoint of the existing legal infrastructure.

In particular, it hopes to answer the following questions:

Under what circumstances should tokens issued in the above categories fall under

existing regulations? For examples, securities as defined by the 1933 securities act.

Under what circumstance can new legal infrastructure be developed which

accommodates these tokens? For example, how can individual tokens be linked to

legally enforceable intellectual property?

To what extent can we rely on technical and contractual means to deploy a system of

internal validation and self-regulation that complies with current sectoral

regulations?

Agenda

Before the workshop, we will set up a small task-force of 10 to 15 people from the legal community

who will be working on documenting the legal space as it currently exists.

The task-force will be subdivided into 4 working groups, working specifically on:

Legal status of cryptographic tokens

Legal status of crypto-equity

Legal validity and enforceability of smart contracts

Intellectual property licensing through smart contracts.

The in-person workshop will be subdivided in three parts:

1.

Open presentation (Friday 16th)

Day one will be a presentation of the output and findings of each working group. Every

presentation will be about 20 minutes in length, followed by 15 mins of Q&A.

Presentations (3-6pm)

Working Group 1: Legal status of cryptographic tokens

Working Group 2: with specific focus on crypto-equity

Working Group 3: Legal validity and enforceability of smart contracts

Working Group 4: Smart contracts with a specific focus on the issue of Intellectual

Property licensing, e.g commons-based property or collective management of rights,

e.g. patent-pools; copyright-licensing

Reception (6-8pm)

2.

Internal workshop (Saturday 17th & Sunday 18th)

Participants will try and come up with regulatory landscape and solutions with regard to the

following subject areas, answering the question Where do we go from here? :

Legal status of cryptographic tokens (WG 1)

with specific focus on crypto-equity (WG 2)

Legal validity and enforceability of smart contracts (WG 3),

with specific focus on Intellectual Property licensing (WG 4).

Day 1 (January 17th)

8:30 - 9:00:

Breakfast

9:00 - 12:00:

Working Groups (initial brainstorming):

Each working group gather together to produce outline of related issues and potential

solutions for each sub-area of research:

09:00 - 10:00: Brainstorming ideas

10:00 - 11:00: Discussing and selecting ideas (2 issues & 2 solutions)

11:00 - 12:00: Drafting the outline

12:00 - 14:00:

Lunch Keynote (speaker to be confirmed)

14:00 - 18:00: Working Groups (document drafting):

Each working group is divided in two sub-groups, first working on the issues and then on the

solutions.

14:00 - 15:00: Issues: each subgroup picks one issue and expand upon it

15:00 - 16:00: Group switch, each subgroup take on and expands on the other issue

16:00 - 17:00: Solutions: each subgroup picks one solution and expand upon it

17:00 - 18:00: Group switch, each subgroup review & expands on each others work

18:00 - 19:00: Working dinner (buffet): plenary session with report back to the other WGs

19:00 - night: Participants keep working on the selected issue or solution

Day 2 (January 18)

8:30 - 9:00:

Breakfast

9:00 - 12:00:

Working Groups: Final touches on collective report on related issues

09:00 - 09:30: Reconvening and assignment of individual tasks for final drafts

09:30 - 11:00: Drafting of each section as an individual task for each participant

11:00 - 12:00: Final review and group editing of the report

By the end of the Workshop, working group participants are expected to produce a collective

statement on these topics. They will come up with a document summarizing the identified

problems and solutions.

3.

Roundtable & Community feedback (Sunday 18th)

The roundtable will convene a small number of entrepreneurs, policy makers and

FinCen/SEC representatives. First, the working groups will first present their findings to the

broader audience, who will then be invited to join the workshop participants in a roundtable

discussion, with a view to assess the viability of the presented solution, and come up with

possible amendments to refine the documents. The objective is to converge towards a

common understanding concerning the applicability of the law to these cryptographic

tokens, and to identify the most pressing issues that should be addressed both in the legal

and technical field.

The resulting documents will then be disseminated to the larger legal community for further

feedback and suggestions.

12:00 - 14:00:

Lunch Keynote (speaker to be confirmed)

14:00 - 16:00:

Roundtable with policymakers & regulators to get direct feedback from them

16:00 - 16:30:

Break

16:30 - 18:00:

Roundtable (continued)

18:00 - 20:00:

Social dinner & Cultural events

Modalities of participation:

The workshop is an closed, invite only workshop (i.e. it is not be open to the public).

Participants will be invited beforehand, or selected through an application process.

