Professional Documents

Culture Documents

Credit Transaction Cases

Uploaded by

Aizza Jopson0 ratings0% found this document useful (0 votes)

56 views1 pagecredit transaction cases

Original Title

credit transaction cases

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcredit transaction cases

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

56 views1 pageCredit Transaction Cases

Uploaded by

Aizza Jopsoncredit transaction cases

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

FIRST DIVISION

G.R. No. 103576 August 22, 1996

ACME SHOE, RUBBER & PLASTIC CORPORATION and CHUA

PAC, petitioners,

vs.

HON. COURT OF APPEALS, BANK OF THE PHILIPPINES and

REGIONAL SHERIFF OF CALOOCAN CITY, respondents.

VITUG, J.:p

FACTS:

Would it be valid and effective to have a clause in a chattel

mortgage that purports to likewise extend its coverage to

obligations yet to be contracted or incurred? This question is

the core issue in the instant petition for review on certiorari.

Petitioner Chua Pac, the president and general manager of

co-petitioner "Acme Shoe, Rubber & Plastic Corporation,"

executed on 27 June 1978,

a chattel mortgage in favor of private respondent Producers

Bank of the Philippines. The mortgage stood by way of

security for petitioner's corporate loan of three million pesos

(P3,000,000.00). A provision in the chattel mortgage

agreement was to this effect

this mortgage shall also stand as security for the

payment of the said promissory note or notes

and/or accommodations without the necessity of

executing a new contract and this mortgage shall

have the same force and effect as if the said

promissory note or notes and/or accommodations

were existing on the date thereof. This mortgage

shall also stand as security for said obligations

and any and all other obligations of the

MORTGAGOR to the MORTGAGEE of whatever

kind and nature, whether such obligations have

been contracted before, during or after the

constitution of this mortgage. 1

ISSUE: W O N a stipulation extending the coverage of the chattel

mortgage to obligations yet to be contracted or incurred is valid.

HELD: The SC ruled in the affirmative. BUT in this case the chattel

mortgage was only limited to the 3 million-peso loan. The reason of the

SC are stated below:

a chattel mortgage, however, can only cover obligations existing at the

time the mortgage is constituted. Although a promise expressed in a

chattel mortgage to include debts that are yet to be contracted can be

a binding commitment that can be compelled upon, the security itself,

however, does not come into existence or arise until after a chattel

mortgage agreement covering the newly contracted debt is executed

either by concluding a fresh chattel mortgage or by amending the old

contract conformably with the form prescribed by the Chattel Mortgage

Law. 11 Refusal on the part of the borrower to execute the agreement

so as to cover the after-incurred obligation can constitute an act of

default on the part of the borrower of the financing agreement whereon

the promise is written but, of course, the remedy of foreclosure can

only cover the debts extant at the time of constitution and during the

life of the chattel mortgage sought to be foreclosed.

A chattel mortgage, as hereinbefore so intimated, must

comply substantially with the form prescribed by the Chattel

Mortgage Law itself. One of the requisites, under Section 5

thereof, is an affidavit of good faith. While it is not doubted

that if such an affidavit is not appended to the agreement,

the chattel mortgage would still be valid between the parties

(not against third persons acting in good faith 12), the fact,

however, that the statute has provided that the parties to the

contract must execute an oath that

. . . (the) mortgage is made for the purpose of

securing the obligation specified in the conditions

thereof, and for no other purpose, and that the

same is a just and valid obligation, and one not

entered into for the purpose of fraud. 13

makes it obvious that the debt referred to in the law is a

current, not an obligation that is yet merely contemplated. In

the chattel mortgage here involved, the only obligation

specified in the chattel mortgage contract was the

P3,000,000.00 loan which petitioner corporation later fully

paid. By virtue of Section 3 of the Chattel Mortgage Law, the

payment of the obligation automatically rendered the chattel

mortgage void or terminated. In Belgian Catholic

Missionaries, Inc., vs. Magallanes Press, Inc., et al., 14 the

Court

said

the loan of P3,000,000.00 was paid

it obtained from respondent bank additional financial

accommodations totalling P2,700,000.00. 2 These

borrowings were on due date also fully paid.

the bank yet again extended to petitioner corporation a loan

of one million pesos (P1,000,000.00)

Due to financial constraints, the loan was not settled at

maturity. 3 Respondent bank thereupon applied for an extra

judicial foreclosure of the chattel

petitioner corporation to forthwith file an action for injunction,

. . . A mortgage that contains a stipulation in

regard to future advances in the credit will take

effect only from the date the same are made and

not from the date of the mortgage. 15

The significance of the ruling to the instant problem would be

that since the 1978 chattel mortgage had ceased to exist

coincidentally with the full payment of the P3,000,000.00

loan, 16 there no longer was any chattel mortgage that could

cover the new loans that were concluded thereafter.

