Professional Documents

Culture Documents

Increase Wafer Size

Uploaded by

Anshuman BanerjeeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Increase Wafer Size

Uploaded by

Anshuman BanerjeeCopyright:

Available Formats

2

Cost Per Wafer

Cost Per Wafer

Cost per wafer is perhaps the most widely

used cost metric in the semiconductor industry. Its value lies in the ability to combine

large quantities of cost data and obtain one

indicator of operating cost that can be used to

compare different pieces of equipment, different processes, alternative materials, etc. Cost

per wafer can also be used as a benchmarking

metric (see Chapter 4, Fab Benchmarking). It

can further be used to estimate a fair price for

foundry-produced wafers.

Information from the Semiconductor

Industry Association in the U.S. indicates

that average cost per wafer has increased by

3X over the last 15 years (Figure 2-1).

Although the cost of labor, materials and

capital expenditures per wafer have

increased, the real cost of manufacturing

semiconductor chips continues to decrease

because the number of transistors that can be

placed on a wafer has grown faster than

manufacturing costs, as shown in Figure 2-2.

equipment and operations. By continually

decreasing or controlling cost per wafer, IC

manufacturers can increase profitability.

Cost per wafer at the fab level can be simply

computed using the total cost of manufacturing divided by the total number of yielded

wafers produced. Cost per wafer at the

equipment level is typically computed from

the ground-up using the cost of equipment

depreciation, cost of direct labor, maintenance and materials, cost of energy and other

facilities as well as building depreciation

costs.

As discussed in Chapter 1, this ever-increasing cost per wafer is offset by the ability to

shrink feature size by 30 percent each

device generation, thereby decreasing the

manufacturing cost per transistor. The

effective price of DRAMs, measured in cost

per bit, falls by 30 percent per year. Rising

manufacturing cost is further offset by manufacturers ability to continually increase

device yields, transition to larger wafers

sizes and increase the productivity of fab

Cost per wafer first enjoyed widespread use

several years following the introduction of

cost-of-ownership modeling by SEMATECH, the consortium of semiconductor manufacturers in the U.S. Cost per wafer is often

used to compare the cost-of-ownership performance of competing pieces of equipment.

It is also used by semiconductor manufacturers for benchmarking purposes, and to

assess the cost of making process modifications and adopting new processes.

Importantly, however, one of the most critical components in cost-of-ownership calculations is the yield of the given process step.

Because yield influences cost so dramatically

and because yield is very difficult to determine on a step-by-step basis, most COO calculations assume identical yields from one

process tool to another. For more discussion

on COO see Chapter 4, Fab Benchmarking.

INTEGRATED CIRCUIT ENGINEERING CORPORATION

2-1

Cost Per Wafer

Non-Labor

Mfg = $157

(21.5%)

Non-Labor

Mfg = $994

(41.9%)

Mfg Cost of

Goods Sold = $432

(59.1%)

S, G&A = $158

(21.6%)

S, G&A = $374

(15.8%)

R&D = $257

(10.8%)

R&D = $74

(10.1%)

Mfg Cost of

Goods Sold = $1,268

(53.4%)

Depreciation = $247

(10.4%)

Depreciation = $67

(9.2%)

Taxes &

Other = $230

(9.7%)

Mfg Labor = $275

(37.6%)

1980

Total = $731/150mm Wafer

Mfg Labor = $273

(11.5%)

1995

Total = $2,375/150mm Wafer

*North American firms only

Source: SIA

21075A

Figure 2-1. Total Cost Per Wafer Start (1980 Versus 1995*)

1,000

Manufacturing

Cost Per Wafer

Index (1982 = 100)

100

DRAM

Price Per Bit

10

Source: SIA

1982

1983

1984

1985

1986

1987 1988

Year

1989

1990

1991

1992

1993

1994

1995

22726

Figure 2-2. How Decreasing Cost Per Bit Compensates for Increasing Manufacturing Cost

2-2

INTEGRATED CIRCUIT ENGINEERING CORPORATION

Cost Per Wafer

Operating Costs

Fab operating costs can be divided into fixed

costs and variable costs. Fixed costs include

equipment depreciation, R&D, overhead,

and general and administrative costs. The

most important variable cost is the cost of

sales (manufacturing cost of goods sold),

which includes the cost of consumables,

spare parts, materials (including cleanroom

garments, etc.), labor, production control,

and facilities (operating power for the plant,

deionized water systems, etc.). The trend of

increasing manufacturing cost of goods sold

is shown in Figure 2-3. This cost of manufacturing wafers, without considering

increasing depreciation costs, rises at an

average rate of 5-6 percent per year.

Operating costs are often defined for wafer

processing alone as assembly and final testing of devices are commonly performed at a

different manufacturing sites, often in

Southeast Asian countries where labor costs

are low by North American, Japanese, and

European standards. In rough terms, IC

manufacturing costs can be divided into

three categories consisting of:

10-15 percent due to labor cost,

35-40 percent due to materials costs

(including starting wafer cost), and

40-50 percent for capital costs[1]

1,300

1,200

150mm Equivalent Wafer

1,100

1,000

Annual Trend

Growth = 5.6%

900

800

Mean

700

600

500

400

1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995

Source: SIA

22727

Figure 2-3. Manufacturing Cost of Goods Sold (Less Depreciation) Per Wafer Start

INTEGRATED CIRCUIT ENGINEERING CORPORATION

2-3

Cost Per Wafer

Beyond these broad categories, operating

costs are typically broken down into four

main components:

Manufacturing cost of devices sold (all

costs directly allocated to production, less

depreciation),

Selling, general and administrative

expenses,

Research and development costs, and

Depreciation expenses.

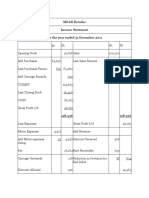

As shown in Figure 2-1, manufacturing cost

of goods sold in 1995 accounted for over 53

percent of the total cost per wafer start for

merchant IC producers in the U.S.[2] Cost per

wafer for IC manufacturers has increased

from 1980s level of around $730 per 150mm

equivalent wafer to 1995s level of nearly

$2,400 per 150mm wafer. In other words, the

cost per wafer has risen by over a factor of

three in a fifteen year period. In addition, the

portion of manufacturing costs due to labor

expenses has dropped dramatically.

