Professional Documents

Culture Documents

Progressive Superannuation

Uploaded by

peter_martin9335Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Progressive Superannuation

Uploaded by

peter_martin9335Copyright:

Available Formats

PROGRESSIVE SUPERANNUATION

A SYSTEM FOR EVERYONE, NOT JUST THE RICH

The Greens plan to deliver a secure retirement for all Australians

Superannuation in Australia has become a tax haven for the

wealthy, rather than a way of delivering a comfortable

retirement for all. If the Government is serious about raising

revenue, it is time to remove the superannuation tax breaks that

are heavily skewed in favour of high income earners, and to start

caring for everyone.

> CURRENT PROBLEM

> A SUPER SCHEME FOR THE RICH

Australias once world leading superannuation system was

established over two decades ago to ensure our ageing

population can retire in comfort and to preserve the pension

for those who really need it. Now, just as baby boomers are

beginning the transition into retirement, the public money

foregone to superannuation concessions will surge from $32

billion to a massive $50 billion a year in 2018. Compulsory

super will no longer be achieving one of its main objectives,

and in fact cost more than providing the public pension for

i

everyone.

Superannuation tax breaks are estimated by Treasury to cost

$32 billion annually. By way of comparison, we spend $20.3

iv

billion a year on Medicare.

Our current super system is regressive and provides the

biggest incentive for those earning high incomes, not to save

for retirement but to maximise their wealth. It is a flat 15% tax

on contributions, whether you are a parent working one day a

week or a full-time millionaire. For example an executive

earning $300,000 per annum with a million dollar retirement

account can receive $37,000 of concessions, 2.5 times the

[ii]

value of the age pension, for every year of their working life.

The most disproportionately affected are women, low-income

and casual workers. 60% of workers earning less than $37,000

ii

are women, primarily because of commitments to care for

others in their family, they only work part-time for many

years. This results in women retiring with only half the

iii

retirement savings of men this gap has to close. A

progressive super system will go a long way in reducing the

inequity of our retirement system.

Half of supers total cost, $16 billion, is spent subsidising

contributions to superannuation funds. Those contributions

are taxed at a flat rate of 15% instead of the individuals

marginal tax rate. As a result, the system is biased towards

those who earn the most.

That means that under the current system, those who earn

$19,400 and pay no tax, still pay 15 per cent tax on their super

contributions the exact same rate as someone in the top

marginal tax rate earning more than $180,000 per year.

It is clear that the current arrangement does nothing to

address the widening gap between the rich and the poor with

more than 90% of superannuation assets held by just the top

v

12% of income earners. As the governments own Murray

Review noted, public revenue is lost to people using the super

vi

system, not for their retirement, but as a tax-haven for their

income and assets.

We need a vision for Australias future, but the Abbott

Governments budget attacks the most vulnerable and

protects their big business mates instead of raising the

revenue to invest in clean jobs, health and education.

For issue on 24 February 2014. | Printed and authorised by Senator Christine Milne, Parliament House Canberra ACT 2600.

Page 1 of 2

> THE GREENS SOLUTION

support progressive tax concessions so contributions are taxed

at marginal rates with either a reduction of 15% or a capped

tax rebate to assist low and middle income earners.

While there are many technical reforms our super system

needs, the most pressing, simple option is to remove the

current flat tax rate of 15 percent for everyone, and replace it

vii

with a progressive system based closely on the individual

employees marginal tax rate.

CASE STUDIES:

Worker on $30,000 per year

Lisa, a mother earning $30,000 a year working

part time, currently pays 15% tax on her super,

which will mean she will retire with savings of

around $290,000.

As a supporting priority measure, the policy also clamps down

on churning wages through super funds. While the $30,000

contributions cap will remain, it will no longer be possible for

over 55s to get a tax benefit just for putting their salary into

their super while drawing an equivalent wage out the other

side of their fund. The concessional tax rate will only apply to

net contributions (the amount deposits exceed withdrawals).

Under the Greens progressive plan, Lisa will only

pay 4% tax on her super contributions, which will

mean$500 more for her retirement every year,

resulting in a $40,000 increase in her retirement

savings to $330,000.