You might also like

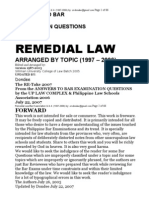

- Civil Procedure Bar QuestionsDocument35 pagesCivil Procedure Bar QuestionsAizza Jopson100% (1)

- Credit Transaction Midterms CasesDocument2 pagesCredit Transaction Midterms CasesAizza JopsonNo ratings yet

- Deposit CasesDocument11 pagesDeposit CasesAizza JopsonNo ratings yet

- SC upholds invalid donation of land shareDocument3 pagesSC upholds invalid donation of land shareAizza JopsonNo ratings yet

- Civil Procedure CasesDocument2 pagesCivil Procedure CasesAizza JopsonNo ratings yet

- Remedial Law Suggested Answers (1997-2006), WordDocument79 pagesRemedial Law Suggested Answers (1997-2006), Wordyumiganda95% (38)

- Labor Relations Bar Questions and AnswersDocument6 pagesLabor Relations Bar Questions and AnswersAizza Jopson100% (8)

- Cid Vs Javier Case DigestDocument1 pageCid Vs Javier Case DigestAizza Jopson0% (1)

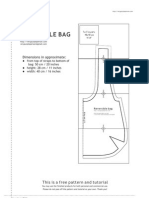

- P150325 Zest Tote BagsDocument2 pagesP150325 Zest Tote BagsRamona Stefana Rusu100% (1)

- Summary of Cases - MidtermDocument6 pagesSummary of Cases - MidtermAizza JopsonNo ratings yet

- Promoting Reproductive Health Case DigestDocument14 pagesPromoting Reproductive Health Case DigestAizza JopsonNo ratings yet

- Consti Bar 2011 MCQDocument5 pagesConsti Bar 2011 MCQAizza JopsonNo ratings yet

- VPP Reversiblebagpattern3Document5 pagesVPP Reversiblebagpattern3Halison Arias100% (1)

- Obra Vs Badua Case DigestDocument2 pagesObra Vs Badua Case DigestAizza JopsonNo ratings yet

- RHBILLDocument10 pagesRHBILLAizza JopsonNo ratings yet

- 2011 Political Law Bar Exam Q&ADocument21 pages2011 Political Law Bar Exam Q&ARaq KhoNo ratings yet

- VPP Reversiblebagpattern3Document5 pagesVPP Reversiblebagpattern3Halison Arias100% (1)

- BDO Home Mastercard Page 2Document1 pageBDO Home Mastercard Page 2Aizza JopsonNo ratings yet

- Angara Vs ELECOM DigestDocument4 pagesAngara Vs ELECOM DigestCharlon Onofre100% (2)

- Persons and Family RelationsDocument3 pagesPersons and Family RelationsAizza JopsonNo ratings yet

- Revised Republic Act 3815Document3 pagesRevised Republic Act 3815Aizza JopsonNo ratings yet

- Indeterminate Sentence LawDocument1 pageIndeterminate Sentence LawAizza JopsonNo ratings yet

- Consti Digest Neri ErmitaDocument6 pagesConsti Digest Neri ErmitaAizza JopsonNo ratings yet

- 02 Macariola V AsuncionDocument14 pages02 Macariola V AsuncionCarmela Lucas DietaNo ratings yet

- Upcat Form 1 (Pds2012)Document2 pagesUpcat Form 1 (Pds2012)Ava MallariNo ratings yet

- Consti Bar 2006 2010 EssayDocument6 pagesConsti Bar 2006 2010 EssayAizza Jopson100% (1)

- Go Vs Ramos& Gonzales Vs PennisiDocument2 pagesGo Vs Ramos& Gonzales Vs PennisiAizza JopsonNo ratings yet

- Romualdez-Libanan-Garcia Case DigestDocument3 pagesRomualdez-Libanan-Garcia Case DigestAizza JopsonNo ratings yet