Interestingly, the dollar amount companies

had to devote to labor was almost exactly the

same in 1995 as it was in 1980.

manufacturing costs and S, G&A costs

increased by almost a factor of 9 each; and

sales by U.S.-based merchant semiconductor

firms increased by a factor of 12. As can be

gleaned from this illustration, during the

industrys most difficult period in the mid1980s, R&D and depreciation expenditures

remained high while the sales index (annual

semiconductor sales) dipped too low to support these expenditures.

In the most recent expansionary cycle

between 1993 and 1996, the focus on increasing expenditures for equipment and new

fabs has increased dramatically. However, as

shown in Figure 2-5, depreciation expenses

as a percent of sales appear to be stabilizing,

despite a long-term average increase of 10-15

percent per year.

The following sections briefly discusses the

cost components for manufacturing costs,

depreciation, and R&D costs. Selling, general and administrative costs will not be covered as these expenditures vary a great deal

from one company to the next, and vary little

from year to year for a given company.

These expenditures can also be viewed relative to annual semiconductor industry sales.

In other words, the rates of increase in

expenditures for manufacturing, R&D,

depreciation, and S, G&A expenses can be

compared to the rate of annual increases in

overall semiconductor industry revenues.

Shown in Figure 2-4 are year-to-year values

for R&D, depreciation expenses, manufacturing costs, S, G&A costs, and semiconductor sales, normalized to 1978 values. Long

term, depreciation and R&D costs have risen

much more dramatically than manufacturing costs, semiconductor sales, and S, G&A

expenditures. Between 1978 and 1995,

depreciation outlays increased by a factor of

17; R&D costs increased by a factor of 14;

R&D and Depreciation Costs

2-4

INTEGRATED CIRCUIT ENGINEERING CORPORATION

As mentioned previously, due to the

extremely high pace of technological innovation in this industry, necessary investment

for R&D, new fabs, and equipment can be as

high as 25-30 percent of sales. In fact, the

percentage of sales that must be reinvested

for R&D in the semiconductor industry surpasses that needed in nearly every other

high technology industry (Figure 2-6).

Interestingly enough, the key industries that

semiconductors feedcomputers, consumer

electronics, communications, and automotiveeach requires lower investment to

develop than the chips that run them.

Cost Per Wafer

18.0

15.0

Mfg. Cost of

Goods Sold

S, G&A

Depreciation

14.0

R&D

17.0

16.0

Index: 1978 =- 1.0

13.0

12.0

11.0

10.0

9.0

8.0

7.0

6.0

5.0

4.0

Sales Index

3.0

2.0

1.0

1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995

Year

Note: U.S. merchant semiconductor manufacturers only.

Source: SIA

19783B

Figure 2-4. Annual Expenditures for Major Cost Components

Depreciation as a Percent of Sales Revenue

16

14

Median

12

10

Mean

4

1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995

Year

Note: U.S. merchant semiconductor manufacturers only.

Source: SIA

19784B

Figure 2-5. Depreciation Expenses Rise More Rapidly Than IC Revenues

INTEGRATED CIRCUIT ENGINEERING CORPORATION

2-5

Cost Per Wafer

Software and Services

,,,,,,,,,,,,,,,,,,

,,,,,,,,,,,,,,,,,,

,,,,,,,,,,,,,,,,,,

Computer Communications

Semiconductors

Health Care

Computers

Electronics

Instruments

Office Equipment

(Excluding Computers)

Aerospace and Defense

Chemicals

Automotive

Telecommunications

General Manufacturing

Electrical Products

0

10

12

14

R&D as a Percent of Sales

Source: Business Week

19781A

Figure 2-6. R&D For Semiconductors Exceed Most Other High Technology Industries

In addition, as technology development

becomes more expensive, it becomes more

difficult to get a timely return on investment.

Generally, IC manufacturers invest 10-15

percent of sales each year in R&D. Figure 27 shows R&D expenditures both in billions

of dollars and as a percentage of sales revenues for merchant IC manufacturers in the

US. While this percentage appears to have

declined over the 1992-1995 period, R&D

outlays rose dramatically at an average

annual rate of 18 percent over the period.

The most important components in development costs are equipment costs and labor, as

illustrated in Figure 2-8. One of the most

important strategies used by semiconductor

companies to control these costs is the formation of strategic partnerships for both

technology development and in some cases,

fab ownership.

2-6

INTEGRATED CIRCUIT ENGINEERING CORPORATION

Also shown back in Chapter 1, the top 10

companies accounted for 55 percent of all

capital spending in the semiconductor

Cost Per Wafer

industry in 1996, and 83 percent of all spending is performed by 25 companies.

Worldwide, SEMI and SEAJ estimate that

63.5 percent of capital spending goes toward

wafer processing equipment, 21 percent

toward testing equipment, nearly 10 percent

to assembly equipment and nearly 6 percent

to facility related equipment (i.e., computers,

automation, etc.). These numbers equate to

1996 market sizes of $26.6 billion for wafer

processing equipment, $8.8 billion for testing

equipment, $4 billion for assembly equipment and $2.5 billion for facility equipment.