For the third day of the workshop, we will invite the key actors in the field, including regulators,

policy makers, entrepreneurs and other interested stakeholders.

The workshop conversations will be off-the-record, although all the documents and proceedings,

including the roundtable discussion on the third day will be made generally available to the public

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- ENGLISH Report Cultural Commons MedellinDocument28 pagesENGLISH Report Cultural Commons MedellinP2P FoundationNo ratings yet

- No Gods No Masters No Coders The Future PDFDocument12 pagesNo Gods No Masters No Coders The Future PDFP2P FoundationNo ratings yet

- The Manifesto of The Rural Social Innovation (Edited by Alex Giordano and Adam Arvidsson)Document71 pagesThe Manifesto of The Rural Social Innovation (Edited by Alex Giordano and Adam Arvidsson)P2P FoundationNo ratings yet

- Uk Commons Assembly - Tate Exchange ProgrammeDocument1 pageUk Commons Assembly - Tate Exchange ProgrammeP2P FoundationNo ratings yet

- No Gods No Masters No Coders The Future PDFDocument12 pagesNo Gods No Masters No Coders The Future PDFP2P FoundationNo ratings yet

- The Invisible Politics of Bitcoin: Governance Crisis of A Decentralized InfrastructureDocument32 pagesThe Invisible Politics of Bitcoin: Governance Crisis of A Decentralized InfrastructureP2P FoundationNo ratings yet

- Cultural Dialogue and Institutional Mediation As Antidotes To Socioeconomic Segregation in Ecovillage DevelopmentDocument24 pagesCultural Dialogue and Institutional Mediation As Antidotes To Socioeconomic Segregation in Ecovillage DevelopmentP2P FoundationNo ratings yet

- Knowpen Foundation ThesisDocument61 pagesKnowpen Foundation ThesisP2P Foundation100% (1)

- How Can Cryptocurrency and Blockchain Technology Play A Role in Building Social and Solidarity FinanceDocument25 pagesHow Can Cryptocurrency and Blockchain Technology Play A Role in Building Social and Solidarity FinanceP2P FoundationNo ratings yet

- Carballa Smichowski Bruno (2016) - Data As A Common in The Sharing Economy A General Policy Proposal (CEPN WP)Document42 pagesCarballa Smichowski Bruno (2016) - Data As A Common in The Sharing Economy A General Policy Proposal (CEPN WP)P2P Foundation100% (1)

- BBS 2016 459609 Schedule of Events (Web) 7ADocument8 pagesBBS 2016 459609 Schedule of Events (Web) 7AP2P FoundationNo ratings yet

- Draft Primer Commons Governance MasterclassDocument5 pagesDraft Primer Commons Governance MasterclassP2P FoundationNo ratings yet

- Commons Camp (Draft Eng)Document20 pagesCommons Camp (Draft Eng)P2P FoundationNo ratings yet

- Torus NetworkDocument25 pagesTorus NetworkP2P FoundationNo ratings yet

- Build The City EbookDocument322 pagesBuild The City EbookP2P FoundationNo ratings yet

- GIFT Movie Synopsis 2015Document1 pageGIFT Movie Synopsis 2015P2P FoundationNo ratings yet

- The Gift Movie Treatment FIN LQDocument11 pagesThe Gift Movie Treatment FIN LQP2P FoundationNo ratings yet

- The Co-Operative Advantage: Innovation, Co-Operation and Why Sharing Business Ownership Is Good For BritainDocument10 pagesThe Co-Operative Advantage: Innovation, Co-Operation and Why Sharing Business Ownership Is Good For BritainP2P FoundationNo ratings yet

- Open Source Open Society Report 2015Document14 pagesOpen Source Open Society Report 2015P2P FoundationNo ratings yet

- Barcelona Metropolis UittrekselDocument8 pagesBarcelona Metropolis UittrekselP2P FoundationNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- WHO Partograph Study Lancet 1994Document6 pagesWHO Partograph Study Lancet 1994Dewi PradnyaNo ratings yet

- Tenancy Law ReviewerDocument19 pagesTenancy Law ReviewerSef KimNo ratings yet

- Bank of AmericaDocument1 pageBank of AmericaBethany MangahasNo ratings yet

- Effects of Organic Manures and Inorganic Fertilizer On Growth and Yield Performance of Radish (Raphanus Sativus L.) C.V. Japanese WhiteDocument5 pagesEffects of Organic Manures and Inorganic Fertilizer On Growth and Yield Performance of Radish (Raphanus Sativus L.) C.V. Japanese Whitepranjals8996No ratings yet