- Ang Yu Asuncion Vs CA Case DigestDocument2 pagesAng Yu Asuncion Vs CA Case Digestelvie_arugay71% (7)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- AC4301 FinalExam 2020-21 SemA AnsDocument9 pagesAC4301 FinalExam 2020-21 SemA AnslawlokyiNo ratings yet

- MC71206A Practices of The Culture IndustryDocument24 pagesMC71206A Practices of The Culture IndustrykxNo ratings yet

- English GradeDocument4 pagesEnglish GradeLloydDagsilNo ratings yet

- Advocacy PresentationDocument13 pagesAdvocacy Presentationapi-459424184No ratings yet

- Key Ideas of The Modernism in LiteratureDocument3 pagesKey Ideas of The Modernism in Literaturequlb abbasNo ratings yet

- Yiseth Tatiana Sanchez Claros: Sistema Integrado de Gestión Procedimiento Ejecución de La Formación Profesional IntegralDocument3 pagesYiseth Tatiana Sanchez Claros: Sistema Integrado de Gestión Procedimiento Ejecución de La Formación Profesional IntegralTATIANANo ratings yet

- Features of A Newspaper Report Differentiated Activity Sheets - Ver - 2Document4 pagesFeatures of A Newspaper Report Differentiated Activity Sheets - Ver - 2saadNo ratings yet

- Investment Research: Fundamental Coverage - Ifb Agro Industries LimitedDocument8 pagesInvestment Research: Fundamental Coverage - Ifb Agro Industries Limitedrchawdhry123No ratings yet

- UNIT 4 Lesson 1Document36 pagesUNIT 4 Lesson 1Chaos blackNo ratings yet

- 50Document3 pages50sv03No ratings yet

- Management: Standard XIIDocument178 pagesManagement: Standard XIIRohit Vishwakarma0% (1)

- Cease and Desist DemandDocument2 pagesCease and Desist DemandJeffrey Lu100% (1)

- Comprehensive Disaster Management Programme (CDMP II) 2013 Year-End ReviewDocument18 pagesComprehensive Disaster Management Programme (CDMP II) 2013 Year-End ReviewCDMP BangladeshNo ratings yet

- Risk Management in Banking SectorDocument7 pagesRisk Management in Banking SectorrohitNo ratings yet

- ROCKS Air-to-Surface Missile Overcomes GPS Jamming in 38 CharactersDocument2 pagesROCKS Air-to-Surface Missile Overcomes GPS Jamming in 38 CharactersDaniel MadridNo ratings yet

- The Christian WalkDocument4 pagesThe Christian Walkapi-3805388No ratings yet

- Navarro v. SolidumDocument6 pagesNavarro v. SolidumJackelyn GremioNo ratings yet

- American Bible Society Vs City of Manila 101 Phil 386Document13 pagesAmerican Bible Society Vs City of Manila 101 Phil 386Leomar Despi LadongaNo ratings yet

- EVADocument34 pagesEVAMuhammad GulzarNo ratings yet

- HRM-4211 Chapter 4Document10 pagesHRM-4211 Chapter 4Saif HassanNo ratings yet

- Division of WorkDocument19 pagesDivision of WorkBharadwaj KwcNo ratings yet

- Noli Me TangereDocument26 pagesNoli Me TangereJocelyn GrandezNo ratings yet

- Schedule of Rates for LGED ProjectsDocument858 pagesSchedule of Rates for LGED ProjectsRahul Sarker40% (5)

- Simple Present: Positive SentencesDocument16 pagesSimple Present: Positive SentencesPablo Chávez LópezNo ratings yet

- The War Against Sleep - The Philosophy of Gurdjieff by Colin Wilson (1980) PDFDocument50 pagesThe War Against Sleep - The Philosophy of Gurdjieff by Colin Wilson (1980) PDFJosh Didgeridoo0% (1)

- CHRAEFSB2016-32-MotoService Tool - Factory Boot ModeDocument2 pagesCHRAEFSB2016-32-MotoService Tool - Factory Boot Modedanny1977100% (1)

- Altar Server GuideDocument10 pagesAltar Server GuideRichard ArozaNo ratings yet

- Phone, PTCs, Pots, and Delay LinesDocument1 pagePhone, PTCs, Pots, and Delay LinesamjadalisyedNo ratings yet

- Renaissance Element in Bacon WritingDocument2 pagesRenaissance Element in Bacon WritingMuhammad HammadNo ratings yet

- Straight and Crooked ThinkingDocument208 pagesStraight and Crooked Thinkingmekhanic0% (1)