6.0

18.0

5.5

5.0

16.0

Billions of Dollars

4.0

14.0

3.5

3.0

12.0

Percentage of Sales

2.5

Billions of Dollars

2.0

10.0

Percent of Sales Revenues

4.5

1.5

1.0

8.0

Annual Trend

Growth = 14.7%

0.5

0.0

6.0

1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995

Year

Source: SIA

22728

Figure 2-7. Semiconductor R&D Expenditures

Other (Including Travel)

8%

Consumables

(Gases and Chemicals)

16%

Equipment

31%

Labor 26%

Facilities and Property

19%

Source: Intel/EE Times

19977A

Figure 2-8. Breakdown of Semiconductor Technology Development Costs

INTEGRATED CIRCUIT ENGINEERING CORPORATION

2-7

Cost Per Wafer

Depreciation schedules vary from one country to another. Semiconductor firms in the

U.S. have attempted to change 5-year depreciation schedules on semiconductor processing equipment to 3 years to better reflect the

rapid rate of technological obsolescence in

fabs today. Despite bipartisan support in the

U.S. House of Representatives and Senate,

the bill to change these depreciation schedules did not pass. However, some progress

was made in 1997 as a bill was passed to

raise R&D tax credit for basic research from 8

percent to 11 percent. The bill also allows a 6

percent manufacturers investment credit for

cleanrooms built by IC manufacturers and

semiconductor equipment companies.

Figure 2-9 shows depreciation schedules for

a fab facility in the U.S.

Within the fab area, the photolithography

cell is the most expensive (Figure 2-10), as

leading-edge steppers and step-and-scan

machines for 0.25um processing are priced

between $5-$7 million each. In addition, the

investment for advanced reticles is rising

rapidly (Figure 2-11). Beyond lithography

costs, the next most expensive is diffusion

processes, followed by etching, thin film

deposition, and ion implantation. Trends

indicate a long-term increase in number of

CVD, sputtering, and etching tools in the fab,

principally driven by an increasing number

of metal layers in advanced logic devices

(currently at 5-6 levels for 64-bit MPUs), and

the introduction of chemical mechanical polishing tools for global planarization. Many

sources estimate that back-end wafer processing (all processing of films above the

substrate level) accounts for more than 50

percent of overall cost per wafer.

Fab

Cleanroom

Building Equipment

Wafer

Office

Processing

and Utility

Equipment

Year in

Service

Land

100%

98%

89%

67%

98%

104%

97%

79%

46%

94%

108%

97%

70%

29%

90%

112%

97%

62%

16%

86%

117%

97%

55%

10%

82%

122%

96%

49%

10%

79%

127%

95%

44%

10%

76%

132%

94%

39%

10%

74%

137%

93%

35%

10%

72%

10

142%

91%

31%

10%

69%

11

148%

90%

28%

10%

67%

12

154%

89%

25%

10%

65%

13

160%

87%

22%

10%

64%

14

167%

85%

20%

10%

62%

15

173%

83%

20%

10%

61%

16

180%

81%

20%

10%

60%

Source: Oregon Department of Revenue 1994-1995 Electronics

Trend and Depreciation Schedules

22729

Figure 2-9. Depreciation Schedules Projected Appraised Value of Investment

as Percentage of Original Cost

2-8

INTEGRATED CIRCUIT ENGINEERING CORPORATION

Cost Per Wafer

Implant

12%

Thin Films

16%

Etch

18%

Photolithography

32%

Diffusion

22%

Source: Microlithography World

21070

Figure 2-10. Relative Costs of Semiconductor Manufacturing Areas

Billions of Dollars

1,000

Semiconductor Market

100

10

Mask Market

1

0.1

1977

1980

1985

1990

1995

2000

Year

Source: Wafer News/Rose Assoc.

22693

Figure 2-11. Growing Investment in Reticles and Masks

Long-term increases in depreciation and

R&D expenditures continually challenge the

cost-effectiveness of IC manufacturing. One

metric used to examine overall cost effectiveness is asset turnover rate. Figure 2-12

shows that in the years preceding 1980,

every dollar of net fixed assets generated

greater than $3.00 in sales revenue. By 1987,

asset turnover rate had fallen by 50 percent.

However, recent trends indicate that asset

turnover rates are stabilizing. However, further deterioration in the rate may affect the

financial future of the industry. Once again,

by making facilities and operations more

cost effective, margins can be preserved and

the rate of technological advancement can

continue at its rapid pace. Astoundingly, the

average employee of a merchant IC manufacturer in the U.S. is supported by $120,000

in net fixed assets (Figure 2-13).

INTEGRATED CIRCUIT ENGINEERING CORPORATION

2-9

Cost Per Wafer

4.0

Net Fixed Assets/Sales ($)

3.5

3.0

2.5

Mean

Median

2.0

1.5

1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995

Year

Source: SIA

22730

Figure 2-12. Net Fixed Assets Rise Faster Than Industry Revenues

140

120

$1,000 Per Employee

100

80

60

Median

40

20

Mean

0

1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995

Year

Source: SIA

22731

Figure 2-13. Net Fixed Assets Per Employee

2-10

INTEGRATED CIRCUIT ENGINEERING CORPORATION

Cost Per Wafer

The Cost of Labor

As semiconductor fabs become more automated and reliable, labor costs typically represent a smaller portion of total wafer

processing costs. As shown back in Figure 21, total labor costs typically constitute 11.5

percent of overall cost per wafer for U.S.

firms. Figure 2-14 shows how the total labor

rate (including wages, salaries, payroll taxes,

etc.) as a percent of sales for U.S. firms has

dropped dramatically over the last several

years and the divergence between the mean

and median lines indicates that larger firms

spend much less on labor than smaller IC

manufacturers, which is expected. Figure 215 gives a sampling of salaries and wages

earned by different individuals working in

or around the fab.

By 1996, labor rate differences between the

U.S. and Japan had diminished due to

changing standards in Japan and the changing value of the yen (Figure 2-16). The

semiconductor industry has become a truly

global industry with fabs now emerging in

all regions of the world. Regions that have

recently attracted fabs include China,

Malaysia, Thailand, India, and Eastern

Europe. These countries offer the labor cost

advantages that Japan once enjoyed over

the U.S. It comes as no surprise that these

regions, home to many assembly houses,

are now being used for wafer processing.

Such developing regions offer enormous

growth potential, as evidenced in the

growth of exports in developing regions relative to export growth in developed regions

(Figure 2-17).