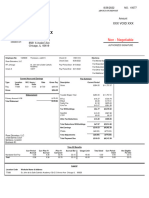

The Greens proposed new superannuation tax regime as of 1

July 2015:

Income plus

super

$0-19,400

$19,401

37,000

$37,001

100,000

$100,001

150,000

$150,001

onwards

$180,001

onwards

Marginal

Tax Rate

0 cents

19 cents

Super rate

33 cents (37

cents from

$80k)

37 cents

15 cents

N/A

30 cents

45-47

viii

cents

30-32

ix

cents

Worker on $200,000 per year

Alan, a corporate lawyer in the top marginal tax

bracket, earning $200,000 a year, currently

enjoys a tax break on his super of 30 cents in the

dollar.

0 cents

4 cents

By shifting to a progressive new super tax regime,

Alan would pay $900 a year more, or 32% tax on

his super contributions, amounting to $110,000

over a lifetime, and still retire with $1.6 million

in savings.

22 cents

Costings from the Parliamentary Budget Office, submitted by

the Australian Greens show that $10.16 billion would be

raised over four years through a progressive superannuation

proposal.

This proposal would restore, and improve the retirement

savings of lower income workers which were destroyed by the

Governments deal with the coal-billionaire Clive Palmer to

repeal the Mining Tax. The progressive rates of our policy will

mean less tax and a higher retirement savings balance for low

income workers while raising revenue for the government.

> WHAT THE EXPERTS ARE SAYING

The approach proposed has broadly been advocated by the

x

xi

ACTU, ACOSS, Anglicare and The Australia Institute.

Tax Expenditure Statement 2014 Treasury and 2014-15 Budget Paper No.1

page 6-11.

[ii]

http://www.tai.org.au/system/files_force/super_tax_concessions_final_7.pdf

ii

Women in Super Submission to the Mining Tax Repeal and Other Measures Bill

page 3.

iii

Ibid

iv

2014-15 Budget Paper No.1 page 6-11.

v

Financial Services Inquiry (The Murray Review) Interim Report July 2014 page

2-121

vi

Financial Services Inquiry (The Murrary Review) Final Report November 2014

pages 137-138.

vii

The highest tax rate will begin at $150,000 instead of the $180,000 income tax

bracket.

viii

The highest tax bracket will also have the additional 2c for the two-year

duration of the so called budget deficit levy, lifting the tax rate to 47c in the

dollar.

ix

The highest tax bracket will also have the additional 2c for the two-year

duration of the so called budget deficit levy, lifting the effective super rate to

32c in the dollar.

x

Economics Legislation Committee Minerals Resource Rent Tax Bill 2012. March

2012 at 154-155

xi

http://www.tai.org.au/system/files_force/super_tax_concessions_final_7.p

The Industry Super Network and the Henry Tax Review both

Printed and authorised by Senator Christine Milne, Parliament House Canberra ACT 2600.

Page 2 of 2

You might also like

- The Work Versus Welfare Trade-off: 2013: An Analysis of the Total Level of Welfare Benefits by StateFrom EverandThe Work Versus Welfare Trade-off: 2013: An Analysis of the Total Level of Welfare Benefits by StateNo ratings yet

- Fact Sheet Pensioner GuaranteeDocument4 pagesFact Sheet Pensioner GuaranteeJack HammondNo ratings yet

- Options To Finance Medicare For All: $500 BillionDocument6 pagesOptions To Finance Medicare For All: $500 BillionBradyNo ratings yet

- Article From Hon PDFDocument3 pagesArticle From Hon PDFAnonymous AYYL0jF1No ratings yet

- Analyse The Policies Available To The Government That Impact On The Inequality in The Distribution of Income and Wealth in AustraliaDocument2 pagesAnalyse The Policies Available To The Government That Impact On The Inequality in The Distribution of Income and Wealth in Australiasimrangill32No ratings yet

- Wayne Swan's 2012-13 Budget SpeechDocument12 pagesWayne Swan's 2012-13 Budget SpeechABC News OnlineNo ratings yet

- Lowering Personal Income Tax (PIT) : Tax Reform For Acceleration and InclusionDocument4 pagesLowering Personal Income Tax (PIT) : Tax Reform For Acceleration and InclusionChristine Joy RamirezNo ratings yet

- Relative Poverty ResearchDocument5 pagesRelative Poverty ResearchpredkotNo ratings yet