- Estimation and Detection Theory by Don H. JohnsonDocument214 pagesEstimation and Detection Theory by Don H. JohnsonPraveen Chandran C RNo ratings yet

- Bug Head - Fromjapanese To EnglishDocument20 pagesBug Head - Fromjapanese To EnglishAnonymous lkkKgdNo ratings yet

- Load Sharing Strategies in Multiple Compressor Refrigeration SystemsDocument8 pagesLoad Sharing Strategies in Multiple Compressor Refrigeration SystemsLiu YangtzeNo ratings yet

- Question Paper: Hygiene, Health and SafetyDocument2 pagesQuestion Paper: Hygiene, Health and Safetywf4sr4rNo ratings yet

- Small Signal Analysis Section 5 6Document104 pagesSmall Signal Analysis Section 5 6fayazNo ratings yet

- BPL-DF 2617aedrDocument3 pagesBPL-DF 2617aedrBiomedical Incharge SRM TrichyNo ratings yet

- BreezeAIR 8000 Data SheetDocument2 pagesBreezeAIR 8000 Data Sheetalfasukarno100% (1)

- Proposal For Chemical Shed at Keraniganj - 15.04.21Document14 pagesProposal For Chemical Shed at Keraniganj - 15.04.21HabibNo ratings yet

- Sangeetahealingtemples Com Tarot Card Reading Course in UsaDocument3 pagesSangeetahealingtemples Com Tarot Card Reading Course in UsaSangeetahealing templesNo ratings yet

- Sacmi Vol 2 Inglese - II EdizioneDocument416 pagesSacmi Vol 2 Inglese - II Edizionecuibaprau100% (21)

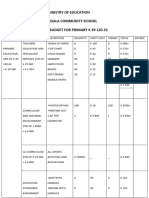

- Ministry of Education Musala SCHDocument5 pagesMinistry of Education Musala SCHlaonimosesNo ratings yet

- Quantity DiscountDocument22 pagesQuantity Discountkevin royNo ratings yet

- YeetDocument8 pagesYeetBeLoopersNo ratings yet

- Paul Milgran - A Taxonomy of Mixed Reality Visual DisplaysDocument11 pagesPaul Milgran - A Taxonomy of Mixed Reality Visual DisplaysPresencaVirtual100% (1)

- IOSA Information BrochureDocument14 pagesIOSA Information BrochureHavva SahınNo ratings yet

- IEEE Conference Template ExampleDocument14 pagesIEEE Conference Template ExampleEmilyNo ratings yet

- Kicks: This Brochure Reflects The Product Information For The 2020 Kicks. 2021 Kicks Brochure Coming SoonDocument8 pagesKicks: This Brochure Reflects The Product Information For The 2020 Kicks. 2021 Kicks Brochure Coming SoonYudyChenNo ratings yet

- Department of Labor: 2nd Injury FundDocument140 pagesDepartment of Labor: 2nd Injury FundUSA_DepartmentOfLabor100% (1)

- La Salle Lipa Integrated School Senior High School Community 1 Quarter Summative Assessment Earth Science AY 2021-2022 Household Conservation PlanDocument4 pagesLa Salle Lipa Integrated School Senior High School Community 1 Quarter Summative Assessment Earth Science AY 2021-2022 Household Conservation PlanKarlle ObviarNo ratings yet

- Toa Valix Vol 1Document451 pagesToa Valix Vol 1Joseph Andrei BunadoNo ratings yet

- Sealant Solutions: Nitoseal Thioflex FlamexDocument16 pagesSealant Solutions: Nitoseal Thioflex FlamexBhagwat PatilNo ratings yet

- Chat Application (Collg Report)Document31 pagesChat Application (Collg Report)Kartik WadehraNo ratings yet

- Bea Form 7 - Natg6 PMDocument2 pagesBea Form 7 - Natg6 PMgoeb72100% (1)

- Health, Safety & Environment: Refer NumberDocument2 pagesHealth, Safety & Environment: Refer NumbergilNo ratings yet

- A Survey On Multicarrier Communications Prototype PDFDocument28 pagesA Survey On Multicarrier Communications Prototype PDFDrAbdallah NasserNo ratings yet

- Economies and Diseconomies of ScaleDocument7 pagesEconomies and Diseconomies of Scale2154 taibakhatunNo ratings yet