50

Percent of Sales Revenues

45

Median

40

35

Mean

30

25

20

1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994

Year

*Includes wages, salaries, retirement expenses, incentive compensation, payroll taxes

**North American firms only

Source: SIA

21072

Figure 2-14. Total Labor Expenses* as a Percent of Sales Revenues**

INTEGRATED CIRCUIT ENGINEERING CORPORATION

2-11

Cost Per Wafer

Minimum

50th

Percentile

Maximum

Average

Semiconductor (Dollars/Hour)

Operator Wafer Fab I

6.30

9.98

Operator Wafer Fab II

7.24

10.55

Operator Wafer Fab III

8.24

12.69

Semiconductor Specialist

9.49

14.78

Semiconductor Line Mech.

13.72

19.72

Process Engineer I

30.8

47.5

Process Engineer II

35.8

56.1

Process Engineer III

44.3

68.7

Process Technician

20.3

31.4

Sr. Process Technician

25.5

38.7

QA Technician I

18.2

27.1

QA Technician II

20.6

30.9

QA Technician III

24.3

36.7

QA Engineer

33.8

51.0

Process Development Manager

53.6

81.6

QA Manager

47.4

74.4

MIS Manager

49.6

78.4

R & D Manager

60.1

94.8

HR Manager

43.6

68.2

Compensation Manager

47.4

71.6

Emp. Relations Manager

50.4

80.8

Gen. Accounting Manager

43.4

68.2

Facilities Manager

43.2

68.6

Office Manager

31.0

47.4

Production Manager

41.1

64.7

Test Engineer

34.5

52.8

CAD Operator I

20.5

30.5

Accounting Clerk I

15.7

23.4

Receptionist

16.6

23.9

Secretary

21.5

31.6

Executive Secretary

24.9

36.9

Administrative Assistant

24.8

37.3

Data Entry Operator

17.0

24.3

Semiconductor (Thousands of Dollars/Year)

Elec. Management (Thousands of Dollars/Year)

Other Technical (Thousands of Dollars/Year)

Clerical (Thousands of Dollars/Year)

Definitions Minimum 50th Percentile: The minimum salary range which

is higher than 50% of all minimum ranges.

Maximum Average: The average of the maximum

salary ranges reported.

Source: American Electronics Assoc.

21076

Figure 2-15. Typical Industry Salary Ranges in U.S., West Coast

2-12

INTEGRATED CIRCUIT ENGINEERING CORPORATION

Cost Per Wafer

1996

U.S. WAFER FAB

DIRECT LABOR RATE

COST

FACTOR

JAPANESE WAFER FAB DIRECT

LABOR RATE

1985 - 1986*

1996**

$11.80

$5.50

$11.21

35%

40%

40%

TOTAL

$15.93

$7.70

$15.69

LABOR COST PER

WAFER TO PROBE

(1.5 HOURS)

$23.90

$11.55

$23.54

HOURLY RATE

FRINGE RATE

* 205 = $1.00

**108 = $1.00

12030J

Source: ICE

Figure 2-16. U.S. and Japanese 1995 IC Facility Direct Labor Costs

220

217.1

200

Percentage of Exports

180

160

140

120

94.2

100

80

69.6

60

40

20

0

Developing

Economies

Source: Wall Street Journal/DRI/McGraw Hill

World

Industrialized

Economies

22701

Figure 2-17. Real Growth of Exports in the World, 1995-1996

INTEGRATED CIRCUIT ENGINEERING CORPORATION

2-13

Cost Per Wafer

Worldwide, the semiconductor industry

employs roughly between 750,000 and a million people (Figure 2-18). Of these, approximately 260,000 are employed by North

American merchant semiconductor manufacturers. Figure 2-19 shows the cyclical patterns in North American on-shore and

off-shore employment levels in response to

changing market condition. As shown,

employment levels have increased significantly between 1992 and 1995, despite continual advances in labor productivity. In

1995, approximately 70 percent of the North

American wages were disbursed to employees in North America, and the off-shore

employee earns approximately one-third the

salary of the employee based in North

America, reflecting the semi-skilled labor at

off-shore assembly operations as opposed to

the base of highly-skilled and professional

workers at North American facilities. This

pay differential is narrowing slowly (Figure

2-20) as off-shore wages steadily increase.

1,200

1,100

Employees (Thousands)

1,000

800

600

725

520

510

1987

1990

400

200

0

1995

2000*

Year

* Projected

Source: Electronic Business Today

22689

Device Cost Modeling

Several years ago ICE developed a simplified

cost model to examine manufacturing costs.

The model estimate a company's gross

margin and revenues for a given device

based on the ASP for the devices at the time,

and a calculation of device factory cost based

on design rules, type of device, equipment

cost, wafer size used, defect density estimates, etc. Among these assumptions, defect

density is the most critical. Through fab

benchmarking studies and cost modeling,

ICE developed the wafer cost estimates

shown in Figure 2-21.

Figures 2-22 and 2-23 show cost model

results for a Pentium microprocessor and

16M and 64M DRAM devices in first quarter

1997. As shown, the advanced-generation

Pentium device yields a significant gross

margin as little competition exists in this

marketplace. As the advanced-generation

Pentiums mature and are replaced by the

Pentium Pro device, Intel will continue to

lower the price of this processor more dramatically and improve yields more quickly

to preserve margins.

The margins on DRAM devices, however,

have dramatically declined in the past year,

forcing important changes in the 16M

DRAM market and the adoption of 64M

technology. At least some DRAM manufacturers are accelerating their transition to 64M

production due to the slim profit margins of

16M devices, as illustrated in Figure 2-23. At

the same time, manufacturers are rapidly

shrinking the die size of 16M devices from

typical levels of 80mm2 to as small as 60mm2

to preserve yields and margins.