- You Did Not Create This Crisis - Don't Be Conned Into Paying For ItDocument4 pagesYou Did Not Create This Crisis - Don't Be Conned Into Paying For Itapi-87568835No ratings yet

- 11 February 2013Document3 pages11 February 2013api-110464801No ratings yet

- BTC Reports - Final Tax Plan2013Document10 pagesBTC Reports - Final Tax Plan2013CarolinaMercuryNo ratings yet

- Essay Evaluate The Effectiveness of Government Policies in Reducing Inequalities Amongst Disadvantaged GroupsDocument3 pagesEssay Evaluate The Effectiveness of Government Policies in Reducing Inequalities Amongst Disadvantaged GroupsamirulazryNo ratings yet

- Understanding the Impact of TRAIN LawDocument5 pagesUnderstanding the Impact of TRAIN LawLauren Nicole AlonzoNo ratings yet

- Train LawDocument11 pagesTrain LawKurtlyn Ann Oliquino100% (2)

- BudgetHighlights2012 2013Document2 pagesBudgetHighlights2012 2013Pallavi ShuklaNo ratings yet

- T P ' A T R: HE Resident S GendaDocument10 pagesT P ' A T R: HE Resident S GendalosangelesNo ratings yet

- 2 Simplifying The Estate and Donor's Tax: 1 Lowering Personal Income Tax (PIT)Document6 pages2 Simplifying The Estate and Donor's Tax: 1 Lowering Personal Income Tax (PIT)mharlon balictarNo ratings yet

- Theoretical FrameworkDocument14 pagesTheoretical Frameworkfadi786No ratings yet

- Train Law Fact SheetDocument5 pagesTrain Law Fact SheetCedric EscobiaNo ratings yet

- Fianna Fail Pre Budget Submission Final DraftDocument40 pagesFianna Fail Pre Budget Submission Final DraftFFRenewalNo ratings yet

- Tax Policy Center Cruz AnalysisDocument37 pagesTax Policy Center Cruz AnalysisAndrew NeuberNo ratings yet

- RITESHDocument94 pagesRITESHrohilla smythNo ratings yet

- REPORT: The Impact of The Tax Framework On Middle Class FamiliesDocument3 pagesREPORT: The Impact of The Tax Framework On Middle Class FamiliesbwingfieldNo ratings yet

- RITESHDocument94 pagesRITESHRahul RajNo ratings yet

- 05 Essay 1: Jeremeh C. Pande BSIT 301ADocument2 pages05 Essay 1: Jeremeh C. Pande BSIT 301AJeremeh PandeNo ratings yet

- Philippine Constitution, Agrarian Reform and TaxationDocument6 pagesPhilippine Constitution, Agrarian Reform and TaxationKatleen DugenioNo ratings yet

- Tax Reform For Acceleration & Inclusion: University of Northern PhilippinesDocument4 pagesTax Reform For Acceleration & Inclusion: University of Northern PhilippinesDiana PobladorNo ratings yet

- Budget Background Taxes 2011 - FINAL PDFDocument2 pagesBudget Background Taxes 2011 - FINAL PDFAndi ParkinsonNo ratings yet

- Tax Reform For Acceleration and Inclusion: I. Lowering Personal Income Tax (PIT)Document8 pagesTax Reform For Acceleration and Inclusion: I. Lowering Personal Income Tax (PIT)ZeroNo ratings yet

- Metro Manila (CNN Philippines) - Poor and Middle-Class Filipinos CouldDocument13 pagesMetro Manila (CNN Philippines) - Poor and Middle-Class Filipinos CouldMayAnn SisonNo ratings yet

- PM Media Release 1may2013Document3 pagesPM Media Release 1may2013Steph GotlibNo ratings yet

- Train LawDocument10 pagesTrain LawkimNo ratings yet

- Sponsorship Speech On GSIS Members Rights and Benefits Act of 2011Document10 pagesSponsorship Speech On GSIS Members Rights and Benefits Act of 2011Ralph RectoNo ratings yet

- RPH Vlog May 10Document2 pagesRPH Vlog May 10Althea Marie DimayugaNo ratings yet