Figure 2-18. Worldwide Semiconductor

Employment

2-14

INTEGRATED CIRCUIT ENGINEERING CORPORATION

Cost Per Wafer

150

North America

Offshore

140

1,000 Employees

130

120

110

100

90

1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995

Year

Source: SIA

22732

Figure 2-19. North America and Offshore Employment Levels

70

Annual Growth

Trend = 10.8%

60

$1,000 Per Employee

50

North American

40

30

Worldwide Average

20

10

Offshore

0

1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995

Year

Source: SIA

22733

Figure 2-20. Labor Expenses Per Employee

INTEGRATED CIRCUIT ENGINEERING CORPORATION

2-15

Cost Per Wafer

Process Technology

Feature

Size (m)

Wafer

Size (mm)

CMOS

14-16 Masks

Advanced

CMOS

18-20 Masks

Advanced

BiCMOS

22 Masks

Bipolar

8-10 Masks

Bipolar

14-16 Masks

Advanced

Bipolar

22 Masks

1.5

125

170

360

210

245

360

1.0

125/150

/310

/575

270/

/575

0.8

150/200

390/

600/990

660/

660/

0.5

150/200

525/

700/1,140

900/1,400

900/

0.35

200

1,415

1,800

20279A

Source: ICE

Figure 2-21. Whole Wafer Cost Before Probe ($)

BiCMOS MPU (0.35)

Tested Wafer Cost

$1,890 (200mm epi wafer)

Die Size

135,000 sq mils (90mm2)

Total Dice Available

Probe Yield

Number Of Good Dice

Package Cost

292

37% (at 1.2 defects/cm 2 )

108

$25.75 (296-pin CPGA)

Assembly Yield

99%

Final Test Cost

$35.00

Final Test Yield

Factory Cost

ASP (1,000)

Approx. Revenue/Wafer Start

70%

$112.41

$350

$26,195

Revenue/Sq In. Started

$542

Gross Margin

68%

Source: ICE

14448G

Figure 2-22. Pentium (166MHz P54CS) Cost Analysis (3Q96)

DRAM, MPU and ASIC Manufacturing

Costs

DRAM device sector. In addition, the manufacturing technology using multilevel metalization designs of 5 layers or more is driven

by needs of the microprocessor supplier. The

industry therefore has two very strong segments, DRAMs and microprocessors, driving

the designs of process equipment, facilities,

automation and factory management.

The semiconductor industry has traditionally been driven by the needs of the DRAM

manufacturers because these companies are

the single largest consumers of semiconductor equipment and materials, and because

DRAM devices, until recently, were the technology drivers. In recent years, microprocessors have become the technology driver as

Intel has speeded its transitions to smaller

feature sizes faster than the transitions in the

DRAM manufacturers produce ICs in high

volume, thereby driving the development of

equipment that delivers the highest throughput possible, while meeting processing

2-16

INTEGRATED CIRCUIT ENGINEERING CORPORATION

Cost Per Wafer

requirements that vary little within a given

facility. For instance, a fab may be producing

1M DRAMs and 4M DRAMs, while running

pilot line production and design of 16M and

64M DRAMs, respectively. In addition, different versions of the same generation may

be produced, for instance, for 3.3V and 5.0V

operation, or 4x4 and 1x16 bit cell configurations. Due to the small differences in processing requirements for these devices,

generally two generations of equipment are

found in DRAM fabs. High-volume production also means that production lots of 24

wafers at a time are almost always run, and

engineers have the luxury of dedicating

process tools to certain processes, thereby

improving processing results.

At the other extreme are ASIC manufacturers. ASIC production means that lot sizes

vary from one to twenty-four wafers; every

lot has a different mask set; wafers are produced in small volume; the product line contains several generations of equipment; and

the fab must be constructed to be very

responsive to changes. ASICs are also more

difficult to analyze than memory devices.

Memories are highly testable structures and

yield learning is only performed once for a

product that will be manufactured for 8-10

years. ROI typically takes 2-3 years for each

new generation of DRAMs. For ASICs, there

is very little time for yield learning and reliability studies. The delivered design must be

"fool-proof," negating the need for failure

analysis and yield analysis. Acceptable yield

from the time manufacturing is started is a

prerequisite for ROI over a few months, and

the guarantee that delivery dates are met.

For these reasons, simulation plays a large

role in device and process development for

ASICs, whereas process simulation for memories is not traditionally performed, and

pilot runs suffice. In general, ASIC manufacturing also drives the development of computer aided design and factory control

software, and packaging technology, due to

larger chip sizes of varying dimensions.

16M DRAM (0.35)

Tested Wafer Cost

Die Size

$1,180 (200mm)

$1,485 (200mm)

84,000 sq mils (54mm2)

232,500 sq mils (150mm2)

476

162

80% (at 0.5 defects/cm2)

40% (at 0.7 defects/cm2)

Total Dice Available

Probe Yield

64M DRAM (0.35)

Number Of Good Dice

Package Cost

380

65

$0.40

$0.50

Assembly Yield

99%

99%

Final Test Cost

$0.60

$1.20

Final Test Yield

95%

85%

Factory Cost

$4.36

$29.15

ASP

$7.75

$55.00

Approx. Revenue/Wafer Start

$2,770

$3,008

Revenue/Sq In. Started

$55

$60

Gross Margin

44%

47%

16912G

Source: ICE

Figure 2-23. 16M and 64M DRAM Cost Analysis

INTEGRATED CIRCUIT ENGINEERING CORPORATION

2-17

Cost Per Wafer

Figure 2-24 shows further differences

between DRAM and ASIC manufacturing.

The high-volume DRAM manufacturing

lines suffer little from reconfiguration and

capacity additions relative to ASIC fabs. The

cost benefits due to automated scheduling,

and wafer and mask tracking for ASICs outweigh the same benefits to the DRAM manufacturer. However, too much automation

can inhibit flexibility. In addition, equipment reliability, mean time to repair (MTTR),

and the importance of being able to quickly

make real-time process changes, are much

more important to the ASIC manufacturer.

Development equipment must be extremely

comparable to manufacturing equipment as

yield ramp-up for ASICs must be minimized.

Other Key Cost Trends

In addition to product yield, cycle time, labor

costs, and equipment productivity, important components in cost per wafer include

the cost of equipment maintenance, test

wafers, and consumables. Although discussing every cost components in detail is

beyond the scope of this book, some highlights provides insight into their importance:

Contracted maintenance costs vary

between nothing ($0) for the first two

years, to up to $400,000 per tool per year,

depending on the equipment supplier and

terms of the contract.

Equipment installation, including tool

hook-up and the running of test wafers to

full qualification, typically adds 35 percent

to the price of the tool.

As far as manufacturing cycle time and work

in process (WIP) are concerned, the fab with a

greater number of different products being

processed at once (greater variability) will

reach higher levels of WIP and longer cycle

times, faster (Figure 2-25). Achieving low

cycle time in the presence of variability

requires either flexible equipment or idle time.

Issues

Modularity

Benefits Due to Computer

Integrated Manufacturing

Important Equipment

Characteristics

The cost of cleaning gases for single-wafer

tools is significantly higher than for batch

tools. In-situ cleaning procedures also contribute significantly to tool downtime.

Measure

ASIC

DRAM

Cost of Reconfiguration

High

Low

Cost of Capacity Additions

High

Medium

Automated Downloading

High

Low

Wafer/Mask Tracking

High

Low

Scheduling

High

Low

Reliability

High

Medium

High

Medium

Medium

High

Real Time Process Change

High

Medium

Dev. Eqpt. = Mfg. Eqpt.

High

Medium

MTTR

Defect Free

Source: Motorola

19775

Figure 2-24. Relative Fab Characteristics

2-18

INTEGRATED CIRCUIT ENGINEERING CORPORATION

Cost Per Wafer

Test wafer cost rises dramatically at the

200mm level as manufacturers use prime

polished wafers, rather than reclaimed

wafers, for process monitoring.

Studies indicate that some fabs are spending $1 million or more a month on test

wafers, which does not include the cost of

lost productivity when tools are running

these wafers[3].

References

1. J. Smits, et.al., Logistics in Fab Design,

Future Fab International, p. 101.

2. 1978-1995 Industry Data Book,

Semiconductor Industry Association

3. S. Billat, "Process Control: Covering All

of the Bases," Semiconductor International,

Sept. 1993, p. 78.

Conclusions

WIP or Cycle Time

A companys ability to drive down cost per

wafer requires an understanding of the cost

components.

Cost competitiveness is

absolutely essential regardless of device

market due to the true globalization of

todays semiconductor market.

Manufacturing with

Low Variability

Manufacturing with

High Variability

Process

Time

Loading

Source: TI

Capacity

19754

Figure 2-25. The Effect of Variability on WIP and Cycle Time

INTEGRATED CIRCUIT ENGINEERING CORPORATION

2-19

Cost Per Wafer

2-20

INTEGRATED CIRCUIT ENGINEERING CORPORATION

You might also like

- Air Duct Plastics World Summary: Market Values & Financials by CountryFrom EverandAir Duct Plastics World Summary: Market Values & Financials by CountryNo ratings yet

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Cost Analysis - Fast Moving Consumer Durables Industry: NOVEMBER 2, 2018Document8 pagesCost Analysis - Fast Moving Consumer Durables Industry: NOVEMBER 2, 2018Saurabh SinghNo ratings yet

- Economics of Chemical Plant Lec 33-36Document46 pagesEconomics of Chemical Plant Lec 33-36Muhammad Ahms100% (3)

- McKinsey - Creating Value in Semiconductor IndustryDocument10 pagesMcKinsey - Creating Value in Semiconductor Industrybrownbag80No ratings yet

- Outsourcing Manifold ProductionDocument8 pagesOutsourcing Manifold Productionaliraza100% (2)

- Short-Term Decision Making in Foundry Unit - A Case Study PDFDocument6 pagesShort-Term Decision Making in Foundry Unit - A Case Study PDFDevendra TaradNo ratings yet

- Maximizing Profits Using Throughput AccountingDocument12 pagesMaximizing Profits Using Throughput AccountingNabil NizamNo ratings yet

- Chap 006Document16 pagesChap 006Tashkia0% (1)

- Taking The Next Leap Forward in Semiconductor SHORTDocument16 pagesTaking The Next Leap Forward in Semiconductor SHORTGerard StehelinNo ratings yet

- Cost AccountingDocument12 pagesCost AccountingrehanNo ratings yet

- Sona Namitha - Cost EvauationDocument31 pagesSona Namitha - Cost EvauationSHYAM SUNDARNo ratings yet

- Estimation HandbookDocument54 pagesEstimation HandbookMathias Wafawanaka100% (1)

- Impact of Data Analytics on Downstream Oil IndustryDocument6 pagesImpact of Data Analytics on Downstream Oil Industryshubham tiwariNo ratings yet

- Measuring Process Performance: Rate, Cost, Quality, and FlexibilityDocument5 pagesMeasuring Process Performance: Rate, Cost, Quality, and FlexibilityFranklin Bravo ChufelizNo ratings yet

- Voltage StabilizerDocument11 pagesVoltage StabilizerShreekant KashyapNo ratings yet

- Management ProDocument5 pagesManagement ProGeethaNo ratings yet

- Technology, Production, and Costs: Chapter Summary and Learning ObjectivesDocument34 pagesTechnology, Production, and Costs: Chapter Summary and Learning ObjectivesRoxana CabreraNo ratings yet

- Abernathy and Wayne - Limits of the Learning CurveDocument24 pagesAbernathy and Wayne - Limits of the Learning CurvexxxsmkxxxNo ratings yet

- CHEMICAL ENGINEERING PROJECT COSTSDocument12 pagesCHEMICAL ENGINEERING PROJECT COSTSWan ShamNo ratings yet

- Life Cycle CostingDocument8 pagesLife Cycle CostinghariNo ratings yet

- COST ANALYSIS OF FAST MOVING CONSUMER DURABLESDocument10 pagesCOST ANALYSIS OF FAST MOVING CONSUMER DURABLESSaurabh SinghNo ratings yet

- Cost Reduction Techniques FinalDocument89 pagesCost Reduction Techniques FinalJaspreet SinghNo ratings yet

- Unit 2Document34 pagesUnit 2Abdii DhufeeraNo ratings yet

- Challenges and opportunities for high-temperature materials developmentDocument7 pagesChallenges and opportunities for high-temperature materials developmentraharjoitbNo ratings yet