- Tax Reform For Acceleration and Inclusion: TrainDocument5 pagesTax Reform For Acceleration and Inclusion: TrainEla Gloria MolarNo ratings yet

- Pre-Budget Submission FINAL 21 Mar 2013Document21 pagesPre-Budget Submission FINAL 21 Mar 2013danbouchardNo ratings yet

- Economics Notes Year 11Document9 pagesEconomics Notes Year 11conorNo ratings yet

- Seniors' Health Care and Benefits: Wildrose CaucusDocument7 pagesSeniors' Health Care and Benefits: Wildrose CaucusMatt SolbergNo ratings yet

- Tax Topics: Blanche Lark ChristersonDocument6 pagesTax Topics: Blanche Lark Christersonapi-301040925No ratings yet

- Train LawDocument25 pagesTrain LawLouem GarceniegoNo ratings yet

- Progressive Principles of Tax ReformDocument3 pagesProgressive Principles of Tax ReformNational JournalNo ratings yet

- The Hon Bill Shorten MPDocument22 pagesThe Hon Bill Shorten MPPolitical AlertNo ratings yet

- TRAIN LAWDocument3 pagesTRAIN LAWLandersol De Vera CrisostomoNo ratings yet

- A Better Singapore: Budget Focuses on Quality Growth, Inclusive SocietyDocument10 pagesA Better Singapore: Budget Focuses on Quality Growth, Inclusive SocietyIndrik WijayaNo ratings yet

- T4-4.5. Role of The State in The MacroeconomyDocument15 pagesT4-4.5. Role of The State in The MacroeconomyBlu BostockNo ratings yet

- 2.2 Fiscal Policy: Done By: Tristan & ZaishanDocument11 pages2.2 Fiscal Policy: Done By: Tristan & ZaishanGhala AlHarmoodiNo ratings yet

- Tax Reform For Acceleration and Inclusion ActDocument6 pagesTax Reform For Acceleration and Inclusion ActRoiven Dela Rosa TrinidadNo ratings yet

- Train Law: The Tax Reform For Acceleration and Inclusion (Train) ActDocument5 pagesTrain Law: The Tax Reform For Acceleration and Inclusion (Train) Actcamille setostaNo ratings yet

- Contributory BenefitsDocument13 pagesContributory BenefitsGail WardNo ratings yet

- Designing A Basic Income Guarantee For Canada-BROADWAY ET AL-qed - WP - 1371Document32 pagesDesigning A Basic Income Guarantee For Canada-BROADWAY ET AL-qed - WP - 1371william_V_LeeNo ratings yet

- Tory Threat To The State PensionDocument5 pagesTory Threat To The State PensionmaxNo ratings yet

- Escaping True Tax Liability of The Government Amidst PandemicsDocument7 pagesEscaping True Tax Liability of The Government Amidst PandemicsMaria Carla Roan AbelindeNo ratings yet

- Emanuel Fiscal Reform AgendaDocument4 pagesEmanuel Fiscal Reform AgendaZoe GallandNo ratings yet

- Obama Administration Econ RecordDocument46 pagesObama Administration Econ RecordZerohedgeNo ratings yet

- Campaign 2012: The Deficit, William GaleDocument4 pagesCampaign 2012: The Deficit, William GaledevonvsmithNo ratings yet

- The Universal Savings CreditDocument25 pagesThe Universal Savings CreditCenter for American ProgressNo ratings yet

- Tax Reform for Acceleration and Inclusion (TRAIN) Law ExplainedDocument5 pagesTax Reform for Acceleration and Inclusion (TRAIN) Law ExplainedGrazel GeorsuaNo ratings yet

- Federal Tax RevenuesDocument12 pagesFederal Tax RevenuesJOijiewjfNo ratings yet

- Collaborative Financial Solutions, LLC Cost-of-Living Adjustments: What They Are and Why They MatterDocument4 pagesCollaborative Financial Solutions, LLC Cost-of-Living Adjustments: What They Are and Why They MatterJanet BarrNo ratings yet

- Scope BusinessDay Economic Survey Panel July 2017Document1 pageScope BusinessDay Economic Survey Panel July 2017peter_martin9335No ratings yet

- AA 2014 Economics2Document2 pagesAA 2014 Economics2peter_martin9335No ratings yet