- Cost Estimation (18 May 2014)Document93 pagesCost Estimation (18 May 2014)AditIqbalIskandarNo ratings yet

- Bridgeton Industries Case Study - Designing Cost SystemsDocument2 pagesBridgeton Industries Case Study - Designing Cost Systemsdgrgich0% (3)

- Estimation of ExpensesDocument23 pagesEstimation of ExpensesBayu MaulidaNo ratings yet

- Study of Equipment Prices in The Power SectorDocument121 pagesStudy of Equipment Prices in The Power Sector이주성100% (1)

- DK5739 CH5Document28 pagesDK5739 CH5Özer ÖktenNo ratings yet

- Technology, Production, and Costs: Chapter Summary and Learning ObjectivesDocument35 pagesTechnology, Production, and Costs: Chapter Summary and Learning ObjectivesseriosulyawksomNo ratings yet

- Economic Measurements of Polysilicon For The Photovoltaics IndustryDocument10 pagesEconomic Measurements of Polysilicon For The Photovoltaics IndustryRishi SoniNo ratings yet

- Manufacturing OverheadDocument5 pagesManufacturing OverheadSheila Mae AramanNo ratings yet

- World Energy June2003Document7 pagesWorld Energy June2003Rubén Reyes SalgadoNo ratings yet

- DME 814 Computer Integrated ManufacturingDocument42 pagesDME 814 Computer Integrated ManufacturingAtif JamilNo ratings yet

- University of Engineering and Technology Peshawar: Name: Insiram NaveedDocument5 pagesUniversity of Engineering and Technology Peshawar: Name: Insiram NaveedInsiram NaveedNo ratings yet

- Manufacturing Dies and Molds TechniquesDocument19 pagesManufacturing Dies and Molds TechniquesTomas Trojci TrojcakNo ratings yet

- Mathematical Modeling With Sem - PLS in Elimination of Six Big Losses To Reduce Production Cost of Steel FactoriesDocument6 pagesMathematical Modeling With Sem - PLS in Elimination of Six Big Losses To Reduce Production Cost of Steel FactoriesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- MR1325 ch9 PDFDocument8 pagesMR1325 ch9 PDFArgelyn Gonzales RubinNo ratings yet

- MR1325 ch9 PDFDocument8 pagesMR1325 ch9 PDFAprameya DashNo ratings yet

- National Textile Center: FY 2003 (Year 12) Continuing Project ProposalDocument3 pagesNational Textile Center: FY 2003 (Year 12) Continuing Project Proposalvasanth paramanandhanNo ratings yet

- Applying Artificial Intelligence at Scale in Semiconductor Manufacturing - McKinseyDocument25 pagesApplying Artificial Intelligence at Scale in Semiconductor Manufacturing - McKinseyBharathi RajaNo ratings yet

- 08 Numisheet2008 Hot Forming Chapter8Document99 pages08 Numisheet2008 Hot Forming Chapter8rdouceNo ratings yet

- Blocher - 9e - SM - Ch03-Final - StudentDocument25 pagesBlocher - 9e - SM - Ch03-Final - Studentadamagha703No ratings yet

- Management Accounting Report SampleDocument13 pagesManagement Accounting Report Samplelearning_light1100% (4)

- Topic 9Document60 pagesTopic 9伟铭No ratings yet

- Us MFG 2015 Global A and D OutlookDocument22 pagesUs MFG 2015 Global A and D Outlookblacktea15No ratings yet

- Managerial EconomicsDocument11 pagesManagerial EconomicsFrankNo ratings yet

- Productivity Analysis of Select Smes in Bangladesh: PlasticsDocument17 pagesProductivity Analysis of Select Smes in Bangladesh: Plasticsmh_rahman7807No ratings yet

- 8.power Plant EconomicsDocument28 pages8.power Plant EconomicsRAVI KIRAN CHALLAGUNDLA100% (1)

- 1 Operational Flexibility PDFDocument37 pages1 Operational Flexibility PDFamir8100No ratings yet

- Trends in Module Pricing 27042010Document5 pagesTrends in Module Pricing 27042010himadri.banerji60No ratings yet

- Cost Classification - MBADocument10 pagesCost Classification - MBAissa.hossam3793No ratings yet

- Capítulo 6 Cálculo Del Costo de Fabricación PDFDocument25 pagesCapítulo 6 Cálculo Del Costo de Fabricación PDFFrancisco QuirogaNo ratings yet

- (Chapter 6) Gael D Ulrich - A Guide To Chemical Engineering Process Design and Economics (1984, Wiley)Document19 pages(Chapter 6) Gael D Ulrich - A Guide To Chemical Engineering Process Design and Economics (1984, Wiley)Rosa BrilianaNo ratings yet

- PR-20 Automated Processing Technology For CompositesDocument8 pagesPR-20 Automated Processing Technology For CompositesglisoNo ratings yet

- Cost Advantage: OutlineDocument14 pagesCost Advantage: OutlineSunit BanchhorNo ratings yet

- CHEMICAL COST ESTIMATIONDocument11 pagesCHEMICAL COST ESTIMATIONRonak ModiNo ratings yet

- AssignmentDocument7 pagesAssignmentsmmehedih008No ratings yet

- The Management of Additive Manufacturing: Enhancing Business ValueFrom EverandThe Management of Additive Manufacturing: Enhancing Business ValueNo ratings yet

- Implementing A Simple Web ServiceDocument25 pagesImplementing A Simple Web ServiceBhanuprakash VC0% (1)

- Mandukya Upanishad An Ancient Sanskrit Text On The Nature of RealityDocument24 pagesMandukya Upanishad An Ancient Sanskrit Text On The Nature of Realityganesh59100% (2)

- Database ERDocument9 pagesDatabase ERAnshuman Banerjee100% (1)

- Brain Imaging - Meditation ResearchDocument7 pagesBrain Imaging - Meditation ResearchAnshuman BanerjeeNo ratings yet

- Drive Time Log Sheet GuideDocument2 pagesDrive Time Log Sheet GuideAnshuman BanerjeeNo ratings yet

- GyroscopeDocument20 pagesGyroscopeAnshuman BanerjeeNo ratings yet

- Think CSpyDocument288 pagesThink CSpyapi-3713317No ratings yet

- Brain Imaging - Meditation ResearchDocument7 pagesBrain Imaging - Meditation ResearchAnshuman BanerjeeNo ratings yet

- What Is SputteringDocument3 pagesWhat Is SputteringAnshuman BanerjeeNo ratings yet

- Vol 2 No 7 Optical Materials Journal July 2014Document1 pageVol 2 No 7 Optical Materials Journal July 2014Anshuman BanerjeeNo ratings yet

- Optical Properties of Solids 2nd Ed by Mark Fox SampleDocument3 pagesOptical Properties of Solids 2nd Ed by Mark Fox SampleAnshuman Banerjee67% (3)

- Optical Properties of Solids 2nd Ed by Mark FoxDocument118 pagesOptical Properties of Solids 2nd Ed by Mark FoxAnshuman Banerjee75% (24)

- Optical Properties of Solids 2nd Ed by Mark Fox SampleDocument3 pagesOptical Properties of Solids 2nd Ed by Mark Fox SampleAnshuman Banerjee67% (3)

- Optical Properties of Solids 2nd Ed by Mark Fox SampleDocument3 pagesOptical Properties of Solids 2nd Ed by Mark Fox SampleAnshuman Banerjee67% (3)

- (Solutions) Introduction To Plasma Physics and Controlled Fusion Plasma PhysicsDocument47 pages(Solutions) Introduction To Plasma Physics and Controlled Fusion Plasma Physicszeeshan_scribd77% (52)

- Case Study Capital Budgeting For Classroom DiscussionDocument4 pagesCase Study Capital Budgeting For Classroom DiscussionakhilNo ratings yet

- Financial Aspect - Feasibility StudyDocument33 pagesFinancial Aspect - Feasibility StudyAgayatak Sa Manen55% (20)

- Develop and Understand TaxationDocument26 pagesDevelop and Understand TaxationNigussie BerhanuNo ratings yet

- Fundamentals of Accountancy, Business and Management 1Document16 pagesFundamentals of Accountancy, Business and Management 1Gladzangel Loricabv83% (6)

- Unit 3.4 CHP 1-4Document102 pagesUnit 3.4 CHP 1-4Thi Van Anh VUNo ratings yet

- Chapter 2 Multiple Choice Answers and SolutionsDocument25 pagesChapter 2 Multiple Choice Answers and SolutionsMendoza KlariseNo ratings yet

- Easy Method Institute: Adjusting EntriesDocument6 pagesEasy Method Institute: Adjusting EntriesKader Jewel100% (1)

- Islamic Financial Accounting Standard 2 - IjarahDocument7 pagesIslamic Financial Accounting Standard 2 - IjarahPlatonic100% (1)

- Cost and Management Accounting FundamentalsDocument202 pagesCost and Management Accounting FundamentalsAvinash Kumar100% (1)

- Financial AnalysisDocument691 pagesFinancial Analysissanu sayed100% (1)

- Financial Policy For IvcsDocument11 pagesFinancial Policy For Ivcsherbert pariatNo ratings yet

- IAS 36 NokulungaDocument54 pagesIAS 36 NokulungaWebster GobvuNo ratings yet

- F7INTFR Study Question Bank Sample D14 J15Document53 pagesF7INTFR Study Question Bank Sample D14 J15Onaderu Oluwagbenga Enoch100% (3)

- Chapter 4Document40 pagesChapter 4prashantgargindia_93No ratings yet

- Process Modeling and Techno-Economic Evaluation of An Industrial Bacterial Nanocellulose Fermentation ProcessDocument16 pagesProcess Modeling and Techno-Economic Evaluation of An Industrial Bacterial Nanocellulose Fermentation ProcessJuan Jose Quijano MendozaNo ratings yet

- CH 11Document12 pagesCH 11ShelviDyanPrastiwiNo ratings yet

- Project Report On Financial Analysis of Nestle India Limited ProjectDocument65 pagesProject Report On Financial Analysis of Nestle India Limited ProjectSonu Dhangar77% (57)

- People Soft Bundle Release Note 9 Bundle9Document29 pagesPeople Soft Bundle Release Note 9 Bundle9rajiv_xguysNo ratings yet

- Annual Report 2016Document40 pagesAnnual Report 2016Muhammad NoumanNo ratings yet

- Case StudyDocument6 pagesCase StudyArun Kenneth100% (1)

- Macroeconomic Measurements, Part II: GDP and Real GDP: References: Ch. 7, Macroeconomics, Roger A. ArnoldDocument12 pagesMacroeconomic Measurements, Part II: GDP and Real GDP: References: Ch. 7, Macroeconomics, Roger A. ArnoldLeonilaEnriquezNo ratings yet

- City of Busselton - Adopted Budget 2016-2017Document314 pagesCity of Busselton - Adopted Budget 2016-2017NeenNo ratings yet

- CH 4 RiskDocument32 pagesCH 4 RiskYisihak SimionNo ratings yet

- 4 2006 Dec QDocument9 pages4 2006 Dec Qapi-19836745No ratings yet

- Merob SchoolDocument27 pagesMerob SchoolRamon ColonNo ratings yet

- Foundations of Financial Management: Block, Hirt, and Danielsen 17th EditionDocument40 pagesFoundations of Financial Management: Block, Hirt, and Danielsen 17th Editionfbm2000No ratings yet

- Ibra Fa 1Document8 pagesIbra Fa 1Michael KitongaNo ratings yet

- Internal Audit ManualDocument92 pagesInternal Audit ManualSudhakar Jalagam50% (2)

- Slid e 4-1Document67 pagesSlid e 4-1Rashe FasiNo ratings yet

- CFAS Computations PDFDocument40 pagesCFAS Computations PDFJay-B Angelo75% (4)