- 2014 Talent Et Al ACT Energy and Water BaselineDocument66 pages2014 Talent Et Al ACT Energy and Water Baselinepeter_martin9335No ratings yet

- Coalition Jobs Pledge November 2012Document2 pagesCoalition Jobs Pledge November 2012peter_martin9335No ratings yet

- Post IncreaseDocument2 pagesPost Increasepeter_martin9335No ratings yet

- Names of Exec Managers CEO and Chief ExecDocument4 pagesNames of Exec Managers CEO and Chief Execpeter_martin9335No ratings yet

- GitAA 2015 EconomicsDocument2 pagesGitAA 2015 Economicspeter_martin9335No ratings yet

- GitAA 2015 EconomicsDocument2 pagesGitAA 2015 Economicspeter_martin9335No ratings yet

- GitAA 2015 EconomicsDocument2 pagesGitAA 2015 Economicspeter_martin9335No ratings yet

- PBO Costing Progressive SuperannuationDocument6 pagesPBO Costing Progressive Superannuationpeter_martin9335No ratings yet

- Letter From PanelDocument1 pageLetter From PanelUniversityofMelbourneNo ratings yet

- ACHR Paper On GP CopaymentsDocument14 pagesACHR Paper On GP CopaymentsABC News OnlineNo ratings yet

- GitAA 2015 EconomicsDocument2 pagesGitAA 2015 Economicspeter_martin9335No ratings yet

- Complaint To CPA Australia PDFDocument13 pagesComplaint To CPA Australia PDFpeter_martin9335No ratings yet

- GitAA 2015 EconomicsDocument2 pagesGitAA 2015 Economicspeter_martin9335No ratings yet

- Industry Consultation Draft IA Roads Report 14Document28 pagesIndustry Consultation Draft IA Roads Report 14peter_martin9335No ratings yet

- Treasuryletter PDFDocument6 pagesTreasuryletter PDFpeter_martin9335No ratings yet

- The Effect of Consumer Copayments in Medical Care Jeff RichardsonDocument36 pagesThe Effect of Consumer Copayments in Medical Care Jeff Richardsonpeter_martin9335No ratings yet

- Proposed Tax Changes - Treasurer Joe Hockey 6-11-13Document19 pagesProposed Tax Changes - Treasurer Joe Hockey 6-11-13fkeany6189No ratings yet

- Commonwealth of Australia: The ConstitutionDocument4 pagesCommonwealth of Australia: The Constitutionpeter_martin9335No ratings yet

- Arnold Bloch Leibler Re Proposed Introduction of FOFA Amendments by RegulationDocument4 pagesArnold Bloch Leibler Re Proposed Introduction of FOFA Amendments by Regulationpeter_martin9335No ratings yet

- 131210-Acting PM - MR Mike Devereux, GM HoldenDocument2 pages131210-Acting PM - MR Mike Devereux, GM Holdenpeter_martin9335No ratings yet

- Administrative Orders For Restructuring The Australian GovernmentDocument45 pagesAdministrative Orders For Restructuring The Australian GovernmentAlan KerlinNo ratings yet

- Prime Minister Tony Abbott's Second MinistryDocument1 pagePrime Minister Tony Abbott's Second MinistryLatika M BourkeNo ratings yet

- CC Report PDFDocument16 pagesCC Report PDFPolitical AlertNo ratings yet

- CC Report PDFDocument16 pagesCC Report PDFPolitical AlertNo ratings yet

- Tony Abbott's First MinistryDocument2 pagesTony Abbott's First MinistryLatika M BourkeNo ratings yet

- COSTINGSDocument5 pagesCOSTINGSPolitical Alert100% (1)

- Tony Abbott's First MinistryDocument2 pagesTony Abbott's First MinistryLatika M BourkeNo ratings yet

- Burnout Prevention: An Integrative Approach For Healthy MinistryDocument37 pagesBurnout Prevention: An Integrative Approach For Healthy MinistryRev. Jose Falogme, Jr.100% (2)

- TGB Communication ReportDocument17 pagesTGB Communication ReportRima AgarwalNo ratings yet

- Introduction To Performance ManagementDocument23 pagesIntroduction To Performance ManagementGajaba GunawardenaNo ratings yet

- CHAPTER 1-6of 301 Updated September 15Document62 pagesCHAPTER 1-6of 301 Updated September 15Emerson CruzNo ratings yet

- HRM Practices in EthiopiaDocument13 pagesHRM Practices in EthiopiaAsfawosen DingamaNo ratings yet

- PresentationDocument22 pagesPresentationDipanjanNo ratings yet

- Absconding PolicyDocument2 pagesAbsconding PolicyDipika71% (7)

- Governance, Business Ethics, Risk Management and Control Case StudyDocument2 pagesGovernance, Business Ethics, Risk Management and Control Case StudyEu RiNo ratings yet

- Cap 47-03 Workmens Compensation BotswanaDocument24 pagesCap 47-03 Workmens Compensation BotswanaGarnette ChipongweNo ratings yet

- Tamil Nadu Manual Worker (Regulation of Employment and Conditions of Work) Act, 1982.Document29 pagesTamil Nadu Manual Worker (Regulation of Employment and Conditions of Work) Act, 1982.Latest Laws TeamNo ratings yet

- Data AnalyticsDocument11 pagesData AnalyticsSatyam TiwariNo ratings yet

- Mango's Internal Audit Review Checklist: A. GeneralDocument7 pagesMango's Internal Audit Review Checklist: A. GeneralRon TeodosioNo ratings yet

- Types of InvestmentDocument6 pagesTypes of InvestmentjashimkhanNo ratings yet

- Report 1Document2 pagesReport 1Raashid Qyidar Aqiel ElNo ratings yet

- Womenomics and Neoliberalism: How Corporate Interests Co-opted FeminismDocument16 pagesWomenomics and Neoliberalism: How Corporate Interests Co-opted FeminismGracedy GreatNo ratings yet

- Employees Union of Bayer Phils. V Bayer Phils. Inc., Et Al.Document4 pagesEmployees Union of Bayer Phils. V Bayer Phils. Inc., Et Al.Patricia GonzagaNo ratings yet

- OM Scott Case AnalysisDocument20 pagesOM Scott Case AnalysissushilkhannaNo ratings yet

- B-Frost Company HRM PoliciesDocument35 pagesB-Frost Company HRM PoliciesMickaela CaldonaNo ratings yet

- Article Competency Based Selection and InterviewDocument3 pagesArticle Competency Based Selection and InterviewMahnoor ShahbazNo ratings yet

- Marc Lavoie - Post-Keynesian Economics - New Foundations-Edward Elgar Publishing LTD (2015) - Páginas-199-246 PDFDocument48 pagesMarc Lavoie - Post-Keynesian Economics - New Foundations-Edward Elgar Publishing LTD (2015) - Páginas-199-246 PDFMaria Alejandra Malaver DazaNo ratings yet

- Organizational Conflict in NestleDocument14 pagesOrganizational Conflict in NestleNursaiyidah AisyahNo ratings yet

- Advt. No. 01 - 2022-Fci Category III Zone-Wise Recruitment of Non-Executives in FciDocument4 pagesAdvt. No. 01 - 2022-Fci Category III Zone-Wise Recruitment of Non-Executives in FciParvesh MehraNo ratings yet

- Project Report of ITC LTDDocument75 pagesProject Report of ITC LTDSwati Pattnaik83% (6)

- Icorr Membership RegulationsDocument7 pagesIcorr Membership RegulationszaxaderNo ratings yet

- Job ShadowingDocument20 pagesJob Shadowinghussain hasniNo ratings yet

- Peril To Pakistan'S Competitiveness Ishrat HusainDocument5 pagesPeril To Pakistan'S Competitiveness Ishrat Husainhassanbabu007No ratings yet

- Pakistan's Leading Packaging GiantDocument253 pagesPakistan's Leading Packaging GiantFaisal AbbasNo ratings yet

- GROUP 2 Organizational Design Structure, Culture, and ControlDocument32 pagesGROUP 2 Organizational Design Structure, Culture, and Controllexine rodrigoNo ratings yet

- 11 South Korea has a higher birth rate than Japan.Secret of Thailand's SuccessDocument8 pages11 South Korea has a higher birth rate than Japan.Secret of Thailand's Successstatus vidsNo ratings yet

- Career Management GuideDocument45 pagesCareer Management GuideSeema RahulNo ratings yet